Yesterday, the Reserve Bank of Australia finally lowered interest rates some months after it became…

No joy for Australia’s low paid workers

The Fair Work Commission, the Federal body entrusted with the task of determining Australia’s minimum wage handed down its – 2012-13 decision – today. The news was not good for more than 1.5 million workers (out of some 11.6 million) who are reliant on award wages in Australia (that is, low-paid workers). These workers are typically found in the retail sector, personal care services, hospitality, cleaning services and unskilled labouring. They already earn a pittance and endure poor working conditions. The FWC gave the lowest paid workers an extra $15.80 per week (a rise of just over 2.6 per cent), which will at best maintain the current real minimum wage but denies this cohort access to the fairly robust national productivity growth that has occurred over the last two years. The decision also widens the gap between the low paid workers and other wage and salary recipients. The real story though is that today’s minimum wage outcome is another casualty of the fiscal austerity that the Federal Government has imposed on the nation which is destroying jobs and impacting disproportionately on low-paid workers. The FWC cited rising unemployment as a reason for its mean pay rise.

I was at Melbourne airport the other day and a worker who regularly provides a low-skill service to me (I won’t mention the service) and is always friendly and helpful said he was stressed because as a result of traffic hold-ups on the freeway out to the airport he was 1 minute late clocking on to his shift. He had been served a “first and last warning notice” as a result, meaning if he late again he loses his job. As a result he was getting up at 2.00 am to start at 5.00 (with a 35 minute standard journey to work) instead of 3.30 am, just to make sure he was not late because he has a mortgage and three kids. I asked him how often had he been late and he said that was the first time. Now, he leaves homean hour earlier than usual and sits in the freezing cold car park for hours just to make sure he is not late and loses sleep in the process. That is the fate of low paid workers facing capricious management. His experience is not exceptional.

Today’s Decision

In its decision, the FWC said:

The most award-reliant sectors of the economy continued to have a mixed experience over the past year. Most have had a fall in hours worked and in employment, although rises in profitability and output have been stronger. The Retail trade industry in particular has improved both sales and profitability, while wages growth and employment in this sector has been below the average for all industries.

In other words, the firms have been taking advantage of the low paid workers to increase their profitability.

The FWC made this overall assessment of the state of the economy (which is more optimistic than my own assessment):

In summary, the economic outlook remains favourable, notwithstanding some easing of growth and an increase in unemployment forecast in 2013-14.

The rising unemployment has nothing at all to do with excessive wages growth (relative to productivity growth). The implication of the FWC’s decision is that by cutting the real wage of the lowest paid workers the capacity to pay of the firms will improve and employment will be higher than otherwise.

The rising unemployment is the direct result of the pro-cyclical fiscal policy that the Government has imposed over the last few years in its obsessive (and failed) pursuit of a budget surplus this year.

This has damaged aggregate demand and caused sales volumes to moderate. Firms will not employ new workers if they cannot sell the extra output produced no matter how cheap the labour is. All they will do is pocket the lower unit labour costs as higher profits.

The minimum wage outcome is another casualty of the fiscal austerity that the Federal Government has imposed on the nation which is destroying jobs and impacting disproportionately on low-paid workers.

As usual there were disparate claims made by unions, social service organisations and employers. The unions wanted a rise of $30 per week which would have, at least kept real minimum wages growing by around 80 per cent of the current productivity growth rate. So by fair standards the union submission was hardly over-the-top. It also doesn’t take into account that the minimum wage adjustment does not compensate for the real wage losses incurred in between the adjustment cycles.

The large employers declared they would tolerate $12.00 per week increase while the Australian Chamber of Commerce and Industry wanted only $5.80 per week – in both cases they were demanding a significant real wage cut for the bottom end of the labour market.

The ABC news report – Fair Work Commission recommends $15.80 per week rise in minimum wage – quoted the CEO of the Australian Chamber of Commerce as saying the decision was a “body blow for the small end of town” (small business):

That is $1.5 billion of increased wages that have to be funded by Australia’s small and medium business community … Job security will be affected, but … [businesses] … will also seek to try to reduce working hours in order to maintain employment but also have a containable labour cost structure. That’s not ideal for the business, it’s not ideal for customers, it’s not ideal for the workers themselves.

The fact is that this organisation had argued that no more than $5.80 per week increase (0.95 per cent) – a real wage cut of at least 1.6 or 1.7 per cent.

Groups like this never consider a wage rise that maintains the real wage or, dare I say it, increases it is acceptable. They have the bizarre quandary then of suggesting that all productivity growth should always be captured by the firms and none shared with workers.

And, it is not as if the employers in Australia have demonstrated over time that they are capable of high levels of innovation. They are typically quite lazy with respect to innovation and training and skill development.

Minimum wage principles

I regularly write analytical reports for trade unions who are defending industrial matters on behalf of the members in the various wage setting tribunals in Australia. That often requires me to appear as an expert witness in the relevant matter.

The most recent hearing was a fortnight ago in Melbourne at the Fair Work Commission, where I appeared on behalf of the union, United Voice who were defending an employer request to eliminate penalty rates for restaurant workers. These are pay rates that apply for working non-standard hours (weekends, late nights etc).

The workers affected are at the bottom of the pay structure and many of them are on minimum wages. The hearing is on-going.

The counsel for the employers adopted the usual tactic of trying to discredit me personally as a means of making my evidence irrelevant – bully-boy tactics.

At one stage, he introduced to the hearing a blog I had written on June 6, 2011 about the June 2011 minimum wage decision brought down on that day by the FWC – Low pay workers dudded again in Australia.

Feigning outrage before the relevant FWC Commissioner, the counsel emphasised the title “low paid workers dudded again in Australia”.

He then said something like “you didn’t agree with the FWC decisions on minimum wages, do you?”. To which I replied that I was of the firm professional view that the minimum wage was too low in Australia and that the institutional machinery that sets it has been mistaken in not increasing it by more in the past.

He then quoted from the blog by saying:

In terms of minimum wage setting my view is simple. I would not have a “capacity to pay” guideline in the set of principles upon which the minimum wage is set. I would ignore cyclical patterns when considering what the level of the minimum wage should be.

He then said something like “that is your view isn’t it?” To which I replied: yes, it is my view.

Advocate: So you don’t think capacity to pay matters and firms that cannot pay the minimum wage “are not suitable to operate in the economy”.

Bill: That is my view.

This was of-course incredulous to him and much huffing and puffing followed as if the view was alien. The aim was to discredit the evidence of-course. These wage setting tribunals are all theatre.

I explained further that I see the minimum wage as a statement of how sophisticated you consider your nation to be or aspire to be. Minimum wages define the lowest standard of wage income that you want to tolerate.

In any country it should be the lowest wage you consider acceptable for business to operate at. Capacity to pay considerations then have to be conditioned by these social objectives.

If small businesses or any businesses for that matter consider they do not have the “capacity to pay” that wage, then a sophisticated society will say that these businesses are not suitable to operate in their economy.

Such firms would have to restructure by investment to raise their productivity levels sufficient to have the capacity to pay or disappear.

This approach establishes a dynamic efficiency whereby the economy is continually pushing productivity growth forward and in tat context material standards of living rise.

I consider that no worker should be paid below what is considered the lowest tolerable standard of living just because low wage-low productivity operator wants to produce in a country.

This view bears on the concept of values. The evidence from the employer’s economist suggested that wages and conditions in the Restaurant industry and the economy in general should be totally deregulated – his report was full of stuff like “let the market work” and then we will see what the workers are worth etc.

The problem is that the so-called “market” in its pure conceptual form is a value-free. It is amoral, ahistorical and cannot project the societal values that bind communities and peoples to higher order considerations.

The minimum wage is a values-based concept and should not be determined by a market. What goes for the “market” should adjust to the social values of collective aspiration.

All of that is in addition to the usual disclaimers that the pure “competitive market” cannot exist for labour given the imbalances between workers and employers and the fact that the use value of the labour power is derived within the transaction (that is, the worker has to be forced to work). This is unlike other exchanges where the parties make the deal and go their separate ways to enjoy the fruits of their trade.

Staggered wage decisions and real wages

An annual adjustment cycle without indexation means that minimum wage workers have to endure systematic cuts in their real wages more than they would if the adjustments were indexed through the year after an annual review decision.

With inflation being a continuous process (more or less), the annual adjustments by the Fair Work Commission hand employers huge gains and deprive the workers of real income. The following discussion and diagram explain why.

Assume that at the time of policy implementation, the real Federal Minimum Wage (FMW) wage was wi and there was no inflation. The wage setting authority (in this case Fair Work Australia) manipulates a nominal minimum wage (the $ weekly value) and the real wage equivalent of this nominal wage is found by dividing the nominal wage by the inflation rate. Assume that inflation assumes a positive constant rate at Point 0 onwards.

The nominal wage is the $-value of your weekly wage whereas the real wage equivalent is the quantity of real goods and services that you can purchase with that nominal wage. For a given nominal wage, if prices rise then the real wage equivalent falls because goods and services are becoming more expensive.

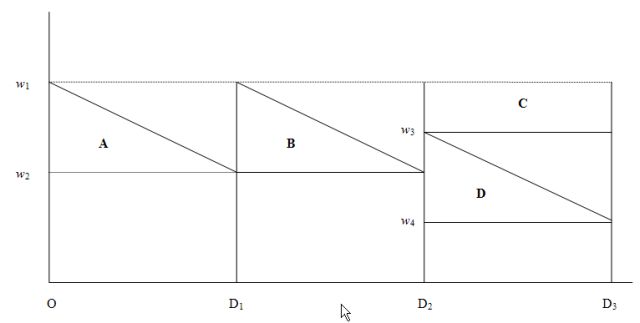

The following diagram depicts the real income losses that arise when indexation is not continuous, that is, when the AFPC makes, say, an annual adjustment in the FMW (you may want to click it to get it in a new window so you can print it while you follow the description):

Over the period O-D1 the inflation rate continuously erodes the real value of the nominal wage and immediately before the next indexation decision, the real wage equivalent of the fixed nominal FMW is w2. The real income loss is computed as the area A, which is half the distance (0-D1) times distance (w1-w2).

At point D1 the wage setting authority increases the nominal wage to match the current inflation rate which restores the real wage to w1, but the workers do not recoup the deadweight real income losses equivalent to area A.

The same process occurs in the period between the D1 and the next decision D2, resulting in further real income losses equivalent to area B. These losses are cumulative and are greater: (a) the higher is the inflation rate; (b) the longer is the period between decisions; and (c) the higher is the real interest rate (reflecting the opportunity cost over time).

Clearly, the patterns of real income loss are different if the wage setting authority adopts a decision rule other than full indexation (that is, real wage maintenance). For example, say it decides not to adjust nominal wages fully at the time of its decision (or in fact at the implementation date of its decision) to the current inflation rate then the real income losses increase, other things equal.

So at time D1 the authority decides to discount the real wage (less than full indexation) and increases the nominal wage rate such that the real wage at that point is equal to w3.

Over the next period to D3, the real wage falls to w4 and at the time of the next decision (implementation time D3) the real income losses would be equal to the triangle D (reflecting the inflation effect over the period D2- D3, plus the rectangle C, which reflects the losses arising from the decision to partially index at D2.

Similarly, one can imagine that the adjustment at a particular time might involve a real wage increase (more than full compensation for the current inflation rate) which would then partially offset some of the real income loss borne in the previous period when nominal wages were unadjusted but inflation was positive.

So if you understand the saw tooth pattern of indexation shown here you will see that the triangles A and B represent real losses for the workers between wage setting points even if real wage maintenance is the preferred policy.

These losses are worse (areas C and D) if there is only partial adjustment. These losses occur because inflation is a more continuous process than the adjustments in FMW and accrue to the employer. The employers are pocketing these wage losses every day because their revenue is geared to the price rises and they are paying constant nominal wages to the workers.

Wage Parity

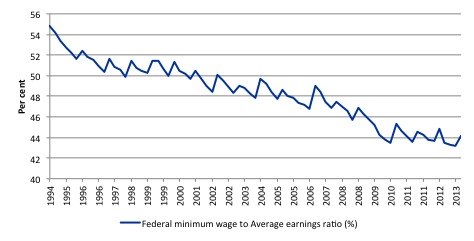

In terms of parities with other wage earners, the following graph shows the ratio of the Federal minimum wage to the Full Time Adult Ordinary time earnings series provided by the ABS (the latest being for the December-quarter 2012). This series in now bi-annual (previously quarterly). I have interpolated on the basis of the most recent growth (2.9 per cent – a slight real wage increase).

I simulated this series out to September-quarter 2013 (the quarter in which the latest FWC Annual Wage decision will start impacting – the minimum wage is adjusted on July 1 each year) based on a constant growth in earnings (assessed over the last 12 months). The new FWC applies from July 1, 2011 so will be constant over the rest of the 2013-14 financial year.

The logic of the neo-liberal period which encompasses the data sample shown (and then some) was to cut at the bottom of the labour market.

Todays, decision by the FWC continues that trend and forces workers at the bottom of the wage distribution to fall further behind in relative terms.

In 1993, minimum wage workers earned around 55 per cent of the Full Time Adult Ordinary time earnings. By June 2013, this ratio will have fallen to 44 per cent. There has been a serious erosion of parity over the last 18 years.

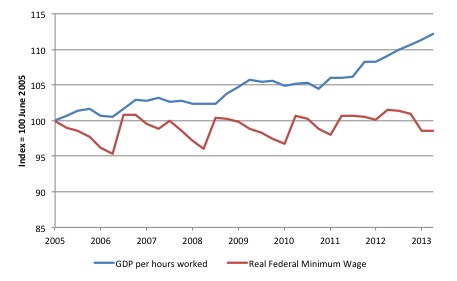

Another way of looking at this dismal outcome is to compare the movement in the federal minimum wage with growth in GDP per hour worked (which is taken from the National Accounts). GDP per hour worked is a measure of labour productivity and tells us about the contribution by workers to production.

Labour productivity growth provides the scope for non-inflationary real wages growth and historically workers have been able to enjoy rising material standards of living because the wage tribunals have awarded growth in nominal wages in proportion with labour productivity growth.

That relationship has been severely disrupted by the neo-liberal attacks on unions, wage fixing tribunals and other legislative initiatives that have eroded the capacity of workers to share in labour productivity growth.

The widening gap between wages growth and labour productivity growth has been a world trend (especially in Anglo countries) and I document the consequences of it in this blog – The origins of the economic crisis.

But the attack on living standards has been accentuated at the bottom end of the labour market. The following graph shows the evolution of the real Federal Minimum Wage (red line) and GDP per hour worked (blue line) since June 2005 up until June 2013 (indexed at 100 in June 2005).

By June 2013, the respective index numbers were 112 (GDP per hour worked) and 98.6 (real FMW).

Staggered adjustments in the real world

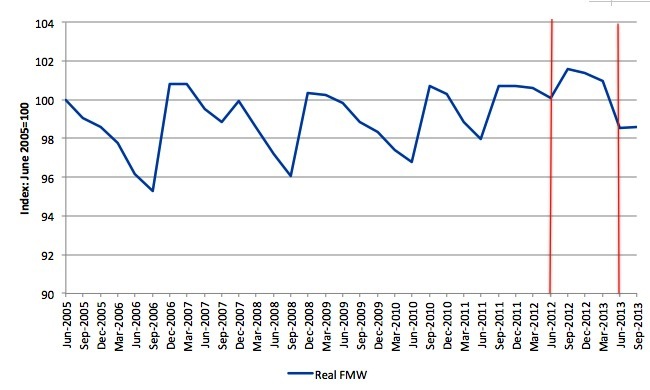

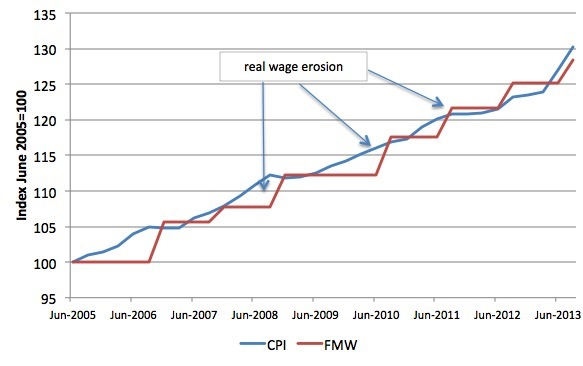

The following graph shows the evolution of the real Federal Minimum Wage (FMW) since July 2005 extrapolated out to September 2013 (the quarter in which today’s decision will start impacting) based on a constant (current) inflation rate. You can see the saw-tooth pattern that the theoretical discussion above describes.

Each period that curve heads downwards the real value of the FMW is being eroded. Each of the peaks represents a formal wage decision by the wage setting tribunal (now the Fair Work Commission).

When the workers get the pay rise on July 1, 2013 their real wage equivalent of the nominal FMW will be significantly reduced on its level one year ago (the drop between the two vertical red lines). Compared to five years ago, the real wage is now much lower (around 1.5 per cent) than its 2005 level.

So while each adjustment provides some real wage gain for workers the duration between the wage determination decisions means that their purchasing power is being cut significantly – these are permanent losses.

The next graph shows the erosion of the real wage more clearly. The blue line is the inflation index and the red line the nominal Federal Minimum Wage index (June 2005=100). The saw-tooth gaps between the red and blue lines indicate permanent real wage losses although in the penultimate decision there was an attempt to increase the real wage (but well below productivity growth).

You can see than in past decisions, the FMW has caught up with the CPI whereas in the current decision that will not prove to be the case unless there is a significant slowdown in inflation in the third-quarter (some slowing will occur but not much).

As an aside, the CPI is also a very limited measure of the cost of living. In May 2011, the ABS published their – Analytical Living Cost Indexes for Selected Australian Household Types – which provided more detailed analysis of the impact of price rises on different household and worker cohorts.

Those on low pay are likely to be significantly worse off than the raw CPI figures suggest.

Minimum wages and employment

For a discussion of this topic please see the blog – Low pay workers dudded again in Australia.

Conclusion

While the $15.80 per week increase is welcome it will still result in real wage maintenance at best and excludes the lowest paid workers from sharing in the national productivity growth that has been fairly robust in the last year.

It is also insufficient to restore the relativities at the bottom of the labour market which have been eroded over recent years.

In that regard, today’s decision does not redress the significant erosion of real purchasing power that low-paid workers have suffered over the last decade.

I would also note that a sophisticated society requires a decent minimum wage that is determined on the basis of what we want the floor in living standards to be. In the absence of regulation it is almost certain that the “market” would drive the wage below that level.

In such cases, the employment is not desirable and so a Job Guarantee could set the minimum alternative employment that the private employers then have to better. They need to invest and ensure productivity can support the higher wage level. Its called a win-win.

It is clear that the FWC has bought the line that with unemployment rising at present and forecast to rise significantly over the next 12 months as the government continues to impose fiscal austerity onto the economy, its wage rise decision had to be moderate at best.

The deprivation of the low paid workers is directly the fault of the Federal government’s mismanagement of fiscal policy. If growth had have been higher, then it is likely the FWC would have awarded a higher minimum wage increase.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Is it just me or is propensity to consume never considered in these cases?

Higher wages enable faster deleveraging which allows for consumption sooner rather than later – which allows the economy to get going which in turn lowers unemployment and gives business and government both more revenue.

And given the lower end of the wage spectrum are likely to spend most of their income, if not all of it and more because they have to just to survive.

Given that, if min wage levels kept up with productivity as you often highlight that it hasn’t, I wonder how much it would be today if it did?

Hi Bill,

“That is the fate of low paid workers facing capricious management. His experience is not exceptional.”

* More should be done to shame these kinds of regimes. Who runs the airport? Is it AIF? The Future Fund is buying this – not the kind of publicity it wants, I’m sure.

“In 1993, minimum wage workers earned around 55 per cent of the Full Time Adult Ordinary time earnings. By June 2013, this ratio will have fallen to 44 per cent. There has been a serious erosion of parity over the last 18 years.”

* To what extent has this phenomenon contributed to the lower headline unemployment rate over that period? Is it possible to calculate?

Also, if the true cost of living for low income households fell, would you stomach an unchanged min. wage (increased real wage)?

Cheers!

“In such cases, the employment is not desirable and so a Job Guarantee could set the minimum alternative employment that the private employers then have to better. They need to invest and ensure productivity can support the higher wage level.”

Is that one of the reasons why allowing private employers to use Job Guarantee labour or to provide working subsidies via Tax Credits, etc is a mistake?

It undermines the efficiency drive to replace workers with machinery and better processes.

Stellar analysis as usual :). I found this post particularly insightful; I had never considered that the saw-tooth nature of the staggered adjustment cycle undermines real minimum income for that period.

Bill, please write an article for the new Guardian Australia’s Comment is Free section. The Australian Guardian provides an unprecedented opportunity to leverage the intransigent Australian media and the parlous economic and political debate.

Hi Bill, not sure I see the connection between the example you gave of the man not wanting to be late for work at the airport and lower wages. Are you arguing that if his wage was increased to a reasonable level that his problem would disappear? Or are you saying that with a government Job Guarantee, this chap would have an alternative to escape to?

Bill:

It seems that screws in OZ are no longer reserved for low paid workers.

Apparently, one cannot practice medicine in OZ with a medical degree, UNLESS one does an internship.

AND AUSTERITY HAS ENSURED A DEARTH OF INTERNSHIPS

To the extent necessary to make nearly 200 of this years graduates careerless, that is, with massive debt

they cannot possibly repay, because there is no place for them in the OZ medical system.

Welcome to Austerity 201

INDY

Dear Bill

In Canada, it is provinces which set the minimum wage. In Quebec, the law now stipulates that the minimum wage has to be 46% of the average wage. Don’t ask me how they determine the average wage.

If the minimum wage has to take into consideration the employer’s ability to pay, then it should be set at zero because for every minimum wage, regardless of its level, there will be some employers who can’t pay it without going out of business.

In Canada at least, the minimum wage is not the same for the employer as it is for the employee. It is higher for the employer because for every dollar that the employee pays into Canada Pension, the employer has to add a dollar, and for every dollar that the employee pays into Unemployment Insurance (called Employment Insurance here), the employer has to add 1.4 dollar.

Regards. James

I wonder how many Airline executives / board members have been sacked because one of their companies planes was a minute late ?

Or indeed were sacked because the companies share price is around only 25% of its former value.

If one is a long term thinker, one will always be focusing on unsustainable trends. Allowing minimum wage increases to consistently fall below CPI (which is undermeasured in any case) is an unsustainable trend. In the long term, it will not be possible to survive on a minimum wage. It is probably already very difficult.

The theoretical end point of progressively transferring national income from wages to profits is wages at 0% of national income and profits at 100% of national income. Of course, this can never happen. Wages cannot fall below the reproductive cost of labour for any prolonged period. At some point, ever more impoverished workers will rebel, strike and seek a revolutionary change to society. Is that what the powers that be want? For this is the logical end point of ever increasing exploitation of workers.

As I recall Ikonoclast, others I hope will correct me if I’m wrong – MMT or at least Wray is against indexation and for a good while I couldn’t understand why. I’m still barely on the cusp of it.

As indexation feeds inflation itself which makes it a procyclical adjustment (I think) which can lead to the wage/price spiral breakouts. << This is the bit I'm not 100% on

If I understand Bill's (broad) view correctly, it is that wages should be linked to productivity. Ultimately that's one of the public purposes of money.

Having said that I understand at least one unionists view that they are happy with what I think they stated was a 2.6% pay rise for minimum wage and I believe that they think that because wages are keeping up with inflation.

On a personal note my thoughts are more with those on 52 weeks+ Newstart than those on Min Wage.

I’m a huge fan of your view that if a firm cannot operate paying employees a decent wage, it should not operate. I am by no means schooled in economics, but it seems to me that there is an amount of demand in an economy that is set by the amount of money available for consumption, not by what people demand in the narrower sense of the word (beyond the essentials such as shelter and basic foods etc), so it’s in some sense immaterial to the economy what services are offered. If your low-wage coffee shop goes busto, people will just spend their disposable on something else. And as others have noted, better-paid workers create more demand because they have more disposable after the essentials and clearing debt, so they in themselves create the demand that will pay for better-paid workers.

The problem with the “market” as a means of resource allocation, it seems to me, is that it only values the money-generating ability of its actors. It does not put a price on the social value of work. That tends to make “fungible” workers cheaper, and their “value” lies in how exchangeable they are, not in what their work actually consists of. I was talking with a nurse friend last night. She is angry that Premier Newman wants to cut her night shift allowance, and when she put that to her boss, she was told she could quit if she liked because there’s a queue of nurses who would take her place and work without a shift allowance.

In fact, it seems to me that the “market” does not work at all well in this sense. If it was efficient as claimed, there would not be a huge oversupply of nurses. Yes, it works efficiently in driving the nurses’ wages down (and has noticeably in other industries: my gf is a graphic designer and wages have fallen in her industry because colleges keep pumping out trained designers into an industry that has no new jobs) but while this may be “working well” from the POV of employers who wish to boost their profits, it doesn’t do much for people who have to sell their labour.