In the annals of ruses used to provoke fear in the voting public about government…

Japan grows – expansionary fiscal policy works!

I have been noticing that a new narrative is coming out of the financial journalists acting as mouthpieces for various politicians and neo-liberal think-tanks around the place – along the lines that we have got it wrong – the debate now is not about austerity versus growth – but, rather, it is about structural reform and freeing up markets. The austerity is just a re-alignment of the public-private mix. I find that offensive but also odd – given that private businesses are being undermined at a rate of knots by the austerity and capital formation is stagnant (thereby undermining future prosperity). But amidst all this reinvention you still read the same scaremongering and mis-information along the traditional lines – austerity is good and the hope that increased spending can help is a pipe dream.

The Wall Street Journal article (May 23, 2012) – Arigato for Nothing, Keynes-san – is a case in point. Arigato means thank you in Japanese – so you get the drift immediately.

The author says that:

With economists and commentators perennially pushing the idea of more Keynesian stimulus in the West (and China-see above), it’s worth looking in again on a country where this experiment has been running for several decades. Japan last week posted surprisingly strong growth for the first three months of the year thanks largely to government spending. Yesterday this good news, such as it is, was overshadowed by Fitch’s latest cut to the country’s credit rating.

I love it when the neo-liberals invoke Japan as their example of fiscal policy gone wrong. The strong growth was no surprise at all – given the fiscal reaction to the Tsunami. There was a strong counter-cyclical increase in government consumption and investment growth in response to the natural disaster which prevented growth from plunging again.

The government also provided cash subsidies to households to enable them to purchase environmentally-friendly motor vehicles.

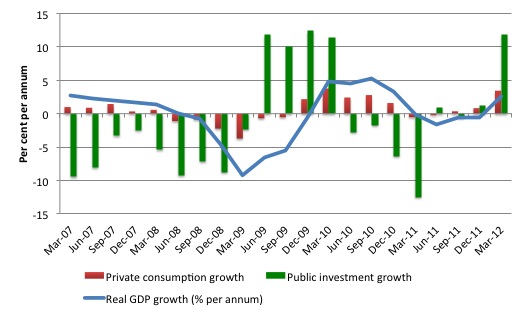

The first graph shows real GDP growth (per annum) in Japan since the March-quarter 2007 (blue line) and private consumption growth (red bars) and public investment growth (green bars) over the same period (up to March-quarter 2012). The data comes from the Economic and Social Research Institute, Cabinet Office, Government of Japan, which is the official provider of National Accounts data in Japan.

Japan was not only hit by the financial crisis (where net exports collapsed in early 2008) but later in 2011 it had to endure the tsunami which devastated its north-east regions.

During the financial crisis, private investment and net exports fell into negative growth for most of 2008-09. There was a strong counter-cyclical fiscal response in both public consumption and investment over this period of private spending decline.

The government started withdrawing its fiscal stimulus too early – even though growth in government consumption continued through 2010 as public investment started to contract. While the non-government components of spending were starting to recover they were not strong enough to resist the slowing fiscal impact and so real GDP growth started to moderate.

The fiscal response in the most recent crisis has been strong and even though net exports once again started to drain growth the overall slump instigated by this devastating natural disaster was relatively modest and short-lived. Once again the recovery has been led by a strong counter-cyclical fiscal response which has also boosted private consumption growth.

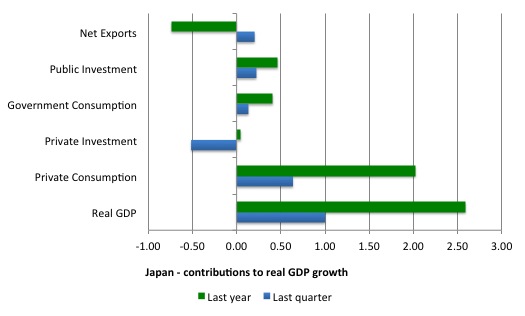

The next graph shows the contributions (in percentage points) to real GDP growth in Japan over the last quarter and the last 12 months (to the March-quarter 2012). Once again you observe the strong contribution from the government sector to real GDP growth at a time when the natural disaster had damaged the nation’s export capacity and spooked private investment.

But the Wall Street Journal article isn’t impressed – “So why isn’t anyone cheering?” we are asked. Well I am sure the workers who retained their jobs as a result of the stimulus are definitely cheering.

The answer apparently to the question is that:

… everyone knows it won’t last … In Japan, it seems, economic growth has literally become a matter of “government spending or bust.” And increasingly Tokyo is aware that it may get both, since government money eventually has to come from somewhere, meaning taxpayers. Tokyo has unleashed trillions of yen over the past two decades in public-works spending, such that debt now stands at more than 200% of GDP.

I often read that Japanese taxpayers are going to have to pay for all the government spending once the debt blows up. These are long-standing predictions. But what are the facts.

Income tax rates in Japan have been falling over the last 30 odd years and the tax structure has flattened considerably (Source). There were some minor adjustments (upwards) to marginal tax rates in certain income segments in 2007.

Further the sales tax rate has stood at 5 per cent for years even though deficits have been increasing.

We must always distinguish between a rise in tax revenue (at constant rates) and rising tax rates itself. The former signifies growing incomes and employment while the latter means that disposable incomes per dollar earned are reduced.

Japan is currently embroiled in another 1997-event as conservative politicians try to push through a doubling of the sales tax (from 5 to 10 per cent).

In 1997, the Japanese government was pressured by conservatives who were predicting an imminent fiscal collapse (government running out of money) into increasing the sales tax from 3 per cent to 5 per cent. This was the last time the sales tax was increased.

For the record, in the early 1990s, there was a major collapse in private spending in Japan, a nation already committed for cultural and institutional reasons to a high private saving rate. The collapse followed the bursting of a very large property price boom. Japan then entered its lost decade.

The Japanese government was overly cautious with respect to the provision of fiscal policy stimulus. They initially adopted an expansionary role which delivered modest real GDP growth. But, over this period they were constantly harassed by the deficit-terrorists and in 1997 succumbed to the pressure and introduced a contractionary budget (increasing the sales tax rate). The economy, which was showing some signs of recovery given the fiscal support, nose-dived.

This led to the period of expansionary monetary policy. Over most of this period the Bank of Japan (BOJ) ran two distinctive policies: (a) its zero-interest-rate policy (ZIRP) which began in February 1999 – in its official statements the BOJ said it would maintain the call rate (the short-term policy rate) at zero until deflationary concerns are dispelled” (Source: BOJ Statement April 1999); and (b) a policy of quantitative easing which saw the BOJ from March 2001 adding bank reserves in excess (by a large margin) of the volume needed to ensure its liquidity management operations could maintain the zero policy rate.

The ZIRP policy wasn’t consistent and in some periods the call rate was allowed to rise to 0.25 of a percent but mostly it was held at zero. The BOJ has consistently told the financial markets that the ZIRP would only be relaxed when the annual core inflation rate has “been positive for several months and, moreover, is expected to remain positive”.

Researchers have studied whether the ZIRP actually impacted on the term structure. A number of poor mainstream studies tried to deny the impact and instead said the long-term rates were just a function of the deflation and would spike up at any time if growth was expected.

They were wrong – as usual.

In 2004, the Bank of International Settlements held a conference in Switzerland on the theme – Understanding Low Inflation and Deflation. One paper presented at the Conference – Japan’s deflation, problems in the financial system and monetary policy – by Naohiko Baba, Shinichi Nishioka, Nobuyuki Oda, Masaaki Shirakawa, Kazuo Ueda and Hiroshi Ugai (hereafter Baba et al) – examined several features of the Japanese monetary policy.

Contrary to earlier studies, the authors found that the ZIRP had:

… significant effects on the term structure of interest rates

Further, in relation to the quantitative easing (QE) the authors find that the aim was to maintain “ample liquidity supply by using the current account balances (CABs) at the BOJ as the operating policy target and the commitment to maintain ample liquidity provision until the rate of change in the core CPI becomes positive on a sustained basis”. The CABs are the central bank reserves held by the commercial banks.

To give you an idea of how significant the QE was in volume, Baba et al note that the BOJs commitment to a liquidity target on the CABs was:

… raised several times, reaching ¥ 30-35 trillion in January 2004, compared to the required reserves of approximately ¥ 6 trillion.

So to maintain the stable zero interest rate the BOJ just had to leave around 6 trillion yen in the system but instead within 3 years of the policy beginning had added almost 6 times that volume.

Two things to note about this. First, the growth in the bank reserves (base money) did not generate anything like a proportional increase in the broader monetary aggregates. Modern Monetary Theory (MMT) teaches you that increasing bank reserves does not increase the ability of the private banks to lend (create credit). This is a myth that mainstream macroeconomics textbooks perpetuates.

Second, the rather significant increase in bank reserves in Japan did not push up inflation which remained persistently wedded to crawling along the horizontal axis (that is, at zero) and occasionally cutting it into the negative orthant. Again this defied mainstream macroeconomics predictions. However, from a MMT perspective it was to be expected.

Please read the following blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – for further discussion on this point.

The Japanese government also reintroduced fiscal stimulus after the 1997 catastrophe. The evidence suggests that it was this move that promoted real GDP growth in the subsequent period which persisted weakly until the recent crisis. The evidence also suggests that the monetary policy interventions were less effective for the reasons I explain in the two blogs noted in the last paragraph.

Baba et al make an interesting observation on Japanese fiscal policy:

Aggressive fiscal policy supported by aggressive monetary expansion could function as a powerful weapon to fight deflation. In a sense, the BOJ has partially provided such a framework by maintaining a near-zero short-term interest rate for almost 10 years. The fiscal authority, however, has stopped shy of exploiting this environment, as can be seen by sharp reductions in public investment since 1996.

So if they had have been more aggressive earlier and consistently so, the lost decade might have been just a drawn out recession and they would have resumed robust growth much earlier than they did.

Fast track to 2012. The IMF has been pressuring the Japanese government to triple the sales tax (from 5 to 15 per cent). In July 2011 – the IMF claimed that the fiscal position in Japan was in urgent need of consolidation – see IMF urges Japan to triple sales tax to steady finances.

Now the new Prime Minister in Japan has been trying to push that agenda through since he was elected in September 2011. He is proposing to double the sales tax by 2015.

My prediction is clear – if they succeed in pushing that through the parliament then a recession will follow under current circumstances.

They should heed the lesson from 1997.

The last thing the Japanese government should be doing is withdrawing its fiscal support by increasing taxes. It has low to negative inflation, steady but persistent unemployment, rising underemployment, emerging growth, a massive infrastructure deficit due to the tsunami, and flat private spending.

What does the IMF think will happen if they further squeeze consumers with a sales tax rise? This is exactly what stalled their recovery in 1997. The economy contracted sharply and the budget deficit continued to rise then because the government fell into the spell of the deficit terrorists who pressured them to do some about the budget deficit by increasing taxes.

We are back to that sort of nonsensical logic.

But the Wall Street Journal article thinks that:

The world’s formerly second-largest economy stands as a rebuke to those who argue Keynesian sprees help unleash private-sector-led growth down the road. Japan is a long way down that newly built, and rebuilt and rebuilt-again road and, as the latest quarter shows again, the country is still waiting for the private growth to materialize.

To see the lie in this claim consider the following graph which is taken from the Japanese National Accounts. It shows the private non-residential investment ratio (as a per cent of real GDP) from the March-quarter 1994 to the March-quarter 2012. The cyclicality is clear as is the reaction in 1997 to the sales tax rise and the drop in consumption spending that followed.

Further with renewed fiscal support following the 1997 disaster, private non-residential investment increased as a proportion of real GDP steadily until the financial crisis hit in 2007. It is once again showing signs of recovering in the aftermath of the devastation left by the Tsunami.

Finally, the same arguments are being wheeled out after the Fitch ratings downgraded Japanese sovereign debt.

I discuss the recent history of Japan’s sovereign debt run-ins with the credit rating agencies in this blog – Ratings agencies and higher interest rates.

In a nutshell, in November 1998, the day after the Japanese Government announced a large-scale fiscal stimulus to its ailing economy, Moody’s made the first of a series of downgradings of the Japanese Government’s yen-denominated bonds, by taking the Aaa (triple A) rating away. By December 2001, they further downgraded Japanese sovereign debt to Aa3 from Aa2. Then on May 31, 2002, they cut Japan’s long-term credit rating by a further two grades to A2, or below that given to Botswana, Chile and Hungary.

In a statement at the time, Moody’s said that its decision “reflects the conclusion that the Japanese government’s current and anticipated economic policies will be insufficient to prevent continued deterioration in Japan’s domestic debt position … Japan’s general government indebtedness, however measured, will approach levels unprecedented in the postwar era in the developed world, and as such Japan will be entering ‘uncharted territory’.”

The Japanese government (Finance Minister) responded very sensibly: “They’re doing it for business. Just because they do such things we won’t change our policies … The market doesn’t seem to be paying attention.”

Indeed, the Government continued to have no problems finding buyers for their debt, which is all yen-denominated and sold mainly to domestic investors. It also definitely helped Japan that they had such a strong domestic market for bonds.

In the New York Times (July 6, 2002), the logic of the rating was questioned:

How … could a country that receives foreign aid from Japan have a better rating than Japan itself? Japan, with an economy almost 1,000 times the size of Botswana’s, has the world’s largest foreign reserves, $446 billion; the world’s largest domestic savings, $11.4 trillion; and about $1 trillion in overseas investments. And 95 percent of the debt is held by Japanese people.

The UK Telegraph article said of Japan at the time:

Bizarrely, securities backed by mortgages sold to people without the income to service the debt they were taking on were being judged a better credit risk than the sovereign government of Japan, with the ability in extremis both to raise taxes and print money to avoid a default.

Rating sovereign debt according to default risk is nonsensical. While Japan’s economy was struggling at the time, the default risk on yen-denominated sovereign debt was nil given that the yen is a floating exchange rate.

In general, the Bank of Japan showed in the period from the mid-1990s onwards that they can keep interest rates very low (zero) and issue as much government debt as they wanted even in the face of consistent credit rating agency downgrades.

So if a government stands up to the agencies their impact is likely to be minimal. Please read my blog – Who is in charge? – for more discussion on this point.

Further the Japanese government has it within their capacity to stop issuing debt whenever they want to change the regulations/laws that dictate these absurd voluntary constraints.

The Japanese government issues risk-free public debt to provide a modest return to the household savers without recourse to foreign-currency denominated sources while maintaining economic growth with spending which provides the source of that household saving and keeps unemployment relatively low.

The Japanese treasury and central bank understand this. The conservative politicians might be getting spooked but then they are probably being advised by young PhD graduates from US universities who have been poorly educated.

Let me say there will be no Japanese sovereign debt crash – now, soon nor ever. The fact is that the Japanese government never has any problem issuing its debt at low yields and at least the bond traders understand that.

Conclusion

Economists and financial market commentators etc have been lining up with predictions of a Japanese apocalypse for years now. As the budget deficits persisted, interest rates stayed at zero, long-term rates were similarly very low and stable and inflation fell and at times deflation was the issue.

If we had the inclination we would be able to produce a time series of predictions of disaster from all the major economists who comment on Japan.

Year-in, year-out they have been peddling the same line. And we waited patiently.

Those of us who work within the framework provided by MMT have never predicted a meltdown in Japan. It all made sense within the stock-flow consistent monetary framework that is one of the basic building blocks of MMT.

On other matters – employment losses in Australia

Australia is currently basking in the glory of a few mining sector billionaires. They throw their weight around claiming to be the creators of all wealth in Australia, threaten governments who dare propose resource rent taxes or carbon taxes, buy newspapers to further spread their banal narratives, and generally make fools of themselves.

The press wheel them out every day as superheroes so yesterday we learned that mining heiress Gina Rinehart is now the richest woman in the world and last year her wealth grew by $A598 per second or $A52 million per day or $A19 billion over the year. She earns the equivalent of the average annual wage ever 2.5 minutes.

But the most insightful comment came from the Fortescue Mining boss who told the media that the economic crisis in the Eurozone (Source):

In global economic terms, it is more storm in a teacup beaten up by the media.

Stunning really – I wish I had thought of that line.

The following is a 700-word article I wrote for the Fairfax press today on the closure of a firm in a regional area of Australia which happens to be the major employer. Remember it was written for a daily newspaper and so there is little scope to explain any of the conceptual points underpinning the argument.

Australian readers will relate to it more than those from abroad although the general principles apply everywhere.

Op Ed text begins

The OECD announced this week that Australia leads all advanced nations on its Better Life index. Apparently we have never had it so good.

We have a mining boom and a government intent on being the first in the developed world to record a surplus after the crisis generated large deficits everywhere.

Yet, pundits are wondering why anxiety levels about the future are so high.

The boom-time narrative doesn’t resonate because it is largely the spin of politicians, neo-liberal think-tanks (such as the OECD) and business leaders.

The same day the OECD was telling us how happy we should be, Kurri Kurri received news that around 350 jobs will be lost as its aluminium smelter finally closes it uneconomic plant. More jobs will go as the flow-on from the lost wages undermines local businesses.

Every day in the industrial heartlands of our large cities and in smaller regional towns where manufacturing and light industry is the key employer the same story is being told. Companies are closing their doors and shedding jobs because of the adverse “macroeconomic” environment and the high Australian dollar.

Our federal government tells us daily how the economy is close to full employment. They say they have to run surpluses to avoid an inflationary spiral arising from the mining boom investment, yet inflation is falling due to declining economic growth.

The ABS estimates broad labour wastage (unemployment and underemployment) to be around 12.5 per cent. The youth labour market is in a parlous state.

It is worse in regional areas such as Kurri Kurri, where unemployment is well above the national average and youth unemployment is endemic. With its major employer leaving, its prospects are bleak.

Our regional towns are being hollowed out as businesses fail and the young and skilled leave to find work elsewhere.

The Government’s current (unstated) strategy (combined with excessively high RBA interest rates) is to deliberately create unemployment in the non-mining regions (where most of us live) so that the idle resources can then service the mining boom. Not only will the required migration patterns fail to occur but non-government spending will not be strong enough to sustain growth.

The Government admitted its recent budget will push unemployment up in 2012-13. Instead of being preoccupied by a surplus and undermining businesses, the government should pursue full employment.

Other factors have also been important in the closure decision.

The company failed to invest in best practice technology with the consequence that its plant has become increasingly unprofitable.

More recent developments have amplified the consequences of this mal-investment.

World aluminium prices – around $3300 per tonne in early 2008 – plunged to around $1200 per tonne in late 2008 and are now around $2000 per tonne.

So while parts of the resource sector are enjoying strong world prices, the fiscal austerity onslaught is generally choking world economic activity and export markets.

Further, cheaper supply operations have emerged in China and elsewhere undermining the competitiveness of old aluminium plants.

The rising Australia dollar – the result of our excessively high interest rates and strong world demand for some minerals – has been the final straw in the firm’s lost competitiveness

The company also has had difficulty in negotiating a long-term electricity supply contract with the NSW government.

The political opportunism of the federal coalition in citing the carbon tax as the major reason for this closure is a cynical and wrongful attempt to score political points while workers suffer.

It is true that a properly designed carbon tax should aim to reduce carbon-intensive activity in our economy and redirect resources to more environmentally sustainable areas of the economy including new renewable energy jobs.

But the factors I have cited dwarf any future carbon tax impacts.

My criticism of government in this regard is that they have no coherent structural adjustment vision in place – including job creation strategies – to allow the losers from the carbon tax to maintain income while re-skilling.

It is the disparate economic fortunes being experienced across our regional space that account for our collective anxiety.

We know there is something intrinsically wrong when Gina Rinehart can earn the equivalent of the average annual wage every 2½ minutes yet workers in our regional areas have to face entrenched unemployment and increasing poverty.

That is enough for today!

Thank you very much for this blog about Japan, very instructive. What about new comer in EU, Croatia, witch has a local currency Kuna floating on almost fixed rate to € 7-7,5 and with exchange constraint to Euro? (means that state in order to spend first buys € and than convert it to local currency, similar to have a kind of gold standard). Isn’t it mad and destructive for their economy?

Thanks again for your wonderful blog and your ideas.

Zaratino

Forrest’s comments are troubling. It sounds to me that he is very concerned about his company, which has a lot of debt itself. A downturn in China and resources will not be friendly to this firm, and I fear his inane bluster says a lot more than people think. Watch this space. Old Anaconda shareholders will be …

Another employment metric worth noting: outplacement agencies. They’re booming.

I have a new plot on Deficits vs. GDP in

http://pshakkottai.wordpress.com/2012/05/25/188/

Any comments?