I started my undergraduate studies in economics in the late 1970s after starting out as…

D for debt bomb; D for drivel …

I had to double-check over the weekend whether I had actually read an article in the Fairfax press – Alarming debt bomb is ticking – given that my flu-ridden state was playing havoc with the clarity of my eyesight. Upon checking today, I concluded that I had read it. It is one of those articles that uninformed readers will consider erudite given the technical language it uses but which in fact is so misinformed at a theoretical level that it is has to be considered pure propaganda. It is sad that this sort of techno-mumbo-jumbo nonsense gets any space in our leading daily newspapers. I would rather more cartoons or brain teasers if they are struggling to fill their pages. Even an advertisement about the latest skin cream that not only eliminates wrinkles but also increases the reliability of the left-hander at Nobby’s would be better (Nobby’s = surf break)!

The article by a Neale Muston, who lists his affiliation as the principal in a trading firm, Excalibur. This appropriately invokes images of fantasy given that Excalibur is the mythical sword of King Arthur and was also a 1981 fantasy film about the legend. So out there in the land of pixies just like the article.

At the outset, the narrative is all alarmist: “Alarming debt bomb is ticking”; “Funding for Australia’s huge deficit”; “threatened by a nearly saturated bond market”; “A looming crisis in the financial markets is threatening the ability of the Federal Government to finance its fiscal stimulus” are clearly designed to raise concern that there is something bad about to happen.

I get suspicious immediately when I read headlines and introductory paragraphs like that. I am forming a billy blog credibility index which current says that the more alarmist the financial headline the less the author knows about anything.

Further, there is no mention of anything real – rising unemployment, rising underemployment, lost income opportunities, spending gaps – all the things that actually matter when considering the recession and the Government’s role in attenuating the consequences of it.

But even if you are going to omit to talk about what the whole thing is about, and, instead, decide to concentrate on the bond market movements then at least you should promote a few basic understandings of how that part of the economy works and why it operates. This character offers 992 words of nonsense parading as informed comment. Bogan register up one.

The only reason I am writing about it is that it serves as a perfect demonstration of the fallacies that are out there and how nonsense is disguised by technical jargon to hoodwink readers into thinking it is knowledge that they should take heed off. No wonder the financial markets are in such a state of disarray and failure.

Muston’s basic take is that:

An unprecedented amount of debt threatens to strangle the bond market and place a dire dependence on foreign investment to fund the budget deficit. In 2009-10 alone, more than $90 billion of Commonwealth and state government bonds must be issued. Add to this almost $100 billion of private sector maturities in the corporate, mortgage-backed and hybrid markets, much of which will need to be refinanced.

First question you always have to ask when some commentator says that a level if very high is whether it is an absolute or relative statement. Always insist on knowing that. So in this context, is it an unprecedented amount of debt or an unprecedented amount of debt relative to the size of the economy?

Some research will tell you that it is the former and definitely not the latter. No sensible analyst would be tricked by the absence of any scaling parameter. Not even the die-hard neo-liberals or deficit-doves out there talk about absolute levels of debt or anything! Only the economic alarmists use un-scaled levels to achieve their purpose. 110 degrees Celsius matters but $90 billion does not matter per se (quite apart from the theoretical points that we will come to later).

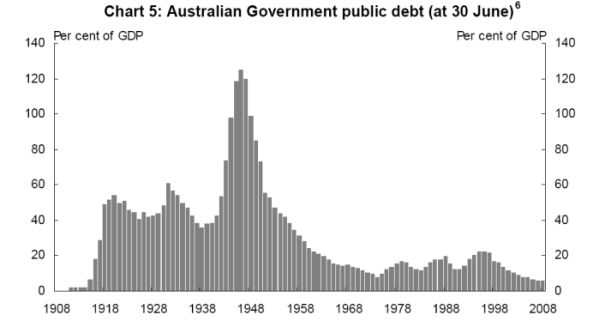

Anyway, around the turn of the C20th, gross public debt issued was around 100 per cent of GDP and had been up to 120 per cent in the decade before. The following graph shows the history of Australian Government debt (as a percentage of GDP) since the early 1900s (Source).

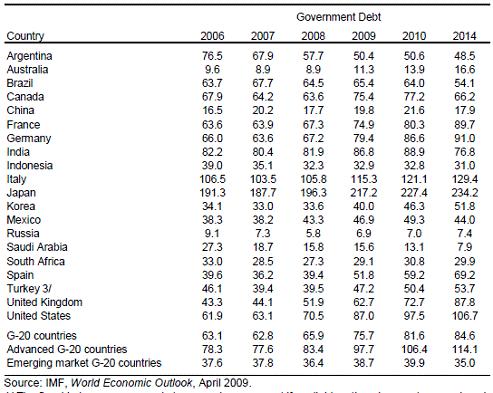

The IMF in its April World Economic Outlook, forecast that the Government Debt to GDP ratio in Australia might reach 11.3 per cent in 2009 and will peak at 16.6 per cent by 2014 (if budget parameters stay on track). There is one thing for certain – if the Government is swayed by the debt-deficit hysteria then the deficit will rise as they try to cut it back into surplus!

At any rate, the statements about unprecedented amount of debt have to be tempered by the reality. The size of the Australian economy is now (scaringly) at an unprecendented high (well it was until it went backwards recently). So what!

Here is the IMF April World Economic Outlook table for interest.

Muston then goes on to moan about the declining corporate welfare opportunities likely to be enjoyed by bond traders as the growing debt issues are added to other securities that can earn traders returns. He says:

There is now a rarely seen arbitrage of about 11 basis points in the bond market, which has prompted some to request a pause from the AOFM and rescheduling of some tenders to shorter-dated maturities. Commonly known as the bond-basket arbitrage, yields of a selected group of Commonwealth bonds determine the settlement price of the three-year and 10-year Treasury bond futures. These futures contracts are heavily traded in the market between speculators, hedgers and arbitrageurs around the globe. At each quarterly expiry, futures settle at a weighted average of yields within a basket of corresponding bonds, with arbitrageurs generally driving the price to fair value. Recently, however, weekly auctions from the AOFM are flooding bank portfolios with new paper, and traders are struggling to offload it all.

This is a crisis? It means nothing at all for the real economy.

Then we get some more technical talk designed to scare us into submission. The amorphous “bond markets” are apparently shaking in their boots for fear that we might have a … wait for it … a “failed auction, when there are insufficient bids from authorised dealers to cover the volume of bonds offered.”

So what actually is failing here?

Recall the voluntary arrangements that the Australian Government, obsessed with neo-liberal Gold Standard doctrine, has introduced via the Australian Office of Financial Management (a division of Treasury), with respect to bond issuance. I covered these arrangements in the following blog – Will we really pay higher interest rates?.

Briefly, the Australian Office of Financial Management was set up as a special part of the Federal Treasury to management federal debt. Previously, bond issues were made using the “tap system”, whereby the government would announce some volume of debt it wanted to issue at a particular rate and then sell whatever was demanded at that yield. Occasionally, given other rates of return in the financial markets the issue would not be fully subscribed – meaning some of the Government’s net spending would be covered in an accounting sense by central bank buying treasury bills (government lending to itself!).

The neo-liberals hated this system and regarded it providing no fiscal discipline on government. They knew that by linking deficits $-for-$ with private debt they could more easily mount the debt hysteria and maximise their pressure on government to cut deficits and withdraw from the market. What still amazes me is that a strong government involvement in the economy such that high levels of employment are achieved is actually good for business. But I digress.

Pressured by the growing neo-liberal squawk, the government replaced the tap system with an auction model to eliminate the alleged possibility of a “funding shortfall”. Accordingly, the system now ensures that that all net government spending is matched $-for-$ by borrowing from the private market. So net spending appeared to be “fully funded” (in the erroneous neo-liberal terminology) by the market. But in fact, all that was happening was that the Government was coincidently draining the same amount from reserves as it was adding to the banks each day and swapping cash in reserves for government paper. The bond drain meant that competition in the interbank market to get rid of the excess reserves would not drive the interest rate down.

The auction model merely supplied the required volume of government paper at whatever price was bid in the market. So there was never any shortfall of bids because obviously the auction would drive the price (returns) up so that the desired holdings of bonds by the private sector increased accordingly. As an aside, at that point the secondary bond market started to boom because institutions now saw they could create derivatives from these assets etc. The financial markets have been very defensive of the profit-making capacity that the auction system provides to them – they revel in the millions of dollars of corporate welfare that they are afforded by dint of the guaranteed annuities embedded in government bonds.

So when this character is talking about a “failed auction” it means that nothing important in real terms is occurring. Ask yourself – will anyone have to hand back their government bonus cheques? Will national infrastructure projects be suddenly halted because the net spending is not “funded”? Answer to all such questions: No! The net spending will go wherever the Government intends it to go – after all the Government needs no funds to spend because it is not revenue-constrained.

So a failed auction is a meaningless construct when related to the capacity of the government to net spend and underwrite higher employment levels.

If the demand for government paper is declining, this more than likely means is that the economy is now offering prospects of growth and investors are diversifying their portfolios again into riskier financial assets and as a consequence desiring less government paper. So what? See further on this below!

What is means in an accounting sense is that the reserve-add arising from the net spending is manifesting in a more diverse array of assets and the extent to which the Government needs to drain the excess funds to maintain control of monetary policy is reduced.

Does that sound like a failure to you?

Further, has any analysis been done of the parameters involved whereby the private market might not take up the debt on issue? I doubt it.

Countries all around the world have been issuing massive volumes on government debt for years – some with high rates of inflation (Turkey) and and others with low rates of inflation (Japan) – without any problem of “funding” at all. The reason is that the deficits, after all, provide the funds that the Government borrows back!

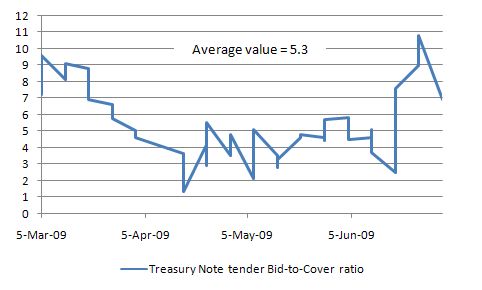

Muston then introduces the concept of the bid-to-cover ratio as proof that things are bleak:

… with each tender now becoming a growing burden on the level of available cash for investment in the market, risks are rising. One gauge of investor interest is the bid/cover ratio. When bids exceed issuance by around three-to-one or greater, the auction is generally considered successful. Twice last month, bid/cover was below two.

The bid-to-cover ratio is just the the $ volume of the bids received to the total $ volumes desired. So if the government wanted to place $20 million of debt and there were bids of $40 million in the markets then the bid-to-cover ratio would be 2.

First, the use of the ratio assumes it matters. It doesn’t because the Australian Government is not revenue-constrained so it could just abandon the auction system whenever it wanted to if the ratio fell to 0.00001.

Second, it is highly interpretative as to what the ratio signals. It certainly signals strength of demand but how strong becomes an emotional/ideological/political matter. Even if you believed that the government was financing its net spending by borrowing, then a bid-to-cover ratio of one would be fine – enough lenders to cover the issue. Some commentators think that 2 is a magic line below which disaster is imminent. There is no basis at all for that.

There is also no basis in the statement that a ratio above 3 is successful and by implication a ratio below 3 is unsuccessful. After all, anything above 1 tells you that some investors do not get their desired portfolio. That sounds like a failure to me.

Third, in the RBA’s Statement on Monetary Policy – May 2009 they make the following observation:

The Australian Office of Financial Management (AOFM) has significantly increased its issuance of Commonwealth Government securities (CGS) this year and, in March, recommenced the issuance of short-term Treasury Notes for the first time since 2003. Auctions for both bonds and notes have been well subscribed. The bid-to-cover ratio on bonds has been around 3½ in recent months, a little above its average over the past couple of decades, while the bid-to-cover for Treasury notes has averaged five.

Fourth, the whole concept is skewed away from a sensible depiction of how the system works. As I have noted in the past, there is no shortage of funds created in the financial markets as a result of net government spending. The idea that this spending sets up a funding exigency that diverts scarce investment funds from other purposes is completely false.

Net government spending finances the desire of the non-government to save and thus creates the funds that make that saving possible. Whether that saving is expressed in tenders for government bonds or other financial assets including cash deposits at banks is another matter and not germane to the point. The funds that the non-government sector uses to buy the bonds come from the government in the first place.

All this talk about a “dire dependence of foreign lenders” fails at square one – foreigners do not issue $AUD. They have to get them from the Australian Government via the net spending activities of the latter, just like we have to get the $AUDs from our national government. It cannot possibly be the case that foreigners or us provide the $AUDs that the Government spends!

Muston then says:

Several factors are compounding our difficulty in financing the deficit. Most significant is the level of the Government’s fiscal stimulus and the effects of the recession on budget receipts ($32 billion and $45 billion in 2009-10, respectively). A combined deterioration of about $270 billion in the four years from 2008 (according to budget figures) will test debt markets like no other crisis before. Surely prudence would call for the Government to scale back the planned stimulus as the economy continues to recover, and allow the benefits of other large stimulus packages around the globe to pass through to Australia in the form of recovering commodity prices and stabilising world growth.

First, the concept that the bond markets are “financing the deficit” is not applicable to a fiat monetary system. Even under the voluntary arrangements in place, the bond issues are not “financing” anything. The Government is just running a system where $-for-$ the net spending is matched by government debt issue which constrains to some extent the financial asset portfolio mix in the non-government sector. Whatever, there is no concept of funding in the debt issuance.

Second, government receipts have fallen dramatically courtesy of the automatic stabilisers triggered by the scale of the global recession. This is why the fiscal stimulus had to be substantial and early. The stimulus places no compulsion on debt markets at all. The debt markets – don’t you just hate these sort of appeals to amorphous constructs like the “market” – we should say the investors – could just ignore the debt issuance tender and diversify the reserve adds into other more profitable financial assets. The Government would not be worse off and the stimulus would still go where it was intended. There is no crisis in that respect at all.

But then you start to see the agenda that is behind this rubbish – the financial markets – that is, the author and presumably his mates – are unhappy that the rise in unemployment is being attenuated a bit! Scaling back the stimulus now will certainly drive unemployment up higher than it is already going. Not a very sensible strategy if you care about real things including people.

And then we read about the “frenzy” that is gripping local debt markets and you get a further clue that the debt market dynamics are actually reflecting expectations of a return to growth rather than any financial meltdown driven by scary deficits. Muston says:

Global stimulus is also starting to hinder local debt markets, with nearly all developed economies in a frenzy to finance huge spending programs. When the integrity of financial markets wavered in October, there was good reason to over-allocate into sovereign-guaranteed securities. But with governments now standing behind bank deposits and quick to support “too-big-to-fail” corporations, much of the fear-factor experienced over the past 18 months has passed and equity markets have posted strong gains in recent months. The need to hold huge allocations of government debt is falling, and investors want to participate in global equity recovery and higher-yielding corporate debt.

So the investors are developing a renewed appetite for risk and are diversifying away from the risk-free annuity provided by government bonds. So what?

Then Muston also introduces Japan, which we have discussed already – several times – in this blog. He says:

One saviour for our bulging debt burden may be a phenomenon that first occurred in Japan. When the Japanese financial system wavered near collapse in the 1980s due to bank insolvency, the response from the public was to save, which reduced exposure to excessive personal debt. This may run counter-intuitive to what many economists and politicians would have us believe is needed to fight a recession, but a large underlying savings pool has allowed the Japanese authorities to finance huge budget deficits for many years. Likewise in the US, and now Australia, cash hand-outs and general economic uncertainty have encouraged people to take tighter control of their financial situation. Bank guarantees and generous term-deposit rates have also been key in attracting more savings, and this will assist in the financing of government securities.

It is not counter-intuitive at all to a modern monetary theorist. The deficits are providing the funds to allow the private sector to restructure their balance sheets after years of budget surpluses drove the non-government sector into deficits. This growth strategy was unsustainable and now the return to private saving requires the budget to be in deficit again if employment and output levels are not to plunge.

The funds that are allowing saving to grow (without triggering disastrous collapses in overall aggregate demand) are then available for bond purchases should the private savers desire those financial assets.

So the large underlying saving pool did not allow Japanese authorities to finance huge budget deficits for many years. Rather the large deficits allowed the Japanese to build up a large underlying saving pool which could then be recycled back into debt purchases while at the same time providing the conditions for economic recovery.

Finally, Muston also warns us against “printing money”. Well I hope the government continues to print some money because we still need notes and coins! But as regular readers will know by now the minting operations have nothing at all to the process of government spending. Muston doesn’t get it:

The Government should also resist any temptation to use quantitative easing to help the bond tender program. Quantitative easing is effectively the printing of money to purchase bonds and has been adopted in the US, Britain, other parts of Europe, and Japan as a last-ditch effort to drive yields lower and reinflate economies.

See my blog on Quantitative Easing 101 for my view on this.

Conclusion:

King Arthur and the Knights of the Round Table was a much better offering than this drivel. The article in question is just brazen political posturing – given the conservatives debt truck has a big debt time-bomb emblazoned all over it – masquerading as informed technical analysis.

Tomorrow, I have some interesting charts coming up on transition probabilities.

Update: Wednesday, July 15, 2009

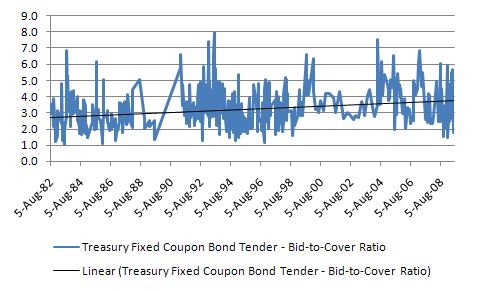

The following graphs are the Times Covered ratio (or bid-to-cover) that the AOFM provides in its official statistics relating to the bond issuance process. They speak for themselves. Note the Treasury Notes issuance was suspended on October 8, 2003 and resumed on March 9, 2009. I have only shown the later period but the earlier period is the same story. Remember a ratio of 1 means that there is enough demand to match the issuance intentions of the government.

The upward sloping black line in the next graph is just a simple linear regression. It is certainly not downward sloping but then I would not read too much into that. The average since August 5, 1982 is 3.2. In the recent period (since the downturn started – February 2008) the average has been 3.5.

Bill, there is a more cynical view. It may simply be that the author is currently short bonds and is talking up his book!

Dear Sean

Probably that too!

best wishes

bill

just read this in passing:

“According to the San Diego Union-Tribune, Republicans and Democrats alike embraced legislation last Friday that would make California IOUs legal tender for all taxes, fees and other payments owed to the state.”

Arnie must have read your note!

Source: http://mikenormaneconomics.blogspot.com/2009/07/is-calfornia-initiating-new-secession.html

The neo liberal view that you speak of, is based on the Friedman/chicago school/monetarism view of macro economics?

Wartime expenditures are something to behold in that graph above. Whats more amazing is that most of the real output at that time was expended on blowing things up. Not a great deal of useful activity occurred at this time.

Regards

Pardon, my ignorance here proff Mitchell,

but whilst yeverything you have said makes sense, why does the source document you quote from with the graph of debt (chart 5) describe the debt, as the money the government owes its creditors.

If as you say we have a fiat currency which is backed by the tax system, and the government can keep issuing debt why does the source document suggest the government owes creditors, since if the government spends money into existence without owing any money except to issue bonds to drain leguidity, then what gives?

Cheers

James

“What still amazes me is that a strong government involvement in the economy such that high levels of employment are achieved is actually good for business.”

This is conflating the “business” of FIRE with the business of going concerns producing real goods and services.

What is good for productive going concerns is not necessarily good for the process of inserting yourself into a strategic location in the flow of funds through the economy for demanding a toll on the funds passing through … and, indeed, beyond a certain point, when FIRE has exhausted the useful services it can provide to going concerns, and FIRE is making its gains from the game of “nice little productive enterprise you ‘ave ‘ere, shame if somefink was to ‘appen to it”, they are in direct conflict.

Gutting progressive taxation is a part of this, since the “big killing” loses appeal compared to the process of long term investment of time and effort in a going concern when “big killings” pay a substantially higher rate of tax than regular salary.

Hi Bill

Some “words of wisdom” from one of my lecturers John Freebairn:

“But, there are good arguments pro and con an activist Keynesian fiscal deficit to stimulate aggregate demand and reduce unemployment in a recession such as now. Some of the causes of the current recession are structural problems, as well as deficient aggregate demand. To focus most of the policy attention to overcome the recession on the demand deficit and away from correcting the structural problems, including restoring business and household balance sheets and reregulating the finance industry, does no more than delay the required structural changes necessary for a sustained recovery.”

Maybe he should read your blog on public deficits funding private savings.

And the old crowding out bug bear gets a run too:

“The most contentious set of arguments for a Keynesian deficit concern the net effect of an increase in government expenditure and reduction in taxation on aggregate demand, or the extent to which the increase in government demand crowds out or reduces private demand.

On the positive net demand stimulus side are: the arguments of a boost to confidence and what Keynes called “animal spirits”; and, that with unused productive capacity, the extra demand will draw into production otherwise unemployed labour, capital and other resources to meet extra sales, output and employment with a further multiplier expansion of demand.

Arguments for a significant crowding out of private demand by the larger government budget deficit include: the required extra deficit funding will reallocate savings and funds from the financial sector (and then for borrowing by businesses and households) to government; and, the private sector anticipating higher taxes in the future to pay-off the debt reduce their perceived long term disposable income and so reduce their current expenditure. This later effect will be smaller the larger is the share of debt financed expenditure directed to productive investment which raises future production capacity and income.”

More grist for the mill.

Full article is below:

http://www.onlineopinion.com.au/view.asp?article=9144&page=0

For what it’s worth, I’ve extracted the data from the Treasury chart Bill showed in this post. I did this using the same technique described here.

Back to the post itself. Bill, you say

and then quote Muston as saying

What he is saying here is that the “corporate welfare opportunities” are actually bigger than they have been in many yars! The implication here is that if there’s lots of money on the table for bond traders, the Government must be doing something wrong (at least, this would be the view of Muston’s “some”).

I actually agree with Muston, to a point (and that point does not include his macroeconomics or alarmism) and it was a point I made on another post. As long as the operating approach of the Government remains $ for $ debt issuance, while the fiscal deficits must perforce correspond to private sector saving, that private sector saving does not necessarily immediately find its way to buyers of bonds. So, in the short term there can certainly be pressure on auctions. In fact, the earlier comment I referred to was in response to just such pressure on the Government T-Note auctions. However, because the savings are there in the private sector, over time there will be rebalancing across different classes of saving and things will normalise. So, while Muston may be technically correct that there will be pressure on interest rates as these auctions are absorbed, I would argue it doesn’t matter a bit because (1) the effect will be short-lived and interest rates will readjust to “normal” levels and (2) current interest rates are very low anyway, so a few tens of basis points of upward movement is not much to get agitated about and (3) since the Government is not revenue constrained it will never have a problem paying the interest anyway (as long as it deems it politically appropriate to continue making the payments!).

Dear Bill

FYI . . . as is usually the case when national debt or debt ratio for the US is reported, the IMF data for the US are wrong, as they include the trust funds for social security and medicare, etc. These are not government liabilities held by the non-government sector, and no interest on them is due to the non-government sector. As you know, even the neoclassical/neoliberal literature on fiscal sustainability agrees that the correct measure of existing debt only uses debt for which there is an existing liability to the non-government sector. It’s in every graduate text in monetary economics. (This is mostly FYI for your readers that might be interested, as I know you already know this.)

Best,

Scott

Dear All

As an update to this post I computed the so-called bid-to-cover ratios (otherwise known as the Times Covered ratio) for Treasury Notes and Treasury Fixed Coupon Bonds. I have put the graphs in the body of the post at the bottom by way of an Update.

Not much sign of the bond markets hating the guaranteed annuity!

Nice addition to the post Bill! It certainly highlights that Muston’s dire predictions of auction failure are somewhat melodramatic. Cover ratios and clearing yields will be volatile, but that volatility is not significant to anyone other than bond traders!

Dear Sean

Note: I didn’t put them up as if they mattered. The bond auction could fail 100 per cent and it wouldn’t matter a bit. I just thought people might be curious and it does highlight the hysterical nature of the so-called journalism.

best wishes

bil

Dear James

Strictly speaking the government does owe the creditors once they issue debt and “borrow” the funds. Where the funds come from doesn’t alter that. And the fact that they don’t need to borrow anyway doesn’t alter that. If I hold a government bond then I have a legal contract to be paid according to the terms of the bond and it is the liability of the government who issued it.

best wishes

bill

Bill: agreed! As I see it, the auction process and resulting movements in interest rates are all very interesting for participants in the bond market (where money can be made and lost as a result), but don’t have much significance beyond that.

Also, I’ve written my own take on the debt hysteria, complete with links back to your blog!

Bill:

I came across a blog from Prof Hamilton concerned about the loss of Fed’s independence due to the fact that the risks on the fed’s balance sheet are ultimately borne by the tax payers. Then he talks about hyperinflation.

http://www.econbrowser.com/archives/2009/07/concerns_about_1.html

” The reason I find that loss of Fed independence to be a source of alarm is the observation that every hyperinflation in history has had two ingredients. The first is a fiscal debt for which there was no politically feasible ability to pay with tax increases or spending cuts. The second is a central bank that was drawn into the task of creating money as the only way to meet the obligations that the fiscal authority could not”

It will be interesting and enlightening for me to get comments from you and others like Scott on this post. Do we really need to be concerned about Fed’s balance sheet? I saw a post from Scott that compared the ECB to the Fed.

Thanks for all the knowledge. Vinodh

‘

Thanks Bill,

I just needed that cleared up……