I started my undergraduate studies in economics in the late 1970s after starting out as…

Debt and deficits again!

The euphoria over a 0.4 quarterly growth figure which translate into annualised GDP growth being at least 2.5 per cent less than would be required to keep the unemployment rate from rising should be attenuated by the fact that National Accounts data is very slow to come out. The picture it paints which conditions our current expectations and debates is old – at least 3 months old by definition. And it is sobering when amidst all the self-congratulation and applause for our strong export performance that newer data has come out today which suggests that GDP growth is probably now negative although we won’t find that out for three more months. Meanwhile the debt and deficits argument continues in the public debate. Here is an update.

One of the advantages of yesterday’s national accounts data was that it has – for about a day or so – defused the Opposition debt hysteria. I imagine they suspended outfitting their latest debt truck when the GDP data emerged although I am reliably informed that it lost its wheels when Joe Hockey stood on it rehearsing for his upcoming Across-Australia Debt Hysteria Tour.

And while the vast majority of media commentators are also in full hysteria mode, Ken Davidson is sailing against the hurricane in his (nice) column in the Melbourne Age today entitled History shows debt need not be a burden. He says the Opposition campaign against the deficit is “deceitful”. Overall his article is very instructive and worth examining a bit. As an aside, I have fond memories of reading Ken’s articles in The Age as a young student growing up in Melbourne in the 1970s and 1980s. He was always worth reading and I learned a lot about the interface between economic reasoning and public policy. Not that I always agreed with his “Keynesian” approach (me being a blooming modern monetary theorist and all!)

He makes the point that one big difference “between the Great Depression and the Great Recession is that the authorities at least now know that any attempt to balance the budget in current circumstances would be self-defeating.”

It is also interesting to read at least one other commentator (other than myself) who is saying the deficit is not large enough. Given yesterday’s national accounts outcomes and the forecasted deterioration in the labour market presented in the Budget papers, a projected $58 billion deficit is probably about 2/3rd of what is required and that is probably a conservative guess. See my blog – Size of Deficit 101 – which presents a framework for thinking about this question.

In relation to this issue, Ken Davidson writes:

The size of the deficit is less than it should be if the Government’s prime concern was to ensure total community spending was in line with the growth in economic capacity. Economic capacity, as measured by the underlying growth in the workforce and labor productivity, will be about 7 per cent in the next two years, and yet GDP growth is forecast in the budget to be only 2 per cent over the same period. As a result, unemployment is expected to grow from 6 per cent to 8.5 per cent.

Even though the budget deficit over the two years will pump $115 billion into the economy, the official figures suggest economic growth will be 5 percentage points, or about $60 billion, less than the underlying growth capacity of economy.

In other words, we are looking at a deflationary, rather than an inflationary gap opening up between national spending and output despite the budget deficit. Cuts in government spending to reduce the debt would open the deflationary gap further and hence increase government debt.

In other words, attempting to reduce the size of the deficit for political reasons – that is, independent of the state of the non-government saving and employment the deficit has to support will be catastrophic and put us on a course for continual sluggish economic performance and high unemployment.

One of the big points of difference between myself and Mike Beggs who recently sought to defend The Greens’ from my criticism that a reading of their macroeconomic policy documents led me to conclude they are mired in neo-liberal-gold-standard type currency thinking was that he believes that you will inevitably get “inflation in circumstances where the government is continually injecting currency into the private sector with ‘unfunded’ deficits.”

Simple neo-liberal argument: unfunded deficits cause inflation. It is in every text book there is. It is taught to every student (other than those I have taught). It is everywhere in economics! Bad luck it is a nonsencal argument that is really used to discpline governments and allow the free market to rip. I don’t impute those latter motives to Mike though!

Given that Mike now believes a sovereign government is not revenue-constrained I suppose his use of the term ‘unfunded’ is not literal but rather refers to whether or not the government drains the reserve adds that arise from net spending (budget deficits).

My position is clear. Barring a major supply shock and independent of whether you have a buffer employment scheme in place (that introduces a separate set of dynamics), a country will get inflation if nominal spending exceeds the real capacity of the economy to absorb it. When the economy has no spare capacity then increasing the budget deficit; expanding investmennt; higher exports or increased autonomous consumption will all drive nominal spending beyond the capacity of the economy to respond in real terms.

In this regard (that is, the add to nominal spending), there is nothing distinct about government net spending. All expenditure components will have the same effect. Which means if we wanted to follow this logic, we should be very suspicious of rising export income; investment growth; solid consumption spending, just as much as we might be about an unconstrained (unfunded) budget deficit. Not!

Further, a budget deficit which adds net reserves to the banking system doesn’t in anyway increase the capacity of the banks to lend. So unlike money multiplier theorists who think the causality runs from deposits -> reserves -> loans -> credit creation, in fact, the way the fiat monetary system operates is for loans to create deposits which then are matched by reserves (gained from interbank borrowing or from the central bank). The reserve adds coming from the budget deficit do not alter this process a single bit. The only positive effect they might have is providing some underpinning to employment and production and creating more credit-worthy customers for the banks to lend money to.

Moreover, up to the point of full capacity, the economy will usually respond to nominal spending impulses by increasing real production and employment rather than trying to hike prices (therefore setting off the pre-conditions for an inflation). I remind everyone that inflation requires a continuous increase in the price level. Some upward price level adjustments in the face of improving demand conditions do not constitute inflation. For example, I was in Melbourne last weekend and the hotel I stayed at in South Yarra is normally around $A220 a night. This weekend it was around $A125 a night because they must be bleeding in the face of the contraction in GDP growth. As conditions become more favourable they will clearly return prices to their “normal capacity” levels. But it would be wrong to think this is inflation and the price level changes have been driven by the budget deficit.

In the light of all this, Davidson’s next point is very interesting:

There is no capacity constraint on real economic growth. It should not be beyond the wit of government to come up with sensible expenditure proposals, which can be wound back in three years when, according to official forecasts, private spending will be able to take up the slack. Even so, if inventing useful activities is beyond the wit of government, it would be better for society to invent more less-productive jobs.

The main reason why the Government is not prepared to adopt a more proactive budgetary policy is that the thinking about government borrowing is still essentially mired in the 1930s.

As Keynes observed in the General Theory, published in 1936, gold mining was a wholly wasteful activity (akin to burying banknotes in disused coalmines, which then could be dug up and put into circulation). Currencies were backed by gold (the barbaric relic).

Thus plentiful supplies of gold were associated with strong growth in the world economy, and when new supplies were scarce, world wealth suffered stagnation and decline.

In the gold standard governments had to raise taxes or issue debt to increase their spending because the money stock was limited by the available gold stocks (given strict convertibility parities were maintained). But in a fiat monetary system where there is no convertibility and flexible exchange rates, governments do not have to borrow to spend.

So with unused capacity – both capital (think about the empty hotel rooms!) and labour (think about around 11.5 per cent broad labour underutilisation) – the deficit is the only show in town.

And it should expand until the excess capacity is absorbed. The quickest way to get full employment in this regard is through direct public sector job creation (yes, a Job Guarantee would be great). This should give it more room to then pursue other public good developments (education, health, telecommunications, environmental quality etc).

What the government does in relation to managing the reserve impacts of the deficit spending is quite apart from its unlimited capacity to spend. So whether it issues debt or not depends on what the central bank is doing with respect to interest rate targetting. If the central bank paid a support rate (return) on overnight reserves held by the member banks equal to the current short-term interest rate then it could maintain this target without issuing debt. Otherwise, it has to issue debt to drain the reserves that are boosted by the deficits.

The debt issuance has nothing to do with financing (funding) the net spending.

The debt issuance has nothing to do with tempering inflationary pressures.

The debt issuance has nothing to do with reducing the capacity of the private banks to lend.

It is everything to do with allowing the central bank to hit its interest rate target!

Davidson continues on with his theme:

It is not well understood in the popular imagination that all currencies today are fiat money, that is money issued by government through their central banks that is not backed by gold, silver or other securities.

A fiat currency country has the option to borrow from the central bank to finance a deficit by issuing IOUs to the bank in return for currency printed by the mint. The interest on the IOUs is profit to the bank, which in turn is owed to the government. Jobs financed this way do not add to the debt burden.

This is a sensible option when, as in Australia, the economy is operating below full capacity and when the major threat is deflation expectations (which provide an incentive to postpone spending in the hope of lower prices in the future) rather than inflationary expectations (where the expectation is higher future prices and encourages investors to bring expenditure forward).

But be warned that given my points above, the central bank has to issue debt to the non-government sector in these situations or lose control of its interest rate target. I am not sure Ken really understands this link – the debt issuance is an interest-maintenance operation. The Keynesian line against the modern monetary line!

Clearly, the central bank can subvert the overnight interbank competition that arises when deficits add reserves to the banking system by just paying the target rate on overnight (excess) reserves. It can also just take the Bank of Japan strategy and let the target rate drop to zero and not drain the entire reserve add arising from their on-going massive deficits. They have been doing this more or less for the last 18 years – and inflation has been deflation! Mike Beggs should think about that for a little while.

On the question of debt burdens, Ken Davidson offers this:

There is no reason why, when the economy has recovered, that part of the borrowings from the Reserve Bank should not be converted to bonds issued by the government to the public to soak up any excess liquidity that might otherwise finance inflation.

Even so, providing the borrowings are used to finance productive activity that yields a return better than the long-term bond rate, there will be no net debt burden on future generations.

Well again be careful to understand what the so-called monetisation would mean for the RBA’s ability to hit its interest rate target.

There was another contribution to the debt hysteria debate today. Peter Martin’s Blog today carries a statement from 21 of Australia’s most respected economists (I wonder where the poll that decided this is or was the title just self-promotion?) that seeks to provide a calming voice to the public debt hysteria. The statement is generally progressive but contains some gold standard reasoning which in my view defeats the purpose to some extent.

Consider this part of the statement:

Of course other things being equal it’s better for governments to be debt free.

But as any homebuyer knows, debt can help us build assets now that we couldn’t otherwise afford, and repay the costs when the assets bear fruit. Australia entered this crisis relatively well placed to weather the storm…

First, what does other things equal mean? They want the private sector not to have a risk free asset in which they can store their wealth and earn a market based income? They want the central bank to lose control of its interest rate target by being unable to drain excess reserves? Maybe they want the central bank to pay the same rate on overnight reserves to the banks as it sets as its target rate? But probably they are in the balance the budget over the cycle camp, which means they then are suggesting non-government net saving will be balanced over the cycle. None of the above is very convincing.

Second, the real dilemma is the sentence that follows. The idea that what is good for the homebuyer or a corporation is good for the government is a very typical progressive Keynesian argument used to defray the monetarists and others who eschew all budget deficits.

So it is a common ploy by “deficit doves” who think deficits are fine as long as you wind them back over the cycle (and offset them with surpluses to average out to zero) and keep the debt ratio in line with the ratio of the real interest rate to output growth. Torturous formulas are provided to students on all of this under the presumption that the government does have a financing constraint but as long as it is cautious things will be fine.

So just as a household or corporation can benefit by increasing their debt levels to expand their wealth or business as long as a sensible return is made that permits the servicing and payback the debt, the government can also benefit by increasing debt.

That is the argument. You can see the problem immediately. It presumes an analogy between an entity (household or coroporation) which uses the fiat currency and is thus financially constrained in its spending – and an entity (the sovereign government) which is the monopoly issuer of the fiat currency that clearly has no financial constraint.

It presumes that the debt in some way “funded” the government spending and was not used to defend the central bank’s interest rate targets.

It presumes that the sovereign government needs to generate a monetary return (how?) to repay the debt without problems.

As a conception of how a fiat monetary system works – it is just plain wrong.

This point reminds me of an E-mail I received in the last few days from a Green’s member (who may even be a politican!). The person (no clues given as to who it was) said that while we could debate whether the macroeconomics statements in their official policy were technically wrong or not in their application to a fiat monetary system, the real issue was that they were politically aimed to defuse criticism. So ultimately their validity in theory didn’t matter that much as a consequence.

So the argument was that as a political party they needed to use politically acceptable terminology to avoid being dismissed as loonies irrespective of whether in fact the statements were akin to neo-liberal reasoning. After all this is the dominant economic paradigm and The Greens wanted to make inroads into other debates where they felt more comfortable.

Progressives generally adopt this view. It is a safe route but ultimately doesn’t get you very far.

The fundamental point I keep making is that the macroeconomic constraints that are embedded in the neo-liberal approach are such that they thwart a genuinely progressive program of social and economic and environmental reform and will always stop the economy short of true full employment.

A sounder approach is to get the macroeconomics reasoning correct in the first place and then show some political leadership by relentlessly pushing this alternative (but correct) framework in the public debates. It is easy to tie a neo-liberal up with questions that they cannot ultimately provide a convincing answer to. Just start with asking them to explain the way in which fiscal policy has operated in Japan – years of massive deficits, zero interest rates, deflation!

Conclusion

I will leave the conclusion to Ken Davidson who says:

It is the task of budgetary policy, in conjunction with monetary policy, to balance the economy as close to full employment as possible constant with price stability irrespective of the size of the deficit.

I could have easily written that article (although not as nicely as Ken did!).

Digression: states attacking people

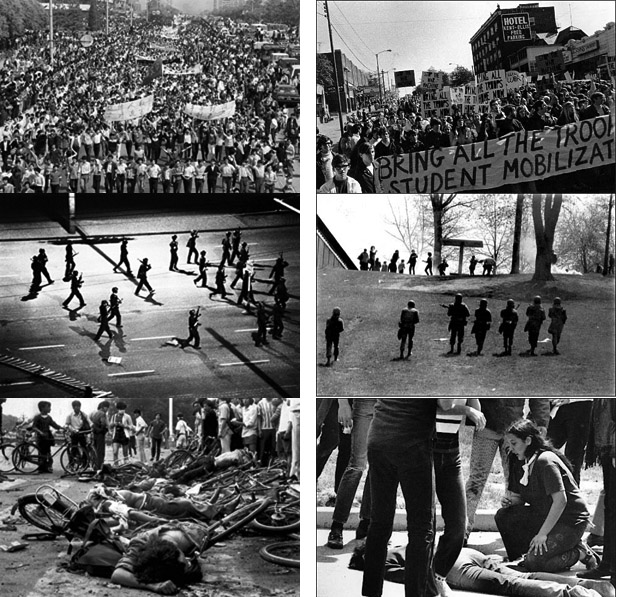

The mainstream media today are making a big deal of the 20th anniversary of the Tiananmen square incident in China which killed thousands of protesting students. Once again we are reminded of how a state which doesn’t have in-built checks and balances can turn against its citizens to the point of killing them. While the “tank man” photo is the one we remember I decided to take a different approach in the little collage presented below!

It also turns out to be a one question quiz. The Tiananmen incident is captured in the three vertically stacked images in the left-hand column. The causal chain is clear: Students organise protest objecting to government policy -> the state troops move in -> students get killed by the state troops.

To focus our attention a bit, I took the following comment from the MSNBC on-line coverage of today’s remembrance of Tiananmen. I could have selected many like it from right across the western press sites.

Communism is a terrible injustice even when you have a booming economy. Humans were born to be free. I pray that China and Cuba may taste true freedom with no fear of oppresion during my lifetime. God bless the Thomas Jeffersons of the modern world.

Now the quiz. Have a look down the right-hand column.

Question: Where and when did that occur? Clue: May 4, 1970.

Right column photos courtesy of Howard Ruffner.

It reminds me of other convenient media truths which nations mobilise around. When September 11 comes along we might revisit this theme.

Kent State University, Ohio, USA