These notes will serve as part of a briefing document that I will send off…

RBA governor adopts a political role to his discredit

Last week, the Reserve Bank of Australia governor, Philip Lowe, confirmed that the claim that the central bank is independent of the political process is a pretense. The Governor was adopting a political role and made several statements that cannot be analytically supported nor supported by the evidence available over many decades. He is insistent on disabusing the public debate of any positive discussion about Modern Monetary Theory (MMT), which, of course, I find interesting in itself. More and more people are starting to understanding the basics of MMT and are realising that that understanding opens up a whole new policy debate, that is largely shut down by the mainstream fictions about the capacities of the currency-issuing government and the consequences of different policy choices. People are realising that with more than 2.4 million Australian workers currently without enough work (more than a million officially unemployed) that the Australian government is lagging behind in its fiscal response. They are further realising that the government is behaving conservatively because it still thinks it can get back to surplus before long and so doesn’t want to ‘borrow’ too much (whatever that means). An MMT understanding tells us that the government can create as many jobs as are necessary to achieve full employment and the central bank can just facilitate the fiscal spending without the need for government to borrow at all. They are asking questions daily now: why isn’t the RBA helping in this way. The denial from the RBA politicians (the Governor, for example) are pathetic to say the least.

The occasion was the presentation of the RBA Annual Report 2019 to the – House of Representatives Standing Committee on Economics (August 14, 2020).

The full exchange is available in – The Hansard.

Here is the – Opening Statement to the House of Representatives Standing Committee on Economics – by the RBA Governor.

The RBA Governor is obviously under pressure given the scale of the damage being caused by the pandemic and the obvious shortfall in the fiscal response from the Australian government.

People are increasingly asking why is the RBA not using its infinite currency capacity to gave a speech where h

On July 23, 2020, he gave a very political speech along these lines, which I analysed in this blog post – RBA governor denying history and evidence to make political points (July 23, 2020).

I won’t repeat what I wrote there but I discussed the notion of a ‘free lunch’ and ‘inflation taxes’ and issues that the RBA governor raised again in his appearance before the House of Representatives’ Committee.

Here are some issues that arise from his appearance last Friday.

In his Opening Statement last Friday, the Governor chose to continue this deception, clearly aiming to avoid any Modern Monetary Theory (MMT) inference:

One monetary policy option that has been the subject of public discussion over recent months is the possibility of the RBA creating money to directly finance government spending.

For some, this offers the possibility of a ‘free lunch’.

The reality, though, is that there is no free lunch. There is no magic pudding. There is no way of putting aside the government’s budget constraint permanently.

As I spoke about in a talk last month, it is certainly possible for a central bank to use monetary financing to affect when and how government spending is paid for. Depending upon how things are managed, it can be paid for through the inflation tax, by implicit taxes on the banking system and/or higher general taxes in the future. But it does have to be paid for at some point.

I want to make it clear that monetary financing of the budget is not on the agenda in Australia. The separation of monetary policy and fiscal financing is part of Australia’s strong institutional framework and has served the country well. The Australian Government and the states and territories have ready access to the capital markets and they can borrow at historically low rates of interest.

So this is his repeating theme despite the fact that the RBA has already purchased $A45,250 million worth of Australian Government bonds under its so-called – Long-dated Open Market Operations.

I discussed this program in this blog post – The Australian government is increasingly buying up its own debt – not a taxpayer in sight (May 26, 2020).

The Government has not been saying much about this program for obvious reasons.

They don’t want the public to know that one arm of the currency-issuing government is accumulating a large proportion of the liabilities issued by another arm (Treasury) to follow the rise in the fiscal deficit.

If they explained what was going on in the real world to the public, it would become very clear that the central bank is effectively ‘funding’ a significant proportion of the increase in the fiscal deficit than any notion of some taxpayer account or the reliance on private bond markets.

It would also disabuse the public of notions that such coordination between the central bank and the treasury, which is at the heart of the understanding you get from learning about Modern Monetary Theory (MMT), is dangerously inflationary.

In their information sheet – Supporting the Economy and Financial System in Response to COVID-19 – the Reserve Bank of Australia outlines a number of policy innovations they are pursuing to help protect the economy and the financial system.

Among these measures they write:

Provide Liquidity to the Government Bond Market

The Reserve Bank stands ready to purchase Australian Government bonds and semi-government securities in the secondary market to support its smooth functioning. The government bond market is a key market for the Australian financial system, because government bonds provide the pricing benchmark for many financial assets. The Bank is working in close cooperation with the AOFM.

You can also view their more detailed explanation of what they are doing in this regard at – Reserve Bank Purchases of Government Securities.

As I explained in the blog post cited above, the RBA is crediting bank reserves (the Exchange Settlement Accounts (ESAs)) in return for bond purchases.

These bonds have been issued in the primary bond markets and then bought and sold generally in the secondary market where the RBA buys them.

In its explanatory note, the RBA seems they need to set up the smokescreen in this way:

The Bank stands ready to purchase Australian Government bonds across the yield curve to help achieve this target. The Bank purchases Government bonds in the secondary market, and does not purchase bonds directly from the Government.

They could have added – ‘As if any of that matters’!

The point is that the primary bond dealers can reasonably anticipate that the RBA will purchase debt from them.

The complete data set is available via the RBA statistics – Monetary Policy Operations – Current – A3 – then go to the worksheet “Long-Dated Open Market Operations”.

What do we learn?

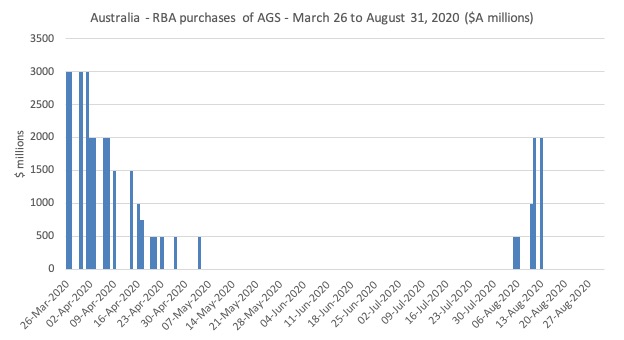

Since March 26, 2020, when the purchases began, the RBA has purchased a total of $A45,250 million million worth of Australian government bonds (at varying maturities and yields).

Here is the pattern of purchases of Australian Government securities by the RBA since March 26, 2020.

In his interaction with the House of Representatives Committee, the Governor repeated the point made in his introductory with a more specific reference to MMT:

One monetary policy option that has been the subject of recent discussion is the possibility of the RBA creating money to directly finance government spending-so-called MMT. To some, this offers the possibility of a free lunch. The harsh reality, though, is there’s no free lunch. There’s no magic pudding here and there’s no way of putting aside the government’s budget constraint permanently.

He then went on to say: “But, looking forward, there are limits to what more we can do. I think the main policy instrument we really have now is fiscal policy.”

He was asked whether this means that monetary policy has run its course and he replied:

I don’t think that at the moment we would get any traction from making adjustments …

And then proceeded to make a series of political statements outside of his official role as central bank governor:

1. Reforming industrial relations – read, further deregulation that has already dramatically undermined the ability of workers to share in productivity growth, created a working poor underclass, cut the wages of the lowest paid, and more.

2. Further deregulation – to reduce oversight on private infrastructure projects, reduce “planning and zoning restructions” (read: make it easier for greedy property developers to invade neighbourhoods and build more towers that later have to be abandoned due to shoddy construction techniques).

He was asked by one Committee member whether the RBA should provide the government with “zero per cent loans” to fund a full employment program, given the scale of the labour market disaster and the stated claim by the Governor that the key issue facing Australia was job creation.

Readers are also reminded that the – Reserve Bank Act 1959 – Section 8, empowers the central bank “to buy and sell securities issued by the Commonwealth and other securities”, “to establish credits and give guarantees” and more.

Also note that under Section 10 Functions of the Reserve Bank Board, Clause (2):

It is the duty of the Reserve Bank Board, within the limits of its powers, to ensure that the monetary and banking policy of the Bank is directed to the greatest advantage of the people of Australia and that the powers of the Bank under this Act and any other Act, other than the Payment Systems (Regulation) Act 1998, the Payment Systems and Netting Act 1998 and Part 7.3 of the Corporations Act 2001, are exercised in such a manner as, in the opinion of the Reserve Bank Board, will best contribute to:

(a) the stability of the currency of Australia;

(b) the maintenance of full employment in Australia; and

(c) the economic prosperity and welfare of the people of Australia.

In other words, the legislative responsibility of the RBA is to maintain full employment with price stability so that all people in Australia are prosperous and secure.

The RBA governor replied to that question with this simpering nonsense:

There’s less cash flow expended in the short run; that’s right. You’re not paying interest on these bonds, and, if you issued in the market, you would have to pay interest. But now the central bank has an asset that’s earning no money, and then, over time, there will be lower profits at the central bank and lower distributions to government, and there will have to be a tax compensation for that. So it’s incorrect to think that providing this financing the other way ultimately lowers the total cost of finance. It doesn’t.

Which is a straight out lie.

This is right pocket of government talking to the left pocket of government stuff.

The RBA doesn’t have to earn money.

The RBA could pay the Treasury any amount it chose at any time.

There would not have to “be a tax compensation for that”. That statement assumes some rigid fiscal position has to be attained so that if the government doesn’t pay itself RBA profits as dividends it has to raise tax rates.

It never has to do that.

The discussion continued, with the Committee member demanding to know why the RBA wouldn’t just fund a full employment program.

The Governor replied:

I take issue with the idea that the government can borrow more cheaply through us. Certainly, the financing costs this year would be cheaper if we gave them interest-free loans. But, ultimately, that still has to be paid back, and there would have to be some adjustment in the system-there would have to be higher taxes or something-to compensate for that. Money creation doesn’t change the ultimate amount of resources the government has to raise to pay for its spending.

A lie.

The government’s right pocket could put numbers in the left pocket and not worry about ever being ‘paid back’. It could simply say that the numbers are a gift to the left pocket.

End of story.

The governor went on:

What gets people back into work is the fiscal spending. I agree with you that that is something we should be looking at-how much fiscal spending we have to get people back into work. I think where we disagree is on how that should be financed. I do not see monetary financing changing the total amount of resources that need to be raised by the government in the end …

A lie.

Right pocket puts a big number into the left pocket then when people are getting jobs, one day, decides to make the number that it recorded against the left pocket, zero.

End of story.

A totally different scenario to issuing bonds to the private investment market, which have to be paid back with interest.

Later in the session, the Committee Chair (a conservative politician) disgraced himself with this statement:

Just quickly going back to what you called the ‘financial trickery of modern monetary theory’-and I very much welcomed the comments you made in your opening statement which clarified that rather than having to go through a long line of questioning …

The question that followed was about inflation (obviously), to which the RBA governor went further into the mire of lies:

Monetary financing of the budget deficit can lead to inflation, and that has all sorts of problems. It’s not guaranteed that we end up in the high-inflation situation for monetary financing, but it’s certainly possible …

Do we think it is okay for an economic system to run in a way where the government has its objective to use fiscal policy to keep things on a very even keel? I would say the history of that in the past has not been particularly good. Neither has the history of governments being able to stop doing this when inflation starts to rise. That’s why we ended up with the monetary arrangements we have …

The best way for government to meet its spending commitments is to borrow in the market rather than going to the central bank, and we can do that.

The reality is that the “monetary arrangements we have” were reflecting the ideological attack on active fiscal policy that accompanied the abandonment of full employment and the neoliberal surge.

Unemployment became a policy tool rather than a policy target.

We haven’t come close to full employment since the government imposed these restrictions on itself in the 1980s.

The monetary arrangements we have undermine prosperity and have allowed national income to be redistributed away from workers towards capital.

The RBA governors comments here just reinforce the neoliberal ideology.

Perhaps the Governor should explain this data

The Bank of Japan has been trying to produce an ‘inflation tax’ for year through its various quantitative easing and QQE programs.

They have not been successful, which is the same experience that the ECB has encountered with its huge public bond-buying programs.

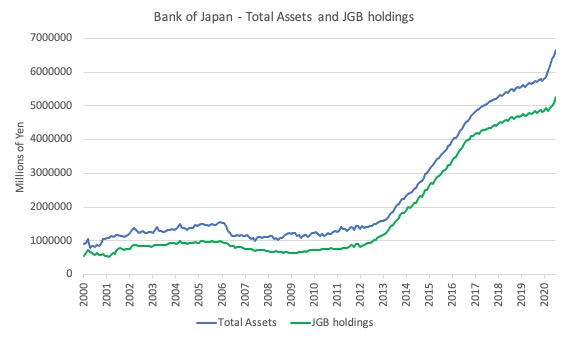

First, the next graph shows the Total assets held by the Bank of Japan as a per cent of GDP (blue line) and the proportion held as Japanese Government Bonds between the March-quarter 2000 to the June-quarter 2020.

In the June-quarter 2020, total assets stood at 125.4 per cent of GDP (and JGB holdings were 98.8 per cent of GDP)

This particular statistic doesn’t matter one iota and just reflects the Bank of Japan’s large government bond purchasing program over the last 20 years.

The fact that buying JGBs in large volumes hasn’t caused any acceleration in the inflation rate demonstrates how ineffective monetary policy is in influencing the path of the inflation rate, despite the massive increase in central bank assets.

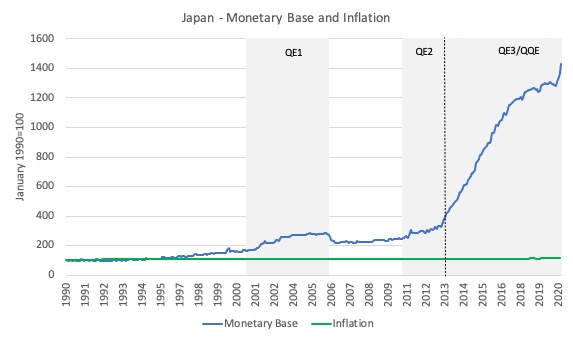

Now study the following graph, which shows the growth in the monetary base in Japan, driven mostly by the quantitative easing programs, and the inflation rate (both indexed at 100 in January 1990).

The Bank of Japan’s quantitative easing history began in earnest in March 2001 (QE1) and this increased the BOJs monetary base by around 66 per cent.

The Bank terminated that program in March 2006, whereupon the Bank sold down some of its holdings of JGBs (also shown in the graph).

A second (QE2) program began in October 2010 and as time has passed it has become QE3 and QQE, which is a much larger scale intervention that that began in April 2013 and continues at a pace today.

The monetary base increased by 36 per cent during QE2 and by, wait for it, 279 per cent in QE3/QQE to date. Not a small number.

You would expect if the mainstream macroeconomics predictions were robust then they should have materialised by now given these relative policy extremes.

The graph shows the evolution of these indexes up to July 2020.

At that date, the monetary base index was at 1429.6, while the CPI was at 101.7 (hardly shifted).

The overwhelming conclusion is that there is no relationship between the evolution of the monetary base (driven by the Bank’s purchases of JGBS in large volumes) and the evolution of the inflation rate.

One could argue that the reversal of QE1 revealed a lack of commitment by the BOJ to really drive the inflation rate up. My assessment is that QE doesn’t work whether it is extended for lengthy periods or not.

The reversal that followed the introduction of QE2 just reduced the monetary base (and the total assets held by the BOJ).

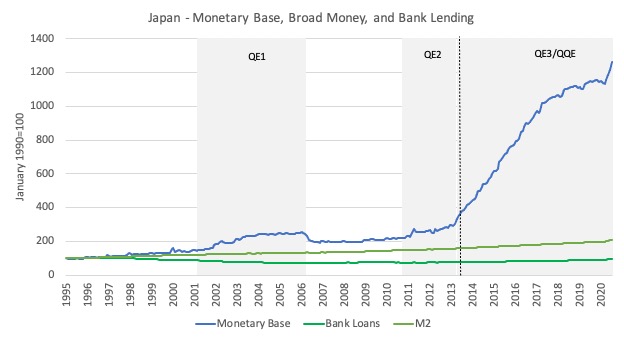

The RBA governor referred to ‘liquidity’ – saying that Australia was “flush with liquidity”. Tied to the rejection of any larger bond purchases, he was rehearsing the standard mainstream line that ‘too much liquidity’ would be inflationary.

But ask yourself what would drive an inflationary spiral.

The answer is that if bank lending increased dramatically and the broad money supply increased, which was a reflection of private spending growth, then that might trigger such a spiral.

How?

By driving total nominal spending growth ahead of the capacity of the productive side of the economy to respond with increased production of goods and services.

The classic Quantity Theory of Money posits that if broad money growth rises, with stable turnover (velocity) of the money stock, then if the economy is at full employment then the only thing that will respond is the price level.

This is the classic Monetarist argument.

They also tie in central bank behaviour to the theory via the money multiplier, which posits that if the monetary base rises, then the broad money supply will increase by some multiple (that is determined by behavioural parameters).

The problems with this approach are many but for our purposes consider the following graph, which shows the growth of the monetary base since January 1995 and bank lending and the broad money supply measure, M2, also indexed to 100 at January 1995.

What do you see?

Nothing of interest in relation to the mainstream claim.

The point is that the massive increase in bank reserves during these QE and QQE episodes did not stimulate bank lending nor the broad money supply.

So while bank reserves have risen (increased ‘liquidity’) the broad money supply has not risen much at all (another measure of ‘liquidity’).

The RBA governor is thus in denial of this reality and is just rehearsing the tired mainstream arguments that haven’t ever been correct.

Conclusion

A sad intervention from the so-called ‘independent’ central bank.

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

Evening Bill,

Do you think some of the confusion comes from what is now the prevailing preference of calling it Modern Monetary Theory rather than Modern Money Theory?

For myself I consider both fiscal and monetary policy to involve money thus it is money-tary. Therefore I think the blinders are deliberate.

Randal Wray calls it Modern Money Theory Sennex.

I don’t think it’s an issue.

Hi Bill

Could the issue the RBA governor be concerned about be the risk of ‘dollarisation’ of the currency is it provides an open cheque book?

Bill,

Could a legal challenge be made against the RBA for failing to meet its remit/ obligations ? Perhaps you could appear as a key witness!

Regards

He completed a doctorate in 1994 at the Massachusetts Institute of Technology (MIT), with Paul Krugman as his adviser.He worked at the Bank for International Settlements in Switzerland, as head of its Financial Institutions and Infrastructure Division.

GROUPTHINK is strong with this one. Krugman didn’t understand bank lending thought reserves get loaned out.

What he learned at the BIS was Wall Street should be the allocator of resources – and should starve the government to “save taxpayers” (or at least the wealthy). He wants a balanced budget or surplus, saying, he doesn’t want the government to fund public infrastructure. He wants it to be privatised in a way that will generate profits for the new owners, along with interest for the bondholders and the banks that fund it; and also, management fees. Most of all, the privatised enterprises should generate capital gains for the stockholders as they jack up prices for public services. Governments should keep out of the way banks should create the currency.

It’s the BIS approach alright – Bullshit in Speeches approach.

Hello Bill, As a layperson I have difficulty with government created money (i.e. its own currency) being called debt.

Debt to me is money I borrowed from someone else and need to pay back.

Government created money is just something the government has created.

It is maybe like a song someone created and copyrighted and can create copies of it to sell or give away.

We are not classed as being in debt when we create things.

Government created money can be similarly given away for all kinds of projects to benefit the country and to pay taxes at which point it is destroyed.

Basically I see no reason to call this money by the misleading title of debt and then say it isn’t real debt because we can’t be in debt to ourselves.

To the public this is an insane illogical statement.

A small step forward would be to call it “government created money (GCM)”. With a small explanation that it is not owed to anyone and cannot be included in our list of debts.

If we don’t owe it to anyone and we can create more if we want to it is really nothing like debt.

So the bottom line to end the discussion is to be brave and keep things simple and stop calling it debt.

Explain why it is created and how it is needed and used.

This will then make sense to the public.

We need a big sign that says GOVERNMENT CREATED MONEY IS NOT DEBT BECAUSE WE DON’T HAVE TO PAY IT BACK. Once the public understand this one thing we will have made a big step forwards.

Ron

Since MMT means the central bank governor role is redundant (and can be replaced with an anonymous civil servant), it’s hardly surprising that they get upset about MMT.

“It is difficult to get a man to understand something when his salary depends upon his not understanding it.”

Ron makes a point I’ve tried to make repeatedly. Perhaps his effort will be more successful than mine. The suggestion Ron and I are making, if I might broaden the subject a bit and, perhaps presumptuously, assume that Ron would go along with the elaboration, is that MMT has chosen, perhaps feeling forced by convention, to use neoliberal economic language to explain its quite different–indeed, polar opposite–concepts. Ron cites the example of calling fiat money, “debt.” I have also cited the example of calling the investment of fiat money by a currency-sovereign government, “spending.” Or again, calling the excess of that investment over tax and bond revenue, a “deficit.” On could go on with other examples where MMT has used (while quickly attempting to distinguish or qualify) neoliberal economic language, with all of its conceptual baggage (by implication, connotation, traditional meaning, etc.), to try to explain its alternative, sharply divergent view of macroeconomics. There’s an old saying to the effect that you cannot take down the master’s house with the master’s tools. IMHO, this is especially true of the “house” of macroeconomics and the “tools” of economic language, and this helps to explain, at least for me, much of the confusion (deliberately created or naturally arising) about MMT, confusion so clearly reflected in this post by Bill and countless others. By the way, only in a twisted hyper-capitalist world of engineered scarcity and relentless competition would a free lunch be considered a bad, impossible thing rather than a blessing.

“The reality, though, is that there is no free lunch.” Apparently, that wholly depends on which side of the economic equation you stand and where the respective profits and losses flow.

And it certainly may be the case in specific instances, but it is certainly not the case generally for the owners of capital, under the current economic arrangement, as both the idea and the application of the principle of the ‘economic free rider’ appears to be an essential component for profit maximization. Taxpayer liability for abandoned mine remediation and other assorted economic externalities or spillovers, is one example.

Further, the current state of political economies, generally, seems to be an uncanny reflection of the observations made by Salvemini more than eight decades ago,

“The Charter of Labour says that private enterprise is responsible to the state. In actual fact, it is the state, i. e., the taxpayer, who has become responsible to private enterprise. In Fascist Italy the state pays for the blunders of private enterprise. As long as business was good, profit remained to private initiative. When the depression came, the government added the loss to the taxpayer’s burden. Profit is private and individual. Loss is public and social.”

See, Gaetano Salvemini, “Under the Axe of Fascism” (New York, NY: Viking Press, 1936), pp. 377-382.

Hi Ron and Newton,

I’ve always thought that calling government created money “debt” as needlessly distracting.

Neil might offer some insights here but I think of it as a problem arising from the application of 15th century double-entry accounting to modern fiat currency, analogous to attempting to use Newtonian physics to explain quantum mechanics.

“GROUPTHINK is strong with this one. Krugman didn’t understand bank lending thought reserves get loaned out.”

Derek, I remember (and lest we forget) that famous exchange Krugman had with a bunch of MMTers on his NYT OP where he asked dismissively “where do you think they get the money [to lend]”.

Not hard to find the genesis of Lowe’s irrational antipathy to MMT.

Government issues IOU’s in exchange for goods and services provided by the private sector to the government. So it is a debt. It accepts it’s IOU’s back when taxes are levied.

Like William, I don’t have a big problem describing money as government debt. It takes explaining to the ordinary citizen, but then the whole banking system takes explaining to the o.c., and we can cover money-as-debt on the way through.

The strange differences from commonly-know private-sector debt are:

1) money debt has no due date

2) the lender of money debt has no recourse to collect the debt

3) the only way this lender can be made whole is to

.a) buy a product that the government sells for a price (eg. permits, etc.)

.b) wait for the government to charge tax and extinguish that new debt with some of the money debt

.c) transfer the debt to somebody else for something valuable.

a) and b) are sort of the same: they’re ways to incur a debt to the government that can be extinguished with money.

3c) is probably the most common way of handling this debt

I went to the supermarket, and brought a big bag of rice to the cashier. The cashier did some things, then I put a little piece of plastic into a slot, a machine blinked “$12?”, I pushed a green button labelled “YES”. After that, the supermarket felt obliged to let me just walk out with a 12lb bag of rice. What’s up with that? How did that work? I swapped an obligation for an obligation. That’s not how I thought of it at that instant, nor how I think of it most times, but it’s part of a comprehensible theory of money.

A worrying trend toward movement to pull fiscal powers out of the hands of any level of democratically elected government.

To that, we can point out what happened when unelected parties were given the power to control monetary policy, and then ask: what difference would giving them fiscal power make in the general trajectory being followed?

I love how RBA violates its own clause on promoting economic welfare and full employment.

Do people even know their own institution’s mission statement?

Dear John Armour,

I believe Bill calls it that as well. As I noted though, the prevailing preference is ‘monetary’.

The Governor of the RBA says “The first order issue-and I think this comes back to modern monetary theory as well-is the idea that the government should just keep spending to achieve its objectives. It’s called modern monetary theory; it’s really some propositions about fiscal policy. The first proposition is that the government should just keep spending to achieve their objectives-either full employment or inflation or whatever. The second proposition is that it shouldn’t worry about financing. But the first proposition is that the government should keep spending. So modern monetary theory really isn’t about anything monetary; it’s really about fiscal.”

So John, if this is the prevalent attitude of those outside the MMT community and I suspect it is – we need to remedy it. That’s why we end up seeing QE=MMT or MMT = monetising debt. Now MMT has a toe-hold on the platform this needs to be addressed (if only they would read the literature).

“I’ve always thought that calling government created money “debt” as needlessly distracting.”

It’s deliberate. “Debt” is pejorative and scares people. It’s a boogie monster. It’s a scare story trick that is very similar to the excessive hysteria over the current virus. That’s how you control people. Scared people are easier to direct.

What people don’t understand is that to anything that operates like a bank, debts are assets. And the government sector operates like a bank.

The trick I use is to turn it around. Don’t try and explain government spending to an individual. Ask the individual to imagine that they are spending like a government.

– they decide what the interest rate is

– they decide how much the bank is going to advance them

– you can pay it back with another loan from the same place

– the bank can demand no collateral and has no choice about whether to advance.

– if anybody at the bank says no, you can sack them and replace them with somebody who will say yes.

Then ask what restrictions they would feel under in that situation.

“So John, if this is the prevalent attitude of those outside the MMT community and I suspect it is – we need to remedy it.”

That’s very easy. We should say that the Job guarantee is paid directly by the central bank (using “QE techniques”), not Treasury. After all it is their failure of interest rate setting that leads to unemployment (in their mind). Therefore those who fail (Lowe) should pay for their failure.

That would determine if he believes the crap he spouts or not. Is he prepared to put his money where his mouth is?

The mistake Lowe is making is seeing “government” as what he thinks is government “Treasury”, when MMT means “government sector”.

“So modern monetary theory really isn’t about anything monetary; it’s really about fiscal.”

Somebody should explain to Lowe that the word “monetary” has other meanings outside the confines of his bailiwick.

If that’s the best that Lowe can come up with Senexx I don’t think MMT has much to fear from the governor. It’s a pathetic argument, somewhere between semantics and spelling.

Besides, if one is looking for the essence of “money-ness”, or to borrow your term “money-tary”, fiscal policy is where all the “monetary” action is.

Lowe would probably like another term as governor of the RBA (on $1 million a year!) so taking a punt on the return of the Coalition government and dropping all pretense of political neutrality makes sense if one doesn’t take the governor’s responsibilities under the charter too seriously.

Hi Bill, yes , I think P. Lowe is abusing his position. Alternatively, just telling government what he thinks they want to hear.

I’ve tried writing to my local federal member, plus Anthony Albanese, plus Josh Frydenberg about the need to change and the need for a Job Guarantee.

So far, after a month, no response and I’ll probably be accused of being an armchair theoretician.

I think part of the problem is that the subject matter is quite difficult (after all we have been in an economic rut for 200 years), so how do we best present what is basically a new approach, to the government. As a starting point we have to recognise that the government will never ask a question to which they don’t already (think they) know the answer. This is quite a stumbling block. So, how to resolve it? I don’t have any ready answers, beyond education, which will take a long time.

Personally, I like the idea of a mathematical model, complete with stock-flow consistency, perhaps using Steve Keen’s Minsky. The question is, how do we get such a model in front of the people who are setting policy?

These are difficult issues, and while we all see the truth/logic of the MMT approach, persuading others of that truth is the most difficult problem. I hope someone out there has solutions I can’t see ?

Regards,

Mike

@ Neil Wilson

“The mistake Lowe is making is seeing “government” as what he thinks is government ‘Treasury’, when MMT means ‘government sector'”.

But is it a mistake? To me it seems that by citing Upton Sinclair’s maxim you already gave the complete explanation of Lowe’s behaviour.

He is, transparently, out to present the RBA – hence himself – as an autonomous agent completely independent of the elected government (which is to say, accountable to no one but itself). That, I suggest, is his paramount (undeclared) aim, dwarfing in his mind all others (like the merely incidental one of discharging the actual responsibilities imposed upon him by statute).

To achieve that strategic aim he will bend and obfuscate the truth to any extent that may be necessary.

Sheer mendacity. (And, as Bill says, arrogating an overtly political role to himself into the bargain).

There is no doubt that every central bank wishes to present itself as the “supreme court” of a nation’s currency – above mere elected entities and answerable to nobody but God (aka the market).

That is the basis of the New Keynesian synthesis mindset.

Mel

Wednesday, August 19, 2020 at 10:05

Dear Mel,

I skimmed through all the nice comments while I have my coffee this morning and came across your’s of debt.

As that is what it is in my mind too, like William and many others have shown and/or understood.

But it just happened that your explanation helps me realize that I would use a different term from ‘I swapped obligation for an obligation’ in that particular situation.

The reason being that in the double-entry booking keeping I learned from MMT, one’s liability become someone else’s assets.

When we received, say payment from government say, by selling our products to them, one side is debt (government side), but on my side it would be asset.

So, if I walk in to a grocery store, I would be swapping one form of asset to another, a kilo of rice here (even though, technically, it is obligation to an obligation).

That would be the term I would use for my own understanding in this case.

What do we think…

Have a nice day.

vorapot

I know it’s off topic, but I’d like Bill’s thoughts on the current stock market surge, and the effects an MMT approach would have on the market. My (limited) understanding is that the stock market is surging due to the massive amount of liquidity in the system looking for a home (reduced business activity, property slumping, etc) – and amplified by the huge fiscal input of governments. If governments spent large amounts more, would that inflate the share market even more?

What was going through my mind was, I walked into the supermarket with a supply of government’s obligations to me. In the transaction, I converted some of them to government’s obligations to the supermarket. In return the supermarket had to let me take the rice.

It’s a strange, abstract formulation, but it has historical roots. It completely matches the way the Bank of England was founded.

And anytime I think about money, it turns into a strange, abstract thing. The ideas that seem to help me turn out to be situational Geldspielen (where I imitate, or maybe parody, Wittgenstein’s Sprachspielen.) Seems to be the way to get any handle at all on this made-up communication system through which we deal with each other. Alternative Geldspielen can be proposed, and we can compare and contrast.

The type of lying he does, rehearsed, deliberate and repeated, let’s you know he’s actually hostile to the public. He’s what is considered an enemy.

I find Bill Mitchell’s evidence-based macroeconomics refreshing, clear and a tonic for optimism.

“and the effects an MMT approach would have on the market. ”

What MMT tells us is that inflation targeting and the manipulation of the interest rate is an artificial market manipulation that *suppresses* asset prices in return for a stream of government funding to banks and finance houses (interest on reserves or interest from bonds)

When you remove the stream of government funding from the finance sector (and give it to the unemployed instead via a Job Guarantee), the yield on private sector assets becomes more valuable which drives up asset prices.

Inflation targeting (via interest rates and government bonds) is essentially the government paying the finance sector to suppress asset prices.

Neil W,

Then what is the current QE and handouts to the rich, but MMT being used to jack up asset prices.

BTW- this as jacks up rents on apts. and commercial properties, which hurts renters and small business people.

I think you didn’t consider that.

.

as jacks => also jacks

Steve, is your question ‘Do the people who are doing those objectionable things understand how MMT explains economics’? Because you would have to ask them. They are responsible for their actions in any case- don’t blame Neil for what they do. I doubt they base their actions on his advice.

As it is, I don’t understand what Neil is talking about here either. If that is any consolation.

Jerry Brown,

No that was not my question.

Neil W. wrote,

[q]What MMT tells us is that inflation targeting and the manipulation of the interest rate is an artificial market manipulation that *suppresses* asset prices in return for a stream of government funding to banks and finance houses (interest on reserves or interest from bonds).[/q]

T me that sounds like MMt is being used to rapidly increase asset prices.

Neil seemed to think using MMT reduces the growth in asset prices.

It seemed like the opposite of what Neil says will happen.

.

Can I ask a question please, with lots of questions intertwined? Would I be right in thinking, for those that would desire to use a Sovereigns legal liability for ‘bank money’ in a beneficial manner to reduce their own personal liability within the private sector. Would it be possible that they allow the private sector debt to build (bubble) and then as a mass default/bankruptcy occurs the creditors cash in on the State liability to pay for those liabilities. Interest is gained throughout these transactions without a down side to the debt market investors, as people within the private sector default and achieve bankruptcy. Is that how safeguards on the creation of currency for public good use are bypassed, when the currency is injected via the banks. Is that also why banking regulations on the currency deployment were sufficiently reduced, bypassing the State safeguards? Is the periodic crisis that evolves seen as a debt markets pay day, as everyday people go to the wall and have their assets sold at a pittance due to bankruptcy. You would need people in power to allow this to happen, and they would also need to be prepared not to give the full picture. Is this all about legally being able to force a Sovereign liability payout on unreasonable debt risk? If my thinking is right, would it not follow that every single citizen that then has to contribute to the Sovereigns liability, paid out to very few are caught in this derogatory strategy. Is this how global banking can use Sovereigns debt liability as a lawful way to take personal gain from whole nations? If this thinking is close to being right, no wonder banks are filling their boots on over-leveraged debt that has no personal consequence to them or their investors, and can operate with next to no need of bank reserves. I can see why they certainly wouldn’t want change.

Which MMT economists recommend QE type monetary policies? None that I know of.

Bill has also said that MMT is mostly a description of how the monetary economy actually works. And that an understanding of MMT can be used by people across the political spectrum. As in sure- policy can have the effect of increasing asset prices if that is the goal of the policy makers. Blame the policy makers for what they are doing- not MMT for describing what they are doing.

Using the MMT framework we can see that when the government deficit spends, the predicted outcome of the spending is that the interest rate that banks can charge each other when lending reserves among themselves would fall towards zero. And that should work itself through the financial system to lower what is called the ‘risk free interest rate’ towards zero in the absence of monetary policy designed to boost those rates. So you could call monetary policy designed to boost the risk free rate an “artificial market manipulation” that also has the effect of artificially suppressing ‘equity’ asset returns relative to interest returns. If the central bank takes no action (allows the risk free rate to approach zero) equity prices would no longer be ‘artificially suppressed’ by the monetary policy.

Well anyways- that is my understanding of it. Neil might express it differently or just disagree entirely with that explanation.

I am waiting for the fireworks to start regarding QE/monetary base expansion. Temporary monetary base expansion was implemented. Now, with the way things are, there is going to have to be an end point to this action. A decision will have to be made, I am not a betting person but, I would have a flutter that permanent base expansion will become the only viable option. I think that will bring about a tsunami, a short term shock (relatively speaking) for interest rates. Worst of all QE had little effect, maybe if the QE wasn’t stuffed into a top end, almost closed currency loop, it may have fared better, but still nothing to write home about. They are running out of sticking plasters, made up, non-conventional monetary policy says to me ‘panic’, and kicking the can towards a brick wall. I can’t see anyone with any sense advocating the way ‘QE’ has been implemented. Time will tell, and my guess is, there won’t be long to wait. We are living in exceedingly turbulent times. Bill gives me hope.

Maria, there was plenty of ‘fireworks’ from certain quarters claiming how QE was sure to be a hyper-inflationary disaster. MMT said that would Not happen. MMT also predicted QE wouldn’t have much effect- one way or the other- on the economy, and that it was stupid to expect either great things or terrible things as a result of QE. Ten years later and it looks like what MMT predicted was exactly right. ‘Unwinding QE’, if for some reason that was desired (because it is not necessary to do so), would have similarly unspectacular impact on the economy. Save yourself some money and do not bet on any tsunamis as a result of QE type monetary operations 🙂

Jerry Brown,

OK, I stand corrected. You explained what Neil W meant much better than he did.

But, then that is one of my large complaints with Neil, i.e., he fails to communicate.

And, I keep telling my wife and others that there are only 2 reasons to say anything.

1] To lie or to confuse those who hear you in order to gain some advantage.

2] To communicate some idea or knowledge you have to those who hear you, or to ask them something.

. . . When this is your intention, then it falls on the speaker to tailor his/her words to the audience. Speaking *and* failing to communicate is much more a negative reflection on the speaker than the listener.

.

It is not that they used base expansion, but the level and way that they used it. The exponential expansion does not reflect real economies. The over leveraged private sector debt ceiling will breach again on the next mass default/bankruptcy, when it is no longer continuously spoon fed. There are a lot of variables at play and god only knows what ‘non-conventional monetary policy’ will be implemented next to move numbers around the private sector spreadsheets, further inflating asset bubbles. Over leveraged value will come home to roost at some point. How long is temporary? What is the difference between temporary and permanent base expansion? I could be wrong, however learning all the time. Kindest regards Maria.

Steve@ 12:52, I disagree with what you said and also with how you said it.

Maria, MMT considers QE to be a swap of financial assets. As such, assuming the price paid for the assets by the central bank reflected actual value (still a questionable assumption to me), it would do very little to repair over-leveraged private sector balance sheets. MMT recommended expanded government deficit spending which has the benefit of improving the private sector balance sheet.

Jerry, can we just agree to disagree?

Neil Wilson,

You have said at least twice that the UK Gov. should use unlimited deficit spending to fund the MMT JGP. I think you said once that actually the Bank Of England should do it ‘off the books’.

Along with the above statement, you twice have said that all other UK spending should be done just like it is now.

I’m 99% sure that this is not what any of the core MMTers have said.

Do you contend that your 2 above statements (that I may have not understood correctly, if so then I’m sorry) are core MMT ideas?

If no, then did I miss understand you? Otherwise, please explain why you said them. If yes, then please explain how they are core MMT ideas. Show me how I don’t understand this core MMT teaching.

Core MMTers talk about planning so as to not use resources that are already being used. You don’t talk about that.

A genuine question to us since we are on the topics of money, banking, assets, interest rates, QE and the likes.

The question is – where I live, in the past 5 years, our currency (baht) has been quite strong. Let’s say it has appreciated by 10% year to date, for the sake of simplicity.

Does it mean that if our GDP is 15 trillion bahts this year, the Central Bank or the Government can expand our ‘fiscal space’, or the money supply by say 10% (of the GDP) as well, if we want to stimulate our economy (acknowledging all the rules, regulations, law, constraints we might put on ourselves).

Could this be a mathematical/logical plausible way to look at things? (I understand all that about deficit spends and the MMT perspectives/lens quite well (I hope), but i just want to find a hard/tangible sales pitch for the people or the policy makers, in case they can be convinced better).

Many kind thanks in advance, and have a Sunday evening!

As far as I can see, the currency appreciation relative to other currencies means:

– people will be tempted to import more

– foreigners will be tempted to buy less

– the goods/ services available on the national market will increase by whatever additional amount is not exported to foreigners. I don’t know that that will be 10%, but that will be the increased fiscal space that the government can work with.

Dear Mel,

Many thanks for your insights!

And if i understood you correctly, when you mentioned in the response earlier regarding the ‘Wittgenstein’s Sprachspielen, or that we need an alternative Geldspielen’, I think it is pretty much what I (we) am doing now – findings alternative ways and means to communicate with one another in the hope for better outcomes.

Danke schoen and have a nice week!

vorapot