The other day I was asked whether I was happy that the US President was…

How’s poor old Ireland, and how does she stand?

Last Friday (December 16, 2011), Ireland’s Central Statistics Office published their – National Accounts – for the September quarter 2011 and guess what? Things just became worse. Ireland is now nearly two years in the enforced austerity and all the deficit terrorists have been watching it closely for signs of life. The slightest upturn in GDP growth has brought a salvo of attacks on any one daring to oppose the harsh austerity. Well, I also watch it closely and the pattern that is unfolding is consistent with predictions. Things are getting worse not better. The only growth “engine” has been exports and with austerity spreading that market will not be strong enough to sustain growth when domestic demand is being ravaged by austerity.

The title of today’s blog comes from the song – Wearin’ o’ the Green – beautifully sung by the famous Irish tenor John McCormack.

O Paddy dear, and did ye hear the news that’s goin’ round?

The shamrock is by law forbid to grow on Irish ground!

No more Saint Patrick’s Day we’ll keep, his color can’t be seen

For there’s a cruel law ag’in the Wearin’ o’ the Green.I met with Napper Tandy, and he took me by the hand

And he said, “How’s poor old Ireland, and how does she stand?”

“She’s the most distressful country that ever yet was seen

For they’re hanging men and women there for the Wearin’ o’ the Green.”So if the color we must wear be England’s cruel red

Let it remind us of the blood that Irishmen have shed

And pull the shamrock from your hat, and throw it on the sod

But never fear, ’twill take root there, though underfoot ’tis trod.When laws can stop the blades of grass from growin’ as they grow

And when the leaves in summer-time their color dare not show

Then I will change the color too I wear in my caubeen

But till that day, please God, I’ll stick to the Wearin’ o’ the Green.

So, how’s poor old Ireland, and how does she stand?

Ireland was the first of the EMU nations to embrace the austerity mantra – the first of the governments to openly engage in economic policy malpractice by abandoning their responsibilities to advance public purpose. The data supporting that claim is easily available (see below).

But at each sign of growth, the conservatives have been jumping up and down claiming victory.

Remember the news in the middle of last year that Ireland was defying the critics of austerity. For example, this Reuters news report (June 30, 2010) – Ireland exits recession but recovery fragile – quoted a Moody’s economist who said:

Realistically, sustained growth is unlikely to take hold until late next year, with continued pressure both at home and abroad

There were many similar predictions about Ireland.

Then this year we read that in the June quarter 2011 – Ireland’s trade surplus hits record high in June.

US academic economist Tyler Cowen (a Chicago School devotee) claimed (September 22, 2011) that the – Irish recovery from “austerity” update, not exactly the Keynesian story.

My prediction has been constant. It will be very difficult for Ireland to grow at all while it is cutting domestic demand and austerity elsewhere is damaging its export markets (mainly the UK).

Please read my blog – Fiscal austerity – the newest fallacy of composition – for more discussion on this point.

The CSO said in their most recent National Accounts release that:

Initial estimates for the third quarter of 2011 show seasonally adjusted decreases of 1.9 per cent in GDP and 2.2 per cent in GNP compared with Q2 2011. Comparing Q3 2011 with the same quarter one year earlier, GDP at constant prices registered a decrease of 0.1 per cent while GNP was 4.2 per cent lower.

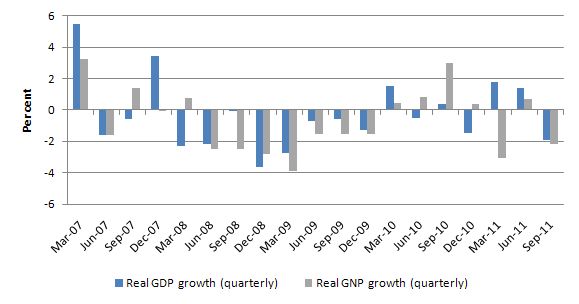

The following graph shows quarterly growth rates in real Gross Domestic Product (GDP) and Gross National Product (GNP) from the first quarter 2007 to the June 2010 quarter. Clearly the GDP growth in the June 2010 quarter is what everybody is focusing on. The most recent quarter shows a 2.7 per growth although GNP continues to be negative.

First, you need to first understand the difference between GDP and GNP. This is a particularly important point when it comes to understanding the Irish predicament (both before the crisis and now. Wikipedia is a reasonable place to start in this respect (but not always). A more thorough understanding of these concepts is provided in the excellent publication from the Australian Bureau of Statistics – Australian National Accounts: Concepts, Sources and Methods, 2000

The two concepts are defined as such:

- Gross domestic product (GDP) is defined as the market value of all final goods and services produced in a country in any given period”.

- Gross National Product (GNP) is defined as the market value of all goods and services produced in any given period by labour and property supplied by the residents of a country.

The Irish CSO publication says that GNP = GDP + Net factor income from the rest of the world (NFI). NFI is defined as:

Net factor income from the rest of the world (NFI) is the difference between investment income (interest, profits etc.,) and labour income earned abroad by Irish resident persons and companies (inflows) and similar incomes earned in Ireland by non-residents (outflows). The data are taken from the Balance of Payments statistics. However the components of interest flows involving banks in this item in the national accounts are constructed on the basis of “pure” interest rates (that is exclusive of FISIM) whereas in the balance of payments the FISIM adjustment is not carried out. There is an equal and opposite adjustment then made to the imports and exports of services in the national accounts which is not made to these items in the balance of payments. The deflator used to generate the constant price figures is based on the implied quarterly price index for the exports of goods and services. In some years exceptional income payments have had to be deflated individually.

In this blog – The sick Celtic Tiger getting sicker – I argued that the so-called “Celtic Tiger” growth miracle was an illusion and was driven by major US corporations evading US tax liabilities by exploiting massive tax breaks supplied to them by the Irish government.

In a New York Times article (May 20, 2010) – Irish Miracle – or Mirage? – by Peter Boone and Simon Johnson, we read that:

… 20 percent of Irish gross domestic product is actually “profit transfers” that raise little tax for Ireland and are owned by foreign companies – the Irish miracle was a mirage driven by clever use of tax-haven rules and a huge credit boom that permitted real estate prices and construction to grow quickly before declining ever more rapidly. The biggest banks grew to have assets twice the size of official G.D.P. when they essentially failed in 2008.

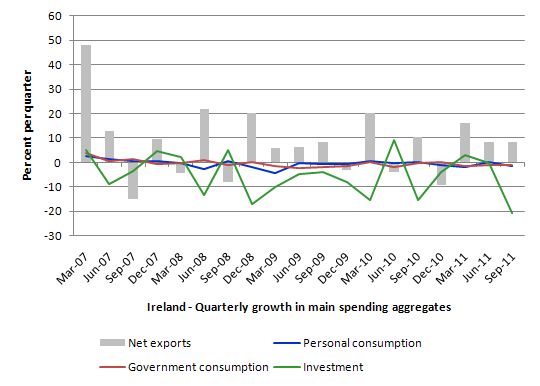

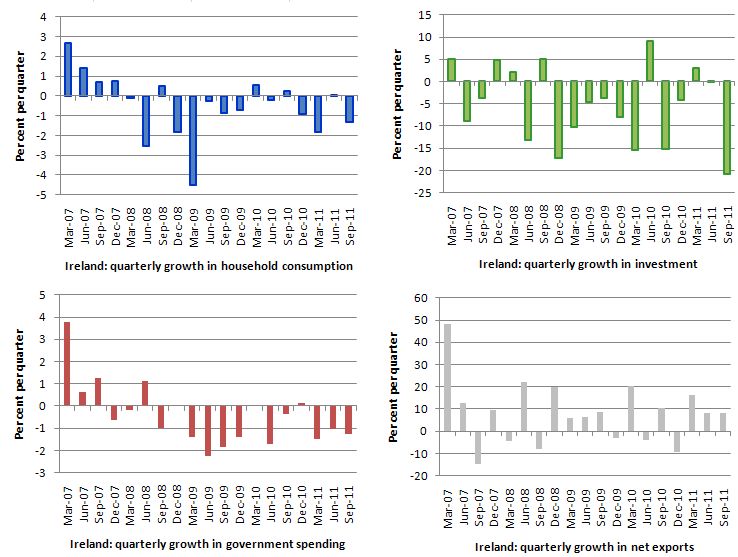

The following graph shows the components of aggregate demand (consumption, investment, government and net exports) as quarterly growth rates since the March quarter 2007. Personal consumption and Government spending have been contracting consistently over the period shown. The behaviour of private investment (capital formation) is very worrying and portents for a very long recession. The only source of growth has been exports.

To demonstrate how harsh the fiscal austerity has been the following graph shows the quarterly growth in Domestic Demand (that is, excluding net exports) since the March quarter 2007. It is hard to be optimistic about that pattern at all.

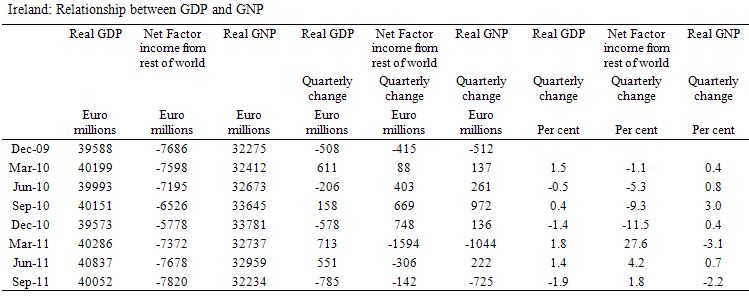

The following Table shows you the breakdown between GDP and GNP and the linking Net Factor Income (NFI) flows aggregates and their evolution since Q1 2010 until Q3 2011 for Ireland using the CSO National Accounts data.

The data puts the “trade recovery” into perspective. The growth in GDP spawned a fall in net NFI. What is the significance of this?

The recent growth is coming exclusively from exports (which is signalled by the GDP figure). However, the domestic economy is still declining with unemployment rising further.

The following graph shows the quarterly growth in the major spending aggregates since the downturn took hold in Ireland (March quarter 2007). All domestic spending aggregates remain negative.

By excluding the expatriated profits of foreign multinationals, GNP provides a better picture of how the domestic economy is delivering welfare improvements to its residents. The fact is that Ireland continues to go backwards in this regard.

In the first quarter 2011, GNP declined by a staggering 3.1 percent and could only grow a miserable 0.7 per cent in the second quarter on the back of a record trade surplus. As its major trading partners are implementing austerity and going backwards, GNP has shrunk by 2.2 per cent in the third quarter.

So Ireland’s growth strategy has been based on increasing exports of real goods and services which are a cost to the domestic economy (forgoing local use). Any growth dividend is being being expatriated to foreigners as rising income.

The only conclusion you can draw at this stage is that the austerity package is further impoverishing the local residents and handing over increasing quantities of Ireland’s real resources to the benefit of foreigners. That doesn’t sound like a very attractive option to me.

In March 2005, the OECD Observer said this:

Ireland is another country where GDP has to be read with care. Ireland’s position has risen up the GDP per head rankings since 1999, and is now in the top five countries in the OECD … But does GDP per head accurately reflects Ireland’s actual wealth, since all that inward investment (and foreign labour) generates profits and other revenues, some of which inevitably flows back to the countries of origin?

Another measure, Gross National Income, accounts for these flows in and out of the country. For many countries, the flows tend to balance out, leaving little difference between GDP and GNI. But not so for Ireland, as outflows of profits and income, largely from global business giants located there, often exceed income flows back into the country. This means that in a GNI ranking, rather than being in the top five, Ireland drops to 17th. In other words, while Ireland produces a lot of income per inhabitant, GNI shows that less of it stays in the country than GDP might suggest.

The reality is that the few quarters of positive GDP growth that Ireland experienced before heading back into negative growth did not impact positively on the labour market – which presumably matters more than whether the economy is producing net income for foreigners.

And … the labour market deteriorates further

The National Accounts data was the second blow for Ireland in a week. Bad news came earlier though on December 12, 2011 when the Central Statistics Office released the latest Labour Force data.

The summary low-lights are (seasonally-adjusted):

- Employment fell by 2.5 per cent or (net) 46,000 in the year to the third quarter of 2011. In the 12-months to the second-quarter 2011, the annual decrease was 2 per cent. So – the situation is getting worse.

- Official unemployment rose by 15,700 (5.3 per cent).

- The official unemployment rate rose from 14.2 per cent to 14/4 per cent.

- Long-term unemployment comprised 56.3 per cent of total unemployment in the third-quarter 2011 compared with 47.0 per cent a year earlier and 25.5 per cent in the third-quarter 2009.

- The labour force shrunk by 1.4 per cent in the third-quarter

The CSO also note that employment fell across the board but the “greatest rate of decline was recorded in the Education sector”. To further accentuate how this fiscal austerity will undermine the future for years to come the CSO reported that:

From an age perspective the fall in employment was concentrated in the 25-34 (-31,700 or -5.8%) and 20-24 (-18,000 or -13.1%) age groups.

Further the overall unemployment rate disguises the fact that for 15-19 year olds, the rate is 39 per cent and for 20-24 year olds it is 27.4 per cent. Both are rising as the austerity continues.

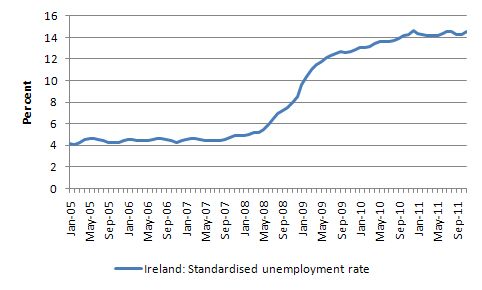

The following graph is compiled from CSO data and shows the seasonally-adjusted standardised (OECD) unemployment rate from January 2009 to November 2011. Does the expression inexorable rise make any sense?

I thought this brief Bloomberg article (December 15, 2011) – Euro Pact Ignores Ireland’s Lack of Synchronicity – made a good point. The author Frank Barry (an academic in Dublin) noted that:

Ireland’s business cycle is out of sync with the euro zone. It has an Atlantic economy: The U.K. remains the major export destination for Irish-owned companies, while the U.S. is the source of most incoming investments. A fiscal policy harmonized within the euro area will not synchronize the Irish business cycle with that of the French-German core.

In the U.S., any such lack of synchronicity among regions is addressed by the enormous federal budget. For every $1 worth of shock to a region’s income relative to the U.S. average, the budget provides 30 to 40 cents through reduced federal taxation and increased regional spending.

That is the core of the Euro problem – a lack of “fiscal federalism”. The Euro designers deliberately left that essential aspect of a currency zone with heterogenous states out purely because it didn’t fit their neo-liberal ideology. They thought that by imposing German-style fiscal rules on the Eurozone that they would resist excessive public spending.

They were dramatically wrong. Even the cyclical deficits (as a result of the automatic stabilisers) blew many of the member-state budgets over the Stability and Growth Pact limits as a result of the deep negative aggregate demand shock the region faced in 2008-09.

Further, the latest rescue plan that was cobbled together at the recent EU Summit also – in Barry’s words – “studiously ignores this need”.

The Euro bosses could only conceive of even tighter fiscal rules and penalties than before. Once failed, twice failed … how many times do their plans have to fall apart before they learn some basic macroeconomics?

Frank Barry says that the:

The current plan will embed within the system a contractionary bias … For those tripped into a recession, however, the plan will impose further austerity. Such automatic destabilizers are surely a recipe for disaster …

The euro system had more design flaws than even its most vociferous detractors recognized, and the Brussels proposals do surprisingly little to address them.

Ireland was the first nation to heel-click to the Euro bullies and in early 2009 imposed a very harsh austerity program on the nation. We were told that it would be tough but growth would come. The Irish people are still waiting while many cannot wait any longer and are leaving the nation behind.

Ireland will struggle while they remain in the Eurozone. The system is geared heavily against them.

This UK Guardian article (December 16, 2011) –

Ireland’s problems are far from over – provides an accurate assessment of what is going on in Ireland at present.

The article says:

Listening to Irish finance minister Michael Noonan you would think that exporting lots medical devices and gallons of milk is enough to support a vibrant economy. More than that, a few minutes in his company and you might be forgiven for believing this export fever will also bring down one of the biggest debt-to-GDP ratios of any nation in modern history.

It is the cheery, optimists version of economics he subscribes to, with the cavalry, in the form of the IMF, rescuing everyone in the final reel …

But Noonan’s strategy is not built on firm foundations. As such, it is not so much a confidence boost as a trick. And one that is being perpetrated on the Irish people to keep them thinking they are best served by remaining in the euro currency zone and paying back all their debts.

The article concludes that the recent Irish National Accounts data “are testimony to Noonan’s ridiculous optimism. The economy contracted by 1.9% in the third quarter, far worse than expected”.

The confidence trick is that the Irish government and the IMF and OECD and all the rest of them keep hoping that “the growing export sector will distract the Irish public from the fundamental problems of paying back debts with a smaller and slower-growing economy”.

Conclusion

In this blog from July 2010 – The Celtic Tiger is not a good example – I noted that Ireland’s growth was coming from the modest growth in the US economy. As the Euro depreciated against the US dollar, Ireland’s exports (pharmaceuticals, software, food and services) became increasingly cheaper and more attractive to its two major trading partners Britain and the US.

Exports were driving Ireland’s growth. I noted then that with the UK economy now being deliberately whiteanted by its own government (via the very harsh budget cuts) and the US economy slowing again, the Irish recovery will be stopped in its tracks. The lack of any spending recovery in the domestic components and the rising unemployment will take care of that.

That is what has happened.

Austerity begets austerity and trade is one way that the transmission occurs.

That is enough for today!

and low corporate tax rates had such promise …..

but why oh why are ireland’s rates still soooo high??? (i’m being sarcstic just in case someone doesn’t get it) … this recent Fed “research” takes the cake – http://www.clevelandfed.org/research/trends/2011/1211/01gropro.cfm

it’s just appalling innit?

The late economist Raymond Crotty predicted this in his many books.See wikipedia.

Congratulations Bill (I think)

You’ve got linked by the FT’s alphaville. Is that a first? If so, about time.

(In the further reading section)

http://ftalphaville.ft.com/

I think the problems of the world economy are bigger than any of this. http://thearchdruidreport.blogspot.com/2011/12/what-peak-oil-looks-like.html

Further to the point above, Bill, I’ve asked before but I don’t know if I’ve seen an answer, where does Peak Oil fit into MMT? Am I a doom-monger? This says it all, I feel:

“The point that has to be grasped just now, it seems to me, is that this is what peak oil looks like. Get past the fantasies of sudden collapse on the one hand, and the fantasies of limitless progress on the other, and what you get is what we’re getting-a long ragged slope of rising energy prices, economic contraction, and political failure, punctuated with a crisis here, a local or regional catastrophe there, a war somewhere else-all against a backdrop of disintegrating infrastructure, declining living standards, decreasing access to health care and similar services, and the like, which of course has been happening here in the United States for some years already.”

@ Elizabeth

That is solely about resource management. And as you can see by this: http://en.wikipedia.org/wiki/List_of_countries_by_electricity_production_from_renewable_sources#cite_note-autogenerated1-25 50% rates of renewable energy production are not far-fetched

@ Elizabeth

The answer to the end of the fossil-fuel age is the beginning of the nuclear age. We don’t need any miraculous breakthroughs. We (humanity) already have the answer. There is enough uranium (and thorium) available to power an advanced industrial civilization for thousands of years and give a decent standard of living for the entire world.

Of course, whether we get there without major disruptions is a bit doubtful. Not to mention that we may see some significant impact from climate change before we implement a non-polluting solution.

Re apj’s link to the Cleveland Fed “research,” if you look at the authors’ bios it appears that the piece was written by Ms. Jacobson, who has a “a BA in economics and French…”

Just lovely. PhDs are going begging or working as slaves as adjuncts, and the Fed is giving its imprimatur to someone with a BA…

If you want to bleed a man – kill him and you get about 5 litres/quarts. But strap him to a gurney with a catheter in his arm and a drip feed in his nose, and he will bleed for you for as long as his system can stand it.

http://www.golemxiv.co.uk/2011/12/plan-b-how-to-loot-nations-and-their-banks-legally/

What do you think of they above?

You’ve neglected the issue underlying the Irish problem, a vastly overbuilt housing supply. And an accommodating well of real estate financing. The same problem as elsewhere. Government can pour money down any rat hole, but it doesn’t lift up severely depressed housing in excess supply. Such progress takes time to wear off. Austerity is no more the root cause, than government spending would have salved the collapsing housing markets worldwide.

Thanks for the post today, Bill – I’m glad you acknowledge the ‘gotcha’ tactics from the austerity freaks every time the statistics show any mild fluctuation. In Ireland, we’re very used to this kind of media chorus every time the unemployment doesn’t maintain its record surge (helped, of course, by the Irish Government re-estimating the unemployment rate with reference to the household survey when the rate became uncomfortably high, earlier this year: inconveniently, the rate is still going up). For these people, every (illusory) advance is permanent, every ‘setback’ is temporary.

The latest GDP drop was met with a response in the Irish media, not of ‘oh my God, we’ve been had about austerity’, but of ‘GDP monthly statistics are volatile, so let’s sit tight and see what happens’. I guess a ‘realisation’ that austerity was counter-productive would lead to similar ‘realisations’, such as, ‘the Government will have to spend more money (shock, horror!)’, ‘we need to issue our own currency and start deficit spending (in the absence of a wholesale personnel purge in the ECB)’ and, most crushingly, ‘public sector workers and people on welfare (including the disabled) are not to blame for the economic meltdown, it turns out’.

P.S.: Apologies to other readers for the over-use of parentheses – I’m a wee bit stuck for time.

Very good if sad analysis. What has happened to the minimum wage in Ireland which was about 8.5 Euros per hour?

I am just wondering on what the emigration rate is from Ireland, as that traditionally has been the major export product of Ireland