My friend Alan Kohler, who is the finance presenter at the ABC, wrote an interesting…

The Australian government is increasingly buying up its own debt – not a taxpayer in sight

In the wake of the $A60 billion bungle, the Australian government has turned its attention to creating smokescreens. Yesterday (May 25, 2020), the Treasurer released a statement – Temporary changes to continuous disclosure provisions for companies and officers – which effectively allows corporations to withold information from the public and investors about the state of their company finances. It will now be very hard to prove that company directors have mislead their investors. This is one of those thin end of the wedge trends that the Government has introduced under its emergency powers. For some time, the business peak bodies have been demanding the Government limit the capacity of shareholders to engage in class actions and for workers to pursue actions under industrial relations legislation (for example, QANTAS staff who have considered a class action against unsafe working conditions). But the point is that these diversions, which may or may not linger after the so-called 6-month sunset clause, take the pressure of the Government for their inept economic management, which is responsible for more than 2.4 million Australians (over 24 per cent of available workers) idle in one way or another. And when the question of economic management is raised we get a litany of lies reinforcing the fictional world that mainstream economists have created to prevent people from really understanding what the currency-issuing, Australian government can and cannot do. Today, I present some data on the RBA bond buying program and the way it is dovetailing with the debt-issuance activities of the Australian Office of Financial Management (AOFM). The Treasurer is in the National Press Club today and will spend his time lying about saving taxpayers’ money and reducing the debt burden for our grandchildren. Meanwhile 2.4 million Australians need more work.

The Signal interview

I did an interview for the ABC program, The Signal – Meet the economists denying debt – over the weekend.

The interview lasted 75 odd minutes and they did a fairly good job of distilling things down to a 17 minute segment.

The title of their program this week is unfortunate but I have no control over that nor the editing of the segment.

But it is good that this team is willing to run against the mainstream tide within the ABC and offer their audience some diversity.

The Treasurer’s story doesn’t align with what his own Department is saying

One of the ruses the Treasurer is using to cover the incompetence of the forecasting error is that it is actually good news because it means that the economy is doing better than they initially thought.

He repeated that claim in almost every interview he has done since Friday.

For example, he told the ABC News Breakfast Program yesterday (May 25, 2020):

But as you know, we had great success in flattening out the curve and we went from having a rise in the number of daily cases at 22 per cent in the week leading up to the announcement of the JobKeeper program, to now having 35 days straight where the number of new cases has increased by less than half a percent per day. So that health miracle has had a real economic benefit, hence the lower number of people who are going to be using the JobKeeper program as a result.

Okay.

So why did the Treasury release last Friday (May 22, 2020) – JobKeeper update – say that:

Treasury’s overall view of the labour market is unaffected by this reporting error … It remains the case that in the absence of the JobKeeper program, Treasury expects the unemployment rate would have been around 5 percentage points higher. Treasury continues to expect the unemployment rate to reach around 10 per cent, although as indicated by last week’s Labour Force survey, the measured level of the unemployment is highly uncertain given the impact of social distancing restrictions on the participation rate.

The two statements don’t add up.

Which goes to the heart of what I wrote back on April 29, 2020 – JobKeeper wage subsidy – some strange arithmetic is afoot.

The aim of the JobKeeper wage subsidy was to keep people from losing jobs and entering unemployment.

5 percentage points of ‘saved’ unemployment is about 685 thousand jobs. Nothing like 6 million or 3 million (now after the error).

But the point is that if the Treasury’s estimates of “the labour market is unaffected by this reporting error” is unchanged, it means that the economy is doing no better than they originally thought.

Which means the Treasurer’s claims are inconsistent with the public claims of his own department.

Further, if the Treasury still believe the difference between the policy being there or not is that “the unemployment rate would have been around 5 percentage points higher” without it, and, that assessment is unchanged, then once again the Treasurer’s conclusions do not make sense.

The fact is that the whole JobKeeper arithmetic and related statements do not add up and are mutually inconsistent.

The lie about national saving

The Treasurer has also made claims that the fact that the Government is now going to spend $A60 billion less than planned means he is ‘saving’ money and reducing the debt burden, which means they have more capacity to deal with future calamities than they would have had had the 60 billion been spent.

Tortured, wrong logic.

A currency-issuing government does not ‘save’ when it doesn’t spend nor when it spends less than its withdraws from the monetary system via taxation and other currency drains.

Saving only is a meaningful term when applied to a currency-user like a household or a business firm.

For us, as users of the currency, we can expand our consumption possibilities next year by foregoing consumption now and earning an interest on the funds we hold back from consumption.

In other words, households (or users of the currency in general) are financially-constrained and have to earn income now, reducing prior saving, sell previously accumulated assets or borrow to fund spending.

Distributing that spending over multiple periods requires saving – because even though we can borrow in the short term on our credit cards – we have to eventually pay the debts back by running surpluses at some point.

That is the defining characteristic of a ‘spending unit’ that is financially constrained.

But it doesn’t apply to a currency-issuing government.

Their capacity to spend now, or tomorrow, or some later date is in no way financially constrained by what it did yesterday.

Running a fiscal surplus, may be appropriate under some limited and rarely seen circumstances, but it never provides the government with more capacity to run deficits now or later.

Currency-issuing governments do not have to forego consumption now (like a household) in order to spend more in the future, should that be appropriate.

It can type numbers into bank accounts whenever it chooses.

Note, I said that the government is in no way financially constrained by what it did yesterday.

That doesn’t mean that there is no path dependence in the way fiscal policy decisions taken now condition opportunities for government tomorrow.

Clearly, if a government has been running appropriately scaled deficits and achieving full employment and a consequence then it is ill-advised to suddenly expand its spending growth now unless it introduces offsets to reduce non-government spending.

Financially, it always can increase spending. But because spending always has to be calibrated against available real resources, past spending choices can impose constraints on future spending choices.

The RBA is buying up most of the debt issued

The Government has also been very quiet about the RBA’s newly-introduced bond-buying program.

The reason is obvious.

They don’t want the public to know that one arm of the currency-issuing government is accumulating a large proportion of the liabilities issued by another arm (Treasury) to match the rise in the fiscal deficit.

If they explained what was going on in the real world to the public, it would become very clear that the central bank is effectively ‘funding’ the deficits rather than any notion of some taxpayer account.

It would also disabuse the public of notions that such coordination between the central bank and the treasury, which is at the heart of the understanding you get from learning about Modern Monetary Theory (MMT), is dangerously inflationary.

Consider the data.

In their information sheet – Supporting the Economy and Financial System in Response to COVID-19 – the Reserve Bank of Australia outlines a number of policy innovations they are pursuing to help protect the economy and the financial system.

Among these measures they write:

Provide Liquidity to the Government Bond Market

The Reserve Bank stands ready to purchase Australian Government bonds and semi-government securities in the secondary market to support its smooth functioning. The government bond market is a key market for the Australian financial system, because government bonds provide the pricing benchmark for many financial assets. The Bank is working in close cooperation with the AOFM.

You can also view their more detailed explanation of what they are doing in this regard at – Reserve Bank Purchases of Government Securities.

Here is the list of the 169 – RITS Membership (Reserve Bank Information and Transfer System).

The RITS is “Australia’s high-value settlement system, which is used by banks and other approved institutions to settle their payment obligations on a real-time gross settlement (RTGS) basis.”

In other words, transactions across the financial system are settled by “the simultaneous crediting and debiting of Exchange Settlement Accounts (ESAs) held at the Reserve Bank of Australia”.

The ESAs are what we call ‘reserve accounts’ and function to allow these transfers to be made.

You find the daily data here – Long-dated Open Market Operations Results.

And complete data set is available via the RBA statistics – Monetary Policy Operations – Current – A3 – then go to the worksheet “Long-Dated Open Market Operations”.

What do we learn?

Since March 26, 2020, when the purchases began, the RBA has purchased a total of $A40,250 million worth of Australian government bonds (at varying maturities and yields).

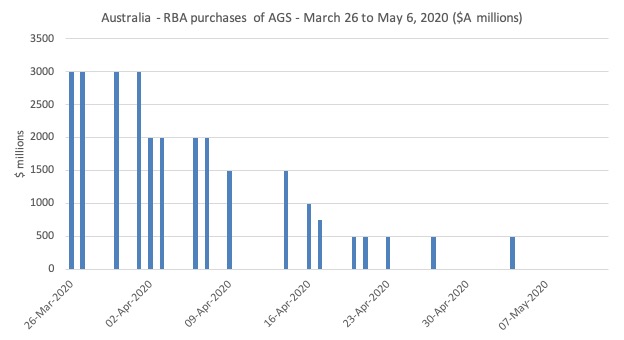

Here is the pattern of purchases of Australian Government securities by the RBA since March 26, 2020.

The overall totals since March 26, 2020 are:

1. Australian government bonds $A40,250 million (100 per cent – see below).

2. NSW government debt $A2.634 million (88.2 per cent).

3. Victorian government debt $A2,361 million (90.5 per cent).

4. Queensland government debt $A2,707 million (88.5 per cent).

5. South Australian government debt $A695 million (82.2 per cent).

6. Western Australian government debt $A2,288 million (89.8 per cent).

7. Tasmanian government debt $A127 million (88.8 per cent).

8. Northern Territory government debt $A107 million (85.6 per cent).

9. Australian Capital Territory government debt $A179 million (99.4 per cent).

The percentage figures next to each entry indicate how much of the total RBA holdings of each jurisdiction’s debt has been purchased since March 26, 2020. In fact, the RBA has been purchasing State and Territory debt since April 10, 2014 according to this data.

Treasury Bond Issuance since March 30, 2020

The Australian Office of Financial Management (AOFM) is the Treasury body that handles all the Australian government debt.

It issues Treasury Bonds using two methods (Source):

1. Price auctions – the dominant method (80 per cent of funds raised) where a selected group of investors bid for the offering and the lowest yield (highest price) bids exhaust the pre-announced volume. The auctions are usually weekly.

The AOFM say that “financial intermediaries as bidders sell the bonds to investors and other market participants” in the secondary bond markets and they are then used as speculative assets.

2. Syndications – are controlled allocations where “the AOFM determines price, deal size and allocations”. They are infrequent and allow the AOFM to develop new maturities (where there is no current secondary market).

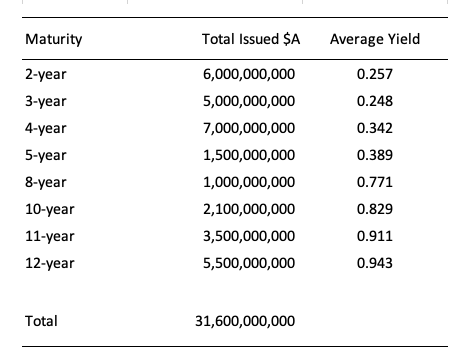

Since March 30, 2020, the AOFM has made two syndicated issues:

1. April 15, 2020 – $A13,000,000,000 (4-year bond, yield 0.47 per cent). The AOFM received bids of $A25.8 billion for this issue.

2. May 13, 2020 – $A19,000,000,000 (10-year bond, yield 1.025 per cent). The AOFM received bids of $A53.5 billion for this issue.

These two issues were the largest in the AOFM’s history.

The boss of the AOFM described the investors ‘rushing’ to get their hands on the Australian Treasury Bonds.

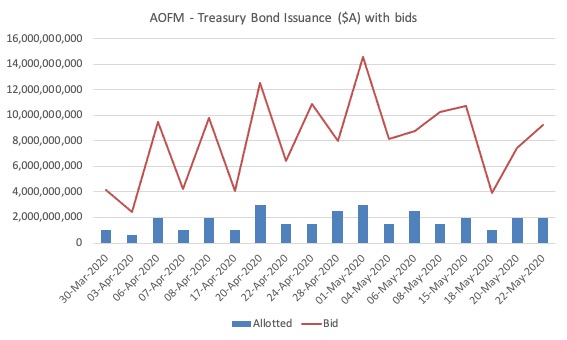

The following graph show the details of the Treasury Bond Issuance (via price tender) since March 30, 2020 (the first auctions after the RBA began its bond-buying program).

The blue bars are the actual issuance totals ($A) for various maturities and the red line represents the total bids at each auction for the maturity offered.

The ratio of the diamond to the bar (if we can call it that) is the bid-to-cover ratio, which mainstream observers claim reflects the strength of market sentiment.

The AOFM managed total issuance over this period of $A30,600,000,000.

The bid-to-cover ratio is just the the $ volume of the bids received to the total $ volumes desired. So if the government wanted to place $20 million of debt and there were bids of $40 million in the markets then the bid-to-cover ratio would be 2.

I wrote about bid-to-cover ratios in these blog posts (among others):

1. Britain confounding the macroeconomic textbooks – except one! (May 21, 2020).

2. Bid-to-cover ratios and MMT (March 27, 2019).

3. D for debt bomb; D for drivel (July 13, 2009).

Here is a graph of the coverage ratio for all the auctions since March 30, 2020 (for the various maturities on offer – see below).

What this data tells me is that there is a massive thirst among the bond dealers for Australian government Treasury Bonds. The coverage ratio is rarely below 4, which means that there are 4 times as much money being offered than the government bids for.

The coverage ratios vary but have averaged 3.45 since the AOFM started publishing data in this form from August 5, 1982.

And why wouldn’t that be the case?

The Treasury Bonds are risk free and with the RBA now operating in secondary markets buying up Treasury Bonds, investors know they can make a capital gain on any bonds they hold as a result of the RBA demand.

The Treasury bond issues vary across the maturity range (when the bonds have to be paid back) and the distribution and average weighted yields since March 30, 2020 are shown in the following table.

It is clear that the RBA has already purchased a significant proportion of the Treasury Bonds (in value) than have been issued by the AOFM via either method.

The current proportion is 63.8 per cent.

That proportion will rise over time.

Conclusion

It’s an uphill battle that is on-going trying to break down all these lies that the mainstream of my profession has injected into the public debate and which politicians use to defend nasty policies or incompetence execution of nasty policies.

We can only keep pushing! One step at a time.

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

I’ve recently (finally — it took me a while) finished reading your Macroeconomics textbook, Bill. Good timing, really, given the current climate.

It’s been very clarifying where proclamations made by the usual suspects are concerned, so thanks for that and these blog entries which continue to debunk the orthodox framing and narratives.

The linked RBA page states that the purchases began on March 20.

Thanks Bill. Strong and clear and right on the cutting edge of the most important economic debate of our lifetime. Keep up the great work.

I’ve been on ABC journalists cases for a while to have you or Steven Hail on to explain how our monetary system actually works.

I’ve sent in the question “Where do you think money comes from?” to Q&A several times for the panelist to answer. Intimating the two signatures on every note of $5 or more was a big hint.

A small step on ABC radio to begin with. Onward and upwards

I wonder if when the first electrum coins were introduced in Asia Minor 2600 years ago, the King had to repeatedly scream at his citizens, “No you silly buggers. I have to spend it into the economy on public servant wages, infrastructure projects and the like before these things enter the market place for any of you imbeciles to earn, buy stuff and pay taxes with it! That’s why it’s got my bloody head stamped on it.”

Bill wrote:

“But it is good that this team is willing to run against the mainstream tide within the ABC and offer their audience some diversity”.

4am in the morning, program named ‘The Signal’ (I’ve never heard of it) accompanied by garbage ‘muzak’ distracting from what is being said?

I’d like to know if Ita would be willing to run the program when people are actually listening; I suspect not, and that censorship is well and truly alive on the ABC.

Meanwhile Fran Kelly, just 4 hours later, is agreeing with politicians of all stripes that “the money has to be borrowed and repaid”, “it’s taxpayer money”, “there is no money tree” (implying the government has to tax or borrow in order to spend) etc etc etc. Same on ‘the Insiders’…at this rate we’ll all be dead before anyone in the general public understands MMT.

Who gets to choose panellists on Q&A? No-one was actually able to explain how we can afford to transition to a green economy without imposing a carbon tax on the economy.

What I can’t see from the tables presented is the price(yield) which the RBA paid. So it would be nice to see what price the RBA paid for any of the April 13, 4 yr, 0.47% o issued by Treasury. I’d like to see what the trading profit actually is or at least an estimate.

Based on my investment banking experience you need a bid to cover ratio well above one if you want to have a decent secondary market and the issuer Treasury in this case prices the issue accordingly.

“A currency-issuing government does not ‘save’ when it doesn’t spend nor when it spends less than its withdraws from the monetary system via taxation and other currency drains.” MMT needs to completely reject the gold standard language still being used to frame economic discussion. By implication and connotation, such language serves to reinforce, at the very outset of such discussions, a false and misleading household model of federal financial affairs. Currency-sovereign governments neither save nor spend, nor do they run budget deficits or surpluses. They either invest in their economies in particular ways by creating and infusing money into them (or invest in other endeavors like foreign aid or aggression), or they do not. “Spending,” which implies and connotes a draw down on something limited and scarce, has absolutely no meaning in a fiat money system. I’ve become convinced that MMT can only win economic arguments and change economic thinking if it insists on appropriate terms at the outset of economic discussions. Even Bill has a tendency to use antiquated gold-standard terminology before he hastens to clarify and correct it. Yet merely by repeating the language of monetary scarcity–spending and saving, budget deficits and surpluses, etc.–seeds are planted which then must be constantly uncovered and uprooted. Small wonder that MMT is so frequently on the defensive, first parroting error then trying to correct it, instead of clearly speaking from the outset, in its own accurate language, the plain and simple truths about fiat money.

Newton, do you think this is accurate language within the MMT lens:

:Sovereign currency-issuing governments can issue debt-free money:

Yes. And your simple, accurate statement contains IMHO the key to everything else worthwhile in MMT. Who really cares, other than economists, if we come up with a more and more accurate lens through which to peer at neoliberal financial machinations designed to manufacture plutocracy and austerity? So what–there are far more edifying things to look at and mull over. On the other hand, everyone should care if it is demonstrated, as MMT has demonstrated, that the linkage of federally sovereign currency to debt is nothing but a pernicious, self-imposed policy decision implemented through a labyrinth of rules and regulations which obfuscate the stunning reality of fiat money…ESPECIALLY when it is proposed to be used on behalf of the average citizen or “the least of these” as opposed to shoring up the already rich or funding unnecessary wars. This core truth (axiom) of MMT, the availability of fiat money to meet pressing human and environmental needs, is about as revolutionary as political thought gets these days, yet there seems to be a lack of excitement, lack of enthusiasm, lack of mission and purpose even among many of the strongest MMT advocates. They’ve got a game-changer, a world-changer, on their hands, IN their hands, but you’d never know it listening to their customary academic, wonky, nit-picky discourse (Bill, of course, and a couple of others, excepted).

Not to worry Bill. MMT is already the mainstream macro used by the US Treasury and the Fed. Congress hasn’t got it on yet. But will, I suspect.

https://www.nytimes.com/2020/04/15/business/coronavirus-stimulus-money.html

Bill, Fascinating to see RBA’s purchases on the various States’ bonds since March 20. In the case of Tassie you have a figure of $1.042 billion. They’re TCVM bonds. Isn’t that Victoria. TCV and TCVM are both Victorian govt bonds aren’t they? Similarly NSW bonds include both NSWT and NSWTT don’t they? Just trying to make sense of the Tassie figures. $1.042 billion is almost 20% of State borrowings. The total RBA purchases of TASC at $143 million might be the Tassie bonds issued by Tascorp P/L??

Dear John Lawrence (at 2020/05/27 at 8:50)

Thanks for your comment and scrutiny.

Yes, I had made a mistake in the coding that produced wrong figures for some states. I have now corrected the Table.

Tasmania comes in at $A127 million.

Thanks again.

best wishes

bill

I recently sent an e-mail to a labor politician with heavy economic credentials in which I asked if Treasury auctions bonds then remits all the proceeds to government to fund deficit, where does it get the cash to repay those bonds when they fall due. Assuming Treasury is not a financial institution with liquid assets of its own to call upon.

I also asked if the Reserve Bank is the agency legally responsible for payment.

His reply;

“The short answer is that the Reserve Bank of Australia manages the payouts of government bonds/securities, utilising the Treasury’s liquid cash balance with the RBA.

Ultimately, the government is on the hook for the money – the RBA only manages the payment process”.

This still leaves open the question of where does the cash to repay bond/securities come from.

Bonds are auctioned, the cash you would assume is “spent” (if spent is right word) by government to fund deficits so the cupboard is bare. The question is pretty clear and how the great unwashed would ask it.

Following this blog for some time leads me to conclude the Reserve Bank will ultimately just type some large numbers into a spreadsheet press enter and voila, job done. No economic or debt effect visible or otherwise on government or the great unwashed now or into the future.

As one of the great unwashed is my reading of the problem and the answer a little too simplistic

Anybody like to supply the correct answer?

Ross

All the government financing activities are conducted by AOFM, part of Treasury. The AOFM Annual Report has everything you need to know. There’s a cash flow statement on page 72 of AOFM 2018/19 annual return which shows the in and outs for the year. Future interest and principal outflows are set out on page 78 for instance, so it’s a simply matter to arrange payment, often by arranging for another bond issue when one bond issue matures. MMT is yet to grace the hallowed halls of Treasury. They could use the click of a mouse, but they still play the game and usually issue another round of bonds.

I’m not sure you have the sequence quite right when you refer to bond proceeds leading to spending which then leaves the cupboard bare. Spending and tax collections are happening 24/7. If they need a top up, currently they might issue more bonds.

Prof bill, all over the world because of low interest rates pension funds and savers are having a hard time. Do you think central bank money creation can be used to top them up and alleviate their worries? Is it also possible to use the central bank to reduce the huge amounts of private debt all over the developed countries?

Two things; we need a mining tax. Billions foregone for not having such thanks to Peta and Tony. Secondly, Fran Kelly is nice and a smart lady but we need someone who will pick Josh up on his lies.

“Anybody like to supply the correct answer?”

It’s the nature of the way banks work. What they do is mark up the accounts during the day and then *clear* the system towards the evening.

All becomes clear when you understand that banks are really just pawn shops with better PR. What the banks do is post collateral at the central banks which the central bank then discount into currency flows if required to cover the flow of payments on that bank’s central accounts. The banks then lend to each other at the end of the day and the central bank drops out of the equation (at least as far as clearing is concerned). That’s what ‘clearing’ is – the central bank getting out of the interbank process.

That collateral is government bonds normally. And Treasury does exactly the same thing. However unlike the commercial banks Treasury can’t run out of its own money…

The correct question to the mandarins at the Treasury is what collateral do they post at the central bank to use the clearing system, where did it come from.

Thank you John Lawrence and Neil Wilson for your replies.

I will attempt to delve into the nefarious workings of treasury.

Sounds suspiciously like a ponzi scheme to me.

“Sounds suspiciously like a ponzi scheme to me.”

No. It’s just the normal operation of a banking system. A loan is an asset to a bank. If you control that bank outright then you have the asset too – even if the liability is to the bank. That’s how a “currency issuer” is different from a “currency user”. When you owe the bank you don’t automatically get a balancing asset on your balance sheet because you own the bank.

However if you did, you would. Think about what you could do if you owned a bank outright and could direct it.

Like your work, but have a few comments. 1. The RBA has not bought a bond since 6 May, and won’t buy again if market conditions remain the way they are (no gaurentee of that of course). 2. Govt bonds are usually bought for the exact opposite purpose of speculation – they are held as liquid, secure assets by bank balance sheets, super funds and central banks – they buy riskier assets when they want to speculate. Hegde funds do speculate with bonds by using leverage – but the AOFM scales them in syndications (hence why they only issued 19b out of 53b in bids). You do not need MMT to achieve full employment – governments could use standard fiscal and montary policy to achive this, but they chose not to (or voters don’t elect them).

Hi Bill,

I thought the Signal interview was effective, it went from currency sovereignty to real resources vs inflation to democracy. Perfect!

George

I think Bill’s point is that standard macro think would lead to increased taxes being required in order to “pay for” a full employment policy. MMT analysis shows you don’t need to do this to implement policy, provided the real resources are idle.

The other point Bill has repeatedly made is that an economy can be in equilibrium with mass unemployment. Which means this is not something that will fix itself over time.

Hi Bill,

Given the Fed has bought up so much of the state and territory government debt, could this be used by the Morrison Government to prevent certain legislation going through at state or territory level?

And does the Fed government essentially backstop the debt of the state and territories and make them faux currency issuers if the Fed is buying up the debt and agrees to pay the debts of the state and territory governments?

There’s an interesting article in The Guardian today about Victoria’s money from the AIIB to fund infrastructure projects (the McGowan Governmebt has also co-financed through this). I presume those deals weren’t done in AUD and rather done in Yuan, otherwise couldn’t the Fed just pay back the AIIB, of which it is itself a member, just not controlling member?

Thanks so much.

Dear Adam (at 2020/08/27 at 11:25 am)

Thanks for your comment.

However, the ‘Fed’ hasn’t bought any state and territory government debt. The Fed is a US short-hand term for the Federal Reserve Bank. We should resist the temptation to use it as a generic terms for a central bank.

best wishes

bill