The other day I was asked whether I was happy that the US President was…

Don’t tell the Germans – the ECB weekly deposit tender failed

Its summer! After reading this blog – The ECB is a major reason the Euro crisis is deepening – many readers have written to me asking to provide more explanation of the “sterilisation” operations that the ECB is engaged in. It is clear that an increasing number of people are becoming interested in arcane things like central bank operations which can only augur well for creating capacity for better public debate. A lot of readers overnight have reacted one way or another to the announcement by several central banks that the swap lines are open again albeit at a lower “cost” than previously. There was also considerable interest in understanding what the “failed” sterilisation yesterday means. The answer is not much but we had better not tell the Germans that the ECB weekly deposit tender failed.

In a recent blog – The ECB is a major reason the Euro crisis is deepening – I provided the most recent data applicable to the ECBs so-called Securities Market Programme (SMP) which was established on May 14, 2010.

You can read more recent information about the programme HERE. The ECB provides the weekly Data (click on the Ad-hoc communications Tab) about the SMP purchases. The ECB announced their SMP in this Statement.

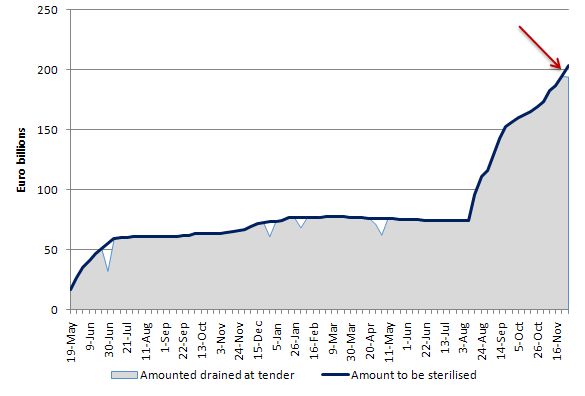

As of November 25, 2011 the ECB has bought 203.5 million euros worth of bonds under the programme. The purchases are accelerating each week.

Since August 2011, the ECB has accelerated their purchases in the secondary bond markets to overcome the fact that the private bond markets have been increasingly less willing to fund EMU member states at affordable yields.

This is evidenced by the widening spreads of member state bonds against the Bund. The SMP is unambiguously a fiscal bailout package which amounts to the central bank ensuring that governments can continue to function (albeit under the strain of austerity) rather than collapse into insolvency.

When the ECB announced the SMP they also said that:

With a view to leaving liquidity conditions unaffected by the programme, the Eurosystem re-absorbs the liquidity provided through the SMP by means of weekly liquidity-absorbing operations. The intended amount for absorption equals the cumulative size of settled SMP transactions at the end of the preceding week, rounded to the nearest half billion.

See also the ECB Annual Report 2010 for more discussion.

As a consequence, the ECB conducts a weekly open market operation in the form of the provision of fixed-term deposits (with a weekly duration) which economists refer to as a sterilisation operation.

The sterilisation concept usually refers to open market operations conducted by a central bank to insulate the effects on the money supply caused by a balance of payments surplus or deficit. It is typically a concept that applied during the Bretton Woods era where central banks were entrusted with maintaining the fixed exchange rates under the agreement.

So if a nation was running a current account deficit, it would face downward pressure on its exchange rate (because more people were supplying the local currency into foreign exchange markets to buy imports relative to those which were demanding the local currency to buy a nation’s exports).

The central bank would have to intervene to prevent the exchange rate falling and they would buy local currency in exchange for its reserves of foreign currency in the forex market and thus soak up the excess supply of local currency and maintain the parity.

However, without any accompanying operation, this would result in the domestic money supply contracting which would drive up the local interest rate and compromise the health of the local economy.

To insulate the domestic economy from the foreign exchange intervention, the central bank could then sterilise the intervention by buying bonds in the local bond markets in return for currency and thus maintain the money supply and interest rates at their desired levels.

There are other examples of sterilisation (for example, when an exchange rate is under upward pressure). But I am sure you get the point.

On December 2, 2010, the then ECB President Jean-Claude Trichet held a Press Conference and the following exchange occurred:

Question: You described the SMP programme as an instrument that enables you to implement your monetary policy in abnormal circumstances. If circumstances get worse, would you be willing to extend this programme?

Trichet: From the very beginning, the aim of the programme has been to help us restore the functioning of our monetary policy transmission mechanism, and it is for the Governing Council to judge how best to do this. It is not quantitative easing; we are withdrawing all the liquidity that we are injecting.

So no quantitative easing – spare the thought!

In a speech on October 21, 2011, a member of the Executive Board of the ECB (José Manuel González-Páramo) – The ECB’s monetary policy during the crisis said in relation to the SMP that:

The main purpose of this programme is maintaining a functioning monetary policy transmission mechanism by promoting the functioning of certain key government and private bond segments … The SMP should, of course, be clearly distinguished from the policy of quantitative easing. While the objective of the SMP is to repair the transmission mechanism, quantitative easing aims at injecting additional central bank liquidity in order to stimulate the economy. As a result, quantitative easing, as for instance with the Bank of England, comes with precise quantitative targets. By contrast, the size of SMP purchases is driven by an intervention strategy which seeks to improve market functioning. Let me stress that the liquidity injected through SMP purchases is re-absorbed on a weekly basis so as to specifically neutralise the programme’s liquidity impact.

The ECB has tried to distance itself from other central banks (such as the US Federal Reserve, the Bank of England and the Bank of Japan) who they consider have exposed their economies to excessive inflation risk by “printing too much money” under their respective quantitative easing programs.

The ECB also continues to peddle the myth that QE is about giving banks more money to lend. The fallacy in that logic is that bank lending has not be constrained by a lack of reserves. Rather there has been a dearth of credit-worthy customers at a time when banks have tightened their lending criteria given the financial uncertainty.

Please read my blog – Quantitative easing 101 – for more discussion on this point.

Quantitative easing is an asset swap designed to bid up the prices of assets in certain maturity ranges and thus keep interest rates in those segments lower.

The only way it would have helped alleviate the crisis is if the lower rates stimulated investment growth. However, with the crisis so deep and consumers bunkering down for fear of unemployment and insolvency (given the debt overhang), firms have been able to satisfy demand with existing capacity.

Further, the fact that most central banks have been offering a return on excess bank reserves means that the SMP is virtually indistinguishable.

Both keep yields lower than otherwise by strengthening demand in the bond markets and both provide an interest-bearing alternative to the bond-holders.

The SMP is however targeted at bailing out governments by buying their debt and taking the risk of default off the private sector.

Modern Monetary Theory (MMT) explains why this view about QE is erroneous. It also explains why QE itself has failed to expand aggregate demand.

Please read the following blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – for further discussion.

There have been a lot of questions asked about the sterilisation operations conducted by the ECB including its limits. The distance that the ECB has been trying to make between the SMP and QE has also been challenged.

First, it is clear that the scale of the SMP is well beyond that necessary to fulfil the objectives that are officially ascribed to the program – “to restore depth and liquidity to dysfunctional markets”.

Second, the neutralising of the SMP purchases does not reduce the capacity of commercial banks to expand credit. If you think that the weekly fixed deposits actually reduce the capacity of the commercial banks to lend then you would be wrong.

The SMP works like this – an EMU government issues bonds to the private market who knows they can sell them to the ECB and thus eliminate any carry risk. The ECB buys the bonds in the secondary market (that is, after they have been issued by the EMU government in the primary tender market) with euros which it creates.

At that point, bank euro deposits and reserves rise.

The inflation risk is in the spending that the bond issue “funded” (when we talk about an EMU nation). There is no inflation risk in the rising bank reserves.

The ECB then offers deposits with the ECB up to the volume of outstanding SMP bond purchases. So they swap the euros for an interest earning account with the ECB instead of leaving the interest-earning bond in the hands of the private sector.

The sterilisation operation drains bank reserves (moving them into a different account at the ECB) while the commercial bank deposit remains.

The commercial banks effectively view the weekly fixed deposits as close substitutes for reserves. And as we know they don’t lend reserves anyway.

Moreover, the banks can always access unlimited funds via the marginal lending facility which I will explain next.

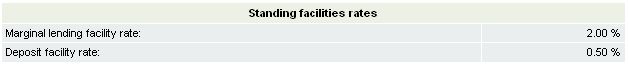

The other part of the picture that you might want to understand is that central banks offer commercial banks what are called Standing Facilities.

This document – The Implementation of Monetary Policy in the euro Area February 2011 – provides a broad description of the various operations that the ECB conducts.

In terms of Standing facilities, the ECB (Section 1.3.2 Standing facilities) says:

Standing facilities are aimed at providing and absorbing overnight liquidity, signal the general stance of monetary policy and bound overnight market interest rates. Two standing facilities are available to eligible counterparties on their own initiative, subject to their fulfilment of certain operational access conditions …

- Counterparties can use the marginal lending facility to obtain overnight liquidity from the national central banks against eligible assets. Under normal circumstances, there are no credit limits or other restrictions on counterparties’ access to the facility apart from the requirement to present sufficient underlying assets. The interest rate on the marginal lending facility normally provides a ceiling for the overnight market interest rate.

- Counterparties can use the deposit facility to make overnight deposits with the national central banks. Under normal circumstances, there are no deposit limits or other restrictions on counterparties’ access to the facility. The interest rate on the deposit facility normally provides a floor for the overnight market interest rate.

The standing facilities are administered in a decentralised manner by the national central banks

So the weekly fixed-term deposits that the ECB is using to drain the liquidity injected via the SMP are very similar to the standard Deposit Facility, which allows the banks to make overnight deposits with the ECB.

Recall that to manage the interest rate target, the central bank cannot leave excess reserves in the payments system unless it offers an interest rate commensurate with the spread it is prepared to tolerate around its target rate.

If they do not offer a return to banks on excess overnight funds (which are only used to ensure integrity in the settlements (payments) system) then the banks will compete among each other in the interbank market to see if they can get a better rate (above zero) and the competition drives the overnight rate down to zero.

Remember that the non-government sector cannot eliminate a system-wide excess of liquidity because every asset created (loan) is matched by an equivalent liability (debt).

The only way the excess reserves can be drained is via the central bank selling government debt to the banks. Paying a return on the excess overnight reserves is an equivalent action.

The Deposit facility works in that way. If you click the Data Tab at the ECB Standing facilities page you will see the following information.

So the Deposit facility rate yesterday was 0.5 per cent. You can see the history of the Deposit facility rate HERE. In 2009, the rate was 0.25 per cent up to April 13, 2011 when it rose to 0.5 per cent. It was pushed up again by the ECB on July 13, 2011 to 0.75 per cent but that was adjusted downwards again to 0.5 per cent on November 9, 2011.

So keep all that in mind and wonder how the Deposit facility is different to the sterilisation operation?

Both are voluntary. The commercial banks do not have to use the Standing facilities nor do they have to bid for the weekly, fixed-term deposit facilities.

What do we know about the sterilisation operation?

You can also download their entire open market operations dataset and if you sort through it and trace the tenders (they all occur at 12.05 – just after midday) you can match the sterilising operations (the so-called fixed variable tender auctions) to the SMB cumulative balance.

You can also see an html page providing some of the details of the open market operations. If you click the link market ANN (meaning annotations) you can find out more detail about the specific transaction.

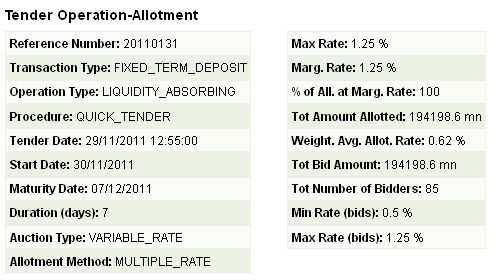

In their weekly memorandum relating to the latest (November 29, 2011 bids for November 30, 2011 settlement), the ECB said:

As announced by the Governing Council on 10 May 2010, the ECB conducts specific operations in order to re-absorb the liquidity injected through the Securities Markets Programme (SMP). In this regard, the ECB will carry out a quick tender on 29 November at 11.30 in order to collect one-week fixed-term deposits with settlement day on 30 November. A variable rate tender with a maximum bid rate of 1.25% will be applied and the ECB intends to absorb an amount of EUR 203.5 billion.

The latter corresponds to the size of the SMP, taking into account transactions with settlement on or before Friday 25 November, rounded to the nearest half billion. As the SMP transactions which settled last week were of a volume of EUR 8,581 million, the rounded settled amount – and the intended amount for absorption accordingly – increased to EUR 203.5 billion.

So they currently have purchased EUR 203.5 billion worth of European government bonds in the secondary bond markets and are the sole reason that several European member states are still solvent.

The following graph shows you the SMB balances and the volumes drained by the weekly auctions. The latest auction (red arrow) was settled yesterday (November 30, 2011).

In the November 30, 2011 liquidity absorption operation (the sterilising action), the ECB sought to drain 203.5 Euros.

Here is the data from the most recent auction that was settled yesterday.

According to this data, the sterilisation failed. The banks only decided to deposit 194.2 billion euros in the weekly fixed-term deposits. The 9.3 billion euro shortfall is almost equivalent to the SMP purchases in the week to November 25, 2011 (9 billion euros).

But before we get carried away, the graph shows that there has not been complete sterilisation on several occasions since the SMP began in May 2010.

The following tenders “failed” – June 30, 2010 (the ECB sought to sterilise 55 billion euros and there were only 31.9 billion euros deposited); August 25, 2010 (sought 61 billion euros and 60.5 billion euros were deposited); December 29, 2010 (sought 73.5 billion euros and 60.8 billion euros were deposited); February 2, 2011 (sought 76.5 billion, deposited 68.2 billion); April 27, 2011 (sought 76 billion, deposited 71.4 billion); May 4, 2011 (sought 76 billion, deposited 62.2 billion); and finally November 30, 2011 (sought 203.5 billion, deposited 194.2 billion).

What does the current “failure” mean?

Not much. It tells us that in a technical sense, it means that the banks have determined that they prefer to keep some of the funds gained from the SMP in as liquid a form as possible.

The average daily increase in the Deposit facility has been 617 million euros. The ECB Historical data on daily liquidity conditions – shows that the increase in the deposits were 25159 million euros on November 29, 2011 and a further 15694 million euros on November 29, 2011.

It is highly likely that the commercial banks prefer to use this facility (which is an overnight deposit) despite the loss of 0.12 per cent in return.

What this probably signals is that a week is a long time in the current Eurozone banking system.

The other point to note is that ECB is paying 0.62 per cent over the next week for the Fixed-term deposits but are paying 0.5 per cent through the Standing facility. Why would they do that? Why give the banks a 0.12 per cent margin? There is no reason for that.

Essentially, these are excess reserves held by the commercial banks at the ECB. The banks would usually take up the 0.5 per cent instead of holding them as zero-earning reserves. So why add the extra 0.12 per cent?

This also bears on the conservative claims that the sterilisation will reach a limit and then the inflation risks will rise.

The Deposit facility has no limits and banks will usually prefer to park their excess reserves there anyway. But whatever arrangement the banks use to handle their excess reserves, none impact on inflation risk.

Even if the weekly tenders attracted zero bids, the inflation risk in the Eurozone would not change.

Conclusion

I hope that answered the many questions I have received about the SMP and the sterilisation operations.

In terms of inflation risk, the operations are neutral. The ECB might think they are being virtuous but when you understand what they are doing – the weekly auction just seems to be offering a superior return on excess reserves than the existing Standing facility.

None of these operations reduce the capacity of the banks to expand credit to the private sector.

That is enough for today!

“The ECB then offers deposits with the ECB up to the volume of outstanding SMP bond purchases. So they swap the euros for an interest earning account with the ECB instead of leaving the interest-earning bond in the hands of the private sector.”

Just to clarify that. I take it the ECB only offers these interest earning accounts to banks that have other ECB accounts. So the change is that rather than the fixed interest-earning long-term bonds being held by anybody in the private sector they are effectively swapped for fixed interest-earning short-term account held solely by those institutions with access to the ECB.

Therefore the shamens at the ECB think that whatever ‘sterilisation’ magic is supposed to happen from this process is a result of restricting the interest earning to banks and financial institutions, or by the inducement offered from the extra 0.12% interest.

One final question. Have you any idea what these central bankers are smoking? Do they use the same incense as the Catholic Priests?

🙂

Dear erwan (at 2011/12/01 at 19:52)

Yes, thanks for your wonderful commentary overnight.

To all readers: Erwan Mahé produces a really insightful newsletter from the European financial markets and his analysis of the ECB balance sheet overnight was excellent.

best wishes

bill

Link to Erwan Mahe?

Dear Neil Wilson (at 2011/12/01 at 18:48)

I will start researching the smoking habits of the ECB staff and report back if I find anything. Whatever it is – it is very strong!

best wishes

bill

Dear Bill

You said that if a country has a curerent-account deficit under a fixed-exchange regime, the central bank has to intervene to keep the exchange rate at its current level. Doesn’t that mean that it has to sell foreign currency? What if it doesn’t have reserves? Then it has to impose exchange controls, I suppose.

Regards. James

A Pathway to Communism

I could have said a pathway to socialism or anything else, but given the worldwide calls for a fairer, more equal society, I thought it time to discuss something provocative. If the moronic elites are going to declare class war on labor, then it is only a matter of time before labor is plunged into more suffering. I don’t agree with the somewhat observatory stance taken by the MMT community, rather a more active role should be taken to equip the next generation so that the same mistakes are not repeated.

What has MMT got to do with this?

After learning about the MMT definition of supply side inflation, the next logical question is how to fix supply side inflation? Generally the response by the state; in the form of taxes, fines, interest-rates, etc; is to destroy or inhibit the ability of a sub-class of economic agents that are dependent on the inflation causing resource. This approach works fine as long as the economic-agents are not people, that is they are firms.

However, as usual, there is a massive deficiency in economic thought when it comes to dealing with supply side inflation. I think that there is a good reason too. If there was a body of work that could describe fair approaches to handling supply-side inflation, then hypothetically, an economy could be run extremely efficiently. From this efficiency, a level of coordination could be achieved, that would in some way resemble Communism.

Right, so you have discussed how MMT via supply-side inflation is involved, but you need to define a way of dealing with supply-side inflation</i.

So my opinion is that when talking about supply-side inflation three concepts are needed, (1) The Guardian (2) Constrained-Token. (3) Quota-Determination.

(1) The Guardian.

The Guardian is suppose to represent the distributional structure needed to distribute a rare resource. The personification of the term is meant to indicate the nature of the structure, and it is an essential detail. The reason why, is because the Guardian is the structure that has complete control, granted by the people, to distribute a resource that is needed for the existence of the people.

The arbitrator has the ability to significantly control the masses, by exerting influence over distributional structure. Now to objectively define the characteristics of the Guardian it is necessary to talk about Game Theory.

The Dictator Game would be the standard of measure of the Guardian(won’t discuss the game here). Basically, the Guardian would need to be extremely altruistic in nature. Further given its position of power, I would deem the Guardian somewhat irrational, because presented with the opportunity to exploit a massive labor force, it instead does the opposite.

Constructing the Guardian is rather a difficult task. You could randomly attempt to construct an institution that in some why is ‘measurably’ altruistic. However I think a more robust framework is needed to describe the construction of the Guardian.

Construction of the Guardian.

IMO there are two factors that need to be considered; (1) The boundaries of the Guardian. (2) The altruistic nature of the Guardian.

The boundaries of the Guardian.

What would prevent two countries that seem to oppose each other going to war? Their definition of ‘self’. As the economic networks between two countries( generalizing to two entities), increase and strengthen, then this leads to the two entities becoming more inter-dependent. The definition of self is no longer clearly defined for either economy. Both economies are connected in a way, that severing networks through hostilities would be mutually damaging. This pattern is repeated through out nature, the connection between the arm and the brain, relationships between people, food-chains, etc. This inter-connectedness redefines the meaning of self, such that destroying something that may have once been considered external, is harmful because of the networks that connect the external with self. This natural pattern can be used to construct the Guardian.

The altruistic nature of the Guardian

Firstly a definition of altruism is needed that does not overlap with ‘the boundaries of the guardian’. So I will define as follows: Altruism is the probability associated given the case; Of an agent interacting with a second party, the first agent has the ability with minimum risk to exert control to exploit the second party; such that it doesn’t.

This would represent a deviation away from optimal behavior. Therefore entities exhibiting this deviation, would for the problem of distributing a rare essential resource, possibly be an essential component of the distribution of said rare resource.

So these two ‘natural’ properties would be used in constructing the Guardian.

(2) Constrained Token

The constrained token would represent an entitlement to an amount of the essential resource. It would function as a separate token system. The issuance would be handled by the token issuer according to a protocol agreed-ed to by the people.

(3) Quota-Determination

Quota-Determination would require a secondary informational system that would measure the wants & desires of the people for the rare resource. Accordingly, it would calculate the appropriate amount of constrained tokens each person would receive.

The Quota Informational System sounds oracle-like, something a bit more practical is needed

The difficulty of the Quota Informational System is that the ‘wants and desires’ measured by it will equal more than the total amount of resources available, by definition that is why it is a rare resource! So the Quota Informational System will also need to exhibit some ‘Guardian-like’ behavior in order to apply a ‘hair-cut’ to want people need & want.

Definition of ideal Quota Determination.

Ideal quota determination will occur when: Everyone first expresses the amount of rare resource that they want & desire and then also express how much they think every other person should receive. The result would be two calculations: The first being the sum of what everyone wants, The second would be the sum of the average of what everyone should receive. There would be an additional factor needed so that the proportion of both calculations would be summed in such a way that would arrive at the total amount of available rare resource.

Cont.

This still appears to have nothing to do with Communism.

Really? Simple, remove money, and distribute everything according to the Quota system. That’s communism right? Everything would be distributed according to notion of “socially necessary”. The wants & desires of each person for each resource would be perfectly allocated given the amount of available resource.

Even so, I don’t see how it will ever be possible.

Sure, I agree, if anything, I’ve shown that communism more likely to be impossible. But that’s missing the point. The Marxian concept of “Socially Necessary Labor Time” is an poorly defined concept. What is socially necessary? Who decides what is socially necessary? These are two essential questions that need to be understood and answered in order for people to understand the financial system. As said elsewhere, the idea of perfectly socially necessary is the ability to measure the wants & desires of everyone everywhere simultaneously. This is currently reflected in the pricing mechanism. When this occurs resources will be allocated perfectly, and the performance of the economy will be maximized.

Although this doesn’t show how to guarantee the creation of communism, it does show via non-violent means a way of achieving socialism.

Also as I have said elsewhere, the quality of prices determines how well resources are allocated. Economic growth is IMO strongly influenced by the pricing mechanism. But the definition of prices, what they are, where they come from is a poorly defined topic. Hopefully, as demonstrated, the idea of Socially Necessary and Price Structure are indistinguishable.

From this perspective prices aren’t determined by the market, they are determined by what people deem socially necessary. This statement should be one of the founding laws of economics.

Bill, again, another wonderful article.

It cracks me up each time you end a thread with, “that’s enough for today.” As a student of MMT, I can tell you that is so right. (Lots to express, and equally a lot to absorb.)

I am sure we all admire the work you put into, well…your work. It benefits us all. Thank you.

http://seekingalpha.com/author/erwan-mahe/instablog » Erwan’s blog

Bill,

UK major market is the EU and some suggestion that now is the time to join as £ devalued wrt Euro over last 18 months and UK accused of sniping from the sidelines on Euro crisis.

Your MMT analysis indicates the Euro countries effectively on a external (cf Gold) standard and previous ERM experience was painful for UK (but lucrative for Soros)!

Can UK have best of both worlds with fiat currency and maintain trade with Euro countries?

Is UK poor economic performance reversible and what are the main MMT prerequites – large forex reserves; natural resources (as Australia?);realistic asset prices (housing in UK?); gold reserves or full employment? If the latter how to compete with rapid increase in world workforce particularly the low paid in developing countries?

Any thoughts to help me understand gratefully received.

Just been reading the media blitz in the Guardian by Black Labour. Which appears to be the extreme neoliberal faction in the British Labour party.

They are totally infested with childlike economic beliefs, like: Government cannot afford borrow and spend any more, the private sector funds government through taxation etc etc. They seem to have strong media connections especially the Guardian.

They echo a strong theme in popular thinking and populist policy. Whether The popular misconception is an intuitive misunderstanding of the economic system or the result of misinformation from propaganda organisations I can’t say. More likely the former, hang heads in shame economists. Except Bill.

It all looks very bleak for reformists. With “progressives” like these clowns, the general population will be experiencing much worse conditions. Maybe then they will think a bit harder about why the system is failing them.

The turning point was when Labour abandoned socialism and their objective became to gain power by whatever means necessary.

Labour is now irrelevant. We wait for a new party of conviction politicians.

New equation?

Orange Liberals = “In the black Labour” = One Nation Conservatives.

Why not form a nice little party for themselves. They all think the same and the colour scheme is sorted out…..it should be popular.

The colour of a bad bruise. Black, blue and orange. How appropriate.

Bill,

I’m a little confused with regard the 7 day maturity on these ECB accounts. Does it mean that the excess reserves are only removed for 7 days? If they are ongoing, are their any rules about withdrawing from these accounts?

Kind Regards

Charlie

It’s okay Bill, I get it – the whole accumulated total of excess reserves are tendered each week, so not much less liquid than interest on overnight excess reserves or the deposit facility.

So if the BoE insisted that excess reserves are kept in a seperate account, for a minimum of, say, 2 nights, then these excess reserves are no longer liquid (they are in fact, solid perhaps), the value of the pound should rise on forex markets!?