I grew up in a society where collective will was at the forefront and it…

The lesson for the Europeans is that the US fiscal stimulus worked

Today, I was reading the latest report from the US Congressional Budget Office – CBO’s Estimates of ARRA’s Economic Impact – which shows that the American Recovery and Reinvestment Act of 2009 (ARRA) has been successful in increasing real GDP growth in the US and reducing the rise in the unemployment rate. Some simple calculations reveal that in the absence of the ARRA US economy would still be in recession. That is, taking a European trajectory. There is also evidence that the Obama administration were presented with analysis that showed that a much larger stimulus than was chosen was necessary, yet this information was suppressed in final documents that were the basis of the fiscal intervention. It seems that the neo-liberal ideologues within the Obama camp deliberately undermined the fiscal intervention and so its impact, while positive, was far less than was required. I also read an interview with the ECB president, Mario Draghi today. The ECB is now pushing fiscal austerity as the only way out of the Euro crisis. In juxtaposition to the US experience, the Europeans remain fixed to the view that saving the flawed institutional structure (that is, the EMU) is a higher priority than insuring that people prosper. The lesson for the Europeans is that the US fiscal stimulus continues to work.

The New Yorker published an interesting article (January 30, 2012) – The Political Scene – The Obama Memos – which details

The New Yorker article said that the “fifty-seven-page memo to the President-elect, dated December 15, 2008, written by Larry Summers, his incoming director of the National Economic Council” framed the approach that Obama took in dealing with the crisis as he considered his presidency.

The document “which has never been made public” indicated that the “The U.S. economy had lost two million jobs that year; without a government response, it would lose four million more in the next year”. You can see the final memo – HERE.

The advice that the in-coming President was given by Summers was that “the government was already spending well beyond its means” and that the challenges of the crisis would require a politically difficult “explosion of government spending”.

Evidently, Christina Romer sought a larger deficit and was asked by the “incoming chief of staff, Rahm Emanuel” – “What are you smoking?”. The hawkish nature of the Obama response was also driven by “Peter Orszag, the incoming budget director”.

The Summer’s memo stressed the “economic” need to constrain the size of the stimulus. In other words, there was no case made on political grounds (that is could not get through the US Congress).

The Obama options (maximum stimulus of $US890) was less than 50 per cent of the estimated output gap in 2009 and 2010.

The New Yorker quotes the memo as saying:

An excessive recovery package could spook markets or the public and be counterproductive … [none of the options] … returns the unemployment rate to its normal, pre-recession level. To accomplish a more significant reduction in the output gap would require stimulus of well over $1 trillion based on purely mechanical assumptions – which would likely not accomplish the goal because of the impact it would have on markets.

So the Obama decision-making was driven by mainstream macroeconomics textbook fears about crowding out. Why didn’t Obama ask Summers to explain how it was that Japan had run rising budget deficits for around 17 years (at that time) yet still managed to maintain interest rates (and bond yields) and around zero over that period?

Summers might have taken time to understand how the Bank of Japan manages liquidity in the monetary system to achieve zero interest rates. The point is that there is no robust between budget deficits and interest rates.

Currency-issuing governments can always maintain a low interest rate environment, irrespective of the current fiscal stance.

The crowding out hypothesis is based on a flawed understanding of the way banking operates. Subject to capital constraints, banks stand ready to lend to credit-worthy customers on demand. There is no finite pool of savings available which public and private debt compete for as is envisaged in the whole classical loanable-funds doctrine.

There was an interesting follow-up to the New Yorker article in the US Magazine The new Republic this week (February 22, 2012).

The article – The Memo that Larry Summers Didn’t Want Obama to See. added some further understanding to the development of the 57-page memo..

The article written by Noam Scheiber detailed how the “57-page memo that Barack Obama’s incoming economic team prepared for him in late 2008” was edited by Larry Summers to exclude a larger stimulus option.

Noam Scheiber presents a comparison between the original draft document and the final document authored by Summers. He also makes the Original Romer Memo available.

The substantive difference is that the Romer proposals included a $US1.7 trillion stimulus which would have closed the estimated real GDP gap (that is, restored the CBO estimate of full employment – which as you will appreciate is biased upwards).

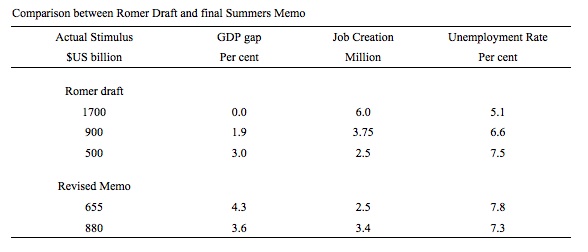

The following Table compares the two stimulus options. The top rows show the original Romer proposal (3 options) while the actual Memo presented two options – $US655 and $US880 billion.

It is also clear that Romer was using larger fiscal multipliers than were used in the final memo. This probably reflects the fact that Summers and Orzag were deficit hawks and probably struggled with prospect of proposing a major fiscal stimulus.

So from the outset, Obama deliberately set about allowing the US economy to deteriorate and he knew that the unemployment rate was going to rise to at least 7.3 per cent and he chose to forgo (on the estimates available) approximately 2.4 million jobs across the US.

Noam Scheiber provides a chronology of how the the original draft was altered and that the larger fiscal stimulus proposal was “dismissed … as impractical”.

It is clear that the stimulus wasn’t large enough given that the US Congressional Budget Office currently estimates the US GDP gap to be somewhere between 5.3 and 5.6 per cent. Which suggests that the Romer-Summers estimates of the gaps were rather conservative to say the least.

This is not to say that the fiscal stimulus was introduced was ineffective. It’s really a debate about how much of the GDP gap the government chose to close.

The US Congressional Budget Office released its latest (February 22,2012) – CBO’s Estimates of ARRA’s Economic Impact – which shows that the American Recovery and Reinvestment Act of 2009 (ARRA) – aka as the fiscal stimulus – “had the following effects in the fourth quarter of calendar year 2011 compared with what would have occurred otherwise”:

- They raised real (inflation-adjusted) gross domestic product (GDP) by between 0.2 percent and 1.5 percent,

- They lowered the unemployment rate by between 0.2 percentage points and 1.1 percentage points,

- They increased the number of people employed by between 0.3 million and 2.0 million, and

- They increased the number of full-time-equivalent (FTE) jobs by 0.4 million to 2.6 million. (Increases in FTE jobs include shifts from part-time to full-time work or overtime and are thus generally larger than increases in the number of employed workers.)

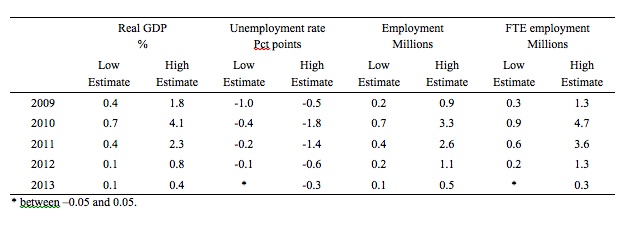

The Full Report documents how the CBO arrived at those conclusions. In particular, Table 1 on Page 3 provides a complete set of estimates of the impact of the ARRA on real GDP growth, the unemployment rate, total employment, and full-time equivalent employment.

The data presented allows us to compare the actual path of these aggregates to the counter-factual (That is, without the ARRA). The counter-factual is clearly conditional on the CBO modelling.

I could make a case that the estimates are biased-downwards but that will have to wait for another blog. In that vein, in the following analysis I chose to use the higher CBO multiplier estimates presented in CBO’s Table 1, which are, in fact, very conservative.

The following Table provides a summary of the annual impacts of that ARRA estimated by the CBO.

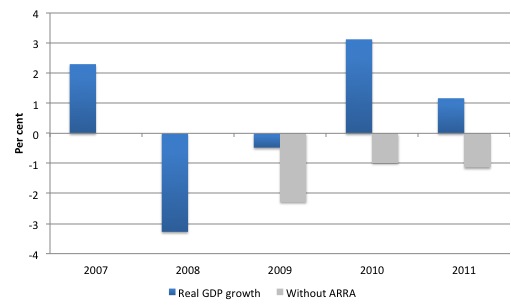

The following graph is based upon the CBO estimates of the impact of the ARRA on Real GDP from 2009 to 2011. The blue columns are actual annual real GDP growth in the US while the grey columns are my calculations based upon whose CBO estimates of what would have happened to real GDP in the absence of the ARRA. In each of the graphs presented the grey columns represent the specific counter-factual.

The point is very clear. What the CBO estimates indicate is if the US government had not have introduced the spending packages associated with the ARRA US economy would still be in recession. It would have experienced 4 consecutive years of negative real GDP growth.

Further, the economy would have gone further into recession in 2011 without the ARRA. So the US is fortunate that its political system, which is currently debating how much fiscal austerity to impose on the economy and when, seems incapable of actually achieving this misguided political end.

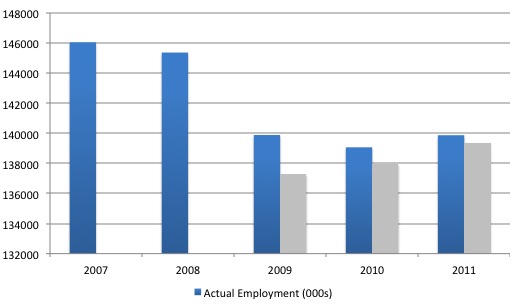

The next graph shows the same analysis for total employment.

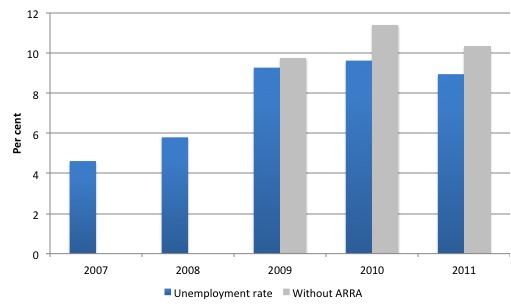

The next graph shows the same analysis for the unemployment rate, which would have reached 11.4 per cent without the ARRA intervention in 2010.

The conclusion, though, is that the US economy continues to grow because it is received sustained fiscal support from its national government. Had the government followed the advice of many of the mainstream economists it would be in worse shape now.

Which brings me to a recent interview with the head of the ECB, Mario Draghi and a speech given by one of the board members of the ECB.

On February 20, 2012, Peter Praet, a Member of the Executive Board of the ECB, gave a speech – Monetary Policy at crisis times – to the International Center for Monetary and Banking Studies, Geneva.

He made the astounding claim that the crisis was fiscal in origin and that:

As a currency, the euro has been a success …

It went from that bad … to worse.

He claimed that fiscal policy should be “solid” (that is, balanced budgets) and not hinder the monetary policy in its inflation targetting.

He asserted that the current crisis in now fiscal:

The fiscal stimulus measures in response to the financial crisis, large-scale government support programmes for ailing domestic banking systems, the working of automatic stabilizers and eroding tax bases in the face of weakening growth have put government budgets in the euro area countries under intense pressure … [but] … some euro area countries government budgets had already suffered from lax fiscal policy before the crisis.

He didn’t mention that Germany or France were the first to violate the Stability and Growth Pact fiscal rules long before the crisis manifested.

He then applauded the new approach to the SGP:

… it is encouraging to see that important steps have recently been taken … strengthens both the preventive and the corrective arm of the Stability and Growth Pact and establishes minimum requirements for national budgetary frameworks … a new “fiscal compact” with a view to achieving a more effective disciplining of fiscal policies. Major elements of the fiscal compact are the strengthening of the role of the balanced budget rule and a further tightening of the excessive deficit procedure. It is of utmost importance, that the rules are now fully implemented in the spirit of this agreement. All these measures aim to ensure that individual countries live up to their responsibilities to bring their public finances in order.

And if that wasn’t bad enough he indicated “it is now all the more urgent to undertake structural reforms to regain competitiveness”.

Presumably, if this character was asked what time of day it was he would reply “we need more fiscal austerity”. If he was asked to comment on whether pro-cyclical fiscal policy was good or bad – he would reply – “it just goes to show that fiscal policy is dangerous and builds inflationary biases into the economy at a time when private spending is growing”.

This is one of the ludicrous aspects of the current mainstream response.

They seem to ignore the irony that while eschewing pro-cyclical fiscal intervention in a growth cycle, they actively campaign for pro cyclical fiscal interventions in a downturn.

By advocating fiscal austerity when private spending growth is flat or declining, these characters are ensuring fiscal policy becomes pro-cyclical.

If a government dared to provide fiscal support in the early stages of recovery then they would be screaming blue murder about dangerous, inflationary, pro-cyclical interventions.

The hypocrisy is staggering.

They further are in denial with respect to the evidence about effective structural change. Major resource reallocations are best achieved during the growth cycle when the costs of dislocation are minimised.

When you read that urgent structural reform is needed, what you understand the person to be saying is that they just want to cut workers wages and conditions.

They don’t talk about productivity enhancement through investment in best practice technology, a demand side strategy. Their obsession with supply-side strategies is ideological in motivation.

Further, as Keynes and others demonstrated, these so-called structural reforms typically undermine the capacity of the economy to purchase what is being produced. Cutting wages may reduce costs but is also reduces aggregate demand.

Which brings me to an interview that the Wall Street Journal conducted with – ECB President Mario Draghi on February 23, 2012.

It seems that the ECB is ramping up an anti-fiscal policy message within Europe and instead pushing the line that the region has to cut living standards because it ha been living beyond its means.

He was asked whether the latest Greek bailout was the “resolution to end all resolutions” and he replied:

… if we didn’t have that package finalized, there would be no game. So this could be the beginning of a new world for Greece where the pending financing problems have been addressed. Now the policies will have to be enacted. The Greek Government has undertaken very serious commitments in the fiscal policy and in the structural policies areas.

Which is a false statement. There could be an alternative “game” – where the ECB deployed its currency sovereignty to allow nations with large GDP gaps to pursue growth strategies.

The choice of the current strategy is ideological not ground in any sound economic theory.

Later he was asked whether “the greatest risk … [to the bailout] …arising from the streets of Greece, or is the greatest risk arising from a lack of growth in Greece”, he replied:

In the end it seems the greatest risk is lack of implementation. Some measures are directly targeted to enhance competitiveness and job creation. Others foresee a radical fiscal consolidation. The two are very complementary to ensure a return to growth after the unavoidable contraction in economic activity.

This raises the point that is often misunderstood by those coming into Modern Monetary Theory (MMT) for the first time.

A nation hollowed out by fiscal austerity will eventually grow. At some point, an entrepreneur will see an opportunity to make a profit and investment will follow. The standard multiplier processes then will see some economic growth, albeit from a very low base.

Even the poorest African country can grow if someone sets up a small craft table a local market.

The problem is that there are major hysteretic costs involved in a drawn out programme of fiscal austerity.

Not only does the skills of the workforce atrophy and incentive to invest in high-level skills to clients, but also the rate of capital accumulation declines.

It is likely that a drawn out contraction of the Greek economy will undermine its prosperity for decades, notwithstanding the fact that eventually some growth may emerge.

In the meantime savings are lost, wealth holdings for ordinary people are decimated and poverty rates rise. There will also be a major redistribution of income and wealth such that both distributions will become increasingly concentrated.

It is a very costly path to take which will ensure that Greece will be returned to a more primitive state (in economic terms).

But that is what Draghi thinks is required. He was asked what he thought about the current strategy of “forcing austerity at all costs in order to bring the budget deficits down”, He replied:

This is actually a general question about Europe. Is there an alternative to fiscal consolidation? In our institutional set up the levels of debt-to-GDP ratios were excessive. There was no alternative to fiscal consolidation …

The important phrase is “In our institutional set up”. The austerity is a product of the design of the monetary union and the SGP rules that were imposed on it.

The problem is the Euro!

Unlike the ECB view that the Euro has been a big success, the reality is that the Euro (and its supportive institutions) have been a disaster. The EMU is in the worst downturn for 80 years and its only “response” is to make it worse because it has introduced voluntary rules that require nations in deep aggregate demand shocks to inflict further spending cuts.

If the “rules” and institutional structure force the EMU to impose pro-cyclical fiscal policy in a recession – the anathema of sound policy conduct – then a sensible person would question the institutional structure.

But Draghi has a different view. He thinks the crisis has demonstrated that the “European social model has already gone” and that a major retrenchment of the Welfare State is required.

The agenda is obvious.

He claimed that all Euro nations had to maintain fiscal austerity because otherwise:

Fiscal consolidation is unavoidable in the present set up … Backtracking on fiscal targets would elicit an immediate reaction by the market. Sovereign spreads and the cost of credit would go up. We’ve experienced all this.

Only if the ECB refuses to use the currency capacity that it has at the top of the monetary system. They have demonstrated via their Securities Market Program that they can successfully deal the private bond markets out of the equation.

So there is a choice. Note his phrase “in the present set up”.

Conclusion

I thought the juxtaposition today between the US experience that is being driven by more pragmatic policies and the ideologically-constrained European dogma was interesting.

I’m sure that if the conservative US Congress representatives could see the way clear then they too would be going down the fiscal austerity gurgler. Fortunately for the American people, the bumbling politicians haven’t been able to agree on the public spending cuts yet.

The evidence is that the fiscal stimulus in the US has been clearly positive and is the major reason why the economy is still growing, albeit more slowly as the stimulus impacts wane.

The opposite is the case in Europe. There, a grinding process of fiscal austerity is reversing years of growth, capital accumulation, social development, and poverty reduction.

In their case, the problem lies in the institution framework that governs the monetary system.

I read that the vast majority of Greeks do not want further austerity but at the same time they do want to stay in the Eurozone. That tells me that there is a mass misunderstanding in the country (and throughout Europe) of what the problem is.

They need to understand that it is the basic design and structure of the EMU that is deeply flawed and should be reformed. The Europeans have no shortage of real goods and services to enjoy much more prosperous lives than they are being forced by the elites to endure. There is no need to abandon their social model. That can co-exist with a sensible monetary system where member states have currency sovereignty.

Ultimately, how high real (material) living standards can go and be sustained is not a financial question. The EMU elites have chosen though to overlay a dysfunctional monetary system over its production sector and make the latter pay for the flaws in the former.

Saturday Quiz

The Saturday Quiz will re-appear sometime tomorrow – and I just don’t know how hard it will be!

That is enough for today!

The UK appears to be following a similar path to the US. Despite all the rhetoric about government cutting spending, the figures show that UK government spending is running about the highest it ever has been.

As MMT suggests whatever the government trims off discretionary spending is replaced by an increase in benefit payments.

That persistent spending now appears to be translating into increased tax receipts – suggesting that the private sector is no longer saving as strongly as it has been doing.

The Automatic Stablisers are working. They are weakened, but just about holding economies up.

Just imagine how quickly they would have worked with a full Job Guarantee in place and with more powerful automatic recession responses in the tax system.

Bill,

I don’t know if you came accross this hilarious piece by jeremy Warner at the Telegraph. According to him the US stimulus was irrelevant to the additional growth what worked in America was….. drumroll……

It’s easier to sack people. So there yoyu have it just strip workers of their rights and everything will be fine. http://www.telegraph.co.uk/finance/economics/9100872/Firms-will-hire-more-workers-if-we-make-it-easier-to-fire-them.html

I have provided the link just to prove I’m not making it up.

I read today that the public sector wages as part of the latest Greek bailout are going to be backdated to November meaning there are a lot of Greek public sector workers who will be working for nothing or even have to repay some of their salary tecieved since then.

Neil – Don’t forget that the cuts have yet to bite, most of the public sector cuts are to come in the next 6 months (assuming the Tories don’t do an about turn). Departmental budgets have been slashed, benefits are to be reduced, jobs cut…all to come. The automaatic stabalizers will be somewhat less automatic.

Well, Obama would have never gotten the whole 1.8T.

The only question is whether starting with that higher number would have made something like 1.4 seem like a compromise.

Dear Bill

You wrote “but also the right of capital accumulation declines.” I take that it that you meant the rate of capital accumulation. However, isn’t capital accumulation mainbly a response to demand. If demand is growing, businesses will invest. Otherwise they won’t.

Regards. James

One article about the backdating of paycuts and requiring Greeks to pay back their employers as a result is “Some Greeks Might Have to Pay for Their Jobs” from the Atlantic Wire. The Troika has finally jumped the shark with this. It is absurd to take anything they say seriously anymore. Unfortunately, the Greeks (and Portugese) must.

The neo-liberals will never accept the view of the CBO or anyone else who claims that the recovery is due to the stimulus package or the budget deficit.

My concern is that if a recovery in the US, China, and the developing world leads Europe out of the mess that it is in, then in any future downturn the neo-liberals will point to the recovery in Europe and claim that it was all because of austerity. Of course they will use that as a basis to force austerity on all of us the next time.

Bill:

Was wondering if there is any historical example similar to that of the US now, running persistent but less than optimal deficits over a period of years during a significant downturn? I believe FDR did something similar in the early part of his first administration, then caved into deficit fears, causing another downturn.

The reason I asked is that I wonder if there can be something like a “tritation” effect in regard to growth if deficits are consistently small over time. Talking about the S-curve you see when adding acid drop by drop into a solution of base. The equivalent neutralization in the econony would the private deleveraging over time.

Not saying this is a preference, but is it a possibility we have not yet seen since politicians haven’t had the courage to stick to even (relatively) small deficits over a sustained period of downturn?

“Don’t forget that the cuts have yet to bite, most of the public sector cuts are to come in the next 6 months (assuming the Tories don’t do an about turn). ”

It’ll be real when I see a reduction in government expenditure in the stats. Until then it’s all ‘getting tough’ rhetoric. It’s much harder to actually do it and make it stick.

This was relevant a comment from the Telegraph article?

“I’m a small business person, and I can tell you that the problem isn’t about how easy it is to fire people (any sensible boss puts new recruits on probation and watches like a hawk and really puts them through their paces during that period).

What is holding back growth is CUSTOMERS ARE TOO SKINT TO BUY MUCH.

Sorry for shouting, but you chaps at the Telegraph seem to misunderstand how business works. It’s all driven by sales. You can cut your expenses all you like, but NO SALES EQUALS NO PROFITS.

As for scaremongering the population at large with blood curdling “We are going to make it easier to Sack You!” threats – that just makes people shut their wallets even tighter and cut back on spending. Guess what that means? No Sales!

The whole reason we are in this economic pickle is that as soon as Osborne entered the govt he made blood curdling threats about how many people people he was going to sack. Millions took one look at his sneering face and simultaneously shut their wallets tight to prepare for redundancy.

You know what happens when everyone stops spending all at once? The economy tanks!

It’s not happening in the USA because Obama doesn’t go around telling people he’s going to SACK THEM ALL. Indeed part of the reason Romney is struggling is because he’s told Republican voters that he likes sacking people, and they don’t think that attitude will help the economy one bit. “

Dear James Schipper (at 2012/02/24 at 23:21)

Thanks very much.

Yes it was a typo. Right = rate. Fixed now. I am experimenting with voice recognition software and it is prone to interpret my triphthong – “a” – as in rAte (which is a distinctive characteristic of the Australian accent) as an – “i” given that the dominant syllable in the triphthong a-I-e is the middle sound.

I am training it to behave but sometimes its slips past my editing.

You are correct in presuming that the rate of capital accumulation is a demand-side response.

best wishes

bill

Nealb says, “I read today that the public sector wages as part of the latest Greek bailout are going to be backdated to November meaning there are a lot of Greek public sector workers who will be working for nothing or even have to repay some of their salary tecieved since then.”

Bit like Qld Health workers eh? 😉 That’s a joke that probably only Queenslanders in Australia would understand.

Also, I thought Bill was being a bit self-deprecating and inventive when mentioning tripthongs. But I found they are real. Always being one willing to push things to absurd lengths, I went looking for quadthongs. Apparently they exist but only the discipline of singing seems to mention them. I could not find any examples of quadthongs in the spoken word but I am sure they exist. And what is throat singing? Parallelothongs?

There’s a really interesting paper available on-line – “Net Fiscal Stimulus During the Great Recession” (Aizenman & Pasrich). It looks at the degree of fiscal stimulus between 2007Q4-2010Q1. The correlation between fiscal stimulus and the present state of the economy seems pretty impressive to me. For example, the Australian budget was far and away the most counter-cyclical in the developed world. No prizes for guessing the most pro-cyclical – Greece.

From this article I envision a grand tug of war between earned and unearned income. Austerity protects capital and creates depreciated asset oppotunities while earned income fights to maintain cash flow and what equity they are two payments away from losing. A proper stimulus-stablizer levels the playing field.

I do not agree with this analysis. The idea presented here is that with aggressive monetary easing and increasing budget Defizits an economy can be made to heal.

The side effects and longterm impact of these policy choices are not addressed. The presented arguments equal the idea of trying to heal an alcoholic with a bottle of Jack Daniels. Sure he will feel better for a while (until the final collapse). It is completely unsustainable.

Especially the monetary policies presently in place do work against the weak members of society in favour of those vested interests and support the corrupt behaviour of the Banking industry making the problem of future instability grow by leaps and bounds.

It is not a question of IF but WHEN this system will collapse and how many other principles of the rules of the free market as well as of the spirit of the rule of law have to be broken until its corruption is visible to the masses.

If your article is right then there should have been a private sector recovery in the USA during the period of fiscal stimulus. If you look at the real data … [Bill edited out a link to an external site] … you can see that the stimulus was correlated with a large downturn in the rate of growth of the private sector.

The real data shows that whenever public spending increases private sector growth decreases. Can you tell us how a fiscal stimulus will help when this fact is etched into the data for the past 50 years?

Dear John (at 2013/02/12 at 22:29)

Unfortunately the data you cite (which you proclaim as a “Law” – I deleted the link) does not decompose discretionary and cyclical impacts. Government spending always rises when private sector spending falls because of the cyclical impacts.

Causation vs Correlation – the oldest problem in the book of statistics.

I would revise your “law” and deploy more sophisticated statistical techniques if I was you.

best wishes

bill