I started my undergraduate studies in economics in the late 1970s after starting out as…

Fact checking the fact checkers is required in macroeconomic matters

There is a lot of misinformation spread in the media about the fiscal history of Australia and elsewhere. The Australian Broadcasting Commission, for example, has now a “Fact Check” facility where it checks statements made by politicians against the facts. It should apply it to some of its own stories and subject more journalists (including its own) to the scrutiny it imposes on the pollies.

The ABC Radio National service runs a “Rear Vision” segment which “puts contemporary events in their historical context, answering the question, ‘How did it come to this?'”. I have been a contributor to those radio shows in the past.

In the aftermath to the May Fiscal Statement by the Commonwealth Treasurer, Rear Vision ran a segment (May 12, 2014) – A history of Australian budget surpluses and deficits, which examined the history of “debt, deficits and spending blow-outs” (noting the emotional terminology in their lead-in).

What exactly is a spending blow-out? The article that accompanied the radio segment certainly didn’t offer any wisdom, and just left it as a throwaway statement, which obviously biases the listener from the start.

Their first so-called ‘expert’ was an American associate professor who has written about the “welcome change from the usual rhetoric” when referring to the US Republican Paul Ryan’s ‘Path to Prosperity’ plan, which was all about the “dangers of inaction on a budget that is spiraling out of control and proposes serious reforms to Medicare and Medicaid, two entitlement programs that are draining government coffers”. (Source).

In other words, he doesn’t understand very much at all about macroeconomics and the options facing a currency-issuing government. Ryan’s plan was one of the more ridiculous and emotional responses to the current situation in the US. Three or more years later his predictions have fallen by the wayside as all these deficit terrorist prognostications of doom have (and will).

Anyway, using this sort of ‘expertise’ is bound to set the tone for the rest of the segment. He claimed on the ABC program that if a government was running a deficit “then to pay its bills the government has to take on debt”. Which is not an accurate statement for most governments that issue their own currency.

He would have more accurately said “under current institutional arrangements, which have unnecessarily declared it taboo for the central bank to directly credit treasury bank accounts to facilitate government spending” … then his statement.

To merely assert as if TINA that government deficits have to be matched by debt issuance is distorting truth in favour of the current ideologically-preferred arrangement.

The same commentator claimed that:

The notion of balanced budgets is tied to the idea that we want to have a society in which we are not implicitly taxing the future to pay for our consumption today … That is, in essence, what deficit spending and government debt does; we are pushing the bill out until later but enjoying the benefits of the government spending today.

Which again is very misleading. For example, even within conventional (mainstream economic) logic this statement is wrong.

There is a well-known notion in the literature called the ‘golden rule’, which limits fiscal deficits to the rate of public investment in productive capital. The ‘golden rule’ essentially means that over some defined economic cycle (from the peak of activity to the next peak) the government should only run a deficit to cover its expenditure of capital (infrastructure).

It should fund all ‘recurrent’ spending (that is, spending which exhausts its benefits in the current year) through current revenue (taxes and fines, etc.).

The ‘golden rule’ reflects the erroneous mainstream economics view that governments have to ‘fund’ their spending just like a household but incorporates a notion of intergenerational efficiency and equity.

Even within that flawed framework, the ‘golden rule’ is considered equitable across generations because the current taxpayers ‘pay’ for the public benefits they receive now, while the future generations have to pay for the benefits that the infrastructure delivers to them benefits in the years to come.

Thus, day-to-day spending that benefits the current taxpaying public should be covered by taxation revenue and capital infrastructure should be funded through debt. The fiscal balance would thus always be zero net of public investment spending.

That is a very different statement to the one the ABC allowed to parade as insightful analysis in its program.

He was also allowed to get away with this statement without further questioning:

But the notion is that we should have on average balanced budgets, that if we engage in deficit spending in one year we should have surpluses in another year, so that on average we are not taking on a significant amount of government debt, because ultimately government debt can cause significant problems for an economy by limiting investment and potentially strangling economic growth.

Even in his own nation there is no evidence to support this claim. The US has run deficits (averaging per cent of GDP) in 71 of the 84 years since 1930 or 85 per cent of the time (data from US Office of Management and Budget.

On the few occasions that the US government has run surplus fiscal positions, the real economy has plunged into recession soon after.

The average deficit to GDP ratio over that long period is 3.2 per cent. If we take out the World War II years (1942-1945) where the deficits were very large (above 20 per cent of GDP) then the average deficit has been 2.2. per cent.

Further, if we examine US private investment growth from National Accounts (I will write a separate blog about this), there is no evidence that it is inhibited by cyclically-adjusted deficits. One always has to take out the cycle from the fiscal position given that larger-than-normal deficits are always associated with poor economic times via the automatic stabilisers.

So you will get correlations showing that rising deficits are associated with slow/negative growth but of-course the causality is flowing from the growth performance to the shift in the deficit in that case, not the other way around.

The second ‘expert’ was an Australian macroeconomist, who works in the private sector as a consultant. He also fell foul of the data despite “having a look” at it.

The commentator said:

I was having a look at that 42-odd years of complete history on budgets … and in those 42 years, roughly half of those years we’ve had a surplus, roughly half we’ve had a deficit and when we compare ourselves to many of the G7 countries, our fiscal position is outstanding. I don’t think there is any other way to describe it.

Hmm.

First, the 42 years of data he is referring to is that provided by the Australian Treasury in Statement 10: Historical Australian Government Data – that accompanies the Budget Paper No 1.

That data goes back to the fiscal year 1971-72. Even if we limit ourselves to that time period we find that there were deficits in 25 of those years – that is, 57 per cent of the time. So if that is “roughly” then ok.

But the RBA publish – historical data than can take us back a further 17 years to 1952-53. In that earlier period 1952-53 to 1971-72, the federal government never ran a surplus. Real GDP growth was also strongest during this period.

If we consider the whole sample then, the government ran deficits 69 per cent of the time, which is significantly higher than the “roughly half” estimate that the ABC allowed to be imprinted in the minds of its listeners.

There is other data going back before the RBA set which shows deficits are overwhelmingly the outcome. The correct statement then is that surpluses are actually a rarity and a 50/50 split (rough or otherwise) is a gross distortion of our fiscal history.

Second, the period includes the 10 from 11 years (1996 to 2007) when the conservative government ran increasing surpluses. But the only reason they were able to do that without causing recession was because the household sector accumulated record levels of debt. That sector is now drowning in debt, the housing market is one of the most expensive in the world, which has locked out the children of the debt holders from participating in homeownership.

Moreover, the period of negative household saving is now over and the households are saving around 10 per cent of disposable income with the consequence that credit and consumption growth is back to more typical proportions.

That period of fiscal surpluses is thus aytpical as is the negative household saving that accompanied it. If we take that aytpical period out of the sample then we see deficits 73 per cent of the time and each time there were surpluses (early 1970s and late 1980s) a major downturn followed.

If we consider the whole sample then Australia is similar to the US – the Federal government ran deficits in 82 per cent of the years since 1953-54.

That is a much more reasonable depiction of our fiscal history. There is other data going back before the RBA set which shows deficits are the norm not the exception.

Third, the average deficit over that period is not zero but 0.7 per cent of GDP and for the whole period since 1953-54 to 2013-14 the average deficit is just under 1 per cent of GDP. So it is more accurate to say that, on average, the Australian government runs a deficit.

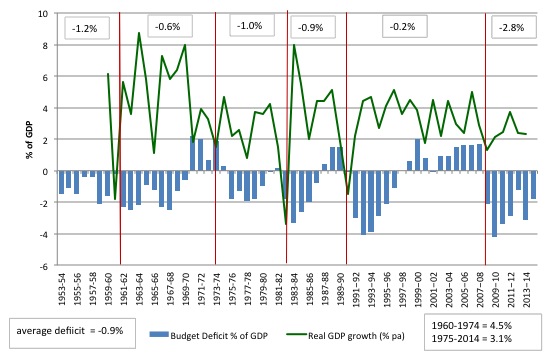

Fourth, the following graph shows the period since 1953-54 to 2013-14. The columns are the fiscal balance as a % of GDP and the green line is the real GDP growth for the fiscal years. The averages shown in the bottom right-hand corner are for real GDP growth and the split in the sample reflects the switch from Keynesian policy ideals – using fiscal policy to generate full employment (prior to mid-1970s) and the Monetarist-Neo-liberal period that followed where deficits became a symbol of lax government.

The growth rate fell in the second period by almost 50 per cent and, of-course, unemployment rose from its average of below 2 per cent to much higher numbers (averaging 6.9 per cent since 1974). Fiscal deficits were higher on average in the earlier period but that mostly reflected discretionary choices aimed at nation-building.

The red lines roughly depict distinct phases of economic growth (note roughly) and the numerical annotations for each of these periods is the average fiscal deficit as a per cent of GDP for the period.

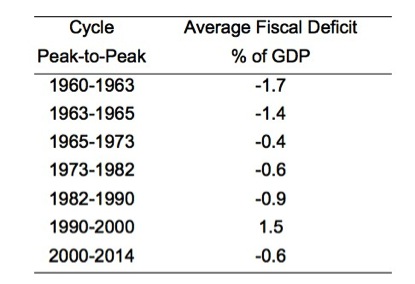

It is hard to align the fiscal years with economic cycles in real GDP growth, given that the peaks and troughs of the latter occur in quarters and the fiscal data is for fiscal years. But a close approximation is shown in the following Table I constructed.

The periods reflect peak to peak (that is, one entire real GDP cycle). The data suggests that there is no tendency to ‘balance the budget’ over these cycles. The norm is for deficits to persist over the entire cycle except for the one cycle noted above where the average was a fiscal surplus – but then during that period, households enslaved themselves with a massive debt build-up and they are enduring the consequences of that now as housing prices become more subdued and casual hours of work for the secondary bread-winner to supplement repayments become more difficult to get.

All of which made me recall an article in the Sydney Morning Herald from July 20, 2013 by its senior economics editor Ross Gittins – The budget facts that Canberra isn’t telling you.

Ross Gittins likes to adopt a sort of down-home style to convince the reader that he is genuine and is telling it straight. Unlike the politicians he regularly lambasts for lying.

Often his articles are interesting and point to issues that are being left unsaid in the public debate. For example, his article this week on how the Australian government is making us a laughing stock in terms of its climate change policy was reasonable – Australia risks becoming a fuel fossil.

What is going on with climate change policy in this nation is unbelievable relative to developments elsewhere. Readers who missed the Four Corners program – Power to the People – which screened on July 8, 2014 should catch up with it on-line.

There was a fabulous quote in the program from the Mayor of Lancaster, California R. Rex Parris who is a hard-line American republican and has led the way for his city to become nearly 100 per cent reliant on renewable energy. He told the New York Times (April 8, 2013) – With Help From Nature, a Town Aims to Be a Solar Capital – that:

I may be a Republican. I’m not an idiot.

Australian conservatives take a leaf!

But I digrees. Lying can take a number of forms and while Gittins is wont to accuse the pollies of “peddling nonsense” he is not averse to peddling his own neo-liberal versions of nonsense when it comes to discussing macroeconomics.

In that article he claimed that fiscal matters needed “a lot of unpacking for non-economists”, which is correct given how ideologically distorted the discussion is in the public arena, as we saw from the ABC program above.

Gittins then, by way of unpacking the truth for the public, said:

Because budget balance … needs to be achieved only on average over a period of, say, a decade, it’s saying there’s nothing inevitably bad about deficits or inevitably good about surpluses.

So there’ll be times when deficits are appropriate and times when surpluses are. Which is which? Deficits are appropriate when the economy is growing well below its medium-term ‘trend’ rate of about 3 per cent a year; surpluses are appropriate when the economy is growing near, at or above trend. Stick to that approach and, in the end, the deficits and surpluses will cancel each other out, leaving no lasting debt burden to be borne by our ‘children and grandchildren’.

See the drift – back to this balanced budget over the cycle nonsense as if it was an accurate depiction of historical reality.

Other things to note here:

First, the trend rate of growth is not a goal that government should seek to replicate unless it is coincident with full employment. An economy could go through a major recession and then experience a much lower trend rate of growth for the next decade but still carry high rates of labour underutilisation.

Referring back to the previous graph – the Australian economy was growing at 4.5 per cent per annum on average until the neo-liberals started to attack public sector activity. The 3 per cent trend since the mid 1970s also is associated, as we noted with a 4 or more percentage point rise in unemployment and a much larger rise in underemployment.

So trend growth is not a policy goal in its own right.

Second, the fiscal balance is uniquely related within the National Accounts with the other two sectoral balances – the private domestic balance and the external balance. Please read my blog – Question 3 answer – for more discussion on this point.

We know that the three balances:

Private domestic saving minus private investment must equal the Fiscal deficit and Net Exports.

If a nation is running an on-going external deficit (as in the case of Australia) then if the government balances its fiscal position over a cycle then the private domestic sector will be spending more than it earns over the same cycle repeatedly and its deficit will equal the external deficit.

At present the external deficit is around 4 per cent of GDP on average. So a ‘balanced fiscal strategy’ will leave the private domestic sector in deficit (dissaving overall) by 4 per cent of GDP on average.

That also will mean it is increasingly accumulating debt of that amount on average, year-in, year-out.

The GFC taught us that the private domestic sector cannot continually be increasing its debt. At some point, balance sheets become too precarious and changes in circumstances (such as rising unemployment) can provoke a major financial meltdown as the debt is dishonoured.

It is thus not a viable long-term strategy for a nation to require its private domestic sector to be permanently increasing its debt burden.

The typical case has been that balance sheet expansion for the private sector is finite and there will be periods when it has to spend less than it earns.

In that case, fiscal deficits are required to ensure that growth is sustained. There is no sense in the Gittins context that sometimes deficits are good and sometimes surpluses are good. The better statement is that usually deficits are required and it will only be in unique cases where the external sector is very strong, that the government can run surpluses and not compromise growth.

I won’t comment on the ridiculous claim about debt burdens for our future generations. That is pure fiction.

Gittins makes another statement that does warrant comment. He is talking about the operation of the automatic stabilisers:

So provided the government of the day doesn’t make changes of its own volition that work in the opposite direction to the stabilisers, they can be relied on to leave the budget balance just where it ought to be as the economy moves through the business cycle.

The automatic stabilisers clearly attenuate the swings in the economic cycle by allowing deficits to rise when private spending is weak and to fall when private spending rises again.

But to suggest that the swings in the fiscal position are always appropriate as long as the government leaves the automatic stabilisers to work without interference is not an accurate statement.

Of-course, in saying that I am thinking different to Gittins. I only ever consider the fiscal balance in relation to the desired state of the economy.

If there is high unemployment and underemployment at the start of a given cycle, which means the previous growth phase was not strong enough to absorb the pool of unemployed and underemployed, then the non-cyclical component of the fiscal balance was clearly too contractionary.

So even if the deficit rises as private spending falls in the downturn, the automatic stabilisers will still deliver a deficient deficit.

Conclusion

There are very few ‘correct’ statements made in the media about fiscal policy. There are many statements that just reflect pure ignorance.

Other statements reflect the ideological restrictions that neo-liberal Groupthink imposes on the commentator whether it be explicit (lying outright) or implicit (a sort of ignorance).

Claims that deficits have to be funded by debt issuance are factually wrong, for example. But the person who makes those claims might know they are lying because they don’t want to de-link the deficits from debt for political reasons. Alternatively, the person might have just not understood all the options.

Lying is lying though!

That is enough for today!

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

The nonsense that is out in the public domain in Australia is astounding and it doesn’t just apply to economics. The media is not entirely to blame as,in most cases, they are simply reporting what is written and said by various people in politics,academia etc.

Of course,the herding factor is always present across the whole spectrum.

This is a very important article, Bill. Have been reading your “Why history matters” and related documents and trying to understand the impact of preventing direct crediting of Treasury accounts. This artificial constraint on Government spending needs to be understood more widely. Also the 87% of deficits would have to raise question in any sane person. Sorry you have to work so hard to make us see what should be obvious.

Bill –

I think you need to fact check that! Here’s an alternative version that I think is closer to the mark:

The GFC taught us that the private domestic sector can not constantly be increasing its debt. Cyclical factors mean that government intervention is sometimes required.

It is thus not a viable long term strategy, and currently not a viable short term strategy in most cases, for a nation to require its private domestic sector to be continuously increasing its debt burden.

We’re perhaps a bit hard on Gittins. The “fantasy” of a government debt burden is only a fantasy if the government can be persuaded to spend without borrowing. I’m a bit more cynical than to accept this as a pure misunderstanding. Governments issuing bonds to “finance” deficits strikes me as a feudal measure, designed to keep public influence in check.

I’m very glad you patiently reiterate these things for us Bill, but neoliberalism is as malicious as it is catastrophic. Unless a significant portion of the political class is educated on the distinction between government deficit and debt, that debt fantasy looks a very real instrument of future austerity.

The “fantasy” of a government debt burden is only a fantasy if the government can be persuaded to spend without borrowing.

We all here at billyblog understand that the government isn’t really borrowing to spend, that it’s a monetary operation to control the cash rate.

But it’s the nucleus of the whole deficit and debt myth and I would’ve thought Gittins, who’s so progressive in many other ways, and easily the best of a bad bunch, would’ve got it by now.

When reason doesn’t work perhaps it’s time for ridicule.