I started my undergraduate studies in economics in the late 1970s after starting out as…

The Asian Century White Paper – spin over substance

Yesterday, the Australian Prime Minister launched the latest Federal Government statement, the – Australia in the Asian Century White Paper. The White Paper is full of jargon and superficial tags – such as “Australia’s 2025 aspiration”. While I am not critical of shorthand statements to capture a policy aim, when the substance that lies below the tag is either missing or based on false premises, then the hollowness of the policy statement is revealed. Such is the case in this document. It is littered with neo-liberalism and like previous statements, such as, “by 1990 no Australian child will be living in poverty”, which was made by a previous Australian Prime Minister in 1987 – to his regret ((Source). The pledge was not only impossible to achieve given the scale of the problem faced and the time before the pledge was due but the explicit embrace of neo-liberalism by that government also rendered the goal impossible. Poverty rates and inequality have increased since then as successive governments – Labor and conservative – have abandoned the government responsibility to achieve the related goals of full employment, equity in income distribution and broad social inclusion in economic outcomes. Yesterday’s White Paper release just continues that trend.

While the White Paper is a complex document and it will take me some weeks to fully absorb and examine the underlying assumptions the following comments capture my first impressions.

The White Paper defined “25 objectives for Australia to take advantage of the Asian boom by 2025 which are divided into five key areas: the economy, education and skills, commerce, regional security and culture” (Source).

The PM claims it is a “road map for national success as Asia’s unstoppable rise continues”.

I have always liked White Papers because they are statements of national aspiration. The famous 1945 – White Paper of Full Employment in Australia, which was among a suite of similar statements by advanced nations at the end of the Second World War were highly ambitious documents. They defined the overarching responsibility of national governments to ensure there were jobs for all and to lift the fortunes of the most disadvantaged.

The full reference is: Commonwealth of Australia (1945) Full Employment in Australia, Australian Government Printer, Canberra.

These full employment White Papers were statements of national solidarity and the role that national governments could play through the use of fiscal and monetary policy, supplemented by wages, industry, and educational policy.

The concept of the “social wage” was a paramount part of the Full Employment commitment. On Page 12 of the Australian White Paper on Full Employment we read:

In Australia, a significant contribution to living standards has been made in the past, and will continue to be made, by a high level of social services. Some of these are in the form of direct money payments, such as invalid and old-age pensions, child endowment and widows’ pensions. Others are services provided directly by governments authorities, including education, health and medical services, kindergartens and libraries.

The current White Paper on the Asian Century talks big on aspiration but ignores the reality of current government policy, which is eroding our chances of achieving some of the targets enunciated, which include (Source):

- By 2025, Australia’s GDP per person will be in the world’s top 10, up from 13th in 2011, requiring a lift in our productivity.

- This will mean Australia’s average real national income will be about $73,000 per person in 2025 compared with about $62,000 in 2012.

- Globally we will be ranked in the top five countries for ease of doing business and our innovation system will be in the world’s top 10.

- By 2025, our school system will be in the top five in the world, and 10 of our universities in the world’s top 100.

- All students will have continuous access to a priority Asian language – Chinese (Mandarin), Hindi, Indonesian and Japanese.

The macroeconomic straitjacket that the national government is imposing on a slowing economy is undermining the development of our educational sector; reducing the opportunities for innovation in our industries and forcing our future productive workers to to bear increasing rates of high labour underutilisation – via unemployment, underemployment and hidden unemployment – and our NEET rate (Not in Education, Employment, or Training) is high and rising.

The White Paper put out a series of Fact Sheets. One covered the Macroeconomic and Financial Frameworks – the Government was pursuing to allegedly support the long-run ambitions.

The usual neo-liberal spin is prominent. The Government claims it will:

We will meet our fiscal targets of achieving budget surpluses, on average, over the medium term (including through maintaining a 2 per cent annual cap on real spending growth, on average, until surpluses are at least 1 per cent of GDP and while the economy is growing at or above trend) and improving the Government’s net financial worth over the medium term.

Our commitment to fiscal discipline, including the return to surplus in 2012-13, will ensure Australia’s balance sheet remains one of the strongest in the developed world-maintaining our triple-A sovereign credit rating.

From a logical standpoint – based on an understanding of the opportunities that the fiat monetary system presents – we can conclude that none of these statements are applicable to a currency-issuing government, such as Australia.

Australia has had a long record of external deficits. The trade components is sometimes in surplus (but rarely). However, the net income transfers on the Current Account are always in deficit and the overall balance will remain in deficit no matter how strong our terms of trade are.

So a government that is planning to run surpluses of “at least 1 per cent of GDP” on average will oversee one of two undesirable outcomes.

First, it will be creating aggregate demand conditions that will undermine economic growth (highly likely) and therefore thwart its fiscal strategy (via the automatic stabilisers).

Second, the alternative is that the only way the economy can keep growing under the strain of this fiscal drag, is if the private domestic sector runs deficits of at least 1 per cent of GDP higher than the external deficit. That means that in balance sheet terms, the private domestic sector will be increasingly accumulating debt, a process that historically has been shown to be unsustainable, no matter how strong productivity growth happens to be.

The second alternative describes what happened in many nations in the lead up to the GFC. Households and firms, collectively, cannot accumulate ever-increasing levels of debt indefinitely. The private sector balance sheet becomes so precarious that even slight shifts in interest rates or labour market outcomes (rising unemployment) create financial crises.

While the concept of “Australia’s balance sheet”, when applied to the currency-issuing national government, which is the context used in the Government’s statement above, is inapplicable, the balance sheets of the private domestic sector have to be sustainable over time.

It is clear that a currency-issuing government can accumulate debt without solvency issues. The same does not apply to the private domestic sector. The Government’s statement thus amounts to committing to a strategy of recession-bias or growing financial instability courtesy of the increased precariousness of the private sector balance sheet.

Neither option is viable over time and neither can be said to be fiscally responsible.

In pursuing its “surplus at all costs” strategy, the Government demonstrates a gross ignorance of the sectoral balances that bind it.

Further, one might argue that the Asian Century strategy will be predicated on an export boom so large that the budget surpluses will be required to prevent the economy from overheating.

That is, a Norway-like circumstance, where the government can run surpluses while still maintaining high levels of public service and the private domestic sector can still pursue saving aspirations without undermining growth.

Even with our record terms-of-trade in recent years the external sector has not contributed positively to growth such is the scale of imports and net income transfers.

It is highly unlikely in the period to 2025 that this situation will change.

The White Paper is also deficient in explaining how Australia will actually increase its – Economic Complexity.

The Atlas of Economic Complexity – published by The Observatory of Economic Complexity of the Harvard Kennedy School and the MIT Media Lab notes that:

… economic complexity reflects the amount of knowledge that is embedded in the productive structure of an economy. Seen this way, it is no coincidence that there is a strong correlation between our measures of economic complexity and the income per capita that countries are able to generate.

The most recent – List of countries by economic complexity – has Australia ranked at 79th and over the period 1998-2008, the ECI score fell by -0.50 (which is large given the 2008 index score of -.0.321). Australia also slid 23 places in the rankings over the same period.

The top ranked nations export very sophisticated manufactured goods and services. Australia, instead, provides huge subsidies to foreign-owned car manufacturers who threaten to close their doors. Of-course, history tells us that even the receipt of these huge payments (currently around $A700 million per annum) does not stop the company closing down with the concomitant employment losses (for example, Mitsubishi). These payments are purely political in nature and do nothing to build the strength of diversity of our industries.

I will be providing more analysis on this question in future blogs because the issue forms part of the work I am currently doing with the Asian Development Bank.

The Government is also predicting a significant increase in real national income per capita. What is real gross national income per person?

The ABS provide this definition in the latest – Australian System of National Accounts, Concepts, Sources and Methods, Australia 2012 Edition 2:

Real gross national income (RGNI) is the real aggregate value of gross primary incomes for all institutional sectors, including net primary income receivable from non-residents.

It is calculated by adjusting real gross domestic income for the real impact of primary income flows (property income and labour income) to and from overseas.

The derivation is as follows:

The volume measure of GDP is adjusted for the terms of trade effect to derive real gross domestic income (RGDI). RGDI is estimated by:

- taking the volume measure of gross national expenditure (GNE);

- adding exports of goods and services at current prices deflated by the implicit price deflator for imports of goods and services;

- deducting the volume measure of imports of goods and services; and

- adding the current price statistical discrepancy for GDP(E) deflated by the implicit price deflator for GDP.

Real primary income (labour income and property income) payable to the rest of the world is deducted from RGDI, and real primary income receivable is added to RGDI. The real income flows are calculated by dividing the nominal amounts by the implicit price deflator for GNE. This adjustment derives real gross national income (RGNI) ….

This measure is then expressed in per capita terms.

So it depends crucially on our terms of trade, labour productivity, and labour utilisation.

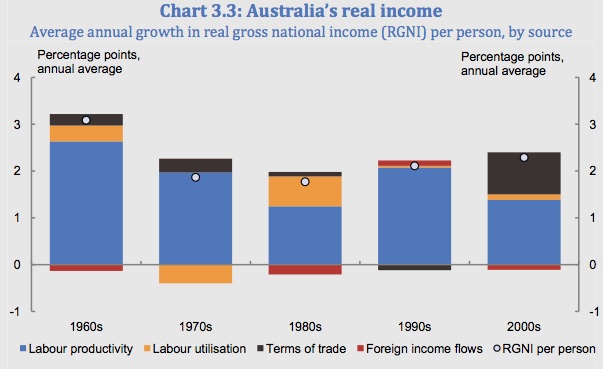

The White Paper provided the following graph (Chart 3.3), which shows the average annual real gross national income per person for the decades since the 1960s.

Note the declining contribution of labour productivity especially as the neo-liberal policy agenda has evolved and the reliance in the recent decade on terms of trade growth.

On Page 84-85 of the White Paper, we read:

The high exchange rate has raised concerns about Australia’s cost competitiveness and led to some to call for Australia’s wage costs to be reduced.

….There are many examples where advanced economies have had rising wage costs at the same time as their global market share has risen. As average living standards and wage incomes and costs surged in Japan and the United States in the post-war period, their share of global trade rose.

Although not necessarily desirable, another way to boost competitiveness would be for employers to reduce the profit share of income and lower the nation’s capital costs …

However, the best way to increase Australia’s real income in future, as has been done in the past, is to boost our productivity and participation and to engage with the region. This will require supporting our innovative firms … and building Australia’s capabilities … so they can tap into global production networks …

There are several points to note, some of which I will leave for another day.

First, in this blog – The fiscal stimulus worked but was captured by profits – I documented the shifts in national income shares in Australia over the last few decades.

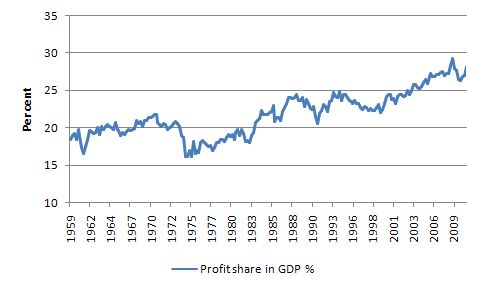

There has been a huge shift rise in the profit share in the last 20 years. The following graph shows the evolution of the profit share in Australia since 1959 (per cent of GDP). The data is available from the Australian Bureau of Statistics.

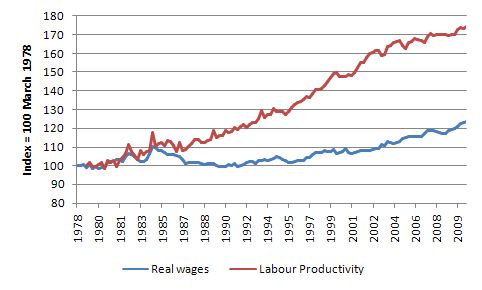

The next graph shows the evolution of real wages (indexed to 100 in December 1978) and GDP per hour worked (in the market sector) – that is, labour productivity for Australia. I could produce similar looking graphs for most advanced countries over this era which show the common trend towards an increasing gap between real wages growth and labour productivity growth. In Australia, real wages fell under the Hawke Labor government Accord era which was the beginning of the government-sponsored fraud against the workers.

Recall, that the Labor government argued that the boost to the wage share in the mid-1970s had “caused” the sharp rise in unemployment in the second-half of the 1970s – which meant they had bought the mainstream lie – the so-called “real wage overhang” argument. They argued that by redistributing national income back to profits within the Accord incomes policy framework the private sector would increase investment and solve the malaise. It was based on flawed logic.

The private sector did not respond in real terms but pocketed the largesse being redistributed to them by the government policy. Further, the centralised nature of the incomes policy only reinforced the bargaining position of firms by effectively undermining the traditional trade union movement skills – those practised by shop stewards at the coalface.

Under the conservative Howard years (1996-2007) there was some modest growth in real wages overall but nothing like that which would have justified by the growth in labour productivity. In addition, the harsh industrial relations legislation that the conservatives introduced further weakened the trade unions and reinforced the trend towards an ever-increasing profit share at the expense of the workers.

In March 1996, the real wage index was 103.4 while the labour productivity index was 132.7 (Index = 100 at December 1978). By the onset of the crisis (February 2008), the real wage index had climbed to 119.3 (that is, around 16 per cent growth in just over 12 years) but the labour productivity index was 170. So the long growth period after the 1991 recession had been associated with the ever-increasing gap between labour productivity growth and real wages growth.

In the most recent period (June 2010), the real wage index was at 125.3 while the labour productivity index was at 174.3 .

So when the White Paper resists the notion that competitive could be increased by restoring the balance in national income shares it is really endorsing the neo-liberal attack on wages.

Why is that a problem?

Prior to the gap between real wages and productivity emerging in the late 1970s, real wages growth kept track with the growth in labour productivity which ensured there would be no “realisation” crisis – that is, to ensure that the consumption demand could keep pace with actual output and the goods produced were sold.

As the gap started to increase the capitalist system encountered a problem. What happened to the gap between labour productivity and real wages? The gap represents profits and shows that during the neo-liberal years there was a dramatic redistribution of national income towards capital. The Australian government (aided and abetted by the state governments) helped this process in a number of ways: privatisation; outsourcing; pernicious welfare-to-work and industrial relations legislation; the National Competition Policy to name just a few of the ways.

Governments around the world introduced similar variants which were designed to ensure an increasing share of real income landed in the hands of capital.

The question then arose: If the output per unit of labour input (labour productivity) is rising so strongly yet the capacity to purchase (the real wage) is lagging badly behind – how does economic growth which relies on growth in spending sustain itself? This is especially significant in the context of the increasing fiscal drag coming from the public surpluses which started to squeeze purchasing power in the private sector over the same period (more or less depending which country we are talking about).

This munificence (income redistribution towards profits) manifested as the ridiculous executive pay deals that we have read about constantly over the last decade or so. It also provided the financial sector with its gambling stakes that exploded into an array of increasingly risky products. The “financialisation” of the global economy would not have been possible if real wages had have grown in line with productivity.

As noted, the realisation dilemma of capitalism was in the past moderated by the fact that the firms had to keep real wages growing in line with productivity to ensure that the consumptions goods produced were sold. But in the recent period, capital has found a new way to accomplish this which allowed them to suppress real wages growth and pocket increasing shares of the national income produced as profits.

The trick was found in the rise of “financial engineering” which pushed ever increasing debt onto the household sector. The capitalists found that they could sustain purchasing power and receive a bonus along the way in the form of interest payments. This seemed to be a much better strategy than paying higher real wages. The household sector, already squeezed for liquidity by the obsession in building national government surpluses were enticed by the lower interest rates and the vehement marketing strategies of the financial engineers.

The financial planning industry fell prey to the urgency of capital to push as much debt as possible to as many people as possible to ensure the “profit gap” grew while the output produced was continually being sold. And greed got the better of the industry as they sought to broaden the debt base. Riskier loans were created and eventually the relationship between capacity to pay and the size of the loan was stretched beyond any reasonable limit. This is the origins of the sub-prime crisis.

The fact that governments were able to run surpluses in this period is no indicator of their financial acumen. Rather, it was because the economic growth was being driven by ever-increasing private indebtedness. It was a folly to think we could sustain that growth strategy. As we know it imploded with severe consequences for the very cohort that has been squeezed by the income redistribution – the workers.

So by refusing to endorse policies that would see a rise in the wages share and a wage rule that allowed real wages to keep pace with productivity growth, the White Paper is just committing the nation to more of the same. We will await the next crisis.

This is, of-course, tied in with the flawed macroeconomic strategy detailed above.

Further, “2025 aspirations” assume “unchanged projections for labour utilisation, net income transfers and the terms of trade”. The latter assumption is unlikely to be realised. The record terms of trade are are already declining and that trend will continue. It is highly unlikely that Australia could enjoy another 13 years of terms of trade at the levels witnessed over the last 10 years (with an interruption for the GFC).

As you can see from the Chart 3.3 above, the growth in real gross national income per capita in the last decade is mostly down to the terms of trade. When that impact is reduced then we will see the impacts of a an economy being starved through fiscal restraint and low productivity.

The – OECD Employment Outlook 2012 – noted the declining wage share in national income and the link with rising inequality:

Like many OECD countries, the labour share – or the share of wages, salaries and benefits in national income – declined in Australia between 1990 and 2007. The latest edition of the OECD Employment Outlook shows that Australia’s labour share fell by 3.8 percentage points and by 5.1 percentage points if the mining and real estate industries are excluded. Many factors have contributed to the decline, including increased domestic and international competition, higher productivity and capital- deepening. However, a reduction in the bargaining power of workers has also played a role. Australia experienced one of the strongest declines in trade union membership in the OECD over that period, as well as a significant drop in the share of workers whose wages were set by collective agreements or awards. Such trends are likely to have reduced the bargaining power of workers, especially the low-skilled. The decline in the labour share in Australia has also been associated with an increase in wage and income inequality over recent decades.

We know that natinos with higher degrees of income equality grow in more stable and robust fashion. Australia has to reverse this trend. But the policy frameworks advocated in the White Paper will not contribute to that sort of dynamic.

We can expect more of the same over the next decade under the current policy framework, which will undermine the aspirations outlined in the White Paper.

Further, the White Paper is in denial about the state of the Australian labour market, particular the youth segment, which will be of crucial importance in the coming decade because today’s youth are tomorrow’s adult workforce.

The overall construct is that “unemployment is low”, which we are told about many times in the White Paper.

On Page 106, we read:

Australia has an enviable combination of solid growth, contained inflation, low unemployment and strong public finances. This stands in stark contrast to the weak and challenging economic conditions faced in many parts of the developed world.

There is no mention of underemployment, which is a major problem in Australia. Even the OECD remarked ….

In the OECD Employment Outlook 2012, there was a section entitled How does Australiac compare?, which documented the issue of underemployment.

The OECD said:

Nevertheless, underemployment continues to be a significant problem, particularly for women. More than 12% of the labour force are now either unemployed or working part-time and would like to work longer hours, an increase of two percentage points since 2007. At 7.2% in the fourth quarter of 2011, Australia’s rate of underemployment is much higher than the OECD average of 5.0%, so that total labour underutilisation in Australia is close to the OECD average, despite much lower unemployment. While underemployment is not as potentially damaging to workers as unemployment, it can have long-term consequences for career progression, earnings potential and retirement income. This is of particular concern as the majority of Australia’s underemployed workers are women, who already suffer from lower earnings and retirement income than men.

The reality is that Australia is wasting at least 12.5 per cent of its willing labour force via unemployment and underemployment. Statements such as “unemployment is low” deny this reality. Further, our participation rates are well down on the pre-crisis peaks and so hidden unemployment has risen.

But, more worrying, in terms of future projections of productivity, is the state of the youth labour market. There is no mention of youth unemployment in the White Paper. There is also no mention of the incidence of

The NEETs in Australia.

In a recent statement – G20 Labour Ministers must focus on young jobseekers – the OECD notes that:

The unemployment rate alone does not reflect the full picture, as many young people who have left education no longer appear in labour force statistics. At least 23 million young people in OECD countries are neither in education, employment or training – so-called NEETs – more than half of whom have given up looking for work.

The May 2012 OECD document – The challenge of promoting youth employment in the G20 countries – notes:

… for many young people inactivity is the result of discouragement and marginalisation, which may reflect the accumulation of multiple disadvantages such as the lack of qualifications, health issues and poverty and other forms of social exclusion.

Australia fares badly in terms of youth unemployment. In my monthly labour force commentaries I document the plight of our youth.

In these blogs – The scourge of youth unemployment and Age discrimination against our teenagers should end – I discuss the teenage issue in more detail.

Australia has high rates of youth underutilisation. The longer-run consequences of this teenage “lock out” will be very damaging.

At a time when we are wasting so much of our future productive potential and our societies are ageing, the last thing we should be supporting is fiscal austerity which not only undermines prosperity in the present but also will irretrievably compromise future prosperity.

Labour markets around the world are failing the youth. At a time when we keep emphasising the future challenges facing the nation in terms of an ageing population and rising dependency ratios these economies fail to provide enough work (and on-the-job experience) for our teenagers who are our future workforce.

There is an urgent need for governments to introduce employment, education and training guarantees for the youth of the world. It will be a much worse place in the coming years if they do not.

What we need are governments who will commit to a policy platform of zero waste of all workers. We are a long way from that at present.

So the youth underutilisation issue is intrinsically related to the challenges faced by the “Asian Century”.

It is clear that governments should always be forward looking and accept that its fiscal position will reflect changing challenges in terms of providing adequate public services and infrastructure while always be seeking to ensure that aggregate demand is sufficient to maintain production at the levels required to fully employ the available workforce.

From the perspective of Modern Monetary Theory (MMT) perspective, national government finances can be neither strong nor weak but in fact merely reflect a “scorekeeping” role.

MMT tells us that when a government boasts that a $x billion surplus, it is tantamount to saying that non-government $A financial asset savings recorded a decline of $x billion over the same period.

So when a government aims to achieve a surplus it must also be wanting the non-government $A financial asset savings to decline by an equal amount.

For nations that run current account deficits over the same period, we can then interpret that aim as saying that it is fiscally responsible to drive the private domestic sector (as a whole) into further indebtedness. That is a consequence of such behaviour. It is not what MMT would suggest is responsible fiscal management.

It follows that the entire logic underpinning the “ageing society-fiscal consolidation” debate is flawed. Financial commentators often suggest that budget surpluses in some way are equivalent to accumulation funds that a private citizen might enjoy.

This idea that accumulated surpluses allegedly “stored away” will help government deal with increased public expenditure demands that may accompany the ageing population lies at the heart of the neo-liberal misconception. While it is moot that an ageing population will place disproportionate pressures on government expenditure in the future, it is clear that the concept of pressure is inapplicable because it assumes a financial constraint.

A sovereign government in a fiat monetary system is not financially constrained.

The government budget constraint is not a “bridge” that spans the generations in some restrictive manner. Each generation is free to select the tax burden it endures. Taxing and spending transfers real resources from the private to the public domain. Each generation is free to select how much they want to transfer via political decisions mediated through political processes.

The real policy issue relating to the ageing society is the movement in the dependency ratio. Please read my blog – Another intergenerational report – another waste of time – for more discussion on the dependency ratio.

There will be no problem with our ageing societies if there are enough real resources are available to meet the future demands. In this context, the type of policy strategy that is being driven by these myths will probably undermine the future productivity and provision of real goods and services in the future.

The quality of the future workforce will be a major influence on whether our real standard of living (in material terms) can continue to grow and we take into account the rising dependency ratios.

We should be doing everything that is possible to educate, train and employ our youth so that they will achieve higher levels of productivty into the future and offset the rising dependency ratio.

Unfortunately, tackling the problems of the distant future in terms of current “monetary” considerations which have led to the conclusion that fiscal austerity is needed today to prepare us for the future will actually undermine our future.

Maximising employment and output in each period is a necessary condition for long-term growth. It is madness to exclude our youth – many of whom will enter adult life having never worked and having never gained any productive skills or experience.

Further encouraging increased casualisation and allowing underemployment to rise is not a sensible strategy for the future. The incentive to invest in one’s human capital is reduced if people expect to have part-time work opportunities increasingly made available to them.

Ultimately the ageing society challenge is about about political choices rather than government finances. If there are goods and services produced in the future, then the sovereign government will be able to purchase them and provide them to the areas of need in the non-government sector.

The challenge is to make sure these real goods and services will be available.

Conclusion

I will have more to say about the White Paper another time.

This blog provides some introductory themes upon which further analysis will be provided. Further, I didn’t even touch on the failure of our education policy, which has seen Australia plummet in world rankings.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

I just love the claim that “by 1990 no Australian child will be living in poverty”. In the UK, poverty is defined as living on an income of less than 60% of average income. That means that if and when the average family has ten houses and ten helicopters / private jets, there probably be millions of “poor” people with six or fewer houses and six or fewer helicopters / private jets.

“That means that if and when the average family has ten houses and ten helicopters / private jets, there probably be millions of “poor” people with six or fewer houses and six or fewer helicopters / private jets.”

And should that ever happen, which of course it won’t because it is a logical fallacy argument, then by the standard of living at the time they will be poor.

By the standard of living in 1912 almost nobody in the west is now poor. But then outside middens, no running water, barely any heating and fifteen people living in three rooms was considered perfectly normal and acceptable at the time.

The less than 60% of average income definition is there to define the shape of the income distribution curve in a country that values social mobility, income equality and social cohesion. It’s the relative differences that matter.

One of the reasons the wealthy abhor MMT proposals, is that even though it would make them richer in absolute terms it would also make them poorer in relative terms. It’s the compression of relative wealth that really seems to upset people.

Gillard – “as Asia’s unstoppable rise continues”. Hah,since when was anything in the realm of Homo Saps “endeavour” unstoppable? I’m getting to the stage where I regard everything this silly woman says as a joke,albeit a sick one.Even the Mad Monk looks good by comparison.

I find the BS about pushing Asian languages on our youth particularly mad and irritating.English is the lingua franca globally at present and probably for some time to come.There is absolutely no benefit for most Australians in learning some obscure Asian language even though teeming millions speak that language in the hell holes of their own making.

In addition,we have a literacy problem in Australia.A lot of our youth, in particular,while nominally literate seldom read by choice,do not fully comprehend what they read,seldom write by choice and what they do write is close to incomprehensible and quite often can’t/won’t speak in a manner comprehensible to anybody outside their peer group/gang/whatever.

Grandiose notions about an Asian Century just don’t cut it with me and I doubt with very many other Australians.We have more than enough home grown problems. Let’s address them first,second and always. But we won’t get anything sensible from Gillard in that regard.

The UK and eu definition of poverty is an individual living in a household where the total income for that household is less than 60% of the median (not average) wage. In the UK the median wage is around £26k and thus that figure is About £15.5k. This is an abismally small wage, and recent figures show that many UK workers earn below this. A shocking indictment of our goverments past and present.

Hi Bill,

Where did you get the real wage data for the 80s and 90s? I have been looking for it everywhere on the ABS site with no success. Historical data of any kind pre-1996 is next to impossible to find.

Thanks mate.