The other day I was asked whether I was happy that the US President was…

A dose of truth is required in Europe

I was going to write about the True Finns today to report some research I am doing at present aimed at exposing how the “left” political parties have ceded legitimate progressive issues to fringe parties who then meld reasonably sensible economic issues with offensive social and cultural stances to create a popular but highly toxic political force. The True Finns who gained 19 odd per cent of the vote in the April 2011 national election exemplify this trend. The Euro crisis is accelerating the growth of the popularist political forces in Europe who are anti-Euro (pro-nationalist) and who will not (I suspect) tolerate the Euro elites impinging on national affairs and imposing a decade or more of enforced austerity. There are political movements/parties all over Europe now (for example, Vlaams Belang, Le Pen, Lega Nord etc) which fit this mould. It would be far better for the mainstream progressive parties around Europe to take the initiative and retake control of the policy debate on what should be bread-and-butter issues for the left. Sadly, these mainstream left parties have become totally co-opted by the neo-liberal agenda and speak the same economic voice as the conservatives. The problem then is that the public debate is distorted by untruths which further reinforce the malaise. A dose of truth is required in Europe.

But you won’t get any of that from my profession.

Chicago University economist John Cochrane was at it again with his latest Bloomberg opinion piece (December 22, 2011) – How Bad Ideas Worsen Europe’s Debt Meltdown.

His basic claim is that “Europe is as full of bad ideas as it is of bad debts”.

I agree. The political leadership is corrupted by Chicago-style economic thinking and the private sector has debts that are crippling aggregate demand growth. The creation of the problem was a direct result of Chicago-style economic thinking although I wouldn’t want to give them the full credit. We can add them to the mainstream profession – they are not that special after all. All of them are droogs after all – in the ideological sense.

John Cochrane is against the Euro nations being “bailed out” by the ECB (or any other source). He says:

Bailouts are the real threat to the euro. The European Central Bank has been buying Greek, Italian, Portuguese and Spanish debt. It has been lending money to banks that, in turn, buy the debt. There is strong pressure for the ECB to buy or guarantee more. When the debt finally defaults, either the rest of Europe will have to raise trillions of euros in fresh taxes to replenish the central bank, or the euro will inflate away.

The ECB has been doing that which has been the difference between the parlous “muddling through” austerity we are witnessing at present and total collapse of the Eurozone monetary system.

Without their Securities Market Program (SMP) several governments including big ones like Italy would have failed to cover their daily deficits. There would have certainly been defaults. I agree with him that a default doesn’t necessarily mean that Greece (or any other state) would have to leave the Eurozone. But that is not the point.

But there is no reason for inevitable default if the SMP was accompanied by a growth strategy. The problem is that the SMP is chasing its tail. By forcing nations to invoke pro-cyclical austerity programs which negate any possibility of growth even via net exports given that they are all doing it – the ECB is either locking itself in to a more or less permanent SMP with devastating consequences for the people who actually live outside the Eurotower or guaranteeing a default once they ease up the SMP.

But that doesn’t mean anything for future taxes or inflation. The EU could simply agree to write all the ECB bad debts off without any further consequence. The ECB creates the currency as a monopoly issuer and it faces no applicable concept of a “loss” that a private bank might encounter if its capital gets wiped out.

There would have to be some accounting gymnastics needed but if we can put a person on the Moon we can surely juggle some books (of largely meaningless numbers) to create some zeros.

Yesterday’s blog – Mainstream macroeconomics textbooks do not impart knowledge – should disabuse you of believing the mainstream line that rising bank reserves lead to inflation then hyperinflation.

John Cochrane then claims that:

Leaving the euro would also be a disaster for Greece, Italy and the others. Reverting to national currencies in a debt crisis means expropriating savings, commerce-destroying capital controls, spiraling inflation and growth-killing isolation. And getting out won’t help these countries avoid default, because their debt promises euros, not drachmas or lira.

Yes, leaving the Eurozone would necessitate a “default” – or rather a conversion of debts into local currency. It wouldn’t be easy. But we have data to show that rather than enduring “growth-killing isolation” a nation can return to growth very quickly once it takes back control of monetary and fiscal policy and is able to deal with bond markets directly without having to succumb to enforced penury courtesy of the Troika (aided by the ECB’s SMP).

We also have data that shows that there will not be enduring “spiraling inflation” in such cases.

I will come back to that in a moment. But more of John Cochrane’s self-aggrandizing hyperbole. He says:

Defenders think that devaluing would fool workers into a bout of “competitiveness,” as if people wouldn’t realize they were being paid in Monopoly money. If devaluing the currency made countries competitive, Zimbabwe would be the richest country on Earth. No Chicago voter would want the governor of Illinois to be able to devalue his way out of his state’s budget and economic troubles. Why do economists think Greek politicians are so much wiser?

Illinois is not a nation and cannot leave the US at the stroke of a government decision. Greece is a nation that made one big mistake – surrendering their currency sovereignty. They could restore it if they chose to and restore their full nationhood.

Moreover, unless my Greek friends mislead me, I am not aware that the Greek government has deliberately trashed up to 50-60 per cent of Greece’s productive capacity in the same way as the Zimbabwean government managed to do as they tried to implement a well-motivated but poorly conceived policy of rewarding the freedom fighters who helped them break the yoke of British colonialism.

From John Cochrane’s comments I conclude he is either very poorly informed about what actually happened in Zimbabwe, or,if he does know the true story, then he is deliberately misleading readers with these statements.

Please read my blog – Zimbabwe for hyperventilators 101 – for more discussion on this point.

What about the data I mentioned?

Think about Argentina about a decade ago. I am very familiar with its crisis and I have dealt with this example before. It scares the hell out of the first world financial markets because the nation demonstrated that a major default doesn’t have to have the consequences that are threatened by the elites (and John Cochrane). Wikipedia provides a brief overview of Argentina’s Economic crisis 1999-2002 (although I would discount some of the “opinions” expressed).

Argentina, in part, provides a model for all nations that have surrendered their currency sovereignty courtesy – either via a peg of some sort of outright use of foreign currencies (as in the Euro case). I was talking to a Jordanian yesterday (hello Ala!) who is trying to work out how to counter the mainstream economics dogma in his nation (which has a currency peg) and the following discussion is relevant there.

In April 1991, Argentina adopted a rigid peg of the peso to the dollar and guaranteed convertibility under this arrangement. That is, the central bank stood by to convert pesos into dollars at the hard peg.

The choice was nonsensical from the outset and totally unsuited to the nation’s trade and production structure. In the same way that most of the EMU countries do not share anything like the characteristics that would suggest an optimal currency area, Argentina never looked like a member of an optimal US-dollar area.

For a start the type of external shocks its economy faced were different to those that the US had to deal with. The US predominantly traded with countries whose own currencies fluctuated in line with the US dollar. Given its relative closedness and a large non-traded goods sector, the US economy could thus benefit from nominal exchange rate swings and use them to balance the relative price of tradables and non-tradables.

Argentina was a very open economy with a small non-tradables domestic sector. So it took the brunt of terms of trade swings that made domestic policy management very difficult.

Convertibility was also the idea of the major international organisations such as the IMF as a way of disciplining domestic policy. While Argentina had suffered from high inflation in the 1970s and 1980s, the correct solution was not to impose a currency board.

The currency board arrangement effectively hamstrung monetary and fiscal policy. The central bank could only issue pesos if they were backed by US dollars (with a tiny, meaningless tolerance range allowed). So dollars had to be earned through net exports which would then allow the domestic policy to expand.

After they introduced the currency board, the conservatives followed it up with wide scale privatisation, cuts to social security, and deregulation of the financial sector. All the usual suspects that accompany loss of currency sovereignty and handing over the riches of the nation to foreigners.

The Mexican (Tequila) crisis of 1995 first tested the veracity of the system. Bank deposits fell by 20 per cent in a matter of weeks and the government responded with even further financial market deregulation (sale of state banks etc)

These reforms loaded more foreign-currency denominated debt onto the Argentine economy and meant it had to keep expanding net exports to pay for it. However, things started to come unstuck in the late 1990s as export markets started to decline and the peso became seriously over-valued (as the US dollar strengthened) with subsequent loss of competitiveness in the export markets.

Lumbered with so much foreign-currency sovereign debt the decline in the real exchange rate (competitiveness) was lethal.

The domestic economy by the late 1990s was mired in recession and high unemployment.

And then the “Greek scenario” unfolded. Yields on sovereign debt rose as bond markets started to panic – a vicious cycle quickly became embedded.

In 2000, under direct orders from the IMF (with the threat of refusal to maintain financial assistance – ring a bell?), the government tried to implement a fiscal austerity plan (tax increases) to appease the bond markets – imposing this on an already decimated domestic economy.

The government believed the rhetoric from the IMF and others that this would reinvigorate capital inflow and ease the external imbalance. But at the time it was obvious that it was only a matter of time before the convertibility system would collapse. They couldn’t hold back the flood waters.

Why would anyone want to invest in a place mired in recession and unlikely to be able to pay back loans in US dollars anyway?

In December 2000, an IMF bailout package was negotiated but further austerity was imposed. No capital inflow increase was observed. That was also an obvious prediction apparently not in the IMF forecasting model’s capacity to provide.

The government was also pushed into announcing that it would peg against both the US dollar and the Euro once the two achieved parity – that is, they would guarantee convertibility in both currencies. This was total madness.

Economic growth continued to decline and the foreign debts piled up. The government (April 2001) forced local banks to buy bonds (they changed prudential regulation rules to allow them to use the bonds to satisfy liquidity rules). This further exposed the local banks to the foreign-debt problem.

The bank run started in late 2001 – with the oil bank deposits being the first which led to the freeze on cash withdrawals in December 2001 and the collapse of the payments system.

The riots in December 2001 brought home to the Government the folly of their strategy. In early 2002, they defaulted on government debt and trashed the currency board. US dollar-denominated financial contracts were forceably converted in into peso-denominated contracts and terms renegotiated with respect to maturities etc.

This default has been largely successful. Initially, FDI dried up completely when the default was announced. However, the Argentine government could not service the debt as its foreign currency reserves were gone and realised, to their credit, that borrowing from the International Monetary Fund (IMF) would have required an austerity package that would have precipitated revolution. As it was riots broke out as citizens struggled to feed their children.

Despite stringent criticism from the World’s financial power brokers (including the International Monetary Fund), the Argentine government refused to back down and in 2005 completed a deal whereby around 75 per cent of the defaulted bonds were swapped for others of much lower value with longer maturities.

The crisis was engendered by faulty (neo-liberal policy) in the 1990s – the currency board and convertibility. This faulty policy decision ultimately led to a social and economic crisis that could not be resolved while it maintained the currency board.

However, as soon as Argentina abandoned the currency board, it met the first conditions for gaining policy independence: its exchange rate was no longer tied to the dollar’s performance; its fiscal policy was no longer held hostage to the quantity of dollars the government could accumulate; and its domestic interest rate came under control of its central bank.

At the time of the 2001 crisis, the government realised it had to adopt a domestically-oriented growth strategy. One of the first policy initiatives taken by newly elected President Kirchner was a massive job creation program that guaranteed employment for poor heads of households. Within four months, the Plan Jefes y Jefas de Hogar (Head of Households Plan) had created jobs for 2 million participants which was around 13 per cent of the labour force. This not only helped to quell social unrest by providing income to Argentina’s poorest families, but it also put the economy on the road to recovery.

A key Argentine government official (advising the Minister of Employment) who was instrumental in the implementation of the Head of Households Plan had earlier attended a Conference in Chicago in 1998 and attended a session where Randy and myself presented papers outlining the way in which a Job Guarantee would operate and provide macroeconomic stability. We have stayed in touch ever since.

Conservative estimates of the multiplier effect of the increased spending by Jefes workers are that it added a boost of more than 2.5 per cent of GDP. In addition, the program provided needed services and new public infrastructure that encouraged additional private sector spending. Without the flexibility provided by a sovereign, floating, currency, the government would not have been able to promise such a job guarantee.

Argentina demonstrated something that the World’s financial masters didn’t want anyone to know about. That a country with huge foreign debt obligations can default successfully and enjoy renewed fortune based on domestic employment growth strategies and more inclusive welfare policies without an IMF austerity program being needed.

The clear lesson is that sovereign governments are not necessarily at the hostage of global financial markets. They can steer a strong recovery path based on domestically-orientated policies – such as the introduction of a Job Guarantee – which directly benefit the population by insulating the most disadvantaged workers from the devastation that recession brings.

By pegging a currency to another, guaranteeing convertibility and then allowing the financial sector to “dollarise” your economy (drown it in foreign currency-denominated debt) – is a sure way to force a country into financial ruin or more or less permanent austerity.

Please read my blog – Why pander to financial markets – for more discussion on this point.

But what about the data?

You can get data from the Instituto Nacional de Estadística y Censos (Argentina’s Central Statistical Office). For National Accounts look for Cuentas Nacionales on left menu.

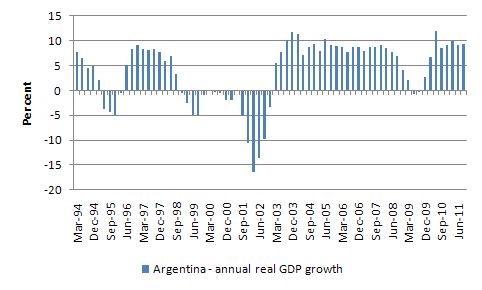

I graphed real GDP growth from the March quarter 1994 to the September quarter 2011. The period before their crisis delivered relatively lower and unstable growth rates compared to the period after the crisis.

The economy dived into a deep recession from December 1998 and then endured 17 successive quarters of negative growth culminating in the real output free fall in the year starting with the December 2001 quarter (-10.5 per cent), March 2002 (-16.3 per cent), June 2002 (-13.5 per cent), and September 2002 (-9.8 per cent).

Once they abandoned the peg and concentrated on domestic policy (and job creation) they began growing again robustly in the first quarter 2003 and continued that pattern for several years until they became caught up in the current global crisis.

During the current world crisis Argentina endured a very modest recession (contracting -0.8 per cent in the June quarter 2009 and -0.3 per cent in the September quarter 2009 – before bouncing back to fairly robust growth.

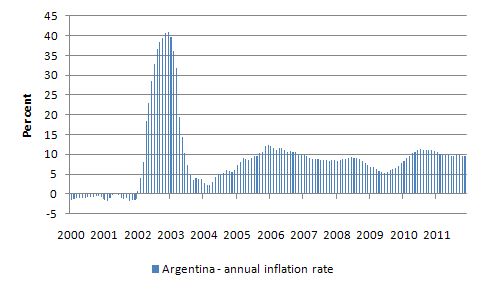

And what about inflation – given the depreciation of the currency?

The following graph shows the annual inflation rate (based on the Consumer Price Index for Greater Buenos Aires) from January 2000 to November 2011. The impact of the crisis and the currency depreciation is clear as is its finite nature.

The other thing to note is that while inflation is relatively high it is not “spiralling”. It has been relatively stable over the post-2001 crisis growth period. The main costs of inflation result from uncertainty and that arises when inflation is accelerating (or decelerating).

I know there are a lot of conservative economists who suggest that the central statistical office is cooking the books and deliberately under-reporting the true inflation rate. If you can read Spanish this article from La Nación (January 23, 2011) – El Indec escondió 80 puntos de inflación en cuatro años – relates that argument. But remember this newspaper is the voice of the right-wing conservative elites!

The other point to note is that the depreciation created a major change in the trade sector. Argentine exports became much cheaper and demand grew rapidly at the same time as import demand fell because of the rise in prices in the newly restored local currency.

It also turned out that the rise in China helped Argentina via soya bean exports which helped stabilise the currency. In general agriculture started booming.

The Government also sought to take advantage of the massive shift in relative prices (terms of trade) by providing incentives for import substitution. The tourism industry also grew rapidly as a result of the currency depreciation.

Before too long, the peso started appreciating again but by then the economy was on a solid growth footing with strong social welfare spending to maintain domestically-sourced growth and a booming export sector.

In the mid-2000s the Government actually had to take measures to stop the peso appreciating further given the size of its trade surplus. The central bank acquired huge stockpiles of foreign reserves (USDs mainly) by selling pesos in the foreign exchange market. The exchange rate is now relative stable at the higher value.

The foreign exchange intervention of the central bank (selling pesos) is sterilised by issuing government debt which is a quite different operation to the current ECB claims that it is sterilising its SMP. But that is another issue again.

Conclusion

I wouldn’t want to suggest that life in Argentina is a cakewalk. The crisis was very damaging and the poverty rates rose alarmingly. But the predictions of the mainstream economists (especially from the IMF) at the time did not come to fruition and an understanding of Modern Monetary Theory (MMT) can help us understand why.

The nation was able to kick start growth very quickly by abandoning the peg and concentrating social spending in the domestic economy.

It had to default on its foreign debt (in US dollars) to achieve that change of policy focus. It also made the most of the increased competitiveness as a result of the massive depreciation by providing incentives for import substitution and renewed export performance. There was a burst of inflation but that fell rapidly and has stabilised as the currency appreciated again.

It is in a far better position now – a decade after all the problems – than it would have been under a “IMF-managed receivership”. The last decade would have looked very different if it had have followed the path that the Greeks and other European nations are now traversing under the same sort of IMF austerity mania.

As the crisis intensified in 2001 and into 2002 and the IMF was demanding more austerity (and basically blackmailing the Government) the Argentine economy was looking very similar to the way the Greek and Irish and other failing economies are looking now.

The Argentinean government had the foresight – in the face of street riots that would have become an open revolt – to abandon the mainstream dogma and take matters into their own hands.

The likes of John Cochrane were out in force in 2002 I can tell you – predicting the absolute worst for Argentina – “spiraling inflation and growth-killing isolation”. The predictions were wrong.

My advice to any government (when I am asked) is the same advice that applied in the Argentine case.

First, restore currency sovereignty by using a local currency that the elected national government issues under monopoly conditions.

Second, that requires any pegs or fixed parities to be abandoned the currency being allowed to freely float.

Third, re-negotiate all foreign-currency debts into local currency units. If that is not acceptable to the counter-parties then default.

Fourth, concentrate the new-found fiscal freedom on domestic job creation to stabilise incomes and provide the jumping board for growth.

Fifth, take advantage of the currency depreciation to provide incentives for import-competing and exporting industries.

The road is a rocky one for sure but better than years of suffering from austerity. There is no real way out of that path.

I will write about the True Finns – because I suspect that these sort of movements will be engines of change like the “street riots” in Buenos Aires circa December 2001 were for Argentina. The problem that I will write about is that the mainstream left should be leading the charge and allying the economic policy narratives with progressive social and cultural policy stances.

Leaving it to movements that want women to be reproduction factories and deny them work, and who hate homosexuals and migrants etc is not a good future.

That is enough for today!

“There would have to be some accounting gymnastics needed but if we can put a person on the Moon we can surely juggle some books (of largely meaningless numbers) to create some zeros.”

Not in Europe apparently. I just wanted to highlight this beautifully constructed sentence that highlights the lunacy of it all when you consider the real consequences of their non-action.

I think the main “cost” of getting the government at work was the death of around 40 people during the riots that happened 10 years ago (plus some days). I wonder if we could achieve this cualitative jump in europe without having to pay that kind of cost, and usually think it’s almost impossible.

I hope you someday make a deeper analysis of the situation and expectatives for argentina right now, I think they dropped Job Guarantee, and are focusing in exports surplus (via proteccionism) and accumulation of reserves. Is that an advisable path? Is difficult to have reliable information, since the journals are polirized lovers or haters of the president…

“The EU could simply agree to write all the ECB bad debts off without any further consequence.” I think there is problem or a “consequence” there.

The above “write off” would be an effective gift by core countries to the periphery. The ECB is an institution in which member countries all have a share (in proportion to their population, or something like that). And amongst the ECB’s assets, are the debts of periphery countries.

If those assets are wiped out, that would suit the periphery. The value of their shareholding in the ECB would decline. But the amount by which their liabilities decline would be much bigger.

Plus that wouldn’t be the end of it: unless something is done about the periphery’s over-valued currency (as Bill rightly says), the periphery’s balance of payments would presumably continue, which would mean the build-up of more debt, which would be written off if five years time?

This Economist article links to the Billion Prices Project (BPP) which tracks millions of online prices. Their data suggests Argentina’s inflation rate is three times the official figures.

Paul Krugman states you can’t use the BPP to directly compare with official CPI figures as BPP is goods-only, although he concludes that (for the US at least) BPP figures approximate well.

My question is – can this BPP inflation rate be easily dismissed as being driven by “conservative elites”? It’s an MIT project but their methodology seems reasonable?

Either way, further analysis of Argentina would be very interesting!

Ralph, the idea that such policies are nothing but gifts of the core to the periphery implicitly makes full employment assumptions. And full employment is even farther off from Europe than inflation, and has been for a very long time. Germany benefits from its mercantilist exportation of unemployment to Greece, which was held off for a time by increasing Greek indebtedness. If you are going to have a monetary union, such decisions of how much each should benefit from spending should be democratically arrived at, to deal with the presently far-off, full employment, moral-hazard issues. But before one gets to full employment, it is not a zero-sum game, but a pleasantly positive-sum one, where aid to one player like Greece will aid the other players, though perhaps not as much. Germans should not beware of “gifts to Greece”, for they redound to their own benefit. And of course the best, most permanent & stable gift the ECB could give everyone is a permanent Eurozone wide Job Guarantee program, written into Euro treaties & national constitutions.

On Bill’s points – a tragedy that the right-wing fringe can be the only ones to retain economic sanity, financial numeracy. Bruning to Hitler, all over again.

growth killing isolation. they already have that!

“Leaving [ leading the charge] to movements that want women to be reproduction factories and deny them work, and who hate homosexuals and migrants etc [like True Finns] is not a good future.” I should only add that True Finns’ (or The Finns’, as they now call themselves in English) main economic ideologist is a staunch Austrian (von Mises kind) Austerian, who opposes euro and ECB because of their “soft money” Keynesian approach.

“Wikipedia provides a brief overview of Argentina’s Economic crisis 1999-2002 (although I would discount some of the “opinions” expressed).”

Wikipedia is being pretty badly hacked by (paid) right wing groups in the US, in particular its sections on politics, political history, and macroeconomics. It is the internet version of book burning.

Wikipedia, apparently aware of this complaint, is now providing an article rating ability at the end of each of its articles. It’s pretty generic and doesn’t allow one to get very specific, but for whatever it’s worth, I’ve been marking articles for bias using this feature for a while now. You should too.

Some of the analysis on Argentina is not right.

The peg to the dollar didn’t dollarize the economy. A long history of very high inflation and eventually hyperinflation did. The peg only made official the dollarization of the economy. Pegging the currency was successful for some time, but was unsustainable. The nail in the coffin was the Brazilian devaluation around 1998, Brazil being one of the main trade partners of Argentina. When the situation deteriorated in late 2001, Argentina did want to borrow from the IMF, but the IMF refused to lend them. And when the crisis spread to Uruguay, the IMF was pushing for Uruguay to default as well, which it didn’t: it obtained a short term loan from the US government who helped them negotiate with the IMF to restructure their debt.

Both countries devalued their currencies and shortly afterwards started growing again at much higher rates than in the past thanks to the boom in agricultural commodities, especially transgenic soya. But the biggest difference between both countries is that Argentina defaulted on foreign debt and on people’s savings but Uruguay didn’t on neither of them and both are doing very well with historically high growth and low unemployment. So all evidence points to the fact that it’s not the default, but the devaluation and the lucky commodity boom that did the trick.

The official inflation figures are often criticized by the Argentinean opposition. It’s hard to tell what the inflation really is, but apparently if you go to a Mc Donald’s in Buenos Aires, you will not find the Big Mac advertised at all, presumably because its price was frozen in order to manipulate the Economist’s Big Mac Index.

I’m looking forward to read your article about the True Finns. In my view, the party is populist but not extreme right-wing. To understand the party’s ideology you should go back to the 1950’s when Veikko Vennamo founded this movement.

http://en.wikipedia.org/wiki/Veikko_Vennamo

A person named BillyBlog posted a comment in today’s Washington Post under Ezra Klein’s article commenting on Paul Krugman’s note about how the Obama administration did not press for more stimulus. Was that your comment?

Dear RayW

No it wasn’t. On the rare occasions I make a comment somewhere, I always use my own name.

best wishes

bill

I really enjoy reading your blog. I’m from Finland and the level of economic discussion in Finnish media is horrible to say the least. There’s practically no genuine discussion about viable alternatives and there’s certainly no real critism about the Troika or these absurd austery measuries being proposed by the EU. All the blame is being shifted to the likes of Greece while we have this unhealthy adulation for Germany’s austery madness.

As someone said above, the True Finns are populist but not really far-right in a neo-nazi way. It’s nevertheless a sad reflection of our poltical system that both of our left-wing parties more or less go along with the neo-liberal narrative. We have this rainbow coalition government with a right-wing prime minister opposing a fiscal stimulus, never mind exiting the euro and re-introducing markka (our earlier currency). The politicians and the media are using our banking crises 20 years ago as a weapong against going back to markka. They try to blame the depression on the fact that we had our own currency when the real reason for the crisis was in fact our central bank’s monetarist policy with high interest rates, a fixed exchange rate and the austery measures implemented by the then right-wing government. One reason was also the financial deregulation that was done in the 1980s without any democratic discussion about it’s implications.

Dear Bill

I certainly don’t wish to criticize the Argentinian government that created the job guarantee plan for heads of household, but I wonder what exactly these 2 million people were doing. It is easy for a government to hire many people in a short time, but it is much harder to insure that they will be doing something useful.

Regards. James

Dear James Schipper (at 2011/12/23 at 14:23)

The Jefes program was very productive. You might like to read http://www.cfeps.org/pubs/wp/wp41.html (overall evaluation) and http://www.cfeps.org/pubs/wp/wp50.htm (Gender impact) to start with.

But in general it doesn’t take much for an unemployed person to be more productive than they are in their jobless state (that is, when they have zero productivity).

As I have noted before, it is highly productive for children to see their parents walking out the door each morning to go to work, quite apart from what the parents might actually do once they reach their employment. After that the “sky is the limit”.

best wishes

bill

Some Guy, I don’t see what “benefit”, as you call it, Germany derives from selling goods to Greece which Germany does not get paid for.

Of course the FIRMS selling stuff to the periphery get paid, but the periphery obtains the funds by running up debt, which is bought by core banks, or the ECB. And that debt then turns out to be worthless or semi-worthless.

Also I don’t agree that Germany “exports unemployment to Greece”. At least, if Germany is at what Bill calls the “inflation barrier” its unemployment cannot be reduced (absent JG), which means any sales to the periphery will be at the expense of sales to solvent countries (inside or outside the EU). Alternatively, if unemployment is above the inflation barrier in Germany, that calls for EU wide stimulus (Greece included). In this scenario, sales by Germans to Greeks do not amount to exporting unemployment, because the stimulus raises employment in Greece as much as in Germany.

“which means any sales to the periphery will be at the expense of sales to solvent countries (inside or outside the EU)”

That’s a crowding out argument. Where’s the evidence that Germany can place these goods/services elsewhere?

Any country with an export surplus is by definition operating a currency value that is too low. A floating currency would rise choking off the exports until it gets to balance. In a country with an obsessive domestic saving habit (thereby reducing imports) and a reluctant government that would cause unemployment in Germany.

You have fallen a victim of propaganda spread by BBC and spread by the corrupt political elite of Finland that has ruled Finland forever as a “the consensus” of three big parties who always speak differently in elections but then always make identical politics while in government (2 in government and 1 in opposition always), plus the swedish speaking peoples party who are ALWAYS part of the government .

The consensus is deadly afraid of the Finns party because the consensus are losing their political power and the political corruption and backroom deals in Finland are being exposed by the rise of The Finns party.

–

The article smearing Perussuomalaiset (official name:The Finns party, previous unofficial translation: True Finns) on BBC was written by a swedish speaking Finn called Jan Sundberg who is NOT a neutral observer because he is a member of the swedish speaking peoples party(RKP-SFP) working in party committees and the swedish speaking party hates the Finns party for exposing their unbelievable privilege and elitism in Finnish society and the intention was to smear and lie about The Finns party because the swedish speaking elite in Finland want to continue FORCING every finnish kid to learn swedish if they want to get through school so that the swedish speaking finnish elite (that is 3% of the finnish population) will always get service in their own language everywhere in Finland.

–

This is language apartheid imposed on the majority by the priviledged minority.

Also the swedish dialect spoken by the swedish language finns is difficult to understand for the neighbouring swedes who make fun of the finnish moomin-swedish and norwegians and danes can’t understand it at all so there is NO real benefit for the finns to be FORCED to learn this swedish other than to continue providing the privilege to a 3% minority to always be able to demand that they will be served in swedish.

–

The actual part in The Finns party election program concerning SUPPORTING students to be mothers WHILE STUDYING reads: “The Finns party thinks that families formed by students should be supported more. Otherwise couples in the best childbearing age have too weak possibilities to have children. If everybody postpones having kids until 30 years of age, as is currently happening, then the number of kids on average will be well under 2 and the population structure will be skewed.

–

This is actually a REAL problem in Finland as can be seen from Statistics Finland:

http://www.stat.fi/til/vaerak/2010/01/vaerak_2010_01_2011-09-30_tie_001_en.html

–

Swedish peoples party of Finland member Jan Sundberg was also chosen to be the “neutral” commenter for international press briefing being given after the election by foreign ministry by then Finnish foreign minister Alexander Stubb (who is also part of the swedish speaking elite in Finland).

Alexander Stubb is a coalition party member and coalition party is the most euro-enthusiastic party in Finland who would like to give over 50 billion euros of finnish taxpayers money to bailout french and german banks through giving more debt through EFSF and ESM to greece,italy etc . which are drowning in debts so it was in Coalition party’s and swedish speaking people’s partys interests to smear and lie about The Finns party because they were afraid of Coalition party leader Jyrki Katainen losing the chance to be prime minister because the social democrats had copied their political promises from The Finns party and did much better than expected in the elections because of this.

Jan Sundberg made several slurs and smears without ANY basis in facts on that briefing of the international press.

–

The government forming was really complicated and the social democrats walked out once from the process so the smears and lies to abroad were done because of the internal political needs of coalition party and swedish speaking peoples party, in the end social democrats betrayed their voters again in “the consensus” tradition partly because of the propaganda being spread internationally.

–

Alexander Stubb was all smiles inside Finland and all the coalition party people were heaping praise on Timo Soini and The Finns party in FINNISH while they had smeared and lied about the Finns party internationally through Jan Sundberg in ENGLISH without any corrections being made to these lies by the Finnish foreign ministry controlled by Alexander Stubb during the government negotiations even after Jan Sundberg’s disastrous lies and smears were revealed when a recording of this event was leaked to the net.

–

In essence coalition party and swedish speaking peoples party destroyed Finlands international image for partisan political reasons because Coalition party wanted the prime ministership and swedish speaking peoples party wanted to continue to oppress finnish majority and maintain their priviledged lifestyle.

–

The finnish speaking majority is also oppressed by giving preferential treatment to swedish speaking students in Finland so that for example swedish speaking finns whose mother tongue is swedish get university places much more easily than ordinary finns. Finnish taxpayers pay the costs of university for everybody so in essence finnish speaking finns pay in their taxes this privilege for swedish speaking finns.

Further the most expensive real estate in Helsinki is owned by tax-free foundations and give the money earned from tax-free profits ONLY to swedish speaking finns using different grants (3% of finns are swedish speaking) and bankroll swedish language newspapers on this tax-free foundation money.

The finns party has proposed taxing all foundations running businesses and being in the billions and billions of euros range so of course the finnish swedish speaking newspapers have been spreading lies and smears in concert with swedish speaking elite who want to continue their educational privileges and to continue forcing every finnish kid learn swedish.

–

It is human nature that newspaper employees want to protect their paychecks too by smearing The finns party in order to safeguard the tax-free status of foundations benefiting solely the swedish speaking minority.

The smearing process works as follows: swedish media copy the news concerning finland from finnish swedish language media since swedish medias have 0 correspondents in Finland and then the finnish language media report what is written about finland in sweden so smears and lies circulate in the nordics and back into the finnish press.

–

Furthermore the Finns party DO NOT hate homosexuals they just disagree on giving marriage rights and the adoption rights included in marriage to homosexuals (homosexuals in Finland already have civil ceremonies which give them same rights as marriage apart from outside adoption and they can also already legally adopt kids provided that the other parent in the homosexual relationship is the biological mother/father and these rights are accepted by The Finns party).

1 person from The Finns party said a stupid remark about more gays dancing in the Presidents castle on independence day than finnish war veterans but there are 39 MP’s in the party and there is lots of effort to tease any controversial statements out of the finns party MP’s by newspapers hungry for a scoop and owned by coalition party favoring billionaires.

(Italy’s Berlusconi is comparable when it comes to complete media domination in Finland by Coalition party (finnish language media) and swedish speaking peoples party(swedish language media))

–

The Finns party DOES NOT hate immigrants.

In fact they have been supporting hard-working immigrants when they are battling immigration authorities to try to stay in Finland and work and provide for their family.

–

The Finns party has been critical of the finnish immigration POLICIES when it comes to the blatant abuse of the immigration systems many loopholes concerning family re-unification fraud by some immigrants and concerning welfare system abuse by some immigrants.

They have also criticized failed integration policies where some immigrant groups are taught their own language at the expense of teaching enough finnish skills in order to succeed in Finland. etc.

–

The name of the party is PerusSuomalaiset which roughly translates into basic finns or ordinary finns but since these sound a bit funny in english the unofficial translation True Finns was widely used but since the name True Finns was latched onto as somehow excluding finns of immigrant origin by political rivals spreading propaganda in order to stop voters switching parties using the “what will they think of us abroad”-strategy(it does NOT and was NOT intended to exclude finns of immigrant origin.) then the party leadership made the official name of the PerusSuomalaiset party The Finns party in english to stop the smearing propaganda.

–

Every party lost voters to The Finns party in last election:

The previous prime minister party center-party lost most voters and dropped from the biggest party to the 4th largest party.

Social democrats lost second most voters (but much less than predicted thanks to social democrats copying The Finns policies)

Coalition party lost third most voters.

Left alliance lost voters.

Greens lost voters.

Christian democrats lost voters and even Swedish peoples party lost voters.

(I remember that about 2% of swedish speaking finns were going to vote for The Finns party in some polls.)

–

Myself I’m a previous Coalition party voter who sometimes have also voted greens and social democrats but decided to start voting The Finns party because of the sneaky and dishonest way coalition party has operated in last government and during the election campaign.

I’m tired of “the Consensus” way and since there is finally a credible alternative I will stick with The Finns party.

–

P.S.

If you have not read the Timo Soini opinion piece in Wall Street Journal please do so for an eye-opener of how right the guy has been.

Search for the original version since the current version on the WSJ website was dumbed down for the American market.

Dear JJ (at 2011/12/26 at 5:09)

Thanks for your comment.

I found it interesting although we might disagree a little on interpretation.

best wishes

bill

It seems that misleading and negative “information” is being spread abroad about True Finns (IMHO, Ordinary Finns would be better translation than True Finns) — probably by their political opponents in Finland.

For example, I have seen claims that True Finns is a (far-)right party, even though on most issues, it is quite typical center/left wing party. Some members of True Finns hold negative views on humanitarian refugee issues, but the party leader and the party itself is not hateful, even though they hold more conservative views on many issues, compared to other parties. You check their view on many issues on this page:

http://en.wikipedia.org/wiki/True_Finns

and using Google translate:

http://fi.wikipedia.org/wiki/Perussuomalaiset

True Finns does not want to deny women work, it is not against work related immigration and does not hate homosexuals (although a larger percentage of MPs in True Finns oppose gay marriage compared to most other political parties). Even their MP, who has publicly said negative things about gays, has befriended a gay MP of parliament who is Green party’s candidate in current presidential election. And at least one of their MPs is a Swedish speaker.

I have previously voted on most elections Green party (and on presidential elections SDP which is the largest socialistic party and Kokoomus which is the largest right wing party), but on previous elections I voted True Finns the first time, because I had had enough of the traditional parties. For example, True Finns was the only party which opposed the oppression of Finnish speakers and preferential treatment of Swedish speakers, was not corrupted to the core like most traditional parties, offered some hope of change of the status quo where nothing seems to change (at least for better direction), had healthy skepticism on many issues etc. It seems that traditional political parties just don’t listen the great majority of people on many issues, like issues concerning Swedish language.

Just as a short comment to what the two True Finns voters said earlier:

Living in Finland myself, I can definitely see where they’re coming from. I consider myself as a supporter of a Keynesian mixed economy. What these two are saying about our corrupt political culture is absolutely true. All of our parties are different variations of neo-liberalism and even the Left Alliance (to the left of the Social Democrats) was among those who took us to the euro system without a referendum. The Left Alliance is now again in the government as a support party to the most right-wing party called Kokoomus(or The National Coalition). Finnish people are really fed up with our political system that doesn’t enhance the policies the people want it to enhance, meaning poverty reduction and job creation. In that context I can understand why former Social Democratic voters and former Centre party voters have began voting for True Finns. Personally I’d prefer the two labour parties to renew themselves as Post-Keynesian progressive parties.

You might be interested to know that your blog was mentioned in a Finnish business newspaper called Talouselämä (straight translation would be probably be something like “The Economic Life). The way they reported you was bad in the way that they only concentrated on what you said about the European far-right parties. It was typical lazy journalism trying to make headlines. The good thing would be if some ordinary people started following your blog and thinking about economic policy in the real light and seeing through the media propaganda about public debt and deficits.