The other day I was asked whether I was happy that the US President was…

The hypocrisy of the Euro cabal is staggering

As they say in the classics – “some of my best friends are” … and in my case I might have added German. The Euro crisis – that is, the crisis that has arisen because the creation of the Euro stripped member nations of their capacity to defend their economies against negative private spending episodes – is being worsened because of the incredible resistance by Germany and the Troika (EU, ECB, IMF). The Brussels-Frankfurt consensus – which claimed the creation of the Eurozone would engender stability and growth is shattered – irretrievably humiliated one might venture to say – yet the cabal that hides behind that “consensus” maintains power and influence. The hypocrisy that the cabal engage in is staggering. Their narrative is almost totally dislocated from the reality. They regularly disregard their own rules to favour the vested interests that keep them in power. And meanwhile, they are overseeing a collapse of all the ideals they claimed their system was designed to achieve.

This article in the UK Observer (November 13, 2011) – There is only one alternative to the euro’s survival: catastrophe – talks a little about “blinkered Germans”. It was written by Will Hutton.

I agree that the crisis is marked by “an insupportable burden of private debt created by oversized, undercapitalised banks” which is a common problem across the globe and constitutes “a crisis in contemporary capitalism” but the EMU crisis is different again.

The US and the UK have a way out of their crisis should they choose to use the capacities that are intrinsic to their fiat monetary systems. Their treasuries and central banks can cooperate to ensure that growth is strong enough to create enough employment to eliminate their unemployment.

Such growth in national income would provide the capacity to the private sector to save and it would also see what are now toxic or difficult loans to the private sector become performing loans. The strain on banks would be significantly reduced.

This is not to say that the credit binge overhang would be eliminated speedily. Far from it. This “balance sheet” recession will take a decade or more to resolve but that resolution could be quicker and less painful if governments used their fiscal capacity to support growth. That should be the priority.

Unfortunately, under pressure from my corrupt profession and the media lackeys who take the ideas of mainstream economists in to the public sphere and the competing vested interests (in the financial markets) who actually profit from the crisis, our governments are not exercising those choices and so the crisis drags on.

But the EMU situation is a step removed from that. There is no elected government that has the capacity to stimulate its own economy.

Why? They signed away their currency sovereignty and now operate in a foreign currency – the Euro. And in doing so they agreed to make their public spending reliant on their tax bases and their capacity to access funds from the private bond markets. Once their tax bases shrunk as a result of the crisis and the bond markets worked out that insolvency was a real possibility, public spending opportunities declined.

You will note that I have been saying that the ECB could rescue the European economy should it use its fiscal capacity (the fact that it has the monopoly rights to issue the currency). But consistent with my tastes for democracy that should only be done through the elected governments (via funding their fiscal decisions) and that is not happening at present.

The ECB is bailing out the system – but only as it descends more or less into its death spiral. The ECB – as part of the cabal that runs Europe – aka The Troika – is forcing its member nations to adopt anti-growth policies which just worsen the financial ratios and prospects and damage the citizenry – while keeping the bond markets out of the picture. This ridiculous and myopic strategy is based on some notion that they don’t want a government to announce insolvency.

Presumably they are delaying that inevitability while they organise all the vested interests and minimise their losses. They are prepared to attack the living standards and opportunities of the unemployed, the pensioners, the elderly, the sick, the small businesses, etc while they preserve their own hegemony and that of their mates.

Hutton, however, doesn’t support the break up of the Eurozone. He seems to think that Britain’s interest “lies in the survival of the euro” and rattles out all the usual stuff about “seismic bank runs in Ireland, Portugal, Spain and even Italy as citizens and companies, fearing the same could happen to them, moved their cash out of their countries” and folding banks, etc. Apparently, the ECB “would be overwhelmed” and the “European economy would slump – and Britain with it”.

None of that bears scrutiny when you understand the options that each nation would have with its own currency. There might be bank runs but we have already seen a great number of banks nationalised in 2008 and still functioning.

Each nation would be able to fully capitalises its banks and protect deposits in its own currency.

Each nation could immediately announce large-scale public employment programs and restore incomes (in the new currencies) to their citizens who are now facing no or little income.

Each nation would immediately be able to pursue domestic growth strategies which would spill over into increased import demand which would help their neighbours.

At present, all those avenues of growth and stability are being thwarted by the manic austerity bias in Europe.

Hutton claims the only two options for Europe are debt forgiveness or inflation. He supports the former with the ECB acting as the “lender of last resort everywhere in the eurozone” – bailing out private banks, governments etc.

It could do that given its capacity. But then what happens when the next negative aggregate demand shock hits? And if you stick with a system that forces governments to issue debt to net spend, how will governments be able to underwrite growth if they are being forced to reduce debt, even if the ECB is bailing them out as they do delever?

Hutton notes that Germany appears to be the sticking point – “consistently blocked making the money flow”:

It has said no to the European Central Bank operating as a lender of last resort across the eurozone; no to creating a genuine European Monetary Fund on the scale needed; no to the creation of single euro bonds. Ireland, Greece and Italy are all doing their part. Germany must now do its – or the euro will buckle.

Germany’s phobias are well-known – inflation and then slump led to Hitler. What’s more, the German constitutional court has ruled that the EU is a Staatenbund (a group of states). This means that Germany can only constitutionally make fiscal transfers to other members if each one is agreed by the German parliament. But phobias and constitutional courts cannot trump the agonising choice facing Germany and Europe.

Before I come back to that, I conclude that Hutton also doesn’t really get to the nub of the problem – of loss of currency sovereignty.

He claims his aim is to promote policies that are in Britain’s best interests – but then says that if “Germany were to act responsibly” and help the EMU out of this crisis then the British Prime Minister should announce that:

Britain would peg sterling to a reformed euro and in the long run even consider joining the regime. Moreover, Britain would do this either way, he could argue – eventually joining a single currency in which Germany accepted its responsibilities or a single currency without Germany.

That would just add another economy to those who risk insolvency and would ensure that Brits no longer had much say on what government policies were followed.

Britain would become another domain for the EU cabal (which includes the IMF) to rule over.

This article in the UK Guardian (November 13, 2011) – These bailouts aren’t democracy. What’s worse, they aren’t even a rescue – touched on some of the anti-democratic developments in Europe that have intensified as a result of the crisis.

Heather Stewart writes:

The deeply undemocratic nature of the euro project had already been laid bare in Cannes by the European elite’s outraged response to George Papandreou’s announcement that he would hold a referendum on the latest “rescue” package for his country … [and] … Italy’s neighbours to be demanding the departure of its democratically elected leader was hardly a shining moment for European democracy … In case there was any doubt that Italy faces joining Greece, Portugal and Ireland as closely monitored protectorates of Brussels, economic and monetary affairs commissioner Olli Rehn wrote to the Italian finance minister last week, demanding details about each one of the 39 reform measures Italy has promised to take.

The article also notes that a report (published November 9, 2011) by the Centre for European Reform – Why stricter rules threaten the eurozone – reminds us that “Germany and France haven’t themselves always embraced the reforms they are now recommending”.

I will consider that paper in another blog later. It has its own issues.

But the hypocrisy of the core EMU states which are now turning on Italy is manifest.

Remember the Stability and Growth Pact (SGP) – aka (The “neither stability or growth pact”) which was adopted in 1997 after the Maastricht Treaty was formalised? It said that:

- An annual budget deficit no higher than 3% of GDP (this includes the sum of all public budgets, including municipalities, regions, etc.)

- National debt lower than 60% of GDP or approaching that value.

My 2008 book with Joan Muysken – Full Employment abandoned – was written before the crisis emerged although it was clear that during the period we were writing it that the world economy was headed for a major recession. We wrote extensively about why the SGP had failed to stimulate growth and was incapable of maintaining financial stability.

The mainstream of my profession, of-course denied most of the obvious criticisms of the SGP. Their usual retort was that I had failed to understand the victory that macroeconomics had achieved by focusing on price stability and adopting largely conservative fiscal positions.

Please read my blog – The Great Moderation myth – for more discussion on this point.

In our book, we analysed the so-called – Sapir Report – otherwise known as the An Agenda for a Growing Europe – which was published in 2003 and was a report to the EU edited by a “panel of experts”. André Sapir managed the project which was funded by the President of the European Commission.

The Report was intended to be a review (evaluation) of how the EU was travelling in the wake of the decision to create the Eurozone within it.

It is interesting to go back to read the sort of doctrinal briefing documents that the EU was receiving from the mainstream economists and then compare what they are saying today. The conclusion – they didn’t get it then – were totally wrong in their assessments – and they use the same logic now to inflict massive damage on the citizens of Europe in the name of an economic strategy.

Sapir is now a “resident scholar” (very high sounding) at a Brussels-based “think tank” – Bruegel. In 2010, it received over 2 million euros from European governments with the bulk coming from France, Germany, Italy, Spain and the United Kingdom. Greece decided not to waste any money supporting the centre. They also receive significant funding (just under a million euros from the big financial institutions such as Deutsche bank, Goldman Sachs, BNP and other corporate heavyweights.

Some of the so-called “experts” that contributed to the Sapir Report also work for the Bruegel Organisation. If you read the 183-page Sapir Report you will see what I mean about these “experts” and their capacity to understand what they were talking about.

The ideas that come out of that so-called “think tank” are nowhere near as beautiful as the paintings of the tank’s namesake. a Flemish renaissance painter and printmaker Pieter Breugel

Some quotes:

Faster growth is paramount for the sustainability of the European model …

The Group considers that three pillars upon which the European economic edifice is now built are fundamentally sound …

Expanding growth potential requires first reforms of microeconomic policies at both the EU and national levels …

there is no doubt that the period of the last 15 years has been a tremendous success …

The main emphasis was that the challenges were at the microeconomic level – to free up more markets and reduce welfare budgets etc.

It argues that the EU should create a “framework of strengthened budgetary surveillance and more effective and flexible implementation of the Stability and Growth Pact, while sticking to the 3% ceiling. The Commission should reinforce its surveillance and be given more responsibility to interpret the rules of the SGP. Also, budgetary responsibility would be enhanced by establishing independent Fiscal Auditing Boards in the Member States”.

So the classic unelected group (Fiscal Auditing Boards) crammed full of mainstream economists like them who pressure and cajole governments into adopting conservative fiscal positions.

On Page 41 of the Sapir Report, you will read the following “manifesto” of the Brussels-Frankfurt consensus:

The maintenance of price stability – reflected in low rates of inflation – facilitates achieving higher rates of economic growth over the medium term and helps to reduce cyclical fluctuations. This shows up in a lower variability of output and inflation. In turn, sound public finances are necessary both to prevent imbalances in the policy mix, which negatively affect the variability of output and inflation, and also to contribute to national savings, thus helping to foster private investment and ultimately growth. The latter beneficial effect is magnified as low deficits and debt, by entailing a low interest burden, create the room for higher public investment, “productive” public spending and a low tax burden. Finally, the beneficial effects of price stability and fiscal discipline on economic performance reinforce each other in various ways. On the one hand, fiscal discipline supports the central bank in its task to maintain price stability. On the other hand, prudent monetary and fiscal policies avoid policy-induced shocks and their unfavourable impact on economic fluctuations while ensuring a higher room for manoeuvre to address other disturbances that increase cyclical instability.

This is the orthodoxy that has created the mess the world economy is now in and, in the case of the Eurozone, driven it to the brink of insolvency and forced the Euro cabal to break its rules about bailouts and forced the ECB to run against its inflation obsession and buy billions of euros worth of public bonds to keep the system from collapsing.

It is also the orthodoxy that is imposing mass hardship on the citizens across the EMU.

In February 2011, Sapir wrote (as a co-author) – A comprehensive approach to the euro-area debt crisis (published by the Breugel Organisation).

The document blames Greece, Ireland, Portugal and Spain for living “beyond their means by accumulating private and/or public debt and running large current account deficits” but fails to mention France and Germany who were exporting to these nations to allow the deficits to occur in the first place.

They claim that workers in these nations enjoyed real wages growth that was “too fast”.

They claim that Greece’s government spent too much and mismanaged its budget.

Their solutions have all been the standard EU cabal gibberish. “Give the EFSF the mission and the financial means to carry out” salvage operations. Enforce fiscal austerity which includes wage cuts. Provide incentives to private firms to invest.

There is always a curious disconnect within papers like this. They realise that growth is the only way out but fail to join the dots.

For example, they claim:

In the meantime, growth will remain subdued and debt, though reduced, will remain high. Private and public sector efforts to pay off their debts will have a negative impact on growth, and low growth will it make more difficult to reduce debt levels.

All of which is true. But then they claim that the EU should “front-load” its structural spending to contribute to “fostering reform and growth” via a “This also requires a joined-up, coordinated approach”.

That jargon-overload claims that if firms get some innovation funding from the EU central structural funds they will speed up the process of wage cutting and sacking (to “increase competitiveness”) which is likely to frustrate the private sector efforts to “pay off their debts” – which is already having a “negative impact on growth” – at the same time fiscal austerity is ravaging growth prospects – and from out of that morass – you will get growth.

These characters are worse than the Alchemists who claimed all sorts of transmutations were possible.

The sort of questions that arise include:

Wasn’t the ECB telling Greek consumers that they were free to borrow at the interest rates that Frankfurt considered to be appropriate?

Did the ECB seek to place restrictions on bank lending to Greek consumers?

Did the EU cabal tell Ireland (the “Celtic Tiger”) or Spain or Greece to stop their consumers buying houses? To place restrictions on banks and financial engineers who were plying consumers with credit? Did anyone in the cabal tell Greece to stop buying ageing German military equipment to satiate their territorial paranoia about Turkey?

Here are some more questions that French financial market commentator Erwan Mahé wrote in his regular newsletter on Friday:

• Who allowed Greece entry into the Eurozone while being aware that its books were cooked?

• Who admits today that the country should have never been admitted entry?

• Who guaranteed investors, based on Maastricht’s criteria, that any country showing a lack of budget discipline would be brought to order by its peers?

• Who decided to ignore these criteria at the first signs of an economic slowdown (2003)?

• Who promised that no country would be allowed to default on the eurozone, but who then proceeded to launch a “voluntary” default?

• Who strongly “encouraged” institutional investors at the time of the first alert in May 2010 to maintain their exposure to Greek government debt? (Apparently, French investors seemed to have taken this encouragement to heart much more than their German peers, which may explain Merkel’s drive to push forward this PSI as well as Sarkozy’s initial resistance).

• Who signed an agreement authorising a 21% discount on NPV (Net Present Value) only to come back three months later to impose a nominal discount of 50%, which probably amounts to a 75%-80% on NPV?

• Who, after earlier introducing the notion of credit risk (with this PSI), has just added the notion of currency risk via their statement that if Greek must hold a referendum that should only concern its continued membership in the eurozone?

The hypocrisy in Europe is staggering.

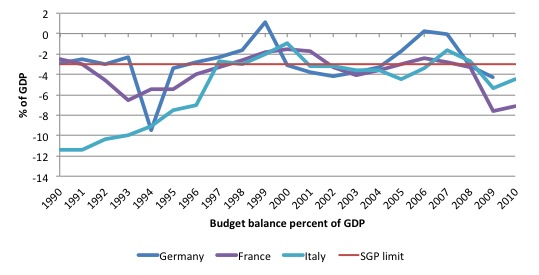

Consider the following two graphs taken from the detailed government expenditure and revenue data available from Eurostat. The first graph shows the annual evolution of the Budget Deficits (as per cent of GDP) for the “core” EMU nations (Germany, France, Italy) from 1990 into the convergence period leading to the creation of the common currency and to 2010.

The red line is the SGP upper limit deficits (3 per cent). Between 2001 and 2005, Germany violated the Treaty without penalty. France violated it between 2002 and 2004 and Italy between 2001 and 2006.

Why didn’t the Euro cabal (and the IMF) and all the rest of the mainstream commentators demand fiscal austerity for these nations. Why didn’t they at least invoke the EMU penalties that were enshrined in the agreement?

Why did the EU pursue penalties under the Treaty (which the SGP is contained) against France and Germany? Further, why did they pursue Portugal in 2002 for breaching the SGP?

The so-called corrective arm of the Stability and Growth Pact is called the excessive deficit procedure (EDP) which the EU’s ECFIN calls the “dissuasive arm”.

ECFIN write that:

The EDP is triggered by the deficit breaching the 3% of GDP threshold of the Treaty. If it is decided that the deficit is excessive in the meaning of the Treaty, the Council issues recommendations to the Member States concerned to correct the excessive deficit and gives a time frame for doing so. Non compliance with the recommendations triggers further steps in the procedures, including for euro area Member States the possibility of sanctions.

Fines of up to 0.5% of GDP are allowed for in the Treaty.

I dug this BBC article (2002) out of the archives – Row over ‘stupid’ EU budget rules – which reported that the then President of the European Commission (Romano Prodi) was quoted as saying:

I know very well that the stability pact is stupid, like all rigid decisions. If we want to adjust these, unanimity is needed and it doesn’t work … The stability pact is imperfect, it’s true, because there is a need for a more intelligent tool and more flexibility.

The comments followed the admission by Germany that they had breached the SGP as had “France, Italy and Portugal”.

Germany was the nation that insisted on the inclusion of the SGP (and as I have noted previously wanted it to be called the “Stability Pact”). They were the first to trangress against it.

This ECB Occasional Paper (published September 2011) – The stability and growth pact crisis and reform contains some interesting history of the SGP.

For example, the authors say:

When it came to implementing the Stability and Growth Pact in a rigorous manner, the first test was failed. Faced with a need to fully apply the provisions of the corrective arm of the Pact in the autumn of 2003, France and Germany, among others, blocked its strict implementation by colluding in order to reject a Commission recommendation to move a step further in the direction of sanctions under the excessive deficit procedure.

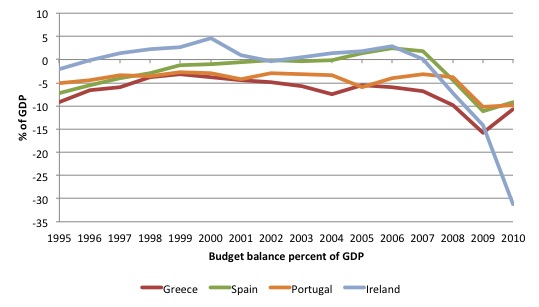

Now consider this graph which shows the budget history since joining the EMU of Greece, Spain, Ireland and Portugal. The intense cyclical deficits are clear in the recent years.

But if you put the two graphs together (I did but the detail is difficult to discern) you would find that the only nations that actually ran surpluses in the common period were Ireland and Spain.

While Germany and France were “living it up” on budget deficits and then bullying the EU Council of Ministers to turn a blind eye to their (stupid) regulations, Ireland and Spain were acting like model EMU citizens.

Should you conclude from this that I would have supported punitive action against Germany or France when they violated the SGP rules? Clearly not. I think the rules are contrary to sound fiscal management and their presence (rather than enforcement) creates an environment – a pretext – for the bullies of Europe – the Troika – to impose whatever ideological slant they want on things. The manifestations of that behaviour are almost beyond belief.

As Heather Stewart’s article says:

… These bailouts aren’t democracy. What’s worse, they aren’t even a rescue.

Conclusion

In closing, over the weekend I re-read and article by American “institutional” economist Richard Freeman wrote once:

What explains strong adherence to a claim whose empirical support is “fragile”, “mixed”, “contingent on factors that need to be clarified”, and so on? The best interpretation I can give is that these economists come to the problem of explaining unemployment with the prior that markets work well absent interventions, and thus that the right place to look for causes of problems is at institutions that may impede the operation of the markets. They have fairly tight bands around this prior, so that it dominates weak evidence, and thus produces posteriors close to the priors, as in standard Bayesian inference.

(Full reference is Freeman, R. (2005), ‘Labour market institutions without blinders: The debate over flexibility and labour market performance’, International Economic Journal, Korean International Economic Association, 19(2), 129-145).

The point he is making is that when the facts contradict their theories, most economists deny the facts. I have noted before that one professor who taught me explicitly said that once – when confronted about why the theory kept failing to explain anything he said “the facts must be wrong”.

The Euro cabal and its supporting “experts” fit into this category perfectly.

I am rushing to catch a flight (sorry for flying!) and so …

That is enough for today!

I had an amusing thought while reading the intro: In the US Constitution, specifically the 14th Amendment, is found the words “The “‘The validity of the public debt of the United States, authorized by law, including debts incurred for the payments of pension and bounties for services in suppressing insurrection or rebellion shall not be questioned.” Tim Geithner, our current Secretary of the Treasury, read that bit of reconstruction-era legislation as a possible solution to the debt ceiling (political) crisis.

One could almost hope that it had gotten to that, so as to let it sink in that there really wasn’t any problem with the debt ceiling. The debt ceiling, incidentally, is the result of WWI-era hysterics, part of a “temporary” package of legislation, and so cannot be said with a straight face to be considered policy.

Of course, as well known, if the anti-debt payment (isn’t that against the libertarian ideals that Tea Partiers claim to espouse? “Contracts [i.e. debts] shall be considered sacred obligations” is the familiar formulation after all) wing of the Republican Party had gotten its way, we might have been forced to rely on that expeditious measure to fix the problem. Or we could have used something completely different – the Federal Reserve destruction of bonds it holds was mooted as well – but the end result would have been the typical pinheaded market reaction, which would have provided the simple cause and effect storyline that the neoliberals were virtually guaranteed of finding, no matter the course of action taken.

As the estimable Justin Horton tweeted:

“Crisis caused by groupthink among economists best addressed by appointing economists to head governments, say all economists.”

In 1847 Ignaz Semmelweis showed that the washing of hands in a chlorinated lime solution reduced the incidences of death in surgery.

It conflicted with the established orthodoxy at the time and he was ridiculed for it. It took over 25 years before Surgeons started to wash their hands before Surgery. In the meantime countless unlamented people died at the hands of dirty Surgeons who thought they knew better.

It led rise to a term – the ‘Semmelweis reflex’ – a metaphor for a certain type of human behaviour characterized by reflex-like rejection of new knowledge because it contradicts entrenched norms, beliefs or paradigms.

How many unlamented individuals are to die due to the Semmelweis Reflex in economics?

Bill Mitchell said, and I qoute, “Unfortunately, under pressure from my corrupt profession and the media lackeys who take the ideas of mainstream economists in to the public sphere and the competing vested interests (in the financial markets) who actually profit from the crisis, our governments are not exercising those choices and so the crisis drags on.”

Bill is a courageous truth-speaker in a world of economic charlatans. I’m glad Bill doesn’t beat around the bush when he launches his criticism. Keep up the good work, Bill. Currently, you are a voice crying in the wilderness. One day your work will be thoroughly vindicated.

If somebody needs further proof for the faulty design of the Euro: Japan announced at the APEC conference, that it is willing and ready to lend Europe a helping hand.

Will Hutton is a windbag who I have studiously ignored for twenty years.

“Should you conclude from this that I would have supported punitive action against Germany or France when they violated the SGP rules? Clearly not.”

But if one takes the analogy to non-sovereign federal states seriously, shouldn’t the deficit rule have really been- no deficits at all, other than for explicit & modest infrastructure bonds, as is the case for US states and doubtless Australian sub-national entities as well?

The actual rule, in this view, was way too loose, allowing profligate lending and borrowing in the absence of real sovereignty. The private lending spree was likewise profligate, and in the US, the debts would never have been assumed by state governments.. the private parties would have headed into bankruptcy resolution. Or the federal government (ECB) would bail them out, if enough panic were afoot. Would California go to the IMF to support its bailout of local BofA operations? The idea is absurd.

Thanks for all your work!

according to MMT banks reserves don’t drive loans ’cause banks can borrow directly from the central bank when they need reserves

but in Italy at the moment banks are attracting deposits paying up to 4-4,5% interest on them when they could just borrow from the ECB at 1,25%

if banks are not reserve constrained why they do that?

I saw a bank in Massachusetts offering around two or three percent. The anwer is usually in the fine print. Minimum balance, fees, etc.. Not sure but that would be my guess.

Very good question Jan. I am afraid you will not get an answer.

it’s a 3% difference, and there are no hidden fees or anything similar

i hope someone here will answer ’cause i just can’t find an explanation for that behavior

The answer is simple: liquidity risk management. As any risk it costs capital and money. Besides you are comparing overnight rates with term rates. ECB is not in the business of term funding and wholesale markets are closed not just for Italian banks but overall. You would better compare deposit rates of Italian banks to yields on Italian government bonds.

but the ECB is in the business or term funding

MTO and LTRO are term funding operations, aren’t they?

Jan,

MRO and LTRO are repo operations. You have sell something to the central bank to get the liquidity and promise to buy it back at the same price. That means you lose the income from whatever you are selling.

So add the income from a 7% bond at an 15% haircut to the cost of the liquidity.

i know they are repo operations

but as far as i know you have to sell something to the central bank to get liquidity and promise to buy it back, but not at the same price as you say. you promise to buy it back at another price, the difference between today price and theendofoperation price determines the yield

and at the moment that yield is 1,25-1,50%, far lower than what some banks are paying to get deposits

“According to MMT banks reserves don’t drive loans ’cause banks can borrow directly from the central bank when they need reserves.”

The first part of that qualification applies most clearly to a banking system and any stock reserve requirement that is imposed on it by authorities. A banking system does not need reserves ex ante in order to lend at the margin, because any reserve requirement generated by that lending is imposed ex post, and the central bank will provide required reserves ex post as a matter of interest rate policy management. At the individual bank level, banks compete for available reserves according to their individual requirements at the time. If a bank can’t get the funding it needs from the public, it has the option of turning to the central bank’s LLR function. (This last part also applies to systems where the statutory reserve requirement is zero (e.g. Canada)).

The ECB normally operates according to an overdraft system, where its assets include regular lending to the banking system, instead of purchases of government debt (which the Fed does). It has broken that rule during the crisis. The Fed by contrast normally manages its asset portfolio with government debt rather than regular bank lending.

No banking system relies exclusively on funding from the central bank. All systems include deposits from the public. So no individual bank would systematically turn down deposits from the public, and rely entirely on central bank funding. Its charter would soon be revoked if it operated that way. This is easier to see in the case of the Fed system. In the case of the ECB, I’m not familiar with the details of how banks determine their funding mix between the ECB and the public. But it is a mix.

By contrast, banks generally require adequate capital prior to building a loan portfolio. They get capital through retained earnings or stock issues. There is a degree of lumpiness to capital generation, so banks don’t really have the luxury of lending first and finding the capital later. They keep a buffer on hand. On the other hand, the reserve requirement lag is pretty routine stuff.

JKH – No banking system relies exclusively on funding from the central bank. All systems include deposits from the public. True.

So no individual bank would systematically turn down deposits from the public, and rely entirely on central bank funding. If I understand correctly, doesn’t follow & isn’t true, or is essentially not true. Banques Commerciales in France traditionally operate this way, or by funding from deposit-taking banks. The two functions can be performed by separate institutions. At least that is what I recall from skimming some papers of Lavoie. E.g. “In France, some banks are specialized in providing loans, while other specialize in collecting deposits… The money market exists to balance the two” Credit and money: the dynamic circuit, overdraft economics, and Post Keynesian economics or “In France commercial banks hardly held any Treasury bills. The only means to acquire banknotes or compulsory reserves was to borrow them from the central bank, as had been shown in detail by Le Bourva (1992 [1962])” On the full endogeneity of high-powered money: Lessons from the Canadian case Think he has a better paper for these points than either of these two, but can’t find it at the moment.

“That means you lose the income from whatever you are selling.”

Except of course the bank probably doesn’t because although the repo makes the central bank the legal owner they are not necessarily the beneficial owner. It all depends on the terms of the repo. So it ain’t that.

From a retail bank perspective there is also the ‘loss leader’ to consider. Retail banks make the real money from the subsidiary services they sell to retail punters – insurances and other products as well as loans. Very often a bank will see the interest paid on a particular deposit offering as marketing spend – particularly where it is a limited offer or an ‘introductory rate’.

The information we’re missing is how much the bank is expecting to raise with that deposit offering relative to the liquidity requirements of the bank as a whole.

“banks generally require adequate capital prior to building a loan portfolio”

Does the capital pledged or repo’ed to the central bank fall out of the capital buffer pool against which loans are assessed? So would using 100EUR of bonds mean that the loan capacity is reduced by 1000EUR (assuming a required 10% ratio)?

“In France, some banks are specialized in providing loans, while other specialize in collecting deposits… The money market exists to balance the two”

It is pretty much valid for most countries as in most countries banking system is two-tiered: large universal settlement-centric banks which are normally reserve borrowers in the interbank market and smaller regional niche players and service providers which are normally reserve lenders.

“Does the capital pledged or repo’ed to the central bank fall out of the capital buffer pool”

Capital is an accounting concept and is on the liability side of the balance sheet. As such it can not be pledged or repo’ed. However, capital as liability of the bank economically corresponds to the liquidity buffer which is on the assets side. The reason it does so is that capital is supposed to cover for risks and therefore should be matched with or invested into risk-free assets. It is an *economic* link between capital and liquidity buffer since there are no accounting links on the balance sheet.

In any regular financial system central government bonds are risk-free. In eurozone – not so. This is especially clear from the stress tests that EBA has just recently finished where it used market prices of eurozone governments debt regardless of the actual accounting treatment of such bonds on bank books.

Since in eurozone government bonds are not risk free then shifting the risk onto the books of ECB would reduce capital requirements of banks. However, the problem is in the way ECB runs its policy as eurozone, as JKH mentioned above, is an overdraft system. This means that ECB does not buy or reverse-repo any government bonds in its regular monetary operations. Instead banks keep ECB eligible bonds on accounts at ECB and these bonds in aggregated represent a collateral *pool* against which banks can go into overdraft at ECB. The bonds in the collateral pool are marked-to-market for the purposes of ECB activities which means that banks, not ECB, still have all market, etc. risk related to securities on the collateral pool.

So when banks in eurozone go to ECB for liquidity they get an additional asset (reserves) and additional liability (to ECB) and no movements of securities. Whereas Fed, which runs an asset-based system, simply does asset swaps with banks to regulate their liquidity needs. ECB market operations are pure and typical bank lending operations which increase both assets and liabilities of the banking system.

“So would using 100EUR of bonds mean that the loan capacity is reduced by 1000EUR (assuming a required 10% ratio)”

In eurozone – yes.

Sergei,

Why do you say that is a “typical lending operation”? Main refinancing operations, that are the main open market operations in Europe, have a weekly frequency and are liquidity-providing operations. Banks, participate at an auction like a simple repos at the FED, nothing really different (yes it changes that repos in US are usually overnight).

Probably the nature of collateral, but ECB consider eligible also government securities, so there isn’t a great difference, in my view.

I mean, it is overdraft vs asset-based, but the operations are strictly similar.

And so, I think that banks go to NCB and not ECB, but is a little irrelevant detail.

Say me if I have misinterpreted your comment.

Luigi, the difference between an asset-based monetary policy and overdraft-based is that the former uses asset swaps which replace one asset with another one while the latter is based on bank lending and creates *new* asset and *new* liability.

“Asset based” and “overdraft” are not very apt descriptors.

The significant difference between Fed (ab) and ECB (o) systems, is that the assets of the Fed are normally claims on government, and the assets of the ECB are normally claims on banks.

The exact nature of the claim is less important to the distinction. Most Fed assets normally are outright holdings of Treasury bonds. Most ECB assets normally are collateralized lending to banks.

Sergei, where can I read something about this?

I remeber some papers by Lavoie and Fullwiler, and both said something summarized by that:

“An asset-based system functions essentially like an overdraft system is all the more clear given substantial intraday credit and that day-to-day open market operations in asset-based systems like the U. S. and Canada are carried out largely or even exclusively via repurchase agreements (Lavoie 2005); as Bindseil (2004, 156) notes, repurchase agreements-since they are simply collateralized loans-are functionally equivalent to overdrafts.”

yes JKH, this is what I know.

\”Most Fed assets normally are outright holdings of Treasury bonds. Most ECB assets normally are collateralized lending to banks\”

Yes, however there is a good reason at least for the \”overdraft\” description because the monetary operations in eurozone are not caused by active lending from ECB but rather by commercial banks borrowing, i.e. going into overdraft, which ECB passively accommodates. In the asset-based system it is the central bank who actively plays in the market with assets of commercial banks. That is an important distinction which also highlights why ECB can not do anything about the yields on government bonds of particular types. ECB has to explicitly commit to lower yields and execute that whereas in the case of the FED yield decisions are pretty much a by-product of regular monetary operations.

What types of assets end up on the central bank balance sheet is less relevant. Fed is free to decides what to buy while ECB was intentionally denied such possibility. I do not see anything special about this for the purposes of interest rate policy.

Sergei,

http://www.concertedaction.com/wp-content/uploads/2011/11/Eurosystem-29-Dec-2006.png

take this image (thanks to Ramanan)

Main Refinancing Operations are the main tool/way used to acquire reserves in Europe, so nothing different (functionally) from a simple repos done by the FED.

This is the reply I’ve been waiting for, Mr William. Thank you

I can’t read it with the proper attention right now, but I shall read it latter and pose the questions that may arise to me.

You have some two broken links. Both on the Sapir report (on is the wikipedia link and the other is the report per se). I didn’t see anything of not eon page 183 of the report, just a bibliography.

I totally agree with your points! One fallacy I keep pointing to my North-European Internet contacts is the nature of the so called reforms:

They speak of the labour market liberalisation.

I ask why

They say all that rubbish – Oh, they can fire, they won’t fear hiring during a crisis with worries about the investment failing. So, unemployment will go down!

To which I point that they can use short-term labour contracts for that. And that when Portuguese labour law unemployment was much lower, and it steadily risen despite the successful liberalisations.

I only know the basics of Economics, having had Political Economy (my presentation during my oral exam was a rebuttal of the benefits of Free Trade) but never being happy with made truths. I always ask why, and that unmasks most arguments.

About the EU promoting de-regulation, that’s hardly the case. There used to be 36 regulations on the sizes and weights of several vegetables and fruits. You have directives such as the “Directive on the driver’s seat of agricultural and forestry tractors”, “Directive on the passenger’s seat of agricultural and forestry tractors”, a similar directive concerning braking devices of those same devices, etc.

I can tell you all those regulations (which cover practically everything) harm mostly small and medium producers who can’t afford to change their production methods to comply with directives.

Dear Talvez (at Submitted on 2011/11/18 at 7:28)

Thanks for noting the broken links. They are fixed. Also you mis-read the post – the text indicates it is an 183-page report and was not referencing page 183.

best wishes

bill

Oops, sorry, my mistake. I thought you were pointing a page.

Thank you for collecting all this information! So, in the end the real PIGS are the ones impeding the growth in the EURO zone.

Greetings form the S in the PIGS!