In the annals of ruses used to provoke fear in the voting public about government…

RBA governor denying history and evidence to make political points

Today, the Australian Treasurer is out in force telling us that the fiscal situation is dire and that they have to start making cutbacks. Meanwhile in the real world, the unemployment rate continues to rise, businesses continue to fail, and the lowest paid workers, are being forced to continue working in dangerous health situations because they cannot ‘afford’ to stay at home like the better paid workers and protect their health. Its doesn’t bear scrutiny. My research centre released an updated report this week that also bears on the situation. The current fiscal stimulus is probably, at least $A100 billion short of where it should be, yet the government is announcing cuts. It will not turn out well. Meanwhile, across town, the Reserve Bank governor has been trying to deny the RBA has the currency capacity to allow the Treasury to keep spending without issuing debt. Already, the Labor party are making political points out of the rising public debt, which just makes them unelectable really, rather than savvy. The RBA governor’s intervention also just proved he is prepared to deny history and evidence to make political points, which had the other consequence of demonstrating how lacking in ‘independence’ the central bank is from the political process. And so it goes on.

Lukenomics casts its expert eye over Modern Monetary Theory (MMT)

A few weeks ago, I was sent a script for an upcoming comedy segment and asked to give input. The first iteration was already terrific and after a few more iterations, it was in great shape – representing Modern Monetary Theory (MMT) faithfully and pointedly.

I was pleased to have been given the chance to advice the writers so they did not misrepresent MMT. Not often that happens. I really respected that.

The segment by comedian – Luke McGregor – was aired last night (July 22, 2020) on the ABC program – The Weekly with Charlie Pickering.

He calls his segment – Lukenomics – and uses it to explain economics things in an amusing but clear way.

Last night, he covered MMT and I saw the script that had been worked on over a few weeks come to life. That alone was an interesting thing for me.

But Luke’s depiction of our work was great and I hope that he will make some cameo appearances in the future for MMTed.

Here is the segment:

Maybe the Treasurer and RBA governor should have been watching

Today, the Federal Treasurer is unveiling his fiscal update.

Already the Opposition Labor treasury spokesperson has been on TV all morning embarrassing himself and effectively demonstrating why the Labor Party are unelectable.

He was raving on about the government ‘crashing’ through some debt ceiling (“half-a-trillion dollars”) and “racking up debt” and all the rest of his ridiculous ranting.

Who is advising this guy? Neoliberal central!

I will analyse the Treasurer’s data next week when I have had time to study it and do some calculations of my own.

In the media release (July 23, 2020) – Economic and Fiscal Update – we learn that:

1. The fiscal balance will rise to an “$85.8 billion deficit in 2019-20 and a $184.5 billion deficit in 2020-21.”

2. “The fiscal measures are also estimated to have lowered the peak of the unemployment rate by around 5 percentage points.”

3. “real GDP is forecast to have fallen sharply in the June quarter by 7 per cent.”

4. “around 709,000 jobs were lost across the country in the June quarter.”

5. “The unemployment rate is forecast to peak at around 9¼ per cent in the December quarter …”

In other statements, the Treasurer said that:

… the government’s actions have saved 700,000 jobs.

Now do some arithmetic.

They will spend around $A70 billion on the JobKeeper wage subsidy program over a 6 month period. Initially, the Treasury claimed that it would be the difference between the unemployment rate rising to 10 per cent rather than 15 per cent.

5 percentage points, which is the figure reaffirmed by today’s statement amounts to around 585 thousand jobs given the current labour force.

Even if the interventions have saved 700 thousand (today’s Treasury estimate) that doesn’t seem like a good deal to me.

On Monday (July 20, 2020), the Centre of Full Employment and Equity (CofFEE), our research centre released our latest technical report – Investing in a Job Guarantee – which was written by myself and Martin Watts.

We used our CofFEE macroeconomic simulation model to explore the impacts on public and private employment of a Job Guarantee program designed to reduce the unemployment rate from 10 per cent to 4 per cent?

The Job Guarantee wage would be equal to the current federal minimum wage.

Using very conservative productivity assumptions, we found that the scale of annual GDP (income) loss resulting from the unemployment rate being at 10 per cent rather than 4 per cent ranges from $95,404 million (if all workers were absorbed in the retail trade sector) to $201,384 million (if the workers had average non-mining productivity).

That range on a daily basis would be $261.4 million (5 per cent 2019 GDP) to 551.7 million (10.6 per cent of 2019 GDP).

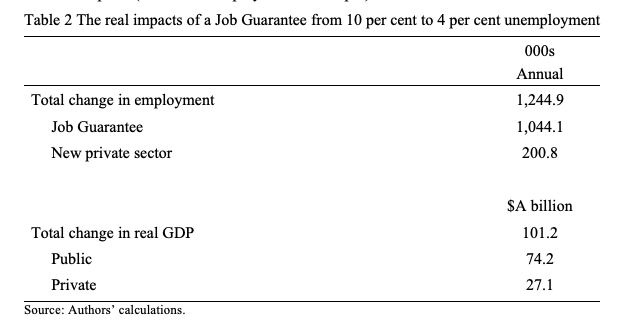

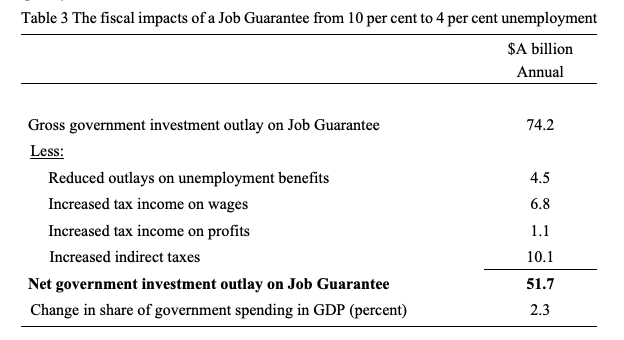

The following tables summarise the employment and output impacts (Table 2) and the fiscal investment parameters (Table 3). Note that these numbers are for an estimation period of 12 months.

The probable outcome would be that investment confidence would be stimulated by the higher employment and output and that the non-government sector would start adding jobs at a faster pace and reducing the pool of workers within the Job Guarantee pool fairly quickly.

Even if the losses are at the lower end of this sort of range, the quantum is very large and represent huge deadweight losses that are never recovered, and losses of some degree accumulate every day that unemployment remains above 4 per cent.

We also did not take into account the massive personal and community losses that accompany the narrow economic (income) losses.

It is obvious that a 6-percentage point reduction in unemployment would deliver substantial net benefits to the nation.

We also concluded that the net investment required by the federal government is clearly within its fiscal capacity and compares well, in terms of dollar returns, to other stimulus measures that the government has introduced.

Further, the program provides a pathway for the nation to end its dependence on welfare payments and the pernicious ‘unemployment’ industry that ‘manages’ the unemployment through a never-ending cycle of punishment and failed outcomes.

The point is that for a net investment of $A51.7 billion over 12 months, the federal government could create 1.24 million jobs, 200 thousand of them in the private sector and the rest in the Job Guarantee sector.

Compare that to the Treasurer’s stated outcomes above – at least $A70 billion to save 700 thousand jobs but still leave around 10 per cent of the willing labour force jobless.

Doesn’t bear comparison.

We presented a paper to the Prime Minister’s office late last week making the case for a Job Guarantee. It probably went in the bin, which means we will pursue our strategy more broadly now.

Yesterday, as part of a suite of fiscal announcements leading up to today’s grand statement, the Government has also announced it is cutting back on the fiscal stimulus it introduced in March.

It is reducing the rate of the JobKeeper wage subsidy and cutting back on the special supplement to the unemployment benefit (JobSeeker).

What responsible government would cut spending when unemployment is elevated levels and rising, underemployment has gone through the roof, and businesses are failing at an accelerating rate as this disaster continues?

Answer: No responsible government would.

Reality: the Australian government is already telling us that it must cutback to save the ‘budget’.

The only thing this will achieve is worsening unemployment (and the increased scarring that goes with long-term unemployment), more failed businesses, mortgage defaults, and a long period of lost income earning opportunities.

The heightened uncertainty about the health issues is reaching dangerous levels in Australia as various commentators start to hint that the Melbourne situation is now out of control and the virus will multiply throughout the regions and across into other states.

The last thing we need now is the worsen that sense of fear by the government withdrawing its life support from the economy.

I have estimated the stimulus was already about $A100-120 billion short of what was required.

Cutting back an inadequate first intervention just magnifies the initial error.

Enter the Reserve Bank governor.

On Tuesday (July 21, 2020), the RBA governor Philip Lowe gave an address to the Anika Foundation entitled – COVID-19, the Labour Market and Public Sector Balance Sheets.

The Anika Foundation supports “research into adolescent depression and suicide”.

I won’t draw any parallels on that front.

The Governor’s speech was held out in the conservative financial media as a rebuttal of MMT.

I saw it more as a demonstration of how political the RBA has become, which, of course, blows the story about it being independent out of the water.

His analysis of the labour market was accurate although I am not as optimistic as he was in terms of his statement that “Fortunately, we have now turned the corner”.

I think that this was probably written before the full import of the Victorian virus second wave was understood.

The renewed Victorian lockdown will retard progress significantly and this is especially important in relation to the observation made by the Governor that:

… many firms … were able to keep many of their employees over recent months because they had a pipeline of work to complete. But as new orders have declined, this pipeline is drying up. If it is not replaced soon, hours worked in these businesses will decline further …

Investment and employment decisions are forward-looking. Firms will not invest in new capital if they are not sure there will be increased sales in the future, when the capital is in place and ready to produce goods and services.

This is why the Federal government should be spending up now to foster new orders to keep the ‘orders pipelines’ full.

The Governor informed his audience that:

1. The “Reserve Bank’s balance sheet has increased from around $180 billion prior to the pandemic to around $280 billion today and further increases are expected over coming months”

2. Among other things, it has “used its balance sheet to purchase $50 billion of government bonds” – which has controlled yields in the targetted maturities.

He claimed this was “viewed as credible by market participants” (what other choice have the ‘participants’ got – the RBA has the power not them).

3. “There is also a broad understanding that the RBA is prepared to use its balance sheet in whatever quantity is needed to maintain the target.” In other words, it will keep interest rates (and bond yields) where it wants and will use its currency capacity to achieve that objective, irrespective of what the ‘market participants’ might desire.

And at this point, the Governor became political and defensive.

He said:

I would now like to address one idea for the use of the central bank’s balance sheet that I sometimes hear – that is, we should use it to create money to finance the government. A variant on this idea is that the central bank should just deposit money in every bank account in the country – this is sometimes known as ‘helicopter money’ because, before we had an electronic payments system the idea was that banknotes could simply be dropped by helicopter.

For some, this idea is seen as a way of avoiding financing constraints – it is seen as holding out the offer of a free lunch of sorts. The central bank, unlike any other institution, is able to create money and the resource cost of creating that money is negligible. So the argument goes, if the government needs money to stimulate the economy, the central bank should simply create it in the public interest.

The reality, though, is there is no free lunch. The tab always has to be paid and it is paid out of taxes and government revenues in one form or another. I would like to explain why.

Hmm.

He said the RBA just credits bank accounts to facilitate government spending. The offsetting asset might be an “IOU from the government to be paid in the future”.

Right pocket of government issuing IOUs to the left pocket!

So how is this not a free lunch?

Enter the inflation bogey – the government spending causes inflation “perhaps to a very high level” – which is a tax on the community. The “spending is just paid for in a different way”.

What if there is no inflation? Think about Japan over three decades. Think about almost everywhere else in the last decade.

What if the RBA pushed up interest rates to fight the inflation? Notice his example, all requires the inflation bogey, to trigger the steps.

Well there is no inflation tax, but other taxes have to rise to pay back the IOU (and interest) to the RBA.

Remember right and left pocket.

Then what happens, he asks, if the IOU was just written off?

Well then the RBA would incur “losses” (left pocket marking down numbers because the right pocket had marked down numbers), the government would not earn any ‘dividends’ from the RBA (left pocket not sending numbers to the right pocket) and the RBA might have to be recapitalised because it was making losses.

All which he claimed would have to be “funded through tax revenue”.

The RBA is not a private corporation. It could function forever with no ‘capital’ and nothing significant would change. The emergence of a ‘loss’ for a private corporation is a problem because the shareholders have to cover the gap.

An accounting ‘loss’ recorded by the RBA is rather meaningless. Numbers that can be altered at will and no-one would care less.

The Governor then tried to deny history:

It certainly is possible for the central bank to change when and how the spending is paid for, but it is not possible to put aside the government’s budget constraint permanently. Where countries have, in the past, sought to put aside this constraint the result has been high inflation.

There is no ‘government budget constraint’. The term has no meaning for a government that issues its own currency.

The RBA is a creature of government. It is part of government. The Australian government can always purchase whatever is for sale in AUDs and has the legislative capacity to instruct the RBA to permanently facilitate that via its balance sheet.

And then we might ask the Governor to explain the Japanese history since 1990 in a sentence.

The Bank of Japan has effectively been funding the Japanese government by buying Japanese government bonds in large quantities – zero interest rates, negative yields on long-term debt and deflation rather than inflation.

And what of the ECB since 2010 – same story.

And the Federal Reserve in the US at various times – same story.

And the Bank of England at various times – same story.

It is a plain untruth for the Governor to say that accelerating inflation is an inevitable consequence of central banks purchasing government debt in large volumes, which is the same thing, functionally, as the governments not issuing any debt in the first place.

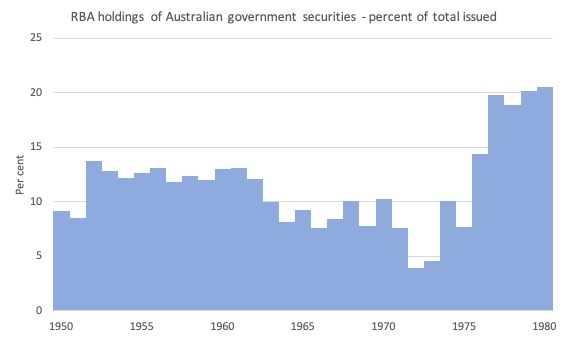

And a little bit of Australian history would not go astray.

I have written before about the significant changes that occurred in Australia in the mid-1980s, when the government shifted from a ‘tap’ system of bond issuance to the current ‘auction’ system.

See the blog posts:

1. Why do currency-issuing governments issue debt? – Part 1 (June 1, 2020).

2. Why do currency-issuing governments issue debt? – Part 2 (June 2, 2020).

3. Direct central bank purchases of government debt (October 2, 2014).

This RBA Bulleting article from November 1993 also bears on the topic – The Separation of Debt Management and Monetary Policy.

Note that the framing of this article is all in the mainstream context that the federal government was financially constrained. But read it for the institutional arrangements it describes.

Essentially, before 1979:

… primary issues of Commonwealth Government securities (CGS) were through ‘cash loans’ or ‘tap’ issues in which securities were offered at pre-determined rates of interest, and the authorities accepted whatever sales occurred at that rate …

When the Commonwealth Government did not sell sufficient debt to finance its deficit, the shortfall was made up by borrowing from the Reserve Bank.

In effect, the RBA would accept “Treasury bills, which were short-term discount securities carrying a fixed discount rate of 1 per cent”.

These bills were also used to fund “finance lags in revenue encountered by State governments” and to “make intra-governmental transfers” between government departments.

The government pockets were very busy recording numbers, adding and subtracting and this all kept the accountants busy.

Between 1950 and 1980, the RBA held various proportions of the total Australian government debt on issue as shown by the following graph.

There was no relationship (coincident or lagged) between these holdings and the inflation rate or tax rates.

In other words, the RBA was already doing what the RBA governor considers to be taboo.

The reason they shifted to the auction system was because the government embraced the Monetarist view that fiscal policy discretion should be discouraged and monetary policy should be elevated to a dominant position.

It was easier to conduct daily liquidity management with the auction system, where the government allows the private bond dealers set the yields.

It was an ideological shift, which was then ‘justified’ with the fictions about inflation, no free lunch, tax burdens and the rest of it.

It was designed to take aggregate policy discretion away from the elected representatives of the people.

It was also at the time when governments abandoned their full employment pledge and instead started to use unemployment as a policy tool (to discipline inflation) rather than a policy pledge.

As I noted in Tuesday’s blog post – An old central banker trying to come to terms with MMT – not quite getting there (July 21, 2020) – when I quoted Alan Blinder:

There is neither theoretical nor statistical support for the popular notion that inflation has a built-in tendency to accelerate. As rational individuals, we do not volunteer for a lobotomy to cure a head cold. Yet, as a collectivity, we routinely prescribe the economic equivalent of lobotomy (high unemployment) as a cure for the inflationary cold. Why?

Anyway, the reality that the RBA governor wants to suppress encircles him – Japan, the US, ECB in Europe, Bank of England etc.

Someone said to me the other day that the RBA will never adopt that sort of monetary leadership because it is a ‘very conservative institution that has the respect of the financial markets’.

So, we are meant to sit around while a few million people cannot work, because the RBA is being preciously ‘very conservative’.

At some point, the citizens will understand all this and demand that the government force the RBA to do what the Reserve Bank Act of 1959 says it should – and one of those legislative responsibilities is to foster full employment.

I was also told that if the RBA ever did just credit bank accounts on behalf of government then the ‘markets’ would lose confidence and respect for it. To which I wondered – so what?

Its a stacked deck in favour of financial capital and the top-end-of-town. The house has to crumble for us to make progress.

Conclusion

Congratulations to Luke McGregor for his wonderful sketch last night.

And, I have a segment on ABC’s special report on today’s fiscal statement tonight where I go into all this.

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

“I saw it more as a demonstration of how political the RBA has become, which, of course, blows the story about it being independent out of the water.”

Given the “monastery ” effect of this “independent central bank” notion, and how it acts like a honey pot for wasps to those with mainstream beliefs – so much so that adherents will elevate its existence above that of the state and government – it may be useful for MMT to advance the narrative that we are upgrading the “independent central bank” to an “autonomous central bank”. One that is self-driving and automatic – with no need of wonks. Saying we would sack the wonks then makes it clear what their attacks are – people desperately trying to hang onto overpaid career positions that have become redundant thanks to MMT.

One way of doing that is to alter the RBA constitution a bit. Rather than 8(d) stating “to buy, sell, discount and re‑discount bills of exchange, promissory notes and treasury bills”, it should state “to buy, sell, discount and re‑discount unused labour hours, bills of exchange, promissory notes and treasury bills”

Since one of the functions of the Reserve Bank in law is “the maintenance of full employment in Australia”, giving it the capacity to discount time will help it achieve that goal. A goal it is singularly failing to achieve at present.

Successfully transforming beliefs often requires co-opting the churches of the old beliefs. Getting the Job Guarantee out of the appropriation bill cycle and pitching it as the appropriate alternative to the failed interest targeting mechanism is important to making it a right for all Australians rather than part of the discretionary spending political football game.

Once the time has been discounted by the RBA, then it is the spare time JG has accumulated that is given to Parliament to “spend”. Not the money.

Great piece by Luke McGregor! Makes it simple, also illustrates that MMT is aware of consequences of spending, a point missed by so many detractors.

A little calculation I did on the 700,000 workers that were laid off because they didn’t qualify for Jobkeeper found the cost to have covered these workers to be $13,650M or an additional 0.7% of GDP, hardly a deal breaker. The cost of Jobseeker (at $450/wk) for the next few years while they all find jobs could be around $50,000M. Adding to this is the likelihood that the second wave in Victoria (and probably coming to a suburb near you soon) was caused by people with unsecure employment , who didn’t qualify for Government Support, and who have poor sick leave entitlements. The stinginess of the measure by limiting eligibility may end up costing more than the money saved! So I am not sure where the common sense has gone.

Didn’t the Rudd Government “helicopter” money ($900) into all accounts? Wasn’t this via the RBA? It certainly didn’t cause runaway inflation!

AMP Capital had this to say about RBA Bonds “Finally, consider what would happen if “shock horror” the Government and the RBA agreed to cancel the bonds that the RBA owns? Apart from a lot of grinding teeth from some commentators the answer would be very little – the Government’s loss on its “investment” in the RBA would be offset by a reduction in liabilities. In other words, it’s not necessarily the case that all public debt has to be paid back if it’s owned by the central bank. For the technically minded, the limit to this would be if all the extra money that the central bank printed to buy the bonds causes inflation – but as Japan has seen, if there is lots of spare capacity, inflation is not an issue.” (Oliver’s Insights – The fiscal cliff is more likely to be a fiscal slope – and why concerns about Australia’s budget deficit are overblown, Dr Shane Oliver Head of Investment Strategy and Economics and Chief Economist, AMP Capital. 21 Jul 2020)

Lastly, sorry for appearing dim-witted, but in pulling back spending in the current climate isn’t the government saying we want to save our money by tapping into your individual pockets (unless you can buy bonds, or, are high income earners who will get early tax breaks)?

Thankyou Bill for this detailed response to yesterday’s disappointing statements from the Treasurer and the RBA Governor. I have two questions that I would greatly appreciate you covering in some way.

1. What do you make of the RBA Governor’s nod (but no follow through) to Stanley Fischer’s recent comments which seemed to show the MMT way was viable.

2. The one aspect of MMT that I have seen least covered is the potential impacts or implications on the exchange rate.

It must be disappointing for you that your paper to the PMO may have just “gone in the bin”. As well as the pitiful performance of the Federal Opposition given the opportunity they have under current circumstances. Where to from here ?

Kind regards

Mark Kelleher

“we want to save our money by tapping into your individual pockets”

Generally it is that they want you to go to the banks and borrow money. It is genuinely swivel-eyed how desperate the mainstream is to make it look like the private banks do everything, when the central bank can create a private bank asset simply by paying somebody who has a private bank account.

The “banking system as stabiliser” narrative is having epicycles laid on its epicycles. Nothing is a greater example of a failing belief system.

The RBA Governor again with the “no free lunch” crack when lunches are being left unmade all over the country due to resources left idle by a government that refuses to address the unemployment caused by its failure to run deficits sufficiently large to engage them. It’s infuriating.

And then what happens once the government makes all these “necessary” cut backs to bring the budget back into surplus, and all the available dollars left in the private sector are taxed out of existence?….cut interest rates to stimulate the economy? more monetary policy intervention?

…..sarcasm intended

…cheers

I find it strange that the treasury forecast unemployment to over 9 percent, and the government thinks this is ok, that they have done, and are doing, enough.

Almost surely, budget deficit is highly correlated with the unemployment rate , JG or not. The JG is basically the “cheapest” (in terms of dollars spent) way to get to full employment without crowding out the private sector.

The US pre covid was a great example of how budget deficits and government debt create jobs. Deficit and debt in us goes up, and virtually all measures of US unemployment/underutilisation go down. It was one of the things Trump was doing well. Sure, they weren’t necessarily good jobs, but still progress.

It’s not really a surprise is it ?

Said all along there would be a fiscal error. Last time before this fiscal error, and the last time before that, going back years. That they would baulk at the numbers and start cutting early.

Will happen all over the world and “they know how it works”. You can’t run a central bank and treasury for hundreds of years and not know how it works. We allow them to get away with it by calling them stupid. You can’t set up the EU the way they did without knowing how it works. The virus shows they know how it works.

Pick a colour any colour and put an X beside it in a voting booth = A sham, a huge con trick, to fool people to believe we live in a democracy. Run by a bunch of crooks.

Geopolitics in the only game in town. Geopolitics demands “Sound money ” financing.

They are not the fools they are Genius. For setting the system up, that can never be challenged in a serious way.

“Politics” implies a certain amount of negotiated decision making, especially within democracies; so It really doesn’t appear as though “politics” well describes what is going on.

On March 27th, 2020, Canadians witnessed the Bank of Canada (publicly owned) beginning to take it’s advice on monetary policy decision making from Blackrock Financial market Advisory, as part of the emergency management response to the virus. it remains to be seen if this arrangement will end when the crisis end.

This followed a similar announcement hours earlier regarding the The US Federal Reserve and Treasury.

More troubling are the rumblings about placing fiscal policy decision making in private hands.

Is their any room left for politics?

“The heightened uncertainty about the health issues is reaching dangerous levels in Australia as various commentators start to hint that the Melbourne situation is now out of control and the virus will multiply throughout the regions and across into other states. The last thing we need now is (to) worsen that sense of fear by the government withdrawing its life support from the economy.” Again, an accurate assessment by Bill with one crucial caveat, actually more like a contradiction, which point he later makes: “The house has to crumble for us to make progress.” Let me explain what I’m getting at. Should we expect the Covid Crisis to make neoliberal government see the MMT light, embrace humanist and environmental values, and invest sufficient public funds to sustain life support at all necessary levels? No, that much we’ve learned. But if we shouldn’t expect these things, then it’s not “the last thing we need now” for neoliberal government to fail to step up and instead fall flat on its face; it’s THE FIRST THING WE NEED. Bill explains why in that caveat/contradiction–because neoliberal government MUST fail and crumble, come apart before our eyes, BEFORE we can move forward with adequate and comprehensive life support programs, socially and environmentally, which must be federally funded in the manner explained by MMT. It’s that old darkest before dawn thing, I suppose, but the darkness we’re now facing, its potential length and depth, is at best conducive to only fitful sleep.

Looks like they are ignoring the inevitable!

“I would now like to address one idea for the use of the central bank’s balance sheet that I sometimes hear – that is, we should use it to create money to finance the government”.

Pardon my ignorance but isn’t that the purpose of the RBA? Doesn’t parliament give the government the OK to fund its budget by instructing the RBA to create the dosh?

All legally and constitutionally correct. Around $500 Billion plus for last year was it?

If the government spends an extra $200 billion on top, what is to stop the RBA making up the difference? Again pardon my ignorance, I am not a top RBA baker. Sorry that should read top RBA banker.

“Doesn’t parliament give the government the OK to fund its budget by instructing the RBA to create the dosh?”

Not according to Central Bank Lore, which seems to be a very strict sect in Aus – that people will literally deny legal and constitutional reality to defend. According to Central Bank Lore even though the government has access to a “strictly limited overdraft facility”, because the government swaps Green Dollars for Yellow Dollars to make that overdraft facility appear very temporary that’s not creating any dosh.

This belief that different colours of money have special powers is incredibly strong amongst mainstream economists. Even though when you ask them why they can’t give a very good answer.

An MMT analysis shows that belief is bunkum. Increased Net Financial Assets are increased Net Financial Assets – whatever the colour of the dollars. Kalecki made the point decades ago: “To understand this process it is best, I think, to imagine for a moment that the government pays its suppliers in government securities. “

The tricks used to hide the power and control of a misuse of money creation.

It is artifice to behold.

Denying people at the point of need, the money they need, is antidemoncratic. And that ‘new’ money keeps the economy (suppliers) going.

A rising tide floats the pooh sticks not the poo boats. That happens after. Always.

Apparently Keynes could not get private to be profitable. Ever.

“So, we are meant to sit around while a few million people cannot work, because the RBA is being preciously ‘very conservative’.”

Pretty funny.

I listened to a discussion between some harvard imbecile and Michael hudson. The libertarian said they are very ‘uncomfortable’ about government regulation of environment and employment.

So we are to sit around for and starve while these libertarians are very ‘uncomfortable.’

@Tom Y.,

Why are the starving people sitting and waiting?

They need to get out in the street and protest.

If the BLM people can do it in the US, why can’t that starving people in Aust. do it?

As far as I can see, Progressives in the US need to join with the BLM people and demand money to buy food and pay rent, etc.

Sometimes the only way to get action from the Gov. is with civil disobedience.

Is not *starving* a good enough reason to demand and *GET* action?

Steve is right, of course. The ONLY effective response that remains available to us is massive, unrelenting, overwhelming civil disobedience/social disorder–so massive, pervasive, and continuous that it quickly moves beyond any possibility of control by the PTB. And I can see it coming, as surely as day follows night, as our neoliberal governments, having bailed out the rich and powerful, leave the rest of us hanging in the wind like they did in the GFC, which, in comparison with what’s coming, will look like a blip on the socioeconomic screen. One hell of scary time to be alive. And also one hell of an exciting one. Let’s face it: the neoliberal world HAD to die, for both human and environmental reasons, and we knew it for quite some time. But we couldn’t pull it off by ourselves; it took the assistance of a virus from hell (heaven?).

Just use:

vote.au

All topics

All can propose

All can discuss

All can vote

Democratic Indications

It might help ‘elites’ hear the people

Bill, if you need to you can delete this.

People, it seems Trump has sent secret police into American cities (esp. Portland) to enforce an illegal executive order to make it a crime to tear down a statue.I don’t think this was passed by Congress.

My source is —

1:13:04 long

Ep. 101: EMERGENCY PODCAST SYSTEM – Donald Trump’s Police State, Part 1 | Rumble w Michael Moore

I live in Thailand. It seems that young Americans have got out there to protest and Trumps Gov. is over reacting.

Listen to this podcast.

Then do what you need to do.

.

Hi Bill

Thank you very much for your commentary calling out Lowe’s politicization of the RBA’s role, via the “shift to the auction system”. Just discovered your invaluable website – congratulations- keep up your good and important work!

We are told that government debt is now greater than the post war period – and that there have been huge foreign bond sales (why?), then I see above a quote “…. Among other things, it (the RBA) has used its balance sheet to purchase $50 billion of government bonds” – which has controlled yields in the targetted maturities.” So as a non-economist, can someone explain to me what is going on.

My understanding of deficits is that under “normal” conditions, bond sales are used to mop up excess cash in bank accounts so as to stabilise the overnight rate.

Lukenomics was well done.

Probably the clearest article I’ve read in the mainstream media was by Gareth Hutchens on the ABC website, July 17, “Modern Monetary Theory – How MMT is challenging the economic establishment”.