These notes will serve as part of a briefing document that I will send off…

Overt Monetary Financing would flush out the ideological disdain for fiscal policy

There was an article (May 24, 2016) – Helicopter money: The illusion of a free lunch – written by three institutional bank economists (two from the BIS, the other from the central bank of Thailand), which concluded that Overt Monetary Financing (OMF), where the bank provides the monetary capacity to support much larger fiscal deficits with no further debt being issued to the non-government sector, was “too good to be true”, in the sense that it “comes with a heavy price” – summarised as “giving up on monetary policy forever“. The argument they make is very consistent with the work that Modern Monetary Theory (MMT) proponents have published for more 20 years now, which is now starting to penetrate the mainstream banking analysis. However, the conclusion they draw is not supported by the original MMT proponents who would characterise OMF as a highly desirable policy development, more closely representative of the intrinsic monetary capacity of the government. The article also raises questions of what we mean by a “free lunch”, a term which was popularised (but not invented) by Monetarist Milton Friedman. Its use in economics is always loaded towards the mainstream view that government interventions are costly. But if we really appraise what the term “no such thing as a free lunch” really means then, once again, we are more closely operating in the MMT realm which stresses real resource constraints and exposes the fallacies of financial constraints that are meant to apply to currency-issuing governments.

I last wrote about Overt Monetary Financing (OMF) in this blog – The Bank of Japan needs to introduce Overt Monetary Financing next.

The motivation for the Voxeu article is the increasing talk – even in mainstream circles – that the so-called non-standard monetary policies (QE, negative interest rates etc) have failed to be an effective antidote against deflationary forces and have failed to stimulate real GDP growth back to desirable levels.

The narrative then goes that the ‘big bazooka’ left for central banks is to use so-called “helicopter money” (or OMF) which would accompany fiscal deficits and, in the words of the authors, be:

… a sure-fire way to boost nominal spending by harnessing central banks’ most primitive power: their unique ability to create non-interest bearing money at will and at negligible costs.

I wrote about helicopters etc in this blog back in 2012, well before, the current popularisation of OMF entered the debate – Keep the helicopters on their pads and just spend.

The title is self-explanatory.

As a matter of history, the references to ‘helicopter money’ comes from Milton Friedman’s suggestion in the introduction (page 4) to his collection of essays – ‘The Optimum Quantity of Money and other Essays”, Chicago: Aldine Publishing Company, 1969 – that a chronic episode of price deflation could be resolved by “dropping money out of a helicopter”.

Some commentators, initially, thought that QE was a close cousin of this idea. They were wrong. QE doesn’t involve anything more than the central bank swapping bank reserves (central bank money) with bonds (or other financial assets) held by the non-government sector.

It was introduced on the false premise that banks were not lending because they had insufficient reserves. Cure? Boost their reserves. How? Use central bank money which is in inexhaustible supply to buy bonds held by the banks in return for reserves. QED! Right?

Wrong! Even the mainstream economists must surely be catching on by now that banks do no need reserves to lend. They worry about reserves after the fact and know they can always get them from the central bank anyway, who operates to prevent financial instability, which might include large scale defaults within the payments system (that is, cheques bouncing because banks didn’t have the reserves to back the loans they had issued).

The only way QE could boost economic activity was because it reduced longer interest rates (because it increased the demand for longer-term bonds and drove down their yields). However, this mechanism also didn’t work because the state of sentiment has been so poor that households and firms have been reluctant to borrow no matter how cheap the loans might have become.

So how do the Voxeu authors characterise OMF?

They write:

There is broad agreement that helicopter money is best regarded as an increase in economic agents’ nominal purchasing power in the form of a permanent addition to their money balances. Functionally, this is equivalent to an increase in the government deficit financed by a corresponding permanent increase in non-interest bearing central bank liabilities (emphasis in original).

In other words, the government (treasury side) spends more or taxes less and matches the increase in the deficit with a government (central bank side) increase in bank reserves.

Whether it is a ‘permanent’ rise is not the point – more about which later.

MMT proponents would also not use the term “financed” here because here we have one arm of government working with another. The fact is that it is the consolidated government that issues the currency and spends it into existence. The two arms of government have to work together on a daily basis for their individual policy ambitions to be effective.

As an aside, there are some Post Keynesian (non MMT) economists who have attacked MMT in the past on this very point (Lavoie, Rochon, Fiebiger etc). There attacks reflect a poorly constructed view of what is being said.

They claim that MMT misrepresents the reality of the situation by ‘consolidating’ the central bank with the treasury, and, that, in fact, the two bodies are separate and so it is not correct to say that the government does not need to fund its deficit.

Apart from the legal and political links between central banks and treasuries in most nations, the criticism is shallow.

In the same way that Marx exposed the superficial exchange relations that overlay the production of surplus value and the essence of private profit, MMT exposes the notion of voluntary versus intrinsic constraints in a fiat currency system. No other Post Keynesian Theory writer had talked about that in the past. It is one of the ‘novel’ features of the MMT literature.

In this sense, MMT exposes the veil of ideology.

The constraints that separate central banks from treasuries, or, impose fiscal rules and debt limits etc – are just voluntary. Once we understand the underlying capacities of a currency issuing government we can easily see that these constraints reflect ideology rather than anything intrinsically binding.

As an aside, I will presenting a keynote speech on this theme exactly at the Post Keynesian Conference being staged at UMKC in Kansas City between September 15 and 18, 2016. I will address the claims by some Post Keynesians (like Palley etc) and New Keynesians that there is ‘nothing new about MMT’ or ‘we knew it all along’. That nonsense.

Following their definition, the Voxeu authors note that:

… how the nominal expansion will be split between increases in the price level and in output depends on the broader features of the economy, notably how much prices adjust (‘nominal rigidities’).

This just means that all increases in nominal spending will have price and output (real) effects. Gross Domestic Product is defined as the market value of all final goods and services produced in any given period.

Market value is the combination of what is produced (output) and what the produce sells for (price). When we talk about real GDP we are expunging the price effect (holding prices constant) from the GDP measure to allow us to how much actual output has been produced and how it has changed between periods.

When an economy is already operating at full capacity, increases in nominal spending beyond the current growth rate (to reflect population growth etc) will have very large (if not total) price effects – that is, they will be inflationary. This is because firms cannot squeeze any more real output out of the resources in use.

Alternatively, when there are idle resources (such as unemployed labour and machines), an expansion of nominal spending will likely be mostly absorbed by higher production (real output) and firms will be highly reluctant to try to increase prices for fear of losing market share to other firms in the sector.

Most importantly, growth in nominal spending can continue even when the economy is operating at full capacity as long as it matches the growth in that productive capacity and doesn’t strain the capacity of the economy to respond to the extra spending with output growth.

So it is incorrect to assume that a constantly growing ‘money supply’ will, inevitably, be inflationary. It all depends.

The Voxeu authors fall back into mainstream constructions of the fiscal choices faced by a currency-issuing government by claiming that by using central bank money to ‘fund’ deficit growth, the government avoids the “need to raise additional taxes”, which would have arisen if had issued debt to the private sector.

This is just plain wrong. It implies that eventually the government has raise taxes in order to pay back this debt. The facts are that governments are ‘paying back’ debt continually as it matures. It doesn’t need to raise taxes at all – ever – either to pay back debt or to spend.

Please read my blog – Taxpayers do not fund anything – for more discussion on this point.

However, that is aside to their essential argument.

They write that:

Given the intrinsic features of how interest rates are determined in the market for bank reserves (bank deposits at the central bank), the central bank faces a catch-22. Either helicopter money results in interest rates permanently at zero – an unpalatable outcome to most, including those that advocate monetary financing – or else it is equivalent to either debt or to tax-financed government deficits, in which case it would not yield the desired additional expansionary effects.

First, the authors do not acknowledge the MMT literature on this issue despite it predating by a few decades the recent interventions by the likes of Adair Turner and Ben Bernanke. To say that it is “unpalatable … to … those who advocate monetary financing” to have permanently zero target policy rates is incorrect.

MMT proponents see this as a desirable outcome – because it recognises that trying to counter-stabilise the economy using interest rate variations is ineffective.

It is much better to set the short-end of the yield curve at zero and then keep investment rates as low as they can be. Then, let fiscal policy, which is more direct and transparent, do the work of maintaining full employment and price stability.

Please read my blog – The natural rate of interest is zero! – for more discussion on this point.

Second, the authors also fall into the usual mainstream analysis that the expansionary impacts of an increase in government net spending is determined by how it is ‘financed’. We will show that is an unfounded assertion.

Here is their logic?

They initially are correct in noting that “(b)anks hold reserves for two main reasons: i) to meet any reserve requirement; and ii) to provide a cushion against uncertainty related to payments flows.”

The major reason is to ensure that claims against them each day from other banks (via the payments system) can be met without the need to access reserves from more expensive sources.

What about reserves that are excess to these actual (reserve requirements) and/or perceived (uncertainty issues) desired holdings?

The Voxeu authors say they are “very interest-inelastic”, which is a fancy term economists use that means that these excess reserves are not very sensitive to interest rate changes.

The additional observation is that the existence of excess reserves in the banking system will influence the central bank’s capacity to manage the overnight policy interest rate.

The central bank has two alternatives in this situation.

1. The Australian system has no reserve requirements and the central bank (RBA) pays commercial banks a return of 25 basis points below the current policy rate on any excess reserves they hold.

The Voxeu authors claim that the situation where central banks pay a return on excess reserves below the policy rate is the “most common scheme”.

The central bank then has to ‘manage’ the excess reserves – that is, eliminate them – to ensure its slightly higher policy rate is maintained.

Why?

The banks, by definition, do not desire ‘excess’ reserves and they would try to dispose of them on a daily basis by seeking to loan them out in the so-called ‘interbank market’ (where banks lend short-term to each other) to other banks who might be short of reserves on any given day.

That competitive act drives the overnight interest rate down to whatever support rate is offered by the central bank, which could be zero (in the case of the Bank of Japan’s long-standing policy).

If the central bank doesn’t intervene, then the monetary policy rate becomes irrelevant as the overnight rate becomes the effective short-term interest rate. In other words, the central bank loses control over the short-term interest rate environment.

The solution for the central bank in these situations is to soak up (‘drain’ in MMT-speak) the excess reserves by selling an interest-bearing government bond to the banks, which eliminates the incentive to loan the funds in the interbank market.

The central bank thus maintains control over the short-term interest rate and the excess reserves are gone. This is what we call ‘liquidity management’.

The alternative is if the banking system was starved of reserves, then the overnight rate would rise rapidly above the policy rate. The solution then is for the central bank to supply the necessary reserves to maintain the integrity of the payments system (that is, meet the desires of the banks for reserve balances) by buying interest-bearing financial assets (government bonds).

So there is nothing controversial about any of that.

This is standard Modern Monetary Theory (MMT), which we have articulated for 20 or more years now.

Interestingly, you will not find any mainstream macroeconomics textbook discussing any of this – these real operational matters pass by the mainstream focus, which still wants to emphasise how the central bank can control the money supply.

Please read the following introductory suite of blogs – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3 – for basic Modern Monetary Theory (MMT) concepts.

2. The Voxeu authors then discuss the second alternative – “the central bank remunerates excess reserves at the policy rate” (emphasis in original).

This means the bank’s have zero “opportunity cost of holding reserves” because they are earning the short-term interest rate (which would also be the prevailing rate in the interbank market).

The “central bank can then supply as much as it likes at that rate” and the excess reserves will just sit in the accounts the commercial banks hold with the central bank and be “a very close substitute for other short-term liquid assets”.

This is the scheme that a lot of central banks have introduced since the crisis (US Federal Reserve, Bank of England, etc).

The upshot is that the capacity of the central bank to set and maintain a preferred policy interest rate becomes independent of the quantity of bank reserves that are held at the central bank on behalf of the commercial banks.

The technical term is that there is a “”decoupling’ of interest rates from reserves” which the Voxeu authors note:

… has not yet found its way into textbooks and economic thinking more generally.

This is standard Modern Monetary Theory (MMT), which we have articulated for 20 or more years now. It is explained in detail in the first version of our MMT textbook – Modern Monetary Theory and Practice: an Introductory Text.

It will be explained in even greater detail in the intermediate MMT textbook we are working on, which is nearing completion (more details will emerge on or about August 4 about publication of this book).

Clearly, these Voxeu authors have ignored (or will not acknowledge) our work, which has been in the public domain for some years now.

Please read the following blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – for further discussion.

The purpose of all that description of the mechanics of central bank reserves is to make the Voxeu authors’ substantive point – that:

The central bank can of course implement a permanent injection of non-interest bearing reserves and accept a zero interest rate forever … This produces the envisaged budgetary savings but at the cost of giving up completely on monetary policy.

What this means in MMT-speak is the following.

1. All national government spending is achieved not by ‘printing money’ but, rather, by creating deposits in the private banking system.

2. The national government, as the monopoly issuer of its own currency is not revenue-constrained. This means it does not have to ‘finance’ its spending, unlike a household, which uses the fiat currency

3. All commercial banks maintain accounts with the central bank which permit reserves to be managed and also allow the clearing (payments) system to operate smoothly.

4. The central bank sets a ‘support’ rate to be paid to the banks for any reserves left in the accounts overnight. This rate, which could be zero, becomes the interest-rate floor for the economy.

5. Treasury spending amounts to nothing more than the treasury debiting one of its cash accounts at the central bank (usually) which means its reserves at the central bank decline by that much and the recipient deposits the payment in their private bank and its reserves at the central bank rise by that amount.

6. So a rise in the fiscal deficit will lead to a rise in bank reserves, which then need to be ‘managed’ by the central bank in accordance with the above discussion about ‘liquidity management’.

7. In other words, an ongoing fiscal deficit places downward pressure on short-term interest rates by pushing up bank reserves, which would drive the short-term interest rate to the support rate (or zero) if the central bank doesn’t intervene and offer portfolio swaps for the excess reserves.

An important contribution of MMT has been to fully understand the mechanics of deficits and their impact on the banking system (as described above). You will not read about these dynamics in any mainstream macroeconomics or monetary economics textbook.

Further, up until recently, the broader Post Keynesian literature was blithely ignorant of these operational matters, despite now claiming in many cases that “we knew it all along”. The correct response is that they didn’t otherwise they would have written about it in the past.

The Voxeu authors thus think that the Overt Monetary Financing option provides savings to the Treasury (by eliminating interest payments) but means the central bank cannot maintain a positive interest rate.

They then make their substantive point attacking the OMF approach.

They say that if the central bank wants to maintain control over its monetary policy (that is, maintain a positive policy interest rate) then it “has only two options”:

1. “It can pay interest on reserves at the policy rate … but then this is equivalent to debt-financing from the perspective of the consolidated public sector balance sheet – there are no interest savings.”

2. “Or else the central bank can impose a non-interest bearing compulsory reserve requirement equivalent to the amount of the monetary expansion … but then this is equivalent to tax-financing – someone in the private sector must bear the cost.”

3. “Either way, the additional boost to demand relative to temporary monetary financing will not materialise.”

First, when the government deficit spends, it stimulates overall economic activity by increasing purchasing power in the economy (either directly through its own behaviour or indirectly by giving the the non-government sector more income).

This stimulus is multiplied through the expenditure system as the induced consumption from the initial rise in income reverberates back into more spending and so on.

The increase in the fiscal deficit also increases the net financial assets in the non-government sector – that is, the non-government sector’s financial wealth increases.

How they hold that increase (in bank deposits, government bonds, other financial assets) is beside the point here.

Second, if the government chose to match the increase in government spending via a tax increase then the stimulus would be less than if it allowed the increase in spending to increase its deficit. That is clear but also beside the point.

Third, what would happen if a sovereign, currency-issuing government (with a flexible exchange rate) ran a fiscal deficit without issuing debt at all (or sold the debt to the central bank instead of to the non-government sector, which is an equivalent act) – that is, the OMF option?

Like all government spending, the treasury would credit the reserve accounts held by the commercial bank at the central bank. The commercial bank in question would be where the target of the spending had an account. So the commercial bank’s assets rise and its liabilities also increase because a deposit would be made.

The transactions are clear: The commercial bank’s assets rise and its liabilities also increase because a new deposit has been made. Further, the target of the fiscal initiative enjoys increased assets (bank deposit) and net worth (a liability/equity entry on their balance sheet). Taxation does the opposite and so a deficit (spending greater than taxation) means that reserves increase and private net worth increases.

This means that there are likely to be excess reserves in the ‘cash system’ which then raises issues for the central bank about its liquidity management. The aim of the central bank is to ‘hit’ a target interest rate and so it has to ensure that competitive forces in the interbank market do not compromise that target.

When there are excess reserves there is downward pressure on the overnight interest rate (as banks scurry to seek interest-earning opportunities), the central bank then has to sell government bonds to the banks to soak the excess up and maintain liquidity at a level consistent with the target. Some central banks offer a return on overnight reserves which reduces the need to sell debt as a liquidity management operation.

There is no sense that these debt sales have anything to do with ‘financing’ government net spending. The sales are a monetary operation aimed at interest-rate maintenance. So M1 (deposits in the non-government sector) rise as a result of the deficit without a corresponding increase in liabilities.

It is this result that leads to the conclusion that that deficits increase net financial assets in the non-government sector.

Fourth, what would happen if the government chose to match the increase in government deficit spending by issuing debt to the non-government sector?

All that happens is that bank reserves are reduced by the bond sales but this does not reduce the deposits created by the net spending.

That is, net financial worth in the non-government sector is not altered. What is changed is the composition of the asset portfolio held in the non-government sector.

The stimulus from the deficit spending would be unaffected because the non-government sector would just be rearranging its wealth portfolio by increasing its holding of government bonds and reducing its holdings of other financial assets (probably bank deposits).

The only difference between the treasury ‘borrowing from the central bank’ and issuing debt to the non-government sector is that the central bank has to use different operations to pursue its policy interest rate target.

If it debt is not issued to match the deficit then it has to either pay interest on excess reserves (which most central banks are doing now anyway) or let the target rate fall to zero (the Japanese solution).

There is no difference to the impact of the deficits on net worth in the non-government sector.

Mainstream economists would say that by draining the reserves, the central bank has reduced the ability of banks to lend which then, via the money multiplier, expands the money supply and causes inflation.

However, the reality is that:

- Building bank reserves does not increase the ability of the banks to lend.

- The money multiplier process so loved by the mainstream does not describe the way in which banks make loans.

- Inflation is caused by aggregate demand growing faster than real output capacity. The reserve position of the banks is not functionally related with that process.

- The banks are able to create as much credit as they can find credit-worthy customers to hold irrespective of the operations that accompany government net spending.

None of this leads to the conclusion that fiscal deficits do not carry an inflation risk. All components of aggregate demand carry an inflation risk if they become excessive, which can only be defined in terms of the relation between spending and productive capacity.

But it is totally fallacious to think that private placement of government debt to match a rise in the fiscal deficit reduces the inflation risk. It does not.

In contradistinction to the assertion from the Voxeu authors, it also does not reduce the strength of the economic stimulus arising from the rising deficit.

Ignoring the ridiculous option where are central bank would just hike up the ‘required reserves’ to match the excess reserves left in the system each day (the second option the Voxeu authors mention), does the payment by the central bank of a support rate on excess reserves equivalent to the policy rate (the first option) amount to the same as issuing debt to the non-government sector?

In one sense, it is a good point because it exposes the nature of government debt and how it is repaid. It is just equivalent to an account at the central bank and when it is repaid it is tantamount to funds being moved from one account (debt) to another (bank reserves).

Simple as that, which means all the scaremongering about public debt are groundless. A currency-issuing government can always service its outstanding liabilities as long as they are in the currency it issues.

If it wanted to the US government could legally require the US Federal Reserve to extinguish all outstanding federal government debt – which would just be a few keystrokes on some computers – shifting numbers from one account (debt) to another (bank reserves).

So it is true that paying interest on excess reserves is not fundamentally different to the government issuing debt to the non-government from the perspective that the income flows to the non-government sector are similar in each case.

It is also true that the central bank can influence the interest payments that are forthcoming under either scheme. Ultimately, the central bank can maintain (as in the Japanese case) zero or even negative interest rates if it wanted to on the excess reserves and on outstanding bond yields.

But so what? This doesn’t effect the degree of stimulus that is forthcoming from the government deficit increase.

It also imposes no additional or less inflation risk arising from the government deficit increase.

And, it doesn’t alter the quantum of net financial assets in the non-government sector. Only the portfolio composition is changed.

Where the difference lies is in public perception. There is no increase in public debt for the rabid financial commentators to beat up into a frenzy and push out predictions of insolvency.

They would turn their attention to the inflation risk – but then that would be shown to be ridiculous after just a few quarters.

So there are major political advantages in using OMF.

Further, it would force the non-government sector to innovate their own low-risk financial asset to be used as the benchmark for assessing risk. The days of corporate welfare in the form of guaranteed risk-free annuities would be over. They would still have risk-free bank reserves but not a stock of government bonds to soothe their uncertainty.

Conclusion

But the preferred option, from a MMT perspective, is the option the Voxeu authors claims “comes with a heavy price”.

That ‘heavy price” is that the central bank would not pay any support rate on excess reserves and accept that the short-term interest rate would drop to zero.

Monetary policy is really such a blunt and ineffective tool that it should be rendered redundant. The mainstream have never provided a convincing case that manipulating interest rates is somehow the preferable and effective option for stabilising the spending cycle.

The GFC experience would suggest otherwise. All the monetary policy gymnastics have had very little impact.

It would be much better to set the overnight rate at zero and leave it there and allow the longer term rates (which are impacted by inflation risk) settle as low as possible.

Then, manage the spending cycle with fiscal initiatives that can be targetted, adjusted fairly quickly and which have direct impacts.

The “heavy price” the Voxeu authors fear would be nothing more than exposing that the emphasis (reliance) on monetary policy is just an ideological stunt to allow the neo-liberals to push fiscal policy into the undesirable basket.

OMF would bring this ideological crusade further out into the public arena and sink it once and for all.

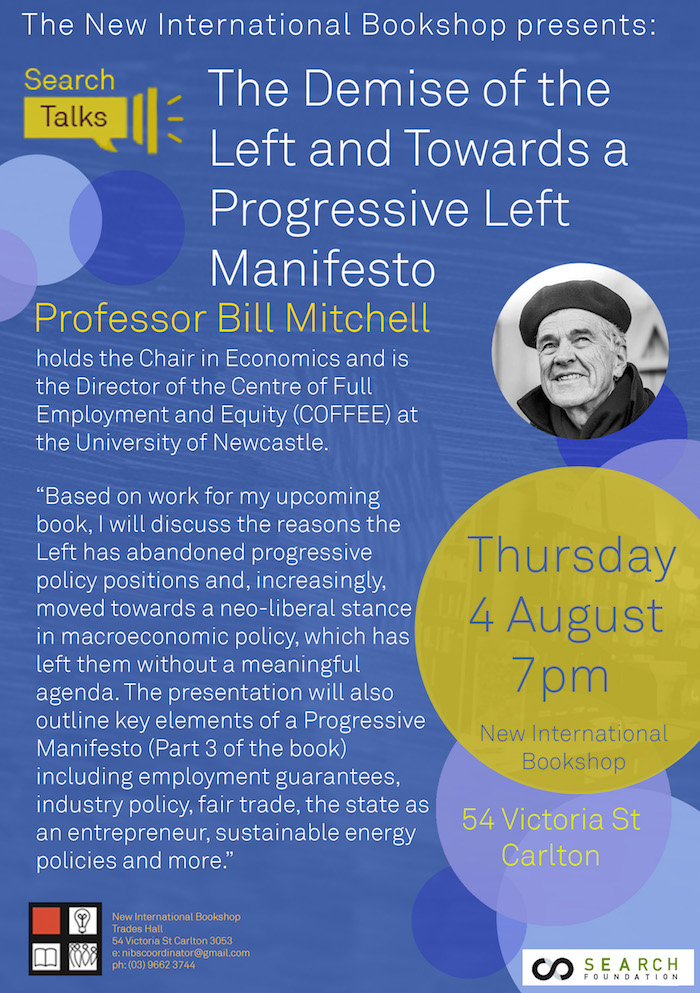

Upcoming talk at the New International Bookshop in Melbourne – August 4, 2016

On August 4, 2016, I will be giving a talk at the New International Bookshop in Melbourne (Australia) on the topic – The demise of the Left and towards a Progressive Left Manifesto – which is the topic covered in my latest book project that is nearing completion.

The talk will run between 19:00 and 20:30 and the venue is at 54 Victoria St, Melbourne, Australia 3053 – which is part of the Victorian Trades Hall.

The actual room will now be the Bella Union bar (upstairs from the Bookshop) and drinks will be available there.

There is a Facebook Page for the event.

The Bookshop is staffed by volunteers who appreciate any support they can get.

I spent many hours in my youth sifting through all sorts of radical books in its previous incarnation as the International Bookshop (operated by the now defunct Communist Party of Australia) in Elizabeth Street, Melbourne.

When I was a university student without much cash at all one – great staff member – there used to give me an orange on a regular basis – she always had one available and I guess she knew I haunted the place.

Here is the flyer. It would be great to see people at the event and the small entry fee goes to helping sustain the Bookshop, which has a long history in providing alternative and radical literature to Australian readers.

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

Has there been anything written about the ‘safe asset shortage’ nonsense?

I don’t think I’ve seen anything more ridiculous in my life. Essentially “We can make loans cheaper and clear the market if government subsidises shadow banking with more corporate welfare”.

I’m going to suggest that as the approach we should take with unemployment. We can’t reach market clearing for unemployment because we are up against the ‘zero lower bound’. So if we issue ‘unemployment bonds’ to the unemployed that pays a coupon to the unemployed then they’ll be able to spend that coupon and that will get them employed again.

Here’s a potted description of the warped thinking. Read the comments below the line for the tortuous curve fitting groupthink that is going on here. It would be amusing if it wasn’t so serious and ingrained.

“Wrong! Even the mainstream economists must surely be catching on by now that banks do no need reserves to lend. ”

It doesn’t appear so. It would appear they are coming up with even more epicycle excuses. Apparently it is banking mechanics now that is keeping the money multiplier low. They just can’t get the staff you see.

So more validation of the great JK Galbraith line: “Faced with the choice between changing one’s mind and proving that there is no need to do so, almost everyone gets busy on the proof.”

bill

thank you as ever for your interesting blog

but still i dont think its right to bash post keynesians too much about deficit spending since even though there is a problem of semantics between post keynesians and mmters people like hyman minsky steve keen marc lavoie acknolewdged the impac of deficits long time ago.

Richard Koo gave a lecture last June which discusses in a lot of detail the reasons for the failure of expanding the money supply to stimulate the economy. I don’t think he discusses it from the MMT perspective, but it looks very explanatory of the position today. He also parses the failure of Maastrict to work and the need for deficit spending etc;

https://www.youtube.com/watch?v=8YTyJzmiHGk

Many thanks for this post.

Regarding the article by Claudio Borio et al you refer to, you might be interested in the following response

http://www.economonitor.com/blog/2016/06/why-helicopter-money-is-a-free-lunch/

There needs to be politicians and policy makers who inspire the people to accept projects and forget about financial engineering. Then ‘money’ and ‘debt’ will come out of the spot light and no one will mention it ever once.

But because there is a shortage of imagination, creativity and competency amongst policy makers to come both with projects and inspire people to accept them. Is not like there is a shortage of them, we have an impeding civilisation collapse of the industrial model from the industrial revolution due to the junk-consumerism, pollution, worldwide heating and borrowing the future through consumption of carbon-based energy.

Without proper leadership and programs we will muddle through until a fascist comes with a project: annihilation of the Other. Then we will forget worrying about debt and money, as it will fade where it belongs (into nothingness) but instead we will accelerate our crash course with reality.

The primary sort of bankruptcy we are facing is political and social, if we cannot fix that one people will keep coming back to the same fallacious arguments and group thinking.

If the overnight interest rate is zero,is their still inter-bank liquidity?Why bother lending your excess/surplus reserves to deficit reserves banks if the return is zero.Let their bank fold and take their market share.

I gather that this is not what happens as Japan hasn’t been suffering from a perpetual credit crunch.But I don’t know if they have small banks which could be vulnerable to this.

Do the overnight credit markets still operate smoothly when rates go to zero?

On the importance of politics, and some hope.

In Canada we suffered through 25 years of household finance justifications for slashed program spending and a balanced federal budget. The media were full of mindless deficit-bashing by know-nothing journalists and economists. It became especially intense after the Conservatives came to power in 2006. But finally, after 9 years of the Conservatives, people got fed up with the damage they inflicted on government programs, institutions, the environment, and so forth, but especially with their dour, oppressive view of the world. Unexpectedly, during our October 2015 federal elections a candidate for Prime Minister broke the deficit taboo. He spoke very positively of the future and of what needed to be done to improve our lives. He expressly promised to run a small deficit (0.5 % of GDP) to build infrastructure, public transit and support the economy. After his party swept in to power the original promise to balance the books by the next election was dropped and much larger deficits (1.5% of GDP) are projected into the indefinite future.

The media focus on the deficit has largely vanished. The big banks support deficit spending. The damage of the past 25 years is being repaired. Our national public pension plan is about to be increased by 30% and leading the charge is the minister of finance, former CEO of a financial firm who wrote a book several years ago arguing in part that no increase in the public plan was necessary. Suddenly the atmosphere has changed. Things that need to be done can be done.

A cynic might claim that our banks want deficit spending to offset the bad loans they made in the oil producing provinces where the drop in the price of oil has produced a major slowdown. Perhaps too the Minister of Finance is an opportunist and just got with the program to get elected. Additionally it could be said the deficits are too small and should be double what they are to make a serious dent in unemployment and that the improvement to pensions is too modest. Perhaps so. But the deficit taboo is gone and after 25 years we are finally moving in the right direction.

Fellow readers of Professor Mitchell’s blog, there is hope. In Canada the change came fast and unexpectedly. It will come for you too.

“Ring the bells that still can ring,

Forget your perfect offering,

There’s a crack in everything,

That’s how the light gets in.”

(Leonard Cohen)

Keith Newman that is a good story and a hopeful one. Maybe people in other countries will take notice of Canadian improvements over time. Thanks for sharing that, I will remain hopeful.

It comes down to this. Parliament (in the UK) can give instructions to private banks to direct legal commands to the private banks to create or destroy credit and private banks are required to execute them.

And that’s fundamentally all you need. Everything else is smoke and mirrors and stupid voluntary constraints hiding, complicating or crippling(!) this simple operational system.

Surely the neoliberals prefer monetary policy precisely because it can only act as a brake on employment. Rather than controlling inflation, interest rates actually reduce employment by a larger or smaller amount. This reduced employment may also affect inflation, but that is really beside the point, except for providing thin justification for their actions.

The “great price” associated with giving up monetary policy is the return to full employment and the resultant loss of power for the plutocracy.

Kono is certainly interesting in his POV. The problem is not deficiency in aggregate demand, but rather deficiency in aggregate credit creation. The government must borrow to make up for a failure of private sector to borrow. He obviously sees much of the evidence, but really can’t shake the bankster group think.

Using employments as an excuse against inflation is tantamount of saying “just go die!”, typical neoliberal rabble and non-solution.

They would rather let people starve and die unemployed than risk some inflation that would damage the interests of the credit class.

Neoliberalism is just slavery and abuse through other name, and it would end up the same way it ended in for Lous XVI in France. They are insane and have lost the plot.

Does Koo totally lose the plot at the end of this video? Trillions of dollars in QE has absolutely no effect, but apparently reversing the swaps when the economy is growing will cause interest rate armageddon? Can anyone enlighten me on this one? Is the Fed determined to make a huge profit and die with the biggest reserve balance?

If the US Fed is panicking about this, we may be in for even more stupidity; like crushing austerity and high interest rates in the near future.

“Can anyone enlighten me on this one?”

He believes in the money multiplier and thinks that with such amount of base money people would start to borrow like crazy, hence triggering an inflation spiral and forcing CB’s to increase interest rates etc.

He is hopelessly abducted by monetarism.

Brendanm suggests that the neo-liberal faith’s real motive for the doctrine of monetary policy is intended as a “brake on employment”, that is, I presume, a means of keeping the cost of labour low as an element in maximising profit. Monetary policy, however ineffective, also seems like some sort of government action and thus has a political value. That they can’t do any better speaks both to their incapacity to lead public opinion and their reflexive deference to big finance.

Monetary “policy” in this context is merely gestural, and its darker consequence is that it occludes a consideration of fiscal actions like OMF. Might the darker motives behind it be simply to do what private capital does- seek monopoly? In this case monopoly over capital.

If it debt is not issued to match the deficit then it has to either pay interest on excess reserves (which most central banks are doing now anyway) Bill

Interest on reserves is corporate welfare too. Changed your mind on that, have you?

or let the target rate fall to zero (the Japanese solution). Bill

Or how about letting citizens actually use their nation’s fiat in the form of inherently risk-free accounts at the central bank itself? Would that not tend to increase interest rates in fiat? Not that high interest rates are good but neither is suppressing them via special privileges for depository institutions.

It would be much better to set the overnight rate at zero and leave it there Bill Mitchell

Ok, my apologies, you are not for IOR.

and allow the longer term rates (which are impacted by inflation risk) settle as low as possible. Bill

Bill

The rich have no more right to be protected from inflation than the poor so the maximum yield for sovereign debt should be 0%.

It would be much better to set the overnight rate at zero Bill Mitchell

Set? You mean allowing banks to borrow directly from the central bank at 0% since interbank lending breaks down at that rate (unless the loans are overcollateralized)?

Isn’t this corporate welfare too?

There is no increase in public debt for the rabid financial commentators to beat up into a frenzy and push out predictions of insolvency. Bill Mitchell.

We both know that the problem is positive interest paying sovereign debt – not sovereign debt itself.

Just a couple of thoughts.

Is it a requirement of membership of the Bank of International Settlements to issue government bonds

to ‘match’ government sector deficits?

To me the big advantage of OMF is political.Austerity is a stick to beat the left with.’How are you going

to pay/tax for that increase in worthy government spending’. OMF seems to be the best way of breaking

that stick directly.However if the consequences of changing current arrangements are problematic current

QE transactions can be directed for the purposes of fiscal stimulus .Governments could commit to exchange

the majority of its savings bonds for reserves indefinitely in any time period from issue.In the context of

a discretionary fiscal stimulus the same increase in private sector monetary savings would occur and any

desired interest rate including MMT ‘s preferred 0 rate could be maintained.

My other thought is should the government provide a safe savings vehicle for its citizens if it is to

provide them with aggregate savings? Households are not monetary sovereign and need savings for

big expenditures{home deposits} and pensions .The supposed brilliant private financial services are useless

when it comes to looking after the hard earned savings of the 99%.Low interest rates do not help .

Government savings could provide another macro economic tool. If inflation rises raise the savings rate

to encourage savings to allow for supply to catch up to demand.

If inflation rises raise the savings rate to encourage savings to allow for supply to catch up to demand. kevin harding

That’s welfare proportional to savings, not need. Nor are savings beyond legitimate liquidity needs an unqualified good – there is such a thing as money hoarding and it should not be encouraged.

My other thought is should the government provide a safe savings vehicle for its citizens if it is to

provide them with aggregate savings? kevin harding

Yes, it should via inherently risk-free accounts at the central bank itself. But those accounts should pay no interest. Neither should they be charged interest (negative interest) up to, say, the first $250,000.

Neither should they be charged interest (negative interest) up to, say, the first $250,000. aa

Needless to say, I hope, is that these type accounts be limited to one per adult citizen so the rich cannot escape negative interest rates via multiple accounts.

Otoh, I suppose the poor might voluntarily lend out some of their negative interest-free account space to the rich – for a price. Why not?

@aka

“Set? You mean allowing banks to borrow directly from the central bank at 0% since interbank lending breaks down at that rate (unless the loans are overcollateralized)?”

Yes this is what I was curious about ,So you are saying that when overnight funds market goes down to 0% ;interbank lending breaks down?But this has not happened in Japan

I would prefer a welfare-free system too

So you are saying that when overnight funds market goes down to 0% ;interbank lending breaks down? But this has not happened in Japan Jake

Logically it would break down as you mentioned in a previous comment of yours UNLESS collateral worth more than the loan was at stake. I think that’s where repos come in; the borrowing bank sells some risk-free assets to the lending bank at below market price and the lender agrees to sell them back to the borrower at a higher price, in effect earning interest on a risk-free loan via the spread in prices.

Hence the desire for risk-free sovereign debt which Bill has rightly called “corporate welfare.”

I would prefer a welfare-free system too Jake

At least not welfare proportional to wealth! Otoh, equal fiat distributions to all adult citizens can be justified, imo, to lower interest rates and punish money hoarding via price inflation.

Hence the desire for risk-free sovereign debt which Bill has rightly called “corporate welfare.” aa

Well, if it pays positive interest it Is “corporate welfare.”

Otoh, negative to 0% interest paying sovereign debt could still be used for repos assuming even more negative rates applied to accounts at the central bank which were non individual citizen accounts or if a citizen account held more than, say, $250,000.

Physical fiat is a means to escape negative interest rates but there are legitimate means to discourage that such as the central bank selling physical fiat at a premium, given the cost of printing, handling and counterfeit detection.

It is not corporate welfare if it is available for all citizens.A maximum individual limit is a good idea.

I am not trying to encourage the 1 % to hoard money tokens ( although that is better than the 1%

owning and controlling even more of the worlds resources and fruits of all are labours) .It is good

for all to save ,for large purchases,for sabbaticals ,for old age when earning capacity is inevitably

lowered remember fiscal stimulus= private sector savings.

Where the private sector fails ,inequality ,providing sufficient decent jobs , providing decent housing

for all ,looking after working people’s hard earned savings etc etc then the state ,the democratic

will of the people should try to do better.

It is not corporate welfare if it is available for all citizens. Kevin Harding

Then it’s welfare proportional to savings, not need.

Besides, every adult citizen could save in their individual, inherently risk-free accounts at the central bank for FREE up to, say, $250,000. After that negative interest would apply to encourage investment, not cash hoarding.

Also, the unused portion of one’s negative interest-free individual citizen account at the central bank could be rented out to banks, businesses and the rich for a slightly less negative rate than what the central bank would charge – further helping individual citizens to save.

Andrew well I am certainly in favour of a state bank on the grounds that any future bailout

should be untenable for a start.The current account of a state bank could be a reserve deposit and

I think that any account guarantee scheme should only be reedemable via the state bank but what

is wrong with savings?

The state should do the best by its citizens who are not monetary sovereign otherwise savings and

pensions are in the hands of the parasitical asset speculators with all the instability that goes with it.

The state should provide a savings account ,it provides the aggregate savings after all.In a sense

that is welfare proportional to savings not need but the government should also maintain a fiscal

management condusive to full voluntary employment and a really progressive tax regime which

I think should include a universal citizens wage ,land value tax and a higher rate of income tax which

was a vital part of the post war settlement .

@Andrew Anderson

Right you are, corporate welfare free system is what I meant.

But lets look at Japan and other zero interest free system, their banking systems are still liquid.

we need zero IOR and a maximum zero yield on public debt.

But we need banks to lend surplus reserves to the small, new or simply banks in a deficit of reserves to facilitate growth in credit and payment settlement.

As well as repos isn’t the bulk of bank lending reliant on uncollateralised interbank lending.

And the discount lending facility at the CB is at a higher interest rate but uncollateralized.(if it was collateralised,why doesn’t the banks just sell tsy for reserves to dealers, no need to go the CB)

Why did it take 20 years to write MMT textbook? We needed it, ahem, twenty years ago.

And I would not care if it were not for a fact that millions of people have suffered as a result.

Question …. doesn’t the govt match deficit spending with bonds which are issued by the AOFM ?

Or can the central bank still issue them from the AOFM ?