The other day I was asked whether I was happy that the US President was…

I wonder what Kepler 22b thinks

I often wonder what outer space thinks of Earth. In recent days a new planet – named Kepler 22b – has been discovered which has Earth-like features and would probably support life. With the CofFEE conference over it was back to the Euro crisis today. Kepler 22b will be following the EU Summit as much as all of us. Laughing with us as the buffoons who parade as leaders work on the next can to kick down the road. The ECB boss gave a press conference yesterday which clarified things a bit – they won’t bail out governments but each week are bailing out governments. That sounds easy to understand. Like the rest of it. I wonder what Kepler 22b is thinking.

I read this Bloomberg article today (December 9, 2011) that EU States to Send IMF $267 Billion in New Crisis Fight which said:

European leaders stepped up the fight against the debt crisis, channeling as much as 200 billion euros ($267 billion) to the International Monetary Fund and bowing to European Central Bank demands for a tightening of anti-deficit rules.

This is being hailed as the latest effort by European leaders to “craft the new approach to fighting the two- year-old crisis, which now threatens to engulf Italy and Spain” (and the rest of the member states it should be noted).

“Craft” implies skill. This is just another attempt to kick the can down the road.

The Economist Magazine (December 10, 2011) also discussed this plan in the article – Cash for credibility Laundering European rescue funds through the IMF.

Their take was:

As a new game plan for saving the euro by enforcing fiscal discipline takes shape … there is growing speculation that Europe’s central bankers could help in another way-by channelling rescue funds through the IMF.

The ECB is not allowed to fund member governments, but it or national central banks could lend to the IMF. Those national central banks have provided resources to the fund before, which is why the ultra-orthodox Bundesbank does not object to filling the IMF’s coffers-even if that money were then used to provide rescue funds for countries such as Italy or Spain.

In many ways this money-laundering would be a clever wheeze. It gets around the central bankers’ hang-ups. It provides discipline, since the fund’s conditionality would help to keep Europe’s peripheral economies on track.

At that point the assembled audience burst into laughter (noting that tears close by given the human tragedy that is unfolding).

Money laundering? Sending euros out to Washington (electronically via some keystrokes on a computer) and then someone in Washington makes some keystrokes on a computer and they funds go to Spain or somewhere else.

While this might add to the bandwidth strain a fraction it will do nothing else.

Of-course, the IMF bullies will savour two things: (a) the rest of the world thinking they are relevant; and (b) the chance to inflict harm and damage on innocent civilians which is their basic modus operandi.

But the ECB doesn’t need the IMF to inflict austerity. They are already doing it.

And then we come to the ECB press release (December 8, 2011) – ECB announces measures to support bank lending and money market activity – popped up in my E-mail box and it completed the fun for the day!

The ECB decided to cut interest rates to record lows and declared they would offer as much liquidity as is necessary to ensure banks remain funded in the Eurozone.

The commercial banks will get unlimited amounts of liquidity for three years (rather than 12 months previously) and lower quality collateral will be accepted in return.

This is the sort of support that other central banks have already announced (in the UK and the US).

In the Question and Answer Session accompanying the ECB decision to cut rates and to offer an unlimited lifeline to the banks, the President of the ECB rejected the suggestion that the the bank would bailout struggling governments or pay into the IMF so they could bailout governments.

The ridiculous part of that response was the he agreed the ECB could provide funds to the IMF to lend to Indonesia but not to a nation in the Eurozone.

He affirmed that the ECB did not have responsibility to help the governments and was prohibited under Article 123 from “monetary financing of governments”.

He was asked whether the ECB was a lender of the last resort and he correctly pointed out that the concept was now being used in different ways. Where he saw the responsibility of the bank was in bailing out the commercial banks in Europe – the traditional concept of the lender of the last resort.

He outrightly rejected being a monetary financier of governments.

What exactly is the logic here?

First, the ECB has all the currency creation powers that any sovereign government typically has.

Second, the ECB is tightly constrained by rules as to what it can do but that hasn’t stopped it from introducing its Securities Markets Programme (SMP) which is currently funding European governments. The Latest data (go to Ad-hoc communications Tab) – shows the ECB now holds 207 billion Euros of public debt – adding an extra 3.5 billion euros of debt to its balance sheet in the last week.

Please read my blog – The ECB is a major reason the Euro crisis is deepening – for recent analysis of the SMP.

Third, the ECB claims that the SMP interventions are fully “sterilised” which as I show in this blog – Don’t tell the Germans – the ECB weekly deposit tender failed – is only partly true.

But, moreover, it is irrelevant.

Commercial banks in Europe can deposit as much as they like in the overnight deposit facility. But what they do with their reserves doesn’t alter their capacity to lend. That is a function of the demand for funds by credit-worthy borrowers. All the manipulation of reserves – whether into the special weekly fixed-term deposits used by the ECB to match the secondary bond market purchases or the deposit facility at the ECB – doesn’t alter the banks capacity to lend.

The two differences between the fixed-term deposits and the deposit facility is the former allows funds to be parked for a week while the latter is an overnight facility and that the former pays a higher return. It smacks of corporate welfare in fact.

Second, the neutralising of the SMP purchases does not reduce the capacity of commercial banks to expand credit. If you think that the weekly fixed deposits actually reduce the capacity of the commercial banks to lend then you would be wrong.

The whole charade being played out is farce.

When a troubled EMU government issues bonds to the private market the latter knows they can sell them to the ECB and thus eliminate any carry risk. The ECB buys the bonds in the secondary market with euros which it creates. Commercial bank euro deposits and reserves rise.

The ECB then offers a weekly deposit facility by tender up to the volume of outstanding SMP bond purchases. So they swap the euros for an interest earning account with the ECB instead of leaving the interest-earning bond in the hands of the private sector.

The sterilisation operation drains bank reserves (moving them into a different account at the ECB) while the commercial bank deposit remains. The commercial banks effectively view the weekly fixed deposits as close substitutes for reserves. And as we know they don’t lend reserves anyway.

The ECB makes out that this deposit drain eliminates the inflation risk of the secondary bond market liquidity injection – except there is no risk in that monetary operation.

There might have been inflation risk is in the government spending that the bond issue “funded” (when we talk about an EMU nation). Although given the current parlous state of economic activity in the troubled EMU nations the risk is more about deflation.

But there is no inflation risk in the rising bank reserves.

To make matters more obvious to those who are struggling with this, consider the fact that the banks can always access unlimited funds via the ECB’s marginal lending facility.

This facility is the flip-side of the overnight deposit facility which are both components of the ECB Standing Facilities and aim to provide and absorb overnight liquidity to banks.

The marginal lending facility allows banks to “obtain overnight liquidity from the national central banks against eligible assets. Under normal circumstances, there are no credit limits or other restrictions on counterparties’ access to the facility apart from the requirement to present sufficient underlying assets”.

Now they are making these lending facilities more generous for the banks?

But notwithstanding the flawed design of the Euro monetary system, wasn’t it the banks that caused the crisis in the first place? Didn’t they push unsustainable credit growth down the throats of Euro consumers and property developers and helped them to build the now abandoned housing estates which are now being taken over by cockroaches and other bugs who are happy to have a warm home for the winter?

Following Mario Draghi’s method of responding to the questions at his press conference: Yes and yes!

Further, it is only the SMP (which is “nearly” direct monetary financing of governments) that is preventing a complete collapse of European financial markets. What exactly is the difference between this and “monetising government finances”?

There are technical differences but in the end – no difference.

The only short-term solution for the Eurozone is that the ECB should announce that it will support a new growth strategy in the EMU and it will ensure tha all governments have enough funds (whichever way it needs to do that).

All the machinations at the moment are just making Kepler 22b laugh.

Digression – those lazy Germans!

The UK Office of National Statistics published the latest Hours worked in the labour market – 2011 yesterday (December 8, 2011).

They said:

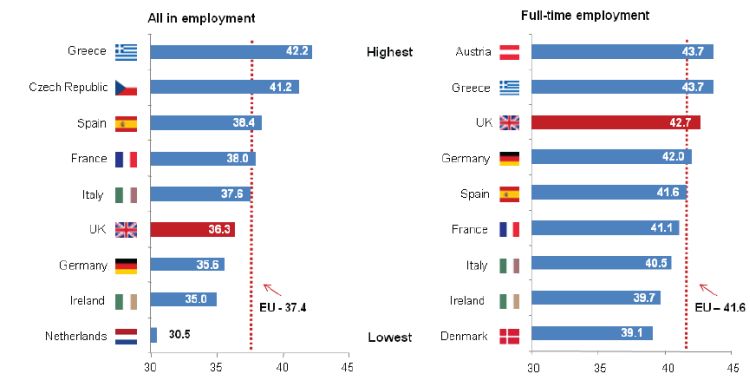

Workers in Greece had the longest average usual hours at 42.2 hours per week. The lowest average usual hours was in the Netherlands at 30.5, although almost half (49 per cent) of people in the Netherlands worked part time. Focusing on full-time workers to account for differences in the percentages working part-time, average usual hours worked in the UK (42.7) were higher than the average for everyone in the EU (41.6). Only Austria and Greece had longer average usual hours of all EU countries, both at 43.7 hours per week. The lowest full-time hours were in Denmark at 39.1 hours per week.

They provided this graphic to make the point:

What are the German workers doing?

Conclusion

I was talking to someone yesterday and the discussion was about how to make sense of all this farce. We agreed that the sub-plot is very sinister and is about finishing the job that was in train prior to the crisis.

Recall that in November 2008, the recently-appointed chief of staff for the Obama Administration (Rahm Emanuel) spoke at at “Wall Street Journal conference of top corporate chief executives” and said (Source):

You never want a serious crisis to go to waste. Things that we had postponed for too long, that were long-term, are now immediate and must be dealt with. This crisis provides the opportunity for us to do things that you could not do before.

How long will it be before the big German manufacturers move more of their operations to the lower wage nations in Eastern Europe and hollow out their operations in the more advanced nations?

I will write more about that in another blog.

Saturday Quiz

The Saturday Quiz will be back sometime tomorrow – about the same “undergraduate” level as always!

That is enough for today!

Hello from Spain.

What can we do here in Spain to get out of this euro trap? Do we have future on it?

Thank you for your blog!

To forget the Euro crisis, I prefer this.

http://www.youtube.com/watch?v=XMbvcp480Y4

The beautiful photos complement the music.

Even better is this and in keeping with the tone of Bill’s post.

http://www.youtube.com/watch?v=zuh3WyfVL2M&feature=related

Equally stunning photos.

Hey Bill,

If I understand correctly the numbers (not an economist!), then

according to this (see esp. fig 1)

http://www.voxeu.org/index.php?q=node/7391

what actually happens when the ECB lends to goverments, is that ECB borrows the money from the German Central Bank (no “money creation” at all).

If that is the case, then things seem to be a lot worse.

Could you pls. comment on this?

Dimitris

Hmmm, “undergraduate” in quotes. Another attempt by Professor Mitchell to lull us into complacency. A careful reading of questions is always advised

Bill

you write this: “consider the fact that the banks can always access unlimited funds via the ECB’s marginal lending facility”

but then you write this: “The marginal lending facility allows banks to “obtain overnight liquidity from the national central banks against eligible assets. Under normal circumstances, there are no credit limits or other restrictions on counterparties’ access to the facility apart from the requirement to present sufficient underlying assets”.”

so if banks obtain overnight liquidity only against eligible assets then your first statement is not true, they can’t always access unlimited funds. Am i wrong?

I can’t help but think that the real point of all this is to simply keep the crippled carcass of the Euro going so the bond vultures can contine to feast on whatever new meat the visible players can manage to attach to its bones. Why after all should the Great Heist conclude before our later day Willie Suttons have emptied the vault of its very last pennies?

OK Well after a day when I’ve been defending Cameron on the wires, I need a very stiff drink.

No doubt tomorrow there will be hell to pay.

What is Sarkozy up to?

I think dimitri is talking about target. I don’t remember quite what it was but it has somthing to do with balancing reserves. Germany always runs surpluses and the piigs deficits and so there is a balancing operation?

The Netherlands is a small paradise. People work as little as possible and they have a pretty good standard of life. Plenty of people work part-time, especially women, and they have one of the lowest unemployment level we can find. Austria also has low unemployment, but it doesn’t appear in the all-in employment figures. Does it mean it’s less than 30 hours? Maybe there is a lesson there for developed countries?

It is intriguing to note that in the diagram comparing the Kepler 22b system to ours;

(a) The so-called habitable zone for the Solar system stretches from close to Venus’s orbit to well beyond Mars’ orbit. The extremes of this zone might be planet-habitable by some bacteria or viruses. I doubt that much of the zone would be planet-habitable by humans.

(b) Keppler 22b appears near the inner rim of the habitable zone in the Keppler 22b system. This might contradict the claim it has a balmy 22 degree C climate.

(c) The Kepler 22b system is 600 light years from earth.

All this suggests;

(i) Keppler 22b is very unlikely to have even bacteria or viruses.

(ii) It is highly unlikely to have any more complex life.

(iii) We will never know anyway.

Speculation is fun (just ask earth’s speculators) but leads to little of lasting worth.