Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

The Weekend Quiz – October 28-29, 2017 – answers and discussion

Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

At present all the EMU member nations face insolvency risk because they use a foreign currency. If one such national government left the Eurozone and re-established its own currency, converted all euro liabilities to that currency, then they would eliminate that risk on all future liabilities issued.

The answer is False.

The answer would be true if the sentence had added (on all future liabilities) … in its own currency. The national government can always service its debts so long as these are denominated in domestic currency.

The answer is false because there is a possibility that the government may borrow in foreign currencies in addition to its own currency.

It also makes no significant difference for solvency whether the debt is held domestically or by foreign holders because it is serviced in the same manner in either case – by crediting bank accounts.

The situation changes when the government issues debt in a foreign-currency. Given it does not issue that currency then it is in the same situation as a private holder of foreign-currency denominated debt.

Private sector debt obligations have to be serviced out of income, asset sales, or by further borrowing. This is why long-term servicing is enhanced by productive investments and by keeping the interest rate below the overall growth rate.

Private sector debts are always subject to default risk – and should they be used to fund unwise investments, or if the interest rate is too high, private bankruptcies are the “market solution”.

Only if the domestic government intervenes to take on the private sector debts does this then become a government problem. Again, however, so long as the debts are in domestic currency (and even if they are not, government can impose this condition before it takes over private debts), government can always service all domestic currency debt.

The solvency risk the private sector faces on all debt is inherited by the national government if it takes on foreign-currency denominated debt. In those circumstances it must have foreign exchange reserves to allow it to make the necessary repayments to the creditors. In times when the economy is strong and foreigners are demanding the exports of the nation, then getting access to foreign reserves is not an issue.

But when the external sector weakens the economy may find it hard accumulating foreign currency reserves and once it exhausts its stock, the risk of national government insolvency becomes real.

The following blogs may be of further interest to you:

- Modern monetary theory in an open economy

- Debt is not debt

- The deficit and debt debate

- Debt and deficits again!

Question 2:

When a nation is enjoying a strong terms of trade with an external surplus, the government can create more space for non-inflationary spending in the future by running fiscal surpluses and accumulating them in a sovereign fund.

The answer is False.

The public finances of a country such as Australia – which issues its own currency and floats it on foreign exchange markets are not reliant at all on the dynamics of our industrial structure. To think otherwise reveals a basis misunderstanding which is sourced in the notion that such a government has to raise revenue before it can spend.

So it is often considered that a mining boom which drives strong growth in national income and generates considerable growth in tax revenue is a boost for the government and provides them with “savings” that can be stored away and used for the future when economic growth was not strong. Nothing could be further from the truth.

The fundamental principles that arise in a fiat monetary system are as follows:

- The central bank sets the short-term interest rate based on its policy aspirations.

- Government spending capacity is independent of taxation revenue. The non-government sector cannot pay taxes until the government has spent.

- Government spending capacity is independent of borrowing which the latter best thought of as coming after spending.

- Government spending provides the net financial assets (bank reserves) which ultimately represent the funds used by the non-government agents to purchase the debt.

- Budget deficits put downward pressure on interest rates contrary to the myths that appear in macroeconomic textbooks about “crowding out”.

- The “penalty for not borrowing” is that the interest rate will fall to the bottom of the “corridor” prevailing in the country which may be zero if the central bank does not offer a return on reserves.

- Government debt-issuance is a “monetary policy” operation rather than being intrinsic to fiscal policy, although in a modern monetary paradigm the distinctions between monetary and fiscal policy as traditionally defined are moot.

These principles apply to all sovereign, currency-issuing governments irrespective of industry structure. Industry structure is important for some things (crucially so) but not in delineating “public finance regimes”.

The mistake lies in thinking that such a government is revenue-constrained and that a booming mining sector delivers more revenue and thus gives the government more spending capacity. Nothing could be further from the truth irrespective of the rhetoric that politicians use to relate their fiscal decisions to us and/or the institutional arrangements that they have put in place which make it look as if they are raising money to re-spend it! These things are veils to disguise the true capacity of a sovereign government in a fiat monetary system.

In the midst of the nonsensical intergenerational (ageing population) debate, which is being used by conservatives all around the world as a political tool to justify moving to fiscal surpluses, the notion arises that governments will not be able to honour their liabilities to pensions, health etc unless drastic action is taken.

Hence the hype and spin moved into overdrive to tell us how the establishment of sovereign funds. The financial markets love the creation of sovereign funds because they know there will be more largesse for them to speculate with at the expense of public spending. Corporate welfare is always attractive to the top end of town while they draft reports and lobby governments to get rid of the Welfare state, by which they mean the pitiful amounts we provide to sustain at minimal levels the most disadvantaged among us.

Anyway, the claim is that the creation of these sovereign funds create the fiscal room to fund the so-called future liabilities. Clearly this is nonsense. A sovereign government’s ability to make timely payment of its own currency is never numerically constrained. So it would always be able to fund the pension liabilities, for example, when they arose without compromising its other spending ambitions.

The creation of sovereign funds basically involve the government becoming a financial asset speculator. So national governments start gambling in the World’s bourses usually at the same time as millions of their citizens do not have enough work.

The logic surrounding sovereign funds is also blurred. If one was to challenge a government which was building a sovereign fund but still had unmet social need (and perhaps persistent labour underutilisation) the conservative reaction would be that there was no fiscal room to do any more than they are doing. Yet when they create the sovereign fund the government spends in the form of purchases of financial assets.

So we have a situation where the elected national government prefers to buy financial assets instead of buying all the labour that is left idle by the private market. They prefer to hold bits of paper than putting all this labour to work to develop communities and restore our natural environment.

An understanding of modern monetary theory will tell you that all the efforts to create sovereign funds are totally unnecessary. Whether the fund gained or lost makes no fundamental difference to the underlying capacity of the national government to fund all of its future liabilities.

A sovereign government’s ability to make timely payment of its own currency is never numerically constrained by revenues from taxing and/or borrowing. Therefore the creation of a sovereign fund in no way enhances the government’s ability to meet future obligations. In fact, the entire concept of government pre-funding an unfunded liability in its currency of issue has no application whatsoever in the context of a flexible exchange rate and the modern monetary system.

The misconception that “public saving” is required to fund future public expenditure is often rehearsed in the financial media.

First, running fiscal surpluses does not create national savings. There is no meaning that can be applied to a sovereign government “saving its own currency”. It is one of those whacko mainstream macroeconomics ideas that appear to be intuitive but have no application to a fiat currency system.

In rejecting the notion that public surpluses create a cache of money that can be spent later we note that governments spend by crediting bank accounts. There is no revenue constraint. Government cheques don’t bounce! Additionally, taxation consists of debiting an account at an RBA member bank. The funds debited are “accounted for” but don’t actually “go anywhere” and “accumulate”.

The concept of pre-funding future liabilities does apply to fixed exchange rate regimes, as sufficient reserves must be held to facilitate guaranteed conversion features of the currency. It also applies to non-government users of a currency. Their ability to spend is a function of their revenues and reserves of that currency.

So at the heart of all this nonsense is the false analogy neo-liberals draw between private household budgets and the government fiscal balance. Households, the users of the currency, must finance their spending prior to the fact. However, government, as the issuer of the currency, must spend first (credit private bank accounts) before it can subsequently tax (debit private accounts). Government spending is the source of the funds the private sector requires to pay its taxes and to net save and is not inherently revenue constrained.

You might have thought the answer was maybe because it would depend on whether the economy was already at full employment and what the desired saving plans of the private domestic sector was. In the absence of the statement about creating more fiscal space in the future, maybe would have been the best answer.

The following blogs may be of further interest to you:

- A mining boom will not reduce the need for public deficits

- The Futures Fund scandal

- A modern monetary theory lullaby

Question 3:

Only one of the following propositions is possible (with all balances expressed as a per cent of GDP):

- A nation can run a current account deficit accompanied by a government sector surplus of equal proportion to GDP, while the private domestic sector is spending less than they are earning.

- A nation can run a current account deficit accompanied by a government sector surplus of equal proportion to GDP, while the private domestic sector is spending more than they are earning.

- A nation can run a current account deficit with a government sector surplus that is larger, while the private domestic sector is spending less than they are earning.

- None of the above are possible as they all defy the sectoral balances accounting identity.

The best answer is the second option – “A nation can run a current account deficit accompanied by a government sector surplus of equal proportion to GDP, while the private domestic sector is spending more than they are earning”.

This is a question about the sectoral balances – the government fiscal balance, the external balance and the private domestic balance – that have to always add to zero because they are derived as an accounting identity from the national accounts.

To refresh your memory the sectoral balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

Expression (1) tells us that total income in the economy per period will be exactly equal to total spending from all sources of expenditure.

We also have to acknowledge that financial balances of the sectors are impacted by net government taxes (T) which includes all taxes and transfer and interest payments (the latter are not counted independently in the expenditure Expression (1)).

Further, as noted above the trade account is only one aspect of the financial flows between the domestic economy and the external sector. we have to include net external income flows (FNI).

Adding in the net external income flows (FNI) to Expression (2) for GDP we get the familiar gross national product or gross national income measure (GNP):

(2) GNP = C + I + G + (X – M) + FNI

To render this approach into the sectoral balances form, we subtract total taxes and transfers (T) from both sides of Expression (3) to get:

(3) GNP – T = C + I + G + (X – M) + FNI – T

Now we can collect the terms by arranging them according to the three sectoral balances:

(4) (GNP – C – T) – I = (G – T) + (X – M + FNI)

The the terms in Expression (4) are relatively easy to understand now.

The term (GNP – C – T) represents total income less the amount consumed less the amount paid to government in taxes (taking into account transfers coming the other way). In other words, it represents private domestic saving.

The left-hand side of Equation (4), (GNP – C – T) – I, thus is the overall saving of the private domestic sector, which is distinct from total household saving denoted by the term (GNP – C – T).

In other words, the left-hand side of Equation (4) is the private domestic financial balance and if it is positive then the sector is spending less than its total income and if it is negative the sector is spending more than it total income.

The term (G – T) is the government financial balance and is in deficit if government spending (G) is greater than government tax revenue minus transfers (T), and in surplus if the balance is negative.

Finally, the other right-hand side term (X – M + FNI) is the external financial balance, commonly known as the current account balance (CAD). It is in surplus if positive and deficit if negative.

In English we could say that:

The private financial balance equals the sum of the government financial balance plus the current account balance.

We can re-write Expression (6) in this way to get the sectoral balances equation:

(5) (S – I) = (G – T) + CAD

which is interpreted as meaning that government sector deficits (G – T > 0) and current account surpluses (CAD > 0) generate national income and net financial assets for the private domestic sector.

Conversely, government surpluses (G – T < 0) and current account deficits (CAD < 0) reduce national income and undermine the capacity of the private domestic sector to add financial assets.

Expression (5) can also be written as:

(6) [(S – I) – CAD] = (G – T)

where the term on the left-hand side [(S – I) – CAD] is the non-government sector financial balance and is of equal and opposite sign to the government financial balance.

This is the familiar MMT statement that a government sector deficit (surplus) is equal dollar-for-dollar to the non-government sector surplus (deficit).

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)) plus net income transfers.

All these relationships (equations) hold as a matter of accounting and not matters of opinion.

This is also a basic rule derived from the national accounts and has to apply at all times.

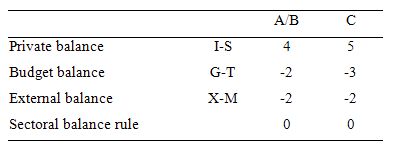

The following Table represents the three options in percent of GDP terms. To aid interpretation remember that (I-S) > 0 means that the private domestic sector is spending more than they are earning; that (G-T) < 0 means that the government is running a surplus because T > G; and (X-M) < 0 means the external position is in deficit because imports are greater than exports.

The first two possibilities we might call A and B:

A: A nation can run a current account deficit with an offsetting government sector surplus, while the private domestic sector is spending less than they are earn

B: A nation can run a current account deficit with an offsetting government sector surplus, while the private domestic sector is spending more than they are earning.

So Option A says the private domestic sector is saving overall, whereas Option B say the private domestic sector is dis-saving (and going into increasing indebtedness). These options are captured in the first column of the Table. So the arithmetic example depicts an external sector deficit of 2 per cent of GDP and an offsetting fiscal surplus of 2 per cent of GDP.

You can see that the private sector balance is positive (that is, the sector is spending more than they are earning – Investment is greater than Saving – and has to be equal to 4 per cent of GDP.

Given that the only proposition that can be true is:

B: A nation can run a current account deficit with an offsetting government sector surplus, while the private domestic sector is spending more than they are earning.

Column 2 in the Table captures Option C:

C: A nation can run a current account deficit with a government sector surplus that is larger, while the private domestic sector is spending less than they are earning.

So the current account deficit is equal to 2 per cent of GDP while the surplus is now larger at 3 per cent of GDP. You can see that the private domestic deficit rises to 5 per cent of GDP to satisfy the accounting rule that the balances sum to zero.

The final option available is:

D: None of the above are possible as they all defy the sectoral balances accounting identity.

It cannot be true because as the Table data shows the rule that the sectoral balances add to zero because they are an accounting identity is satisfied in both cases.

So what is the economic rationale for this result?

If the nation is running an external deficit it means that the contribution to aggregate demand from the external sector is negative – that is net drain of spending – dragging output down.

The external deficit also means that foreigners are increasing financial claims denominated in the local currency. Given that exports represent a real costs and imports a real benefit, the motivation for a nation running a net exports surplus (the exporting nation in this case) must be to accumulate financial claims (assets) denominated in the currency of the nation running the external deficit.

A fiscal surplus also means the government is spending less than it is “earning” and that puts a drag on aggregate demand and constrains the ability of the economy to grow.

In these circumstances, for income to be stable, the private domestic sector has to spend more than they earn.

You can see this by going back to the aggregate demand relations above. For those who like simple algebra we can manipulate the aggregate demand model to see this more clearly.

Y = GDP = C + I + G + (X – M)

which says that the total national income (Y or GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

So if the G is spending less than it is “earning” and the external sector is adding less income (X) than it is absorbing spending (M), then the other spending components must be greater than total income

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

1 out of 3.

Question 1 I made the mistake of assuming new liabilities would be in sovereign currency.

Question 2 I can’t plead any reasoning except example: Norway has trade and govt sector surpluses and a sovereign fund, so…I should’ve noticed “running fiscal surpluses and accumulating them in a sovereign fund” meant the sf would not be in foreign exchange.

Ahh – number 1 I fell into same trap as Sam – assuming new liabilities would be in sovereign currency – surely if they went to the trouble of turning old EURO debts into sovereign currency debts they wouldn’t be so silly as to issue new debt in foreign currency ;-). But I suppose they might.

Number 3 – feel confident now with this.

Number 2 – Yes – those sovereign wealth funds seem to me to be silly in NZ context. Generating paper wealth doesn’t mean we will be able to support an aging population. We should be using money to invest in our children and economy’s future capacity to produce enough to sustain us gen X’ers as we age. Investing in overseas shares while we have such poverty and homelessness seems pointless to me.

Re Q2.

Sadly, in contrast to his usual clarity, Prof. Mitchell seems to get tangled up in a morass of tortuous illogicality whenever he discusses sovereign wealth funds.

He is of course 100% right regarding the trivial point that at any time a sovereign government can print its own currency or bonds, so there is no point in a “wealth” fund holding such assets.

However, sovereign wealth funds in the real world hold saleable assets which the government cannot manufacture, which is a very different matter.

.

A country which has substantial natural resources (e.g. oil, gold) which can be sold on world markets is demonstrably better able to buy goods and services to improve the lives of its citizens compared with countries with few such resources. For example, the Saudi Arabian government is able to buy infrastructure, hospitals, new cities, etc. In contrast such spending is impossible for the governments of Bangladesh, Bhutan, Botswana, Burundi etc.

Likewise, a country which has substantial sovereign reserves of financial assets or commodities which can be sold on world markets is more able to buy goods and services to improve the lives of its citizens compared with countries lacking such resources.

.

So the answer to Q2 is TRUE.

Yeah, a stash of foreign funds is a very useful thing to have when you have to shop in foreign markets. But saving from your own fiscal surplus doesn’t create a stash of foreign funds. At best, in the Q2 scenario, you buy foreign funds to save by spending your own currency, and ultimately by selling your own production. The question becomes: does your export sector need savings in a foreign currency? I guess Norway found itself with a great deal of oil to sell, and no healthy way to absorb that wealth immediately into its own economy.

Kingsley Lewis, I think your argument is good- except that a country that tries to save by ‘investing’ in production in some other nation is going to get screwed as soon as that other nation decides not to pay. That will happen to Norway sooner than it would happen to my militaristic USA.

Yes, a country that has resources that others desire is in a better bargaining position than if they didn’t have those resources. But who enforces the whatever deal they make?

Aside from all that, Question 2 asks if “the government can create more space for non-inflationary spending in the future by running fiscal surpluses and accumulating them in a sovereign fund.” The best, most realistic answer to that is ‘False’. No government can rely on valuations of assets under the control of some other country as a plan to provision itself in the future. Yeah, maybe it will work out sometimes for a small country like Norway. Just because the costs involved with paying Norway might be less than the costs of repudiating those payments though. A large country like Germany or France would be s.o.l. very quickly if they were depending on foreign investments to provide much of their income.

A foreign wealth fund is not a sovereign wealth fund, by definition. Likewise a gold mine is not a sovereign wealth fund, nor an oil field a sovereign wealth fund. These are real resources and it’s well established by MMT that these are finite. Now it may be politically apt to pool foreign funds, or oil, or gold – but that is not what the question was.