Today (January 22, 2026), the Australian Bureau of Statistics (ABS) released the latest labour force…

Why does anyone read the New York Times?

It is Wednesday and I offer a few snippets for readers today. I have a number of projects on the go at present and time is short today. Apart from introducing a stunning guitar player (now long dead) that very few people have ever heard of but is one of my favourites (what does that say?), I ask the question: Why does anyone read the New York Times? I also announce the development and publication of our latest Employment Vulnerability Index (EVI) now in its third iteration. You can look at colourful maps as a result of this work! And tomorrow I will be trawling through employment losses around the world. All along the path to releasing my 10-point plan later next week.

I don’t know why anyone reads the New York Times

I was sent this article – No Fight Over Red Ink Now, but Virus Spending Will Force Tough Choices (published April 18, 2020) – a few days ago and wondered why anyone is writing this sort of stuff.

It gives air to and is representative of the dangerous ignorance that abounds, which, if it gains traction in the coming year or so, will derail economic recovery (should we solve the health issue) and significantly exacerbate the damage that will be caused by the lockdowns etc.

The basic premise is:

1. “The deficit hawks have had their wings clipped” – they don’t dare at present rail against the fiscal expansion. In the US case, that is, in part, not because of the size of the intervention but mostly, probably, because trillions have been directed at the top-end-of-town (corporations, Wall Street) and only a pittance is providing support for the millions entering poverty because of job loss.

2. I am also unsure whether the journalist’s construction that the US government has thrown “open the spigots in an unstinting effort to protect both American lives and the nation’s financial underpinnings.”

My reading of the data at present is that there has been a very poorly resourced response to the medical emergency and a totally inadequate fiscal response to support the poor who are without work or never had work.

3. The journalist though cannot help himself with the “Something will eventually have to give” story line.

This is the amorphous scaremongering that the fiscal conservatives introduce all the time when they cannot really tell you what that something is or when the give comes but still use the uncertainty to invoke fear among the masses.

The mainstream economists who are usually ready to offer their nonsensical opinions at any chance have also been quiet but you know what they will unleash in the coming months.

All the lies:

(a) Bond yields will rise making government spending more expensive and risking insolvency.

(b) Interest rates will rise because the government is competing for scarce funds in the (mythical) ‘loanable funds market’.

(c) That accelerating inflation moving to hyperinflation is just around the corner.

And more.

None of which will happen as a consequence of the fiscal stimulus provided by the government(s).

4. Then the journalists quotes some fiscally conservative Republican Senator who offers another platitude:

My problem is, we should have been fixing the roof when the sun was shining. But we didn’t.

Progressive Europhiles also use this metaphor too and I wrote about it in their context in this blog post – Fiscal policy paralysis and ECB credibility in tatters (June 18, 2019).

What does it mean?

The journalist informs us that the Senator:

… was referring to the period before the outbreak, when the economy was booming and the deficit was already projected to skyrocket to an estimated $1 trillion for 2020.

Well obviously they think the federal US fiscal deficit was too large before the crisis. And given the low unemployment that had been achieved, they think the federal government should have imposed austerity on the economy to ‘save up’ currency to meet the current crisis.

They don’t stop to think for a minute that the reason that the unemployment rate was relatively low and the economy had been growing was because Donald Trump DIDN’T impose austerity, and, instead, continued to provide fiscal support to the economy.

That sort of basic macroeconomic logic is a step too far for them.

The ridiculously created – US Committee for a Responsible Federal Budget – published a recent report (I won’t link to it to save you wasting time), which is notable for the size of the numbers they report.

As if these numbers have much meaning. They attach no intrinsic meaning to them – they are just large and the reader is meant to be scared – just as you would if you confronted a ‘cliff’ that was high above the beach and you had to get to the beach.

The Report says deficits and debt will be “unsustainable” in the US.

The journalist’s take is that “In other words, the bill will come due, as it always does”.

He must have a different historical recollection than I because, even though I am a foreigner and live in Australia, I am not aware of any major fiscal catastrophe in recent US history (post 1971) that required pernicious austerity being invoked to ‘pay back debt’ or save the government from insolvency.

And the idea that the rising deficits now will “make budgeting in the future extraordinarily difficult” is equally asinine.

Why?

As the coronavirus crisis has demonstrated – even with the deficit which the journalist says is “estimated $1 trillion for 2020” – the journalist writes:

… any flimsy barriers to spending that remained were demolished in an instant …

Reflect on that a moment.

The logic in one paragraph dismissed (unknowingly) by the logic in the next!

And after all that, the “future generations” enter the narrative, as they always do, and so we read that taxes are going to have to go up.

There is no differentiation between tax rates and tax revenue.

The latter will go up when growth resumes. The latter doesn’t have to do anything in relation to raising funds to reduce the deficit.

Oh, and I nearly forgot, the article would not be the complete disaster unless it got to the storyline:

The spending surge … could prompt inflation, and it also leaves the nation far less prepared in the event of another emergency.

Perfect although he didn’t include the bond yield-insolvency point. We will give him 8/10 for that lapse.

The journalist is listed as having been a “chief Washington correspondent and a veteran of more than three decades of reporting in the capital”.

Standards!

Employment Vulnerability Index (EVI) Version 3.0

In the last few days, I have completed the development of our – Employment Vulnerability Index 3.0 – in partnership with Professor Scott Baum (Griffith University).

I wrote about this in these blog posts:

1. EVI update (August 13, 2009).

2. The CofFEE/URP Employment Vulnerability Index – with updates (March 17, 2009).

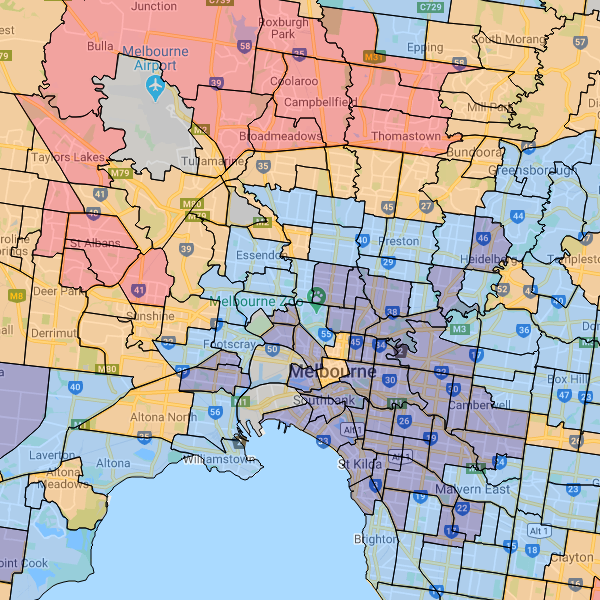

The EVI identifies the small regions (akin to suburbs) across Australia that are most vulnerable to job losses as a result of the economic crisis.

We created the series at the onset of the GFC to better guide policy on where stimulus measures should be targetted.

We developed an economic model to predict the employment vulnerability suburb by suburb. The EVI covers all the Capitals and major regional cities – that is, around 70 per cent of the total population.

The EVI revealed those ‘suburbs – Red Alert and Amber Alert suburbs – which are most exposed to potential job losses and least well placed to escape disadvantage associated with increasing unemployment.

The high risk suburbs included the traditional working class suburbs.

But what was disturbing is that we have also identified a new arena of socio-economic disadvantage that will emerge as a result of the current crisis. The new arenas included the mortgage belt suburbs that have grown on the periphery of our major cities.

So the neo-liberal debt binge that preceded the GFC became a noose in these types of suburbs when the economy headed into the downturn.

We also identify those suburbs that have Medium low risk (light blue) and, in turn, Low risk of job loss (dark blue).

Subsequent analysis of the relevant data at the time demonstrated that our EVI groupings stood up well as a predictive framework. The interesting deviations were traceable to the impacts of the fiscal stimulus packages brought in my the federal government. The risk assessment forecasts were based on a no intervention assumption.

EVI 3.0 extends this analysis in several ways, which will be discussed in the major report we will release early next week.

We have taken the new ABS weekly employment data (taken from the Australian Tax Office payroll series that is now available) to tweak the weightings of the index to see whether the unusual nature of the crisis – forced lockdowns etc – alters the analysis much.

The answer is that it doesn’t but there are some interesting variations which will be documented in the final report.

My research centre – Centre of Full Employment and Equity (CofFEE) – hosts the EVI 3.0 site and allows those curious to see the coloured maps (the graphic above is a snapshot for a part of Melbourne) and detailed rankings across the vulnerability groups and community profiles.

I should add that another group within Australia has recently published what they call an EVI, which appears to be similar to our concept. They have been asked to desist given that we hold the intellectual property rights to the concept and acronym and legal recourse will be sought should they decline.

Call for MMTed Support

I imagine the current crisis will put a halt on people donating to causes.

And I am very appreciative of the financial support that is so far come in. We have been trialling technologies and putting the pedagogy together. I will be announcing a special session soon (which will be held next Friday).

So we are making progress in developing the program that will become – MMTed.

I ran my first Masterclass in London recently and it was well attended. I received good (useful) feedback from several people which will help tune the way we run these face to face classes.

The planned further Masterclasses (May in Australia, June in Europe, September in the US) are on hold while we assess the state of the world. But I hope we will be able to offer them sometime this year.

And on-line curricula is being developed.

But we still need significant sponsors for this venture to ensure that we can run the educational program with negligible fees.

If you are able to help on an ongoing basis that would be great. But we will also be appreciate of once-off and small donations as your

You can contribute in one of three two ways:

1. Via PayPal – which is our preferred vehicle for receiving donations.

The PayPal donation button is available via the MMTed Home Page or via the – Donation button – on the right-hand menu of this page (below the calendar).

2. Direct to MMTed’s Bank Account.

Please write to me to request account details.

Please help if you can.

We cannot make the MMTed project viable on a sustainable basis without funding support.

We will always maintain strict anonymity with respect to donations received, except if the donor desires to be publicly associated with the venture and gives their permission in writing to appear on the Donors Page.

Music – Classic blues guitar – Fenton Robinson

I was listening to this album this afternoon while trying to figure out some json code for layering maps – a sort of retrospective interlude wth one of my favourite guitar players.

The song is – As the Years Go Passing By – and I think a lot of aspiring blues guitar players attempt this piece early on because it is the classic slow blues form with all the scope that that offers.

But no-one playes it better than the original (although Albert King’s version was also great), which was recorded in 1959 by – Fenton Robinson – who is one of the most ignored Chicago blues players in history.

And it doesn’t make sense, given the way he could play – and he was an early electric guitar blues exponent.

This version was a re-recording that he did in 1977 for Alligator Records on his album – I Hear Some Blues Downstairs, the second album of three that he recorded for this emerging blues label.

His band included virtual unknowns – Bill Heid (piano), guitarist Steve Ditzell, bass player Larry Exum, and Ashward Gates Junior (drums).

Here is the – Original 1959 recording – by Fenton Robinson. You can easily hear how recording and production techniques had improved over the space of 15 years or so.

There is extraordinary talent that never achieves the recognition they deserve, although for all fans of the Blues Brothers movie, his major contribution – Somebody Loan Me a Dime – was used.

He died young (62) of cancer.

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

Today in New Zealand I managed to get an economics graduate to agree that money does grow on trees. Indeed, money can be created out of thin air!

Bill, I sent you an email stating that the rules between Australia and New Zealand requires a physical address in the form. Can you send me the physical address of say your University in order for the money to go through?

Warner in the UK Telegraph with the same guff: “For how long can the Treasury afford to bankroll the economy?”

But the counter myth is rather more interesting, and needs addressing.

“Theoretically until the imports required cannot be paid for in the national currency.

This would have resulted in massive inflation unless the country in question was self sufficient.

Which the U.K. is not.

Myth busted”

This falls into the same category of blinkered thinking as “Just get all your doctors and nurses from abroad”.

What’s particularly funny is that these clowns believe in ‘export led growth’ (aka ‘steal demand from other nations so we don’t have to create enough of our own’) at the same time.

Well Bill, even though you are a foreigner and live in Australia, you knew how the US federal government actually operates far better than most Americans- and better than I did. Politics may be a different story- but you could be right there also.

Why do people read the New York Times? Well in the US the NY Times is still perhaps the premier newspaper for national and international news and one of the few that can still afford to pay for reporters around the country and world, at least to some extent. People read it because they think other ‘important’ people read it and to some extent that still holds true.

“This falls into the same category of blinkered thinking as “Just get all your doctors and nurses from abroad”.

What’s particularly funny is that these clowns believe in ‘export led growth’ (aka ‘steal demand from other nations so we don’t have to create enough of our own’) at the same time.”

Ha Brilliant !

When you explain this in Scotland they look at you as if you have 3 heads. They morph into Homer Simpson before your eyes. They think you can just give all your real resources away and have no idea what they are going to with the blips that earn extra blips you get in return.

I read and subscribe to the NYTimes purely to get a handle on the current thinking of the Acela Villagers as relayed by their stenographers. Its utility ends there.

Just watch,

If Scotland enters into a faux independence and tied to the corrective arm and EU convergence program. Export your way to growth will be sung in churches on Sunday’s. Rammed down our throats until we choke on the BS.

The Indy think tanks have the white papers sitting their ready. Homer Simpson in charge of trade policy.

Having left office, British PM James Callaghan was asked what he considered to have been his greatest achievement. As a junior transport minister in the Atlee government he had been responsible for introducing cats eyes to the roads of Britain. The measure had saved countless lives. That was his proudest achievement.

Introducing Fenton Robinson to his readers, thereby soothing their souls amid the stresses of the lock down, has got to rank among Bill’s finest achievements.

“If Scotland enters into a faux independence…”

You presume the EU will still be in existence in a few months time? If national governments are impaired in their efforts to provide an adequate stimulus program for their citizens, how long can that situation persist before complete socio-economic collapse? If the Scottish Government had sufficient foresight, they should declare independence and immediately issue its own currency and central bank – but there’s that word “if” again…

On the other hand, sometimes real political economy sometimes does get reported in the New York Times, whose print edition I buy most days, even embarking on long walks to find an open newsstand here in Brooklyn.

This article, How the Government Pulls Coronavirus Relief Money Out of Thin Air (https://news.yahoo.com/government-pulls-coronavirus-relief-money-190301335.html)

, appeared in the April 16 print edition. I searched for it in the online edition but for several days could not find it — until Yahoo! News picked it up. You can now find it on the Times’ web site at https://www.nytimes.com/2020/04/15/business/coronavirus-stimulus-money.html

As I commented elsewhere, “It would be too much to say, ‘We’ve won the war!’ What we’ve done is to win a strategic hilltop in an important battle — but most of the war is still ahead of us. The battle is with neoliberalism and the war is that against injustice and inequality.”

“Introducing Fenton Robinson to his readers, thereby soothing their souls amid the stresses of the lock down, has got to rank among Bill’s finest achievements.”

Amen to that. Obviously I come here (mainly) for the economics, but Bill doesn’t half pick out some beauties in his musical interludes.

I’ve got a pretty eclectic taste and reasonable grasp of musical history, but still been introduced to loads of new stuff through Bill.

The finest economic thinking on the planet and music to sooth our souls to boot. Perfection.

This garbage about paying back the stimulus debt and a return to austerity begs the question; to whom or what do you pay back the loan? AFAIK “thin air” is not an entity with a bank account..

It’s up there with another favourite of mine; “Can you spend or save a budget surplus?”. AFAIK another non sequitur is the concept of government [national] debt. It’s totally bogus. There is no national debt as there is no debt to repay. it has already been settled at the moment the deficit spend occurred. So as well as the state having no need to offset the deficit, it’s just a sop to the big end of town and the screamers who say its a massive burden on our children, starting 70-80 years ago now. No doubt there is more.

No end to struggles. but we keep trying.

“This falls into the same category of blinkered thinking as ‘Just get all your doctors and nurses from abroad'”. (Neil Wilson)

Why does Steve Keen (in most other respects supportive of MMT) get so worked-up about MMT’s doctrine that exports are a cost and imports a benefit – in real terms? He’s fulminating about that again on

http://macroncheese.com/supply-chains-and-pandemics-with-steve-keen

with Steven Grumbrine.

In the interview he homes-in on supply-chains, with particular reference to the corona pandemic.

He argues it’s insane for any country to make itself wholly or largely dependent for supplies of critical goods (eg respirators – or even just clinically-approved face-masks) or parts (eg for I-phones – sourced he claims from 41 countries!) on foreign sources of supply which can be cut off at any time, through any number of conceivable causes. He argues the plight of the US healthcare system in the face of the pandemic illustrates this particularly graphically, but that that only dramatises what he sees as the doctrine’s inherent invalidity. He rejects it outright. Doesn’t he have a point?

Taken to its logical extreme he seems to be advocating autarky. But MMT appears to adopt the equally extreme opposed position. Where is the dividing-line to be drawn? Based on what?

You read the NYT to act like you are part of the middle class work-hard-and-you-will-be-fine bubble.

The article is likely to backstop the Senate’s intention to starve the poor now that the wealthy have been paid. In America, evil roams in packs.

Thanks for the Blues offer today, Bill.

Amazing contrast between the two versions: from a slightly traditional version (in a different key) with a rocky sax riff to a cooler, more transcendental, spaced out version with a great keyboard part and subtle harmonic touches, maybe jazz influenced rather than standard blues.

Superb.

“Why does Steve Keen (in most other respects supportive of MMT) get so worked-up about MMT’s doctrine that exports are a cost and imports a benefit – in real terms?”

I don’t know about Steve Keen (in fact I don’t know very much generally,) but it seems to me like a question of focus.

Many people look at imports after they’ve been paid for, and see that they’re a drain on foreign reserves, or at the very least a claim on domestic resources hanging over the importer’s head.

But that’s taking more into the frame than has to be taken in. It’s not essential (in the philosophic sense) that imports be paid for. The big pile of U.S. Treasury securities held by China represents a huge pile of imports that U.S. has received from China and not paid for yet — since essentially they’ve been “paid for” with IOUs. Hey! Free stuff! And in the trade war that seems to be going on, the U.S. can threaten to renege on all those IOUs if China doesn’t do what U.S. asks.

People who object to seeing imports as benefits can point to potential downsides further along: exporters might cut off your free stuff after you’ve come to count on it, or you might find you’re forced to sell something really vital to balance the exchange.

But you can choose to weigh these consequences independently from the simple deal that purchases imports.

@ Mel wrote, “But you can choose to weigh these consequences independently from the simple deal that purchases imports.”

Well, yes you can, just as you can end your analysis of taking out a bank loan at the point you spend the money and got some stuff. But, should you do that?

To me it is ideal for every nation to be able to balance their trade exchanges. That is nations like Germany that export much more than they import are beggering their trade partners. To be able to keep buying they need to borrow from Ger. banks or the nation must sell its bonds to Germans.

. . . OTOH, nations like the US could see nations like China and other rich foreigners buying up its real estate or comp. stock to own American comp. Because American comp. are allowed to contribute to American politicians campaigns, our politicians can be bought by foreigners. IMHO, this is a terrible thing to have happen.

. . . At this point in time, it is really necessary that the US Gov. finance all elections in the US. This is the only way now [given the trillions that are outside the US] to keep foreigners from buying the politicians to get the Gov. policies they like. This applies to all levels of gov.

. . . The only alternative would be to cancel all bonds held by possible enemies. Or, maybe capital controls. Both of these are *far worse* as a solution.

IMHO, Steve Keen seems to be wrong here. IMO, the household analogy makes a lot of sense when thinking about foreign trade. {But, not in thinking about internal Gov. deficits, etc.} That is, how long can 2 neighboring farmers remain friends if one (farmer A) is selling the other stuff in excess of all the new income the neighboring farmer B has. [Here, ‘new income’ is the income from that neighbor’s sales of the food he grows (which in this analogy is his income from other exports, i.e., trade.)] The neighbor must, in this case, borrow to get money to buy the stuff from neighbor A. Obviously, this can’t continue, someday there will be a problem.

In the US, the hidden or un-tracked trade between the states is balanced by the US Gov. taxing the rich states more than it spends in the rich states and then spending it in the poor states so they don’t see all their dollars sucked out of their state to go to the rich states. This is *very necessary* for long term stability. This is what Europe lacks.

Where am I going wrong with this analogy?

robertH,

‘Exports are a cost and Imports are a benefit’ is a general idea to reverse the orthodox thinking that exports are a benefit (export-led growth rubbish) and imports are a cost. It doesn’t drill down to specific items or circumstances, nor does it say ‘all’ imports are a benefit. (I’ve found Warren Mosler isn’t great at details; he’s a big-picture kind of bloke.) So yes, Steve Keen is right that there are circumstances where relying on imports is inappropriate and leaves a nation very vulnerable.

Every country should be aiming for self-sufficiency in essential goods and services (food, energy, education, medical supplies etc.) The dividing line is that: is it an essential good/service? And of course, there should always be redundancy factored in. The Corona Virus pandemic is revealing that none of that has been considered. Governments have been asleep at the wheel with the advance of globalisation and just-in-time supply chains.

Steve Keen gets worked up about it, because he wasn’t one of the MMT founders. He’s always trying to one-up them; it’s just an ego thing.

Steve,

It’s good to have the mental flexibility. When I got into this kerfuffle elsewhere, the other side was saying that of course the deals have to close, the trade has to balance, the money has to go around, that’s what the economy is, money going around and around. Which is commonly true. But when that was all that people thought, 2008 came by, the money stopped going around, and they all got blindsided as the world economy crashed. 2008 gave us a great question: “Why did the money just stop? It wasn’t supposed to.” A lot of people learned a lot, and a few other people got to teach them.

Here is a shortish post from Bill Mitchell about the debates on trade. I think it was the third in a series that provoked remarkable numbers of comments and argument and was designed to explain some of the nuances about the statement ‘imports are always a benefit’.

https://billmitchell.org/blog/?p=39420

We, Mel,

In 2008 the money stopped gong round and round because the people could not make the payments on their mortgages. That is, the private debt got too big.

I see the same problem with international trade. That is, in international trade the nations *are* quite like a household. This means they have to make the payments. To keep buying they must have the money to spend. Nations like Greece did this in 2 ways; 1] Greece sold bonds to Ger. banks to deficit spend, and 2] the Greek people borrowed directly or indirectly from Ger. banks. So, in both cases, Germans were making loans to Greece so they could buy German made stuff. IMHO, this has got to stop. One way or another it will stop. That is, someday the sh*t will hit the fan and it will stop.

I suppose that German nation could let the ECB make loans to Greece (to buy Ger, stuff) by buying Greek Gov. 1000 year-bonds at zero interest and never make them pay it back. This would let Greece deficit spend into its economy like the US can. But, this seems quite impossible to me.

Re Steve Keen and imports/exports, costs/benefits.

I’ve always been a bit baffled at the confusion some people seem to get in (including some people who otherwise seem to fully ‘get’ MMT) around what MMT says re import/exports costs/benefits.

To me, it seems very obvious what MMT is saying. I wonder if perhaps a lot of the confusion is just people talking at cross-purposes because costs/benefits are somewhat humpty-dumpty words (another Neil-ism) that people interpret differently.

Take the two main problems people usually have with a trade deficit:

1) It causes domestic unemployment

2) It leads to a reliance on exports

For (1), a trade deficit is just caused by foreigners saving your currency, in exchange for sending you more real stuff than they need purely for the purposes of getting real stuff back from you. Those savings are a demand leakage from your domestic economy, and yes, if your government isn’t prepared to something about that demand leakage, that could result in domestic unemployment.

But domestic deficits are just savings of the domestic private sector, and are a demand leakage in the same way. From a macro POV, it doesn’t really matter where the physical location of those savings are held – they’re just savings in your currency zone (which isn’t tied to physical borders). It seems to me, as soon as people understand MMT, they ‘get’ what the domestic deficit is (private sector savings) and understand this as a demand leakage, and thus see it as incumbent upon the government to ensure they replace that demand sufficiently to ensure full employment. They don’t suddenly start railing against domestic residents saving money.

But some of these same people treat a demand leakage caused by foreign savings completely differently, and blame the trade deficit for the unemployment, rather than blaming the government for not dealing with the demand leakage. As such they get upset at the idea of imports being a ‘benefit’, when they see net imports as being responsible for domestic unemployment.

For (2), this is more about how broad your scope of defining a cost/benefit is. Importing a good/service that you would otherwise have had to use domestic resources producing is a simple benefit in a pure/narrow sense. However, that doesn’t mean it is necessarily the best long-term for your society. If that leads to a reliance on the import and that supply is unstable, and the good/service is critical to the functioning of your society, of course that probably isn’t a great way to plan things. This links in with another Neil-ism re the compromise between efficiency and resilience. The import still had less cost to you (in a narrow sense), but in terms of making your society robust, it actually would have made more sense to incur the extra cost of producing the good/service yourself. So overall you could say it was more ‘beneficial’ to have not imported and produced yourself – but that is just using a wider scope of the notion of ‘benefit’ than the more narrow ‘cost’/benefit’ MMT is using.

Again, this isn’t limited to foreign interactions. Training more doctors than you need to cope with a normal level of health demand ‘costs’ you more as a society, than only training the minimum you need (you could employ those extra doctors to do something else instead). But when you hit a flu pandemic, that extra cost was worthwhile in a broader scope.

As a simple example on how words can be used differently, consider choosing between a £300 and £500 washing machine. You choose the £300, but it only lasts 2 years and needs replacing. The £500 would have lasted 5 years. Clearly the cheaper washing machine cost you more in the long run. But does it make sense to say it cost more to buy? Depends exactly what cost you’re talking about – and there’s no point one person getting angry saying “clearly the £300 one cost more” and the other person screaming back, nonsense, “£300 is less than £500, so obviously it cost less” – when they’re both talking about different costs (the purchase price vs the long term investment).

Note this example is just to highlight how different interpretations of words arise from seemingly simple situations – I’m not trying to claim producing your own is *always* more beneficial in the long run than importing. I’d say it pretty obviously dependent on exactly what good/service you’re talking about, how critical it is to your society, how robust/diverse your supply chain is, how realistic producing the good/service yourself would have been etc etc. In other words a whole bunch of things far wider in scope than the narrow terms in which MMT uses when we talk about the cost/benefit of the import/export. But that doesn’t make what MMT is saying any less true or valid.

Michael Berks, I really can argue for days about this and would be happy to do that. Steve Keen is more right about this. But if you and your country are only interested in the medium term benefits of getting things- then Warren Mosler is right. I thought Bill Mitchell struck a balance I can sort of agree with in the link I posted above.

Maybe Bill will post another essay on the trade thing and that will keep me occupied during this virus thing.

“Taken to its logical extreme he seems to be advocating autarky. But MMT appears to adopt the equally extreme opposed position.”

It’s rather more nuanced than that. You have to remember that the distilled quotes are always in riposte to the Mainstream position: hence “The natural rate of interest is zero”, etc. You end up with a touch of truth by repeated assertion with them – particularly when they get detached from the mainstream position they are the response to.

My general analysis is that the trade argument is, as usual, about control and power. The dynamics of the situation are really quite complex and I’m hoping that if I can get the NewWayland game up to a decent degree of sophistication we can play about with the dynamics a bit more and shift the Heat/Light ratio more towards the latter.

Imports are a net benefit in real terms. There is no doubt about that. But as a currency area you have, by definition, only indirect control over them. As with public sector jobs, it is perhaps useful to divide imports into two categories – Required and Nice to have. To recap: my thesis is that Required Public sector jobs should be matched by Targeted Taxation measures so that they operate as pure transfers. The Nice to Have public sector jobs are what people on the Job Guarantee do – and they can come and go as required. Required Jobs are time and space critical – where ‘no deal’ isn’t an option. Nice to Have jobs are not.

You can then take a similar approach with imports. Imports that are Required probably need to be matched with exports that are similarly Required elsewhere. Imports that are Nice to Have can be matched or unmatched as required. The optimisation goal is to have only Nice to Have Imports, full domestic employment and only Required exports. At the moment that would be you only import Mercedes Cars, have a full Job Guarantee, and you can make PPE with the click of a finger. That gives your country maximum power and control on the world stage. Accounting and everybody else trying to do the same thing will stop you getting there.

Having lots of Nice to Have Imports is useful because if there is a ‘currency crisis’ you would just ban their import until the currency stabilises. Similarly you would ban price rises in the local currency on imported goods and services (or locally made goods where the owner is foreign, which I call the Marmite principle). All those tactics forces losses onto those areas where the currency is rising against yours – encouraging them to do something about it. I would suggest simply having the threat of doing those things hanging over the market will stop any shift that would trigger them. due to the expectations channel.

So you can, in usual times, have lots of control over Required imports simply because you have lots of Nice to Have imports you can threaten to chop. If you have an import surplus (aka a trade deficit) then your stick is likely bigger than the other guys in real terms.

Similarly if the other guy is pursuing “export led growth” they need your demand or they are in trouble. We’ve seen that this week in the oil market. Demand has dried up and the storage is full. Oil is a commodity with a futures market and the futures were up for delivery. Position covering and an excess of supply over demand drove prices negative. Not just on the excess, but on all the deliveries at that point.

The same would apply to tomatoes. They have to sell them to you, or they risk trashing the market for all their tomatoes – and everybody elses. So even though they are a Required import you still have some power over it because it is a commodity item that has a de minimus supply flow speed. You can only slow down an oil well so far. Similarly you can only stock tomatoes so long before they collide with newer tomatoes.

The dynamics are fascinating and no doubt there’s more in my tacit mental model. But that only reveals itself at 3am – usually after eating too much chocolate.

Jerry, I guess my point was, this seems like one of those topics people often appear to disagree on, but that’s actually just because they haven’t properly, formally agreed the proposition they’re debating first. So one person is arguing ‘this’, while the other ‘that’. So person X may be more right about ‘this’, but that doesn’t mean person Y, was wrong about ‘that’.

Even when the topic seems fairly well-defined, each person brings their own set of starting assumptions, and if those are different to the person they’re debating, they again end up debating two slightly different things.

I think happens a lot in blog comments/social media debates because people pick up on individual posts (or even a specific sentence within a post), that the reader, under the assumptions they are working with, disagree with – but actually the real point of difference were the different assumptions/context in the mind of the author when they made the post.

I suspect if the same two people were in the pub with a beer (oh, if only…!) and were given a very specific list of say 100 policy decisions – not abstract concepts, but actual ‘do option 1’, ‘do option 2’ decisions, then we might find they actually agree on most of them.

“if I can get the NewWayland game up to a decent degree of sophistication”

Neil, I know I’ve mentioned this in the past, but if this something you ever want help with and have some specific programming tasks to complete, I’d be more than happy to help.

JM Keynes essay on ‘National Self Sufficiency’

“The nineteenth century carried to extravagant lengths the criterion of what one can call for short “the financial results,” as a test of the advisability of any course of action sponsored by private or by collective action. The whole conduct of life was made into a sort of parody of an accountant’s nightmare. Instead of using their vastly increased material and technical resources to build a wonder city, the men of the nineteenth century built slums; and they thought it right and advisable to build slums because slums, on the test of private enterprise, “paid,” whereas the wonder city would, they thought, have been an act of foolish extravagance, which would, in the imbecile idiom of the financial fashion, have “mortgaged the future”–though how the construction to-day of great and glorious works can impoverish the future, no man can see until his mind is beset by false analogies from an irrelevant accountancy. Even to-day I spend my time–half vainly, but also, I must admit, half successfully–in trying to persuade my countrymen that the nation as a whole will assuredly be richer if unemployed men and machines are used to build much needed houses than if they are supported in idleness. For the minds of this generation are still so beclouded by bogus calculations that they distrust conclusions which should be obvious, out of a reliance on a system of financial accounting which casts doubt on whether such an operation will “pay.” We have to remain poor because it does not “pay” to be rich. We have to live in hovels, not because we cannot build palaces but because we cannot “afford” them…..

….Or again, we have until recently conceived it a moral duty to ruin the tillers of the soil and destroy the age-long human traditions attendant on husbandry, if we could get a loaf of bread thereby a tenth of a penny cheaper. There was nothing which it was not our duty to sacrifice to this Moloch and Mammon in one; for we faithfully believed that the worship of these monsters would overcome the evil of poverty and lead the next generation safely and comfortably, on the back of compound interest, into economic peace.”

One could ask why anyone reads any newspapers.

Thanks for the introduction to Fenton as well. Smooth.

As for the JG and the current crisis, they are not such a bad fit according to some experts. A JG isn’t wishful thinking in our MMT world.

Yale epidemiologist Gregg Gonsalves says “We need a Marshall Plan. We need a New Deal. We need a WPA for public health,”

How Do We Exit The Shutdown? Hire An Army Of Public Health Workers – Kaiser Health News

“Put Americans Back to Work Fighting the Coronavirus” from yahoo finance says

“Nearly 17 million Americans have lost their jobs since mid-March, when the coronavirus started spreading around the country. Many won’t be able to return to work until the outbreak is contained. Meanwhile, there’s a proven strategy for containing infectious diseases, which is notoriously difficult to carry out because it’s so labor-intensive.”

A National Plan to Enable Comprehensive COVID-19 Case Finding and Contact Tracing in the US from Johns Hopkins estimates 265,000 people are needed to do a Wuhan level response; 100,000 for a lesser response probably inappropriate for the USA. My wife’s friend/student Liu did such work in Wuhan – and came down with it. A permanent JG could provide a base for such a quick, flexible and large-scale response.

Tried to post his on earlier relevant thread but was rejected as spam, so I removed the links, hope they are easy to find through google.

It seems to me that MMT begins with the simple observation that “money is a public monopoly.” JG is a conclusion, a result of a line of thinking and insight.