I started my undergraduate studies in economics in the late 1970s after starting out as…

Rising income and wealth inequality – 1% owns more than bottom 99%

This week is – Anti Poverty Week 2015 – in Australia and there are many events and happenings on to mark the time and to highlight the issue of poverty. I will be appearing on a panel on Wednesday afternoon in Newcastle (see below). I was thinking about what I might say in my short presentation next week as I read a report in the UK Guardian (October 17, 2015) – Wealth therapy tackles woes of the rich: ‘It’s really isolating to have lots of money’ – that appealed for sympathy from the rest of us for the top-end-of-town, who have to undergo psychological counselling because they are stressed out being wealthy. Apparently, they also have to engage in “stealth wealth” which means they “are hiding their wealth because they are concerned about negative judgment”. I immediately felt bad for them. Oh, the pain the top 1 per cent feel owning around 50 per cent of all the assets in the world! What a shocking plight they face. In the context of this week’s focus on Anti-Poverty, I couldn’t quite rouse the sympathy the story was seeking to elicit. Sorry!

When we talk about inequality it is important to differentiate between income and wealth inequality.

Together they constitute one of the clearest examples of how the neo-liberal policy structures that have been in place over the last 30 odd years are failing and are pushing the world toward an unsustainable reckoning where it is anybody’s guess what the manifestation will look like – but I predict it will be destructive and ugly and drawn out and may not resolve itself into anything we would like.

Income is a flow of cash that is received over time. For most of us, our incomes come from work. For some, it is the absence of work that generates income flow – as a result of wealth holdings.

Incomes are distributed in a skewed fashion with inequality rising.

High incomes which allow for high rates of saving tend to spawn growing stocks of wealth. The flow of saving feeds into the stock of wealth.

Low income earners tend to have low to zero saving ratios and hence never accumulate any wealth over their life time.

Wealth is a stock of owned assets (real and financial) which may or may not generate a flow of income. A person can be income rich and asset poor (say a young educated professional worker) or, conversely, asset rich and income poor (an older person who has retired or a wealthy person employing tax minimisation strategies.

Income inequality is typically much smaller than it is for wealth, which is why we have to consider both aspects.

Inequality matters. Why? First, it undermines the notion of a collective in society which is necessary for social sstablity and cohesion.

Second, rising inequality undermines the growth potential of a nation and introduces greater propensity to economic crisis.

Third, taken together, these factors tend to meant that nations will higher levels of income and wealth inequality endure more social violence and higher crime rates, higher rates of suicide, poorer mental and physical health standards, shorter life expectancies, and other pathologies.

Fourth, human potential is stifled in nations with higher inequality. Access to education, health and other services are improved when there is less inequality.

You may ask why? The answer lies in how the resources of the nation are made available to the people. Nations with high levels of income and wealth inequality have systems in place which restrict the capacity of a significant portion of the population to access the nation’s resources.

In this blog I am considering wealth inequality only.

The Credit Suisse – Global Wealth Report 2015 – is now in its 6th edition (first published in 2010).

I won’t discuss the methodology that they use to estimate wealth in each nation and its distribution but it is an heroic task.

The first point to note is that household wealth between 2014-15 fell in Africa (-10.3 per cent per adult), Asia-Pacific (-12 per cent per adult), Europe (-12.9 per cent per adult), India (-3.1 per cent per adult) and Latin America (-18.5 per cent per adult).

Household wealth rose only in China (+5.9 per cent per adult) and in North America (+3.2 per cent per adult).

These losses are largely due to exchange rate movements (against the US dollar) in the year. The Report says that “the underlying wealth trends have been generally positive, but the gains valued in domestic currencies have been more than offset by adverse exchange rate movements against the US dollar”.

Overall, despite the financial crisis which arguably was centred in the US and provoked by the poor and criminal behaviour of the American banking system (and its regulatory structures):

… the United States again led the world with a substantial rise in household wealth of USD 4.6 trillion. This continues a remarkable streak since the financial crisis, which has seen seven successive years of wealth gains and new record levels of household net worth for the past three years.

Further, financial assets are now increasingly “important” in determining a person’s total wealth and the gains in the last few years are driven by rising share prices

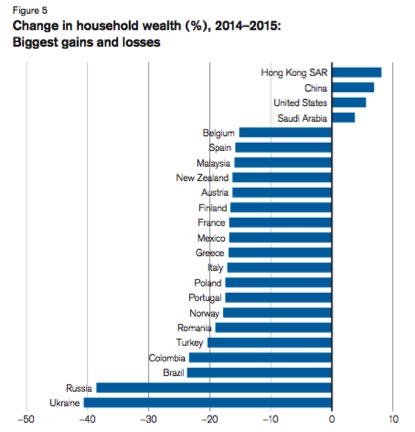

The following graph (reproduction of Figure 5 from the Wealth Report) shows the gains and losses by nation. The Report says that in terms of losses “only those exceeding 15% are displayed”.

Note the concentration of Eurozone nations among the loss nations.

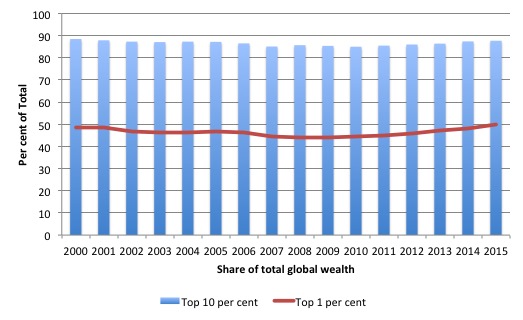

But the really striking results emerge when we consider the distribution of wealth across individuals and wealth inequality.

1. “Once debts have been subtracted, a person needs only USD 3,210 to be among the wealthiest half of world citizens in mid-2015”.

2. “USD 68,800 is required to be a member of the top 10% of global wealth holders, and USD 759,900 to belong to the top 1%.”

3. “While the bottom half of adults collectively own less than 1% of total wealth, the richest decile holds 87.7% of assets, and the top percentile alone accounts for half of total household wealth.”

May I type that again in bold characters – the top percentile alone accounts for half of total household wealth.

I put together a time series of these trends from past data and incorporated it with the latest Global Wealth Report information.

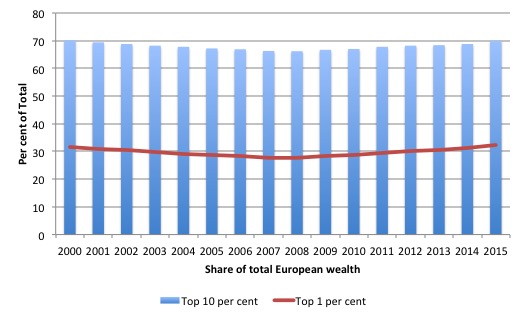

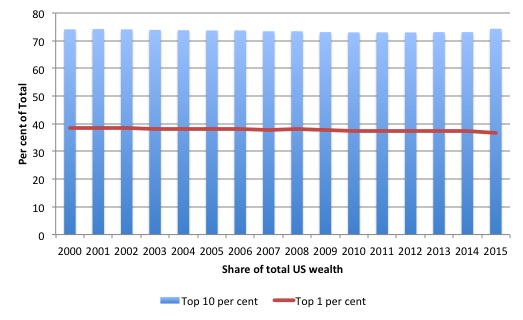

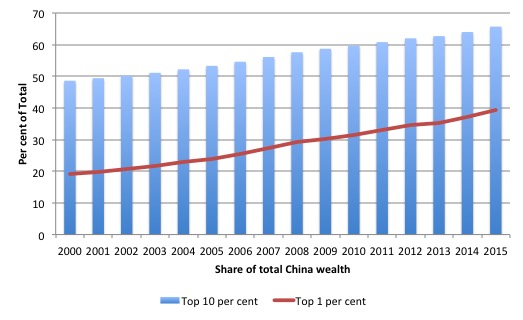

The following graphs show the proportion of total wealth held by the top 10 per cent of the distribution (blue bars) and the top 1 per cent (red line) for the World, then Europe, then the US and finally China.

Wealth inequality is rising despite the GFC and there is an increasing concentration among the top 1 per cent. That pattern is noted in Europe and particularly China, but the top 1 per cent have seen a small decline in their share between 2014 and 2015 while the top 10 per cent gained share.

There has been a marked concentration of wealth at the top end of the distribution in Europe despite the prolonged crisis that has caused millions to lose their jobs.

When anyone wonders what all the austerity is about it pays to think of these distributional processes that have further cemented the power of the wealthy and expanded their opportunities to entrench their interests further.

When the IMF talks about ‘structural reforms’ I think about these distributional outcomes that result from the typical IMF programs that are inflicted on nations.

Earlier this year, OXFAM released a briefing report on inequality (January 2015) – Wealth: Having it all and wanting more – which anticipated the trends reported in the recent Global Wealth Report 2015.

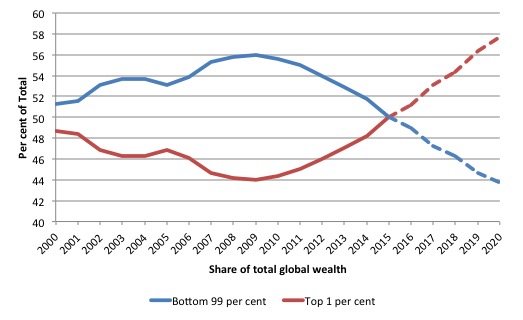

They produced the following graph (Figure 2 in their Report), which compares the top 1 per cent and the bottom 99 per cent of the global wealth distribution and extrapolated it out to 2020.

They actually underestimated the rate at which the top 1 per cent are accumulating wealth relative to the rest. They predicted that it would be 2016 before “the top 1% will have more wealth than the remaining 99% of people”. That outcome happened in 2015.

I updated the exercise given the latest wealth distribution estimates. If the current trends are maintained then the top 1 per cent will own around 58 per cent of the total global wealth by 2020.

Here is the graph.

OXFAM point out that in 2014 the wealth of the richest 80 people in the world “is now the same as that owned by the bottom 50% of the global population … 3.5 billion people”.

So how should we think about an economic system and its supporting polity that reallocates increasing share of wealth to fewer and fewer people.

Also do not forget that there must be income flows that reinforce this increasing wealth inequality.

Quite apart from the moral issues, there are two major and interlinked issues are: (a) economic; and (b) political.

OXFAM talk about the “morally questionable” nature of rising economic inequality. See – Working for the Few: Political capture and economic inequality – published January 20, 2014.

But even if you don’t buy into that value system, it is now clear that the trickle down claims made at the outset of the neo-liberal period are lies. Please read my blogs – Trickle down economics – the evidence is damning and Inequality and growth and well-being – revolutions have occurred for less – for more discussion on this point.

Rising economic inequality is bad for economic growth. It undermines the capacity for individuals to invest in education, which is the most reliable source of economic development (skill development).

In the 2014 paper, OXFAM also highlight the political ramifications. They say that:

In many countries, extreme economic inequality is worrying because of the pernicious impact that wealth concentrations can have on equal political representation. When wealth captures government policymaking, the rules bend to favor the rich, often to the detriment of everyone else. The consequences include the erosion of democratic governance, the pulling apart of social cohesion, and the vanishing of equal opportunities for all.

In its 2015 Report, OXFAM further note that the sectors which generate the largesse that goes to the most wealthy also spent “millions of dollars” lobbying governments to pressure them to introduce policy structures that perpetuate the inequality.

For example, the “financial sector is … the largest source of campaign contributions to federal candidates and parties”. Further, in 2013, “the pharmaceutical and healthcare sectors spent more than … any other sector in the US” on lobbying. Similar trends occur in the EU.

During a period that the Ebola outbreak threatened a world crisis, pharmaceutical companies spent 6 times more on lobbying than on assistance to Ebola prevention.

OXFAM notes that the “largest increase in wealth between 2013 and 2014 by a single pharma-related billionaire could pay the entire” losses in output that the Ebola crisis will cause in “Guinea, Liberia and Sierra Leone”.

OXFAM also enlighten us on where this lobbying cash goes – mostly to manipulate government spending and tax changes which are designed to favour the donors.

They note that:

Lobbying on tax issues in particular can directly undermine public interests, where a reduction in the tax burden to companies results in less money for delivering essential public services.

Which is a statement that buys into the neo-liberal logic itself. The lobbyists come from sectors that lead the charge when it comes to berating governments about fiscal deficits and spending on income support for the most disadvantaged people in society etc.

But at the same time they are calling for welfare cuts to the poor, they are also manipulating governments to hand out as much public spending in the form of corporate welfare that goes largely into their own pockets.

It is an audacious hypocrisy that abounds. And the rest of are largely silent because we have bought the myth that regulation is bad, that welfare for the poor erodes incentives and all the rest of the nonsense.

I even read comments on my own blog from so-called progressives that it is outrageous and unfair to criticise politicians that aspire to national leadership who claim that fiscal deficits have to be cut and maintained in balance.

The deficit mania is part of the myth that free market allocations are the most efficient because they respond to the preferences of all consumers.

But it is obvious that a system of allocation that responds to spending will distort the allocations in favour of those who spend the most.

The market is driven by dollar votes. The more one spends the more power one has. So even at the most elementary level the concept of a free market is flawed. There is no such thing. It is preferences backed by cash rather than the latent desires that the market responds to, even in the abstract theoretical models.

But then once the inequality reality is overlaid onto that narrative and we recognise the massive spending that is designed to lobby for particular policy environments, which further distort the market allocations, we realise that the concept of the free market that is taught in economics programs throughout the world is a myth.

It is a convenient metaphor to give the impression that we all have a chance and the market will deliver outcomes according to our efforts.

Marx long ago recognised that crises occur when those that had overproduced were unable to access any of that production. Unemployment occurs when there is not enough spending to absorb the production (so output is overproduced relative to spending) and it also denies those who had been part of the productive output teams an income.

In the 1940s, Kalecki talked about the “captains of industry” who had a vested interest in opposing government policies aimed at creating full employment. Please read my blog – Michal Kalecki – The Political Aspects of Full Employment – for more discussion on this point.

Now these “captains” do not engage in much industry even. They dominate the financial sectors.

Remember the most obvious cases of Enron or the rating agencies being paid to give the top ratings to financial products that were never able to justify that sort of quality rating nor the conflict of interest being disclosed. Remember the shameless behaviour of Goldman Sachs deliberately conniving with the Greek government to deceive the European Commission during its transition into the common currency?

And the countless other examples of corruption that combined to create the GFC and its aftermath? We only know about the tip of the iceberg.

If the extrapolations that I produced in the last graph above then these levels of corruption and chaos will worsen.

One of the consequences of the rising inequality in income and wealth is that the bastion of social stability – the middle-class – is being eroded.

It is a trend that is occuring in all nations.

An April 2014 report from the Federal Reserve Bank of St. Louis – The Middle Class May Be Under More Pressure Than You Think – considered income inequality trends.

It found that once we consider “the characteristics of individual families in the middle class or how families with different characteristics fare over time” it becomes clear that income rankings along do not explain the full story of what has been happening in the US over the last 30 years.

To some extent it is the difference between what an economist chooses to focus on – “rankings of income or wealth” which are “relatively easy to measure” abnd what sociologists consider important – “demographic dimensions like race, education, occupation and status”.

Their study considers both.

They defined three types of households in the income distribution:

1. “Thrivers … Families likely to have income and wealth significantly above average in most years”.

2. “Middle class … Families likely to have income and wealth near average in most years”.

3. “Stragglers … Families likely to have income and wealth significantly below average in most years”.

Each of these groups have particular demographic characteristics, which define sets of characteristics which are associated with whether the family is persistently poor, average or rich.

They find that between 1989 and 2013, the median income of the middle class decreased by 16 per cent whereas for the other groups it rose by 2 per cent for thrivers and 8 per cent for stragglers.

The median wealth of thrivers was 22 per cent higher in 2013 compared to 1989 while the middle class lost 27 per cent and the stragglers 54 per cent of their wealth over the same time period.

The income of the median family ranked as ‘middle class’ in 1989:

… based on age, education and race or ethnicity ranked at about the 55th percentile of the overall distribution … by 2013 the median middle-class family had dropped to about the 45th percentile in the overall distribution.

The same family “was slightly worse in terms of wealth”.

The point is that the middle class is being eroded by the same changes that are driving these increased disparities in income and wealth.

Marx said that religion was the opiate of the masses. In the neo-liberal era it is mass consumption driven by credit. Both doping strategies are unsustainable especially when the latter also systematically undermines the prosperity of those that the system relies on for mass consumption.

I wrote about the OXFAM report when it was released in this blog – Rising inequality – fundamental changes required.

In that blog I outlined the sort of changes that would be required to redress the trend towards higher inequality.

In Australia, the inequality problem is getting worse.

ACOSS reports that (Source)

1. “The share of both income and wealth for to the highest group has risen while the share going to the

lowest (and in the case of wealth also the middle) groups has decreased over the past 20 years.”

2. “The wealth of the highest 20% wealth group increased by 28% over the period from 2004 to 2012. By comparison the wealth of the lowest increased by just 3%.”

3. “Over the 25 years to 2010, real wages increased by 50% on average, but by 14% for those on lower incomes (10th percentile), compared with 72% for those on higher incomes (90th percentile)”.

Conclusion

At some point, ‘we’ the people will fight back. It would be better if it was through the ballot box and we pushed out governments that were ‘pro business’ and elected governments that were keen to advance general public welfare initiatives.

But when so-called progressives support the socialist parties and labour-type parties that denounce so-called deficit deniers and when in power manage and implement pernicious austerity programs there is little hope in the foreseeable future of such enlightened politicians getting their hands on power.

Something ugly is the alternative and human history tells us that it happens.

I am thinking about these issues as I craft my presentation for the Wednesday event.

Video Promoting Anti-Poverty Week in Australia

Anti Poverty Week Event – Newcastle, NSW

There will be a special Anti Poverty Week event in Newcastle – Pushed to the Margins: Poverty in our Region – on Wednesday, October 21, 2015.

The event will take place between 17:30 and 19.30 at the Newcastle City Hall, 290 King St, Newcastle 2300.

ABC Lateline’s Emma Alberici will be hosting a panel of distinguished local and national speakers as they explore the realities of poverty and inequality in our community, its causes, impacts and how collectively we can bring change.

A conversation guaranteed to enlighten, engage and stimulate – A rare opportunity not to be missed!

Panelists include Dr John Falzon (CEO St Vincent de Paul), Professor Bill Mitchell (CofFEE), Dr Clare Hogue (HRF), Kelly Hansen (Nova), Jody Broun (NSW Executive Director, Red Cross) and Sue Cripps (CEO Homelessness NSW).

Organised by: Nova for Women and Children and the St Vincent de Paul Society

The event is free and you can register at http://pushedantipoverty.floktu.com/

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

I don’t think it helps criticising governments for being pro business.

The criticism should be that governments are pro big business.

Because in my experience government does absolutely nothing to defend small business or indeed workers from the ridiculous compliance and cost cutting measures inflicted upon them by big business / multinationals

Dear Bill

The political influence of the rich could be drastically reduced if political parties were regarded as public institutions and financed by the Treasury. In Canada we had such a policy. A party would receive about 2 CAD per year for each vote that it received in the previous election. This policy was terminated by the Conservatives. Contrary to widespread belief, parties and election campaigns aren’t all that expensive if measured as a % of GDP.

Suppose that there are 16 million eligible voters in Australia and that 75% of them vote in federal elections, which is a total of 12 millions votes cast. If an Australian federal party were to receive 20 dollars annually for each vote cast in a federal election, that would be a total cost of 240 million, about one dollar per Australian per month. All donations to political parties by individuals or companies would still be legal but not be tax deductible. I would exclude parties that receive fewer than 250,000 votes from this scheme.

An alternative would be to allocate a fixed total sum to political parties each year. That sum would then be divided among the parties in proportion to the number of votes received in the previous election, excluding those parties that receive a very small number of votes.

This scheme wouldn’t work very well in the US because so much electioneering there takes place in the primaries. To finance political parties is one thing, to financial candidates in primaries quite another.

If parties were publicly financed, the rich could still own media outlets and bankroll think tanks, thereby influencing public opinion, but their hold on political parties would be weakened considerably. There is no need for donor democracy when political parties don’t depend on private donors.

Regards. James

Hello Bill,

I just finished the video of your great presentation at Helsinski – How do you assess if the private deleveraging is done ? in the Eurozone for example ? looking at sectoral balances only provide us with a picture of the level of saving/spending at at a point in time, so what data should we use to asses it ?

Kind regards. Antoine

Dear Bill,

Great post, as usual.

There seems to be a tag missing near the bottom of it, after the event name “Pushed to the Margins: Poverty in our Region” which makes the rest of the page appear slanted.

Regards,

Hi Bill, there seems an unleft ‘italics’ HTML tag () in the end of your post screwing the comments.

Delete this when/if it’s fixed. Cheers.

Conservatives should consider how much government bureaucracy and taxes could be eliminated (welfare, unemployment insurance and even eventually social security) by universal dividend and retail discount mechanisms distributed directly to the individual. Progressives should ask themselves how much more economic democracy would immediately be created by those same mechanisms. They should also both consider that if the unemployment “problem” was thus replaced by these mechanisms then modern robotic re-industrialization of hollowed out western economies could continue apace and much more leisure enjoyed by all with a middle class income thus guaranteed. Integrating the efficiencies of capitalism and the economic democracy intentions of socialism via direct distribution instead of re-distribution would accomplish this.

Or capitalist and socialist advocates could fight for another 250 years, accomplish much less and probably just reactively end up suffering under Finance capitalist or vulgar socialist hierarchies to boot.

Dear Ignacio (at 2015/10/20 at 4:28)

Thanks very much. Fixed.

best wishes

bill

I think it’s important to recognise that Marx rejected overproduction relative to income as a precondition to crisis. Marx observed that it can happen but it’s not characteristic of a Marxian overproduction crisis. Many people seem to believe that a job guarantee would prevent a crisis. In the run up to a crisis, wages and employment are often booming. The profit motive causes a qualitative mismatch between need and production. Nominal monetary balance between production and wages is not sufficient to match the needs of workers with the output of production. To achieve that, the profit motive would have to be replaced with decision processes based on need.

It’s the instability created by the profit motive that causes crisis. Marxian demand side analysis uses the value form which includes notional analysis based on the utility of a commodity. Science and technology studies suggest that this “use shape” is a heterogeneous network. Many edges of a commodity are public by nature. Public policy needs to compensate for the inherently unstable “animal spirits” of capitalist investment. Public investment is therefore a major component of economic stability.

Hacky The Hufrex:Many people seem to believe that a job guarantee would prevent a crisis.

The key is that a JG would prevent a macroeconomic “crisis” from being a microeconomic one for human beings.

To achieve that, the profit motive would have to be replaced with decision processes based on need.

That’s what the JG, a public investment, does.

Stabiliser policies have a negative feedback effect in order to reduce the gain of private sector positive feedback which is inherently unstable. The job guarantee does this but has a threshold of full employment because it is designed not to crowd out private employment when there is no output gap. Therefore a job guarantee doesn’t act as a stabiliser in a booming economy.

In the period of railway mania there was an exponential growth of railway production. In this type of environment the private sector is desperate for labour. Output is rising, employment is rising and wages are rising but it’s leading up to a crisis. A policy to stabilise capitalist investment mania is needed in order to apply negative feedback when there is no output gap.

Kalecki suggested that capitalist investment instability may be due to the delay between investment decisions and returns. In a period of private sector investment mania, a stabilisation policy would have to crowd out private sector investment and maintain heterogeneous public sector investment with decisions being made on domain specific criteria. The returns on these decisions would not follow the private business cycle because they would not follow the logic of profitability.

Marx said “crises are always prepared by precisely a period in which wages rise generally and the working class actually gets a larger share of that part of the annual product which is intended for consumption.”

He was describing a typical overproduction crisis. I think it’s arguable that underconsumption and overproduction crises both exist. Underconsumption crises may be a consequence of having a monetary system and overproduction crises may be a consequence of the profit motive. Marx considered the inherent instability of capitalism to be a complex problem. I disagree with attempts to simplify the problems of capitalism.

Hacky: Therefore a job guarantee doesn’t act as a stabiliser in a booming economy.

Sure, in a boom, the JG is small and doesn’t have much direct effect.

A policy to stabilise capitalist investment mania is needed in order to apply negative feedback when there is no output gap.

Why? Needed by whom? How is the nonexistence or size of an output gap determined? Who is wise enough to see when a speculative boom is based on unrealistic exuberance, who will not overhastily abort a true high-growth period? There may be answers to these questions, but the point is that the need is not very great, minor in comparison to the need for a JG, which will be necessary for the solution of the above, lesser problems in any case.

So the above misses the point. The point of the JG is that a monetary economy without one is a ludicrous, sadistic & above all moronic idea, a very gross insult to one’s intelligence, common sense and morality. The fact that they have been the norm does not detract from this. There will always be crises, instability, whatever. So what? There is not the slightest reason for crises & instability to have the enormously destructive & unjust effects they do now.

Some Guy

My original point about the job guarantee was that it does not prevent capitalist crisis. I never said there shouldn’t be a job guarantee or that it doesn’t have any benefits. When I said that an investment stabiliser is needed, I meant [is needed in order to prevent capitalist crisis]. The points that I have made are all relevant to what I originally said about the nature of capitalist crises.

Bill referred to Marx. His comment on Marx was carefully worded but not obvious in implication. The the point I made is that Marx did not believe that macro economic stabilisers were sufficient for economic stability.

Bill has commented on Marx, Keynes and Kalecki and in my view Kalecki was the only one who thought that capitalist crisis was a problem that could be solved. Kalecki suggested that understanding investment was the key to understanding economic crises because he thought that consumption was not inherently unstable.

I mentioned the output gap in the context of the job guarantee which is an automatic stabiliser and therefore works automatically. No decisions about the output gap are required for it to work.

I have not advocated any solutions to the problem of investment in this thread but I’ve mentioned people who are working on the problem in previous comments. My comments on Marx’s value form and the heterogeneity of “use shape” would suggest that I don’t consider the concept of the output gap useful as a way to prevent crisis. Production for profit is not the same as production for utility. This explains why commodities produced for profit can never meet people’s needs. This is in volume one of capital. Many consider it a difficult explanation to read but it’s an important concept.

In a previous comment I have suggested that stabilisers may not be a viable solution to the problem of capitalist investment but a direct offset may be achievable. This could be done by building the structural capital in the public sector that is able to make effective investment decisions using domain specific criteria. This would merely reduce the size of crisis relative to the size of an economy such that a capitalist crisis might then be a crisis only for capitalists.

When you say…

“There may be answers to these questions, but the point is that the need is not very great”

…presumably you mean the present need.

We are in an underconsumption crisis at the moment because that’s what rich people want. If it’s possible to overcome the power networks of the rich then the problem of capitalist overproduction will arise again as it has in the past.

Your observations about Marxism are actually well taken. However, ultimately Marxism is flawed in this respect. It is not an integration of economic thinking. An integration is defined as a combination of ONLY truths, workabilities and applicabilities. This is as opposed to either a reaction to or compromise with two apparently opposing theories/viewpoints wherein unworkabilities, inapplicabilities and/or untruths are enforced/insisted upon inclusion in a combination of those theories. As the RE-distribution of already and systemically enforced scarce individual incomes does not remedy scarcity socialist re-distribution fails the standard for an integration. A direct and additional DISTRIBUTION of income to the individual is workable and applicable and hence qualifies as an actual integration…and as an actual solution to the basic problem of monetary scarcity…instead of a reaction or compromise. The debate over capitalism versus socialism needs to be resolved, and it is resolved by understanding and moving to a third and unifying theory of Monetary Distributism.

Wisdom is integration, the integrative process and the unifying result of same. I suggest economists adopt Wisdom as their theoretical standard.

wisdomicsblog.com

The above was Posted to Real World Economic Review Blog in response to a Steve Keen post and also the following short post:

The need is obviously an integration of capitalism and socialism…..so let’s do that integration…before the economy either collapses under the weight of its accumulated debt and/or an historically rhyming war in an age of modern weaponry. So Dr. Keen, what are your policies for that integration?

Hacky:

My original point about the job guarantee was that it does not prevent capitalist crisis.

Yes, in one way, there is no disagreement here, the JG does not prevent a capitalist crisis. Although, as I said above, other countercyclical “anti- crisis” measures are made more effective and applicable with a JG. It is like suggesting surgery without – or with transfusions.

“There may be answers to these questions, but the point is that the need is not very great”

…presumably you mean the present need.

No, I was trying to be as clear as I could that the need can’t be, is NOT EVER very great. The presumption is the opposite of what I was saying.

This [direct offset etc] would merely reduce the size of crisis relative to the size of an economy such that a capitalist crisis might then be a crisis only for capitalists.

I know I am belaboring it, but a JG is a “direct offset” that does this already. It does prevent a capitalist crisis, always. In a country with a JG, a better word for such a crisis, which is a “crisis only for capitalists” is “schmisis”.

The the point I made is that Marx did not believe that macro economic stabilisers were sufficient for economic stability.

Not sure if he did or didn’t. But what is meant by “economic stability” – and why is it desirable? In some meanings it is highly undesirable. I was collecting some quotes from Marx to post on my long-in-desuetude blog that suggest he wouldn’t / didn’t care too much about “crises” in a full-employment JG society. Minsky certainly didn’t – look at the last few paragraphs iirc of Stabilizing an Unstable Economy.

It is not correct to look at a JG only as a macro-stabilizer like unemployment insurance or progressive taxation or to focus on accidental features like “not competing with the private sector” to the exclusion of the essential. As many, not saying, you, do. Conceivably there are adjuncts to a JG which would make it work better, but giving everyone an OK, maybe not perfect job – the JG – already does an OK, maybe not perfect job of what you are suggesting is needed. Certainly far better than pretended to be done by today’s crazily circuitous routes.

Some Guy

“It is like suggesting surgery without – or with transfusions”

Except I never said there should not be a job guarantee and I never said that it does not have any benefits. Therefore the issue that we seem to disagree on is whether there is a need to address the inherent instability of capitalist investment.

The model of stability that I am using is from control theory which is a special case of stability theory. Negative feedback is defined as reducing the gain of a change. Positive feedback is defined as increasing the gain of a change. Systems without negative feedback are inherently unstable.

In the context of medical metaphors the appropriate medical concept would be the endocrine system. The endocrine system works in the same way as economic stabilisers. Negative feedback is used to reduce the gain of a change in state. If you eat something this pushes your blood sugar up, there is a feedback signal via the Islets of Langerhans. The control centre reacts with a message which is translated into a hormonal change via the hypothalamus and pituitary gland. This is a broadcast message for a global system change. It also works the other way round. If blood sugar is too low then the sensors will detect it and a broadcast message will be sent to burn fat and raise the level of blood sugar.

This is a simple control system. The body has more complex systems than this. For example the adrenal control system is much more complex and has a number of modes which come into effect depending on whether the stress is short term, medium term or long term.

The job guarantee acts in a similar way to a mode in a modal control system. The mode takes effect to compensate for a quantity adjustment of employment. I think there’s a need to develop systems that are more resilient. Unfortunately we don’t know what type of crisis will happen in the future and we only have the evidence of past crises.

What I’ve suggested in the past is that the post war period saw the expansion of a command and control model within large vertically integrated firms. These firms were focussed on the efficient production of more and more of the same things. This period is the subject of The New Industrial State by JK Galbraith. The profitability of these firms collapsed in the mid 1960s. In my view the low profitability and overcapacity of these firms is typical of the process described by Marx. Marxists refer to this as an overproduction crisis. This was followed by a stock market crash and the stock market didn’t move for over 10 years. My view is that these firms were then vulnerable to a supply chain shock because they had very little mark-up and they didn’t have the ability to adapt. When a supply shock happened they had no choice but to push up prices or go bust.

My general argument is that there were a series of events following on from the second world war that led up to the situation we are in now. The earliest that a job guarantee would have taken effect is the 1970s and by then there was a serious mismatch between production and utility. This caused capitalists to shift their profit expectations for productive real capital and this triggered several successive asset bubbles.

The policies in the period of full employment were not sufficient to prevent the crisis that started to unfold in the mid 1960s. Therefore I believe there was a need in the post war period for something that would compensate for the imbalances in the private sector caused by capitalist investment decisions.

I should not have used the term direct offset. It doesn’t really have any meaning other than to myself because it’s a term from electrical engineering. Basically what I meant is that a cycle can be shifted upwards. For example, if you have fluctuating employment then you can shift the whole cycle upwards so that there is never a quantity adjustment and it forces price adjustments. It’s not the same as a stabiliser which has a counter cyclical effect by using negative feedback. I wasn’t suggesting an offset for employment because this is actually similar to the post war policies. I was suggesting an offset for investment because it’s difficult to design an investment stabiliser. If investment in the public sector is pushed up to peak capacity then the private sector cycle will always be based around a higher level of profit and this should make it easier for the private sector to adapt. This is a policy that would crowd out the private sector but the private sector could be crowded in at the same time by purchasing investment from private firms. The mix of crowding out and crowding in could possibly be a stabiliser but this option doesn’t exist unless the entire investment level is pushed upwards. This is what I’m calling an offset.

On the issue of Marx and capitalist stability, I don’t think he believed it was possible. He did consider the value form to be an important factor in capitalist instability and one side of the value dialectic is the “use shape” of a commodity. Production for profit causes a mismatch between utility and price. This is not an imbalance of macroeconomic aggregates but a mismatch between production and need.

What I’ve been saying is also compatible with Stabilizing an Unstable Economy but I’m not sure what you mean by iirc. Is that a chapter abbreviation? I looked at the end of the book which says pretty much the same as what I’m saying. I also looked at the end of the section about employment and that just talks about inflation. I’ve been talking about investment stability and social need so I’m not sure how you think Minsky contradicts what I’ve said. In particular that book agrees with what I’ve said on some very specific points.

1. The end of the era of full employment is the mid to late 1960s. I consider the significant events being either the collapse in American profitability of the mid 1960s or the American stock market collapse of 1968. Minsky uses 1966.

2. Minsky talks about crisis being preceded by full employment. He doesn’t use the term investment mania but I only chose that term to match the theme of railway mania in my first example of an overproduction crisis.

3. Minsky says that institutions are as important as economic aggregates. His analysis is qualitative. He doesn’t put all his eggs in the macroeconomic stabiliser basket.

I think what I’ve said fits quite well with Minsky’s analysis of the capitalist crisis that developed from 1946 – 1966, i.e. the crisis which caused the political crisis that created the opportunity for the neoliberal era. This is why I suggest that crowding out capitalist investment from 1946 – 1966 would be better than waiting until the early 1970s when the crisis has already started. My model for public investment is heterogeneous domain specific criteria. I haven’t invented this, it’s the way a lot of public investment already works.