Yesterday, the Reserve Bank of Australia finally lowered interest rates some months after it became…

Labour costs are not driving Australia’s competitiveness

Australia is caught in a bizarre warp at the moment. We have a national election in September and the incumbent Labor Party is heading for obliteration with the Party conducting an internal power struggle that defies description. The Prime Minister is deeply unpopular and is being poorly advised (as evidenced by the sequence of strategic disasters). The politician she deposed as PM is popular with the people but hated internally and he also proved to be a policy disaster. The current PM should step down to limit the electoral damage that will be wrought on the Party in September (that is, save some seats) but she won’t and the other character won’t challenge because he is behaving as the wrecking ball – bitter, revengeful and, most significantly without sufficient support (just). Its a tragic comedy of epic proportions. The Opposition is gliding into power without coherent policies and will reinstate the agenda it pursued when last in power (1996-2007), which means attacks on welfare and unions and handouts to the rich. Anticipating the change are the employer groups which are increasingly claiming they are being disadvantaged by excessive wage outcomes in Australia. Same old. It doesn’t help when the media produce headlines such as “Labour cost growth hits business hard”, which are not sustained by any coherent analysis that follows. It is a bizarre time.

That headline appeared in the Melbourne Age article this morning (June 24, 2013) – Labour cost growth hits business hard – courtesy of the economic editor Tim Colebatch.

The reader is immediately told to focus on labour costs hitting business hard and that mindset conditions the way the rest of the story is comprehended.

The opening paragraph reinforces the message:

Labour costs in Australia have grown at twice the pace of other OECD countries over the past decade, adding weight to claims by Holden boss Mike Devereux that Australian wages are out of line with the rest of the world.

Which is followed by this paragraph:

But the OECD figures show that the difference in growth in labour costs between Australia and its peers is less significant than the dramatic rise in the dollar’s value over the same period.

And this fact is the most important part of the story if you analysis the data correctly and the headline should not have mentioned labour costs or if it did it should have read – “Real Labour Cost reductions in Australia provides a boon for business”.

And if that had have been the headline the readers would not have been given the full story but would have a totally different mindset in other discussions.

Further, it would choke off the nonsensical oxygen that the business lobby groups are using to further entrench their attacks on labour at a time when workers are becoming increasingly vulnerable because of deteriorating labour market conditions and the prospects of a hostile government coming into power in September.

I should qualify that last comment. It could have easily read – the prospects of an even more hostile government towards workers than we have in place at the moment.

The Age article notes that:

Over the decade to 2012, on average, labour costs per unit of output rose 3.25 per cent a year in Australia. That is more than twice the 1.4 per cent annual growth in the decade to 2001. It tells us that wages were rising much faster than labour productivity.

The gap between wage growth and productivity growth in Australia was easily the highest among the 10 largest Western economies.

The article produced this graphic which I will refer to presently.

The conclusions reached in the quotation above are true but as we shall see only part of the story.

Here is how the relationships mentioned fit together. Regular readers will have seen this before (so skip if you are confident with it).

Economists differentiate between nominal GDP ($GDP), which is total output produced at market prices and real GDP (GDP), which is the actual physical equivalent of the nominal GDP. GDP (real or nominal) is a flow of income.

Employment (L) is a stock and is measured in persons (averaged over some period like a month or a quarter or a year).

Nominal wage costs are a flow and is the product of total employment (L) and the average nominal wage (W) prevailing at any point in time.

So the total nominal wage costs = W.L (note the dot signifies multiplication, so the previous expression W x L).

Labour productivity (LP) is the units of real GDP per person employed per period. Using the symbols already defined this can be written as:

LP = GDP/L

so it tells us how much real output (GDP) we get on average for each labour unit that is added to production.

Nominal unit labour costs (ULC), the object of the Age article are calculated as total nominal labour costs divided by nominal GDP or:

ULC = (W.L)/GDP$

They tell you what each unit of nominal output is costing in labour outlays. So if nominal unit labour costs are rising, and with a positive inflation rate, you can conclude that nominal wages are rising faster than labour productivity.

Is that an interesting thing to focus on. The Age article thinks it is and ties it in with statements made recently by one of the remaining car manufacturers about international competitiveness.

We read:

When costs rise faster here than in other countries, it weakens Australia’s competitiveness. But the difference between Australia and the rest in labour cost growth, while significant, had far less impact than the rise in value of the Australian dollar, which also adds directly to producers’ costs in the global market.

The first sentence is not entirely accurate. International competitiveness depends not only on nominal cost movements in economies but relative price levels and as is hinted in the second sentence – nominal exchange rate movements.

The first point to note is that real unit labour costs (RULC) matter for determining whether business costs are rising in real terms and whether a nation is losing competitiveness relative to other nations.

Nominal ULC can rise but capital can still secure a higher share of national income depending on domestic price movements. In that sense, it is difficult to conclude that businesses are being hit hard if RULC are falling.

Then we know one more thing – that the real wage, which is the draw on real production that workers get when they receive the nominal wage, is growing at a slower rate than productivity growth (or falling more quickly).

Take the expression for nominal unit labour costs ULC = W.(L/GDP$). We know that nominal GDP is equal to real GDP inflated by some measure of prices (the GDP implicit price deflator). We might call that deflator P. If we deflate nominal GDP by P then we get real GDP. The alternative is if we multiply real GDP by P we get nominal GDP.

So GDP$ = P.GDP

The real wage is defined as the purchasing power equivalent on the nominal wage that workers get paid each period. To compute the real wage we need to consider two variables: (a) the nominal wage (W) and the aggregate price level (P).

The real wage (w) tells us what volume of real goods and services the nominal wage (W) will be able to command and is obviously influenced by the level of W and the price level. For a given W, the lower is P the greater the purchasing power of the nominal wage and so the higher is the real wage (w).

So the real wage is:

w = W/P

Consider this expression:

RULC = (W.L)/GDP$ or (W.L)/P.GDP

Compare that to the expression for ULC. The difference is that real unit labour costs are equal to ULC deflated by the price level.

In English, it is a real measure of what each unit of output is costing. If real unit labour costs are rising, it means that total wages are rising relative to total nominal output.

If we decompose the last expression (in economics, we often look for alternative way to write expressions which maintains the equivalence (that is, obeys all the rules of algebra) but presents the expression from a different perspective).

So an alternative (but equivalent) expression for RULC is:

RULC = (W/P)(L/GDP)

Note that (L/GDP) is the inverse (reciprocal) of the labour productivity term (GDP/L).

We can use another rule of algebra (reversing the invert and multiply rule) to rewrite this expression again in a more interpretable fashion.

So an equivalent but more convenient measure of RULC is:

RULC = (W/P)/(GDP/L) – that is, the real wage (W/P) divided by labour productivity (GDP/L).

This expression is also equivalent to the wage share in national income.

That journey might have seemed difficult to non-economists (or those not well-versed in algebra) but it produces a very easy to understand formula for the wage share.

It should be obvious to you that if nominal wage (W) and the price level (P) are growing at the same pace the real wage is constant. And if the real wage is growing at the same rate as labour productivity, then both terms in the wage share ratio are equal and so the wage share is constant as are RULC.

So even though nominal ULC might rise, RULC can fall if the nominal wages growth is being deflated away by a larger rise in the price level for a given productivity growth rate (note I have note put these formulae into growth terms – that is a further step which is unnecessary at this stage).

What does the data actually tell us then?

The Bank of International Settlements publish monthly Effective exchange rate indices – for 61 countries from January 1994.

You can learn about this data from their publication – The new BIS effective exchange rate indices – which appeared in the BIS Quarterly Review, March 2006.

There was an earlier publication – Measuring international price and cost competitiveness – which appeared in the BIS Economic Papers, No 39, November 1993.

Real effective exchange rates provide a measure on international competitiveness and are based on information pertaining movements in relative prices and costs, expressed in a common currency. Economists started computing effective exchange rates after the Bretton Woods system collapsed in the early 1970s because that ended the “simple bilateral dollar rate” (Source).

The BIS say that:

An effective exchange rate (EER) provides a better indicator of the macroeconomic effects of exchange rates than any single bilateral rate. A nominal effective exchange rate (NEER) is an index of some weighted average of bilateral exchange rates. A real effective exchange rate (REER) is the NEER adjusted by some measure of relative prices or costs; changes in the REER thus take into account both nominal exchange rate developments and the inflation differential vis-à-vis trading partners. In both policy and market analysis, EERs serve various purposes: as a measure of international competitiveness, as components of monetary/financial conditions indices, as a gauge of the transmission of external shocks, as an intermediate target for monetary policy or as an operational target.2 Therefore, accurate measures of EERs are essential for both policymakers and market participants.

If the REER rises, then we conclude that the nation is less internationally competitive and vice-versa.

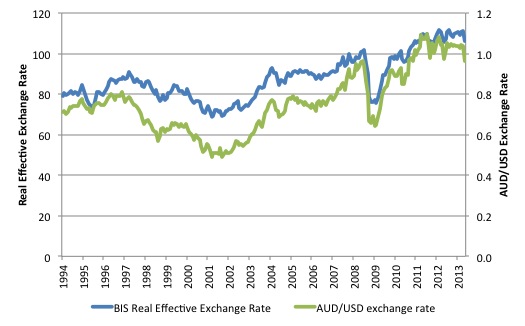

The next graph shows the REER for Australia (left-hand axis) and the nominal AUD/USD exchange rate (right-hand axis) from March 1994 to May 2013. The correspondence between the two in terms of trends and turning points is replicated if I use other parities (include yen, TWI).

The conclusion? Most of our movements in international competitiveness over this period appear to be driven by nominal exchange rate movements.

To claim that labour costs are the major reason for changes in international competitiveness one would have to argue that they also drive the exchange rate.

That is one argument no-one would be prepared to make for obvious reasons.

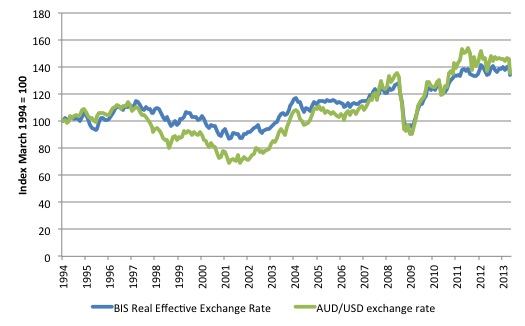

To see this more clearly, I indexed the two raw series to 100 at March 1994 to produce the following graph.

That tells us that the headline of the article in question erroneously focuses the readers’ attention on labour costs and only really adds as a secondary matter the exchange rate effect.

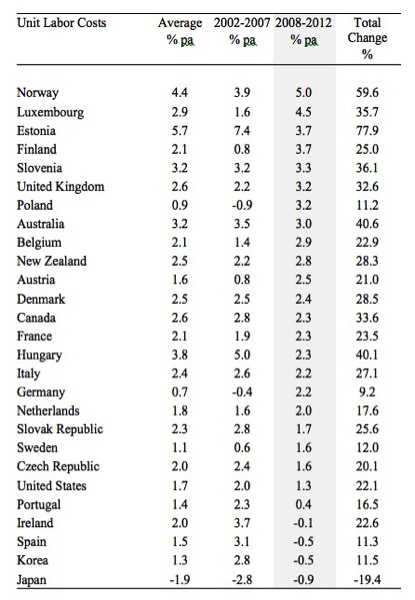

But we can go further than that. I put together the OECD ULC figures and took IMF GDP deflator data for most OECD nations to produce the following set of tables.

I was largely able to reproduce the information in the opening graphic that appeared in the Melbourne Age article but I added more nations and decomposed the average growth in nominal unit labour costs into two periods – 2002-2007 and the crisis and beyond period 2008-2012.

I ranked the average annual change in nominal unit labour costs largest to smallest for the period 2008-12. The average of that column is 2.1 per cent per annum.

So Australia is in the upper group but its most recent performance is below the performance for the whole 2002-2012 period. Once you include other nations you get the view that Australia is actually in a central cluster of nations.

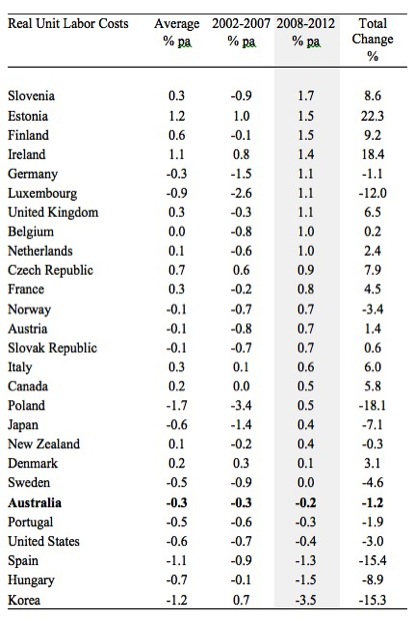

Now what about the situation when we take into account movements in prices (represented by annual movements in the GDP implicit price deflator). In this context, the percentage change in the price deflator provides a better price inflation variable than, for example, the consumer price index. The results, though, would not have been greatly different had I use the CPI-based inflation measure.

Real unit labour costs are equal to the rate of growth in nominal unit labour costs minus the growth in the price deflator. The next Table shows what happens when we take into account these price movements.

I ranked the data on the 2008-2012 column (largest to smallest) but the results do not depend on that ranking.

Australia may have experienced average annual nominal unit labour cost growth of 3.2 per cent per annumn over the period 2002-2012 but the price deflator grew on average by 3.5 per cent per annum. That means that real unit labour costs fell on average by 0.3 per cent per year.

A bonus to business! It means the wage share was falling each year on average. It means that real wages growth failed to keep up with labour productivity growth and there was a redistribution to profits.

The headline might have reported that. But then I suppose that wouldn’t achieve the aim. Whatever the motivation was for producing that headline I consider it to be an example of misinformation and designed to distort the public debate.

Conclusion

When foreign-owned car companies start screaming that labour costs are too high you know they are angling for yet another massive government handout which they typically repatriate back to their northern hemisphere head office.

When they start arguing that money wages are too high what they really want is to further redistribute real income away from workers. That is, to further drive a wedge between productivity growth and real wages growth.

One of the reasons the global financial crisis occurred in the first place was that workers were forced to rely on credit to maintain consumption growth because neo-liberal attacks on the capacity of workers to achieve real wages growth commensurate with labour productivity growth were successful.

If we are talking about balance – which is all the rage these days – then one of the stark changes that are needed is that real wages growth has to be stronger and match productivity growth over time. That might spur some innovation which will lift productivity growth and make everyone better off.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

This is informative post on a difficult topic.

It’s also quite appropriate to my comment on the answers to Saturday’s quiz. Just to understand it better, I looked at Australian CPI inflation over the same 2002-2012 period, which I worked out as an annual rate of 2.8% (I’m not familiar with Australian statistics – I used series A2325846C from Dec 01 to Dec 12 – I hope I’ve got that right). This would imply that, measured in terms of the cost of living, real wages actually grew over this period despite the declining profit share, largely due to changes in the terms of trade. That seems to rather neatly illustrate the point I was making.

I would like to stress that I’m not disputing the point you make in this post, even less arguing for lower wage growth.

Bill said: “The current PM should step down to limit the electoral damage that will be wrought on the Party in September (that is, save some seats) but she won’t and the other character won’t challenge because he is behaving as the wrecking ball – bitter, revengeful and, most significantly without sufficient support (just).”

I agree that he is bitter (who wouldn’t be in the circumstances) and without sufficient support. And there is a good reason why he does not command majority support within caucus – namely, that many regard him as being a control freak. However I do not see any evidence that he is behaving as a wrecking ball. That story is essentially a beat up propagated by irresponsible (indeed hysterical) mass media, and echoed gleefully by the opposition. If anything, it is the media that are behaving as a wrecking ball, along with a few unhappy backbench members who are currently in panic mode upon realising that they are about to lose their seats.

Great post, Bill.

Rumour has it that the federal election will happen in early August…

I think it’s the case that if the PM goes to the GG this week that only the lower house will be up for grabs, and the Senate will hang on for a bit longer.

Cheers!

“real wages growth has to be stronger and match productivity growth over time. That might spur some innovation which will lift productivity growth and make everyone better off.”

I think you are making a really crucial point here. There is the idea that the industrial revolution occurred in europe and not in China because a couple of centuries ago in China labour was cheap and plentiful so there was little need for mechanization.

I read something just the other day about how in Australia manufacturers were at the cutting edge of 3D printing technology because high labour costs meant that they had to do things smarter.

I guess there actually is some truth that high wages support a strong currency. Nigeria had a plummeting currency for the 1980-2000 period because an impoverished domestic market means that those who get money from exports don’t want to invest in serving the domestic market where there are no consumers able to pay for anything. Instead all the money from exports gets sent abroad to buy assets in London, Switzerland and the USA.

Tim Colebatch should put his money where his mouth is and take a voluntary pay cut of 50% to make his paper’s owners richer. He would still be overpaid as his ramblings are not worth 1c.

I agree that it is desirable to keep Australia as a high-wage, high tech economy, and prevent a plunge to the bottom — one of the basic requirements of the predator class, and of the neoliberal philosophy which underpins it and serves its interests.

It is my belief that Paul Keating completely misread the significance and intent of the neoliberal (economic rationalist) agenda. Owing largely to Keating’s misunderstanding, and following his time in office, his party has been saddled with a schizophrenic disposition — in which it has been trying to embrace the objectives of neoliberalism on the one hand, and of retaining decent incomes/working conditions/educational opportunities/health facilities for the population as a whole on the other hand. It has clearly failed to serve the irreconcilable interests of both the people as a whole and of the predator class, and now stands for little that is not in the interests of the predators. In consequence it is largely driven by opinion polls.

What most people seem to be unaware of is that the federal opposition, which is destined to be swept into office with a sizeable majority in September, will be working exclusively in the interests of the predators. Batten down the hatches — we are in for a sustained period of austerity budgeting, high unemployment and recession, at least until the public wises up to what is happening. I do not expect the incoming government to last for more than one electoral term.

So, Bill, what (if anything) do you think should be done to save the car manufacturing industry?

And if the car manufacturers go, what should be done to save the component manufacturers that currently depend on it?