Today (January 22, 2026), the Australian Bureau of Statistics (ABS) released the latest labour force…

UK labour market – when “stabilising” means outright deterioration

The British Office of National Statistics released their Labour Market Statistics for December 2011 yesterday and it showed that employment continues to collapse in the UK and unemployment rises. I was at the airport this morning and heard a commentator invoke the words of Albert Einstein. They are very apt in this current economic climate – “The significant problems we face cannot be solved at the same level of thinking we were at when we created them”. The British Employment Minister gets empirical evidence that the Government’s economic strategy is causing massive damage to the economy (who would have thought) and told us that the collapse in employment and vacancies, the rise in unemployment and the record levels of youth unemployment are signs that the “labour market is stabilising”. The UK nor Europe nor anywhere will get out of this mess using the sort of thinking that created the crisis in the first place. Until we work that out and attack this political evil millions are heading for poverty.

The summary results from the UK labour market data covering the period August to October 2011 were:

- Employment fell by 63,000 for the quarter with 67,000 (net) job losses in the public sector and only 5,000 (net) job gains in the private sector.

- There are now 2.64 million people officially unemployed in Britain with a staggering 128,000 extra workers being added to the jobless queue in the third quarter.

- The unemployment rate was 8.3 per cent – up 0.4 percentage points. ONS reports that this is “the highest since 1996 and the number of unemployed people is the highest since 1994”.

- Real wages continue to fall rather dramatically. ONS reports that the UK Inflation rate is running at 4.8 per cent on the year. Total pay (including bonuses) rose by 2.0 per cent over the year to the third quarter 2011 meaning a 2.8 per cent cut in real wages. It is even worse for regular pay (excluding bonuses) which “rose by 1.8 per cent on a year earlier” – translating in to a 3 per cent real wage cut.

What you can glean from the LFS data is the following:

1. Total employment (aged 16 and over) fell by 63,000 in the three months to October 2011 and by 14,000 in the year to October 2011.

2. Total employment for employees fell by a staggering 252,000 in the third quarter 2011.

3. Total employment for self-employed persons increased by 166,000 in the third quarter 2011. The ONS says this is the “highest number of self-employed people since comparable records began in 1992”.

There is always a debate about what a rise in self-employment means. There is strong evidence to suggest that when redundancies are rising (especially in the public service) displaced workers attempt to set up small businesses to maintain an income in the face of declining vacancies elsewhere.

While neo-liberal governments will applaud the trend and claim it is the true “small business ethic” emerging in Britain, the rise in self-employment is more likely to be a sign of desperation. I would note that the bankruptcy rate in the first year of operation for small businesses is very high.

4. Public sector employment fell by 67,000 in the the three months to September 2011 – the “lowest figure since September 2003”.

5. With total employment falling by 63,000 and unemployment rising by 128,000 the difference is explained by the slight rise in participation (called the “activity rate” in Britain). This is somewhat curious because with a deteriorating labour market we normally observe a declining participation rate (hidden unemployment rising). So that requires further research.

The British Employment minister quickly put out a Press Release declaring that the:

There has obviously been an unwelcome increase in unemployment since the summer but these latest figures show some signs that the labour market is stabilising. The number of people in employment is higher than last month’s published figure and the number of unemployed people is steadying. Encouragingly this is also the case for young people not in education.

The increase in those claiming Jobseeker’s Allowance has slowed and our welfare reforms are having a positive impact with overall benefit claimant numbers falling by around 40,000 in the last 18 months.

Grayling, by the way, was also recently embroiled in the controversy where he defended the rights of the owners of a hotel (for profit) to refuse to provide accommodation to a gay couple for no other reason but that they were gay (Source).

Here is his E-mail address – graylingc@parliament.uk – you might like to write to him and point him in the right direction.

In the UK Guardian article (December 14, 2011) – Unemployment is only stabilising in Chris Grayling’s mind – Larry Elliot suggest that Grayling “appears to have been taking lessons from Dr Pangloss” which is a reference to the “professor of métaphysico-théologo-cosmolonigologie” who is the eternal optimist in Voltaire’s Candide.

First, the ONS say that:

The claimant count measures the number of people claiming Jobseeker’s Allowance (JSA) and differs from unemployment (which measures people who meet the internationally agreed definition of unemployment).

The monthly data for November shows that the “claimant count in November 2011 was 1.60 million, up 3,000 on the previous month and up 138,600 on a year earlier”, While it was “unchanged on the previous month” it is “0.4 percentage points” higher than it was in November 2010.

The unemployment numbers cannot be compared because the Labour Force survey is published on a quarterly basis while the rather than the Claimant Count which is designed to indicate the jobless who are receiving benefits.

This DETINI document explains the difference between the LFS unemployment measure and the Claimant Count.

Those excluded from the claimant count measure but included among LFS unemployment include:

- people whose partner is working.

- young people under 18 who are looking for work but do not take up the offer of a Youth Training place.

- students looking for part-time work or vacation work; or

- people who have left their job voluntarily.

It is also true that a claimant of unemployment benefit may fail the LFS activity test (“seeking and available for work”) and thus be excluded from the LFS unemployment measure.

The data shows that the Claimant Count is consistently lower in the UK than the LFS unemployment measure and the latter tends to accelerate upwards more quickly than the former in times of a deteriorating outlook.

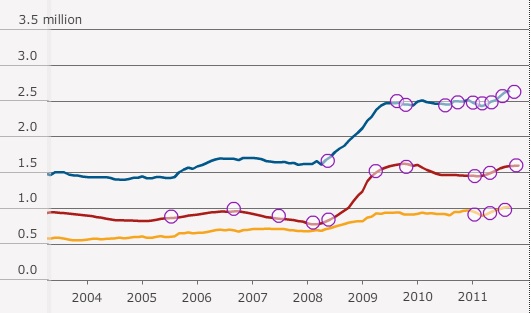

I didn’t have time today to construct a comparable series (it requires some juggling) so I captured this chart courtesy of the Guardian. The blue line is the LFS unemployment count, the red line is the Claimant Count and the orange line is Youth Unemployment. The chart is not perfect but is indicative and refutes the “stabilisation” claim.

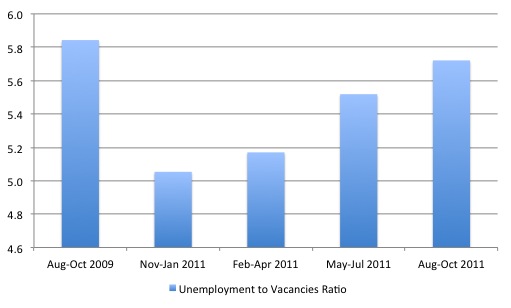

A good guide to how the labour market is travelling in terms of demand and supply is provided by the so-called U-V ratio which measures the number of unemployed per vacancy. A falling ratio is a good sign and vice-versa.

The following graph compares the movements in the ratio over the last 12 months (to the third-quarter 2011). Clearly, on the back of the fiscal stimulus, the labour market was improving with vacancies rising and unemployment falling – a virtuous combination. With the cutbacks and the damage to confidence, those trends are now in reverse.

Vacancies have fallen since the first quarter 2011 from 483 thousand to 455 thousand in the period September-November 2011 and they have been consistently falling in recent months.

So a combination of rising unemployment and falling vacancies is always a sign that the labour market is deteriorating.

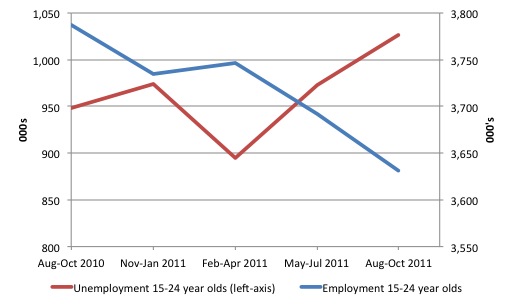

The following graph shows the evolution of employment and unemployment in Britain for 15-24 year olds over the last year. The trend is deteriorating on both measures of activity.

The ONS report that “the number of unemployed people aged from 16 to 24 increased by 54,000 over the quarter to reach 1.03 million” and say this is an all-time record high. I will come back to youth unemployment later.

I thought this “error” by the Justice secretary and former Chancellor (reported HERE) was a good summary. He was asked a question as to the impact on prison places of the emerging recession and replied

It is possible that with the prolonged recession and the long period of youth unemployment, there will be an increase in acquisitive crime … The Prison Service is responding very well to it at the moment, though of course we have to adjust the capacity of the estate.

Clearly, more information than he had to give but also clearly an assessment of what the Government “knows” rather than what they spin

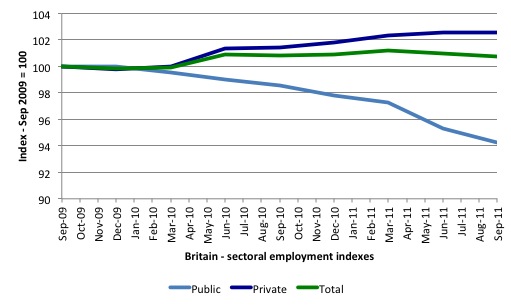

There were dramatic declines in public sector employment. The following graph is shows indexes (September 2009=100) of employment by sector including total (dark blue), private (green) and public (light blue).

The dramatic decline in public employment began around the time of last year’s election. The public sector cutbacks were the first manifestation of the austerity program being pursued by the British government.

The obvious point is that austerity proponents like to claim that the public sector employment losses they create will be more than offset by private expansion. There is some erroneous logic attached to this claim along the lines of private confidence rises when budget deficits are deliberately cut. There might be a negative correlation between budget deficit reductions and private confidence but the causality is the reverse of that proposed by the maestros of austerity.

When private confidence grows, economic activity picks up and budget deficits fall. There is no evidence to support the fact that private domestic confidence rises if a government embarks on a major austerity drive. The evidence is that quite the opposite occurs.

This Bloomberg article (December 14, 2011) – Four Ways to End the Euro’s Crisis of Confidence (written by an ex-UBS banker now a “strategy adviser”) – claims to outline a path that Europe can follow to resolve its crisis.

It compared the US approach which it asserted “relies on monetary easing: bringing liquidity back into the markets to make them operate properly and to support growth” with the “German (and now European) way calls for institutional austerity in a bid to create sound public finances as a basis for economic expansion”.

We could dispute the description of the US approach. It is clear that there is still significant fiscal stimulus impacts operating in the US and the monetary easing is a sideshow. But that is not the point I want to discuss in this blog.

He acknowledges that if the current proposals coming out of last week’s EU Summit are embraced then they:

… will bring widespread austerity to Europe. In the short term, growth will be meager, living standards will drop and unemployment will be high. In the long run, however, we may see another German “Wirtschaftswunder,” or economic miracle.

This is an extraordinary statement.

The former USB banker went on to claim that the EU Summit “addressed the underlying evil: the lack of fiscal discipline and too much leverage in public finances” which I will leave. The underlying evil is the collapse in private spending resulting from the overhang of the private credit binge and the flawed design of the Euro monetary system that prevents governments from acting responsibly and expanding their deficits sufficiently to meet the spending gap. The writer is clearly caught up in the neo-liberal myths but that is another topic.

But what of his claim that “in the long run” an “economic miracle” may come from the austerity?

The immediate costs of unemployment are well-documented and render absurd the mainstream belief that much of unemployment is a voluntary choice that individuals make between leisure and earned-income.

Please read my blog – The daily losses from unemployment – for more discussion on this point.

I summarised the significant economic, personal and social costs thay arise from unemployment to include:

- massive and permanent foregone (lost) current output and income;

- major medium-term increase in uncertainty and rising fear which acts as a deflationary force (reduces private spending even further);

- major spatial (regional) disparities with long-term consequences;

- social exclusion and the loss of freedom;

- skill loss;

- psychological harm;

- ill health and reduced life expectancy;

- loss of motivation;

- the undermining of human relations and family life;

- racial and gender inequality; and

- loss of social values and responsibility.

The research evidence (which I have contributed to in my own work alone and with colleagues over the years) show that these costs are enormous and dwarf the measures that various governments have come up with to estimate losses arising from so-called microeconomic inefficiencies (such as transport systems not running on time etc).

Moreover, it is the long-lived nature of some of these costs that mean that unemployment scars entire family (and societal) futures for generations beyond.

I recall listening to a talk provided by Gary Burtless at the Brookings Institute. His closing comments stuck with me. He was discussig the advantages of direct public sector job creation programs during recessions and he said that while they overcome or attenuate the well-documented costs of unemployment a most persuasive argument for them is that “the kids see their parents going out to work each morning instead of learning about unemployment”.

That was a neat way of summarising how the children of the unemployed inherit the disadvantage and so the failure by governments to attend to the jobless problem now creates new problems in the future.

It is this recognition that always militates against the views of commentators who claim that some short-term austerity will have long-term advantages.

While the concept of a long-term evades exact definition it is clear that the maestros of austerity are oblivious to the costs that can arise with a decade or more of high unemployment. Somehow the unemployed are the inconvenient cost of seeking what may be an economic miracle.

The unemployed become the detritus for the rich to ensure their wealth remains intact and capital repositions itself to accumulate even more wealth.

I have noted before that during the 1970s, as Monetarism became the dominant macroeconomic doctrine and unemployment was increasing as a result of the failure of governments to deal with the OPEC oil price hikes properly, Milton Friedman was asked how long it would take for a deliberately imposed deflationary strategy employed by the central bank (rising interest rates supported by fiscal austerity to bring down inflation) before the economy returned to “full employment”.

He replied, without blinking or blushing with shame, that it might take 15 years or so. That is, a whole generation is sacrificed.

Remember Friedman’s concept of full employment was the blighted natural rate of unemployment which is the object of another debate. Please read my blog – The dreaded NAIRU is still about! – for more discussion on this point.

There were several articles in the journal Family Matters (No. 83, 2009 – published by the Australian Institute of Family Studies which provide evidence to support the contention that entrenched unemployment damages families for generations.

The articles are interesting and worth reading.

In the article – The impacts of recessions on families – we read that:

Recessions can also have significant behavioural impacts that can extend to groups beyond those who become unemployed. A few examples are:

- elevated joblessness among young people, which influences their decisions to enter and/or remain in education, and delays in leaving home;

- delayed formation of committed relationships and reduced rates of fertility;

- decreased demand for child care or use of cheaper, potentially lower quality, unregulated child care;

- deferral of retirement or premature retirement in response to job losses; and

- return of retirees to the labour market, in competition with younger workers for existing jobs.

All of which lock-in the disadvantages of unemployment.

The article – Joblessness, family relations and children’s development by Ariel Kalil says that:

… there is increasing evidence that parental job loss adversely affects children’s educational attainment

The negative effects manifest in a number of ways – including failure, suspension, low achievement generally which blights employment and earnings prospects into the future.

Children who grow up in jobless households demonstrate less motivation for work in later life and often cycle through a sequence of low paid, insecure jobs in between spells of unemployment (and increasingly long-term unemployment).

Conclusion

Even under conservative assumptions, the economic and social costs of sustained high unemployment are extremely high. The inability of unemployed individuals and their families to function in the market economy gives rise to many forms of social dysfunction, in addition to output loss.

While the immediate losses are huge – they reverberate into the future as the children take the multiple disadvantages into adult life. There is a very high rate of return to society in ensuring the all our youth are either study, in training or working.

Leaving a million 15-24 year olds idle (although a small proportion of that figure includes full-time students looking for part-time work) is a lethal recipe for future mediocrity or worse.

The apparent failure of neo-liberal supply side policies to reduce unemployment prior to the crisis is now highlighted during the crisis. There is now an urgent need to address the large pools of unemployment in world economies.

The daily income losses alone are enormous and overwhelm other inefficiencies notwithstanding the productivity heterogeneity that exists across the workforce.

There is no financial reason why the government should not deal with this problem directly by introducing a Job Guarantee. If the Government had the political will, it could readily overcome the problem of persistently high unemployment.

I have to run to get a flight (sorry for flying)!

That is enough for today!

Grayling is an idiot. No mea culpa from the Tories, it is never their fault always someone else’s but the UK Labour party advocate more or less the same policies. We are reduced to shouting at the tele day after day…after day. Would you (anyone) believe the Tories have a lead in the polls? I guess that when it’s a choice between idiots it doesn’t really matter who you vote for.

.

The Tories went about systematically destroying mining communities in the UK in the 80s (they succeeded) and they are systematically destroying the aspriations of our young people (they are succeeding). While I appreciate your blog is about economics and I truly believe the widespread adoption of the policies you advocate would solve many of the problems we face, political patronage is everything. Black labour (whose efforts are presumably sanctioned at the highest level of the Labour party) are clearly unable to grasp the fact that the policies they are proposing are the exact same ones that are failing right now.

.

Bill,

One of the reasons for the increase in the labour force might be the dramatic decline in families emmigrating to foreign countries. This apparently has show up as a suddenrise in net immigration. If this flow of emmigration is significantly reduced, whilst the flow of immigration remains constant, then I would imagine the labour force would have to increase.

Re the self-employment – one of the reasons both Tory and Labour want this to increase (and something missing from the DETINI document) is because self-employed people who have no current work are not allowed to receive JSA! This is truly a scandal, and presumably would not be the case under Job Guarantee.

Bill,

A further point to note about public sector job losses starting before the election, is that all these jobs were lost in 2010 under Labour plans, not the coallition. Clearely revealing their neo-liberal bias! If I remember correctly, Labour had forced local authorities to make 3% cuts in real terms to their spending every year from 2008 onwards. The Tories just took that to the next level.

Dr. Mitchell: Your comments on the value to children of seeing their parents go off to work each morning reminded me of the comments by one of the US republican candidates, Mr. Gingrich. He proposed a jobs plan for the children of unemployed workers to clean bathrooms and floors in their schools. Apparently no such plan is contemplated for the unemployed parents. This is what passes for innovative new thinking in the last days of empire. Thank you for your work. Regards, Jim

I should point out that ‘self-employment’ is the standard approach in the UK of getting around the minimum wage legislation.

There has been a big increase in ‘party plan’, ‘franchises’ and ‘self-employed collectors/delivery’. Not to mention post-office subpostmasters, and practically anything sold on the open market as a supposed ‘business’. Very few pass what I call the ‘McDonalds test’ – where you would be better off getting a job at McDs. (However at the moment even they are spoiled for choice in the UK).

Of course we now have ‘internship’ where people work for extended periods of time for nothing on the off-chance somebody might eventually give them a job on the pretence of ‘work-experience’.

None of these scams would exist if we had the Job Guarantee. And moreover the genuine self-employed professional wouldn’t be persecuted as a ‘disguised employee’ either.

Neil, Re your claim that “None of these scams would exist if we had the Job Guarantee”, there is not actually a big difference between internships and JG. At least both can, at a stretch, be characterised as “temporary subsidised employment”.

There is of course the difference that interns get no pay (as I understand it). But suppose that defect was rectified, i.e. suppose interns got min wage. Would there then be anything wrong with internship, and more important, would internship result in a net rise in employment? Put another way, would each intern simply displace a normal “fully waged” employee, and if not why not?

Ralph,

My argument for/against your idea that JG would crow-out regular work:

Given Bill’s assumtions about trade unions, it would be those same trade unions which would police JG to make sure such crowding-out is minimal IN NORMAL TIMES. Though it would also be true to say that in times of recession or contraction (to avoid infation) – workers may have to accept moving to lower wages (or minimum wage, on JG) rather than becoming unemployed.

How does the ex-UBS banker now a “strategy adviser” expect to see another German “Wirtschaftswunder,” or economic miracle without the massive rebuild of the economy via a “Marshall Plan”?

He should read Tony Judt, Postwar History of Europe

Ralph: All employment is temporary subsidized employment. Nobody lives forever = temporary. All employers ultimately get the money they pay their workers with from the state = subsidized. The JG just cuts out the middleman.

How much interns/ JGers would displace “regular” “normal” “fully waged” employees depends on the JG wage. If it is high enough, practically everyone is a JGer, and taxes or prices for state-produced goods might have to be raised in our Soviet Republic against inflation. With a living wage JG, there could be some displacement, probably not much. Some displacement of low wage jobs could be a socially beneficial aim of the program, a feature, not a bug.

Unless the economy were at damn full employment, the JG would of course result in a net rise in employment because the huge army of the un(der)employed would disappear. Full employment & a democratic JG would be the best friend labor unions ever had, not an opponent. That’s why it was really important for the survival of oligarchy in the USA for the WPA to be destroyed in WWII – and the oligarchs back then knew very well that they had to do it when they could.

Of couse it all depends on the wage & the program design, which Bill of course assumes will be sane & democratic. The ultimate aim and result of the oligarchical principle though is to have full employment. I forget which Nobeloid economist characterized as universal, natural and laudable the desire to be the last oligarch standing, the dictator who runs a JG program of everyone else being his slaves.

Some Guy, Obviously all jobs are temporary in the sense that eventually we all die. In fact all jobs are vastly more temporary than that in that the average job only lasts 5 years or so (I forget the EXACT number). But those are pretty meaningless uses of the word temporary. I.e. what I meant by temporary was “a few months rather than a few years”.

I am puzzled by your idea that “All employers ultimately get the money they pay their workers from the state.” If that’s the case, how come employers were able to pay their employees prior to roughly 1900 when the “state” was near non-existent: i.e. the state took a minute portion of GDP compared to nowadays?

I agree that one factor determining the extent to which interns would displace regular workers depends on the intern wage. For that reason it would be nonsense for the intern/JG wage to be above the min wage.

Another wheeze that would limit the extent to which interns displaced regular workers would be to place a strict limit on how long an intern stays with a given employer. I.e. after two months or so the state could call the employer’s bluff and give the employer the option of either paying the intern a full regular wage, or letting the state transfer the intern to another job where possibly the latter would be more productive. If the employer really thought the intern justified a regular wage, the employer would keep the intern, and save the state the cost of paying the intern.

When the state is nearly non-existent, there is usually anarchy & chaos. As Keynes said, Modern Money is 4000 years old (older than that really) – and Modern Money is what Modern Monetary Theory is about. Sure there are subtleties & historical variations – some of which are not relevant anywhere in the world nowadays, or after the middle ages. But fundamentally and originally and nowadays a monetary economy is a kind of command economy, where all the money comes ultimately from the state. All the JG does is cut out the middleman, as I said.

Only the state can print dollar bills, reserves, Treasuries, NFA. Modern states regulate banking, private credit money that leverages state money. The state is the currency monopolist, as Mosler says. Lerner et al analyzed the “capitalist” & “socialist” (“command”) economies of their day simultaneously, with the same concepts, speaking of the “monetary authority” – making Mosler’s point in other words. I am just saying money is a creature of the state. An employer that does not have a chain of customers & lenders, people from whom it somehow gets ready money, which ultimately reaches back to and ends at state spending, is an employer that is going bankrupt.

In 19th century laissez-faire, the state might not issue many commands, except the weird one of setting a price for useless commodities like gold or silver in terms of its intrinsically valuable fiat money. But it was still in charge, still essentially had monetary sovereignty. Did pre-1900 employers coin their own money? Did workers usually accept it? No, they paid in dollars or pounds, which were ultimately backed by their acceptability as payments to the state. Yes, there were company towns & their scrip, and private banking (there still is 🙁 ). There was chattel slavery too.

I’d note that MMT academics are alert to the agency problems involved by having private employers having JG workers – state-imbursed, privately employed interns. In short, the peril of being closer to slavery than a democratically organized, publicly adminstered JG like the WPA, or maybe even “regular” jobs from the capitalist middleman.

“If that’s the case, how come employers were able to pay their employees prior to roughly 1900 when the “state” was near non-existent:”

You’re confusing a stock and a flow again. A small amount of fiat stock is leveraged via the intangible ‘money creation licence’ assets of private banks to provide a larger stock. That stock then turns through the economy at velocity.

It is from this flow that workers receive their wages and execute their spending.

“Another wheeze that would limit the extent to which interns displaced regular workers would be to place a strict limit on how long an intern stays with a given employer”

That’s an unnecessary complication. If you want the Job Guarantee to apply to the private sector then you go for the universal wage approach – where the Living Wage is nationalised and given to all workers – public, private, voluntary – directly by the state. Their private wage is reduced accordingly and will result in many if not most people literally receiving zero private wage for their efforts.

Since the private sector wants people to work for zero wage, then one solution is to give them that by redefining zero.

You then have the voluntary and public sector work available so that the conditions of employment have some competition from a minimum standard. That means that although zero wage is possible,80 hour weeks for the same money are not – as people would just leave for the voluntary sector.

Or you implement the JG as Bill has envisaged, where people are restricted to working in the public or voluntary ‘non-profit’ sector and the private profit sector has to bid them away from that work. Bill has detailed that system in his writings extensively.

But messing around in the middle with a bunch of withdrawal and exception rules is silly. It’s all that early withdrawal nonsense that causes tax credits to fail in their purpose. In systems simple is always best as it avoids any problems with unexpected emergent behaviour.

For me the important function of Job Guarantee is to allow an individual to say no to a job offer. You can’t have a functioning market unless you can say ‘no deal’ and walk away.

Some Guy,

I don’t agree with your claim that because an economy uses the state’s money, therefor the economy is a “command” economy. The phrase “command economy” normally refers to something along the lines of Russia prior to the collapse of communism, or the economies of the US, UK and Germany during WWII. I.e. the phrase refers to the virtual suspension of market forces, with nearly all economic decisions being taken by government.

The fact of using the state’s money is perfectly compatible with a free market economy.

I also don’t agree with the idea that JG “cuts out the middleman” (i.e. normal employers). MMTers who advocate JG do not envisage JG taking over the roles of the main public sector employers: schools, hospitals,etc. Nor do those (like myself) who advocate private sector JG advocate having JG run supermarkets or car factories. What I do advocate is having JG supply temporary subsidised labour in small quantities to EXISTING employers.

WPA did involve what you might call “entirely new employers”, but that gave rise to understandable objections from private sector employers in similar lines of business (construction, mainly). In other words, where is the sense in having one lot of contractors who have to EARN the money for their employees’ wages in a competitive free market, and another lot who get the money for employees’ wages for free from the state?

Neil:

If the money for all wages was supplied “directly by the state”, there’d be little incentive for employers to make maximum or sensible use of labour. I think quite a big reduction in GDP would ensue.

“If the money for all wages was supplied “directly by the state”, there’d be little incentive for employers to make maximum or sensible use of labour. I think quite a big reduction in GDP would ensue.”

Not all wages – just the ‘living wage’ bit.

Employers do not make maximum of sensible use of labour now. That’s why there are 4.8 million people in the UK without work with many literally being paid to do nothing.

That’s a pretty big reduction in GDP already.

Employers will make maximum and sensible use of labour when demand increases – because by definition there won’t be an unemployed buffer pool for them to draw on. Their only option would be to increase productivity – or put prices up which would invoke a tax response to control inflation.

It’s difficult not to be in sympathy with Bill’s passionate diatribes against the (uniformly deleterious) effects of unemployment.

But one early precursor of his JG proposal was Speenhamland which that icon of the left Karl Polanyi (no irony intended, I’m an admirer) stigmatised as having had the entirely unintended consequence of reducing the economic circumstances of once-independent rural workers to (or below) those of slaves. Amid universal anathema from across the entire political spectrum the system was finally abolished – but not before two or more generations had had their lives blighted by it. Its aim had been to prevent the new factory-owners hoovering-up the rural labour-force and – thereby – to preserve in aspic a way of life and a pattern of rural society which was in any case already changing. In other words: a failed experiment in social engineering.

Likewise – at least according to the more jaundiced accounts (but not without scholarly supporting evidence) – the WPA. Roosevelt, who was a shrewd (to the point of being unprincipled) political operator, used it quite shamelessly to promote his and his party’s electoral fortunes. Which is not to say that it didn’t have substantial achievements to its credit. Some critics have contended that it actually exacerbated unemployment though (I would expect Bill to dismiss that contention out of hand).

The point is that all such schemes are always going to have serious flaws, and are a constant delicate balancing-act between opposing tendencies. Inevitably with time they decay. Almost always they produce some consequences that were not foreseeable, some of which may actually be the reverse of those intended. The counter-argument is, I suppose, that nothing could be worse than the socially-corrosive effects of mass-unemployment so why not give it a try. But that fails to convince most people.

In Britain we already experienced a generation or more of “make-work” employment. Virtually the whole of the workforce was – in obedience to the slogan “full employment” slavishly pursued by governments of both parties, in alliance with all-powerful trade unions – under-employed. For every craftsman there had to be a mate; no craftsman would dream of undertaking work he was perfectly capable of performing but which fell on the other side of a union demarcation-line – so one craftsman interrupted his work and waited, idle, while another (also less than fully-employed) filled the gap: the once world-beating British car industry was destroyed by the combined efforts of incompetent managements and perpetually strike-prone class-warriors applying blackmail to extort ever-higher piece-rates and exercising total control over hiring and firing; Fleet Street and the docks were a standing joke with their armies of “ghost” workers appearing on the payrolls with names like “Mickey Mouse”; and so on. Britain became “the sick man of Europe”, but at least we had “full employment” didn’t we? – except that actually we didn’t. It was illusory and bound to end in tears eventually. Thatcherism was the backlash.

That kind of experience takes some getting-over.

“Britain became “the sick man of Europe”, but at least we had “full employment” didn’t we? – except that actually we didn’t.”

Don’t confuse correlation with causation. The reasons behind the demarcation system are complex and heavily rooted in the job insecurity of the pre-war and Victorian period. The whole IMF episode was precisely because the politicians wouldn’t deal with supply side reform. And then up popped Thatcher, like Mugabe in Zimbabwe, as an extreme reaction to the failure of the politicians that went before.

The design of Job Guarantee addresses the issue face on. It is not ‘full employment’ in the old sense of propping up everything just in case somebody lost their job. It specifically expects businesses and jobs to die, and it lets them. The stabilisation is merely to catch people as they fall out of this maelstrom and allow them to live at the minimum acceptable standard while the malinvestment resolves itself.

Job Guarantee means that the ‘special pleading’ of ‘important employers’ should fall on deaf ears. Businesses should be allowed to smash themselves up on the rock of entropy so that better organisations can arise in their stead. In fact it should be encouraged.

The current unemployment buffer is too low a standard of living and it doesn’t allow government to ignore employers threatening to lay off people. Job Guarantee is simply a better automatic stabiliser that actually makes the labour market more like a market and less like a monopoly.