I started my undergraduate studies in economics in the late 1970s after starting out as…

Full employment is still low unemployment and zero underemployment

You won’t see much debate or coverage of the desirability of making full employment the central goal of economic policy these days. The politicians, infested with neo-liberalism, do not admit they have abandoned full employment as a policy goal. Instead, they lie and wheel out various flawed analyses that try to make out that full employment now occurs at much higher rates of labour underutilisation in the past. Norway tells us that that proposition is a lie. In Australia, the government still tries to suggest that a state where more than 14 per cent of available labour is idle in one way or another represents close to full employment and a justification for fiscal austerity. We believe them because we have been seduced by the lies and our educational systems have downplayed critical scrutiny. But until we cut through the swathe of lies and misinformation we won’t get back to the bountiful state of full employment where not only workers enjoy higher incomes but dignity becomes a priority. Whatever else the liars say, full employment is still a state of very low unemployment and zero underemployment.

In the latest IMF – Concluding Statement of the 2013 Article IV Mission to The United States of America – which is the regular assessment that the IMF makes of member-state economies, the IMF continues to walk the tightrope between its bad austerity persona and its increasingly, pro-stimulus stance.

It clearly blames fiscal deficit reduction attempts both within the US and abroad (“a weak external environment”) for the “tepid growth” in the US over the last year.

In modelling likely political developments in the US it notes that its is assuming the:

… the general government deficit will decline by over 2½ percent, subtracting between 1¼-1¾ percentage points from growth in 2013 … On the fiscal front, the deficit reduction in 2013 has been excessively rapid and ill-designed. In particular, the automatic spending cuts (“sequester”) not only exert a heavy toll on growth in the short term, but the indiscriminate reductions in education, science, and infrastructure spending could also reduce medium-term potential growth.

That sort of narrative was also levelled at the UK recently and so we conclude the IMF is now making the case that it denied for so long – that there can be a fiscal contraction expansion – under present circumstances.

But, from an educational perspective, I thought the following statement was of interest. In cataloging the role of monetary policy at present, the IMF said that:

The prolonged low-interest rate environment could sow the seeds of future financial vulnerabilities as investors and financial institutions aggressively search for yield-despite the increased regulatory and supervisory focus on financial stability risks.

Just wait for the financial press reaction when treasury bond yields, which are currently very low, start to rise because the investment bankers start diversifying in search of higher yields (and higher risk).

We will be flooded with claims that the cost of government spending has risen (it will not have!) and the road to government insolvency is fast reaching its end (the road is infinite – that is, not defined).

On myths that persist, I thought the UK Guardian article (June 12, 2013) – The politics of full employment are the progressive answer to austerity – was interesting.

Regular readers will know that I have devoted my academic career to researching, in a variety of ways, the concept of full employment.

I currently define a full employment state in Australia as being satisfied if:

1. The official unemployment rate is between 2 and 3 per cent, leaning towards the lower edge of the band. So remaining unemployment is of a frictional nature – moving between jobs.

2. There is zero underemployment – that is, no part-time workers signals they desire more hours of work.

3. There is zero hidden unemployment – that is, participation rates are at their peak.

We can debate the qualitative aspects of that quantitative definition, which bears on the quality of jobs defined under Criterion 1 and the lack of skills-based underemployment under Criterion 2.

I think that is an important debate and aspiration. Regular readers will note that I consider “loose” full employment, which is defined as a market-determined outcome supplemented with a Job Guarantee, is the minimum state that a nation should tolerate.

This state does not necessarily eliminate skills-based underemployment (especially during a serious downturn. The extent to which this type of economy (with a Job Guarantee buffer stock) eliminates skills-based underemployment will thus depend on the state of the economic cycle.

At periods of high pressure, there will be very little skills-based underemployment but at other times there will be more. The introduction of a Job Guarantee provides an incentive to employers to upgrade the quality of their job offerings anyway to make sure they can profitably function above the Job Guarantee wage, which would become the wage floor.

Clearly, loose full employment is the minimum state. The currency-issuing government should use its fiscal policy capacity to ensure that it pilots the labour market to achieve high quality employment within the inflation constraint. A high-wage, high productivity economy will provide better jobs (both within the public and private sectors) than a nation that feeds at the bottom of the productivity and wage levels.

That is the context in which I read the UK Guardian article.

The writer, Gavin Kelly considers that the notion of full employment should not be seen as the natural preserve of the Labour party in the UK (or elsewhere) and that the notion of:

Full employment is not fantasy economics, but debate is squashed by economic complacency and fatalism …

The UK Guardian article delves into history and reminds us that in the UK the same circumstances that are apparent now (untrusted Labour leadership, insecure Conservative backbenchers sensing electoral defeat, “a recession-wearied public agitated about welfare bills and a stubbornly high deficit, and a welfare secretary seeking to focus public debate on the alleged failings of claimants” were operating 20 years ago

in Britain.

Gavin Kelly says that:

These familiar circumstances confronted the last mid-term Conservative chancellor two decades ago. Ken Clarke’s response – to the surprise of many – was to remake the argument for full employment and a strong welfare state as key pillars of a properly functioning market economy. How times change.

The point is that while it is “in Labour’s genes to believe this issue is its own”, previous Conservative politicians have “insisted that Tory manifestos be committed to maintaining full employment as the ‘first aim of a Conservative government'”

The reason no one talks about full employment now is according to the Guardian article due to “the troubling mix of economic complacency and fatalism that dominates much of today’s economic discourse”.

Apparently, Brits are complacent because “the UK jobs market has performed better than many predicted with unemployment rising less than expected given the fall in output”.

Really? At least the article notes the “2.5 million unemployed and 3 million under-employed” and points out that when politicians (all over the world” make statements such as they have overseen a “record numbers of jobs” created they also fail to emphasise the increase in the “adult population” over the same period.

Of-course the labour market is bigger in most nations now – but good performance is about ensuring employment growth absorbs the population growth – that is, the employment-population ratio does not fall.

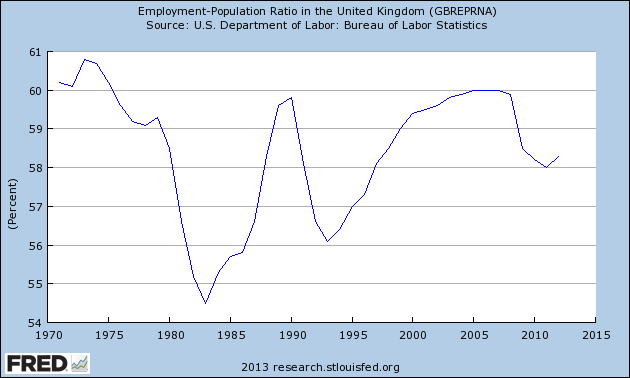

In Britain the employment-population ratio has plunged since the 1970s, when the nation last enjoyed full employment.

Here is a graph produced by the – St Louis Fred Data showing the British employment to population ratio since the early 1970s.

It is fair to say that the nation never really recovered from the Thatcher assault on full employment.

The Guardian article also notes that eliminating large employment gaps not only helps the unemployed gain work but also helps improve the fortunes of those currently employed:

… those with jobs desperately need it too. In the post collective-bargaining era, a tight jobs market – where employers chase applicants as much as the other way around – is the best wages policy available to low and middle earners.

Which makes you wonder why the neo-liberals have been able to divide and conquer the workers into two broad groups – the robust workers and the lazy unemployed.

How have they done that? – Ignorance fuelled by misinformation. See below.

The Guardian claim that there is a “fatalistic mindset” in Britain based on the belief:

… that the UK is afflicted with such intractable problems that to cast ahead to the possibility of full employment is to indulge in fantasy economics.

That is, neo-liberalism is TINA. Margaret Thatcher lives on.

Inasmuch people perceive TINA, the problem is a lack of political leadership and an unquestioning willingness of lazy politicians to accept the flawed mainstream economics doctrines.

The Guardian does acknowledge that the “the policy environment is shifting”.

The IMF introduction is evidence of that. The doomsayers are running out of credibility even among those that might have believed their lies five years ago and never bothered to, for example, think of what has been going down in Japan for 20 years or more.

We are seeing that “only the economically paranoid would discern inflationary risk emerging from our labour market any time soon” and that interest rates are not going through the roof despite the on-going deficits.

I would put the “complacency/fatalism” in different words. There is a systematic conspiracy among the elites to prevent governments from pursuing full employment. The elites comprising the captains of industry and the establishment politicians who feed off the largesse provided through the lobbyists working from the captains hate full employment.

Why? Because it shares the real income around more equitably and shifts the balance of power back to the majority.

So their approach is two-fold:

First, they lie by suggesting that they all love full employment but that the level of labour slack which now defines full employment has risen – due to this and that.

Please read my blog – The dreaded NAIRU is still about! – for more discussion on this point.

Second, they drown the populace in a swathe of mis-information to reinforce the lie. So all the austerity myths:

- The government has run out of money.

- Deficits will drive up interest rates.

- Deficits will cause hyperinflation.

- Deficits will rack up unsustainable debts on our grandchildren.

- Bond markets will punish governments who run continuous deficits.

- Deficits undermine growth because the private sector thwarts their intent by increasing saving to pay for higher implied taxes in the future.

- Direct job creation creates unreal jobs that are worthless.

- A Job Guarantee would undermine the capacity of private employers to attract labour and drive down productivity.

- ETC, the list goes on.

We are continually being drawn towards conclusions that unemployment is not really a problem because people choose to remain jobless. The culprit is singled as the income support system which subsidises those choices. Or depending on the day of the week, the other culprit is excessive real wages. Or then, on another day, it might be hiring and firing protections. ETC.

That if the labour market was deregulated and the income support system abandoned then we would quickly eliminate unemployment. Put people on the margin of starvation and they will work out of desperation.

We see that approach in the poorest nations where families scavenge through rubbish and sewerage heaps for the barest scraps of food. That is what desperation and a lack of jobs ends up leading to.

And meanwhile, there is mass (preventable) disease and high rates of infant mortality. The market working at its best.

The Guardian article says that “(g)etting back on the path towards full employment” will require a major shift in policy – and are:

… likely to involve an expansionary macro-policy tempered by measures that puncture potential asset bubbles; a revamped childcare system that makes it worthwhile for both parents to work; and tax reform that makes hiring labour more attractive and sitting on cash piles less so.

It will require an abandonment of the neo-liberal mindset – a return to collectivism and a fundamental shift in the balance of power towards workers again.

Cutting through all that cant and misinformation, the concept of full employment is simple – create enough jobs and working hours to satisfy the preferences of the available labour force.

That might put some upward pressure on wages – so the “captains of industry” who have been waxing fat on the massive redistribution of real income to profits under the neo-liberal era will have to be told that things have changed. That workers are going to, once again, enjoy their share of productivity growth.

That is the first return to normality that is required. The neo-liberal period, which has systematically suppressed the capacity of workers to gain real wages growth in line with labour productivity growth, was atypical and unsustainable. That has to change.

It might lead to higher imports and cause the exchange rate to depreciate a little, which means that elites will pay more for their imported luxury cars than they do right now and face more expensive ski trips to the Alps. Tut tut! What a shame that would be.

It might lead to private employers having to restructure their workplaces to ensure they can produce at higher levels of productivity to meet the wages that would be required to attract labour out of the Job Guarantee pool in times of expanding investment. That would be a national disgrace, no!

Think about Norway. From its – Labour Force Survey – we note that it currently has an unemployment rate of 3.7 per cent and largely resisted the great recession.

For example, juxtapose all the austerity rhetoric that we read these days in British government narratives (Budget Papers, OBR documents etc) with this commentary that appeared in the recent Norwegian Statistics publication (April 30, 2013) – Economic Survey 1/2013 – (Chapter on Cyclical developments in Norway 1-2013).

This is an English version of the quarterly business cycle report from Statistics Norway. “It includes an analysis of recent trends in the Norwegian economy and a forecast two-three years ahead”.

Box 5 on Page 20-21 analyses “The importance of immigration for the functioning of the Norwegian economy”. The analysis estimates the economic benefits that arise:

… where investments in public administration increase equivalent to 1 per cent of the mainland GDP each year.

The analysis is based on “two versions of Statistics Norway›s macro-econometric model, KVARTS”. The first assumes that immigration is inversely affected by the level of unemployment while the second assumes that immigration is invariant to the “changes in the Norwegian economy”.

The overall modelling concludes that:

Higher public investments lead to an increase in demand for labour regardless. The pressure on the labour market therefore increases and unemployment falls. Higher employment and wages lead to an increase in demand from households, and the higher level of domestic activity also contributes to an increase in industry investments. From the second year onwards, mainland GDP increases by more than the initial impulse

This is very realistic modelling – it has strong public expenditure multipliers which crowd-in private economic activity.

The IMF models, recall, that were used to justify the austerity programs assumed exactly the opposite. At least the IMF now have admitted they were wrong on this.

I will leave it to you to read the results of the simulations, which are all credible.

The point is that this sort of analysis is eschewed in the rubbish that the OBR and its likes produce to support the austerity machine.

The difference we can see easily – Norway is much closer to full employment than nearly anywhere else.

Please read my blogs – Norway … colder than us but … and Norway and sectoral balances – for more discussion on this point.

Conclusion

And need I add my appalled vote to those who would dismantle the Greek government forthwith for their decision (presumably supported by the EC and the IMF) to close its public broadcasting services down.

What goes on in the mind of these maniacs – they are not even subtle about their attempts to purge democracy – of which, information is an essential aspect. The problem is that Stalin and Hitler and others who are less obvious than these tyrants and who live in the West, didn’t have the Internet to deal with.

We know more things now, more quickly and more of us learn of things than in the past.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

As MMTers (me included) are always pointing out, the deficit and debt are not obstacles to raising demand and employment: the real obstacle is inflation. So while offering all the unemployed a JG jobs is obviously theoretically possible, a substantial rise in the number of REGULAR jobs (i.e. non JG jobs) raises the possibility of excess inflation.

Given that inflation in the UK has been above the 2% target for several years, it’s reasonable to be concerned about inflation. So I suggest advocates of the “let’s have full employment” idea should concentrate on explaining why a significant rise in demand won’t be inflationary.

On a separate point, Bill repeats the popular idea (Item No 1 above) that “moving between jobs” is an explanation for some sort of irreducible minimum level of unemployment. Bill cites “between 2 and 3 per cent”. I’d question that on the grounds that the majority of those changing jobs go straight from one job to another without any intervening unemployment – see paper by J.P.Mattila in the American Economic Review “Job Quitting and Frictional Unemployment” (1974).

I.e. the unemployed are by definition “between jobs”. But that doesn’t prove that the need to change jobs is a CAUSE of unemployment. Someone could write a 10,000 word paper on that!

“So I suggest advocates of the “let’s have full employment” idea should concentrate on explaining why a significant rise in demand won’t be inflationary.”

Because there is a ton of excess capacity in the economy, and inflation is an obsession by those who are more interested in numbers than the welfare of real people. Inflation has little impact on anything up to really quite large numbers – as long as it is stable. This obsession with 2% is a neo-classical construct designed to protect those who lend at fixed interest – who are really the only people who lose out under any level of inflation.

The way you set up the change is to introduce a Job Guarantee, and you state clearly that you expect that it will cover itself via the expansion in output of the economy *and if it doesn’t it will be extracted via taxation and levies from the spending power of the wealthy to force the necessary shift in production focus.*.

Do that and I practically guarantee it will pay for itself in real terms.

Dear Ralph

Inflation is a serious problem to a minority of the population, namely those who own lots of financial assets, cash, bonds and other credits. Their assets can’t appreciate in line with inflation. Of course, it is possible to have indexed loans, that is loans in which the principal is adjusted upward in accordance with the inflation rate.

Another problem with inflation is that it makes part or all of capital gains illusory. Suppose that you bought an asset in 2000 for 10,000. Last month you sold it for 25,000. If inflation during that period had been 50%, then your real capital gain is 10,000, not 15,000. I’m in favor of full taxation of capital gains, but of real gains, not spurious gains which are only compensation for inflation.

Regards. James

Neil,

Just saying “there is a ton of excess capacity” won’t convince many economists. It’s blindingly obvious that there excess capacity in the sense that unemployment is by definition a form of excess capacity. But that’s just a circular argument.

It would be better to cite some actual evidence. One bit of evidence is a study by NIESR which showed that there are currently significantly more people doing part time work and who want to do full time work than is normal. See:

http://niesr.ac.uk/blog/underemployment-uk#.Ub7s65y0R9C

To that extent, the unemployment figures underestimate the amount of excess capacity (that’s the good news). The possible bad news is that given a rise in demand, the extra work might get done largely by those part timers switching to full time, leaving the unemployed out in the cold.

Anyway, that NIESR study is the sort of evidence that Bill needs to cite I think. Another bit of evidence (which has occurred to me, but not to anyone else far as I know), is that UK wage earners have been getting pay increases of about 2% a year for no good reason: i.e. productivity increases have been zero or even negative. That suggests to me that Keynes understated his point when he said that “wages are sticky downwards”. He should have said that “wages move irrevocably and slowly upwards even given excess unemployment”.

So possibly the 2+% inflation we have is largely down to that “wages moving upward phenomenon” and has nothing to do with excess demand or labour shortgages. For that reason, an increase in demand might not raise inflation by much.

James,

Unlike Austrians, I’m quite happy with a modest amount of inflation: as you imply, it’s a tax on people who can’t think of anything to do with their money except stuff it in a bank and leave it there.

But it’s difficult to know where to draw the line. Personally I’d stop further increases in demand when inflation reaches 5%.

“is that UK wage earners have been getting pay increases of about 2% a year for no good reason: i.e. productivity increases have been zero or even negative”

That’s because you haven’t understood the productivity statistics and what they are saying.

Lack of effective demand reduces the amount of output, but not employment levels. In a modern lean staffing structure you still need Fred whether you’re using 40% of Fred or 90% of Fred. And in the majority of British businesses (ie small ones) the bosses actually like their staff and will move heaven and earth to keep them going.

Lack of demand distorts the productivity numbers. Everybody is working just as hard and effectively as before – likely more so. There just aren’t the orders to use up the machinery.

“The coalition believes that the rich must be made richer to encourage them to work and the poor must be made poorer to encourage them to work. In the meantime, the economy stagnates, the prospects of growth retreat before our very eyes and the pain of fiscal consolidation intensifies.” (Lord Eatwell – Labour

And yet, I do believe I heard Canadian Prime Minister Stephen Harper still praising the merits of continued austerity for Europe in his address to the UK parliament last week! No pain no gain and all that.

… that the UK is afflicted with such intractable problems that to cast ahead to the possibility of full employment is to indulge in fantasy economics.

Full employment of the available workforce is the solution to deep social and economic problems. It’s not just some kind of added side-benefit that flows from their solution by other means.

The fact that private enterprise fails to generate full employment when there are so many unsolved problems and daunting challenges facing the globe, all of them calling for an application of human work effort, is manifest evidence of the inefficiency of the private enterprise system as the sole means of organizing and allocating human labor. The vast inequalities in the distribution of the product of that labor are a further mark of the irrationality and indecency that come from an over-reliance of private enterprise.

It would be good to see the Guardian Australia pick up this discussion in view of our refusal to address NewStart poverty and recent related treatment of single parents.

One “Jacob Kirkgaard” could be about to join the unemployed I fear.

This chap is/was a Senior Fellow with the Peterson Institute (!)

He’s just reinforced the IMF’s statement about the US deficit reduction programme, describing it as “reckless and dumb”, along with some harsh criticism of the Republicans.

http://www.aljazeera.com/news/americas/2013/06/201361514211826626.html

Dan, Given that about 40% of GDP in European countries is taken by public sector, why do you blame “private enterprise” for unemployment? Put another way, there has been a VAST INCREASE in the proportion of GDP allocated to the public sector over the last 150 years or so, with no corresponding drop in unemployment.

In fact that’s something for JG advocates to think about. Public sector JG jobs are supposed to reduce unemployment. But why has the above mentioned VAST INCREASE in public sector jobs, had no effect on unemployment? That’s a nice question to test people’s grasp of the theory behind JG. I know the answer. Anyone else like to give an answer?

“I know the answer”

You don’t.

Ralph knows the answer?! I excite! Oh, you havent given it.. And when you do someone will point out why you have misunderstood, as Neil W did with your last point, and you will ignore it.

Seriously though its good that you are here, so that rather than some of us getting too deep into surface issues we are reminded that there are still so many who fail to grasp some of the major, deeper issues.

On your point about the last 150 years ya-da-ya-da. Really? You are comparing the full employment of a 15 hour a day agricultural economy with slaves and almost no machinery to today? Please at least raise a point that can be debated a little more seriously.

@Ralph, “Put another way, there has been a VAST INCREASE in the proportion of GDP allocated to the public sector over the last 150 years or so, with no corresponding drop in unemployment.”

You are aware of the Euro project in Europe I take it, Ralph. Clearly the implication of this is that public spending must be paid for via taxation (or borrowing) from the private sector, especially considering Euro treaty rules, but also under the prior ESM and Bretton Woods periods. It all comes back to an imposed budget deficit constraint, even if that is a real part of the financial system (a gold standard), mandated by treaty or to avoid currency devaluations.

If the government taxes the private sector, in order to set-up its own public sector employment this shrinks the private sector contribution to GDP and enlarges the public sector contribution to GDP, but unless there is a substantial difference in the product quality (I am thinking of modern necessities like Tulip bulbs in this case!) there is no net contribution to GDP (it’s a transfer). This explains why Europe has high unemployment regardless of differences in the composition of their GDP (exactly according to MMT).

Also note any suggestion of a JG in Europe (as far as I have seen) has had the ECB pay for it, so MMT economists are well aware of the importance of this…