I started my undergraduate studies in economics in the late 1970s after starting out as…

Fiscal austerity violates basic economic efficiency requirements

Economists like to tell students about efficiency. The concept – which really distils down to – zero waste (even though that term is loaded) – is drilled into undergraduates and graduates alike as a dogma that should not be violated. Most of the attacks on government intervention by the mainstream economists are couched in terms of efficiency – or the alleged lack of it. The seemingly objective framework that defines the orthodox approach to efficiency allows all the ideological indisposition towards government involvement in the economy to be discreetly hidden. But even then the mainstream do not consistently apply their own constructs. And when the empirical world violates the utopian vision (for example, when there is mass unemployment), the response is to either blame the government some more or redefine the violation away and continue on as if nothing was amiss. This sort of intellectual dishonesty has never been more apparent than in the current period as nations struggle with a deep and enduring crisis. This blog is about two examples of that – health care and youth unemployment.

Mainstream economics does not have a monopoly over concern about efficiency. Modern Monetary Theory (MMT) is also concerned about efficiency except the MMT approach provides a consistent conceptualisation of what zero waste actually means.

You will not be surprised to learn that the MMT appraoch is significantly different, in part because it is consistent, from the approach taken by the mainstream.

Macroeconomics is the part of economics that studies the economy in aggregate. The aggregates that concern us in this area of study are the level (and growth) in production, the rate of aggregate unemployment, and, the level and rate of change in the overall price level.

A central idea in economics whether it be microeconomics or macroeconomics is efficiency – getting the best out of what you have available. The concept is extremely loaded and is the focus of many disputes – some more arcane than others. But my profession would be united in saying that developing policies about how efficiency is to be attained at any level is a core activity for an economic theorist.

At the macroeconomic level, the “efficiency frontier” is normally summarised in terms of full employment. The hot debate that has spanned the years is what do we mean by full employment but it is a fact that full employment is a central focus of macroeconomic theory.

When mass unemployment arises it is a sure sign that there is waste going on. The mainstream response to persistently high unemployment is to re-define what they consider to be the “equilibrium” rate of unemployment. So in the literature you will find articles trying to justify why the steady-state unemployment rate jumps from 2 per cent to 8 per cent in a couple of years despite none of the variables that are implicated changing!

Fiscal austerity is wreaking havoc on economies because it undermines the very thing that allows economic growth to proceed – aggregate spending. It intentionally does that despite all the conservative rhetoric that non-government spending growth will more than offset the cuts in net public spending.

All manner of psycho-babble notions are advanced to justify that a priori claim – such as an alleged private fear of government deficits. None of the predictions are supported by what psychologists tell us about the fear that persistent unemployment creates among households, which leads them to constrain their spending (consumption) nor it the reality acknowledged that firms will not invest when consumption demand is muted.

Further, the evidence that subsequently emerges – slowing economy, rising unemployment and the like – demonstrates the failure of the austerity cult. I use the word cult because that is what a degenerating paradigm (in the Lakatosian sense) becomes.

As the empirical void becomes obvious, those who hang onto the theoretical propositions become cult worshippers and lose all “scientific” credibility.

The irony is that the summary indicators that are held out as goals of fiscal austerity fail to be achieved – such as declining public debt ratios. The cultists then cry – cut more and their credibility shrinks to below something more than nothing.

Even relatively conservative commentators are now coming out of the woodwork and letting it be known that austerity is failing. For example, the UK Guardian article (October 30, 2012) – This is a European suicide pact.

The author (boss of the UK-based NIESR) tells us that:

… fiscal consolidation … is likely to be self-defeating for the EU collectively. As a result of the deficit cutting plans now in train, debt ratios will be higher in 2013 in the EU as a whole, rather than lower. This will also be true in almost all the individual states (with the exception of Ireland). Coordinated austerity in a depression is self-defeating. The implication is that the strategy being pursued by individual members, as well as the EU as a whole, is making matters worse …

What we have seen in Europe is the creation of a death spiral of deficit cutting, leading to reduced growth – which leads to reduced revenues and pressure to cut deficits faster. Paradoxically the EU was set up in part to avoid such problems by allowing members to co-operate to secure better outcomes. Coordinated EU fiscal consolidation looks less like economic policy co-operation and more like a suicide pact.

Which is what the MMT proponents have been saying from the outset – in the face of worldwide attacks on our sanity from our mainstream colleagues.

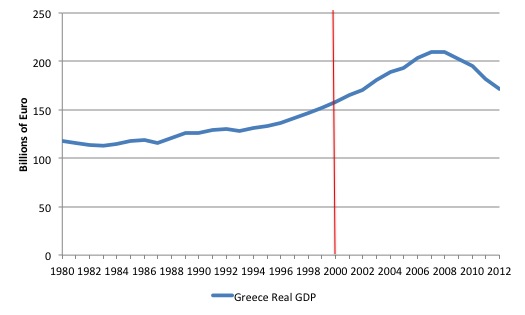

Greece is the current austerity poster child. The following graph (taken from IMF WEO data) shows the evolution of real GDP for Greece from 1980 to 2012 (the last year being an estimate, which will certainly be optimistic).

The red vertical line marks the year Greece entered the Euro. In terms of the size of the economy, the Greeks are back to 2002 (in real terms). The per capita figures are similar. The Greeks have already lost a decade of economic growth and the situation will worsen over the next year.

It is highly likely that the Greek economy will be back to levels that existed prior to entry into the Euro. On that basis alone the Greeks have not benefited one iota from the abandonment of their own currency.

But the discussion about how bad fiscal austerity is goes beyond the current period.

The imposition of austerity is certainly undermining the status of Greece as an advanced nation much more than these production figures (or the unemployment data) would suggest.

The most valuable resource a nation has is its people. Maintaining a healthy population while ensuring education and skill development is of a high-quality is a crucial component in the drive for efficiency.

Efficiency is not just about short-term use of resources. Dynamic efficiency requires that a nation maintain skills development to meet changing circumstances and high health standards.

Last week (October 25, 2012), there was an EU Observer headline – Greek finance minister briefly in hospital for ‘fatigue’.

The story was brief:

Greek finance minister Yannis Stournaras spent a few hours in hospital on Thursday and was diagnosed with fatigue and viral infection following weeks of negotiations with the troika of international lenders on budget cuts required for the next bailout tranche.

I guess with his salary and entitlements (that presumably remain intact) he could afford to relax a bit under the care of the hospital system – at least what remains of it.

A definining characteristic of an advanced and wealthy nation should be the sophistication of its health care system. As a nation develops, a universal and high-class health care system moves from being an aspiration to a reality under the guise of significant public investment and support.

There have been a number of reports over the last year about the decline of the Greek health system.

In September 2012 we read that the – Greek health system crumbles under weight of crisis. The article documents an appalling decline in health care standards.

This recent article (October 1, 2012), for example – A dying health system – reported about the “wave of desperation and anger over austerity-driven healthcare cuts” in Greece.

Under the strain of austerity cuts Greece “cannot sustain the primary healthcare system – pharmaceutical costs, hospital care and private healthcare.”

Unemployment is forcing people to lose their health care insurance and access to care.

In this story (October 1, 2012) – Hospitals in need of emergency care – we read that Greece is “facing increasingly greater shortages in everything surrounding healthcare: medicine, medical supplies, biomedical equipment of hospitals and personnel”.

For those reliant on the public health care system the situation is dire in Greece:

Shortages in hospital supplies have grown over the last two years, with lack of basic items in certain cases. Hospitals have also been increasingly unable to pay procurers. Providers may delay delivery of essential items – such as stitches – to pressure the state to pay what it owes them. Supplies are also in short supply for hospital oncologists, who rely on expensive chemotherapy drugs.

We also learn that the proportion of GDP devoted to “public healthcare is among the lowest in developed countries”. The rich remain insured and can ship in medicines, while the poor will increasingly die due to lack of health care.

While not all of the problems in Greek health care are due to austerity, the Troika has to shoulder the majority of the blame. In the:

… bailout memorandum … public health spending cannot exceed 6 percent of GDP – or about 12 billion euros for 2012. That requires a spending cut of 800 million euros from 2010 levels.

Spending equals income. But health care expenditure also saves lives. Income is falling and unnecessary suffering (and death) is rising as a result of austerity.

The point of this example, is that one of the most significant contributors to efficiency in a nation is the health of its population. A sickening population will be associated with declining productivity standards and, increasingly, declining real living standards.

The second example of how fiscal austerity deliberately undermines economic efficiency relates to the huge rise in youth unemployment that has occurred since the crisis began.

Governments are tolerating rates of youth unemployment in some cases above 50-55 per cent and the Troika insists that more cuts are required which will worsen this situation. I know there are some analysts who attempt to whitewash this by claiming the figures overstate the problem. But even the NEETs (Not in Education, Employment or Training) data shows dramatic waste of young talent.

In these blogs – – The daily losses from unemployment and The costs of unemployment – again – I discussed the massive costs arising from mass unemployment.

It is well documented that sustained unemployment imposes significant economic, personal and social costs that include:

- loss of current output;

- social exclusion and the loss of freedom;

- skill loss;

- psychological harm, including increased suicide rate (which I will return to later);

- ill health and reduced life expectancy;

- loss of motivation;

- the undermining of human relations and family life;

- racial and gender inequality; and

- loss of social values and responsibility.

All of these costs are multiplicative.

The simplest calculation reveals that the daily income losses alone that arise from mass unemployment dwarf any reasonable estimate of microeconomic losses arising from the so-called “structural inefficiencies” or microeconomic rigidities (a favourite of the IMF) that have dominated public debate over the neo-liberal era.

It is just plain madness to ignore huge costs and then go about pursuing small costs (if they exist). One of the problems is that in pursuing these micro costs the government almost always will increase the macroeconomic costs.

Even before the crisis hit, these costs in most countries were huge as policy makers began using unemployment as a policy tool rather than a policy target as the obsession with inflation-targetting took hold.

Most people do not consider the irretrievable nature of these losses. Every day that unemployment remains above the full employment level (allowing for a small unemployment rate arising from frictions – people moving in-between jobs) the economy is foregoing billions in lost output and national income that is never recovered.

The magnitude of these losses and the fact that most commentators and policy makers prefer unemployment to direct job creation, shows the powerful hold that neo-liberal thinking has had on policy makers. How is it rational to tolerate these massive losses which span generations?

As noted, to some extent these losses are a mystery to society in general. While the unemployed and their families are certainly aware of them, the remainder of the society are less aware. For example, we might notice rising crime rates in our neighbourhoods but do not associate it with unemployment.

Neo-liberalism has also changed the way we think about unemployment. In the past we understood clearly that it arose as a result of a shortage of jobs.

However, in recent decades, we have been conditioned by a relentless (lying) press and government statements to perceive unemployment as an individual problem. So the unemployed are type-cast as being lazy; having poor work attitudes; refusing to invest in appropriate skills; and subject to disincentives arising from misguided government welfare support, and all the rest of the arguments that mainstream uses to obfuscate the social problem.

The focus in the public debate is to “blame the victim” and suggest that most are unemployable and prefer to live on welfare, where that support is available.

But the other consideration – and I am doing some empirical research on this issue at present which will be published in due course – is that the daily costs – every day – don’t really tell us about the future losses.

We know that the losses encountered during a prolonged recession reverberate into tortured recoveries and that the damage that unemployment causes spans the generations.

There significant research which shows that children that grow up in jobless households inherit the disadvantage that their parents endure and take it into their adult lives.

This manifests in the form of unstable work histories, lower human capital accumulation, lower pay and incomes, frequent periods of unemployment, and other social pathologies (see list above).

So fiscal austerity now commits the youth of the nation to a bleaker future than otherwise. It cannot be efficient to follow that course of action.

However, it gets worse in the current period given that not only is mass adult unemployment high and has been that way for 5 years in many nations, but the youth themselves are enduring ridiculously high jobless rates.

There is also undeniable research evidence showing that unemployment among youth not only undermines current prosperity but also reduces any prospects in the future.

Why is that? The answer is obvious. The youth that are being left on the jobless scrapheap by the fiscal austerity policies are being denied the essential opportunities that help people move upwards in the labour market over time – in terms of wage outcomes, job mobility and skill development.

The unemployed youth of the world are being deliberately locked out of the chance to gain vital experience and on-the-job training.

The point is that these workers are the engine of future prosperity. By diminishing their prospects now, a nation undermines its own future.

Conclusion

If you sit in economics lectures – especially microeconomics classes – you will hear a lot about cost-benefit analysis and learn to interpret cost-benefit ratios. You will be told that patterns of resource allocation that yield ratios above 1 are inefficient.

You will be told that all government policies should be continually subjected to CBA to ensure there is no waste and that outcomes are optimised.

The subtle or not so subtle sub-text of a typical lecturer will be that it is hard for the public sector to achieve cost-benefit outcome superior to the private sector.

The crisis has taught us how badly the private sector fails without proper government oversight.

But it has also taught us that when this sort of ideological bias is applied to public policy – which is really the motivation for fiscal austerity – the cost-benefit ratio sky-rockets.

Fiscal austerity is creating massive inefficiency both in a contemporary setting (that is now) but also for the future. When health care systems crumble a nation’s claim to advanced status is untenable.

When significant proportions of the future workforce are deliberately denied the opportunity to acquire the essential skills and experience that drive high productivity the nation faces a bleak future.

The conclusion is that mainstream economics is inconsistent and seems incapable of seeing the elephant (the macroeconomic losses and inefficiencies) while it obsesses about the flea (on the elephant).

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

Dear Bill

Suppose that youth unemployment in a country is 50% while in the age bracket 25-29 it is 20%, then unemployment may not be permanent for people in the age bracket 18-24. If the unemployed youth were to remain unemployed for the rest of their lives, then 5 years from now, unmemployment among the 24-29 will have to be 50% also. 10 years from now, unemployment among the 30-34 will have to be 50%, and so on. Is that going to be the case? I doubt it. In any case, a longitudinal analysis would be required.

Regards. James

Great article but I disagree in your use of the term efficiency.

A functional more national economy has a greater redundency and therefore by definition reduced efficiency.

You can see this drive for greater efficiency (therefore increased leverage) withen the Euro car industry.

For example UK Ford Transit must move to Turkey to reduce labour costs (4 euros a hour in Turkey) but also the domestic UK banking system must also increase credit to sustain as less people will get wages as the car supply chain moves east.

The system becomes more efficient/ fragile / profitable until the supply chain breaks down.

Something very similiar happened in Ireland.

Indeed they even bused in Turkish workers to build a Cork city road as the non labour costs also increased (energy etc).

The Turks sent their reduced wages home and the banks filled the demand hole created with more credit which was of course malinvested as there was no rational demand signal now.

The system was extremely efficient but had a catostrophic lack of redundency.

The euro system especially orbits around the concept of exporting countries capital and knowledge base to ever more extreme shores so that the bank credit industry can sustain its profit ratios via Labour arbitrage.

I think the reason for euro area fiscal austerity is quite simple on one level , post 1986 european capital was exported to the BRICs and others.

All that remains is paper internal claims on real external productivity.

There is a desperate effort to keep that fiction and thus very

fragile supply chains alive.

The term ‘efficiency’ has no real meaning on its own, as I think is shown by the Dork of Cork, where he indicates that ‘efficiency’ in his context means increased leverage. But it could mean other things in other contexts. The term only adequately functions as an adjective, not a noun, hence can not effectively stand on its own. Neo-liberals who go on and on about efficiency without saying with respect to what or delineating the relevant context are uttering empty phrases. Sometimes the context is clear, albeit implicit. But mostly, coming from them, it is not. The fact that the term can be used as a noun is partly due to the rules of English allowing almost any term to be turned into a noun, whether meaningfully referential or not.

Addendum:

Bill indicates that he intends ‘efficiency’ to mean wasteful spending, that is, spending that neo-liberals don’t like. They also use the term to mean wasteful allocation of resources, that is, allocation neo-libs don’t like, such as restricting building on green sites. But they also use the term as a collective noun that means nothing at all – in logical terms, it fails to refer to anything.

James: I believe the evidence suggests that youth unemployment has lasting effects (I’m afraid I don’t save up references, but others here probably have them). Effects that persist throughout a working lifetime. So, although unemployment among 24-29 may not be 50% in 5 years, it will be significantly higher than it would have been if youth unemployment were at normal levels.

Oh come on, Bill! The banks are anything but private sector. It’s doubtful they could even exist to any large extent without government deposit insurance and a legal tender lender of last resort and especially if the bogus debt they are “owed” by the population was abolished.

And what else have the banks done? Besides driving the population into onerous debt whose repayment is undermining aggregate demand, they have provided loans of new money (so-called “credit”) to industry to automate the worker’s jobs away with the worker’s own stolen purchasing power!

1. Who benefits from Neo-liberal ideology.

2. How and why does this group benefit from Neo-Liberal ideology ?

I agree that loss of currency sovereignty and “austerity” (pro-cyclical) economics is a big part of the problem for Greece. But is it the whole problem? Does not Greece also suffer from higher energy prices being a net energy importer? “Energy imports; net (% of energy use) in Greece was last reported at 65.99 in 2010, according to a World Bank report published in 2012. Net energy imports are estimated as energy use less production, both measured in oil equivalents.” – tradingeconomics dot com

Also, does not Greece also have a large military for a relatively small country spending at 3.1% of GDP in 2010?

“Greece continues to be one of the world’s biggest arms importers, despite having little chance of meeting the deficit reduction targets pegged to its International Monetary Fund (IMF) bailout loan, according to a preliminary report by the organization’s debt inspectors.

The IMF report will likely recommend more austerity in Greece, in addition to 89 other stalled reforms Athens has failed to enact.

Despite the push for cuts in other spheres, the Greek government continues to spend a considerable portion of its budget on arms, amounting to 7 billion euros in 2011. From 2002 through 2006, Greece was the world’s fourth-largest importer of weapons. Despite the country’s ongoing debt crisis, it remains the tenth-largest military importer.

As a proportion of its GDP, Greek defense spending is nearly double that of any other EU member. The country also has a less-than-transparent procurement process and a reputation for budgetary corruption.” – RT’s Peter Oliver reports.

The MMT focus on macroeconomics, government finances and aggregate demand is a key part of the analysis and I agree the fix starts there. However, shouldn’t we include consideration of real economy factors too (like energy costs?) and places where austerity (military spending) would make economic and social sense. Cut Greece’s military spending by 10% and you free up $700 million for Greece’s hospitals. If that transfer was from arms imports to domestic hospitals it would give a primary boost to the economy of about $700 million. Add in a multiplier for local economic activity and youy would be looking at maybe double that or $1.4 billion.

I have a question as to the difference between productive and efficient? Personally I’d differentiate between the two, and say that what a lot of the article is talking about is being productive/productivity rather than efficient/efficiency. The European Union is probably wasting a lot in both productivity and efficiency, but they are really separate issues.

Unemployment is ultimately about productivity — the unemployed aren’t productive, bottom line, and efficiency isn’t even an issue as you have to be productive or producing to be efficient. Efficiency is how productive you are vs. other people doing your same job. I know this personally as I work in a health care system that measures both my productivity and efficiency in numbers every month, and I’m generally more productive and more efficient when compared to others in the system. I’ll illustrate: I see more patients per hour than then average, meaning that I’m more efficient than the average worker they have as I see more poeople in the same time frame. That said I’m not necessarily more productive, I am, but not directly, I bring in more overall per hour because I’m more efficient and productive in new visits as I can bill more than the average, but am less productive in follow up visits than the average, though my higher efficiency counteracts this and my revenue per hour, or time frame is overall higher.

The point here is the differece between having people productive and efficient. The problem in countries like Greece and Spain is that you have a large populace who are neither productive nor efficient — and if you aren’t productive you can’t be efficient, and important point. The other point is that efficiency is dependant on productivity, and thus secondary to it: you can’t have people be efficient if they aren’t productive and then unemployed are by definition unproductive.

Greece at the moment is neither productive nor efficient — and hasn’t ever really been efficient, but the bigger problem at the moment is that is being made more and more unproductive by rising unemployment. Making Greece more efficient would mean keeping people working, but getting them to ‘produce’ more during that time frame, and would mean investing time and money, and training in making them more productive in a given time frame. Merely cutting budgets isn’t going to automatically make people more efficient, or productive within the same time frame which is what productivity is. A cut in funding isn’t going to make people more effective or produce more per/hour, and may actually make them less productive if they then have less resources and are expected produce the same amount of work.

The jarring difference between the economics of the lecture theatre and the economics of the world outside during the period 1982-1985 is something I never came to terms with as a student. It is only in my readings since the onset of this crisis that I have – to a considerable extent – done so.

Of course banks have been and substantially still are private companies. They are private companies that have benefited from government subsidy through deposit protection and a regualr flow of government business. But if you subsidise activity and de-regulate those activities too then you do contribute to increasing financial fragility.

What’s inefficient is stealing the population’s purchasing power to increase productivity and then having to refund some of that stolen purchasing power in taxes to (partially) compensate the victims of that theft.

It seems quite common to conflate efficiency & resiliency, when both are strategies for surviving extended bouts of natural selection.

My personal experience is that it is quite common for economics 101 courses to equate efficiency to adaptive power, since I frequently meet businesspeople bent on achieving systems “lean” enough to qualify as brittle and easily broken by the slightest situational variance.

Reality, and testimony from the bulk of non-economists, is that adaptive power is a function best described as an the real-time output of an exceedingly long polynomial, i.e., F[i*f(a) + j*f(b) + k*f(c) + …. z*f(n), etc]. Both efficiency and resiliency are attributes used to describe methods for adjusting the permutations of all possible cofactors, and the factors themselves. Adaptive rate is a function of both extent and kinetics of variance, and is commonly attributed to a resilient substructure of even more subcomponents executing what we call interdependency of emerging components, processes and features.

In the very short term, efficiency always seems attractive.

In all perspectives longer than very short term, resiliency outweighs efficiency.

Don’t conflate the two concepts. Muddled semantics & ill-defined terms only reduce our adaptive rate.

@Iconoclast

With regards to the military spending in Greece, there are a few points which worth consideration:

1. Somehow they seems to fear(?) Turkey

2. Germany have pressured Greece not to reduce it’s military spending, in my opinion because of military imports (e.g. submarines) from Germany

3. The conservatives around the world (e.g. US and Australia) are mostly against reduction in military spending and austerity is a policy of the conservatives (including some ignorant progressive as well)

4. Although I personally doubt this, maybe the Greek politicians think (because of point 3) that this is the only way they can keep some of the government spending?