Today (January 22, 2026), the Australian Bureau of Statistics (ABS) released the latest labour force…

The daily losses from unemployment

I have been doing some work again on the costs of unemployment and this blog gives a snapshot of part of that research. One of the strong empirical results that emerge from the Great Depression is that the job relief programs that the various governments implemented to try to attenuate the massive rise in unemployment were very beneficial. At that time, it was realised that having workers locked out of the production process because there were not enough private jobs being generated was not only irrational in terms of lost income but also caused society additional problems, such as rising crime rates. Direct job creation was a very effective way of attenuating these costs while the private sector regained its optimism. In fact, it took about 50 years or so for governments to abandon this way of thinking. Now we tolerate high levels of unemployment without a clear understanding of the magnitude of costs that that policy position imposes on specific individuals and society in general. The single most rational thing a government could do was to ensure that there were enough jobs to match the available labour force. Mostly, they fail badly to achieve this level of sophistication.

In the growth period before the current crisis few countries had returned to the full employment states that they achieved in the Post World War 2 period up until the mid-1970s when the OPEC oil shocks led to a paradigm change in macroeconomic policy setting. The neo-liberal approach emphasised fiscal austerity to support an increasing reliance on monetary policy for counter-stabilisation.

So already in this period of relatively better economic growth there were substantial losses being recorded both in terms of lost GDP (production and income foregone) and the additional personal and social costs that accompany persistent unemployment.

It is well documented that sustained unemployment imposes significant economic, personal and social costs that include:

- loss of current output;

- social exclusion and the loss of freedom;

- skill loss;

- psychological harm;

- ill health and reduced life expectancy;

- loss of motivation;

- the undermining of human relations and family life;

- racial and gender inequality; and

- loss of social values and responsibility.

These costs are enormous and dwarf the measures that various governments have come up with to estimate losses arising from so-called microeconomic inefficiencies (such as transport systems not running on time etc).

In the past I have done work on this with a colleague Martin Watts and you can see an early working paper (subsequently published but the working paper is free), which outlined the sort of method we used to compute the “costs of unemployment”.

Even before the crisis hit, these costs in most countries were huge and they are irretrievable every day that the economy remains above full employment. It shows the powerful hold that neo-liberal thinking has had on policy makers that these massive losses have largely been tolerated. Policy makers began using unemployment as a policy tool rather than a policy target as the obsession with inflation-targetting took hold.

To some extent these losses are a mystery to society in general. While the unemployed and their families are certainly aware of them, the remainder of the society are less aware. For example, we might notice rising crime rates in our neighbourhoods but do not associate it with unemployment.

Neo-liberalism has also changed the way we think about unemployment. In the past we understood clearly that it arose as a result of a shortage of jobs. In recent decades, we have been conditioned by a relentless (lying) press and government statements to perceive unemployment as an individual problem.

So the unemployed are lazy; have poor work attitudes; refuse to invest in appropriate skills; are subject to disincentives arising from misguided government welfare support, and all the rest of the arguments that mainstream uses to obfuscate the social problem. In Australia, this sort of “blame the victim” approach was accompanied by a new nomenclature that entered our daily public discourse and was promoted by government ministers including successive prime ministers.

We were told that the unemployed were bludgers, job snobs, cruisers and worse. Television current affairs programs targetted unemployed families and lured them into looking as though they didn’t want to work.

All of this despite the overwhelming evidence from studies in most countries that the unemployed were highly motivated to find work and were victims of a shortage of jobs.

The dominance of the neo-liberal ideology led governments in most countries to have eschew the adoption of policies of direct job creation to reduce the rate of unemployment and to minimise these massive costs. Fiscal policy became geared to the achievement of budget surpluses as some sort of token of prudent financial management.

Employment policy shifted from a demand-side emphasis to a supply-side focus (active labour market) which targetted individuals with futile training programs divorced from a paid-work context and pernicious welfare-to-work rules.

What was going on with respect to the deregulation of labour markets and the retrenchment of the Welfare State in the face of persistent unemployment was being mirrored in the approaches governments were taking to financial markets. The lack of oversight of the latter has been the fundamental reason we are now enduring the worst crisis from 80 years.

Given the costs of unemployment are so large and irretrievable, one would think that at the very least direct macroeconomic intervention should have been a priority in these years – that is, direct job creation.

In 1978 while still a student at the University of Melbourne and in recognition of the then rising economic and social costs of unemployment, I formulated an early model of what I now call the Job Guarantee approach to full employment.

The JG would work under the principles of a buffer stock mechanism and the jobs would be designed to increase per capita social welfare by satisfying social needs that are not met by the private sector in areas including environmental services, community and social services, health and education.

Thus this increase in public sector employment would contribute to the reduction in the negative externalities that tend to increase with increasing levels of production by increasing the share of final output that is associated with green, public sector employment.

With the current crisis, it should be clear to everyone that the neo-liberal construction of unemployment is (and always was) patently false – just an ideological gimmick to transfer power away from workers to ensure a greater share of national income was available for capital.

Now it is clear – 6 or so percent of the US labour force; or 10 per cent of the Spanish labour force; or 2 per cent of the Australian labour force didn’t suddenly get lazy; or were waylaid by government welfare benefits; or lost their skills – in the space of a year or so.

The crisis should make it obvious that unemployment arises when there are too few jobs being created (net) relative to the available labour force. There should be no mystery about that now for anyone.

But despite the transparency of the causes of mass unemployment governments have failed to use direct job creation as a way of dealing with the rising costs associated with the joblessness. The vestiges of neo-liberal ideology are proving hard to shake.

If governments had have had a Job Guarantee in place there would be hardly any discernible rise in official unemployment and the costs of the crisis would have been significantly reduced. Yes there would have been some skills-based structural underemployment (high skills workers taking Job Guarantee jobs) and some obvious loss of income.

But overall these losses would have been attenuated and some of the other costs would have been mostly negated. Of significance, which shows you how ideologically-blinded our policy makers have become – their budget deficits would not have risen by nearly as much as they have. While I don’t pay much attention to the actual budget deficit figure, you might have thought a government facing a chorus of squawking neo-liberal mouthpieces (the media) would have found the lower deficits to be something of a political advantage.

Anyway, today I was doing some updated calculations on the daily costs of persistent unemployment as a consequence of the economic crisis. In this blog, I will report some results for Australia and the USA.

While the previous work I have done on this topic has sought to compute the broadest possible measure of costs, in this blog I just focus on lost GDP income. T

In focusing on the foregone output resulting from unemployment and underemployment you have to decide a benchmark to measure the current situation against.

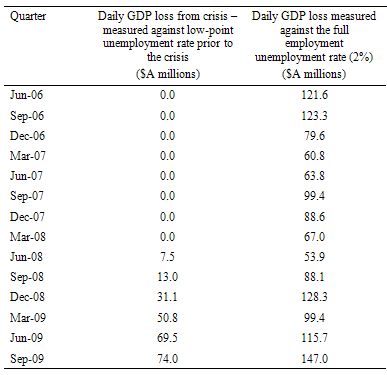

In the work that follows, I used the low-point unemployment rate prior to the crisis – for the US 4.5 per cent in March 2007 and Australia 4.0 per cent in March 2008 and the high-point participation rate prior to the crisis – 66.3 per cent for the US and 65.5 per cent for Australia.

The high-point participation rate allows us to adjust the labour force to eliminate the cyclical decline that occurs in a crisis as the discouraged workers who stop looking for work are not counted by the statistician as being unemployed. Economists call these people the hidden unemployed – they would work immediately if a job was offered to them.

The use of the low-point unemployment prior to the crisis is just a convenience and does not presupposes that this level was a full employment state. The question being asked is: What are the daily GDP losses arising from the increases in the unemployment rate as a result of the crisis?

For Australia, I also compute the daily GDP losses that arise from the economy being away from full employment (which I assume would occur at an unemployment rate of 2 per cent – the so-called frictional level of unemployment). So the question that is being asked then is: How has the divergence from full employment which has been exacerbated by the crisis impacted on daily GDP losses.

I also ignore underemployment in this analysis. So the estimates that follow are underestimating the true costs of the fiscal austerity. I use the term fiscal austerity because even though governments are running relatively large (historically) budget deficits as a proportion of GDP, they are still inadequate to effectively deal with the unemployment problem. The austerity reflects an overhang of the destructive neo-liberal ideology.

Method

First, I computed potential employment – so this can be computed as the employment level that would have existed given population growth had the crisis not occurred. In this way we fix the participation and unemployment rates at the peak of the last growth cycle as described above (we do this for the US and Australia).

Also for Australia, I computed the potential employment level which would exist if the unemployment rate was 2 per cent (that is, the full employment unemployment rate).

Second, I computed potential GDP using the potential employment levels multiplied by actual labour productivity (real GDP per person employed). So this series tells us what real GDP would have been if employment was at its potential level (defined above) and those workers were producing the average GDP per unit. Note that the concept of potential in this case does not mean the maximum GDP that could be produced.

Remember the selective way I am defining potential employment – as a departure from the maximum achieved prior to the crisis. For Australia the full employment employment potential is more accurately thought of as the highest employment level one could attain given other parameters.

Further, some will ask – why use average productivity when it is obvious that the unemployed are typically drawn from the lowest productivity pool? Surely putting these people back to work will not generate average productivity per person. That is true but not relevant in this case. By using actual labour productivity series I am actually understating the production gains that would occur.

Third, I calculated the daily real GDP losses in billions of dollars per day for the US and millions of dollars per day for Australia by dividing the gap between actual and potential real GDP by the number of days in each quarter.

This approximates the daily loss (never to be regained) in real income that is foregone by allowing unemployment to remain either above the level that was achieved immediately prior to the crisis (in US and Australia) or in the second case for Australia, by allowing unemployment to depart from its true full employment level of 2 per cent. The first estimates (deviations since the start of the crisis) understate the true costs by a greater margin than the second estimates for Australia (the departure from full employment).

Given the results are terrible as they stand and demand immediate policy attention, the fact the true results are in fact worse than these estimates just adds to culpability of our national governments.

Finally, I also computed as a standalone exercise a simulated real GDP series for the US and Australia based on the assumption that from the respective peaks (June 2008 for the US and September 2008 for Australia) real GDP continued to grow at the average rate of real GDP that had held for the 8 quarters prior to the peak – 2.4 per cent per annum for the US and 3.6 per cent for Australia.

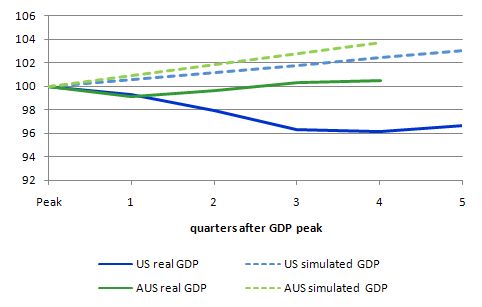

These simulations converted into index numbers to allow for comparability are shown in the first graph below along with the actual path of real GDP for each country.

The comparison gives you a good idea of the relative depths of the crisis in each country.

Results

The following graph shows the indexed time series for actual real GDP and the simulated potential GDP (if potential employment was achieved) where the base = 100 was the GDP peak quarter (June 2008 for the US and September 2008 for Australia). The horizontal axis represents the quarters after the peak up until September 2009 (the last available national accounts data). The index numbers allow us to compare the evolution of the two economies.

So actual US real GDP went from 100 at the peak to 96.2 at the trough and in September 2009 was 96.7 (index number values). Over the same period, its potential GDP rose from 100 to 103 leaving a huge gap of 6.3 percentage points.

For Australia real GDP went from 100 at the peak to 99.1 at the trough and in September 2009 was 100.5 (index number values). Over the same period, its potential GDP rose from 100 to 103.7 leaving a smaller gap of 3.2 percentage points.

So the cumulative GDP losses have been much smaller in Australia’s case but still significant.

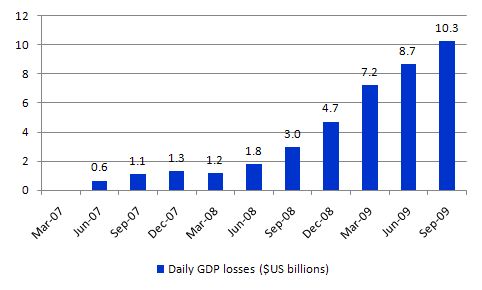

The daily GDP losses that the US economy is enduring as a result of the decline in economy activity below it previous peak are shown in the following graph. You can see that in the September quarter these stood at 10.3 billion per day.

Just say it to yourself – every day the US government is allowing $A10.3 billion to go down the drain in lost income just because they are too stupid to implement sensible direct job creation strategies.

There has been a marked unwillingness by the US government to engage in direct job creation. How can these deadweight daily losses be justified? The policy inaction is culpable in the extreme in this regard.

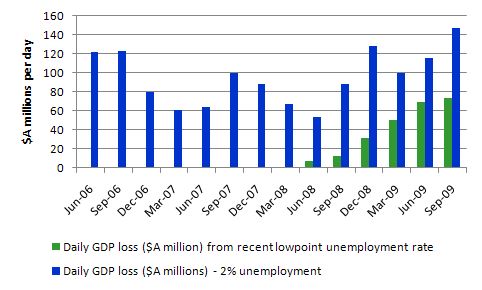

For Australia, I compared the daily losses that have occurred since the crisis began in Australia with the actual losses that have been on-going for some 35 years as a result of the contrived departure from full employment that has been imposed on us by the free-market ideological dominance?

One of the reasons I didn’t do this for the US is because I am less sure what the frictional unemployment rate is. The point is that it is probably below the 4.5 per cent benchmark I used so the daily losses I report are likely to seriously understate the actual losses.

There was also no point comparing the US and Australian losses in equivalent units because the relative costs for Australia are very small when you convert into billions of USD. But relative to each economy the respective losses are enormous.

The following Table shows the calculations. Relative to our recent best unemployment rate we are now losing $A74 million every day as a result of allowing the unemployment rate to rise. When considered against the current departure from true full employment unemployment rate (a 2 per cent) we are foregoing $147 million every day.

Just say it to yourself – every day we are throwing $A147 million down the drain because of our neo-liberal policy obsessions. No one in their right mind could justify that. It is the ultimate con of the mainstream economics profession.

The average daily loss since June 2006 as a result of the Australian government allowing unemployment to persist above the full employment level of 2 per cent was $A95.5 million.

Those losses are enormous and as noted above understate the true cost of the policy failure in allowing the unemployment rate to rise in the current crisis and also maintaining a fiscal regime that has stopped the economy achieving full employment.

The following graph shows the comparison for Australia (that is, just graphs the data in the Table above).

Conclusion

Even under conservative assumptions, the economic and social costs of sustained high unemployment are extremely high. The inability of unemployed individuals and their families to function in the market economy gives rise to many forms of social dysfunction, in addition to output loss.

The apparent failure of neo-liberal supply side policies to reduce unemployment prior to the crisis is now highlighted during the crisis. There is now an urgent need to address the large pools of unemployment in world economies.

The daily income losses alone are enormous and overwhelm other inefficiencies notwithstanding the productivity heterogeneity that exists across the workforce.

There is no financial reason why the government should not deal with this problem directly by introducing a Job Guarantee. If the Government had the political will, it could readily overcome the problem of persistently high unemployment.

Tomorrow – the Australian Labour Force survey for December comes out and so I will surely have something to say about that data.

Firstly, I added this blog to my list of economics blogs without knowing that Bill was a Professor at my own University where I study. Small world.

Secondly, conventional wisdom and I suppose conventional neo-liberal economics suggests that an unemployment rate of 2% would yield adverse cost pressures within the economy. Would the structure of an employment guarantee mean that cost pressures would not be present?

Just reading into the idea on the CofFEE website explains the inflationary impact of the system: http://e1.newcastle.edu.au/coffee/job_guarantee/JobGuaranteeAnswer.cfm?question_id=5

Curious, very curious. Although I do worry about the statement: “The budget deficit is too small if there is unemployment”.

Dear Rationalist

Small world – I am a Research Professor at the University and am attached these days to the Research Division rather than the teaching faculty. So I am not in the Faculty you are studying in.

Conventional wisdom doesn’t exist – it is always some concept pushed by the dominant ideology of the day. How come Australia had below 2 per cent unemployment for over 35 or more years without significant inflation? When inflation did become a problem it was driven by an external cost shock (OPEC).

I am in Engineering :).

In your view, can the principles of a generally “lean” government, with taxation <= 30% of GDP and some kind of comprehensive employment policy coexist with a policy for a balanced budget over the long term?

My impression of your methods are that you extrapolate GDP based on full private employment, rather than calculating GDP that would result from JG employment. Which is a very different thing. JG employment promises to contribute little towards GDP, either by way of pay, which would be substantially less than the private employment the fired workers previously held, or by way of productivity, which promises to be minimal indeed, due the various management difficulties of JG.

Dear Burk

You said:

The vast majority of workers who lose their jobs in a downturn are low-wage workers. The difference between the JG wage and their wage would be very small in fact. I also don’t think the productivity gap (however measured) would be that different also – what is the contribution of a worker rebuilding a damaged water course or helping an elderly person with their daily needs versus the productivity of a person working in stall selling mobile phones on a small commission? One might hypothesise that the former workers are very much more productive than that latter.

Overall, I don’t think the productivity loss be “substantially” large. Maybe even a productivity gain for society although the low-wage, high cost employers might not like it.

What exactly are the management difficulties of the JG? Already the unemployed in most advanced countries are “in the public sector” being “managed” by elaborate welfare and taxation systems. The only problem is they are not able to contribute. We have done a lot of research on this question for Australia and it is clear that the administrative arrangements to implement a JG are not more of a challenge than the systems we already have in place.

best wishes

bill

The US is facing prolonged structural unemployment (see links below) unless the government acts more forcefully. The cost of not acting is huge in terms of lost economic potential and decline of social welfare. According to the MMT analysis, there is essentially no financial cost for acting, since a sovereign government that is the monopoly provider of a non-convertible floating fx currency of issue is not financially constrained and can always purchase goods and services (like labor) for sale through currency issuance without the need to tax or borrow (although the US would have change the current voluntary political requirement of offsetting spending $4$).

The privilege of being the monopoly currency issuer is not only a sovereign prerogative, but also carries the responsibility of providing ample currency to balance nominal aggregate demand with real output potential. The only constraint is real. If the government provides in excess, then inflation results, and if deficient, then economic contraction and unemployment, or an increase in private debt. The US has already exhausted the private debt option, and is now facing debt deflation as a consequence of Ponzi finance. Time to get real.

Private sources of spending cannot sustain job growth

Number of job seekers per job opening rises to 6.4 in November

Even in a Recovery, Some Jobs Won’t Return

BLS: U3 10%, U6 17.3% Dec 09, trend rising

A Lost Decade for Private Sector Jobs

A decade of high unemployment is looming

In regards to the US, I have read that many jobs are being lost permanently. Does this indicate that potential, as well as actual, output is decreasing? If true then isn’t it also true that everyday unemployment increases future potential productivity further decreases? A double-loss if you will.

For example, unemployed graduates are not developing skills in the workplace that will enable them to contribute to aggregate output. Thus, over their lifetime, they will produce less than they otherwise would but for the current recession.

On the question of managing a JG scheme, as a Centrelink employee and I can say I am constantly amazed at the complexity of the programs we manage. Given the complex systems other agencies, such as Medicare and the ATO, also manage I have no doubt that we, as a nation, could effectively manage a program like this if the political will existed.

My only question is how would the jobs be determined? Would there be some kind of bidding and proposal process which NPOs or even private companies are invited to participate in? Perhaps a program where the government paid half the wages and the private partner paid the other half if the private partner agreed to provide a predetermined level of training. I think it would be important to keep it as independent of the political process as possible to avoid things like pork-barreling.

” Does this indicate that potential, as well as actual, output is decreasing?”

Productivity in a contemporary economic is chiefly a function of technological innovation. A lot of jobs are going away because they are being superseded. For example, Chrysler recently completed an entirely robotic auto production plant. Just feed in the materials. Robotics is at the cutting edge of technology, and it is going to be a huge factor going forward. A comparable plant can produce much more with fewer workers, so potential output increases and is only limited in use by demand. (One benefit of this could be falling prices down the line.)

A lot of jobs have left the developed countries and will continue to do so because of comparative advantage. Bad for low-skilled workers who have to complete with the low-paid workforce in emerging countries, since low-skilled jobs, especially, are fungible. But increasingly higher skilled positions are meeting competition, too. However, this is good for workers in the emerging countries. The developed countries are going to have to figure out how to deal with this or have growing problem at the bottom of society.

A JG would address these issues directly and as Bill has pointed out, it is far healthier socially than increasing the dole or homelessness. Moreover, economically it expands true GDP, which nominal GDP only approximates, since service work is under-compensated in relation to social contribution. Quantifying quality doesn’t really work since a lot gets missed. Moreover, economic “efficiency” is the servant of social effectiveness, not the master of it, as some ideologues seem to think.

I would also propose more educational grants and service programs to soak up excess workers higher up the chain rather than idling them or forcing them into under-employment or early retirement when they still want to work. There is plenty to learn and plenty to do, and the government can afford to take advantage of these resources not only as a social welfare contribution but also to increase true GDP measured in quality instead of just nominal quantity.

Hi Bill

Thanks for you daily writings.

Thought the following graph from the St Louis Fed would be relevent to this discussion.

http://research.stlouisfed.org/fred2/series/EMRATIO

Goes to show that you could justify a higher daily loss figure for the US if you go back to the dotcom participation high.

It seems to me that such a system would be a bit like the RBA’s interventions in the market which invariably return a profit (often substantial) to Government – they are buying currency when it is poorly valued and selling when it returns to normal levels. In this case, the Government can access relatively low wage resources when they are undervalued in the private market and effectively sell back a money earning asset (in terms of the taxes that they will be able to impose on a productive member of society) to the private sector as the economy improves.

But wasn’t it Mike Keating who did an investigation into the effectiveness of job creation programs in the 70’s or 80’s and concluded they were a waste of money, which led to them pretty much being scrapped? How did he come up with such a different answer?

Tom,

Moreover, economic “efficiency” is the servant of social effectiveness, not the master of it, as some ideologues seem to think.

How do you define “social effectiveness”? Is it the greatest good to the greatest number? Equality of consumption? Some subsistence level of consumption? Does “effectiveness” imply a minimum of economic disparity between individuals, or some sort of equality of distribution or outcome?

I assume that people produce to the maximum utility of themselves and their families (see “The “Selfish Gene”). Have modern technological societies permanently defeated scarcity, thus advancing beyond their own evolutionary biology?

csmith, according to Peter F. Drucker, efficiency is doing things right, effectiveness is doing the right things. The problem with neoliberalism as a policy-guide is that it equate economic policy with economic efficiency instead of social effectiveness. Economics is the servant of policy, not the master. In the US the preamble to the Constitution enumerates one of the chief purpose of government is providing for the general welfare. That is clearly a social goal with economic implications. It is a philosophical and political question as to how that will be implemented at any time in the country, but the debate is ill-served by the neoliberal assumption that good policy is based on economic efficiency, in that the way it is interpreted it makes capital the determining factor in their analysis. Capital is given the cover to extract what it can from the economy, and prosperity is measured in terms of GDP, not a broad measure of the standard of living. We can do better. but no one of us, nor any group of us, is the arbiter. It is the decision of all and it should be made in an informed way, taking into account the capacity that the government has to create broad prosperity through application of functional finance in a fiat regime according to MMT principles. Different political groups have different views on this, so let the debate begin. Right now, it is being stifled through ignorance and manipulation.

After as evolutionary biology is concerned, Nietzsche observed, I think correctly, “Man is to be transcended. What have you done to transcend him?” (Thus Spoke Zarathustra). Progressives believe in progress. Radicals believe in transformation. I am a radical.

Tom:

There is a point where “effectiveness” and efficiency work at cross purposes. If you take capital/savings/profit as a given, yes, you can argue for all the “transcendental” policies you want. In the real world, however, man makes his way to a higher state of general welfare only via his own effort and a bridge sturdy enough to carry him. I’m talking about a real bridge. You’re talking about an artist’s conception of a bridge.

Yes, man is to be transcended. What have I done to transcend him? I HIRED him.

Dr. Mitchell………Economics is a field driven by “indexes”-so where is our “Social Index” [Phillips Curve] which measures the damage caused by unemployment? Where is our doctoral dissertation?

President Obama/Council of Economic Advisers:

WILL RACISM DOOM AMERICA?

The major issue in the 2008 election-BEFORE-the Great Meltdown, was:

FIX UNEMPLOYMENT–

According to internationally recognized economist, Dr. William F. Mitchell, “High and persistent unemployment has pervaded almost every OECD country since the mid-1970’s.”-resulting in ubiquitous unemployment since.

And, since the mid-1970’s, as a result of automation, globalization, etc., the Market has been less, and less, capable of creating the jobs necessary to its viability. [We celebrate automation and then get a “deer in the headlights” look re the displaced employee]-

Economics is a field driven by “indexes”-so where is our “Social Index” which measures the damage caused by unemployment? And in spite of the May Jobs Report-why are we not looking at unemployment through such an index?

According to Dr. Mitchell, our “social” losses include:

“loss of current output; social exclusion and the loss of freedom; skill loss; psychological harm; ill health and reduced life expectancy; loss of motivation; the undermining of human relations and family life; racial and gender inequality; and loss of social values and responsibility.”

Further, Polls show that 86% of Americans believe that “Anybody willing to work should be able to find a job”….and if the market fails, the unemployed are out of luck…

In fact, Congress has the “authorization”-by federal law [15 USC § 3101]–as I write, to reduce our unemployment rate to 3% for persons aged 20 or over, and not more than 4% for persons aged 16 or over.

The bottom line, however, is: Going forward in the 21st Century, an expanding and contracting public workforce is an-indispensable– component to the effective functioning of a modern market economy….

In short, FIX UNEMPLOYMENT is a “win-win” solution-the American people win, and capitalism wins-thus, requiring our highest priority….

So there we have it-We know the problem, we have the support of the American people to solve it, and we have the legal authority to solve it–

But we have a Washington in paralysis, and being undermined by our lowest common denominator:

RACIST-DRIVEN, HYPER-PARTISAN REPUBLICANS IN CONGRESS, who are injuring the safety and well-being of millions of Americans–So they can pander to a tiny handful of racists constituents [bordering on criminality] -in their zeal to undermine President Obama!

See also: OUR GREED AND IGNORANCE, on Amazon/Kindle

Jim Green, Democrat opponent to Lamar Smith, 2000