I started my undergraduate studies in economics in the late 1970s after starting out as…

There is no limit to government debt issuance – if you have your own currency

Japan has a new leader of the ruling Liberal Democratic Party, who, given the majority of the LDP in the Diet will become prime minister in the coming days. He was interviewed over the weekend about the current crisis and the role that the Japanese government can play to attenuate the costs. He stated clearly that there was no limit to government debt issuance. The meaning of this statement is clear. The Japanese government should ignore claims that its public debt ratio is too high or is facing impending insolvency or bond-market revolts or any of the other manic predictions that economists who do not know better keep making. Instead, as Yoshihide Suga noted, the challenge is jobs and incomes. The only limits are real resource constraints and when there is a pandemic and rising unemployment, those constraints ease and the fiscal space for more net spending increases. At least one world leader understands that.

Japanese fellowship

As an aside, I was notified last week that I have been awarded a fellowship from the – Japan Society for the Promotion of Science (JSPS) – which is “Japan’s premier research funding agency” to promote “collaborative research between excellent researchers in Japanese universities and institutes and their overseas colleagues”.

I was very happy to receive this award and it will allow me to work in Japan for two months next year (from February).

I have my fingers crossed that the Australian government ban on international travel will have been lifted by then and that it is safe to take up the residency in Kyoto.

I thank Satoshi Fujii and his team for their support and work in helping to make this fellowship a reality.

Mr Suga

As Chief Cabinet Secretary, Yoshihide Suga was a strong supporter of the Bank of Japan’s bond-buying policies.

On January 29, 2016, the Japan Times carried an article – Government applauds BOJ’s ‘bold’ step into negative territory – which noted that Yoshihide Suga “appreciates the introduction of a bold method tho achieve its price stabilization goal”.

This was after the Bank of Japan had cut its policy interest rate to below zero.

In his interview last Sunday, Mr Suga told the audience:

Only when we have economic growth can we push through fiscal reform. What’s most important is to create jobs and protect businesses.

Which is the appropriate priority ranking.

A government should never withdraw a fiscal stimulus until the economy is recovering and non-government spending is able to take up the slack.

Too often governments freak out about the size of their fiscal positions and cut their net spending prematurely. We saw that in Australia in 2012, which really paved the way for the sub-trend growth that the economy exhibited as it entered the pandemic.

And in a few weeks the Australian (penny-pinching) government will cut the special unemployment benefits supplement it introduced at the beginning of the pandemic.

It has been estimated that returning to the old payment level (which was well below the poverty line) will result in a loss of GDP of around 1 per cent ($A31.3 billion over two years) and a loss of 145,000 jobs (Source).

Madness is not the worst thing about this. Must worse – their decision is delinquent.

Mr Suga is a conservative but light years ahead of understanding the capacities of the government and its central bank than our government.

He was asked whether there was a “limit on bond issuance” (Source), he replied:

I don’t think so … What’s important now is to improve current (economic) conditions … Japan’s GDP suffered its biggest postwar contraction in the second quarter, so we need to do whatever it takes to support growth. We have reserves set aside, so we can of course tap that. But if additional steps are necessary, we would act.

So – there is no limit on the issuance of public debt in Japan, which is a very powerful denial of the sort of hocus pocus dished up by my mainstream colleagues, who propose all sorts of insolvency thresholds, which just amount to trying to distort the political debates in favour of less government involvement in the economy.

These thresholds are often passed and nothing happens.

It doesn’t stop them recycling them.

It is thus refreshing to hear the likely, incoming prime minister of Japan, speak frankly about these matters.

Bank of Japan now holds 43 per cent of the outstanding Japanese government debt

I did some calculations this morning using the latest Japanese government data.

Shinzo Abe came to office in December 2012 and has just announced he will step down as prime minister due to ill-health.

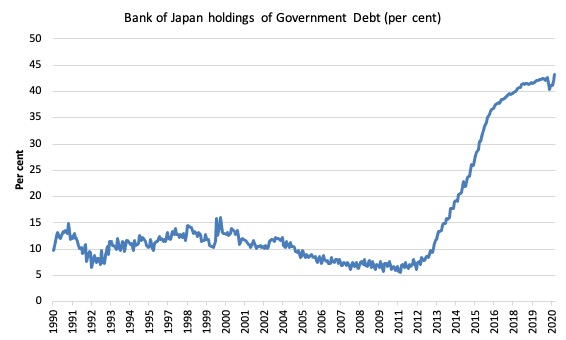

Over his period as PM, the share of government bonds held by the Bank of Japan has risen from 9.7 per cent of the total to 43.2 per cent (as at July 2020).

The following graph shows the shift in Bank of Japan holdings of outstanding government debt.

The following table shows that the change in Bank of Japan holdings of Japanese Government Bonds has been 222.3 per cent of the actual change in outstanding JGBs since December 2012.

That is, the increase in central bank holdings of JGBs since Shinzo Abe came to office has exceeded the actual change in outstanding JGBs by a factor of 2.22.

In other words, it has been effectively funding the entire fiscal deficits for the entire period.

Further, the secondary JGBs market has been very thin since the QQE program began and sellers in that market have declined.

Why? Because as the auction yields have gone negative, current bond holders who purchased the debt instrument at positive yields, will worry about having funds (from sales) which are only going to attract negative returns (losses). The smart strategy in that case is to maintain long positions.

So the corporate welfare is being squeezed.

| Date | Outstanding National Debt (100 million yen) | Held by Bank of Japan (100 million yen) | Proportion (per cent) |

| Dec 2012 | 9,972,181 | 974,219 | 9.7 |

| July 2020 | 11,831,247 | 5,107,658 | 43.2 |

| Change | 1,859,066 | 4,133,439 | 222.3 |

Any talk that this could render the Bank of Japan insolvent is erroneous. Central banks can never become insolvent.

See, for example, this blog post – The ECB cannot go broke – get over it (May 11, 2012).

What these monetary operations really mean is that the Japanese government is spending by using credits created by the Bank of Japan, whatever else the accounting structures might lead one to believe.

Yes, the Bank of Japan is purchasing the government bonds in the secondary markets rather than in the primary issue.

But that doesn’t rescue the mainstream case.

It really is of no consequence that they are waiting for the bond dealers to make the market in the primary issuance phase and then hoover up all the debt next ‘day’.

With inflation low and stable, these dynamics surely put paid to the various myths that a currency-issuing government can run out of money and that central bank credits to facilitate government spending lead to hyperinflation.

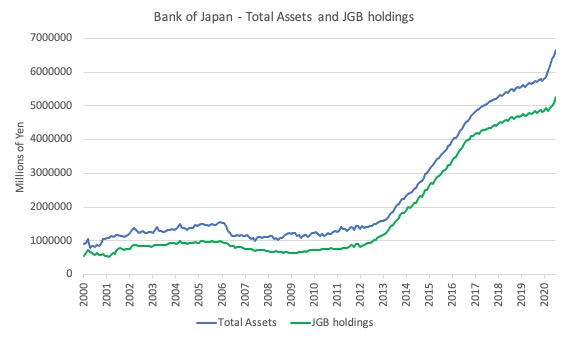

I noted in a recent blog post – RBA governor adopts a political role to his discredit (August 18, 2020) – that in the June-quarter 2020, total Bank of Japan assets stood at 125.4 per cent of GDP and their JGB holdings were 98.8 per cent of GDP.

This graph shows the acceleration in bond holdings (and total assets) since the pandemic hit.

I also showed that the growth in the monetary base in Japan has been driven mostly by the various quantitative easing programs introduced by the Bank of Japan.

The Bank of Japan’s quantitative easing history began in earnest in March 2001 (QE1) and this increased the BOJs monetary base by around 66 per cent.

The Bank terminated that program in March 2006, whereupon the Bank sold down some of its holdings of JGBs.

A second (QE2) program began in October 2010 and as time has passed it has become QE3 and QQE, which is a much larger scale intervention that that began in April 2013 and continues at a pace today.

The monetary base increased by 36 per cent during QE2 and by, wait for it, 279 per cent in QE3/QQE to date. Not a small number.

You would expect if the mainstream macroeconomics predictions were robust then they should have materialised by now given these relative policy extremes.

The overwhelming conclusion is that there is no relationship between the evolution of the monetary base (driven by the Bank’s purchases of JGBs in large volumes) and the evolution of the inflation rate.

Mr Suga clearly understands that.

The governor of Australia’s RBA does too but won’t admit it.

The reason Japan’s unemployment rate is so low

The Japanese government has not held back in dealing with the pandemic.

Its first stimulus package (April 7, 2020) injected ¥117.1 trillion (21.1 percent of 2019 GDP) into the economy, although some of the announced measures had already been foreshadowed in previous fiscal statements.

On May 27, 2020, it injected a further ¥117.1 trillion (21.1 percent of 2019 GDP) into the economy.

It also pledged $US100 million extra support to the IMF “to provide grant-based debt service relief for the poorest and most vulnerable countries to combat COVID-19” and gave an additional SDR3.6 billion to the IMF Poverty Reduction and Growth Trust.

So, not only looking after its own citizens but also seeking ways to help the worst off nations.

Meanwhile, the Bank of Japan continued to purchase JGBS “without setting an upper limit on its guidance on JGB purchases” (Source).

It is also providing interest-free, unsecured loans to SMEs of ¥90 trillion.

Compare that the Australian situation where the fiscal stimulus has been of the order of only 9.3 per cent of GDP over the period to 2023-24.

The State and Territory governments have added an extra 1.9 per cent of GDP in their programs.

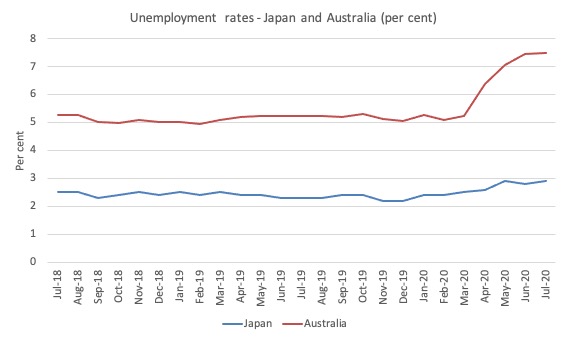

And compare the labour market data that results:

1. The Labour force in Japan has risen by 0.1 points since January 2020, whereas the Australian labour force has shrunk by 1.6 per cent as employment opportunities dried up. In the Australian case, this has meant the official unemployment rate is an understatement of the joblessness that has arisen as a consequence of the pandemic.

2. Employment in Japan has fallen by 0.5 percent, Australia 3.9 per cent.

3. Participation in Japan has remained unchanged but fallen by 1 per cent in Australia (as in point 1).

4. The unemployment rate has risen from 2.3 per cent to 2.9 per cent in Japan (0.6 points) but in Australia it has risen from 5.3 per cent to 7.5 per cent (2.2 points), but noting the official rate is understating the severity of the downturn in Australia.

The following graph shows the evolution of the unemployment rates from July 2018 to July 2020.

The differences in levels and dynamics between the two labour markets is largely due to the fiscal and monetary policy position of the respective governments.

Remember that unemployment is a policy choice.

The Japanese government values the welfare of its people more than the Australian government does.

The latter is more concerned with grandstanding about achieving fiscal surpluses that they never achieve (because they undermine the ambition by killing growth).

How refreshing it is to hear a national leader (of the third largest economy) openly admit the limits on government deficits and debt-issuance are only to be understood in terms of providing jobs and incomes for the citizens.

Conclusion

We will observe Mr Suga’s performance as the new Japanese PM with interest.

Among those who were touted as contenders for the job were some fiscal conservatives who had pushed the sales tax rises.

It is a relief that they have not got to the next step.

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved

Surprised to hear Australians are captive in Australia?

In New Zealand we are allowed to leave as long as we go into quarantine on arrival back.

I understand the Australian Wallabies are allowed to leave and play rugby in NZ.

Very interesting Bill.

Was wondering what Japan would do.

Not sure about these though – It also pledged $US100 million extra support to the IMF “to provide grant-based debt service relief for the poorest and most vulnerable countries to combat COVID-19” and gave an additional SDR3.6 billion to the IMF Poverty Reduction and Growth Trust.

The IMF don’t normally help out they put countries in a debtor’s prison. Who are only allowed out after promising to introduce neoliberal globalist reforms.

Congratulations on your award Bill! Well-deserved indeed. We can all hope that the travel ban will be lifted before too long (as it already has for certain former Prime Ministers…). Also pleased to see you note that Mr. Suga is a conservative. Having a non-ideological understanding of how the economy actually works across party lines is now the critical need everywhere – I have often been surprised by the distress on (progressive) listener’s faces when I explain that both left and right could readily find policies to their liking which are consistent with MMT principles! The coalition’s insistence on cutting JobSeeker will cause tragic and entirely avoidable human and economic damage; yet from that act of vandalism may finally flow the end of the delusion that the Liberals are the “natural economic managers”.

おめでとうございます、ビールさん!

Congratulations on the fellowship award Bill. Here, in the UK, we now have Gordon Brown writing in the Guardian that the Bank of England needs a new dual mandate for unemployment and inflation, as well as the need for better control of the management of destabilising capital flows and an industrial policy. Small steps, from a well-past PM, and in a hypocritical paper I know, but it’s in the right direction.

Also: ‘there is no limit on the issuance of public debt in Japan’. We may in time get to the point where the no limit turns to no need for and where governments take mandates upon themselves, rather than pushing them sideways to the central bank, in order to fulfil their human rights requirements (as noted the other day).

Congratulations on the Fellowship, Bill. Glad the Japanese seem to understand their fiscal capacity. Let’s hope you’re allowed to travel for it.

Enlightening post as always. Thanks. 🙂

Will the RBA’s bond buying program that purchased state and territory government debt allegedly to finance JobKeeper and Seeker, provide the state and territory governments as currency users, with greater fiscal capacity by effectively wiping their debt slate clean?

And if so, can this purchasing of debt be used by the Federal Government to make demands of state governments? For example, could they demand that their borders reopen by a certain time? Or is this not in the interests of the Treasury and the RBA to point out as it would let too much out of the bag?

This is great.

Such huge stimulus is unthinkable in America.

QE didn’t do anything to inflation at all. Turns out bank lending isn’t reserve constrained! Who would have thought!

In reply to Patrick B.

Gordon Brown writing in the Gaurdian is just evidence of no change. After all it considers Tony Blair an International Statesman rather than the international criminal he is.

‘This’ is the view of a ‘Thatcherite’ monetarist.

“In Japan, policy-makers managed to increase the amount of money significantly for the first time in decades, and they are likely to hit their 2% inflation target (or even to exceed it) in the next few years. “

A small question to the author.

In a paragraph you note that “in the June-quarter 2020, total Bank of Japan assets stood at 125.4 per cent of GDP and their JGB holdings were 98.8 per cent of GDP”

The following graph can confuse some readers, I think there is a typo in the names of the curves as BOJ’s JGB holdings (blue) accidentally exceed Total Assets (green).

Otherwise an excellent post.

Dear Timur Zolkin (at 2020/09/07 at 4:07 am)

Thanks very much. I have fixed the graph now.

best wishes

bill

Congratulation Bill on being awarded “the fellowship from the – Japan Society for the Promotion of Science. (JSPS) – which is “Japan’s premier research funding agency” to promote “collaborative research between excellent researchers in Japanese universities and institutes and their overseas colleagues”.

From what I can recall, Japan and other countries (I believe) have created special arrangements for professionals/specialists and people-in-need to travel and in out of their countries.

Maybe you can look into that arrangement, if the usual channels are not possible.

I hope you will have time to get out and explore the city and nature a bit during your visit.

Is there an article specifically on the issue of expansion of monetary base and evolution of inflation rate?

@ Rafael Isaacs

I had already excerpted a blog by Bill on your question. Maybe this will be useful to you:

Regarding Inflation and “money supply”

Excerpt from Prof. William Mitchell blog post 2-1-12

https://billmitchell.org/blog/?p=18007

….There are also those that claim that quantitative easing will expose the economy to uncontrollable inflation. This is just harking back to the old and flawed Monetarist doctrine based on the so-called Quantity Theory of Money. This theory has no application in a modern monetary economy and proponents of it have to explain why economies with huge excess capacity to produce (idle capital and high proportions of unused labour) cannot expand production when the orders for goods and services increase.

Should quantitative easing actually stimulate spending (via increased demand for credit), then the depressed economies will likely respond by increasing output not prices.

What about the relation between the monetary base and broad money (M4)?…

…In the Autumn 2005 edition of the Quarterly Bulletin there was an interesting article – Publication of narrow money data: the implications of money market reform – which discusses the monetary base.

The article says that narrow money (M0) had previously been described as the (wide) monetary base and comprised: notes and coins in circulation plus bank’s vault cash plus bankers’ deposits with the central bank.

The article claims that the “(b)ankers’ operational balances have constituted a tiny component of M0” – which was the case in 2005 – just 1.3 per cent in August 2005.

The article does provide some interesting history of economic thought and demonstrates the influence that mainstream macroeconomics has had on monetary policy practice.

It says that:

In the second half of the 1970s, UK counterinflationary policy came to place greater weight on measures of aggregate money than before, evidenced by the publication of annual intermediate targets for broad money growth. The Conservative government elected in 1979 initially maintained targets for broad money growth, but, influenced by academic economists, it also considered monetary base control as an alternative technique to achieve its medium-term objective to reduce inflation.

Regular readers will recognise this as the three-fold myth of mainstream thought:

1. That there is a money multiplier which says that the money supply is a causal multiple of the monetary base.

2. That the central bank can control the money supply because it can control the monetary base.

3. That such control reduces inflation risk, because inflation occurs when the money supply grows.

I have written several blogs outlining why this causal chain of thinking is an incorrect depiction of the way central banking works and the influence of its operational decisions on the money supply and inflation.

Yesterday’s blog – Latest ECB data shows how bad things have become in Euroland – is a good place to start.

I covered the base money-money supply relationship in these blogs among several – Money multiplier – missing feared dead and Money multiplier and other myths.

Further, the following blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – provided relevant analysis.

[blog post continues]

Professor Mitchell,

Congratulations on the fellowship, it is well deserved.

Best,

Justin Holt

Congratulations, prof. Mitchell.

You gave me your autograph when you came to Japan last November, which is one of my treasure.

I would be looking forward to seeing you again, professor.

As to Suga-san, I’m very concerned.

While indeed Suga-san said there’s no limit to bond-issues, he had said in another interview that elevation of consumption tax beyond 10% will be inevitable in near future, though he quickly withdrew and added it’s not necessary for 10 years in the face of criticism.

https://asia.nikkei.com/Politics/Japan-after-Abe/Suga-says-consumption-tax-hike-inevitable-then-backtracks#:~:text=TOKYO%2FNEW%20YORK%20%2D%2D%20Chief,citing%20the%20rapidly%20aging%20population.

Also, when asked about his slogan as the prime minister, he said on TV, “self-help, mutual help, and public support”, which is almost the same as “There’s no such a thing as society”.

What should be most concerned about him is that he is very close to Heizo Takenaka, who is an infamous neoliberal economist believed to be responsible for cruel austerity during Koizumi-era.

Briefly, he is more neoliberal than Shinzo Abe, and it would be no surprise to me that his administration would utilize the currency-issuer capability to provide further support only to the rich and wealthy.

Suga more neoliberal than Abe?

Disappointing; but maybe nevertheless MMT may find more fertile ground in a non-Anglo culture such as japan which is typically less enamoured with individualism, than our own culture. (And China also?)

Bill’s recently awarded fellowship in the Japan Society for the Promotion of Science might indicate this possibility.

Meanwhile I only see resistance to MMT, in Oz. But hopefully one funeral at a time, in academia…and the new MMT textbook is out there now.

Bill this post is another historical marker of yours – one of those points in time the tectonic plates shifted a little.

Can you share your data sources please ?