Yesterday, the Reserve Bank of Australia finally lowered interest rates some months after it became…

Friday lay day – the neo-liberal real wage scandal

Its my Friday lay day and I am trying to finish one paper that is due and also prepare the presentations that I will be giving in Finland next week. But I was reading a Briefing Paper (No 406) from the US Economic Policy Institute (published September 2, 2015) – Understanding the Historic Divergence Between Productivity and a Typical Worker’s Pay – that resonated with me today. One of the defining characteristics of the neo-liberal era has been the divergence between real wages growth and productivity growth. It has been a deliberately engineered divergence as policy makers have shifted from mediating the distributional struggle between labour and capital to being ‘pro-business’ and introducing a range of initiatives that have allowed capital to gain greater shares of national income and build a booty that has then been pumped into the increasingly deregulated financial markets. Oh, and to allow the bosses and their managers to take out obscenely high salaries and swan around in private jets. The dynamics unleashed by these distributional shifts helped cause the Global Financial Crisis. A sustainable recovery with progressive outcomes (reductions in income inequality etc) will only be possible if Governments abandon the ‘pro-business’ bias and instead introduce policies that ensure real wages grow in line with productivity (along with other changes).

I have considered the shift in national income distribution in previous blogs:

1. There is a class warfare and the workers are not winning.

2. Massive real wage cuts will not improve growth prospects.

3. The origins of the economic crisis.

4. Redistribution of national income to wages is essential.

5. Declining wage shares undermine growth.

6. Wage rises are required – real wages must grow in line with productivity

Distributional shifts towards profits of the magnitude we have seen since the 1980s are damaging to economic growth and financial stability.

The EPI report provides a detailed account of the same sort of trends in the American labour market. The divergence has occurred in many advanced economies over the same period.

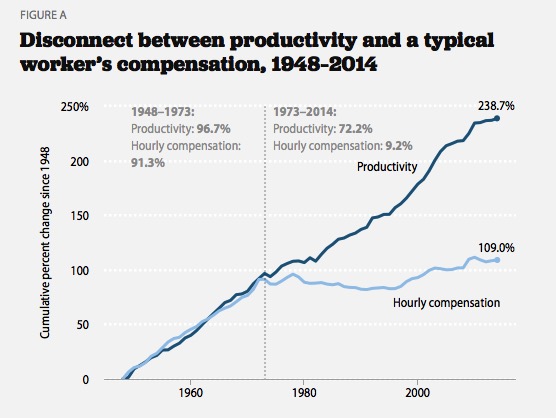

This graph is reproduced from Figure A in the EPI Report. It is a stunning indictment of the neo-liberal era and we will look back on this at some point in the future and wonder what the hell the workers were doing electing governments that allowed this divergence to occur.

In most nations, the wage share of national income was constant for several decades following the Second World and this constancy was so marked that Kaldor (the Cambridge economist) termed it one of the great “stylised” facts.

So real wages grew in line with productivity growth which was the source of increasing living standards for workers.

The productivity growth provided the ‘room’ in the distribution system for workers to enjoy a greater command over real production and thus higher living standards without threatening inflation.

If real wages grow in line with productivity, then Real Unit Labour Costs (RULC) are constant and there is thus no inflationary pressures emerging from the labour market (given constant mark-ups on costs).

Since the mid-1980s, the neo-liberal assault on workers’ rights (trade union attacks; deregulation; privatisation; persistently high unemployment) has seen this nexus between real wages and labour productivity growth broken. So while real wages have been stagnant or growing modestly, this growth has been dwarfed by labour productivity growth.

As a result, the wage shares in most nations have been falling. Where has the real income gone? To the profit share!

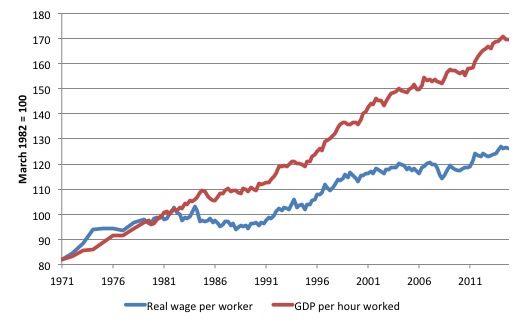

Here is the same graph for Australia, showing movements in real wages and GDP per hour worked since 1971. The data does not allow me to go back as far as the US graph above. But other data (not compatible here) show that hourly real wages grew more or less in line with productivity per hour worked for almost all the Post War period up until the early 1980s.

Between the September-quarter 1971 and the March-quarter 1982, GDP per hour worked grew by 22 per cent while Real Wages per worker grew by 21 per cent.

From the March-quarter 1982 to the June-quarter 2015, GDP per hour worked grew by 69.5 per cent while Real Wages per worker grew by only 26.3 per cent.

The divergence in Australia has not been as great as shown by the EPI for the US. And the resulting increase in income inequality has not been as great as a consequence.

But neither trend (US or Australia) is sustainable.

The EPI concluded that for the US:

1. “wages did not stagnate for the vast majority because growth in productivity (or income and wealth creation) collapsed. Yes, the policy shifts that led to rising inequality were also associated with a slowdown in productivity growth, but even with this slowdown, productivity still managed to rise substantially in recent decades. But essentially none of this productivity growth flowed into the paychecks of typical American workers”

2. “pay failed to track productivity primarily due to two key dynamics representing rising inequality: the rising inequality of compensation (more wage and salary income accumulating at the very top of the pay scale) and the shift in the share of overall national income going to owners of capital and away from the pay of employees.”

3. “although boosting productivity growth is an important long-run goal, this will not lead to broad-based wage gains unless we pursue policies that reconnect productivity growth and the pay of the vast majority.”

When the EPI released the report, the accompanying Press Statement said that:

The fact of the matter is, for decades, a typical worker’s pay rose alongside productivity-but since the 1970s, as a hugely disproportionate share of income generated by rising productivity has gone to extraordinarily highly paid managers and owners of capital …

The relationship between rising productivity and worker pay has broken down because workers’ bargaining power has been intentionally hamstrung by a series of intentional policy decisions, made on behalf of those with the most income, wealth, and power …

Our problem is not a lack of growth. For the past 40 years, productivity has gone up substantially, but these gains have not reached working people … The problem is that wages have been suppressed by a restructuring of rules on behalf of those with wealth and power.

The EPI also noted that “If the hourly pay of typical American workers had kept pace with productivity growth since the 1970s, then there would have been no rise in income inequality during that period”.

That is a stunning conclusion in itself.

This has been a deliberately engineered increase in inequality by governments that we vote for. Once again we see the cognitive dissonance of supporting policies that undermine our own welfare.

The declining wage share and the resulting credit binge in many nations were clearly causal in creating the global financial crisis. The mainstream economists believed that the markets were efficient and that there would be no problems with placing an increasing proportion of real income into the hands of the Casino economy.

The problem that arises is if the output per unit of labour input (labour productivity) is rising so strongly yet the capacity to purchase (the real wage) is lagging badly behind – how does economic growth which relies on growth in spending sustain itself? This is especially significant in the context of the increasing fiscal drag coming from the public surpluses or stifled deficits which squeezed purchasing power in the private sector since the late 1990s.

In the past, the dilemma of capitalism was that the firms had to keep real wages growing in line with productivity to ensure that the consumption goods produced were sold. But in the lead up to the crisis, capital found a new way to accomplish this which allowed them to suppress real wages growth and pocket increasing shares of the national income produced as profits. Along the way, this munificence also manifested as the ridiculous executive pay deals and Wall Street gambling that we read about constantly over the last decade or so and ultimately blew up in our faces.

The trick was found in the rise of “financial engineering” which pushed ever increasing debt onto the household sector. The capitalists found that they could sustain purchasing power and receive a bonus along the way in the form of interest payments. This seemed to be a much better strategy than paying higher real wages.

The household sector, already squeezed for liquidity by the move to build increasing federal surpluses were enticed by the lower interest rates and the vehement marketing strategies of the financial engineers.

The financial planning industry fell prey to the urgency of capital to push as much debt as possible to as many people as possible to ensure the “profit gap” grew and the output was sold. And greed got the better of the industry as they sought to broaden the debt base. Riskier loans were created and eventually the relationship between capacity to pay and the size of the loan was stretched beyond any reasonable limit. This is the origins of the sub-prime crisis.

So the dynamic that got us into the crisis is present again and with fiscal austerity emerging as the key policy direction the welfare of our economies is severely threatened. This is a dramatic failure of government oversight.

Conclusion

This is one of the defining characteristics of the neo-liberal era and is clearly causal in terms of the GFC and its aftermath.

The IMF, the Troika and all the rest of the right-wing voices that invade the policy debate all call for governments to lift productivity growth to provide the path for increased living standards.

But as the EPI conclude, raising productivity growth “is an important long-run goal” but that alone “will not lead to broad-based wage gains unless we pursue policies that reconnect productivity growth and the pay of the vast majority”.

Otherwise all these so-called structural reforms aimed at increasing GDP per hour will just be siphoned off by the top end of the income distribution and the largesse will continue to swim around the Global Financial Casino – ready to break out and cause the next major crisis.

Politicians misusing official labour market data

One of the radio interviews I did this week was in response to a Conservative federal Member of Parliament claiming that his electorate’s labour market was performing well. When I looked at the official data his claims didn’t appear to be believable.

The ABC (South East NSW) where the MP is located then decided to analyse the data a bit more after my interview and they wrote this story as a follow up (September 29, 2015) – Unemployment stats: better because they don’t count people who gave up looking for jobs that don’t exist?.

It shows how politicians can misuse of official data to put their ideological spin out and the benefit of having a national public broadcaster that is officially required to present both sides of the story.

Overseeing a company cheating its workers but don’t let that get in the way of buying your private jet

There was an article in the Australian Financial Review (September 30, 2015) reporting that the

7-Eleven boss had just bought a new private jet worth about $A10 million.

His sister had also just splashed out $A20 million om a new mansion in Melbourne.

The reason I note this is because the company he manages is being investigated for massive underpayment of its low-wage, casual workforce. The company has been exposed exploiting its workers and paying around half the legal minimum wages.

I note that the legal minimum wage is barely above the poverty line.

A bit later on September 30, 2015, the ABC carried the news report – 7-Eleven chairman Russ Withers and chief executive Warren Wilmot resign.

The ABC reported that:

An inquiry into Australia’s temporary work visa program found the underpaying of staff in the convenience store chain was systemic and had been happening for decades.

The private jetter doesn’t lose that much though. He remains the “chairman of the group holding company that has as its investments 7-Eleven and Starbucks together with real estate and a share portfolio.”

These bastards have no shame!

Music – Freedom Sounds

This is what I was listening to this morning while I was working.

Here are the Soul Brothers, who were featured (as a backing band) in last Friday’s blog. This time they are playing in their own right.

A new series of historical Studio 1 recordings have now been reissued by the Japanese record label – Dub Store Records. It is a magnificent venture.

In some cases, my old vinyl records from Jamaica have become too worn to play and so these reissues are a godsend.

Here they are with the hit song – Freedom Sounds – originally made popular by the Skatalites in 1964. As I noted last week, the Soul Brothers emerged out of the Skatalites when they finished (for the first time) in August 1965.

This version marked the transition from Ska to Rock Steady – slower tempos – on the way to Reggae.

For make up of the band and some history please see my blog – Friday lay day – lightweight garbage from The Economist

Upcoming Events

Finland, October 2015

I am visiting Finland between October 7-11, 2015 and will be giving a number of presentations and talks during those four days.

1. Thursday, October 8, 2015 – SOSTE Talk 2015.

SOSTE is the “Finnish Federation for Social Affairs and Health is a national umbrella organisation that gathers together 200 social and health NGO’s and dozens of other partner members.”

I am their guest and I will be speaking at their annual conference – SOSTE Talk. The topic will be on Full Employment and how governments can achieve it.

I will be speaking between 9:00 and 10:30.

2. Thursday, October 8, 2015 – Austerity and Beyond – University of Tampere

After a 90 minute train trip from Helsinki to Tampere I will be speaking at the University of Tampere on the theoretical and political background of Eurozone austerity. There will be two discussants and a free conversation to follow.

The presentation and discussion will run between 15:00 and 18:30. All are welcome.

The location is Tampereen yliopisto (University of Tampere), Kalevantie 4, 33014 Tampereen yliopisto Tampere, Finland.

For more details E-mail: kirjaamo@uta.fi

3. Friday, October 9, 2015 – Guest Lecture at University of Helsinki – Economic Austerity and the Alternatives.

The Topic will be similar to the discussion at the University of Tampere although I will branch out and discuss Modern Monetary Theory (MMT) undoubtedly.

There will be two discussants and an open discussion to follow.

The event is free and open for everyone. It is organized by the Finnish Society for Political Economy and the Department of politics and economics, University of Helsinki.

The Finnish Karl Marx Society has promised to organise a good quality video broadcast from the event which will be available on YouTube soon afterwards.

The event will run from 17:00.

The location is Unionikatu 40, 00170 Helsinki, Finland.

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

Brilliant work and easily accessible even to an economic dunce like me. I am figuratively in your debt.

Welcome to Finland… We really need your help, cause our government is making inner devaluation at the momement by cutting holidays, making you pay your sick days yourself, cutting wages by cutting holiday return moneys and with some other things, which ain’t clear yet. They are still “innovating”.

First we forced PIIGS-countries to do the inner devaluation and now we are in the same wagon. This is a way too hilarious and nobody has a clear pictrure about wtf is happening. We are only doing what Germany says us to do and can’t do any own thinking. Mostly it’s against our own intrerest, but we still do it. Dumb and real sad chapter in our history. Debt deflation is just around the corner.

Challenge. All other things remaining the same, as retail sale to an individual is the terminal end of both the productive process itself and also the sum of all costs for any item or service….how could a discount to prices at that point , especially if it was fully rebated back to the retail merchant, possibly do any harm to any enterprise?….and why is it not part of the answer to not only the chronic inflation that dogs advanced economies, but also an opportunity for leaders and economic policy makers to seamlessly create actual price deflation in profit making economies?

Their are two overriding elements to the developments you describe since the second world war; During the latter stages of the first period, fear of the political right (neoliberals, in your words) that worker power was extracting too much of a threatened cake. During the second period the greed that right wing policies allowed the capitalist class to indulge unrestricted.

@Bill

Great post, as usual.

The 7-Eleven scandal is really just the tip of a very large iceberg. Most international students I know considered 7-Eleven to be a “good” place to work as they pay relatively well to most other places they can get work; this was before the public revelation. To secure a job at the legal minimum wage is something of a miracle for international students in Australia, and they otherwise toxic work environments to keep them.

@Steve

I’m sorry, but that’s a pretty ridiculous proposal.

Correct me if I have misread you, but what have described is essentially a negative VAT/GST, which you are proposing as a solution for high than desired rates inflation.

Disregarding the fact the Japan, much of Europe and pretty much the entire Anglosphere are suffering from lower than desired rates inflation, if not outright deflation (both carry undesired impacts), I don’t think a negative VAT will achieve what you would like it to achieve.

Firstly, say our national statistical agencies chose to count prices post-VAT, this would be once-off reduction in prices. Inflation is defined as continuous changes in prices, not a single event. So unless you’re proposing to index your discount in-line with inflation (a terrible idea, as I will explain below), your discount will not result in deflation. Again, many countries around the world would benefit from high rates of the inflation at the present.

Now here’s why you really don’t want to be indexing your negative-VAT to inflation:

A positive (regular) VAT is relatively effective way to reduce consumption. Take a look at the hit to consumer spending in Japan when the government increased their VAT last year as a recent example. I think its safe to assume that a negative VAT would lead to an increase in consumption as goods become cheaper relative to the same level of income; maybe not a symmetrical increase, but an increase nonetheless.

Given that most economies aren’t running close to full employment, an increase in demand isn’t necessarily a bad thing at present and would not be outright inflationary, but as an economy approaches full employment a negative VAT would have an inflationary, not deflationary impact. To indexing it would be to set up the economy for hyper-inflationary potential. It’s a pro-cyclical action, the mirror opposite of increasing taxes in a recession.

The most striking aspect of wage suppression is that it’s the opposite of what’s expected in the run up to a Marxian overproduction crisis. This is because Marx’s analysis is based on a period of scarcity of real capital. In the post war period we’ve had a boom, an overproduction crisis, another boom then an underconsumption crisis. The post war investment crises are caused by attempts to reproduce class relations in the context of decreasing scarcity. The current strategy of business as usual will fail because it’s not economically viable. It’s likely that the focus of class war will eventually turn to the means of reproduction of social relations, therefore countervailing power needs to challenge power relations at all levels. The best response from the left is to reject hierarchy and establish mutual social relations based on dialogue. By these means exploitation will simply become uncompetitive.

There may have been a general decrease in scarcity but in terms of industrial evolution a decline had set in by the late 1970’s in England’s manufacturing and heavy industry power base. This was particularly evident in places like Teesside (James Cook country) which was heavily reliant on Steel and Chemicals.

These industries were also closely associated with skilled apprenticeships and consistent pay levels across wide swathes of employment. Employment was also union dominated.

As competitive pressures built up, both internal and foreign, it was not surprising that governments, of either complexion, would fret about the long term effects of allowing unions to maintain or strengthen their power.

The outcome of the political solution is now apparent.

The replacement of a predominantly industrial economy by one more closely associated with consumerism has probably contributed to a lowering of (real) wage levels. The important median wage would presumably reflect this.

Steve,

. . .and why is it not part of the answer to not only the chronic inflation that dogs advanced economies, but also an opportunity for leaders and economic policy makers to seamlessly create actual price deflation in profit making economies?

Spending is not the sole cause of inflation and reducing it will inflict depression before you break workers and firms of their ability to raise prices and wages. In a situation where inflation results from other phenomena you would be gratuitously inflicting a bout of stagflation on your society.

The hold neo liberal thought has on so many people is remarkable. Even young people who suffer because of it, blindly support it, because they have been taught to believe it is required to maintain the essence of the form of capitalism which might someday bring them middle class comforts and possibly real wealth. Not having lived in the past they don’t see the lie that’s been propagated.

They don’t see that free market fundamentalism isn’t really about free markets.

The global elite to whom we have ceded power, long ago, caught on to the socialist relation forming potential of a mixed economy and consumer capitalism, and are now trying desperately, once again, to shift us toward something more fascist in nature to secure control from the top of a hierarchy they can manage; established by the corporate rule which has replaced democratic governance. This is psychopathic behavior upon stilts.

Psychopathic motivations are often difficult to detect. It is characteristic of psychopathy to combine charm, wit and the ability to precisely read and manipulate human emotion in order to attain extremely selfish goals with a complete lack of empathy or fear of consequences. A slow stealthy approach is most successful for predators; this is how neo liberalism advances.

The consequences of neo liberalism as with early attempts to establish fascist type control in one form or another have been devastating; millions of lives have been senselessly destroyed world wide both through austerity and the outright violence associated with this onslaught globally.

Social relations are woven within the marketplace; even in a world were we would wish to preserve the environment by changing the nature of some of the output we wish to consume. The older fundamental lessons of classical economics, combined with the newer lessons MMT teaches, seem to be quite important in determining a path forward.

Were all capital dispensed equally among worker-business owners who are the essence of both consumption and production we might then be able to reestablish democratic control and have markets with the maximum possible freedom while capturing a maximum of human output for distribution. We don’t need an armed to the teeth elite controlled world government to set the path we the people wish to follow. Sovereign money gets it’s power from the people who must use it in their daily lives to trade for the things they need. For a small group to hold power over it’s distribution and uses in todays world is a crime. It’s time to start taking democracy seriously again.

I’m suggesting that in the 1960s there was already an overproduction crisis which was in line with a Marxian interpretation of economic crises, i.e. declining profitability and increasing wage share leading to an asset bubble caused by capitalists seeking profitable opportunities. In response to this the capitalists went to war with government and labour. It didn’t help that the Keynesian consensus had combined with G.A. Feldman style central planning. Centralisation is bad for technical progress and technical progress is needed to make sure there is sufficient notional demand to avoid nominal demand policy side effects. Governments need to do a lot of blue sky research and development that creates potential for new products because the private sector has a bias towards improving production. In the UK a lot of centralisation took place in the golden age of employment and this also created an opportunity for state capture.

Much of the financial engineering has not gone to household debt, but to corporate debt, particularly corporate financial debt in the form of leveraging. One solution to this is to prohibit any bank chartered with the Federal Reserve from loaning money to any hedge fund, private equity firm, or any corporation that buys its own stock.

Dear Professor Mitchell,

If the Australian minimum wage had kept pace with labour productivity gains since 1971, what would the minimum wage be today?

I hate to get all ABBA on you Bill but “thank you for the music”, that was tickling my sub at a less than discrete level.

the true nature of the problem faced is that this divergence has been illustrated and articulated for sometime and yet this fact is seldom is recounted in tandem with static’s like drops or lags in a countries productivity like here in the UK. Productivity has been represented as an almost floor in the UK’s work force, although housing (high prices forcing people to live further away from work), transport costs, and technology have been mooted, the message is very ambiguous and unclear, and seems to suggest an issue linked to working practices. This is all very much in keeping with the current governments belief that changing legislation from Brussels in terms of employment law is the key to increasing such things as productivity and freeing business from the neo-liberal Bogeyman, “the red tape.”

whilst their is no doubt that productivity is an essential key to understanding and maintaing a healthy economy, unless its use in public debate includes all the facts it will just be a tool for proving the validity of an argument through the narrowing its scope of understanding.

Same trends observed in Indonesia. Except in the manufacturing sector where the link was reestablished in 2008-2013. This is largely associated with growth in the union movement and reforms that encouraged the use of bipartite cooperation institutions as well as growth in sectoral minimum wages. Reforms are now under way to revise the minimum wage fixing system, to make is fair, simple and predictable. Collective bargaining here is very minimal, so a key consideration should be an assessment of how changes will impact on labour market institutions and the link between productivity and wages..

I think economic rent is the wedge that separates wages from productivity and drives inequality. With economic growth comes inevitable increases in sources of economic rent (principally, increases in land values, natural resource prices, finance, and other monopoly power) which reduce labour’s share. Rent is normally subsumed in profits, but it is distinct from interest and has an entirely different kind of dynamic. It’s also entirely undeserved, as we all learned from the classical economists. Michael Hudson has written extensively on this almost universally ignored but vitally important process. It’s silly to talk about increasing productivity growth when monopoly power extracts the gains before the workers can receive them.

RE: Figure A, I must be having a brain failure. The 1973 productivity increase from 1948 was at 96.7%. In 2014 it was at 238.7% of 1948. I know it’s simple math, but how does increasing from 96.7% to 238.7% equal a 72.2% increase over 96.7. Wouldn’t a doubling (100% increase) from 96.7 equal 193.4, so 238.7 would be greater? Sorry for such a simpleton question. In any case the discrepency between productivity and wages is gross.

Dear Lyle (at 2015/10/05 at 9:58)

The left-hand axis denotes the “Cumulative percentage increase”.

best wishes

bill

Has anyone tracked the the 51 st percentile wage against productivity or GDP growth?

Just to add to my comments above.

Whilst productivity is more than just hard work this is an example of the climate in the UK I was trying to illustrate.

http://www.bbc.co.uk/news/uk-politics-34447916