The other day I was asked whether I was happy that the US President was…

Tightening the SGP rules would deepen the crisis

This week, the European Union Summit should see the leadership take the monetary union further into the mire and further away from an effective solution to their woes. The German Chancellor has vowed to create a new fiscal union across the Eurozone. She announced this plan to the German Parliament and declared she would push for a change to the treaty that established the common currency. Let me state at the outset – the plan as the press are reporting it – will not work. It is just the latest in a long line of Euro “solutions” that has fallen on its face soon after being announced as the way forward for the EMU. It won’t work because it doesn’t address the problem and will make changes that will make the actual problem worse. Europe is suffering a lack of aggregate demand and needs to address that head on by increasing public spending. Further constraining the capacity of governments to spend will make the situation worse.

The Australian Broadcasting Commission (ABC) reported late Friday (December 2, 2011) – Europe on verge of fiscal union: Merkel – that the fiscal union would have “rigorous budgetary oversight” and they quoted the German leader as saying:

… We are not only talking about a fiscal union, we are beginning to create it … fiscal union with strict rules, at least for the eurozone … “Anyone who had said a few months ago that we, at the end of 2011, would be taking very serious and concrete steps toward a European stability union, a European fiscal union, toward introducing [budgetary] intervention in Europe would have been considered crazy … Now these items are on the agenda, we are on the verge of it, there are still difficulties to be surmounted but their necessity is now widely recognised … Rules must be respected. Respect for them must be supervised. Their violation must have consequences

Get that whip out!

The ABC also reported the French leader as saying that “the developed world was entering a ‘new economic cycle’ dominated by austerity, heralding tough times ahead for jobs and business” and that “this would require a new political and budgetary consensus that would win back the confidence of the markets”.

Never mind the confidence of the unemployed who vote. Given the major parties in most nations have converged and promote neo-liberal macroeconomic policies, voters have very little room to move. It is a case of like it or lump it for the unemployed.

Sarkozy also used said that France and Germany were fighting for more “discipline, more solidarity, more responsibility… true economic government” and wanted governments to adopt a “Golden Rule” which would oblige them to balance their budgets.

The German leader went further and proposed that the EMU adopt a “European debt brake” which would tightly constrain government spending.

There was a lot of talk about rules and respect and supervision and that penalties.

The interesting aspect of her proposal is that she still opposed the concept of a Eurobond. So this is to be a very strange fiscal union. Merkel told the Bundestag:

Those who claim eurobonds can currently be implemented as a rescue measure for the crisis have not understood this crisis … [the Eurobonds proposal] … does not contribute to the resolution of the crisis.

I agree with that. The proposal relies on nation states, none of which have currency sovereignty, being jointly responsible for the debts of all the states. It is only a twist on what already exists.

Taking a step back, the main problem that the EMU faces is that the member states, despite what their political rhetoric might suggest, are not sovereign nations because they surrendered their currency-issuing capacities when they joined the union.

This means they operate in a foreign currency in an analogous way to a state in any federation such as Australia or the United States. However, the way a typical federation works is to have a national (federal) government with full fiscal and monetary powers including currency issuance and the capacity to address asymmetric aggregate demand shocks when they might occur across the federal space.

Such national governments also borrow in their own right and have elaborate transfer systems (tax and spending) between them and the member states. Unemployment in that sort of federation is a national problem and has to be addressed at that level.

Importantly, they are elected by the citizens of the member states to act in a way that is compatible with the interests of the whole and the units that make up the whole.

When the EMU designers set up the monetary system they deliberately eschewed that structure and left the union without the capacity to address negative aggregate demand shocks in any systematic way. They also deliberately constrained the central bank to prevent it from being able to act as a lender of last resort (in a fiscal sense) if one of the member states got into trouble.

The ECB has found a way around this to some extent by purchasing government debt in the secondary markets and this is the only action that is preventing the system from collapsing into insolvency at present. It should guide the upcoming EU Summit as to the direction they need to take reform. Unfortunately, the German and French proposals are not heeding the warnings.

I have noted in the past that there are only two ways the EMU can make progress now:

1. To create a true federal fiscal authority which integrates with the central bank and to make major spending and taxing decisions at that level. Should the EMU wish to continue to issue debt (which I would advise against given there would be no reason to do so) they would have to issue at this level (that is, the Eurobond – sort of).

OR

2. Given Option 1 is not going to happen for cultural, historical and other reasons, the only way forward is to have an orderly break-up of the EMU and restore independent currencies and then work together to ensure there is a broad-ranging political consensus is retained.

Option 2 will not occur by volition but will ultimately be forced on them as time goes by.

But the fiscal union that the Germans are proposing is not consistent with either of the above Options.

The UK Guardian (December 2, 2011) also reported on the fiscal union plans in this article – Angela Merkel vows to create ‘fiscal union’ across eurozone.

The only interesting nuance was that they said Merkel was determined to create the new fiscal union “across the eurozone with wide-ranging powers to avert catastrophe”. Avert catastrophe? They are already at that point – the private bond markets, which are the ultimate parasites – queuing up to get hold of what should be risk-free annuities (corporate welfare) have said enough.

They have taken their beggar’s bowl to Japan and the US where they know there is zero risk of default.

And with a decade (at least) of high unemployment ahead and no mechanism available to stimulate growth (other than the inflation-obsessed ECB) I would already call that catastrophic.

I thought Merkel’s marathon analogy showed how poorly the Euro bosses understand what the issue is. The Guardian quoted her speech to the Bundestag:

Marathon runners often tell you that it gets particularly tough after 35km. But they also say that the whole distance can be completed if you are fully aware at the start of what you are about to do. It’s not the one who starts quickest who is necessarily the most successful, but the one who respects the whole feat.

I have run a few marathons and understand the process quite well. The essential ingredient to finishing fast is to maintain what we might term as “growth” – by keeping enough fuel coming into the muscles to avoid the closure from excessive lactic acid.

What Merkel and the cabal are suggesting is more strict adherence to anti-growth. Her marathon attempt wouldn’t have got past 10 kms. The evidence of this thinking is there for all to see – the Eurozone is deteriorating and all the remedies and tough talk using the same mentality that created the problem in the first place is failing.

As an aside, over the weekend, the BBC carried an extraordinary headline (December 3, 2011) – Jacques Delors: Euro was flawed from beginning.

The statement from the former EC head Jacques Delors was in the same league as the confession by former US Federal Reserve boss Alan Greenspan who gave evidence before the Committee on Oversight and Government Regulation at its October 23, 2008 Hearing on the the Role of Federal Regulators in the Financial Crisis. Here was Alan Greenspan’s Testimony/

However, things became interesting when the questions and answers started.

In the Preliminary Hearing Transcript (be careful it is 32 mgs) the former Federal Reserve boss was questioned by the Chairman of the Committee (Henry A. Waxman) and you read that Greenspan admitted that he had “put too much faith in the self-correcting power of free markets and had failed to anticipate the self-destructive power of wanton mortgage lending (Source):

Those of us who have looked to the self-interest of lending institutions to protect shareholders’ equity, myself included, are in a state of shocked disbelief …

In the following interchange Alan Greenspan admitted to be ideologically motivated:

Mr Waxman: You had the authority to prevent irresponsible lending practices that led to the subprime mortgage crisis. You were advised to do so by many others, Do you feel that your ideology pushed you to make decisions that you wish you had not made?”

Mr. Greenspan: Yes, I’ve found a flaw. I don’t know how significant or permanent it is. But I’ve been very distressed by that fact …

Mr Waxman: Were you wrong?

Mr Greenspan: Partially …

And – he stayed out of jail.

So now another one of the ideological warriers, Jacques Delors who was a key force in the design and implementation of the European Monetary Union, has admitted that the “eurozone was flawed from the beginning”,

His version of design problem is that the “lack of central powers to co-ordinate economic policies allowed some members to run up unsustainable debt”.

He failed to mention that the “unsustainable debt” is only defined in that way because the member states abandoned their currency-issuing sovereignty. He also failed to mention that had they had stricter rules – like Merkel’s fiscal union then the situation now would have been much worse in terms of lost real output and higher unemployment.

His statements suggest he remains in denial about the true design problem of the EMU.

The media report said that:

Mr Delors says the debt crisis stems not from the idea of a single currency itself, but from “a fault in execution” by political leaders who oversaw its launch.

He says they turned a blind eye to the fundamental weaknesses and imbalances of member states’ economies.

As noted, if they had have implemented tighter fiscal controls and enforced them from the beginning Germany and France would have gone into recession around 2003-04 (given their deficits were rising to support demand and growth and were well above the Stability and Growth Pact rules for some years).

Further, they would have entered the current crisis with lower growth and higher unemployment and been forced to implement pro-cyclical fiscal policies earlier (“to contain the debt”) and so we would have witnessed a Great Depression Mark 2 Europe-style.

There seems to be a new collective wisdom that they needed a federal level “state” to accompany the common currency. Delors said that those who called for that early “had a point”.

But the version of this “federal state” that Merkel and Delors and the rest of the cabal that are in denial want is not remotely equivalent to the capacity that is required (as discussed above). Their version will make things worse now and commit the citizens of Europe (elites excepted) to a drawn out future of austerity and increasing poverty.

What is astounding about all of this is that poverty used to be a lack of means in real terms. With today’s technological advances and resource availability the “lack of means” is all self-inflicted. There is no reason for Europe to be mired in recession (or hovering around the zero growth line) with inequality and poverty rising.

It is all the work of the elites who, like Alan Greenspan in 2008, just cannot admit they got it wrong and nothing short of a total remake will salvage the situation.

I have been going back to re-read the literature that supported the creation of the SGP at the inception of the monetary union. The proposal for a fiscal union with even stricter fiscal constraints motivated this excursion back in time.

The exercise has been interesting.

We should note that at the time of the Maastricht Treaty (February 7, 1992) it is now widely acknowledged that the SGP provisions were just “plucked out of the air” and had no robust modelling to support them.

In the period that followed and before the introduction of the common currency, there was a raft of retrospective studies which sought to justify the fiscal rules and claim that they were robust and well-grounded in the empirical reality.

Take this OECD Economic Studies paper from 2000 – Estimating prudent budgetary margins for EU countries; A simulated SVAR model approach. The paper is interesting quite apart from the topic because of the techniques used but I won’t comment on them in this forum. They interest me as an econometrician.

The aim of the paper is to explore the scope that the Maastricht Treaty provided EMU governments to respond to a negative aggregate demand shock (which would manifest as an output gap).

Recall that the Maastricht Treaty had several conditions:

1. Public debt limit of 60 per cent of GDP.

2. Deficit ceiling of 3 per cent of GDP.

3. A raft of procedures and definition of “excessive deficits” and the sanctions involved when nations had “excessive deficits”.

The current proposal for a fiscal union clearly aims to make these conditions (particularly Item 3) more onerous and restrictive.

The 2000 OECD paper claims that the:

The imposition of such debt and deficit ceilings does not necessarily impose a binding constraint on the use of counter-cyclical fiscal policy because countries can run a structural deficit that is well below 3 per cent of GDP. How far below 3 per cent is likely to be enough to allow the government deficit to play its role as a shock absorber in times of an economic slowdown or recession? The answer to this question depends on the size of economic shocks, the sensitivity of deficits to those shocks, and the extent to which the authorities might want to go beyond automatic stabilisation.

That is the aim of their study and it is a very interesting question.

I have claimed that the fiscal rules already in place are too restrictive to cope with a negative demand shock of the proportions we have now witnessed. It is clear that the advice that the EU was getting at the time was that expected negative shocks would be in a certain range – well below what we have now seen possible.

The rules, in other words, were designed on an overly optimistic view of what was possible. When you look back on the literature that the elites wheeled out to support their case it is clear that they didn’t anticipate how fragile their system really was.

The OECD paper tries to estimate “probabilities of breaching the 3 per cent ceiling in the future”. There were several other studies at the time which sought to accomplish the same end.

For example, one approach was to perform a “retrospective application of the excessive deficit procedure” by examining the history of budget deficits in previous business cycles. A 1997 study by Buti et al. for EU economies between 1961 and 1996 found that between 1961-1996:

1. There were 24 severe recessions identified among the 15 member states of the EU at the time according to the SGP criteria of a GDP decrease of more than 0.75 per cent. The average decline in real GDP (output) was 2.5 per cent.

2. On average, the output gaps (the departure from trend output) was 5.5 per cent over this period.

3. While the increase in the fiscal deficits varied for each identified episode the average increase was 3.6 percentage points. Almost all of the increase was due to the automatic stabilisers (on average 3.5 percentage points).

4. Assuming an average starting point deficit of 2 per cent before the recession struck, in 18 of the 24 episodes identified, the resulting increase in the deficit would have been considered an ‘excessive deficit’ under the SGP rules.

The authors concluded that the “risk of incurring an excessive deficit is high in case of protracted recessions” even if the starting point is a balanced fiscal position and that the “same conclusions can be drawn for exceptionally severe recessions with negative growth of 2% or more” (p. 29). The risk of breaching the SGP thresholds was thus identified to be high unless the nations undertook “a pro-cyclical budgetary stance” (p. 29).

(Full reference – Buti,M., Franco, D and Ongena, H. (1997) ‘Budgetary policies during recessions – retrospective application of the Stability and Growth Pact to the post-war period’, European Commission, Economic Papers, No. 121).

There were other studies that supported that sort of conclusion which makes you wonder why the EU accepted the SGP rules given that it was very likely that several or many member states would be caught out and forced to introduce growth-sapping pro-cyclical fiscal interventions.

Further, given the logic of the EMU, these same nations would soon encounter the disdain of the “bond markets” and a crisis would be inevitable.

The OECD 2000 paper proposed another approach to examine the sensitivity of deficits to the business cycle, which:

… consists of looking at the maximum negative output gap observed in the past for each country and, on the basis of the average cyclical sensitivity of that country’s budget, derive the distance that would be needed from the 3 per cent deficit limit in order to be able to accommodate such a shock in the future.

This approach is a bit different to the previous method because it introduces ad hoc elements – such as estimating output gaps – which I have noted in the past can reflect the inherent ideological positions of the researchers.

Please see the following blogs – Structural deficits – the great con job! and Structural deficits and automatic stabilisers November 29th, 2009 – for more discussion.

For example, the output gaps that are published by the IMF and the OECD are almost certainly too conservative because they are typically based on concepts such as the NAIRU. Please read the following blog – The dreaded NAIRU is still about! – for more discussion on this point.

The upshot is that the estimates of the cyclical components of the actual deficits will almost assuredly biased downwards, which means the estimates of the “structural” component will be biased upwards.

This, in turn, means that we will be led to conclude that the discretionary fiscal position adopted by the government in question will be more expansionary or less contractionary than it actually is.

So when reading the following be mindful of those biases.

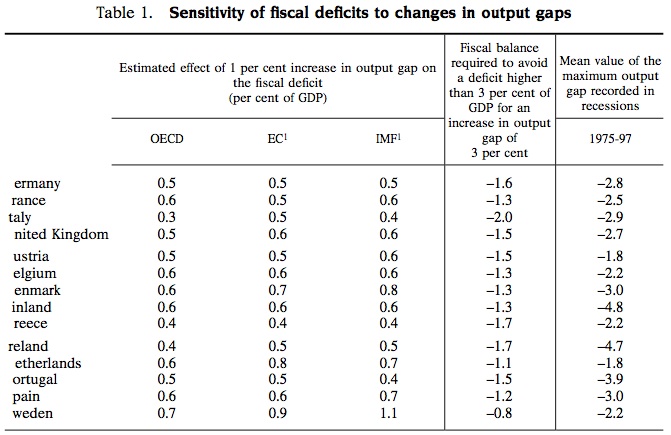

The OECD Paper published the following Table (their Table 1) which “summarises historical declines in output relative to potential and applies elasticities of the response of deficits to output changes”. Note it includes non-EMU nations (such as the UK, Denmark etc).

I should add that the truncated nation names in the first column was in the original paper rather than my capture of the Table.

The first three columns of numbers in the Table show “effect of 1 per cent increase in output gap on the fiscal deficit” as estimated by the OECD, EC and the IMF. The methodologies used by the three approaches are all based on similar (biased) assumptions.

My own estimates of these sensitivities, which are based on different assumptions of what constitutes true full employment produces effects tha are considerably larger that those presented in Table 1 (for the nations I have estimated these effects for).

My own work will appear in a forthcoming book (early 2013 at this stage).

But it is always useful to take the biased estimates as the starting point because they present the mainstream case in its “best” light. If that case collapses under their own “best” assumptions then you can conclude they have a problem.

The fifth column is self-explanatory – it shows the average output gap for each nation during recessionary periods between 1975 and 1997. I will compare those averages later with output gaps estimated for the current crisis.

But once again be warned that these output gap estimate are biased downwards. It is almost definitely the case that the true lost real output relative to potential was higher than these figures suggest.

The column second from the right shows how much room the SGP provided to governments to run structural deficits. The OECD compute these estimates using their own estimates of the fiscal sensitivity to the output gap (from their Interlink model) and multiply those estimates by the average real output gap and then subtract from 3.

So the first calculation estimates the rise in the cyclical component when the output gap rises and the second calculation (shown in the column) then produces the allowable structural deficit under the SGP rules.

The OECD 2000 paper interprets these results as saying that:

For most euro area countries, a structural deficit below 1.5 per cent of GDP would be enough to avoid breaching the 3 per cent threshold for an output gap of 3 per cent, which roughly corresponds to the mean value of the maximum output gaps recorded in recessions in the major EU economies during 1975-1997.

They also cite an IMF paper that claimed that “structural deficits in the range of 0.5 to 1.5 per cent of GDP (depending on the country) would allow the full operation of automatic stabilisers without exceeding the reference value for most euro-area countries”.

In other words, the SGP was justified by arguing that close to balanced structural budgets would be suitable and that output gaps would not exceed 3 per cent (even in the worst recession). There were a bevy of similar articles all lining up to justify the SGP.

There are several reasons why this analysis would not provide a satisfactory estimate of the “space” available to run structural deficits.

First, the analysis assumes that before the recession all nations were at full employment already (zero output gap) which is clearly not a viable starting point. The output gaps were persistent across the Eurozone in many economies so they went into the crisis with cyclical deficits. Not all the deficits were of a structural nature.

When you consider that and note that some governments were running actual surpluses before the crisis then you start to appreciate how much fiscal drag was in the system and how reliant on private credit growth the region became. That was an unsustainable but typically neo-liberal growth strategy.

Further, the austerity approach en masse relies on the private sector offsetting this fiscal drag (and the drag on exports from the austerity given how closed the Eurozone is as a trading market). In the same way that the UK austerity assumes an already heavily indebted private sector will accumulate more debt to get the economy growing the same logic applies to the Eurozone. That is, they are just repeating the errors that led to the crisi.

Second, the analysis ignores problems of path dependence. For example, a nation could be caught in a sequence of recessions which would, under current arrangements, ratchet the public debt ratio up over time. So each recession would reduce the “space” for structural deficits in the future under the SGP rules, irrespective of whether the nation recovered to full employment in between the episodes.

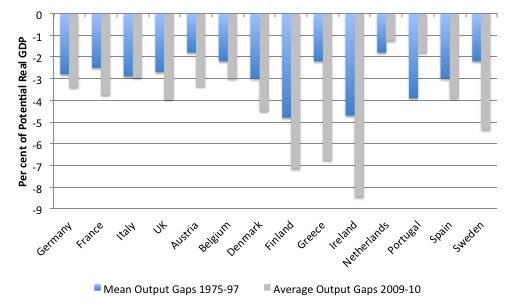

To get an idea of how poorly crafted these supporting studies were consider the following graph, which compares the average output gap for each nation during recessionary periods between 1975 and 1997 from the Table above (blue bars) with the average output gaps published by in the latest OECD Economic Outlook database for 2009-10 (grey bars).

Remember that it is almost certain that these output gaps are underestimates of the true situation (and in some cases by a not insignificant amount).

Also for many countries, the output gaps are estimated by the OECD to be even higher in 2011 than 2010. For example, they estimated Greece’s output gap in 2010 was 8.9 per cent and suggest it will rise to 15 per cent in 2011.

In almost every case, the output gaps experienced in the recent recession were considerably larger than those that we considered to be reasonable to justify the SGP restrictions.

It suggests that there was no chance that the majority of budgets in the EMU could withstand the current crisis and remain within the SGP rules.

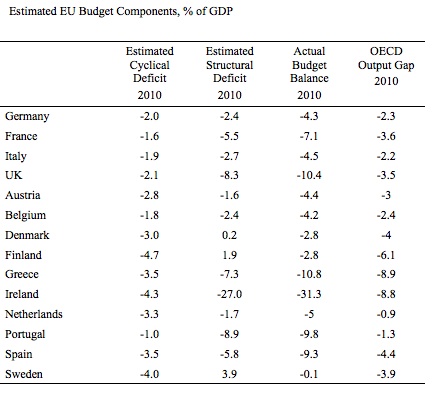

To give you some idea of what the problems with the official and related estimates are I produced this Table. The calculations were as follows:

1. Compute the difference between the output gap in 2010 relative to the 2008 gap (to get a change in the output gap). This will definitely be a downwardly-biased depiction of how deep the recession was in each country.

2. Multiply the change in the output gap by the EC estimates of the fiscal effects of a 1 per cent change in the output gap (column 2 of numbers in the Table) which we could call the cyclical change in the fiscal position (again this is assuredly a gross underestimate of the actual cyclical deterioration – for example, it also includes the bank bailouts in Ireland which were purely cyclical).

3. Subtract the cyclical component from the actual budget outcome (provided by Eurostat) to get the “structural” component (which will be a gross overstatement of the true discretionary fiscal stance if there was full employment).

Taking the EU and OECD data and assumptions at face-value (remembering I consider they substantially underestimate the output gap and the cyclical sensitivity of the fiscal balance to changes in the output gap) we can compare the estimated structural component (actual minus cyclical) to the OECD output gap.

Even with all the inherent biases that accompany these estimates (but, importantly, recognising that the EU/IMF/OECD would consider these estimates to be reasonable) the results of the exercise should raise lots of questions about the logic used to justify the SGP.

Note that even when the output gap is below 3 (which the OECD 2000 paper judged to be a severe recession), the budget outcome is well above the Maastricht SGP and would warrant pro-cyclical fiscal policy being imposed (that is, austerity) and excessive deficit fines.

In other cases, even though the output gap is well below 3 the accompanying budget balance would violate the SGP fiscal rules.

And when the output gap is not far from 3 per cent, say in the case of France, there is a major violation of the SGP.

In each of these cases, the pro-cyclical fiscal policies that would be forced on these nations would increase the output gap. The governments would have to cut discretionary net public spending – so attack the structural component but also face a worsening cyclical component.

The other point to note is that the cyclical component alone in many cases breaks the SGP constraints (for example, among the EMU economies – Finland, Greece, Ireland, Netherlands, Spain).

The question that arises is – what sort of fiscal rule would force a nation to run a budget surplus at full employment as a matter of course (irrespective of the other sectoral balances) – if the cyclical response that might accompany a severe recession would violate that rule?

The Eurozone system is clearly biased against growth as it stands and if they try to tighten the fiscal rules (under Merkel’s proposal) then things will be even worse.

While I won’t show you today (time is running short now), I altered some of the assumptions – first, the fiscal response to a 1 per cent change in the output gap (to accord with what I consider to be more reasonable estimates of the cyclical response), and, second, the output gaps to depict a more reasonable measure of the departure from full employment – and the analysis just presented becomes even more stark.

The cyclical component in many cases exceeded the SGP fiscal rules in 2010 by more than 100 per cent which makes a mockery of them as a reasonable depiction of the likely fluctuations an economy can experience as a matter of variations in private spending.

And in a later analysis (which I haven’t time to report) I will show you how this all ties in with unemployment. The result is that there is no way the structural deficit estimates that are implied from official data are accurate (they also imply very high steady-state unemployment rates).

I also finish by cautioning you not to take these estimates as being more than the lower bound of what is likely. The true situation is almost assuredly much worse than these figures demonstrate.

Conclusion

If the EU Summit endorses the creation of a fiscal union under the conditions being proposed by the Germans and the French then it will just be another demonstration of their failure to come to terms with the true nature of the Eurozone problem.

The markets are not dumb and will see through it just as quickly as they rejected the October statement and all the huff and puff statements before that.

They have only two options (as noted above). Neither seems within the grasp of the elites to embrace. Ultimately as the situation deteriorates they will have to iterate to one of them.

I have to catch a train now (I have been in Sydney at the Heterodox Conference). This week is very busy as I am hosting the Annual CofFEE Conference (aka the 13th Path to Full Employment Conference/18th National Unemployment Conference) in Newcastle.

Lots of MMT-types are soon to be in town. Also this week (Wednesday) the Australian National Accounts come out and we will see where we were 3-months ago and how that stacks up with the Treasurer’s claim that we need major cutbacks.

May I also just note that over the weekend the Australian Labor Party (our governing party – in minority) altered its platform to allow more uranium to be exported to nations that are not signatories to the nuclear proliferation treaty and they also confirmed as party policy offshore processing of refugees and forced imprisonment of boat people (and their children) despite knowing that detainees deteriorate quickly and display a range of mental problems. This was once the great Labor Party – the political arm of the trade union movement. It cannot even claim the high ground on these issues and is too busy talking about budget surpluses.

That is enough for today!

As a longtime lurker, I’ve finally found something I can comment on – and it isn’t economics. Relating to your marathon analogy. the idea that lactic acid causes fatigue has been superseded by the recognition that lactate is actually an intermediate source of energy (ref: http://www.runningplanet.com/training/lactic-acid.html). It is true that fatigue is correlated with the onset of blood lactate accumulation, but it is not thought to be the cause (observation #1 – economics isn’t the only subject where causation and correlation can be confused). The current causal culprits are thought to be accumulating hydrogen ions, potassium build, or maybe even a central nervous system response (observation #2 – economics isn’t the only subject where it is sometimes difficult to “unlearn” what we were taught earlier in life). Just as the evolving understanding of running physiology has led to more effective training methods, I hope that your contributions to a better understanding of economics are recognized, and lead to a faster way out of the mess we find ourselves in. Keep up the good work, and try a couple of LT training sessions if you haven’t already.

Sir,

I am not an economist so going through all your post is rather difficult for me. Anyhow I wish to leave a comment. First of all I have to say that I am form Itali, the country whose sovereign debt in this moment is on the first pages of the newspapers of all the world, considering that a default of the Italian debt would create a chain-reaction that noone is able to foresee where it will end. That’s the reason why I feel strongly involved with the situation.

Let me say, first of all, that I perfectly agree with the fact that the construction of the euro does not allow any flexibility to manage with recession. Therefore it should be changed absolutely.

On the other side I am trying also to understand the German position.

It’s true that Germans are rather rude and they are trying to impose their vision. And it is also true that, as you say, there is a lack of aggregate demand. But aggregate demand of what? Of the last model of mobile phone or of new technologies, new productive investments?

The real problem is that most of the people are ready to buy the last smartphone but when it is coming to the point of spending money for real investments, well they do not like.

Let me go back at the time when we had the Lira. At that time our governement was deficit spending without any problem, was also increasing the sovereign debt without any problem (at the end of the day it was in the position of printing money as much as it wanted).

But, was it spending that money in a way that, although minimal, was somehow useful? The answer is, in reality, NO. Most of the deficit spending was to pay people “to make holes in the sand and then to fill them back”. Just look at how many useless public works we have in Italy, in most of the cases they were useful only to finance the organized criminality, or how many public employees than, rather than making the life easier to the private sector, are making the life more difficult.

I remember that, when Maastricht Treaty was signed, the comments were: “Finally there will be something that will force the governement to spend in the right way”. Simply, it did not happen, and the same was in other countries, to tell the truth.

I believe that also the Germans understand perfectly that a recession cannot be cured with recessive measures. I believe Germany would accept other countries running a deficit IF that deficit was somehow useful. But many countries, including Italy, are still spending for the holes. And that is only a temporary relief from the recession.

Just to give another example: when an industry, because of a crisis, is dismissing some of its employees, the government provides to those people a basic salary to survive but does not require from them anything in exchange, even something simple like cleaning the streets (that is productive, turists will like more to come in a clean country). Now, it that happens occasionally for a single industry and a limited period of time it’s not a problem. But what about doing like that since when the current crisis started in 2008?

And the politicians are providing the worst example, increasing their salaries and their own unproductive expenses continuously.

Thanks for the hospitality

The information is out there for anyone who cares to look but as it states in the video politicians prime objective is re-election and they are too lazy to try and understand the real complexities of the system and build a better society!

http://www.youtube.com/watch?v=J8_eIlugO10&feature=player_embedded

Then i uncovered this nugget.

Finally to understand why elites are behind the global protests, one must realize that real Soft Power is based on owning the “Narratives”, not just the pro-system narrratives, but the anti-systems/anti-establishment narratives as well. That’s what we see here, and it is important because the narratives must be designed to apply the appropriate Positive/negative feedback into the Cybernetically designed system (in order to achieve the desired results).

If this is the case what chance do we have, public opinion and social knowledge will just never be up to speed with all developments? I despair!

Vincenzo,

The problem you highlight is not a problem of spending too much money. It is a problem of corruption and poor governance. Even if the crooks are paid to dig holes and put most of the money in Switzerland. They still spend some money in local shops and restaurants, so the economy does benefit from some increased demand. This is not the most efficient spending but it still boosts the economy.

If the Italian government spends less money without solving corruption the crooks get less and the local businesses get less. It makes the problem even worse.

THe correct answer is to solve the corruption problem AND increase demand by spending more.

«But aggregate demand of what?»

Aggregate demand in general. In Portugal, the retail sector had it’s first closures in 10 years, even the food retail sector was already hit with losses! There will be no one employing people if there aren’t buyers for the goods.

«The real problem is that most of the people are ready to buy the last smartphone but when it is coming to the point of spending money for real investments, well they do not like.»

Today it was a day filled with euro and crisis news: Smartphone and mobile phone in crisis in Portugal. And, think about, many people’s jobs rely on people buying the latest smart-phone, the latest computer, etc: there are factories in the Eurozone that make those goods and employ people. And those factories, yes, those factories will use the money the consumers spend in investments, real investments.

«Most of the deficit spending was to pay people “to make holes in the sand and then to fill them back”. Just look at how many useless public works we have in Italy, in most of the cases they were useful only to finance the organized criminality, or how many public employees than, rather than making the life easier to the private sector, are making the life more difficult.»

Ah, we have those ones here too in Portugal. What a waste of money.

But that isn’t arguing against spending in general, but to a way of spending. Now imagine that all those millions that were poured in concrete and tar were instead spent in schools, hospitals and lower taxes?

But this reminded me of the constant political pressure exerted by Germany (and the European Commission) so that Portugal builds the damn bullet train which is expected to give losses. What does Germany win: their manufacturers will get the contracts for the trains.

«I believe Germany would accept other countries running a deficit IF that deficit was somehow useful.»

Unless Germany doesn’t trust herself: she was the first to have a no deficit clause. No, what Germany thinks it’s that the strict rules that worked in their country will also work everywhere else, and simply don’t work because you (we) are lazy. In reality, the reason those rules worked in their country was because we in the South had deficits. If money is in limited amount (as it happens with the euro), someone’s surplus will be someone else’s deficit.

«I remember that, when Maastricht Treaty was signed, the comments were: “Finally there will be something that will force the governement to spend in the right way”.»

Some people said and thought that here too. It simply doesn’t happen. If we want our Governments to spend our money in things that interest us, we must do it ourselves.

Well, maybe I have to be shorter and clearer.

What I have been always told in any sales training I attended (well, I work in the private sector so to survive I need to sell what I do) is that “people buy from people”. Logic consequence is that “people sell to people”. Essntially they exchange the goods and services they produce.

But if one is producing food, something useful indeed, and the other one is producing “holes in the ground”, even if making “holes” is named with some nice governement name like “restructuration of the landscaape” how long do you think it will take to the guy producing food that in reality he is working to subsidize the other one that is not doing anything useful for him? For sure the guy doing “holes” is sweating, even more than the other guy, but he is definetely not working, not in the sense of producing wealth. It can work for a while, but finally the system will collapse because the economy cannot work with half of the people working and half sweating.

The real problem with the government spending money and providing jobs is that, after a very short period of time, even if the program is started with the best purposes, it ends up with people sweating.

And that is because of politicians that needs to buy the votes to be re-elected.

The ancient Romans were already doing that, buying votes, but, at least, they had a level of civilization that we have lost such that, rather than making holes, they were doing road and bridges that we are still using bridges and, why not, ” “circenses” to enjoy people.

My understanding is that both Germany and France, the financially healthy members of the EMU, violated the SGP in the years before the great financial crisis (GFC). Ireland and Spain met SGP requirements before the GFC but are now highly indebted. My question is why did this happen and will the proposed strengthening of the SGP prevent what happened to Spain and Ireland from happening again?

A curious American

Vincenzo, first congratulations on your English from one who could never say so much in another language.

Your last example seems classic. You sell food; the hole diggers are earning money and can buy your food. Now that there are hole diggers buying more food than they did before they got a job digging holes you have to hire more people to make the food and ship it and etc. Some of those hole diggers might even get a job in your industry. More jobs more food buying more taxes. etc

The Germans lent money to the Greeks and Italians et al so that the Greeks and Italians could buy all the good German stuff. This Income surplus to Germany allowed it to grow, pay and employ everyone and not use deficit government spending to maintain employment. In other words the Germans lent the money knowing they would get it back and still demand repayment and the selling off of public assets.

ok I’m done.

Micky,

thanks for the appreciation of my english. I am working since 30 years in an American company, so I’ve been forced to learn it.

I agree with you that, at the end of the day, giving some money to the hole diggers to buy food, the owner of the food industry will hire the hole diggers so that everyone produces food and not holes. But that can be a temporary solution, to overcome a critical situation.

But there is nothing more permanent that the temporary jobs offered by the government!!! Those people will go on for their entire life digging holes.

For what I see the problem both with the advocates of MMT and with the libertharians, pure advocates of von Mises (you have much more in common of what you think), is to believe to live in a perfect world where everyone is committed to work seriously and honestly.

By far, that is not the truth.

It is not true that all the entrapreneurs will pay to the workers the marginal utility of their job as it is claimd by the Austrians. Rather he will try, by scaring them or falsifying the income statement, to pay them less.

It is not true that the governement will employ the jobless to give them a job sopmehow useful if the market is shrinking, just for the time needed for the economy to recover. The politician will rather buy forever the votes of those people giving a total useless job that, rather than helping the rest of the economy, will damage the rest of the economy because it will force to produce a lot of useless papers rather than real goods.

We do not live in a perfect world, that’s the reason why we need so many recipes for the economy. One might work in one moment, the other one in another one. If there were only one good recipe, it would be enough to build a super-computer, we can do it now, put the recipe inside al let the computer rule the world.

Coming to the Germans lending money to Greeks and Italians. If Greeks and Italians had used that money not to buy new Mercedes and BMW but rather to develop (the Greeks) or to improver (the Italians) their own industry in order to be able to produce their stuff in exchange of the German cars, now we all would be in a much better condition without all the financial troubles we have.

If you think a little bit, the Germans did exactly what you say the governement should do: give money. It works for a short period, not forever.

Vincenzo,

I don’t think everyone works seriously and honestly!

A bigger problem is that people are not rewarded fairly for their effort or the societal value of their work.

Put on face paint, dance like a fool, put on a funny accent…. Be an actor paid millions.

Kick a football for 90 mins a week… Get paid millions

Invent a new drug and save 100,000 lives… Get a $10,000 bonus then get retrenched.

Be a zillionaire with 20% ownership of the drug company…. Get billions over charging suffering patients.

Clean a house 7 days a week, cook 15 meals, wash underpants all week…. Get paid $0

Work 15 hours a week in insurance telling lies about the products you sell… get a huge salary + big bonus.

Work 45 hours a week assembling fantastic products in a factory… Get paid peanuts

Great science…0

Bad economics…millions.

Etc. etc .etc

There are other dimensions to life and society you are not considering either, so go back and think your criticism a little harder.

Vincenzo, the problem of which you speak is mostly political and of the nature of the political system. No economic thought can resolve that.

«Coming to the Germans lending money to Greeks and Italians. If Greeks and Italians had used that money not to buy new Mercedes and BMW but rather to develop (the Greeks) or to improver (the Italians) their own industry in order to be able to produce their stuff in exchange of the German cars, now we all would be in a much better condition without all the financial troubles we have.»

The EU pays 400€ per hectare per year for you to do nothing, absolutely nothing with your land in Portugal. They also paid for decommission of fishing boats and imposed agricultural and industrial quotas.

It’s your money in this too: Italy is the fourth(?) net contributor to the EU budget.

But I’ll proceed to address the other face of the issues you raise. If you had used that money to develop your industry, in order to get yourself a nice surplus (I thought Italy was a major exporter, so I don’t see how could that be an issue) someone would get a deficit somewhere else. Instead of bailing out Italy, Portugal or Greece, we could be bailing out the Netherlands, France, etc. Sure, we could all be OK if everyone had a 0 surplus and deficit.

This, however, only holds if the private sector doesn’t feel the need to have a surplus. But the private sector does want a surplus (it needs to if it wants to repay it’s debts – an Australian economist called for the creation of money to give to people in order to reduce the amount of debt-generated money in the economy in BBC). And for the private sector to have a surplus, the public sector will need to have a deficit, since money is a limited in the Eurozone. Roubini compared the Euro to a Gold Standard, and that’s not far from the truth.

Wow. I got nothing. All I can say, this all sounds a lot like arguments and politics I hear in the US about ourselves. Also about the lazy- fill in the blank- workers.

I’m not sophisticated enough yet in MMT but Talvez makes me think of yesterdays Billyblog. A hard concept to get one’s head around is the idea that a trade deficit is actually a gain of wealth and a trade surplus is a drain. A nod to Vicenzo- as long as they buy the right stuff. Also, if I got it somewhat right, the owing of money is not an issue as long as the debt can be serviced gracefully in relation to growth and interest rates.

I guess I’m with Talvez about the political nature Vincenzo’s comments. And Andrews comment too seems political. kind of points us to the oligarchs and the income gap. Where are the radicals ( aside from Bill of course)?

Finally, about vincenzo’s comment, The Germans( et al) lent money, didn’t give it; and the recieving countries spent it abroad, not on growth. Oh yeah that’s what Vincenzo said. Well I feel weakest in that argument anyway. I really don’t know what happened to all that money that the Greeks, Italians et al borrowed. Didn’t a lot of it go to servicing previous loans? I could be totally wrong. But apropos of the yesterdays Billyblog the real problem became the servicing of the debt during the recession and the rapidly increasing cost to service.

ok I quit.

The germans are a disciplined, highly structured and organised race with a focus on details.

I worked steel fixing and concreting for a few years on and off in germany with an rough vagabond group

of irish/english workers. Hard to understand why we were needed there, the germans did’nt think so

however when the plan went wrong due to either the plan being WRONG or because the part was wrong

then all hell would break loose, all the german workers would stop and the architect would be called where he would look puzzled and blame someone else. Then a consultant would be hired who would bring a team of draftsmen and after a few weeks talk a “new” drawing would be developed.

It would really piss em all off when us ragtags had used our heads worked out that a bit of steel needed modifying a bit and that would work fine and we would get the job done!!!

what germans really lack the ability to actually accept is that perfection is not a human trait but being adaptable and flexible in order to survive is.

Phil Knaggs (a non economist but i can count my change :))