Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – January 24, 2015 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you understand the reasoning behind the answers. If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern Monetary Theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

Assume a nation is running an external surplus equivalent to 2 per cent of GDP and the government manages to run a fiscal surplus equivalent to 1 per cent of GDP. The national income changes associated with these balances would ensure that the private domestic sector was running an overall deficit of 1 per cent of GDP.

The answer is False.

This question requires an understanding of the sectoral balances that can be derived from the National Accounts. But it also requires some understanding of the behavioural relationships within and between these sectors which generate the outcomes that are captured in the National Accounts and summarised by the sectoral balances.

We know that from an accounting sense, if the external sector overall is in deficit, then it is impossible for both the private domestic sector and government sector to run surpluses. One of those two has to also be in deficit to satisfy the accounting rules.

The important point is to understand what behaviour and economic adjustments drive these outcomes.

So here is the accounting (again). The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

Equating these two perspectives we get:

C + S + T = GDP = C + I + G + (X – M)

So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

A simplification is to add (I – S) + (X – M) and call it the non-government sector. Then you get the basic result that the government balance equals exactly $-for-$ (absolutely or as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances).

This is also a basic rule derived from the national accounts and has to apply at all times.

So what economic behaviour might lead to the outcome specified in the question?

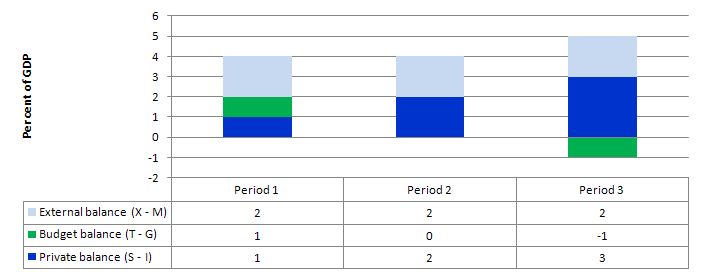

The following graph shows three situations where the external sector is in surplus of 2 per cent of GDP (note I have written the fiscal balance as (T – G).

The data in Period 1 describes the situation outlined in the question. You will note that with the government fiscal balance in surplus (of 1 per cent of GDP) the private domestic balance is in surplus (1 per cent of GDP). The net injection to demand from the external sector (equivalent to 2 per cent of GDP) is sufficient to “fund” the private saving drain from expenditure without compromising economic growth. The growth in income would also allow the fiscal balance to be in surplus (via tax revenue).

In Period 2, the rise in private domestic saving drains extra aggregate demand and necessitates a more expansionary position from the government (relative to Period 1), which in this case manifests as a balanced public fiscal balance.

Period 3, relates to the data presented in the question – an external surplus of 2 per cent of GDP and private domestic saving equal to 3 per cent of GDP. Now the demand injection from the external sector is being more than offset by the demand drain from private domestic saving. The income adjustments that would occur in this economy would then push the fiscal balance into deficit of 1 per cent of GDP.

The movements in income associated with the spending and revenue patterns will ensure these balances arise.

The general rule is that the government fiscal deficit (surplus) will always equal the non-government surplus (deficit).

So if there is an external surplus that is greater than private domestic sector saving (a surplus) then there will always be a fiscal surplus. Equally, the higher the private saving is relative to the external surplus, the larger the fiscal deficit.

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

Question 2:

Starting from the external situation in Question 1, with the surplus being the equivalent of 2 per cent of GDP but this time the fiscal surplus is currently 2 per cent of GDP. If the fiscal balance stays constant and the external surplus rises to the equivalent of 4 per cent of GDP then you can conclude that national income also rises and the private surplus moves from minus 2 per cent of GDP to plus 2 per cent of GDP.

The answer is False.

Please refer to the explanation in Question 1 for the conceptual material required to understand this question and answer.

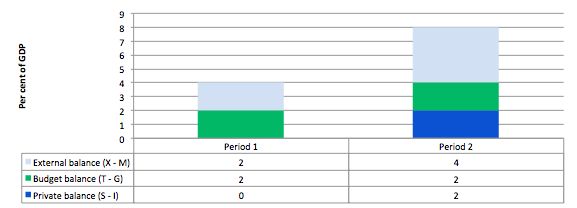

Consider the following graph and accompanying table which depicts two periods outlined in the question.

In Period 1, with an external surplus of 2 per cent of GDP and a fiscal surplus of 2 per cent of GDP the private domestic balance is zero. The demand injection from the external sector is exactly offset by the demand drain (the fiscal drag) coming from the fiscal balance and so the private sector can neither net save overall nor spend more than its earns. So the starting position for the private domestic sector is a balanced state.

In Period 2, with the external sector adding more to demand now – surplus equal to 4 per cent of GDP and the fiscal balance unchanged (this is stylised – in the real world the fiscal balance will certainly change), there is a stimulus to spending and national income would rise.

The rising national income also provides the capacity for the private sector to save overall and so they can now save 2 per cent of GDP. Please note the difference between saving and saving overall.

The fiscal drag is overwhelmed by the rising net exports.

This is a highly stylised example and you could tell a myriad of stories that would be different in description but none that could alter the basic point.

If the drain on spending (from the public sector) is more than offset by an external demand injection, then GDP rises and the private sector overall saving increases.

If the drain on spending from the fiscal balance outweighs the external injections into the spending stream then GDP falls (or growth is reduced) and the overall private balance would fall into deficit.

You may wish to read the following blogs for more information:

- Back to basics – aggregate demand drives output

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

- Barnaby, better to walk before we run

- Saturday Quiz – June 19, 2010 – answers and discussion

Question 3:

Even a sovereign, currency-issuing government has to receive tax dollars from the non-government at times in order to to spend effectively.

The answer is True.

First, to clear the ground we state clearly that a sovereign government is the monopoly issuer of the currency and is never revenue-constrained. So the question is not about the tax revenue per se but rather the role taxes play in the monetary system. A sovereign government never has to “obey” the constraints that the private sector always has to obey.

The foundation of many mainstream macroeconomic arguments is the fallacious analogy they draw between the fiscal balance of a household/corporation and the government fiscal balance. However, there is no parallel between the household (for example) which is clearly revenue-constrained because it uses the currency in issue and the national government, which is the issuer of that same currency.

The choice (and constraint) sets facing a household and a sovereign government are not alike in any way, except that both can only buy what is available for sale. After that point, there is no similarity or analogy that can be exploited.

Of-course, the evolution in the 1960s of the literature on the so-called government fiscal constraint (GBC), was part of a deliberate strategy to argue that the microeconomic constraint facing the individual applied to a national government as well. Accordingly, they claimed that while the individual had to “finance” its spending and choose between competing spending opportunities, the same constraints applied to the national government. This provided the conservatives who hated public activity and were advocating small government, with the ammunition it needed.

So the government can always spend if there are goods and services available for purchase, which may include idle labour resources. This is not the same thing as saying the government can always spend without concern for other dimensions in the aggregate economy.

For example, if the economy was at full capacity and the government tried to undertake a major nation building exercise then it might hit inflationary problems – it would have to compete at market prices for resources and bid them away from their existing uses.

In those circumstances, the government may – if it thought it was politically reasonable to build the infrastructure – quell demand for those resources elsewhere – that is, create some unemployment. How? By increasing taxes.

So to answer the question correctly, you need to understand the role that taxes play in a fiat currency system.

In a fiat monetary system the currency has no intrinsic worth. Further the government has no intrinsic financial constraint. Once we realise that government spending is not revenue-constrained then we have to analyse the functions of taxation in a different light. The starting point of this new understanding is that taxation functions to promote offers from private individuals to government of goods and services in return for the necessary funds to extinguish the tax liabilities.

In this way, it is clear that the imposition of taxes creates unemployment (people seeking paid work) in the non-government sector and allows a transfer of real goods and services from the non-government to the government sector, which in turn, facilitates the government’s economic and social program.

The crucial point is that the funds necessary to pay the tax liabilities are provided to the non-government sector by government spending. Accordingly, government spending provides the paid work which eliminates the unemployment created by the taxes.

So it is now possible to see why mass unemployment arises. It is the introduction of State Money (government taxing and spending) into a non-monetary economics that raises the spectre of involuntary unemployment. As a matter of accounting, for aggregate output to be sold, total spending must equal total income (whether actual income generated in production is fully spent or not each period). Involuntary unemployment is idle labour offered for sale with no buyers at current prices (wages).

Unemployment occurs when the private sector, in aggregate, desires to earn the monetary unit of account, but doesn’t desire to spend all it earns, other things equal. As a result, involuntary inventory accumulation among sellers of goods and services translates into decreased output and employment. In this situation, nominal (or real) wage cuts per se do not clear the labour market, unless those cuts somehow eliminate the private sector desire to net save, and thereby increase spending.

The purpose of State Money is for the government to move real resources from private to public domain. It does so by first levying a tax, which creates a notional demand for its currency of issue. To obtain funds needed to pay taxes and net save, non-government agents offer real goods and services for sale in exchange for the needed units of the currency. This includes, of-course, the offer of labour by the unemployed. The obvious conclusion is that unemployment occurs when net government spending is too low to accommodate the need to pay taxes and the desire to net save.

This analysis also sets the limits on government spending. It is clear that government spending has to be sufficient to allow taxes to be paid. In addition, net government spending is required to meet the private desire to save (accumulate net financial assets). From the previous paragraph it is also clear that if the Government doesn’t spend enough to cover taxes and desire to save the manifestation of this deficiency will be unemployment.

Keynesians have used the term demand-deficient unemployment. In our conception, the basis of this deficiency is at all times inadequate net government spending, given the private spending decisions in force at any particular time.

So the answer should now be obvious. If the economy is to fulfill its political mandate it must be able to transfer real productive resources from the private sector to the public sector. Taxation is the vehicle that a sovereign government uses to “free up resources” so that it can use them itself. But taxation has nothing to do with “funding” of the government spending.

To understand how taxes are used to attenuate demand please read this blog – Functional finance and modern monetary theory.

The following blogs may be of further interest to you:

This Post Has 0 Comments