In the annals of ruses used to provoke fear in the voting public about government…

Fiscal policy paralysis and ECB credibility in tatters

Last week, the EU finance ministers (the ‘Eurogroup’) met (June 13, 2019) in Luxembourg as part of their regular schedule. There was a lot of talk in the lead-up to the meeting whether Emmanual Macron’s push for a more coherent EU fiscal capacity to act as a counter-stabilisation capacity for the beleaguered Economic and Monetary Union (EMU). As is normal, there was no progress made and the press reports said that the finance ministers “continued to clash over almost every feature of the new fiscal tool, including the source of funding” (Source). No surprises at all. So the ‘fix the roof while the sun is shining’ agenda, that many Europhile Left commentators have been hoping for, was abandoned. The roof still has gaping holes and the EMU will once again fail badly when the next economic cyclical downturn comes through. And further, the lack of leadership in the fiscal area is creating a massive dilemma for the ECB and its conduct of monetary policy. In effect, the lacuna is demonstrating to all and sundry that monetary policy is incapable of achieving the aims despite the ECB deliberately breaching the legal framework established for it in the Treaties. The Eurozone dysfunction goes to a new level – and it is a time of growth.

The Eurogroup paralysis

Just evaluate what has been going on:

First, when Emmanuel Macron was elected in May 7, 2017, the French government demanded changes to the European treaties to allow for more integration in the form of the creation of a fiscal capacity at the European level.

At a press conference on May 15, 2017, just after his election, Emmanuel Macron joined German Chancellor Angela Merkel, and told the World that at the time that he was seeking nothing short of an “historic reconstruction of Europe and the eurozone” (Source).

He has not got very far in that ambition.

Second, the French and the Germans signed the so-called ‘The Meseberg Declaration’ on June 19, 2018.

It was followed up with another 2-page document – Proposal on the architecture of a Eurozone Budget within the framework of the European Union (agreed on November 16, 2018) – which iterated on the Meseberg wording.

The ‘Declaration’ was not proposing stabilisation capacity, which after all is a key function of fiscal policy – to offset fluctuations in non-government spending in order to avoid recession or economic downturns and/or overheating and inflation.

Thus, any ‘budget’ initiative would not be seen as a short-term spending capacity to offset fluctuations in non-government spending (either up or down). It would be locked into the seven-year fiscal period and would only be available for longer term things such as “research and development, innovation and human capital”.

These are important responsibilities for governments but they are in addition to the counter-stabilisation function of fiscal policy.

The ‘Eurozone budget’ would be funded by the Member States themselves and would have no independent capacity to create net financial assets at the European level.

It was proposed as a temporary redistribution mechanism.

Any proposal to draw on the ‘budget’ would require conditionality. So, in the current context, Italy would be forced to contribute to the fund but would not be able to draw on it because it is deemed to be in conflict with the Stability and Growth Pact and the Fiscal Compact.

In short, if implemented, the ‘agreement’ would provide no effective buffer to prevent crises. The Member States would still be unable to cope with a major downturn in non-government spending.

The figures mentioned at the time were minuscule and functionally useless in a time of crisis.

And there was no proposal to alter the Treaties. Rather it was proposed to be an intergovernmental agreement, which as history tells us, take forever to achieve.

Crises come and go while the 28 (soon to be 27) Member States fight among themselves about where to put commas and full-stops in Communiqués.

I considered those deliberations in detail in these blog posts:

1. Franco-German ‘agreement’ is another European dead-end (November 29, 2018).

2. The Meseberg Declaration – don’t hold your breath waiting (June 26, 2018).

2. The Finance ministers have been discussing these issues for the last 6 months.

Third, there has been “a torrent of warnings from experts and academics about the need to complete the economic union with a fiscal pillar”.

But because France and Germany will not consider a Treaty change on this matter and because there is no unity among the Member States the discussions have stalled just like similar discussions in the past.

Remember back to 1970 – well before the common currency – when the – Report to the Council and the Commission on the realisation by stages of Economic and Monetary Union in the Community (aka the Werner Report), which was released in March 1970, outlined a staged plan to a common currency.

The Werner Committee conceptualised the proposed economic and monetary union as a new ‘nation’ where the member countries effectively become states of a federation.

The Report was clear that retaining the overriding fiscal policy responsibilities at the national level would not be sufficient to address asymmetric development or cyclical stress.

There was an extremely powerful statement in the Report (pp. 12-13), which echoes today:

The centre of decision for economic policy will exercise independently, in accordance with the Community interest, a decisive influence over the general economic policy of the Community. In view of the fact that the role of the Community budget as an economic instrument will be insufficient, the Community’s centre of decision must be in a position to influence the national budgets, especially as regards the level and the direction of the balances and the methods for financing the deficits or utilizing the surpluses.

And moreover:

… transfer to the Community level of the powers exercised hitherto by national authorities will go hand-in-hand with the transfer of a corresponding Parliamentary responsibility from the national plane to that of the Community. The centre of decision of economic policy will be politically responsible to a European Parliament.

The Parliament would be elected on the basis of universal suffrage thereby recognising that economic policy should be democratically determined and those responsible for the policy should be held accountable to the will of the people.

There was no hint that this level of intervention would be the domain of officials centred in Brussels who would do deals with unaccountable bodies such as the IMF that would result in millions of Europeans being made unemployed, which is the norm in Europe today.

The later – Report of the Study Group on the Role of Public Finance in European Integration (aka the MacDougall Report, released April, 1977) – reinforced the need for a central fiscal authority and the responsibility of a European Parliament for the decisions taken by that authority.

The Member States could not agree in 1970 nor 1977 on any of these matters despite creating successive enquiries into how they could create a monetary union.

There was a sort of death wish – they kept talking about it but could never do it.

I wrote about that history in fine detail in my 2015 book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale.

This blog post (among others) also discusses this period – The European Project is dead (July 20, 2015).

Nothing has changed.

1970, 1978, 1991, and on.

The most recent Eurogroup meeting ended on Friday (June 14, 2019) with no agreement to create a counter-stabilising fiscal capacity at the European level.

The Report from EurActiv (Jorge Valero, journalist) – No Agreement On Euro Budgetary Tool: Ministers Send ‘Hot Potato’ Back To Leaders (June 16, 2019) – said that:

1. “EU finance ministers … continued to clash over almost every feature of the new fiscal tool, including the source of funding”.

2. “There was no progress in other key areas flagged by EU leaders, such as the European Deposit Insurance Scheme (EDIS).”

3. “The watered-down guidelines given by the leaders last December already greatly limited the potential of the new instrument to the extreme of impeding describing the new tool as a true eurozone budget.”

4. “a group led by the Netherlands accepted to open the discussions only if the new fiscal cushion excluded any stabilisation role, an essential budgetary feature.”

5. “After 15 hours of negotiation, the Netherlands and others continued to oppose those who wanted to expand the sources of revenues.”

6. The French finance minister tried to spin the line that “This is a mini-revolution… a real game-changer” but that was just part of his campaign to become Macron’s EU Commissioner for France. “But his overly optimistic reading contrasted not only with the results but also with what happened inside the room.”

7. On the European Deposit Guarantee Scheme, “Germany continues to be the great obstacle … opposing the mutualisation of deposits”.

The lack of decision-making at the Eurogroup meetings just reflects the long-standing divisions among the Member States who think they should be joined in some way but can’t stand the idea of giving up their ‘sovereignty’.

And when the ‘let’s join-up more train’ started to accelerate in the late 1980s, what the Member States ended up conceding was the most important aspect of their sovereignty – their currency-issuing capacity!

So we should not see the failure of the Eurogroup to agree on anything that would help insulate the Eurozone from further crisis and eliminate the entrenched (in-built) bias to austerity as anything new.

They are just voicing the cultural divides in Europe that will not go away any time soon and which render the Eurozone dysfunction at the most elemental level and resistant to any meaningful reform.

Why this matters …

The lack of decision-making leadership about fiscal policy is highlighting the ineffectiveness of monetary policy in Europe.

There are two broad ways of generating data which indicate inflationary expectations (short- and long-term): (a) run a survey; (b) use ‘market’ data – which can either be in the form of inflation swaps (a direct measure) or the difference between the current yields for nominal and inflation-indexed bonds (indirect measure).

There are pros and cons with each. Some say that because ‘money’ rides on the market data, the latter are more indicative of what people actually think.

The ECB utilises both types of data.

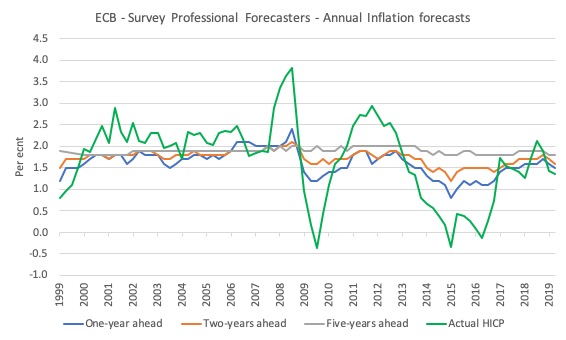

For example, their Survey Professional Forecasters (SPF) publishes quarterly data for the inflation forecasts – one-year ahead, two-years ahead and five-years ahead.

The following graph shows the most recent forecasts for these horizons plus the actual annual inflation rate. Over the course of 2019, to date, all three expectations have fallen sharply and are well below the 2 per cent threshold that the ECB states is its price-stability target.

The market measure of inflationary expectations that is particularly in favour at the ECB since Mario Draghi took over is the ‘inflation swap forward five-year, five-year’ rate.

It plunged to 1.1342 per cent on Monday (June 17, 2019). It fell by 0.23 percentage points in the last month alone.

It hasn’t been that low since the data series was first introduced in 2003.

What is this measure and why is it used as a market measure of inflationary expectations?

An inflation swap is a derivative product which transfers inflation risks between counterparties based on agreed fixed cash flows.

One of the parties (the payer whose core business may be sensitive to inflation) pays a fixed sum (cash flow) to the other on some nominal principle, while the other party provides the former with a variable cash flow based on adjusting the nominal amount to some inflation index (for example, the HICP in the European setting).

So the party paying the variable cash flow is punting that the inflation rate will be falling over the period of the swap.

To make a trade possible, the present values of the fixed and variable sums must be equal and the fixed sum that is agreed becomes a measure of what the market thinks will be the future inflation rate.

In the ‘5y5y’ case, the inflation swap becomes operational in 5-years time and matures five years after that.

It thus indicates what investors think inflation will be (on average) over the five-year period beginning five years from now – that is, inflation over years 5 to 10.

The following chart is taken from Bloomberg (up until yesterday).

Last week, Bloomberg’s article (June 15, 2019) – Europe Inflation Expectations at Record Low Worsens ECB Headache – noted that:

Euro-area inflation expectations slid to a record low … well below the ECB’s target of close to, but below 2%. That suggests the central bank may have to take further steps to revive inflation, such as restarting bond buying, or potentially even cutting interest rates deeper into negative territory.

On June 16, 2019, the Bloomberg article – ECB Will Act If Inflation Expectations Deteriorate, Guindos Says – reported that:

The European Central Bank’s vice president said policy makers will add stimulus if inflation expectations become deanchored

The ECB pointed out that the SPF measures were more “stable” than the movements in the market-based expectations data.

The concept of anchored price expectations just means that there should be some correspondence between expectations and reality and that this correspondence is reflected in our behaviour.

When expectations are ‘anchored’ they tend to display inertia in the face of current data movements. In other words, a few months of inflation spikes will tend not alter the expected rates.

If the expectations become unanchored, then it usually means that short-run deviations in actual inflation from the current expectation will feed into revisions in the expected inflation, which then becomes a self-fulfilling prophecy – a spiral up and down.

I discussed the failure of the ECB to meet its price stability remit in these recent blog posts:

1. Monetary policy has failed – we must reprioritise fiscal policy (February 5, 2019)

2. ECB denial is just embarrassing (April 4, 2019).

Despite a massive bond buying program and other measures to inject liquidity into the European banking system, the ECB has not been able to stabilise inflation around its target which they outline as:

… a year-on-year increase in the Harmonised Index of Consumer Prices (HICP) for the euro area of below 2% … the ECB aims at maintaining inflation rates below, but close to, 2% over the medium term.

Claims that the euro has been a success in terms of maintaining price stability are just nonsensical.

The behaviour of the data is not surprising to an analyst cognisant with Modern Monetary Theory (MMT).

In the absence of an institutional bias towards inflation (indexation schemes, etc) or a imported raw material (for example, energy) shock, inflation will be low if not negative if aggregate spending growth in the relevant ‘economy’ is weak (in relation to what is required to maintain high pressure and low unemployment).

So the specific lack of correspondence between the actual Euro area inflation rate and the ECB’s price stability target provide us with evidence that the Euro area has been wallowing in a low growth environment, contrary to claims by Euro officials that the euro has been a “historic success” in terms of promoting strong real growth.

The fact that the inflationary expectations are heading south tells us that the ECB is becoming even more compromised.

These expectations thus feed into ECB monetary policy decisions.

First, they indicate likely private sector spending behaviour and bargaining pressures in the labour market.

Second, they influence the pricing of financial assets such as government bonds, which means they impact on the way monetary policy is linked to the real economy.

Third, they provide some idea of how well the economy is performing.

The problem for the ECB now are multiple as they are facing a major credibility test brought about because other policy makers in the Eurozone have failed to create a viable system.

Since the crisis, the ECB has been ‘saving’ the Eurozone from breakup by ensuring that no Member State government becomes insolvent.

Its massive bond-buying program has been effectively directly funding Member State government deficits even though the narrative has been determined to represent it as a liquidity management measure.

Clearly, they have been violating Article 103 (the no bailout clause) of the EU Treaty.

And, add to that the other gymnastics the ECB has been implementing – for example, the long-term refinancing operations (LTRO).

These measures have been introduced while the European Commission pushed an ever-deeper austerity bias in the fiscal policy stances of the Member States.

In a way, the ECB has been forced to become a fiscal agent but the politics of the Eurozone have forced it to engage in this role selectively and in partnership with the fiscal austerity (conditionalities etc).

The credibility problem should be obvious to all now:

1. The ECB is locked into its price stability objective.

2. It is losing that battle and that loss has demonstrated the ineffectiveness of its policy measures.

3. According to its own logic it has to inflate – ease rates into negative territory, more bond purchases, buy up private debt, etc.

4. Yet it cannot because its measures are largely ineffective.

5. And fiscal policy the only effective option to stimulate growth is no option in the EMU because of the ideological straitjacket the system has designed.

This problem exemplifies the dysfunctional system they have created and why it should be dissolved.

Conclusion

Even before the next crisis has hit, the hangover from the GFC is clearly still present in the Eurozone.

The lack of leadership on the fiscal front has forced the ECB to go well beyond its monetary policy remit and exposed its lack of effectiveness.

Yet, in the Eurozone, the ECB is all they have.

And the dysfunction is there for all to see.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

One of the few economists that makes sense.

Hello,

It is like Warren Mosler says, they have monetary policy backwards. Lower rates means lower inflation as the price of credit falls and there is a general drop in prices and vice versa.

These wise words from Prof Wray are also relevant:

10. Monetary policy is weak and its impact is at best uncertain-it might even be mistaking the brake pedal for the gas pedal. The central bank is the government’s bank so can never be independent. Its main independence is limited to setting the overnight rate target, and it is probably a mistake to let it do even that. Permanent ZIRP (zero interest rate policy) is probably a better policy since it reduces the compounding of debt and the tendency for the rentier class to take over more of the economy. I credit Keynes, Minsky, Hudson, Mosler, Eric Tymoigne, and Scott Fullwiler for much of the work on this.”

Source Professor Randal Wray 2018 http://multiplier-effect.org/modern-money-theory-how-i-came-to-mmt-and-what-i-include-in-mmt/#more-14285 )

If they want inflation they need to lift rates and creates faux inflation ala cost-push inflation. But that would sink the banks with their NPLs even more than they are now. It is end game for monetary policy in the Eurolands.

I’m not the sharpest tack in the box, so I probably misunderstood the gist of the statement “He has got very far in that ambition”. With no effective structural changes to date, shouldn’t it be hasn’t?

Dear Willy (at 2019/06/18 at 9:21 pm)

Yes, thanks for picking that up.

Appreciated.

best wishes

bill