I grew up in a society where collective will was at the forefront and it…

Leading indicators are suggesting recession

In the last two days, some major leading indicators have been released for the US and Europe, which have suggested the world is heading rather quickly for recession. It seems that the disruptions to global trade arising from the tariff war is impacting on US export orders rather significantly. The so-called ISM New Export Orders Index fell by 2.3 percentage points in September to a low of 41 per cent. The ISM reported that “The index had its lowest reading since March 2009 (39.4 percent)”. This is the third consecutive monthly fall (down from 50 per cent in June 2019). Across the Atlantic, the latest PMI for Germany reveals a deepening recession in its manufacturing sector, now recording index point outcomes as low as the readings during the GFC. Again, exports are being hit by China’s slowdown. However, while export sectors (for example, manufacturing) are in decline and will need the trade dispute settled quickly if they are to recover, the services sector in Japan, demonstrates the advantages of maintaining fiscal support for domestic demand. Japan’s service sector is growing despite its manufacturing sector declining in the face of the global downturn. The lesson is that policy makers have to abandon their reliance on monetary policy and, instead, embrace a new era of fiscal dominance. With revenue declining from exports, growth will rely more on domestic demand. If manufacturing is in decline and that downturn reverberates through the industry structure, then domestic demand will falter unless fiscal stimulus is introduced. It is not rocket science.

In economics, when analysing time series movements in relation to the economic cycle, we talk about leading and lagging indicators.

We often focus on lagging indicators, which reflect the manifestations of cyclical movements, because they are ‘output’ measures that are readily available. For example, unemployment shows up after the cycle has turned down.

Leading indicators reflect changes that typically are predictive of the direction of the economic cycle rather than reactive.

The various Purchasing Manager Indexes that are produced around the world are leading indicators.

Germany

The latest – IHS Markit / BME Germany Manufacturing PMI (October 1, 2019) – is a train wreck story.

The key findings are:

Headline PMI slips to 41.7 in September

Faster decreases in output, new orders and employment

Output charges fall to greatest extent since March 2016

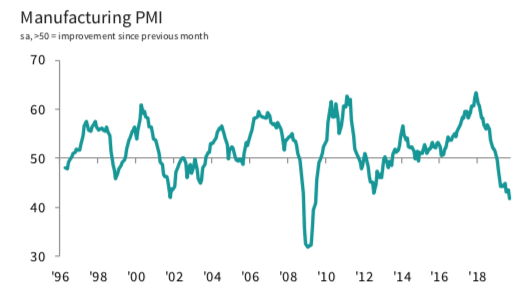

The following graph from the publication shows what has been going on with the ‘headline PMI’, which is “derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases”.

The related commentary leaves no-one in doubt:

Germany’s manufacturing sector recorded its worst performance since the depths of the global financial crisis … contractions in output and new orders accelerated. Job shedding also intensified, with factory employment falling to the greatest extent for almost a decade …

the survey revealed a growing number of firms cutting output prices amid increasing competitive pressures, and a sustained decline in the cost of raw materials.

Output fell for the “eighth month in a row” and the “rate of decline accelerated”.

New orders “fell even faster … dropping to the greatest extent since April 2009 and leading to a further reduction in backlogs of work.”

And as we know, employment intentions follow output trends and “the pace of staff shedding accelerating to the quickest since January 2010”.

The outlook is bleak.

While the trade disruptions are implicated, the irresponsible policy position of the German government (refusal to run fiscal deficits) and the European Union overall is exacerbating the external weakness.

Germany is especially reliant on external conditions, given its suppression of domestic demand. It is now paying the price of that imbalanced growth strategy.

US manufacturing now in trouble

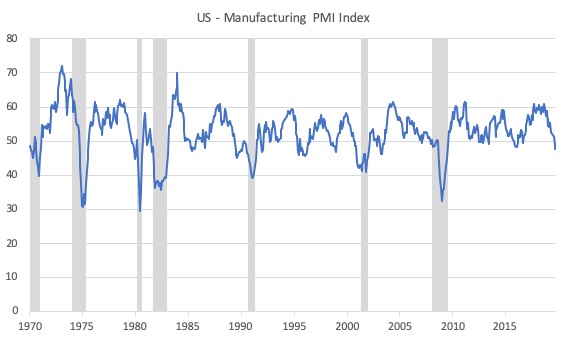

The Institute of Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI) is a leading indicator and is derived from monthly surveys of “purchasing and supply executives in over 400 industrial companies”, which ask a series of questions relating to “New Orders, Backlog of Orders, New Export Orders, Imports, Production, Supplier Deliveries, Inventories, Customers Inventories, Employment, and Prices” (Source).

The way the PMI is a ‘diffusion index’ which has the property of “leading indicators and are convenient summary measures showing the prevailing direction of change and the scope of change.”

The ISM tell us that:

A PMI® reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally declining.

The following graph shows the movements from January 1970 to September 2019 in the overall US Manufacturing PMI (the shaded bars are NBER-classified recessions).

The series is quite erratic but it seems that the turning point came about a year ago and it has been mostly heading downhill since then.

For the last two months, the overall index has been predicting contraction.

The US PMI has a good track record as a leading indicator.

The US Federal Reserve will probably join in the interest rate cutting charge, which will once again show the ineffectiveness of monetary policy.

Further, if the US manufacturing sector is now in a significant decline, then nations that export into the US such as China, Canada, Mexico (to name a few important ones) will be hit hard.

That is how a global recession spreads through the supply chain linkages reducing orders and employment, which in turn, reduces workers’ income and impacts negatively on consumption expenditure, which then feeds back onto production.

I won’t comment on what this all means for prices of financial assets (shares and bonds) but you should be able to work it out yourself (hint: shares down, bonds up, yields further lower).

But before we make to much of the PMI result, which is bad for Manufacturing, other data is not suggestive of a major recession looming.

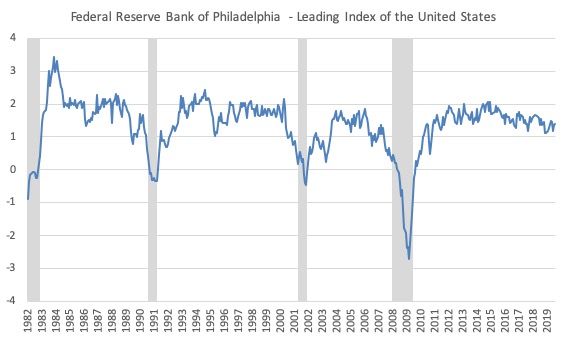

For example, the Federal Reserve Bank of Philadelphia publish a – Leading Index for the United States – which is a composite of the individual leading indexes compiled for each of the 50 US states.

The Federal Reserve Bank of Philadelphia’s index combines various variables including “state-level housing permits (1 to 4 units), state initial unemployment insurance claims, delivery times from the Institute for Supply Management (ISM) manufacturing survey, and the interest rate spread between the 10-year Treasury bond and the 3-month Treasury bill.”

The following graph shows the evolution of this series since January 1982 to August 2019.

The Bank’s – Current Report: August 2019 – says that the US coincident index “is projected to grow 1.4 percent over the next six months.”

That would not suggest a recession is imminent.

And in Japan?

The – Jibun Bank Japan Manufacturing PMI (published October 3, 2019) – showed that:

Japan’s manufacturing sector remained under pressure at the end of the third quarter as firms cut production amid sustained weakness in demand. A sharper drop in output was accompanied by quicker declines in new orders and purchasing activity, while inventories were also reduced. Selling charges were discounted to encourage sales, but global trade frictions and concern towards domestic economic health led to a subdued business outlook …

The headline Jibun Bank Japan Manufacturing Purchasing Managers’ Index PMI … – a composite single-figure indicator of manufacturing performance – fell to 48.9 in September, down from 49.3 in August, its lowest mark since February. Overall, the PMI signalled a modest, but sharper deterioration in the health of Japan’s manufacturing sector.

The survey revealed that “Firms link export weakness to lower sales to China, US and Europe” and the “Strength in the trade-weighted yen so far this year has also meant that the currency has not been able to mitigate the impact of the global trade slowdown.”

The commentary indicated that “the service sector’s ability to weather the sales tax hike in the fourth quarter will be crucial to keeping the economy afloat into the year-end.”

I wrote about the consumption tax hike that came in on October 1, 2019 in this blog post – Japan about to walk the plank – again (September 30, 2019).

Up to this point, the services sector in Japan has been performing well.

The – Jibun Bank Japan Services PMI (published October 3, 2019) – showed:

… a thirty-sixth month of expansion in Japan’s service sector, with panellists reporting solid order book volumes as a key driver behind sustained growth …

The seasonally adjusted Business Activity Index recorded 52.8 in September. This was down from August’s 22-month peak of 53.3, but was above the average across the current three-year stretch of services output growth …

Greater inflows of new work were registered by Japanese service providers in September …

Employment was expanded by Japanese service providers in September …

… latest survey data indicated that businesses expect activity to be higher than present levels over the coming 12 months. Confidence strengthened to a three-month high in September, lifted by expansion plans and forecasts of stronger demand. Nonetheless, a number of firms expect the sales tax hike to have an adverse impact on the economy.

With the export sector (manufacturing) in trouble as a result of the world slowdown, the last thing that the Japanese government should have done was to introduce a destabilising negative force into its domestic sector (such as the consumption tax).

We will see in coming months how damaging that move will prove to be.

Conclusion

The policy settings of governments around the world, biased by neoliberal austerity thinking, are delivering difficult conditions for manufacturers at present.

Combined with the ridiculous trade war that Donald Trump is fighting (and losing) then we have the environment for a world recession.

Wasteful and totally avoidable with some shifts in policy.

Not the Nobel Prize

I have received a lot of E-mails about this so-called prize and voting is apparently going on at present.

I don’t know anything about it other than some Tweets I have seen but many readers want to know about the process. Further, I was told in London the other day that I had been nominated for this “Not the Nobel Prize” by several different people.

However, my name never appeared among the nominations that were published. I was asked why that would be.

My answer – I have no idea what the process was but it was claimed on the sponsoring site that “You can nominate as many people as you like” among the conditions and then a final list would be culled according to some voting process.

It seems though, that the organisers conducted an unspecified cull of nominations to avoid certain people appearing on the voting list. Hence my name never appeared.

Which, if true, makes this ‘Prize’ more of a fraud than I thought.

I know nothing more than that and would not have accepted the nomination anyway, given the rule of framing, that in negating a frame we reinforce it (Not reinforces Nobel Prize).

And what a scam that is.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

Bill, you wrote

The US Federal Reserve will probably join in the interest rate cutting charge, which will once again show the ineffectiveness of fiscal policy.

You mean Monetary policy, don’t you?

“In the last two days, some major leading indicators have been released for the US and Europe, which have suggested the world is heading rather quickly for recession.”

The perfect scapegoat for the deliberate economic vandalism of the Morrison mal-administration, unfortunately.

Dear Rod White (at 2019/10/03 at 4:05 pm)

I do mean monetary policy. Thanks for the correction. I was typing fast.

best wishes

bill

Viewing Twitter and all its works with abhorence, I knew nothing before now about the “Not the Nobel Prize”. I take it to be designed to debunk the artfully-constructed mystique of the “Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel” by inferentially claiming to possess no less worth than that does while selecting as candidates for it only economists most directly opposed to the mainstream (from which those awarded the Sveriges Riksbank’s prize are – almost without exception I imagine – customarily drawn; as of course they would be, considering the credentials of the jury-members who choose them).

That so-called “Nobel Prize in Economic Science” came into existence as a shameless PR stunt staged by Sweden’s central bank to bamboozle the more gullible among non-economists into becoming party to the pathetic delusion harboured by some economists (usually the more mediocre and/ or self-serving) that their profession merits being given “parity of esteem” with the physical sciences – mainly on the ground that it sometimes employs mathematical equations (often spuriously) to “prove” – so it claims – its “axioms”. Their ruse was successful: to have been awarded a (misleadingly-dubbed) “Nobel Prize in (Economic) SCIENCES” for one’s work in the field of economics has indeed – unjustifiably – acquired in the public’s mind a level of approbation and authoritativeness *borrowed* (more like “purloined”) from that imparted with infinitely greater scientific justification by the award of a *real * Nobel Prize. It has proved to be a meal-ticket of great value to those “economics Nobel laureates” (don’t laugh) not too self-respecting to exploit it to that end (which might well have been among the Sveriges Riksbank’s motives for inventing it in the first place – these people are not naive).

The whole charade positively invites satire (which to my mind is what the “Not” prize amounts-to and which I would therefore automatically have applauded). It does seem. though, that the organisers may have queered their own pitch by trying to be too clever by half. A pity.

Trump’s tariff war now extends to Scotland (25% on Scotch whisky, approved by the WTO), and we are reciprocating by refusing planning permission for a housing estate near his Turnberry golf course.

In reality the planning permission is unrelated, but Trump will think otherwise so perhaps this suggests a powerful method of fighting against Trump’s trade war. There’s nothing a neoliberal hates more than an attack on his future wealth prospects.

According to a pro-Brexit YT video I have just been watching, but won’t bother linking to, this goes wider and deeper than just Scotch Whisky, and apparently comes after many years of litigation. The WTO has given the USA permission to raise tariffs on a range of goods from the countries that participate in the Airbus consortium, as a punishment for the EU’s “illegal” subsidies to the latter. The video suggested that although this has nothing to do with Brexit, no doubt the hardline enemies of Brexit will somehow find a way of blaming Brexit.

The video also says that the USA has not yet implemented all the tariffs that it is allowed to, and the ones it has are in the hope of forcing the EU to the negotiating table.

Recession?

Its okay. We have saved up a lot of funds with fiscal surplus to deal with just that!

So once UK leaves the EU – and provided the Scots are not daft enough to then secede from UK and enter the EU – further perpetuating the tariff on Scotch would cease to be of any use at all to the Yanks as a bargaining-counter, and Mr. Trump can be gracefully granted his planning-permission.

Yet another reason (in addition to fisheries and miscellaneous others) for some Scots to end their foolish infatuation with their supposed paragon the EU and embrace Brexit instead.

Personally I wish the Scots well, which is one reason why I hope they won’t be so short-sighted as to damage themselves to no better purpose than cocking a snook at us poor inoffensive English. At present they’re in danger of cutting off their nose to spite their face.

Recession in the USA. At this time, I don’t see it coming.

robertH

“- and provided the Scots are not daft enough to then secede from UK and enter the EU – further perpetuating the tariff on Scotch would cease to be of any use at all to the Yanks as a bargaining-counter, and Mr. Trump can be gracefully granted his planning-permission.”

It is not the ‘poor and inoffensive English’ that Scots want to be shot of, it the very wealthy and very offensive ones.

If there is any nose cutting-off going on it is by English politicians who consistently diminish the role of Scotland in the UK, but are happy enough to cash in on the advantages.

The sort of attitude you express should hasten the process of separation. And there’s a lot of it about.

Brexit has far more potential to cripple the Scotch whisky industry than a Trump tantrum, if that is what it is. England is already well advanced in damaging the Scottish brand and slapping a union flag on whatever products it can get away with. Some of us don’t like it.

There’s a lot I don’t understand here. You have sort of been saying that the US is still below production capacity and deficient in aggregate demand and employment for a while now.

As much as I do not like Donald Trump, net government spending seems to be increasing. And doesn’t seem likely to stop anytime soon.

The MMT position on exports is that they are mostly a cost for the exporter- so why worry about a trade war unless you can’t produce substitutes for what you import into the country? I mean if you are below production capacity- what’s the harm?

@ Andrew (Andy) Crow:-

“Brexit has far more potential to cripple the Scotch whisky industry than a Trump tantrum, if that is what it is”.

Strange logic. Assuming for the sake of argument – as your hypothesis does – UK as now constituted, marshalling and deploying all indigenous productive resources to the maximum achievable effect will *have* to be the paramount economic-policy objective, in order to withstand the strains the UK economy will come under in the immediate post-Brexit period at least. A bit like a war-economy. What use could damaging the Scotch whisky industry conceivably serve for *any* post-Brexit UK government under those circumstances?

“It is not the ‘poor and inoffensive English’ that Scots want to be shot of, it the very wealthy and very offensive ones”.

You misunderstood me: I was using the word “poor” not (in the way you’ve taken it) in its sense of “impoverished” but in its other sense – roughly equivalent to the Italian “simpatico” – “likeable”, if you will (you probably won’t).

Besides, aren’t there *any* “very wealthy and very offensive” Scots (naming no names)? Nor do I follow the logic of describing an English person expressing sincere concern for Scotland’s well-being as being “(an) attitude … hasten(ing) the process of separation”. That strikes me as a bit paranoid.

In the U.S. fiscal support is at record levels. FY 2019 ended with a record of $5 trillion of Federal Gov’t spending and the deficit at $1 trillion, the biggest in 7 years. So it’s not just Japan. Why wasn’t this mentioned?

@Jerry Brown:

“As much as I do not like Donald Trump, net government spending seems to be increasing. And doesn’t seem likely to stop anytime soon.”

Do yo have any speceifics on this, Jerry? As other posters have pointed out before, not all government spending is born equal. The culmination of the trickle-down-to-fascism ride is when government directly pours public money into the private enterprises that support it. This is old school Mussolini capitalism*.

Any public spending that goes to enterprises like Eric Prince’s Blackwater mercenaries, his sister Betsy DeVos’ charter schools of de-education, uncecessary weaponry by Lockheed&Martin, etc. produces more negative effects in the long run that whatever meager fiscal stimulus they may provide in the short one. This kind of stimulus would be like Keynes famous hole-digging only that it is not holes but graves. Medicare4All, GND, free college and proper funding of public schools, now that is the kind of spending I’d like to see. Problem is, the plebs profit too much from it and the lizard-people at the top only get to live their privileged lifes on without the satisfaction of stomping the boot ever harder on the faces of said plebs.

As for the capacity of production and the deficient demand, I think that what goes into it is that an overqualified working force is getting by on internships and sh*tty jobs on overtly “flexible” contracts, while at the same time most of the production that could happen at home has been outsourced. I think Bill often says that it is not reasonable to think that an increase in demand at the current time could not be answered by an accomodating rise in the supply of goods and services. It’s when this is not the case that inflation arises. But since this demand is lacking, the supply-side chooses to “invest” it’s vast reserves in the FIRE sector giving way to the asset price inflation evidenced by (amongst other things) the stock and real estate prices.

*I think fascism in this context should be dropped and called what it is: the authoritarian end-form of capitalism. After all, the other side of the aisle doesn’t bother to differentiate between stalinism, maoism, socialism, communism or even democratic socialism so why should we?

Cheers!

Hermann, you have pointed out some of the reasons I don’t like Donald Trump. But one thing I do like about him is that he has not been anxious to start any wars. At least so far.

As for specifics- Mike Norman @20:25 gives the specifics my comment was lacking.

As an aside, Yale Professor Robert Shiller has called modern monetary theory a “fad narrative” invented by SUNY professor Stephanie Kelton and popularized by Alexandria Ocasio-Cortez (D-NY). “We do have to worry about debt,” he said, “because it has to be repaid.”

@ Esp,

What an idiot Yale Professor Robert Shiller is.

Does he not know that England/UK has has had a national debt in every year since 1694? It has mostly never even been paid down. The graphs that you see are not the raw debt vs time. The are the ratio of the raw debt to the total GDP vs time. This appears to go down because of growth in the denominator from population growth, growth in the wealth of UK, and inflation. So, the UK has had a debt for 425+ years and it has not needed to be paid down, let alone paid-off.

During those 425 years UK gained and lost its Empire, and it sank to the 2nd level of Great Powers. For me, 425 years is long enough to see that a nation’s debt will never be paid-off. It will be rolled over until the nation ceases to exist. Some examples of this are: Imperial Russian bonds were not paid-off, Polish bonds issued between 1918 and 1939 were never paid-off, and German bonds from the Nazi period were never paid-off. The bond holders lost it all because those nations ceased to exist.

Some day the UK & US will also cease to exist. As will every other nation. However, this is not a problem for people living today. And if it is, well the people of the US & UK will have a bigger problem than the bond holders are losing their investment. Like the people’s dollars or pounds will be worthless.

@Jerry:

” But one thing I do like about him is that he has not been anxious to start any wars. At least so far.”

Indeed. Though I’m not sure this is out of conviction or lazyness. His sabre-rattling on behalf of Prince “Bone Saw” of SA tells me he wouldn’t mind going after Iran for no good reason. Here’s to him resisting the neocon siren’s songs for war.

Cheers!

@Steve_American – thank you for your response