The other day I was asked whether I was happy that the US President was…

The fantasy Barro(w) is still being pushed

I read the latest “fiscal stimulus has not made a jot of difference” Op Ed from Harvard’s Robert Barro as a classic example of how mainstream economists manipulate data that few understand well to support a case that is the opposite of the facts. nd wondered why he bothers. My profession are experts at either denying that facts are facts (the “when all else fails” strategy – that is, if the facts are inconsistent with the theory then the facts are wrong) or using data selectively when they know most people interpret economic data in a superficial and intuitive manner that often leads to wrong conclusions. The Wall Street Journal article (May 9, 2012) – Stimulus Spending Keeps Failing – which carried sub-title challenge “If austerity is so terrible, how come Germany and Sweden have done so well?” was typical Barro. I realise he cannot perform a detailed data analysis in a standard Op Ed (which is one of the great advantages of blogs). But with the sparse word-limit available in an Op Ed, the writer should also stick to the facts and draw relevant rather than spurious conclusions from the facts presented.

The austerity camp is slowly being abandoned by the citizens that it has inflicted its misery on. The latest news from Germany is excellent with Merkel’s Christian Democrats losing the election to the Social Democrats in the North Rhine-Westphalia elections (their vote was down to 26 per cent from 35 per cent in 2010). The snap election there followed the rejection of the ruling Social Democrat’s budget.

Merkel had campaigned on the issue of the “thrifty” Christian Democrats versus the “ever more debt” leftist parties (Social Democrats and Greens) – see story in Sydney Morning Herald (May 14, 2012) – Merkel’s austerity push rejected in bellwhether state.

Over the weekend, I read a few articles about last week’s Australian labour force data release which kept emphasising how the economy must be in good shape because unemployment fell. The commentators forgot to mention that nearly all of the decline in unemployment was due to the participation rate falling (people dropping out of the labour force because of the lack of jobs).

So the data actually was not an indicator of “good news”, but probably the opposite, depending on how much confidence we can place in the accuracy of the employment data at the moment.

Please read my blog – Australian labour market – converting unemployment into hidden unemployment – for more discussion on this point.

The Barro Op Ed also still manages to conclude one thing when the actual data he refers to tells us that exactly the opposite is the reality.

Barro claims that there are renewed called for more fiscal stimulus in the face of a move back to recession in key nations but:

Curiously, this plea for more fiscal expansion fails to offer any proof that Organization for Economic Cooperation and Development (OECD) countries that chose more budget stimulus have performed better than those that opted for more austerity. Similarly, in the American context, no evidence is offered that past U.S. budget deficits (averaging 9% of GDP between 2009 and 2011) helped to promote the economic recovery.

There is a plethora of evidence.

Over the crisis I wrote a series of blogs examining some of the evidence. There is too much evidence in favour of the “stimulus worked” view to capture in my blogs.

Here are some in chronological order:

- Fiscal stimulus effects …

- What else but a fiscal stimulus?

- Stimulus package continues to boost Australian economy

- Fiscal stimulus and the construction sector

- The fiscal stimulus worked but was captured by profits

- US fiscal stimulus worked – more evidence

- The lesson for the Europeans is that the US fiscal stimulus worked

I have also written many blogs about the deteriorating state of the Eurozone economies and then the UK (after the May 2010) election.

Where fiscal austerity has been deliberately imposed the economies have slowed and unemployment has risen.

Barro though thinks there are important exception which challenge the “stimulus works” view:

Two interesting European cases are Germany and Sweden, each of which moved toward rough budget balance between 2009 and 2011 while sustaining comparatively strong growth-the average growth rate per year of real GDP for 2010 and 2011 was 3.6% for Germany and 4.9% for Sweden. If austerity is so terrible, how come these two countries have done so well?

Note the loose language – “toward rough budget balance”. From where? How? What does “rough” mean?

But an examination of the data reveals that this statement is untrue.

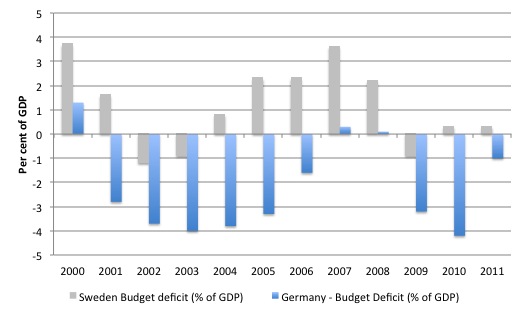

The Statistics Sweden Public Finances data (up to 2009, supplemented with Eurostat data up to the end of 2011 allows us to see what has been happening to the budget outcome in Sweden and Germany.

The following graph shows the budget deficits (-) for Sweden and Germany as a per cent of GDP from 2000 to 2011. You note that Germany was an early violator of the fiscal rules imposed by the Stability and Growth Pact.

As I discussed in this blog – The hypocrisy of the Euro cabal is staggering – the Germans violated the SGP for several years from 2001 to 2005. If they hadn’t have maintained the level of fiscal stimulus (above that permitted under the Treaty) then their economy would have probably fallen into recession during that period.

But in relation to Barro’s claims, it is far fetched indeed to claim that either Sweden or Germany were running a balanced budget during the downturn.

The following graph shows the evolution of the budget deficits (-) as a per cent of GDP for Sweden and Germany from 2000 to 2011.

For Germany, the budget deficit went from a 0.1 per cent of GDP surplus in 2008 to deficits of 3.2 per cent in 2009, and 4.2 per cent in 2010. This is an enormous fiscal shift over three fiscal years.

In the case of Sweden, the budget surplus declined from 3.6 per cent of GDP in 2007 to 2.2 per cent in 2008 and the into deficit of 0.9 per cent of GDP in 2009.

By any stretch of imagination, a 4.5 per cent swing in the fiscal stance in two years is a very expansionary change.

The point is that it is not only the actual budget balance that matters when we are appraising the direction of fiscal policy (expansionary or contractionary). A shift from a budget surplus of 3.6 per cent to a deficit of 0.9 per cent of GDP is likely to be highly expansionary in the context of what else is happening in the economy (private domestic sector and external balances).

So the “two interesting case studies” provided by Barro work against his argument.

Barro then claimed that:

The OECD countries most clearly in or near renewed recession-Greece, Portugal, Italy, Spain and perhaps Ireland and the Netherlands-are among those with relatively large fiscal deficits. The median of fiscal deficits for these six countries for 2010 and 2011 was 7.9% of GDP. Of course, part of this pattern reflects a positive effect of weak economic growth on deficits, rather than the reverse. But there is nothing in the overall OECD data since 2009 that supports the Keynesian view that fiscal expansion has promoted economic growth.

The size of the deficit tells you two things. First, the discretionary position of the government with respect to spending and taxation policies. Second, the state of non-government spending, given that the automatic stabilisers work in a counter-cyclical manner pushing the budget towards or into deficit in a downturn as tax revenue declines with private activity.

Barro hints at that without explaining it when he says that “part of this pattern reflects a positive effect of weak economic growth on deficits, rather than the reverse”. Why did he not then make the next valid conclusion?

Which is – that the large deficits in many of the Euro nations have come because the scale of collapse in non-government spending and the resulting real GDP gaps have been so large. Further, the European nations have much stronger automatic stabilisers as a result of their more generous welfare states.

The more you move north – into Scandinavian economies – the more generous these provisions tend to be. So while the Swedish government provided for some more infrastructure spending by way of discretionary stimulus and some income tax cuts the nation’s welfare system – quickly sustained the incomes of those who lost jobs.

But the larger the collapse in non-government spending the larger will be the budget shift towards or into deficit (other things equal). To then claim that the states with poor growth rates have the highest deficit ratios which allows us to conclude that there is a negative relationship between fiscal stimulus and real GDP growth is to blur the obvious impact of the automatic stabilisers.

The facts are that the Eurozone nations have been imposing harsh austerity – discretionary budget cuts which have undermined the growth prospects of their nations. But the budget deficits in some cases have been growing despite the austerity because the declining growth has further undermined the tax revenue.

A close examination of the Eurozone situation substantiates that conclusion.

Next up, Barro invokes Japan as his next example and says:

Once a comparatively low public-debt nation, Japan apparently bought the Keynesian message many years ago. The consequence for today is a ratio of government debt to GDP around 210%-the largest in the world.

This vast fiscal expansion didn’t avoid two decades of sluggish GDP growth, which averaged less than 1% per year from 1991 to 2011. No doubt, a committed Keynesian would say that Japanese growth would have been even lower without the extraordinary fiscal stimulus-but a little evidence would be nice.

Japan resumed growth after its monumental property market collapse on the back of a fiscal stimulus. The conservatives derailed that growth in 1997 when they forced the government to increase sales taxes to get the “budget back in balance”. The evidence is clear. The nation double-dipped and remained sluggish until a renewed fiscal stimulus was introduced.

Barro finally claims that:

Looking forward, there is a lot to say on economic grounds for strengthening fiscal austerity in OECD countries.

The economic grounds being?

There was an interesting speech made on January 20, 2009 by the Deputy Governor of the Sveriges Riksbank – Svante Öberg: Sweden and the financial crisis – which considers the way in which Sweden was reacting to the onset of the global financial crisis.

He discussed the usual ways in which central banks reacted – “The central banks have primarily contributed by adding large amounts of liquidity via loans against collateral to the bank” – “guarantees and capital injections to minimise the risk of further bankruptcies in the banking sector” etc, and noted that:

Sweden is a small and open economy with extensive foreign trade and a financial market that is well integrated with the international markets. Sweden’s dependence on the outside world has increased over time. This means that a global financial crisis combined with a severe international economic downturn has a substantial impact on the Swedish economy.

The Swedish banks were tightly regulated after the financial meltdown in the early 1990s and the extent of risky debt was significantly reduced.

Some of the specific developments the Deputy Governor outlined were:

1. “the Riksbank’s balance sheet for the second half of 2008 has increased from SEK 200 billion at the end of June to SEK 700 billion at the turn of the year. The loans from the Riksbank together with Swedbank’s borrowing under the government’s guarantee programme mean that the State provided or guaranteed more or less all of the banking sector’s borrowing in the last few months of 2008.”

2. “The Swedish National Debt Office, Finansinspektionen and the Government have also acted to safeguard the functioning of the Swedish financial system and to mitigate the effects of the crisis on the real economy. The National Debt Office has acted to meet the dramatic increase in demand for treasury bills. Extra auctions have been held in order to issue larger volumes of short-term treasury bills than normal. By the turn of the year, the National Debt Office had issued more than SEK 190 billion in treasury bills over and above the regular loan programme”.

3. “Sweden is also pursuing an expansionary fiscal policy in order to counter the downturn in economic activity.”

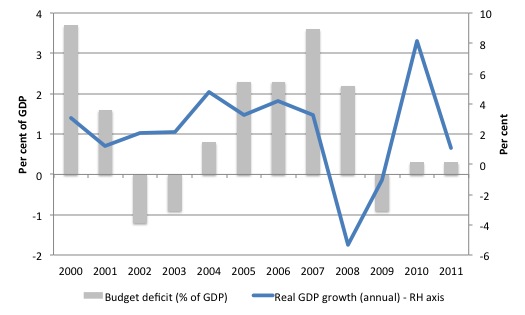

Building on the earlier analysis, and supplementing the budget data with detailed quarterly and annual National Accounts data, available from Statistics Sweden we can add some more insight into what was going on in Sweden during the crisis.

I would note that the presentation of the Statistics Sweden National Accounts data is not particularly user friendly. That is, it requires some manipulation to get it into a time series format for analysis.

The following graph shows the evolution of the budget deficit (% of GDP) and real annual GDP growth (per cent) for Sweden from 2000 to 2011. So as noted above the plunge in real GDP growth saw the budget surplus decline from 3.6 per cent of GDP in 2007 to 2.2 per cent in 2008 and the into deficit of 0.9 per cent of GDP in 2009.

This was a mixture of discretionary and strong automatic stabiliser effects. But taken together and as noted above, a 4.5 per cent swing in the fiscal stance in two years is a very expansionary change.

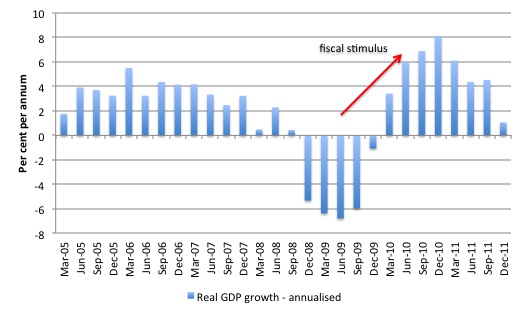

The following graph shows the quarter-by-quarter (annualised) real GDP growth rate since the March-quarter 2005 in Sweden to the December-quarter 2011. The fiscal stimulus began in 2009 and continued into 2010. One could argue in the light of real GDP slowing that the Swedes were in too much of a hurry to get back into surplus.

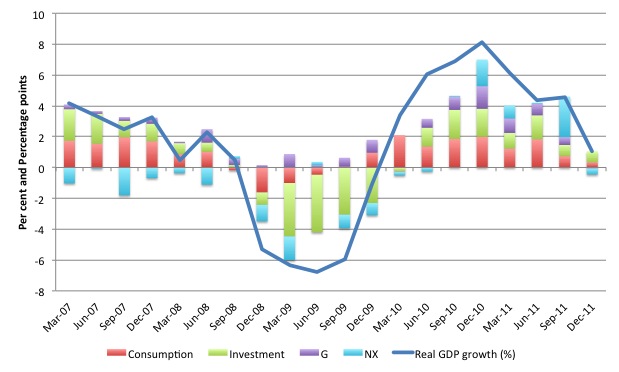

The following graph is taken from the national accounts data and shows real GDP growth (from March-quarter 2007 to the December-quarter 2011) in annualised terms (per cent) and the stacked columns show the percentage point contribution to that real growth from private consumption, private investment (not including inventories), government (consumption and capital) and net exports.

The pattern is very clear. Private spending was driving strong growth leading up to the crisis and there was a small contribution from the government sector. While exports growth was strong, the income leakage from imports was stronger and so the overall contribution form net exports was negative.

As the crisis began to erode exports, the rising unemployment saw private consumption and investment emerge as negative contributions to real GDP growth.

Throughout this period, the government contribution to real GDP growth remained positive and the strong impulse from the automatic stabilisers helped private consumption to recover fairly quickly.

As investment continued to languish, undermining growth, the government sector supported growth right through 2009 and 2010.

As the government started to contract its contribution and the impact of the world downturn has had a negative impact on exports, private consumption and investment is stalling and the economy is heading south again.

Further assisting the Swedish economy during the crisis was the fact that Sweden refused to join the Eurozone and the currency flexibility has worked in its favour of the course of the crisis.

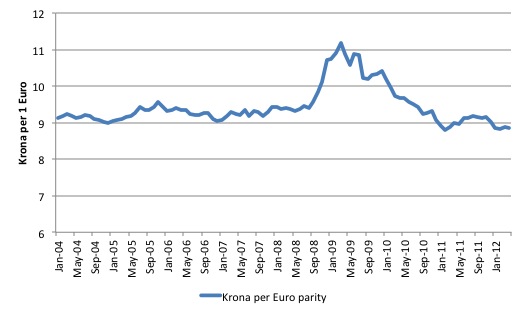

The following graph shows the movement in the Swedish Kronor-Euro exchange rate since January 1, 2004 (monthly averages). The data is available from the Swedish Riksbank.

At the onset of the crisis there was a movement away from the Krona and the exchange rate depreciated against the Euro. It has since recovered it original parity as Eurozone growth stalled and the Swedish economy resisted a major downturn. The Swedish krona also fell sharply against the US dollar.

Both movements improved the competitiveness of Swedish exports and offset to some extent the decline in the volume demand.

In 2009, the Deputy Riksbank Governor said that (article linked to above):

The financial crisis has also affected the Swedish krona. However, the Riksbank’s assessment is that the weakening of the krona is temporary and primarily a result of the financial crisis. In times of financial turbulence investors tend to turn to the larger currencies, which are regarded as “safer”. The result of this flight to quality is that smaller currencies like the Swedish krona weaken … During a normal economic downturn it may be an advantage that the currency depreciates in this way and thus dampens the downturn.

But as the real GDP and contributions graph (above) shows, the Swedish economy is now becoming caught up once again in the austerity mania in the rest of Europe. The government generally adopts a conservative approach to the budget and as exports, private consumption and investment become contractionary influences on real GDP growth, they will have to inject more stimulus to keep growth positive.

On November 16, 2011 – the Swedish National Financial Management Authority (ESV) issued this briefing – Public finances still close to balance despite sharp for Sweden – we read that:

After two years of strong expansion, demand and growth are now slowing down sharply. Swedish GDP is stagnating and is forecast to rise by just 0.1 percent in 2012.

The growth outlook is weak for both the euro area and the US in the coming years, and low global demand affects Sweden through weaker exports. Household consumption will also be low, as expectations about both personal finances and the whole economy have deteriorated drastically. Moreover, household wealth has fallen with share prices.

The report tells us that in 2009 and 2010 there were deficits but the government “expected to produce a surplus of 0.4 percent of GDP this year”. However, the “sharp slowdown in the economy in 2012 means that general government net lending will deteriorate again next year to give a deficit of 0.3 percent of GDP”.

Conclusion

For more on the fantasy world that Robert Barro lives in (academically) – please read the blog – Pushing the fantasy barrow. His predictions have failed to materialise over the course of his academic career.

While this blog is not a definitive analysis of either Germany or Sweden and their response to the financial crisis. But even a cursory examination of the basic facts provides information that runs counter to the Barro obsession that deficits are bad and austerity is good.

I am also not suggesting that all is well in Sweden (nor Germany). But to say they demonstrate the case that stimulus has been proven to be ineffective is false and not supported by the most obvious facts.

That is enough for today!

Hear! Hear!

Yes I spotted that article by Robert Barro the day it was published and nearly threw up. David Glasner is similarly unimpressed (to put it politely):

http://uneasymoney.com/2011/08/24/barro-on-keynesian-economics-vs-regular-economics/

When I get time I might do a special post on my blog about Harvard University twits, and give Robert Barro pride of place. I’ll also mention Martin Feldstein who doesn’t understand how the banking system works. Do a word search for Feldstein here:

http://www.voxeu.org/index.php?q=node/7955

Those Harvard economics students who walked out of their class should have walked right out of the university permanently.

I would be interested in more comments on the Swedish surplus. To run a surplus for as long as they did is interesting. Was the economy supported by export surpluses, or dissaving by the private sector?

This quote is full of (I am guessing unintentional) irony – which misery was inflicted by the CDU on German citizens? Also, just for the sake of correctness, the CDU only got 34.6% of the votes in 2010.

… and, forgot to add, didn’t drop in third place. They are still the second-strongest party, the third beging the greens.

Robert Peston wrote an interesting blog today pointing out that if Greece, Italy and Spain left the euro, Germany would take a hit of over half a trillion euros which would be quite a surprise to the German people.

If that’s right, it seems to me that, short of Germany sending in the tanks, the PIIGS have them by the short and curlies. It just needs one of the eurozone’s countries to call their bluff. They won’t get a functioning central bank but they might get a bit more cooperation in trying to grow their economies.

Does anyone else see it this way?

Is Peston really saying that? IIUC, the hit should be being taken by the ECB, and he’s saying that the Bundesbank is the ultimate backer of the ECB, so would be ultimately liable. But that’s a rather long path to go down.

“Public finances in Germany indeed are contributing noticeably to macroeconomic stabilisation. The German government has implemented discretionary measures in a magnitude of over 2% of GDP for the years 2009 and 2010. Most of the effects of these measures have still come into effect. With regard to fiscal stabilisation it is also necessary to keep in mind that its effects should not only be evaluated by discretionary measures alone. Built-in adjustments in public budgets – so-called automatic stabilisers – provide stimulus through a rule-based fiscal framework. These automatic stabilisers are more important in countries with larger social security systems and progressive tax systems. For example, in Germany the contribution of automatic stabilisers in 2009 and 2010 will be nearly 3 % of GDP (including developments in profit-related taxes).”

http://www.bundesbank.de/download/presse/reden/2009/20090513.weber.london.en.pdf

I just wanted to tell you that during todays debate on the budget and fiscal policy of Sweden in the parliament Anders Borg listed 4 reasons why Sweden had fared so good. Number one a was a stable financial sector, and the second was expansive monetary AND fiscal policy.