The other day I was asked whether I was happy that the US President was…

100 per cent forecast errors are acceptable to the IMF

Imagine you had a headache and some economist tells you that you can cure the headache by bashing your head against a wall. So you duly bash your head against the nearest brick wall and not only does it hurt (perhaps drawing blood depending on the severity of the blow) but you note the headache is now worse. The economist then concludes you didn’t bash your head hard enough and instructs you to stick to the “rule” and give it another try – only this time go harder. Blood is now flowing, the head is traumatised and the headache gets even more unbearable. Welcome to Greece which is being bullied by the Troika (EU, ECB and the IMF) in a similar way. The latest IMF medium-term forecasts for Greece reveal a staggering failure by that institution to understand causality and the impacts that their austerity programs have on real economies. Without a blush, the IMF presented the world yesterday with revised forecasts for Greece which reveal their previous forecasts will be around 100 per cent wrong over just over a 6-month horizon. That sort of error is beyond any accepted professional standards. The IMF’s response – bash your head even harder.

The IMF released its latest review yesterday (December 13, 2011) – which has the very important-sounding and long title – “Greece: Fifth Review Under the Stand-By Arrangement, Rephasing and Request for Waivers of Nonobservance of Performance Criteria; Press Release on the Executive Board Discussion; and Statement by the Executive Director for Greece” but which in English can be understood as “We are bullies, we got it wrong, we need to twist the screws even tighter”.

These Reviews are part of the so-called Stand-By Arrangement – that is, the IMF bailout contributions to the Greek government. The “three-year Stand-By Arrangement for Greece” was approved by the IMF on May 9, 2010. Each review leads to a further tranche of the overall bailout funds being released.

Recall that the IMF was threatening not to release the latest tranche if the Greek government didn’t increase the fiscal austerity over and above what had been agreed earlier.

The news was clear. The UK Guardian article (December , 2011) – IMF slashes growth forecast for Greece – told us clearly that the IMF had got it wrong again.

Larry Elliot wrote:

The International Monetary Fund slashed its growth forecasts for Greece and warned that ever-deepening recession was making it harder for the debt-ridden country to meet the tough deficit reduction targets under its austerity programme.

In the Fifth Review, the IMF said that the economic situation in Greece has “taken a turn for the worse”:

The notably weaker-than-expected economy and the attendant contraction in the revenue base is a key reason why the authorities are struggling to meet their fiscal targets and face a need for significant new measures.

Which was entirely predictable several years ago when the Troika began its deliberate destruction of Greek prosperity.

What we learn from this “experiment” is that economies require an expansion of aggregate demand (spending) in order to grow. The financial ratios that the IMF is obsessed with (public debt to GDP and budget deficit to GDP) are highly sensitive to economic growth.

It is very difficult to reduce a budget deficit via discretionary cut-backs (fiscal austerity) because the damage to growth will blow out the cyclical component of the deficit.

Please read my blogs – Structural deficits – the great con job! and Structural deficits and automatic stabilisers – for more discussion on this point.

However, the IMF then pulled out its standard line and said that the:

… government’s medium-term program slipped considerably over the summer, while crucial institutional reforms (to improve tax collection and contain arrears) have continued to move at a slow pace. Staff welcomes the passage of corrective fiscal measures, in particular the more ambitious and upfront cuts to public wages and employment. The draft 2012 budget submitted to parliament now needs to be passed, consistent with program parameters and agreed measures. Going forward, stronger management of the wide-ranging and complex reforms in the program will be needed. Staff welcomes the EC’s commitment to scale up technical assistance, alongside the Fund’s TA, to help keep reforms on track.

Just the tone is objectionable. “Staff welcomes” – referring to the IMF staff. “Staff requires” – this is in the context of a so-called democratically elected government.

The deputy director of the IMF’s European department and mission chief to Greece told the assembled press corps (at the release of the Fifth Review) that (Source):

There has been too much reliance on taxation … Structural reforms have fallen short. They are well behind schedule … Our view is that there is a need to refocus the fiscal program on the expenditure side. We have reached the limit of what can be achieved through increase in taxes.

Tax revenue will continue to decline as growth declines as spending declines. The IMF’s prescriptions will just make this worse.

As Larry Elliot noted “Greek officials are privately saying that the budget black hole is likely to be “in excess of 10%”, making the imposition of yet more austerity measures inevitable. “Pay cuts have only made the recession worse,” one source said.

The Greek economy has already declined by 15 per cent and the projected cutbacks in the government net spending will be of the order of 25 per cent. An economy cannot grow in those circumstances especially when its trading partners are also in decline (for the same reason).

Let’s go back to the First Review which the IMF put out on September 14, 2010. In that document we read:

The slowdown is progressing as expected … While establishing a track record of program implementation will require time, as foreseen in the program, the authorities felt that some skepticism is now gradually starting to fade. The authorities’ strong ownership and determined implementation of the program so far, in the face of some unrest, has started to deliver results … Staff and authorities agreed that nominal growth will be somewhat higher than originally anticipated

By the time the Second Review (December 17, 2010) was published the story was changing a little:

The contraction in activity is trending slightly deeper than expected … Growth projections have been reduced by a small amount … Modest quarter-on-quarter growth is still expected to resume in late 2011, with external adjustment the main support … In the medium-term … there appears to be comparatively more upside potential, provided structural reforms are implemented as planned.

So they were still hanging onto the myth that the harsh fiscal retrenchment would be more than offset by an export-led recovery despite evidence at the time – which they clearly chose to ignore (or failed to understand) to the contrary.

In the Third Review (March 16, 2011) the IMF said:

The economy is expected to bottom out in the second half of 2011. Keeping projected quarter-on-quarter growth rates for 2011 unchanged (given the better than expected performance in Q4 2010), suggests that the -3 percent projection remains well within reach. From an aggregate demand perspective, domestic demand is trending weaker than anticipated, reflecting the deteriorating labor market and tight credit conditions. However, improved prospects for external demand, due to faster recovery in Greece’s main trading partners, improving competitiveness, and a rebound in tourism from the low 2010 base, should offer some offset.

Keep that “-3 per cent projection” in mind.

Overall, the IMF was still in denial by March 2011. They were still claiming that productivity would rise – which as we will learn in the Fourth Review failed to occur.

They were still asserting that the export-led recovery tactic would deliver offsets to the fiscal cutbacks.

A few months later in the Fourth Review (July 13, 2011) the language was changing again:

Market sentiment has taken a sharp turn for the worse … Greece is adjusting in macroeconomic terms, although the deep recession is driving the process, and productivity gains are not yet apparent … Indicators of economic activity suggest that the decline in domestic demand continued unabated in the first quarter of 2011 … Unemployment has risen sharply, exceeding 16 percent in March 2011. Leading economic indicators have been mixed, with industrial turnover and new industrial orders from abroad as well as hotel bookings increasing slightly, while activity in the construction and services sectors is still on the decline and economic sentiment still deteriorating.

I love the way they make virtue out of disaster – with phrases like “Greece is adjusting in macroeconomic terms, although the deep recession is driving the process” – which means in other words, the economy is plunging deeper into the abyss and all the policies that we are forcing on the Greek government are making the situation worse.

Of-course, an economy “adjusts” in macroeconomic terms as the business cycle unfolds. But this is not the “adjustment” that the IMF or its Troika buddies foresaw. The adjustment is a straight forward demand collapse made worse by the imposed fiscal austerity.

In yesterday’s Review, the forecast was that it wouldn’t bottom until 2013. The “-3 per cent projection” for 2011 that they boasted about in the Third Review is now estimated to be -6 per cent which amounts to a forecast error of around 100 per cent.

The problem is this. The IMF (and the rest of the Euro bullies) design their austerity programs based on these forecasts. One would expect that given the “risk” involved – that is, actual people and their lives are the “experiment” – agencies like the IMF would want to be very risk averse in their forecasting and err on the side of modesty.

But this is not the IMF’s style. They treat the “populations” they are dealing with as numbers on a spreadsheet and it is of no consequence to any of their economists if the numbers change each time they get it wrong. Who loses their jobs in the IMF when they make such large errors.

Imagine if this was a civil engineering firm designing bridges. How long would the firm last if its professional judgements were so wrong so often?

The IMF have been doing this for years which is why the low income nations who have been subjected to the so-called IMF Structural Adjustment Packages have made very little progress over the last 30 years.

Please read my blog – IMF agreements pro-cyclical in low income countries – for more discussion on this point.

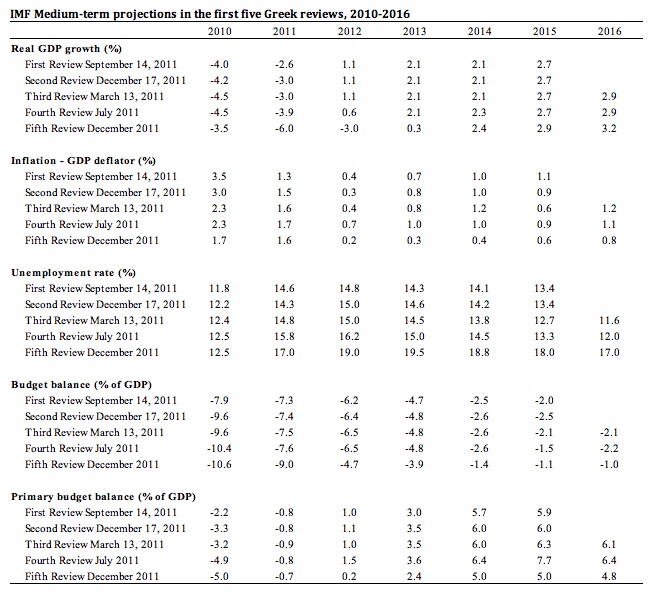

In the following Table I compiled the moving feast of projections for Real GDP growth, the inflation rate, the unemployment rate (all in percentages), and the budget balance and primary budget balance (both as per cent of GDP) that are contained in the IMF’s Medium-Term Macro Framework, which accompanies each of the “Reviews” that are provided “Under the Stand-By Arrangement” that the IMF has with the Greek government (aka the bailout package).

The pattern is clear. They initially assume a higher inflation, higher real GDP growth trajectory and a lower unemployment rate profile.

This ensures that they forecast a very quick fiscal consolidation – with a major disconnect between that and the real economy.

You can see in the First Review that they were forecasting an overall primary budget surplus by 2012 (meaning their forecasts of tax revenue were very optimistic given the scale of adjustment that would have been required to accomplish that fiscal transformation.

Even up to March 13, 2011, the IMF considered that Greece would be growing in 2012 (at 1.1 per cent per annum) with a strong bounce-back in 2013.

Their growth projection for 2011 how now been revised to -6 per cent (twice as high as the forecast a year ago) and the economy is now forecast to still be in major collapse in 2012 and barely growing in 2013. You can discount the growth forecasts for 2014 and beyond. They are ridiculous under current policy settings.

The unemployment rate projections have also been revised upwards – very significantly. When they imposed the austerity on Greece, they were forecasting a peak unemployment rate of14.8 per cent in 2012 dropping to 13.4 per cent in 2015.

Even by the second quarter 2011 (see Greek National Statistics Office) the Greek unemployment rate was 16.3 per cent and rising, which is reflected in their 17 per cent estimate in the latest Review). I think that it will go beyond 17 per cent by year’s end.

But the latest projection is now forecasting a peak of 19.5 per cent in 2013 which is a far cry from the already horrendous forecasts in the earlier Reviews. The upward unemployment rate revisions for 2013 forecasts are around 36 per cent.

These errors and revisions are beyond the margins that we would consider to be professionally competent.

They indicate an organisation which has serious deficiencies in their modelling capacities, which in turn, reflect a major deficiency in the understanding of the IMF economists on what is actually happening in the nations they impose these austerity programs on.

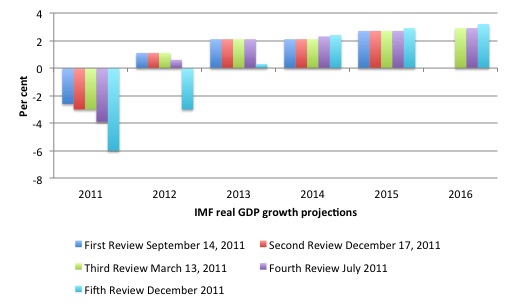

The following graph is derived from the previous Table and shows the projected real GDP growth rates that the IMF provided in the five Reviews. The last three Reviews forecast out to 2016 while the first two Reviews ended their projection period at 2015.

You can easily see what has been happening. The IMF always play “catch-up” – they regularly present an optimistic scenario when they are advocating major fiscal cutbacks (thus underestimating the impact on aggregate demand of the cutbacks) and then as the event unfold and inexorably show the decline to be deeper – they edge their forecasts down.

Note their medium-term (out around 2014 and beyond) forecasts remain highly optimistic. That is, they also fail to model the likely hysteretic effects of the current decline. They assume the economy is not path-dependent and the major shortfall in private investment at present will not have longer-run effects on the capacity of the Greek economy to grow.

I considered the IMF forecasting errors in an earlier blog – What if economists were personally liable for their advice. The forecast errors I discussed then pale into insignificance when you consider what the IMF is presenting in its Fifth Review.

I wrote in that blog that IMF inflated its growth outlook for 2012 and beyond to make the fiscal austerity they were promoting more palatable to the politicians. Given the data available at the time there was nothing to justify that heightened optimism. The situation gets worse by the month.

At the time, I traced the changing IMF growth estimates for Greece as published in the World Economic Outlook and concluded that revised they were excessive. It was clear – once you evaluated the whole picture – the austerity – the likely growth effects, the falling tax revenue and declining real activity and, most importantly, the broader external environment as European growth faltered – that growth would be much lower (and hence the recession much deeper) than the IMF predicted.

I have consistently said that over the last several years.

Once again, I consider the revised estimates of growth in the Fifth Review to be inflated (meaning the downturns are likely to be deepeer and the positive growth estimates to optimistic).

But taking them at face value, we are presented with a very bleak scenario.

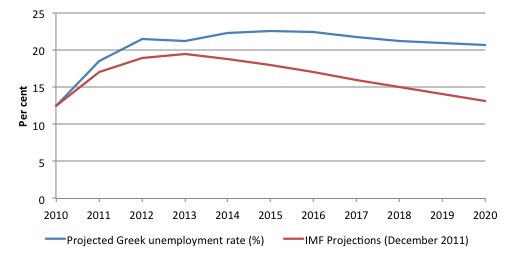

How do they impact on the unemployment rate projections?

In this blog – The aftermath of recessions – I outlined the so-called Okun’s Law arithmetic (after the late Arthur Okun) which was developed to estimate how deficient real GDP growth leads to rising unemployment rates.

Okun’s Law (it was in fact a statistically estimated relationship with stochastic variation) is the relationship that links the percentage deviation in real GDP growth from potential to the percentage change in the unemployment rate.

The Okun “rule of thumb” relates the major output and labour-force aggregates to form expectations about changes in the aggregate unemployment rate based on output growth rates. The “rule of thumb” helps us make guesses about the evolution of the unemployment rate based on real output forecasts.

The derivation is explained in the earlier blog but in summary we know that if the unemployment rate is to remain constant, the rate of real output growth must equal the rate of growth in the labour-force plus the growth rate in labour productivity.

Remember that labour productivity growth reduces the need for labour for a given real GDP growth rate while labour force growth adds workers that have to be accommodated for by the real GDP growth (for a given productivity growth rate).

It is an approximate relationship because cyclical movements in labour productivity (changes in hoarding) and the labour-force participation rates can modify the relationships in the short-run. But it provides reasonable estimates of what will happen once all the cyclically-sensitive components of the economy return to more usual values.

Labour force growth is close to zero in Greece at present (actually negative) as workers give up looking for work in a climate of declining vacancies.

The stagnant labour force growth is one factor that is attenuating the rise in unemployment given the parlous real GDP growth rate.

Productivity growth is also negative at present despite all the claims by the Troika that a harsh domestic deflation would lead to a spur in such growth. In fact, real GDP growth is falling faster than employment growth.

Over the period since March 2001, labour productivity growth averaged 1.6 per cent per annum and the labour force grew on average by 0.8 per cent per annum.

However, over the same period, when real GDP growth was above 2.5 per cent per annum, the average labour force growth rate was around 1 per cent rising to a peak of 2.7 per cent while average labour productivity growth rate was 3 per cent.

We also know that labour force and labour productivity growth rates tend to overshoot their longer run averages as the business cycle turns around and growth resumes. This is because the hidden unemployed re-enter the labour force and hoarded labour is put back into more productive activity.

So assuming real GDP growth to be equal to the IMF medium-term projections which will surely be over-optimistic over the time horizon I assumed some modest overshoot (labour force growth rising to 1 per cent between 2014-2016 then dropping back to 0.8 per cent for the rest of the horizon; labour productivity growth at 2.5 per cent in 2014, 2.2 per cent in 2013, 2 per cent in 2012 dropping back to 1.6 from 2017).

These assumptions are fairly conservative. So the projections for the unemployment rate to 2020 are likely to be biased downwards.

The projections show that the unemployment rate will peak around 22.6 per cent in 2015 and then hover around 20 per cent indefinitely.

If the IMF growth estimates do prove to be inflated, or if the labour force or productivity growth rates are faster than their averages since 2001 (after accounting for the overshoot), then the rise in the unemployment rate will be even larger. If average hours worked rises, the rise in unemployment rate will be larger.

The following graph shows my projections in comparison with the IMF Fifth Review medium-term outlook projections.

While the IMF Fifth Review doesn’t provide projections for 2017-2019, the do project an unemployment rate of 13.1 per cent in 2020. The red line in the graph is a linear interpolation of the change between 2016 and 2020.

Think about the IMF’s projected decline in the unemployment rate between 2016 and 2020 will be 3.9 percentage points.

Trying to understand how that might happen will give you a sense of how poorly the IMF estimates are crafted.

That would imply that real GDP growth was 3.9 per cent higher than the sum of labour force and productivity growth over the 4-year period. The IMF forecast real GDP growth in 2020 will be 2.6 per cent.

To achieve this outcome, the IMF must be projecting a massive contraction in either labour force growth and/or productivity growth (or some weird changes in average working hours).

A major drop in productivity is not viable (given they believe the real GDP growth will come from a substantial increase in international competitiveness.

In other words, that forecast, like most of them is highly problematic.

Whichever way the future turns out (red or blue line), the real situation – down on the ground where people live – is very dire for Greece and I couldn’t think of any circumstance that would justify a government deliberately imposing this level of austerity and income loss on its population.

Conclusion

This is another sorry tale from the IMF – another in the long history of sorry tales.

As I have noted previously, other professions are held legally liable for their professional behaviour. If they consistently make large errors then they will be deemed unfit to practise.

The IMF economists are immune from these standards. They consistently make bold predictions and impose harsh austerity programs based on those projections. The predictions are consistently shown to be wrong when the data arrives.

We are not talking about minor forecast variances which are normal and reasonable given that we are dealing with highly uncertain environments.

The 2011 IMF forecast prediction for real GDP growth (-3 per cent in March 2011 and -6 per cent in December 2011) is not small beer. It represents a dramatic failure to understand what is happening on the ground and the way in which fiscal austerity impacts on the real economy.

The models and theories that the IMF use to construct these forecasts is clearly wrong – in a major way.

The IMF should be excluded from public policy influence and governments around the world should withdraw their funding from the institution immediately.

That is enough for today!

“To achieve this outcome, the IMF must be projecting a massive contraction in either labour force growth”

Isn’t the neo-classical model based upon elimination of the excess population – either through starvation, shortened life expectancy or emigration?

Is it likely that the IMF is expecting the resident population of Greece to shrink?

That is the basis of the Latvia ‘miracle’ – massive emigration – make the excess population somebody else’s problem. The obsession with export based growth does the same thing but achieves it via a financial transfer.

Harking (sic) back to Malthus’s “Classical” Economics Neil?

The IMF has form. Wherever they go they leave poverty, destruction and despair. The bankers get paid though.

I cannot imagine 23% unemployment, that is 1930s era stuff! Poor buggers, I don’t for one second support David Cameron’s reason for flouncing out of the recent summit (the proection of the city indeed!)….but thank god we (the UK) are not in the euro. Having said that since we are pursing decfict reduction through austerity measures then we might as well be. This is not going to end well.

Don’t know how Greek elections work, but could someone put the IMF on the ballot as a party? Might as well go through the motions of a democracy.

Dear Bill,

I realise that it is rather pointless commenting on the validity of an IMF model, but I’m curious to know why they think that Greek inflation will definitely be < 0.7% in 2012, when the relevant historical evidence suggests that the only way to achieve that would be to have another GLOBAL financial crisis next year, not just the regional one they are promoting. Any thoughts?

dnm

I find it curious that both Mitchell and Mosler, who no doubt are gifted economic analysts as well as very intelligent men, subscribe to the “incompetence theory” when it comes to the actions of the Troika. In the heads or economists – even in the heads of brilliant ones like Mitchell -, political strategy doesn’t exist or is irrelevant. As most other analysts, they try to compartimentalize and divide something that is indivisible: the intervention in REALITY by means of the application of POWER, be it economic, financial, psychological, technological or military power.

Economic irrationality can serve as a disguise for (geo)political rationality.

Serious geopolitical games are being played – as they have been played throughout history – and our most brilliant men try, in vain, to make sense of this all-encompassing reality employing incomplete maps. One can only begin to see the semblance of truth by aproaching reality as the indivisible continuum that it is. Economic power, political power, psychological power, military power, technological power and all other faces of power have to be taken into account. This is what rational men are supposed to do when trying to make sense of reality.

If we good men keep hiding ourselves behind the myopic glasses of our professions and academic credentials, a minority of “evil” non-specialist generalists (a.k.a “the sophists”) will keep getting their way.

Down with tunnel vision analysis.

It all makes sense if you start with the total refusal to envoke demand-side remedies. Without demand, of course, there can be no investment opportunities (in real production, that is) for all of this cash that’s been running around creating bubbles. The only way to get your ROI in this case is to hold cash and force-induce deflation. It’s got to be pretty obvious that this is what they (bankers, of course — they are running things) are trying to do.

Now what will end up happening also as they do this is that Europe (and perhaps elsewhere) will explode into violence; perhaps even war. But that’s OK too. War is a great DEMAND-SIDE investment opportunity.

[Perhaps I’m overly cynical. Perhaps they really are overly stupid.]

Mauricio,

Yes I agree but these “successful” power power players are also deluded. Mrs Merkel and Mr Schaeuble (see “The maverick behind Merkel” on Reuters) think that they are winning. The price will be very high – wrecking the economy and pushing 20% of the people in the peripheral countries into persistent unemployment. They may get what they want in the short run (the Austerity Union) but at the same time they are unleashing dark powers which may literally kill them. (Schaeuble was already wounded in an assassination attempt quite a long time ago, apparently by a psychopath).

The political atmosphere in Poland resembles what was there before the assassination of Gabriel Narutowicz, the first president of the Second Republic. Any serious economic downturn and people will start taking things into their hands I am afraid. The Germans have to provide a constant supply of carrots to Poland. If they stop, sticks won’t work, this has been tried in Poland many times. It is not that difficult to find a mentally unstable person and convince him that he has nothing to lose and can become a new Messianic hero by sacrificing himself. The pussyfooting around Breivik in Norway shows that insane fascist ideas can easily get traction and therefore the mainstream social-democrats are too afraid to confront them.

“Only five days after taking office, on 16 December 1922, Narutowicz was assassinated while attending an art exhibition, in the National Gallery of Art “Zachęta”. The assassin was a painter, Eligiusz Niewiadomski, who had connections with the right wing National Democratic Party. Narutowicz’s murder was the culmination of an aggressive propaganda campaign vilifying him. His assassin was sentenced to death and his execution took place outside of the Warsaw Citadel on 31 January. Part of the right wing camp perceived him as a hero.” (wikipedia)

The relentless droning of nationalists, Catholic fundamentalists and outright fascists is pitting “True Poles and Catholics” against the traitors of the Polish Nation – “Germanophiles”, so-called “Jews” and “Russian Agents”. If the political discourse has been reduced to lobbing acquisitions of outright treason on political opponents then there is only one logical conclusion of that process.

If what’s going on in Hungary is the model of the future unified Europe than yes, this may be feasible. The model introduced by Lukashenka is even more stable. However I would not count on the loyalty of people like Viktor Orban to the German and Austrian financial capital.

I don’t see any risk to the stability of the system coming from the left. The Social-Democrats or Communists have been incapacitated. But if you think that the Germans can get what they want, “eat a cake” and still “have a cake” I don’t think I can agree. The Germans believe that the economy in the peripheral countries may somehow start recovering once they digest enough austerian medicine. They are deluded and the recession is coming to roost right to the centre, what will affect the poorer Central European countries too. This is exactly the point Bill is trying to make.

I agree that what is going on is multidimensional but in the end you cannot build a democratic multicultural and multinational society in Unified Europe just by applying “sound finance” and austerity. You can get a prison camp but the prisoners often riot.

I don’t think we will ever get close to that state, the plug will be pulled very soon. Nothing will change in the long run, it will be soon back to normal, Monti Python as usual. The American banksters, the true overlords of the West, are deeply frightened by the brinkmanship of the European politicians. Somebody has already started throwing dirt at the German president Wulff. If Dominic Strauss-Kahn could have been removed, we may soon discover that the German mavericks were KGB agents or simply suffer from serious heart diseases. It is OK to impoverish your own people or enslave the Greeks but interfering with the operations of Goldman Sachs in Europe will not be tolerated for much longer.

To do something on the demand side, Greece should sign a pact with China to liberalize the issuance of tourist visas to the Chinese middle class. Tourism is a major current account surplus industry for Greece.

These forecast’s are at the crux of the issue. They are fairytales that are used to justify ‘expansionary austerity’. When Latvia adopted austerity policy forecast’s were for about 4% contraction next year. Actual contraction was over 18%! So the question arises: how do they get this so wrong? We need good intellectual refutation of their methods.

Bill,

http://www.macrobusiness.com.au/2011/12/from-bad-to-worse-for-the-imf/

As I noted yesterday it appears that the situation is about to get even worse with the head of the IMF mission for Greece now stating that the previous plan of taxing has failed so he is going to try something new… Cutting government spending…

Your head on wall analogy is apt IMHO

The function of the IMF is to impose austerity. They do that very well. Being wrong in their projections is all part of the job.

@ Adam

Characterising the situation along national lines of division is falling into the trap of those running the mainstream narrative. Whilst majority ordinary citizens in some countries are presently better off relative to others, the direction for labour in all countries remains the same – down.

Former German finance minister Dr Heiner Flassbeck’s presentation at the University of Texas is interesting in this regard, linked here:

http://www.nakedcapitalism.com/2011/12/class-war-low-wages-and-beggar-thy-neighbor.html

What we are seeing is the acceleration of low waged (or no waged for increasing numbers) debt servitude for the many in order to maintain accelerating wealth for the financial oligarchy (as represented by the ECB & major financial players) and their cronies & useful idiots (politicians etc) of the top few percent.

(UMKC) Michael Hudson’s analysis along these lines is spot on imho.

I strongly suspect that at the highest levels of the oligarchy, globally, serious geo-political players all, what we are seeing is their response to major global resource constraints coming soon. Rather than hit a wall of rapidly growing key commodity prices, eg fossil energy, the opportunity is being taken to steadily, forcably, diminish the resource consumption (wages, living standards, public services) of the majority citizens in developed countries – a far easier process to PR/media/politically manage vs rapid resource constraint shocks. It is, of course, merely a stepping up of the neo-liberal principles that have proved so successful in widening inequality over the last 3 decades. With that length of time to incrementally exclude dissenting notions from persons occupying positions of power or influence, there is little need for much ‘conspiracy’ in this.

Recall, Greece’s PM Papandreou was swiftly despateched for the audacity to suggest some belated democracy in proposing a referendum. This couldn’t have been so easily achieved if half his own party had not supported his ‘resignation’. The irony is, in my view, that Greece will be dumped out of the euro (or forced to that position) quite soon anyway. But not before the ECB gets its ‘Austerity Union’ ‘pact’ tightly into legal force before it ‘prints’, as required, to make good every last euro reckless lender (outside Greece) to the last cent, caught in any ‘contagion’, whilst deflecting any notion that it could ‘print’ just as readily to stimulate growth to benefit citizens.

@ Bill

Great analysis as ever. How do organisations like the IMF keep getting away with such rediculous ‘forecasts’ than become nonsense within months (if not sooner)? No mainstream media journalists seem to take the slightest notice. Very well trained (selected?) useful idiots I suppose, but no less astonishing.

Dear Bill, you wrote

“Tax revenue will continue to decline [in Greece] as growth declines as spending declines.”

A small note: The Greek economy is well past the point of growing and is now firmly in contraction territory. It’s no longer a question of slowing down growth but of accelerating contraction. Yet, the recent change in government seems to have acted as a pacifier to the Greek people.

We seem resigned to our head being bashed against the wall. This time, though, even our legendary strong-headedness cannot save us. Not unless we move to stop the madness.

@Mike Hall :

Dear Mike, I’m a sworn enemy of conspiracy theories but your theory is the first one that seems sensible to me since quite a long time.

…But where do they meet ?

@ Vassillis

I don’t think a conspiracy in the traditional sense of some smoke filled room is required. Very influential people, particularly a mix from mega financial & political circles meet in any number of forums & very likely keep informal contacts. Forums such as Davos, Bilderberg, Tri-Lateral Commission etc. plus the myriad of think tanks pouring out policy prescriptions. Most of these (certainly all the largest/richly funded), and most of the paticipants are already well steeped in the neo liberal paradigm. They wouldn’t be invited/join if they weren’t.

Is it likely that imminent fossil fuel constraints have not been discussed at some point? Is it likely their response would have been, ‘..ok, let’s share more while we invest in renewables..’ ? I don’t believe there’s any group with a greater sense of entitlement on the planet than ‘High Net Worth Individuals’ (HNWIs). So, if the answer isn’t ‘share’ & the ‘pie’ +must+ get smaller, the policy choices now become obvious, whether the financial crisis itself had any element of ‘planning’ or not. IIRC, Tim Geithner is reported to have quipped ‘…never let a good crisis go to waste..’.

Note that the present system, even in a severe crisis, still funnels wealth to HNWIs at a compound rate of ~ 5% per year (Merrill Lynch, Citigroup reports). The top few percent don’t feel threatened in any way.

Mike,

I agree that there is an oligarchy ruling the West and they may think that they are preparing the world for the environmental crash but these people are also seriously deluded. This is the problem. Look at what was going on in the 1930s – did the German oligarchs in the end achieve what they wanted to get? Are the current policies “rational” even from the point of view of the richest? Instead on investing in new technologies and developing means to live in the post-peak oil world we are in a kind of stupor. You don’t increase the net wealth of the plutocracy by spinning money. You increase it by exploiting workers.

In my opinion the Western parliamentary plutocracy system is currently being subverted by the Chinese. This is the reversal of the Opium Wars and the Chinese cargo is the new opium. So the Chinese are not stupid by sending us cheap cargo for otherwise worthless monetary tokens. We don’t pay in silver. They are sending us cargo and trading with us in exchange for the real influence – this is our debt denominated in foreign currency we’ll have to service. Our system is vulnerable precisely because it is a capitalist democracy – money buys power. (In China and Russia is the opposite – power generates money).

Just look at the hysterical reaction of Clive Palmer to the planned deployment of the US Marines in Australia (the quote is from Sydney Morning Herald, Peter Ker, November 22, 2011)

“Mining magnate Clive Palmer has accused US President Barack Obama of trying to drive a wedge between the Australian business community and China by increasing the American military presence in Australia’s north.

In a gesture that Mr Palmer said was tantamount to giving China a “poke in the eye”, Prime Minister Julia Gillard last week joined President Obama in Darwin, where the Australian and US armed forces announced a deal to station 250 American troops in the Northern Territory.”

So one of the most influential business people in Australia is no longer loyal to the “Mother Ship” of the high bourgeois that is to America and the Western international capital. How many Clive Palmers addicted to making profits on cheap Chinese labour (or on “selling dirt dirt cheap”) exist in the US? How much lobbying power do they have? Aren’t they getting more influential than people like Paul Krugman who wanted to go after China?

The Chinese don’t need to use any military means to increase their global share of the real resources (I mean mostly natural resources) if the propaganda ministry run by the husband of Mrs. Deng pushes the West into a slow-burning austerian economic suicide by destroying the productive capacities of the West. The support of Peterson Foundation, Tea Parties and other front-ends financed by Koch Bro is greatly appreciated.

Good on them – they are simply smarter than us. You obviously know the quote from Lenin about the rope and capitalists. This is not a conspiracy – all the information is in the public domain. Just connect the dots.

Mike Hall

I agree with you 100%, as disconcerting as your suggestions are. We are at the end of an era, where the economic growth we were accustomed to is no longer possible (was it ever?) without destroying the capacity of our planet to support us. Global peak oil was reached five years ago, and net available energy is on the decline. Governments, and their militaries, have been aware of this for some time but have not felt the need to inform the general population, and, in many cases, have been instituting increasingly repressive measures to control their citizens. We are kept in an infantile state of consumerist fantasy while the very basis of our civil society is eroded away behind closed doors.

I would suggest that the psychopathic elites have no Plan B, other than to ensure that the Titanic of neoliberal delusion remains full speed ahead for the iceberg of debt/resource constraints, and that all available lifeboats are filled by themselves. As you say, sharing is anathema to them. Their modus operandi is exploitation, and they will continue to do this for as long as we allow them to.

We live in dangerous times.

Small but crucial typo: “[These revisions] indicate an organisation which has no serious deficiencies in their modelling capacities” should read “[These revisions] indicate an organisation which has serious deficiencies in their modelling capacities.”

Cheers.

Dear Vassilis Serafimakis (at 2011/12/24 at 4:00)

Thanks for picking up the “small but crucial typo”. Fixed now. I appreciate the scrutiny.

best wishes

bill

Greece at 9 May 2010 had 25 billions primary deficit , now we have less than 5 billions primary defiicit.This is a bad or a good impact?What else could we do?The IMF every year told to the goverment to take austerity measures , after they made the forecasts , then the goverment was lying to them and they didn’t do anything and finaly the IMF did have a 100 % error as you say.You are telling the true bad it is not so simple ,i think so. Also can you give us a different way if you were a prime minister at 9 May of 2010 , with a 25 billions primary deficit? Can we use a Keynsian policy with huge dificites?I don’t think so…