Today (January 22, 2026), the Australian Bureau of Statistics (ABS) released the latest labour force…

Minimum wage decision – one of the worst ever!

Sometimes in public policy a poor decision is made. Other times you conclude a very bad decision has been made. Then there are times when you witness one of the worst decisions that could be made. Today’s Australian Fair Pay (Not) Commission decision falls into this latter category. It was a decision made by highly-paid officials in secure employment which will impacts disastrously on the lowest paid workers and their families. in the context of a demand-deficient (that is, spending failure) downturn, the FPC has denied the low-paid workers a pay rise. The decision consolidates the triple whammy attack against the poor which is the Government is largely turning a blind eye too while it swans around preaching social inclusion.

The triple whammy is:

- The response by firms to falling revenue is to scrap full-time work and generally ration hours of work and increase casualisation – all adjustments impact disproportionately badly on low income workers. They amount to a real wage cut of significant proportions for these workers even if they keep their jobs.

- TheThe largest proportion of jobs that are being scrapped at present are those held by low-skill workers.

- And now, the FPC has decided to further cut the real living standards of the lowest-paid segment of our labour force by failing to pass on a nominal wage increase sufficient to protext these workers against inflation.

So much for the social inclusion aspirations of the Government which are in tatters today. One of the problems I believe is the Government’s stated intention to avoid the so-called night of the long knives when they came to power. Instead they retained the neo-liberal stooges that Howard had put into to do his dirty work. The one labour economist on the FPC, has consistently argued over her career for wholesale deregulation of the labour market – claiming that “unemployment is primarily a consequence of labour market regulation and adverse welfare incentives” in a speech she gave in 2002 for example. I won’t give any references to her work but you can find them if you bother (to waste your time) and search.

So at the bottom of today’s disaster is the Government’s failure to put in place a realistically independent process for determining minimum wages. The previous safety net rulings via the Australian Industrial Relations Commission were more protective of evidence-based analysis than the sham that the conservatives replaced it with.

It is clear that the issue of minimum wage adjustments always invokes a lot of debate. We always get the usual (boring) reactions from employer groups and conservative economists who say that you cannot have a minimum wage rise because it will cause unemployment among the low-skill ranks of the workforce. If you believed their logic, then there never would be a minimum wage rise. The reality is that there is no evidence available to support these notions and lots of evidence to refute it.

The new problem is that the current Federal government is now aligning with the conservatives and using the same defective logic to oppose any reasonable rise in the minimum wage. This what they said in their Australian Government submission to the 2009 minimum wage hearing:

5.25 The majority of empirical research, as previously recognised by the Commission suggests that there is a negative relationship between minimum wage increases and employment. While this relationship has been relatively weak in recent years given that rises in the minimum wage have co-existed with strong employment outcomes for the low paid, the Government cautions the Commission that expected negative impacts on employment of minimum wage increases could be stronger in a slowing economy.

In other words, they were aligning with comments made by the Chair of the AFPC who had taken the extraordinary step of prejudging the decision by briefing various journalists some months ago along the lines that he believed there is a negative relationship between employment and minimum wages. In my view this should have disqualified him from overseeing the process – there is certainly no evidence to support that generalisation. You might care to read my blog – Minimum Wages 101 – on this issue.

In reaction to the Australian Government’s claims the following points are relevant.

First, the majority of (reasonable) studies do not find a negative relationship between the minimum wage increases and employment. The most careful studies actually find no relationship.

Second, the Government seems to acknowledge that this relationship has been non-existent in “recent years” (they use “relatively weak” because they cannot bring themselves to admit that there has been no negative effect at all) because employment growth in the low-paid segment has been strong but they expect the relationship to turn negative again in the weaker labour market. What?

Did you spot the flaw in logic? The relationship between minimum wage changes and employment is “positive” when employment growth is positive but, allegedly, “negative” when employment growth is negative. They fail to note that employment growth is always driven by aggregate demand. So if you measure the correlation between wage rises and employment growth when aggregate demand is strong and believe that correlation equals causation then you will conclude that wage rises cause stronger employment growth. Then, if you correlate measured wage rises with employment growth when aggregate demand is weak you will conclude the opposite. Both conclusions are flawed.

The impact of today’s decision will induce the correlation between static nominal minimum wages and hours and employment losses. What theory are they going to pull out to explain that one?

Third, the neo-classical theory they rely on doesn’t consider a relationship between nominal wage increases and employment levels. The theory is always expressed in real terms such that real wage rises would cause employment losses. The fact is that depending on the inflation rate assumption you make there was clearly scope to deliver a real wage neutral decision but still award low-pay workers some nominal wage growth.

I computed previously that if inflation was running at 2 per cent per annum then a real wage neutral increase in the minimum wage to $554.76 would be required (a rise of $10.98 per week). If inflation is running at 2.5 per cent a rise of $13.77 would have been required and $16.56 for an annualised inflation rate of 3 per cent. But this would only take workers up to October 2009 (a year after the last decision became active).

Of-course, there is no clear relationship of the neo-classical variety that has been found in the empirical literature. I note that the Australian Government Submission (page 26) cites only one article – a US survey that concluded the majority of studies found such a relationship. Of-course, if you read that survey and then investigate the articles they analyse you soon realise that the comparison is biased towards finding the neo-classical result given the flawed methodologies used by the studies on the “for case”.

The fact is that the wage rises in recent years have not damaged low-paid employment. Low-paid employment will definitely fall in the coming months but not because of cost factors. Firms will not keep workers employed if there is nothing for them to do no matter how much they “cost”.

So what is the impact of the decision?

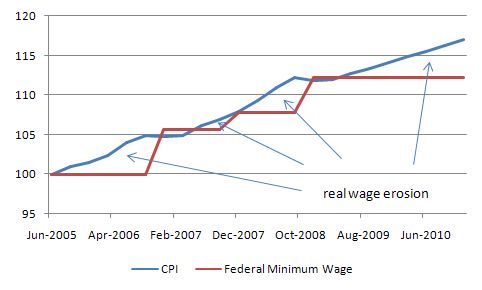

The following graph shows the evolution of the Consumer Price Index (blue line) and the nominal Federal Minimum Wage (red line) since the AFPC was inflicted upon low-wage workers. For the first few decisions, the lowest-paid received inflation adjustment at the time of the decision but then as you can see suffer real wage erosion (the gap between the two lines). It is another story but the next highest paid rung of workers actually suffered real wage cuts throughout this period as a result of the AFPC squeezing the relativity between the bottom and their wage contour.

You can also clearly see that the latest decision will just extend the erosion into the foreseeable future.

CPI and Federal Minimum Wage movements – 2005 to 2010

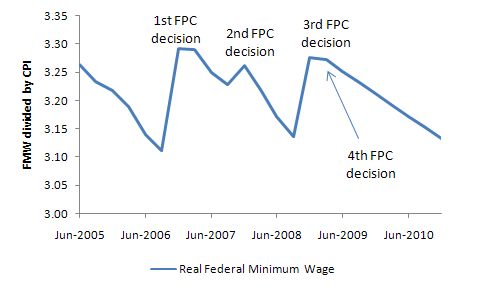

To see how this translates into real wage movements (here real wage units are just the nominal Federal Minimum Wage divided by the CPI index number – so they don’t actually give you an easy interpretation in $s but show direction), consider the following graph. You can see that the final decision of this body will deliver substantial real wage cuts for an extended period into 2010 for the low-paid workers. The gap between each decision also resulted in sharp real wage cuts which means that every day (between decisions) the nominal minimum wage is being eroded by rising prices and the standard of living for low income workers is being squeezed.

The FPC thinks this will prevent these workers losing their jobs. It won’t have any impact at all on the ability of these workers to hold their jobs as the demand collapse tsunami gathers pace. The decision will just make it harder for those who keep their jobs.

Real Federal Minimum Wage movements under the AFPC

The FPC claimed they took into account the impact of fiscal policy transfers in making the decision. They said (Decision) that they recognise:

… that consumer prices continue to increase, putting some pressure on household disposable income. However, the Australian Government’s changes to the tax/transfer system and its recent fiscal stimulus packages have provided real increases to disposable income for most households and have thus enabled the safety net to be maintained without the risk of increasing unemployment.

First, this amounts to more corporate welfare in that the fiscal stimulus is going to underwrite higher profits by cutting wage costs. I thought the fiscal stimulus was about adding new spending rather than replacing existing spending. Aggregate demand policy should not become a hidden wage subsidy.

Second, the impact of the tax changes largely benefit the higher income earners anyway. So why are they able to enjoy real wage protection (or growth) as a result of Government largesse and the lowest paid workers get their nominal wages cut because the government is taking up some of the slack?

Overall, I could write chapter and verse about the type of research the FPC cites to justify its decision. Probably most of it would be libellous.

The bottom line is that this will not protect any jobs. It will just make life more difficult than it already is for the poorest workers in our communities. It is a pathetic decision.

I note that the Employment Minister has been reported as saying that:

… although the Government believed minimum wages should be set by an independent umpire, this time the commission had failed to strike the right balance.

In two submissions to the commission, the Government asked it to award a considered pay rise to low income workers

Well in reality the Government might be disappointed now but in their Submission they went along chapter and verse with the neo-liberal nonsense that wage rises would cause higher unemployment. They failed to show leadership in this matter and it is rather wan to now say they are disappointed.

Digression: Opposition Environmental Policy Announced

I noted today that we finally have an environmental policy launch from the Federal Opposition. The wording is something like this:

Get a big truck and put a huge trailer behind it with some pictures on it of a time bomb which indicates the environmental problems that will arise if we drive the said truck hither the thither across the highways of Australia. Especially if you put big Joe Hockey in it which will use up more fuel and rubber.

Here is the said truck!

Other news of note (not!)

Barry Halls quits South – he won’t punch anyone on the field for the rest of this season!

Conclusion

Tonight I am off to play in my blues band and will stay calm as a consequence!

Dear Prof Mitchell

I admit here that this is all to depressing, and therefore only wish to comment on the debt truck (Digression: Opposition Environmental Policy Announced).

The comment is UNFORTUNATELY PEOPLE BELIEVE THIS CR#P!!!

The world has gone mad!!!

You adequately explain, why the government does not have to finance its own spending, and people still go on with this rubbish, mind you that is why I would like to see you on Q&A a long story but briefly though it would be good if you could dispell some of these myths, by going on Q&A and reaching a bigger audience..

I also have to conclude that like some kind of strange Masocistic cult group we all, (the geenral public anyway) want to stand in our despair tourturing ourselves, with hot needles, because we dont want to accept that we can have full employment, and the stability and happiness that goes along with it. We would rather subject ourselves to some unpleasentness in the name of FALSE ECONOMICS.

Aditionally since you bring up the environment, it is interesting that the government is spending money on new roads, rather than more on cycleways…. Imagine Joe Hockey towing that sign behind a pushbike, at least it would be environmentally freindly false information. It might be healthier for Joe as well, if he didnt have a heart attack pulling the sign. Then again it might give the public a legitimate (for once) reason to hate cyclists..

Cheers

James

As someone who runs a very much part time business, I have considered employing someone in the past, and have to say that the major reason for not employing someone has NOTHING to do with the cost. It has everything to do with lack of customers, or in economic speak, insufficent demand. It would be nice to grow my business but their is not enough work.

Employers should encourage efforts to boost demand because that gives them more customers and alows them to start to employ more people, and in simple greed terms gives them more money. More customers, orders, volume etc creates more work. More things to do creates more work, plain and simple. If everyone has more money to spend maybe they will get me to provide my business’s services more, then ill get more work and more money, and maybe employ someone then they will get more work etc.

Simple really, but again nothing to do with cost.

Cheers

James

I hear you James!

Here is Rudd’s response to the debt truck:

“World must stop spending spree” he declares, clearly worried about the traction that the debt truck strategy will have with a tragically misinformed public.

I don’t know if I like our chances of a third package aimed at jobs.

Good post. This decision is a very poor one indeed. Unfortunately, Not many media outlets are giving it the right sort of attention. As you say, this is a real minimum wage cut. This will cut the living standards of millions of Australians who live on the minimum wage. This decision will not save jobs. I would have had absolutely no problem with an increase tied to inflation – that would’ve been affordable for employers.

Dear Al

About 1.2 million workers are affected directly by the decision.

best wishes

bill

I don’t agree, Bill.

Firstly, minimum wages are a very inefficient anti-poverty instrument because in Australia most people on low awards live in multi-waged households. Secondly, unemployment is a very efficient pro-poverty instrument. So logically the demand curve for labour has to be only slightly elastic for a rise in the minimum wage to worsen poverty. And the consensus of virtually all labour economists these days is that, while the “new labour economics” has shown that elasticity to be lower than was once believed, it is not zero. Add to that the fact that Australia still has the highest min wage in the world (and the elasticity of employment wrt min wage rises with the level of the min wage – no CES here).

There’s not really a strong case for raising it in Oz even in good times, let alone times when all that’s holding unemployment down is a bit of labour hoarding. However much we sympathise with the low-paid we need a hard-nosed respect for empiric evidence if we want to improve their lot.

On the macroeconomic side, wage cuts are only a problem if there are deflationary expectations for them to feed into (that’s what was wrong with the Premier’s Plan, BTW). We aint near that here, at least yet.

James Davies is the only businessman I’ve ever heard of (outside dotcom boom venture capitalists and spruikers of CDOs) who doesn’t focus on cost control. May I gently suggest, James, that if you want your business to make a quid you have a look at that again? Lower costs permits lower prices which means more market share, for a start. Let the government stimulate aggregate demand, not you.

Dear derrida derider,

You say “we need a hard-nosed respect for empiric evidence”. So where is your empirical evidence for your first two assertions, namely “Firstly, minimum wages are a very inefficient anti-poverty instrument because in Australia most people on low awards live in multi-waged households. Secondly, unemployment is a very efficient pro-poverty instrument.”? I’d be interested to see it

Graham, the following report should answer some of your questions – it profiles the minimum wage workforce:

http://www.fairpay.gov.au/NR/rdonlyres/2C6F7A49-183D-415B-B83C-A0C5E4D84C2C/0/AFPC_ResearchSeries_0406.pdf

Hi Bill

I was recently having a bit of a debate with a rather well known financial commentator in Melbourne.

They argued that a large part of the reason for high unemployment in Australia post 1970 was the increasing workforce participation rate of women.

This was on the basis of static equilibrium theory, and I quote:

“Assume for a moment that the economy is generally capable of employing X% of the adult population, and that if a significant proportion of one gender isn’t seeking work (ie women), then a greater proportion of the other gender (ie men) will gain jobs. As social attitudes change, however, and a much greater proportion of women seek work, then by definition a lower % of men will have jobs.”

Thereby unemployment increases.

A question off the topic I know, but what does static equilibrium theory have to do with full employment in Australia?

My feeling is nothing.

Dear Timothy

Nothing!

Since when is total employment fixed over time!

Norway has had the highest increase in participation of married women since the 1970s – check out their labour market aggregates. All absorbed and the predominant growth in service sector employment has been in the public sector there providing high quality personal care services to their population.

best wishes

bill

“On the macroeconomic side, wage cuts are only a problem if there are deflationary expectations for them to feed into”

derrider derider, I’m not sure what you mean here. Are you saying that cutting aggregate spending power can only cause problems if everybody thinks that it will?

Derrida Derider,

You mention the elasticity of demand for labour yet make no reference to the income elasticity of demand. The neo-conservatives simply assume the former is greater than unity and the later is infinetly small and from this they arive at the conclusion that a rise in the minimum wage causes unemployment.. How they arrive at the result is simple – rather than estimating the income elasticity of demand they more often than not simply make it up.

I won’t announce any names here but he was (maybe still is) at Monash.

Dear derrida derrida

1. I disagree that virtually all labour economists have found a positive elasticity. The correct statement is virtually all neo-classical economists have found that – in the main using dodgy methodology.

2. Under sustained attack from non neo-classical economists including myself, the OECD provided some very telling reviews of their previous statements regarding minimum wages and employment etc. In the 2004 Employment Outlook, the OECD (2004: 81, 165) admitted that “the evidence of the role played by employment protection legislation on aggregate employment and unemployment remains mixed” and that the evidence supporting their Jobs Study view that high real wages cause unemployment “is somewhat fragile.” After further papers were released which revealed the majority of the studies that bolstered the OECD line on minimum were deeply flawed, the 2006 (June) OECD Employment Outlook entitled Boosting Jobs and Incomes reported they had done a comprehensive econometric analysis of employment outcomes across 20 OECD countries between 1983 and 2003. The study sample for the econometric modelling included those who adopted the 1994 Jobs Study as a policy template and those who resisted labour market deregulation. The Report revealed a significant shift in the OECD position.

OECD (2006) finds that:

* There is no significant correlation between unemployment and employment protection legislation;

* The level of the minimum wage has no significant direct impact on unemployment; and

* Highly centralised wage bargaining significantly reduces unemployment.

That was a comprehensive rejection of the sort of theory and empirics that you are outlining in this comment. I base all my policy advice on “hard-nosed empirical evidence”. There is no hard-nosed evidence that will bear scrutiny that says that minimum wage changes impact on low-paid employment.

3. Your statement that Australia has the highest minimum wages in the world is plainly incorrect and I don’t know why you want to perpetuate that myth. The “hard-nosed empirical evidence” shows that your statement is incorrect both as a statement about absolute levels and a statement about relative levels (average wages). For example, you might like to read OECD Report, which is one of the few sources of cross-country comparisons (in equivalent units).

I have studied this stuff for years!

best wishes

bill

Bill, I too have studied this stuff for years. On the price elasticity of low-wage emplyment, start with Neumark & Wascher’s coomprehensive survey of the US literature. Of course it’s possible for that demand curve to have a positive region (I’ve read Alan Manning and Chris Pissarides too). You can even find local empiric examples of it; no-one has managed to torpedo Card & Krueger on the NJ fast food industry, despite many attempts. But the macro-scale studies are pretty clear. By and large, demand curves do slope downwards.

Now if the US with its far lower min wage can still generate a negative elasticity, then Oz with its much higher min wage must a fortiori have a negative one, through the ordinary neoclassical mechanisms. You must expect the chances of being in a positive or flat region of the demand curve to be less and less likely the higher the min wage, simply because employer monopsony rents are more likely to have been exhausted (as indeed Card and Krueger themselves pointed out). As you know, empiric studies of this in Oz are hard (we don’t get a sample of 52 varied states for the econometricians to work off), but have a look at Andrew Leigh’s stuff on the WA minimum wage – and Andrew is almost as much a lefty as you :-).

I emphasise again that we are not talking about whether the min wage should have been higher in the US in the 1990s (I think there would have been a substantial net welfare gain from doing so) but whether the Australian FMW should be raised in 2009. Always remember that some things are true even if The Australian says they are.

On “the highest min wage in the world” issue, it is sensitive to which exchange rate you use. I had a job for some years where I regularly had to calculate cross-national ones using a variety of scales (market rates, Penn, OECD). So you’re right – its reckless to say it’s the absolute highest at the moment; I’ll now say it’s “consistently the highest or near-highest”. But for many years we were indeed the highest using any of the popular PPP scales. The Immersoll working paper you referenced uses market rates (Table 1) rather than PPP, so it can’t compare buying power. In fact given that the Oz vs US dollar market rate is always way below PPP market rates Table 1 is just plain meaningless for this particular purpose.

And what’s EPL got to do with things? That’s a whole set of separate issues. Not that your quote, taken in context, means exactly what you claim anyway – the OECD study found that EPL clearly changed who is unemployed in the direction that theory predicts, even if it didn’t change the aggregate level of unemployment (where, as you know, neoclassical theory will be agnostic anyway). And the “high real wages” reference was to aggregate, not minimum, wages.

Mind you it was good to see the OECD disowning the 1994 Jobs Study – I agree that was a dreadful right-wing hatchet job, which I said at the time.

derrida derider,

are you able to answer my question?

cheers

I’m saying, Lefty, that absent expectations and the precautionary behaviour that expected deflation leads to, a cut in wages is pretty neutral for demand because prices will then follow. Changes in demand can, in any case, be directly offset with government spending.

Its the opposite of an inflationary spiral. If you raise wages during a boom and do accomodative monetary policy (yes, I know that with deflation monetary policy loses its oomph – that’s why I specified fiscal policy above) then, absent expectation-induced further changes, you’ll get a one-off lift in prices. But the real damage is done when people expect wage/price rises to continue, adjust wages and prices again accordingly, and then off you go into the wild blue yonder.

There’s no sign of us going into a 1930s (or 1990s Japan) downward price spiral yet. So from a macroeconomic, rather than distributional, point of view wage cuts then would not currently be a big problem. Not that I’m advocating general cuts – it wouldn’t actually help the macro side, and the distributional effects would be awful.

Having expressed an opinion, a note of caution. I’m a labour economist, not a macroeconomist. I’m a lot less sure of my ground here than I am on the specific question of the effects of minimum wages.

How can anyone be a labour economist without a thorough understanding of macroeconomics ?

How can anyone wthout a thorough understanding of macroeconomics understand the dynamics of inflation ?

Seriously.

So you’re saying that if every household took a 25% income cut, demand would remain unchanged as prices of consumer goods and services would simply compensate by falling by an equivalent level?

I assume you can point to solid examples of this occurring in real life not just in econometric models?

After my brother-in-law lost his job in the downturn, their household consumption spending was reigned in (well, how could it not be?) in order to keep servicing the mortgage. Actually, he was made redundant because the demand for the services his employer provided evaporated because the resource company they were contracted to took a pay cut.

With the fiscal stimulus pumped into the economy with great speed in the form of a direct “cash splash”, I am not surprised that we have not seen any great downward price spiral to date.

While I may be misinterperating your argument, it doesn’t make much sense to me.

And I see that while the minimum wage copped a freeze, the average price of rental accomadation in Brisbane has gone down by – wait for it – $10 a week!

Low income earners in Brissie must be doing handstands eh?

I remember an old text by Carlin and Soskice which effectively demonstrated that a rise in the minimum wage (or perhaps wages in general) could lead to a reduction in unemployment.

Unfortunately I don’t own a copy – perhaps Bill knows of the book I am referring to ?

Somewhat of a digression, but the first piece of econonomic literature I ever read was an old uni textbook for first-year students. Printed in the late ’60’s, the general tone of the book is that the whole point of economics is to advance the public purpose and general well-being of society.

I immediately began to wonder why everything seemed to have changed since the book was written.

Dear Lefty

What was the textbook?

The newer textbooks are a disaster. I am writing a blog about this topic soon.

best wishes

bill

Oh dear, I forgot that on a blog you have to pretend to be expert and dogmatic about everything, or people will just assume you’re inexpert and vacillating about everything.

Strangely enough economists, like doctors, have their special subjects. You don’t expect an optician to know as much about immunology as an immunologist. Though you do expect them to know more than the average member of the public because sometimes the immune system can affect the eyes. Same with economists – because the macro economy affects labour markets, and because the microeconomics of labour markets have important macro effects (indeed, in one school of macroeconomics – RBC – it’s virtually everything), a labour economist should know a bit of macroeconomics. But there’s no reason he or she should know as much as a specialist macroeconomist. And anyway macroeconomics is one of those topics where it is unwise for anybody – expert or not – to be too dogmatic.

On textbooks, I have always found elementary economics textbooks to be shockingly bad, killing all passion for the subject. They are often not even focused on what I understand economics to be about (which is indeed human wellbeing).

I think the text is called “Descriptive economics” Bill.

I’m not 100% certain though. I will dig through my book collection (I have heaps sitting in boxes, I really must get myself another bookcase and organise them properly) and see if I can turn it up.

cheers

I am no expert, but I agree that low income earners are not treated well in this country. I don’t want to talk about myself but from my experience at uni, I was never entitled to welfare payments because I had two casual jobs that paid nothing. The amount of money people are allowed to earn to get welfare payments is nothing. If you earn just over this I don’t know how you would really get by, especially low income families. I agree from what I know about this decision it was very poor.

Yep, that’s it. “Descriptive economics” by P.T Nankervin. First published 1950, mine is the 1970 edition.

Alan has mentioned something that I as a non-economist have come to wonder about the profession. Being a specialist is fine – as long as you understand the basic nuts and bolts and overall framework. And make sure you are updated if this changes.

An uncle of mine is a doctor and he has his special subject (he is a specialist obstetrician). However, one cannot become a medical specialist of any kind without first qualifying as a GP. A doctor who knows everything there is to know about obstetrics but does not first understand the basic nuts and bolts workings of the human body and it’s ailments will end up killing somebody.

I wonder how many economists are specialists who do not fully understand how the modern macroeconomy functions.

Dear Lefty,

I have the 1968 8th edition of “Descriptive Economics” Blue cover with white writing on it.

With respect to specialisation economics much like mathematics has become such a large beast that it is impossible for anyone to be expert in all areas of its study.

However, I’d say that without a solid understanding of the modern macroeconomy a Labour economist is doomed to failure. Why ? Because the macroeconomic problems of labour markets is easily solved via the government becoming an emplyer of last resort.

Unfortunately, the microeconomic problems of labour markets which the macro illiterate Labour economists concentrate on are impossible to solve. Why ? Because of uncertainty with respect to the behaviour of agents being anything but rational in any formal sense of the word.

In my experience I would guess that less than 1% of economists understand modern money macroeconomics (and that is being generous).

Most still think that Say’s Law holds and just as many think that IS-LL (LM) is Keynes’ model.

cheers, Alan

Although I’m sure its not as good as owning the original, I thought others might like to know you can read Descriptive Economics online at google books or open library…

http://books.google.com.au/books?id=cP8KA7ujMNcC&dq=Descriptive+Economics&printsec=frontcover&source=bl&ots=ci-VMUVag7&sig=m9CGg-zNm9NO0n_F49UwG6ScLxE&hl=en&ei=JiWZSqivE4aKsgOh0NGmAg&sa=X&oi=book_result&ct=result&resnum=4#v=onepage&q=&f=false

If the economy is a complex system its beyond the ken of anyone . Lots of nice therories to amuse at meetings.

No one has a clue what happens next. So get off your high horse and come up with a doable policy to cope with the end of the housing building boom. Its going to turn off like a tap in Australia. The pain for family men and women not able to provide stable shelter for there families is a bigger problem than what university course speciality you did.