I started my undergraduate studies in economics in the late 1970s after starting out as…

The IMF bullying as usual

The head of the IMF gave an extraordinary interview to the UK Guardian (May 25, 2012) – Christine Lagarde: can the head of the IMF save the euro?. It is extraordinary because of the language used by the IMF boss and the almost shameless increase in the intensity of Troika bullying of Greece at its prepares for another round of national elections to attempt to resolve the impasse that was left after the last election. The Troika know full well that the majority of people in Greece hate austerity and support an alternative growth-oriented policy agenda. The Troika also knows that its spin that austerity means growth is not resonating with European voters who can read the newspapers and understand the blatant untruth of the fiscal contraction expansion narrative. So they are exploiting the irrational view held by the majority of Greeks that they are better off staying with the Euro. By making out that the issue is about membership of the Euro, the Troika are introducing fear into the voting process to reinforce the TINA line that austerity is the only show in town. The Greek voters will succumb to that fear because they do not appreciate that membership of the Euro is austerity under current arrangements.

There was also a related article (May 27, 2012) – It’s payback time: don’t expect sympathy – Lagarde to Greeks.

Note the way the language has changed. Previously constructed as a “bailout” – the oppression being exacted on Greece is now “payback time”.

The question is payback for what exactly?

The details of the interview are well-documented. The UK Guardian editorial (May 27, 2012) – Eurozone crisis: Ms Lagarde’s morality tale – placed her remarks in a broader moral context.

The editorial said:

Not only should Christine Lagarde know better, she does know better. When the head of the IMF agreed in this paper on Saturday that the crisis across southern Europe was “payback time”, she contravened both common sense and her own arguments. Imprudent borrowers require foolhardy lenders, and in Greece and elsewhere that role has often been played by northern European banks … Ms Lagarde knows all this. Indeed, as France’s finance minister at the tail end of the boom, she must be held partly responsible … Which is what makes this weekend’s outburst so surprising – and important. The morality tale Ms Lagarde sets out is not a new one: feckless southern Europeans ran riot for the euro’s first decade and now have to be bailed out from their mess. Indeed, it has justified austerity programmes in Greece, Portugal and Ireland, and allowed the rest of Europe to avoid sorting out their vulnerable banks. But it is neither accurate nor useful. Until the financial crisis, Spain’s government had a tighter grip on public finances than France: it was Spain’s private sector that went berserk. And when it comes to total debt as a proportion of annual GDP, France is not far behind either Spain or Italy … Clamping down on the public sector rather than sorting out crises in the private sector is a large part of the reason Spain is in the mess it is now … If this is a morality tale, it is not Ms Lagarde’s yarn about northern v southern Europe – but about out-of-control banks, for whom the rest of us are now having to pay.

This very atypical Bloomberg editorial (May 24, 2012) – Hey, Germany: You Got a Bailout, Too Germany – provided a very lucid argument which connected the dots as to who is to blame, who has benefitted etc.

The Editorial says:

Would it surprise you to know that Europe’s taxpayers have provided as much financial support to Germany as they have to Greece? An examination of European money flows and central-bank balance sheets suggests this is so.

Thereafter was a very detailed trace that showed that “Germany’s banks were Greece’s enablers” and they exploited the “lax regulation” at the EU level. By the time the crisis hit, the German banks “had amassed claims of $704 billion on Greece, Ireland, Italy, Portugal and Spain, much more than the German banks’ aggregate capital.”

Then the bailouts benefited these loose-lending German banks and saved the German taxpayer from otherwise bailing them out.

The Editorial shows how the European banking system interacted with the bailout funds to benefit the German banks. The benefits dwarf the amount of funds Greece has received.

So when Lagarde talks about payback time it is clear that she is continuing the IMF tradition of bullying the weak and vulnerable to benefit the rich and strong.

But it was these gratuitous comments that bothered me the most:

I think more of the little kids from a school in a little village in Niger who get teaching two hours a day, sharing one chair for three of them, and who are very keen to get an education. I have them in my mind all the time. Because I think they need even more help than the people in Athens … And I think they … [the Greeks] … should also help themselves collectively … By all paying their tax. Yeah.

First, even if the Greeks paid more tax, they would still need historically large budget deficits right now to engender economic growth and to arrest the free fall the nation is in.

Increasing the tax burden on the “rich” might sound like a good equity move (to me also) but is not part of an effective response to the current problem. Even if the impact of higher tax rates (and effective collection) on the rich doesn’t have much negative impact on aggregate demand, the reality is that the nation needs a significant increase in aggregate demand.

There is no evidence that the harsh internal devaluation policies pushing down wages and pensions etc on ordinary folk will enhance competitiveness anyway. It is likely that the damage to investment will reduce productivity growth even further. Further, with austerity being imposed everywhere, an export-led growth strategy is unlikely to work.

Please read my blog – Fiscal austerity – the newest fallacy of composition – for more discussion on this point.

What Greece needs is a substantial increase in public and private investment supported by increased income support to the poor. Austerity will undermine all the dynamics that might give the nation a way out of this mess. And the mess is of a systemic origin rather than being exclusively the result of Greeks overspending (publicly or privately).

Remember, that Greece was not in crisis before the Euro was imposed. Its crisis is the result of lax regulation by EU officials interacting with a flawed monetary system design. Even if it had imposed austerity on its citizens along the lines of the Hartz reforms in Germany it would still have been in trouble given the flaws in the EMU and the scale of the collapse in private spending following the housing market collapse in the US and elsewhere.

Second, the IMF has an appalling record in Africa and continues to inflict poverty-increasing policies on the poorest nations.

It seems that the institution is now turning its attention to middle-income countries and seeking to impoverish them too. The bullying is reaching new heights in the lead up to the next Greek election because the EU elites aided and abetted by the IMF desperately wants to avoid the popular sentiment against austerity manifesting in political outcomes (seats in Parliament).

As a matter of record, on June 30, 2011, the French finance minister (out-going) signed an acceptance of a job offer to take on the position of Managing Director of the IMF.

Among the conditions of employment were the following:

1. Five years contract.

2. She is “expected to observe the highest standards of ethical conduct, consistent with the values of integrity, impartiality and discretion”.

3. Her salary would be $US467,940 per annum – net of income taxes.

4. She receives an “allowance … of $83,760 per annum, similarly net of any income taxes, payable in equal monthly installments, without any certification or justification by you, to enable you to maintain, in the interests of the Fund, a scale of living appropriate to your position”.

5. If that wasn’t enough, she is “reimbursed for reasonable expenses actually incurred for entertainment directly related to the business of the Fund”. All travel “shall be in first class”.

6. She can claim a “per diem at the rate applicable to Executive Directors plus reasonable vouchered expenses not covered by the per diem, including all hotel expenses, incurred by you for travel in the interest of the Fund”. Expenses for her spouse/partner (travel, hotel etc) are also covered.

7. The salary is indexed to the “Washington metropolitan-area Consumer Price Index”.

8. Very generous superannuation benefits including life payments to spouse/partner and her children.

9. Very generous holiday allowances.

So such a well-paid executive should oversee an organisation that delivers positive outcomes for its clientele.

The IMF was initially conceived at the UN Monetary and Financial Conference at Bretton Woods, New Hampshire in 1944 as one of the two major international institutions (along with the World Bank) to rebuild the damaged economies after the Second World War and to ensure (in the case of the IMF) that there would be no return to the Great Depression.

The IMF was empowered to be an unconditional lender to nation’s in trouble to ensure there would not be another collapse. It quickly morphed into ensuring the fixed exchange rate system was sustained.

Its so-called free market credentials now, were not in evidence then. It actively sought to maintain the market distortion that was imposed by the Bretton Woods system of currency convertibility.

All currencies were valued against the US dollar and the IMF loans subsidised these parities in the face of shifting trade balances.

That system became unworkable (and will never work) because it imposed massive political costs on external deficit nations who were forced to endure persistently high unemployment or lower than necessary economic growth as its central bank defended the currency from depreciation.

The collapse of the fixed exchange rate system in 1971 (and formally in 1973) meant that the IMF had no role to play. With considerable deftness and in an increasingly neo-liberal milieu, the IMF reinvented itself again and established its mission as being the lender to poor nations who faced currency pressures as a result of foreign debt accumulation.

The neo-liberal ideology came to the fore in the late 1970s when the IMF started to implement their so-called Structural Adjustment Programs (SAPs). These programs were a response to the debt crisis that engulfed the world – a crisis that was significantly related to IMF loans.

The debt crisis was constructed as a crisis for the developing nations but it was really a crisis for the first-world banks. The IMF made sure the poorest nations continued to transfer resources to the richest under these SAPs.

The SAPs were vehicles by which the IMF forced nations to adopt free market policies – the same sort of policy changes that created the conditions for the crisis in the advanced nations.

The poorest nations were forced to privatise state assets, make cuts to education and health services, cut wages, eliminate minimum wages and free up their banking sectors to allow speculative capital to prey on them.

The results in all cases was to increase the inequality in the wealth and income distributions, to increase poverty rates and open the nations to extensive environmental damage.

Nations with subsistence agriculture were forced to convert into cash for trade crops. The impact of the increased supply on world markets was to reduce the price below which was necessary to repay the IMF loans. More repressive conditions were then imposed.

Some nations pillaged their natural resources to the point that they had no export potential left but a residual of onerous IMF loans remained. And, in the process, they undermined the viability of their subsistence sector and so world hunger rose.

The obvious measure of the failure of this approach has been that the IMF has not decreased world poverty. In fact, the overwhelming evidence is that these programs increase poverty and hardship rather than the other way around. The IMF has a long-history of damaging the poorest nations.

There are many mechanisms through which the SAPs have increased poverty.

First, fiscal austerity is almost always targetted at cutting welfare services to the poor – which often means health and education (the IMF claims that educational and health cuts no longer happen). But moreover, the cuts prevent sovereign governments from building public infrastructure and directly creating public employment. Areas such as the military which do little to enhance quality of life are rarely included in the IMF cuts – in part, because these expenditures benefit the first-world arms exporters.

Second, public assets are typically privatised. Foreign investors often benefit significantly by taking ownership of the valuable resources.

Third, contractionary monetary policy forces interest rates up which often discriminate against women who survive running small businesses. But the restrictive monetary policies interact with the de-regulation of the financial sector such that the higher interest rates promote speculative investment (hot money) that fails to augment productive capacity.

Fourth, export-led growth strategies transform rural sectors which traditionally provided enough food for subsistence consumption. Smaller land holdings are concentrated into larger cash crop plantations or farms aimed at penetrating foreign markets. When international markets are over-supplied, the IMF then steps in with further loans. But the original fabric of the land use is lost and food poverty increases.

Fifth, user pays regimes are typically imposed which increases costs of health care, education, power, and in some notable cases, reticulated clean water. Many of the poorest cohorts are prevented from using resources once user pays is introduced.

Sixth, trade liberalisation involves reductions in tariffs and capital controls. Often the elimination of protection reduces employment levels in exporting industries. Further, in some parts of the world child labour becomes exploited so as to remain “competitive”.

I note that Adrian Beecroft was recommending that the British government allow child labour to be legal in the UK in his report – analysed in this blog – 2012 becomes 1844 or thereabouts.

Trade liberalisation (as it is called) allows cheap products, often of dubious quality, to be dumped on local markets which has been shown to undermine local producers – many in the cottage industry segment.

The IMF loans also provide largesse to private firms (often large multinationals like BP, ExxonMobil and others) and undermine the natural environment in poor countries.

A 2000 paper – The Effect of IMF and World Bank Programs on Poverty – by former World Bank official now rebel William Easterly was written in the aftermath of the East Asian currency crisis in 1997 which dented the fortunes of several nations including Korea and Thailand.

Interestingly, both countries returned to growth fairly quickly as a result of their currency adjustments a possibility not available to the EMU member nations. All the adjustment in the latter case has to fall onto domestic wages and related conditions in the context of no explicit move to curb profit margins.

William Easterly examined “the effect of IMF and World Bank adjustment lending on growth” and found:

… no effect … which is in line with the previous long and inconclusive literature. My main result is that IMF and World Bank adjustment lending lowers the growth elasticity of poverty, that is the amount of change in poverty rates for a given amount of growth. This means that economic expansions benefit the poor less under structural adjustment …

This pre-crisis research paper from 2003 – The Impact of IMF Economic Policies on Poverty Reduction in Low-Income Countries – published by the Japan Bank for International Cooperation studied the SAPs and concluded that:

1981-2000″:

Low-income countries experienced little per capita economic growth during 1981-2000 … Between program and nonprogram countries, the overall macroeconomic performances of the former have fallen below those of the latter. Compared to nonprogram countries, program countries have achieved a lower level of real GDP per capita (both in terms of US dollars and purchasing power parity [PPP]), accumulated larger external debt as a share of GDP, borne a heavier debt service burden relative to exports, held fewer months of foreign reserves, and adopted a lower pace of trade openness (measured by the sum of exports and imports as a share of GDP). Another feature of program countries is their heavy dependence on official development aid (ODA).

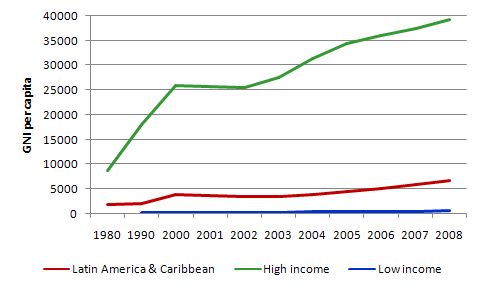

The following graph comes from the World Development Indicators, provided by the World Bank. It shows Gross National Income per capita, which, in material terms is an indicator of increasing welfare.

Latin America and Sub-Saharan Africa (which dominates the low income countries) were the regions that bore the brunt of the IMF SAPs since the 1980s.

While the high income countries enjoyed strong per capita income growth over the period shown (since 1980), Latin America (and the Caribbean) has experienced modest growth and the low income countries actually became poorer between 1980 and 2006.

The two trends are not unrelated. The SAPs are responsible for transferring income from resource wealth from low income to high income countries.

Conclusion

The Lagarde interview merely demonstrated that the EU elites (which is supported by institutions such as the IMF) – are getting worried about the popular support in various EMU nations against austerity.

The Troika know full well that the majority of people in Greece hate austerity and support an alternative growth-oriented policy agenda.

They also know that the data is continually exposing their lie – that austerity means growth. So now it is getting to the threat stage – payback time!

The IMF continually reverts to form. The world would be better off without it.

That is enough for today!

I read Lagarde’s piece in the Guardian with dispair and disgust. I sincerely hope the voters in Ireland and Greece dispense the justice that is required (indeed do themselves justice) and kick these hopless elites that support her out of power. Sadly Lagarde is not elected and cannot be removed directly, she and the IMF are a disgrace so my other hope is that the next bunch of politcians (and economists) move to limit and then destroy their malign influence. God help the world’s poor, the IMF (ECB, EU, OCEC) certainly won’t.

Bill, you might want to look at today’s Guardian article, if you haven’t already.

David Miles of the Monetary Policy Committee puts this forward as a serious argument:

“On the most pessimistic assumptions, the output gap – the difference between where the economy is now and where it could be if the spare capacity were utilised – is not 14%, but about 2%.

Estimates of the output gap matter because they affect the way the Bank and the Treasury set policy. A small gap would mean that even a relatively modest pick-up in growth would quickly see the economy run up against supply constraints, which would be reflected in rising inflationary pressure.”

Isn’t this a gross misreading of the source of inflation? At a time of great unemployment and below-capacity workplaces, employing these unused resources would hardly be inflationary.

Well it highlights the further danger of ESM ,a even more secretive banking cabal beginning to form.

A banking cabal with permanent access and full control of European fiat as they realise their credit money is almost worthless.

These organisations given the nod by chiefly western treasuries seemed to favour them somehow when their activities were chiefly abroad – then they waged war on east Asia back in 98.

But it has experienced a blow back….. the Asians have accumulated a $ war chest to counter any further opium war like activities.

Now they must feed closer to their host countries , with Greece next on the Menu as they slowly move up the food chain.

But the nasty history of the IMF in Western countries goes far back , when the City of London used the IMF and the Labour Goverment to extract more then a pound of flesh from its Host Britian when it destroyed its Boffin culture during the 1960s.

The question is payback for what exactly? Bill Mitchell

If I understand banking correctly, for credit that was conjured out of thin-air in exchange for a promise to repay that credit plus interest. If a legal counterfeiter is lending isn’t near everyonce compelled to borrow?

“Isn’t this a gross misreading of the source of inflation? At a time of great unemployment and below-capacity workplaces, employing these unused resources would hardly be inflationary.”

The problem is that the counter-argument isn’t put forcefully. If the output gap is so woefully small that we’re going to run up against constraints so quickly, then the millions of people left on the shelf should be compensated for the failure of the economy to provide sufficient work.

And obviously to avoid inflation the very wealthy should be taxed heavily to fund that.

I suspect if you put that proposal forward, the output gap would magically expand.

@Neil – that might be obvious to us, but … we all know that the unemployed are only unemployed because of their lack of willpower …

I suspect if you put that proposal forward, the output gap would magically expand. Neil Wilson

The problem is the sovereign debt holders, isn’t it? They wish to protect the real returns on their (Bill’s words) “corporate welfare”?

Is Legarde proposing that Niger join the Eurozone, or that Greece is the only EZ country whose citizens avoid taxes?

The magically shrinking output gap now would fit the social-darwinist agenda of these institutions and elites.

Off course supply and inflation problems would rapidly disappear if the top 1% of the population would be taxed to hell and back, because it’s only fair we tax consumption of the wealthy their profligate way of life and inflation creation tendencies before letting people starve without any income.

But this game is about some people ending with all the assets and consumption ‘quotas’, creating a lord-serfdom society, so that won’t happen, let them eat the cake.

A Tale of Two Sales

So anyways, I have this old car I want to dump, and I take it to a dealer. “How much?” I ask. He takes one look at the odometer and laughs. “We don’t do high-mileage crap,” he says. Disappointed, I take the car home.

The next day, I call up my buddy, “God’s-Work” Goldman, and ask him for a little bit of his magic, for which I will certainly pay him a handsome fee. He comes over, and spins the odometer back 100K, and armed now with my “low mileage” vehicle, I return once again to the dealer. “Great car!” he says this time, knowing full well it’s the same car, and promptly forks over a nice check.

Not a very likely story, is it?

And yet, that’s the exact story that the bankers are asking us to believe about Greece and how it got into the Euro. Greece’s books (public knowledge) looked terrible one day, someone cooked them the next, and suddenly bankers armed with some of the most sophisticated financial research staffs ever assembled got conned.

Not a very likely story either, is it?

The fact of the matter is that the only way my story works, and the only way the Greek story works, is if the dealers were in on the con. Maybe my buddy Goldman kicked them back a few, or maybe there was something else in it for them, but it was the same car, and the same Greece, and everyone knew it.

And anyone now trying to tell you otherwise is a liar.

This is the best synopsis of the IMF, and the most damming, that I have ever read.

Following Bill’s example her is another Guardian piece on how Christine Lagarde pays no tax — but then her contributions to aggregate demand are negligible too, poor thing.

http://www.guardian.co.uk/business/2012/may/29/christine-lagarde-pays-no-tax