It is true that all big cities have areas of poverty that is visible from…

I would be voting NO in Scotland but with a lot of anger

I am fairly tied up today on the Gold Coast where I presented a Keynote address to an unemployment conference. But I was reading the news on the plane this morning from Melbourne. While in Melbourne for work last week, I stayed over and saw a great movie at the weekend at the Melbourne Film Festival – Human Capital – which I recommend. On the plane this morning I noticed our intrepid Prime Minister has taken to lecturing the Scottish about their political destiny. His exhortations are both hypocritical and reflect a failure to comprehend the options that national sovereignty would provide Scotland, which has a referendum coming up on September 18. But even if they build a bit of national solidarity in Scotland (against the foreigner), the First Minister who is pushing the YES vote is still proposing to enslave the nation to a foreign power – none other than Britain. His currency Plan A amounts to madness and would not underpin a vibrant independent Scotland. As such I would be voting NO at the referendum but feeling bad that the so-called progressive political classes in Scotland were so entranced with neo-liberalism that they forced obvious YES votes to become NO votes.

Tony Abbott (Australia’s PM) has just spent some time with the British PM and appears to be placing himself as a spokesperson for the Conservative voice on the Scottish referendum.

He was quoted in this artcile (August 16, 2014) – Advocates of Scottish independence not friends of freedom and justice: Tony Abbott – as saying:

What the Scots do is a matter for the Scots and not for a moment do I presume to tell Scottish voters which way they should vote. But as a friend of Britain, as an observer from afar, it’s hard to see how the world would be helped by an independent Scotland. I think that the people who would like to see the break-up of the United Kingdom are not the friends of justice, not the friends of freedom, and that the countries that would cheer at the prospect of the break-up with the United Kingdom are not the countries whose company one would like to keep.

Go figure!

The current Scottish First Minister Alex Salmond instructed his spokesperson to tell the press that Mr Abbott had “put his foot in it”. Which seems to be an understatement.

First, for those not familiar with Australian history, is that on January 1, 1901 Australian Federation became operational whereby the former British colonies became states of the Commonwealth of Australia.

While we didn’t become a Republic (and have still not been able to achieve that obvious status), the Federal government did manage to gain the constitutional power on that day to issue the national currency and remove that capacity from the States, which had been using British currency.

It wasn’t until 1910 that Australian coins became the exclusive currency and then we had to wait for several decades while we participated in various gold standard schemes, including the Bretton Woods exchange rate system, until we had the benefits of a fully fiat currency.

After President Nixon abandoned US dollar gold convertibility in August 1971, all nations had the choice of going fiat. The point of taking that step was that the currency-issuing government was no longer financially-constrained in its spending options.

Under the fixed exchange rate system with convertibility into gold, all participating governments had to raise tax revenue or issue debt (that is, take money out of the non-government sector) in order to spend, even though it issued the underlying currency.

The central bank could only issue currency in proportion to the gold stocks it held.

After 1971, with gold convertibility out of the picture, governments could spend as they liked, without recourse to tax revenue or debt issuance. Regular readers will know that this is a familiar theme of this blog.

Would anyone say that by breaking away from our colonial past and forming a separate nation (the Commonwealth of Australia) undermined the freedom of other nations or the citizens of our own nation (notwithstanding the on-going abhorrent treatment of our indigenous citizens)?

Would anyone say that the creation of the Commonwealth of Australia endangered the enforcement or achievement of justice, whatever that means?

Should all our allies have shunned us because we separated from our colonial past to for a new nation?

Hypocrisy has no bounds it seems!

Does anyone believe that if the citizens of Scotland vote to create a separate nation that they will become a haven for anti-freedom, anti-justice, terrorist groups intent on world domination and attacking our freedoms? Only Tony Abbott it seems.

First Dog on the Moon – Tony on Scotland

Here is the promotion for today’s excellent Australian Guardian edition comic from the brilliant – First Dog on the Moon. Click the following image for the full cartoon – it is worth it.

Back to Scotland

The second point goes beyond the eccentric ravings of our Prime Minister (noting how free I am to say what I want in this country).

The Scotsman newspaper – reported – yesterday (August 17, 2014) that the voting is 61 per cent No and 39 per cent Yes.

This came after the debate between the First Minister and the so-called Better Together campaign head Alistair Darling. But the latest polling actually shows that 9 per cent are undecided which means that the No Campaign in Scotland is at 55 per cent to 45 per cent. That is a different picture but the Referendum looks like going down anyway.

The proposal by the Nationalists (supporting Yes) is, however, deeply flawed and centres on poorly constructed plans for the currency arrangements that might follow a Yes vote.

The so-called Plan A proposed by the the Nationalists under Alex Salmond, would see the new country sharing the British pound.

What you say? Why would Scotland want to enter a currency union with the British and use a foreign currency?

Salmond lives a short distance from the biggest failed currency union of all time – the Eurozone. What does he actually think would be the prospects for Scotland using a foreign currency, being forced to take its interest rates from the Bank of England, and being subjected to strict fiscal rules that would choke spending in the economy?

He might want to check out Eurostat data and scroll down to Greece, Portugal, Spain, Italy, or take a ferry to Ireland. That would be the future of Scotland under his preferred Plan A.

Facing critics from all sides of British politics who claimed that the Bank of England would never agree to such a plan, the First Minister was quoted in the UK Guardian article (August 9, 2014) – Scottish independence: Salmond refuses to consider currency Plan B – as saying:

Plan B implies settling for what’s second best. And neither myself, my colleagues in the SNP, or the wider yes campaign will ever settle for second best for Scotland.

Which suggests that just like our own Prime Minister, the Scottish First Minister has ‘put his foot in it’.

The YES campaign has a WWW site, which has the logo – “YES, Scotland’s future in Scotland’s hands” (Source), and then proceeds to advocate that:

The Scottish Government proposes that an independent Scotland will continue to use the pound and enter into a formal currency agreement with the government of the United Kingdom.

In other words, Scotland’s future will not be in its own hands but rather be severely limited by the fiscal and monetary policy decisions taken by the British government, as now.

The YES Campaign says that “based on expert advice”:

Scotland should continue to use the £ as part of a currency union with the rest of the UK … A currency union also means cooperation over other issues including financial supervision and agreed fiscal rules.

As is the case now, the Bank of England (which is publicly owned) would retain responsibility for monetary policy – including interest rates – throughout the currency area, as well as continuing to act as lender of last resort to financial institutions in difficulty.

So no currency sovereignty at all.

The YES Campaign claims that forming a currency union is just a matter of “common sense”

The “expert advice” came from none other than the Scottish Fiscal Commission, which has among its members Joseph Stiglitz, who is currently considered one of the darlings of the progressives. Which just goes to show.

The Commission has released a number of reports to support Plan A.

Its report on – Fiscal Rules and Fiscal Commissions claims at the outset that:

Public sector borrowing is one of the most important and valuable tools of macroeconomic policy open to any independent government.

A fully independent government does not need to borrow. Such borrowing is a left over from the old Bretton Woods system when governments had to fund deficits. A fiat monetary system means the government does not have to borrow any longer. The retention of such borrowing has been used by neo-liberals ever since 1971 to stifle government spending and force austerity onto economies.

It is a redundant tool of macroeconomic policy and should be discontinued. No progressive should argue otherwise.

The Report also runs the Eurozone angle – “harsh lessons of the global financial crisis and economic downturn have highlighted the need for greater fiscal sustainability and resilience, and for fiscal rules that embed these into economic policy making”.

Which is a ridiculous statement. The GFC has taught us that:

1. Monetary policy is largely ineffective as a counter-stabilising stimulatory tool.

2. Fiscal policy is extremely effective at redressing short-falls in private spending and saved millions of jobs when it was expanded. Government stimulus was withdrawn too early and too quickly and the rest is continued stagnation in many nations.

3. The only nations that encountered trouble with their bond markets were those that do not issue their own currency. Any suggestion otherwise is a total lie.

The Commission also recommends that the public sector fiscal balanced be balanced over a fixed period of time, which tells you that they consider fiscal policy to be understood only in terms of the ‘balance’ rather than the function that the net spending is fulfilling.

There is no reason that a fiscal balance should be anything in particular over any particular time period. It should be whatever is necessary to support the non-government spending and saving decisions and ensure there is sufficient spending in the economy to achieve full employment.

If that requires continuous fiscal deficits of 10 per cent of GDP then so be it. It is required permanent surpluses of 10 per cent of GDP then so be it.

For a nation with a very large external surplus (say a large energy exporter) and strong private saving, then a fiscal surplus might be appropriate.

But most nations will have external deficits of varying magnitudes and then if the non-government domestic sector desires to save, the public balance has to be in deficit, or else a recession will ensue.

The only way around that is if the private domestic sector goes on a debt binge and keeps growth going that way. But that growth strategy is ephemeral, as we have seen with the GFC and eventually the private sector stops the credit glut and tries to restore its balance sheet – at that point, fiscal drag kills growth.

So no standalone rule like a ‘balanced budget over a cycle’ makes any sense at all. It all depends on the spending and saving decisions of the non-governent sector and they can change.

The Scottish Fiscal Commission also put out a report on the desirable – Macroeconomic Framework – which says that:

Under independence, the Scottish Government would be responsible for the design and implementation of its own macroeconomic framework.

Yes, it would free Scotland from the decisions made by the UK government – if they also ditch the currency and set up an independent central bank.

So what does the Commission recommend:

– Currency – Sterling

– Central Bank – Bank of England (the ‘BofE’)

– Day-to-day monetary policy discharged independently (operationally) by the BofE.

– Interest rates set to promote price stability across ‘Sterling Zone’

Which they claim would give “Full economic sovereignty with Scottish Parliament” but which in practice would still tie the country to the United Kingdom and thwart any particular spending initiatives that might run counter to the existing fiscal position of the British government.

The Scottish government could not run an independent full employment policy with large-scale public sector job creation, for example, when the UK government was running austerity and it was forced to balance its budget.

There is thus very little to support in the Scottish National Party’s referendum pitch.

I would recommend the Scots vote YES in September. But only if the Referendum was clear that the new nations would introduce its own unpegged, floating currency and avoid any talk of joining the Eurozone or entering a currency union with Britain.

Further, I would only recommend voting YES, if the political parties committed to a clear statement that they would use the newly created currency sovereignty to achieving full employment and abandoned the neo-liberal austerity straitjacket that it is trapped in as a result of being part of Britain.

Under those circumstances,the creation of a separate nation would unambigously improve the welfare of the Scottish people. If they continued to use the British pound and/or maintained the austerity mindset that dominates neo-liberal governments around the advanced world at present, then nothing will be gained that would benefit the Scottish people.

But Plan A is anything but that and so I would vote NO.

While the ‘nationalist’ sentiments that go back in history are an important part of a nation’s defining culture, which are driving the need to be independent of Britain after losing that status in 1707, the currency arrangements define what a government can do and cannot do on behalf of its people.

In general, the statements by the Fiscal Commission about fiscal autonomy and full fiscal responsibilities are fraught with misconceptions given that the Government does not propose full currency sovereignty.

The absence of their own central bank would completely compromise the new government’s capacity to advance public purpose independent of policy settings from Westminster.

If you are wanting more information about that I recommend you read the following blogs – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3

Then you should read these more specific blogs – Fiscal sustainability 101 – Part 1 – Fiscal sustainability 101 – Part 2 – Fiscal sustainability 101 – Part 3.

A sovereign government in a fiat monetary system has specific capacities relating to the conduct of the sovereign currency. It is the only body that can issue this currency. It is a monopoly issuer, which means that the government can never be revenue-constrained in a technical sense (voluntary constraints ignored). This means exactly this – it can spend whenever it wants to and has no imperative to seeks funds to facilitate the spending.

This is in sharp contradistinction with a household (generalising to any non-government entity) which uses the currency of issue. Households have to fund every dollar they spend either by earning income, running down saving, and/or borrowing.

Clearly, a household cannot spend more than its revenue indefinitely because it would imply total asset liquidation then continuously increasing debt. A household cannot sustain permanently increasing debt. So the budget choices facing a household are limited and prevent permanent deficits.

These household dynamics and constraints can never apply intrinsically to a sovereign government in a fiat monetary system.

There is also a sharp distinction between a state within a federal system (which uses the federal currency and has no central banking capacity) and a truly sovereign national government.

A sovereign government does not need to save to spend – in fact, the concept of the currency issuer saving in the currency that it issues is nonsensical.

A sovereign government can sustain deficits indefinitely without destabilising itself or the economy and without establishing conditions which will ultimately undermine the aspiration to achieve public purpose.

Further, the sovereign government is the sole source of net financial assets (created by deficit spending) for the non-government sector. All transactions between agents in the non-government sector net to zero. For every asset created in the non-government sector there is a corresponding liability created $-for-$. No net wealth can be created. It is only through transactions between the government and the non-government sector create (destroy) net financial assets in the non-government sector.

This accounting reality means that if the non-government sector wants to net save overall in the currency of issue then the government has to be in deficit $-for-$. The accumulated wealth in the currency of issue is also the accounting record of the accumulated deficits $-for-$.

So when the government runs a surplus, the non-government sector has to be in deficit. There are distributional possibilities between the foreign and domestic components of the non-government sector but overall that sector’s outcome is the mirror image of the government balance.

If Scotland wants to be truly independent it has to have its own currency.

Then all the issues about what ratings the public debt would get from the bond markets and the rating agencies and all the rest of the nonsense would fade away into irrelevance.

Another leading commentator puts his foot in it!

To show how mixed up people are about currencies, the national Murdoch rag, The Australian wheeled out one of its regular conservative commentators in this morning’s edition. In the article –

Big picture must frame reform – Henry Ergas, who regularly advocates greater deregulation and reduced government spending really put his foot in it.

He opened by asserting:

In Australia’s case, we cannot run large budget deficits forever. At some point, debt accumulation, combined with loss of confidence and external shocks, will force painful adjustments.

First, we do not run large fiscal deficits anyway but could without any negative consequences if they were scaled to the non-government sector spending gap.

Further we ran continuous fiscal deficits for most of our history as I explained in this blog – Fact checking the fact checkers is required in macroeconomic matters.

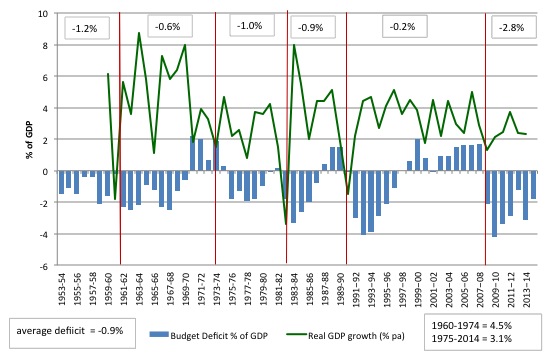

The following graph shows the period since 1953-54 to 2013-14. The columns are the fiscal balance as a % of GDP and the green line is the real GDP growth for the fiscal years. The averages shown in the bottom right-hand corner are for real GDP growth and the split in the sample reflects the switch from Keynesian policy ideals – using fiscal policy to generate full employment (prior to mid-1970s) and the Monetarist-Neo-liberal period that followed where deficits became a symbol of lax government.

The growth rate fell in the second period by almost 50 per cent and, of-course, unemployment rose from its average of below 2 per cent to much higher numbers (averaging 6.9 per cent since 1974). Fiscal deficits were higher on average in the earlier period but that mostly reflected discretionary choices aimed at nation-building.

The red lines roughly depict distinct phases of economic growth (note roughly) and the numerical annotations for each of these periods is the average fiscal deficit as a per cent of GDP for the period.

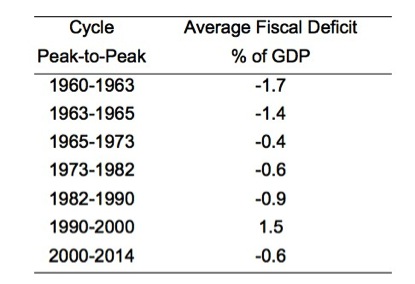

It is hard to align the fiscal years with economic cycles in real GDP growth, given that the peaks and troughs of the latter occur in quarters and the fiscal data is for fiscal years. But a close approximation is shown in the following Table that I constructed.

The periods reflect peak to peak (that is, one entire real GDP cycle). The data suggests that there is no tendency to ‘balance the budget’ over these cycles.

The norm is for deficits to persist over the entire cycle except for the one cycle noted above where the average was a fiscal surplus – but then during that period, households enslaved themselves with a massive debt build-up and they are enduring the consequences of that now as housing prices become more subdued and casual hours of work for the secondary bread-winner to supplement repayments become more difficult to get.

Henry Ergas then really put his foot in it, saying:

Last week’s news from Europe shows just how painful those adjustments can be. After modest signs of recovery, the eurozone has slipped back into zero growth, with even Germany, its powerhouse economy, sliding into negative territory. While the European Central Bank is ramping up its interventions, monetary policy has proven more effective in preventing collapse than in reigniting expansion. With government after government reaching the limits of indebtedness, the eurozone seems set for a lost decade.

Nor is there any doubt who is paying the price. Recently released OECD data shows that poverty has increased most in the countries where the fiscal crisis has been most severe. On even the narrowest definition of the poverty line, the proportion in poverty has more than doubled since 2007 in Ireland and Greece, while nearly doubling in Spain. And even countries with well-developed safety nets, such as The Netherlands, have struggled to maintain their effectiveness as slower growth and fiscal constraints bite. To make matters worse, stagnation is fuelling neo-populist movements, such as France’s Front National, whose opposition to economic reform will entrench Europe’s difficulties.

Note, he is writing about Australia here. In the previous two (quoted) paragraphs is there a single currency-issuing nation mentioned.

Answer: No. All the nations that are in crisis use a foreign currency (the euro) and have signed up to nonsensical fiscal rules (the Stability and Growth Pact).

The fact that monetary policy has had little stimulatory effect is hardly surprising – why would it if fiscal policy austerity is deliberately creating millions without work and destroying the investment climate. Why would anyone want to borrow under these circumstances?

The fact that he think monetary policy should have done something (implicit in his ‘surprise’) is testament to the skewed neo-liberal thinking that says fiscal policy is largely ineffective and monetary policy is the principle counter-stabilisation tool.

It never was and never will be. That is just neo-liberal Groupthink mantra! Wrong as usual.

There is only a ‘fiscal crisis’ in nations that surrendered their currency sovereignty. There is no such crisis in any other nation irrespective of the level of public debt.

Why doesn’t Henry Ergas cite Japan? The reason is that it would be too inconvenient because it blows the mainstream claims out of the water – highest public debt ratios, high deficits for two decades, zero interest rates, and deflation! Everything that the mainstream economics textbooks tell us shouldn’t happen.

Everytime the government in Japan tries to impose austerity, the economy goes into recession.

Of-course, countries that impose harsh fiscal austerity will force poverty rates up. Who would be surprised by that? Austerity kills jobs and unemployment is the principle cause of poverty.

The ultimate cause though is that these nations surrendered their currency sovereignty. The analysis therefore is totally inapplicable to Australia which retains that sovereignty.

Ergas either doesn’t understand that or is deliberately misleading his readers. Either way his message should be disregarded.

The so-called fiscal “day of reckoning” for Australia that Ergas proclaims is approaching is just neo-liberal claptrap – ignore it.

Conclusion

The problem for the Scottish people is that their so-called progressive political party, which is pushing the YES vote are all closet neo-liberals and probably don’t even understand the reasons I say that, which is part of the problem.

They think that by falling into line with the Washington Consensus which is now the Brussels-Frankfurt consensus as well and supporting a currency union with Britain with tight fiscal rules that they are appearing to be fiscally responsible and the bond markets will like them.

The reality is that their grand plans for independence would grind to a halt because they would be using a foreign currency and the bond markets would know that. Greece all over again.

The only fiscally responsible position is to base independence on the creation of its own separate sovereign currency. Then the Scottish Government could achieve its goals to enhance the common good and it could avoid the nonsensical fiscal austerity that has captured the British government.

Running a nation of 5 million odd people with limited resource diversification would not be easy. But I suspect the people would be better off overall with true independence.

However, if they keep the British pound, then independence will achieve little – other than soothe the nationalist desires.

I would be voting NO under the current proposals and feeling a heavy heart in doing so.

That is enough for today!

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

Bil –

Can you quantify the benefits of financial sovereignty? At what point does it exceed the cost of the impediment to trade?

I have to reluctantly agree although some ‘YES’ proponents argue that this is simply a referendum about the principal of Scottish independence and that the currency question could be resolved later but, given such a short timetable for transition, if the result is a ‘YES’ vote I don’t see how that argument can be taken seriously.

The SNP has handled this, once in a lifetime, opportunity extraordinarily badly.

Bill,

I understand that Salmond’s orginal plan was to join the Euro but subsequent events forced the SNP rethink. The only hope for the Scots in the event of a Yes vote is that poltical bickering forces a Scottish pound to emerge. My expressing this view is met with hostility by SNP supporters on Uk websites!

well the scots are not having a vote on austerity mores the pity

yes the snp position on a currency union is madness.

but the uk rump are very unlikely to grant such a union anyway

so a yes vote would inevitably sooner or later lead to a more progressive electorate

with an independent currency .

Impossible as it sounds that could still lead to an out of the fire pan into the fire scenario

with a nationalist government choosing an even more disastrous monetary union in the euro

Whatever the poll result scottish people are unlikely to escape the neoliberal paradigm.

But consistently the scottish electorate have instinctively rejected it implicitly .

The legacy of thatcher north of the border was a complete wipeout of tory mps

With all its flaws the yes vote still looks for a government serving the public purpose

The no campaign the voice of fear .I do not envy their vote.

But where can an electorate find a poll which relates to monetary reality?

I advised a friend north of the border to vote yes with a nose peg to cover the stench

hope springs eternal and all that

Dear Bill,

After 1971, with gold convertibility out of the picture, governments could spend as they liked, with recourse to tax revenue or debt issuance.

Shouldn’t that be “without recourse to…”?

I think if you were here you would still vote Yes, as this independence-lite offers at least the possibility of sovereignty in the future. Can you really see the UK establishment getting into MMT? Their rhetoric has long been the opposite and Labour has resorted to a me-too approach.The Scottish Government has been (cynically) triangulating to win over undecided voters fearful of change- so we keep NATO, The Queen, and a currency union with the UK. Yes are really promising baby steps. The logic is for an independent currency but this has clearly not played well with the focus groups and there is zero chance of a fair hearing with a relentlessly negative media. Many in the Yes campaign are biting their lips in the hope of persuading the cautious- the people can decide in the long run, which certainly won’t happen in the event of a No vote- billions of cuts are already promised by the UK up to 2019.

Bill, the YES campaign has to convince an electorate that is continuously pummeled with Unionist fear propaganda to take a chance on a hopefully better future. Nobody on either side (publicly) knows anything about MMT. This is not the time to try and convince the economically brainwashed that they are deluded about Sound Finance. Bad politics.

I have hopes that a new Scottish government will ditch the UK pound in a few years time and go for the truly independent solution you suggest. That government may even be formed by a new Scottish Labour Party, freed from Westminster, that is actually left-wing. Why not?

The mistake almost everyone makes is they think independence is an instantaneous event that you have an independence day and you get everything that you’re going to get on that day & never get any more. Actually independence is normally a long term process. In Ireland those who belived it was a single event & those who belived it was a process failed to agree and had a civil war, Michael Collins on the process side famously said “In my opinion it gives us freedom, not the ultimate freedom that all nations desire and develop to, but the freedom to achieve it” – Dáil Éireann – Volume 3 – 19 December, 1921 DEBATE ON TREATY

The Green party who are the second biggest party in the Yes campaign want a separate currency after a short transitional period. The Scottish governments Fiscal Commission Working Group produced a report with a number of alternative currency options including a separate currency but picked a specific currency union proposal they devised as the best option (http://www.scotland.gov.uk/Resource/0041/00414366.pdf). Alex Salmonds refusal to explain the alternatives are probably due to political rather than economic beliefs. The SNP, one suspects, are largely driven by the idea that in order to turn the polls they need to choose the least scary options & currency change makes people scared. Personally I don’t doubt that an independent Scotland will end up with a separate currency, the only question is when. One of things I have against the SNP currency proposal, apart from the fact that I don’t think the UK would accept it even if its politicians weren’t playing silly games, is that it looks it might be quite difficult to dis-establish when the time comes.

The Irish currency experience was that initially it simply continued to use the pound without any formal currency union. A 1927 Currency Act created a new currency the Saorstát Pound but pegged it to Sterling. This was achieved by a currency union in which the Republic lodged assets equal to every pound printed with the Bank of England. In return the Bank of England guaranteed that Irish banknotes would be honoured at par in sterling without fee, margin or commission. The financial restrictions of this system are blamed by some for the failure of the Irish economy to develop in that period, the Celtic tiger didn’t really emerge till the arrangement ended. Ireland didn’t create its own central bank until 1943 whilst continuing with the currency peg. The sterling link was finally broken in 1979, ostensibly to enable Ireland to join the EMS, though actually the peg to Sterling had already come under question as no longer being fit for purpose in the early 70’s, the primary argument being that Ireland was being inflicted with UK inflation.

https://www.centralbank.ie/paycurr/notescoin/history/Documents/spring8.pdf

Dear Brian (at 2014/08/18 at 19:39)

I guess that is why I am not a politician! But the consequences of voting YES and keeping the sterling and central bank rule from Britain would be a worsening economy, which would then be blamed on the baby steps and undermine any feasible chance of getting full sovereignty.

And then when the next crisis comes, Scotland becomes Greece.

At least now they can blame Westminster.

best wishes

bill

“The Scottish Government proposes that an independent Scotland will continue to use the pound”. Pointless. Vote NO.

Dear Bill

As Brian said, more people would NO if the Nationalists were to announce that an independent Scotland would have its own currency. Another fear is that Scotland may not be able to join the EU. Spain has already announced that it will try to block Scottish entry into the EU.

Scotland seems to be like Quebec. In the Quebec referendum, a lot of the NO voters didn’t oppose separation out of love for Canada but out of the fear that independence would have negative economic consequences. Similarly, many Scots will vote NO because they fear an economic deterioration and not because they love Britain.

In my opinion, Scotsmen are simply Englishmen who wear a kilt now and then. The fact that most Scots still don’t feel British despite having been united with the English for more than 3 centuries, speaking the same language as the English and being culturally very similar to the English attests to the persistence of national consciousness. If national consciousness were based sole on objective factors, the Scots and English would long ago have started to feel British. Although I’m all in favor of nationalism, I have no sympathy for the Scottish nationalists because they are essentially backward-looking. The Scots aren’t a nation but a clan.

Regards. James

The Scots will destroy their economy if they retain the sterling and if they stay in the union. This is because their tax revenues are majorly dependent on oil and gas revenues. These have been buttressed by rising oil prices in the past few years but it seems unlikely that this will continue. Eventually the revenues will start to fall and Westminster will impose austerity and trash the economy. I did a report on this for the Levy Institute which I gave to Salmond’s top economic adviser. My impression was that they didn’t want to hear anything about this at all because they had invested all their political capital in maintaining the sterling. The report is available here:

http://www.levyinstitute.org/pubs/ppb_134.pdf

A big loser of Scottish independence would the British Labor Party. About 90% of Scottish seats are held by Laborites. Since Scotland has about 10% of the seats in the Lower House, the Labor Party would have a smaller chance of gaining a majority. Let’s look at the following situation.

…………Scottish seats…other seats

Labor……………9…………….43

Conservatives…1…………….47

In this scenario, the Laborites have a majority of 52%. Without Scotland, they would have a minority of 47.7%.

Aidan ~

Perhaps you could explain how having a floating currency could “exceed the cost of the impediment to trade”? In fact, should you like an example of how NOT having a floating currency could exceed the cost of the impediment to trade, you need only glance across the Channel at Portugal, Italy, Greece, and Spain.

The referendum ballot asks:

Should Scotland be an independent country?

There is no commitment there to any particular system.

If you gain independence, you have the freedom to change your policies

I’ll be voting yes, because I think it should be. Like it or not,Mr schipper, while it is not monolithic,there is a different culture north of Hadrian’s wall.

The delicious irony of the sterile, negative unionists is that, if they stuck to their guns, it would force an independent currency.

Alex Salmond has been extremely I’ll advised by his chief economists, who nixed the idea of a ‘groat’ some time ago, and the fearful framing of his strategic advisers.

However,the idea is not dead yet.

Benedict@Large

I’m well aware of examples of the cost of currency sharing exceeding the cost of the impediment to trade. I think everyone who reads Bill’s blog is aware of that now, along with many who don’t.

But consider Luxembourg: a much smaller country, so a much greater prortion of cross border transactions. And every time someone buys or sells something in a different currency, the bank takes its cut. So I’d argue that Luxembourg’s much better off in the Eurozone than out. So how big or closed does an economy have to be before having its own currency is of net benefit? I don’t know (which is why I asked) but it obviously depends on what the conditions of remaining in the currency union are.

If Scotland did create its own currency, is there any truth to what this eminent professor from Glasgow University says ? i.e. in respect of building up foreign reserves:

top-economist-currency-union-would-collapse

Did Australia need years of austerity in February 1966, when the dollar was introduced?

Of course not, but that doesn’t tell us anything – firstly because Australia wasn’t going it alone, rather we were just replacing an old currency with a new one, and secondly because Australia already had plenty of reserves.

Launching a completely new currency when the budget is very unbalanced is generally a bad idea, as it’s likely to result in people factoring the effects of devaluation into their expectations. But if a new currency is launched when the budget is balanced or in surplus (or even with just a small deficit) there is no need to build up foreign reserves.

Steve,

“Can you really see the UK establishment getting into MMT?”

No more so than the Scottish establishment. If Scotland votes for independence the new Government would probably use the Pound, at least initially. For the reasons explained by Bill it would turn out badly.

Then the EU would pressure the new Scottish government to switching to the Euro, and could even make it a condition of continued membership. As it wouldn’t be going too well with the £, the feeling in an independent Scotland would probably be that switching to the Euro might improve matters. No doubt, the EU would offer a little carrot to encourage that way of thinking.

But, for reasons explained by Bill, that wouldn’t turn out to be the case. Scotland would be in exactly the same position as Ireland, which only has a lower unemployment rate than Greece due to the high level of emigration from the country.

I’m holding my nose and voting yes, because I feel like the opportunity to gain independence and escape the woefully corrupt influence of Westminster will probably never present itself again in my lifetime, whereas the possibility of instituting a new currency will persist in an independent Scotland. I’m also unsure just to what extent the proposal to keep Sterling is a political move to reassure voters, and how open the Scottish government is to full sovereignty.