I started my undergraduate studies in economics in the late 1970s after starting out as…

At least 172 thousand Brits have their government to blame

It amazes me that politicians actually believe the neo-liberal lies that the path to lower fiscal deficits is to cut the hell out of public spending during a recession when private sector expectations are conservative if not downright pessimistic and their spending is subdued. If you add in the fact that these politicians make these claims en masse – that is, they are all caught in this “fiscal consolidation” madness – then it becomes obvious that the only other route to growth – exports – will also be closed. The latest data from Britain is all bad and suggests that the claims that cutting net public spending would stimulate growth are wrong and also that the way to cut a deficit is not to deliberately reduce economic growth. At least 172 thousand Brits have their government to blame refers to the change in unemployment in Britain since June 2010 (just after the new Government was elected). The unemployed are the human face of the ideologically-driven vandalism that the British government is currently engaged in.

Yesterday (November 16, 2011), the UK Office of National Statistics published the latest Labour Force data for November 2011 and it painted a very bleak picture and added to the growing evidence that the British government is deliberately undermining the welfare of its own citizens in pursuit of an ideological holy grail.

While one issue is the divergent of the aspirations of the Government (and the elites they are now serving) and those that define public purpose and social welfare. That is very obvious now as poverty rises on the back of rising unemployment and community stability is threatened.

The other issue is that the holy grail they are seeking is not only meaningless in the context they construct it – that is, there must be a budget surplus because public debt is dangerous – but also unattainable using the strategy they are pursuing.

I am not so cynical to believe that the British politicians are pursuing a strategy of fiscal austerity without thinking at the same time that they will actually restore their much-desired budget surplus. I think they are prepared to subject the unemployed to the cold winds of austerity because they actually believe a surplus will result.

If you share that belief then you will also conclude that their advisers etc haven’t a clue of how the economy operates and have become so blinded by their ideology and the mainstream economics dogma that supports it that they cannot get it into their head that deficits are likely to rise when fiscal austerity is imposed, especially if there are no apparent sources of growth that are alternative to public spending.

The UK Office of National Statistics labour market report indicated that:

The employment rate for those aged from 16 to 64 was 70.2 per cent, down 0.4 on the quarter. There were 29.07 million people in employment aged 16 and over, down 197,000 on the quarter. The unemployment rate was 8.3 per cent of the economically active population, up 0.4 on the quarter. There were 2.62 million unemployed people, up 129,000 on the quarter. The unemployment rate is the highest since 1996 and the number of unemployed people is the highest since 1994. The inactivity rate for those aged from 16 to 64 was 23.3 per cent, up 0.1 on the quarter. There were 9.36 million economically inactive people aged from 16 to 64, up 64,000 on the quarter.

Total pay (including bonuses) rose by 2.3 per cent on a year earlier, down 0.4 on the three months to August 2011 (with both the private and public sectors showing lower pay growth). Regular pay (excluding bonuses) rose by 1.7 per cent on a year earlier, down 0.1 on the three months to August.

So every labour market signal is bad:

1. Falling employment.

2. Rising unemployment.

3. Falling participation (so rising hidden unemployment).

4. Significant cuts in real wages.

The data shows that the labour market situation worsened in the September quarter 2011, with 197 thousand (net) jobs being lost in the UK. As the ONS reports the “number of people in full-time employment … in the three months to September 2011 … [was] … down 80,000” with part-time employment falling by 117,000 (net) over the same period.

The trends have been pointing downwards for the whole year now and cannot be blamed on the recent Euro breakdown. This UK Guardian Reality Check article (November 16, 2011) – Is youth unemployment really rising because of the eurozone crisis? – provides an excellent analysis to show that the Euro shenanigans cannot be implicated in the British demise.

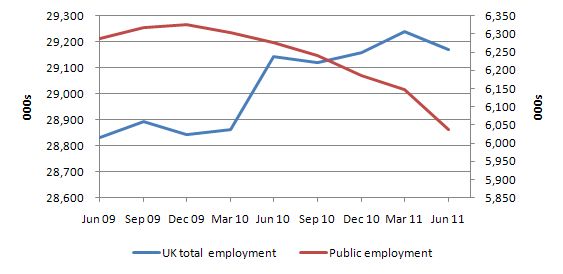

The following graph shows seasonally adjusted public employment and total employment up to the June quarter 2011. Public employment has fallen by 290 thousand jobs since June 2009 with 240 thousand of those jobs being lost (net) since the current British government has been in office.

In the early part of 2010, it was clear that employment was starting to recover with 303 thousand jobs added (net) in the first two quarters of 2010. The British economy was starting to recover under the impetus of the fiscal stimulus that the previous government had (reluctantly) introduced.

Since then employment has risen by only 24 thousand jobs (net) and in the June quarter, employment fell by 69 thousand as public employment plummeted by 111 thousand jobs (net).

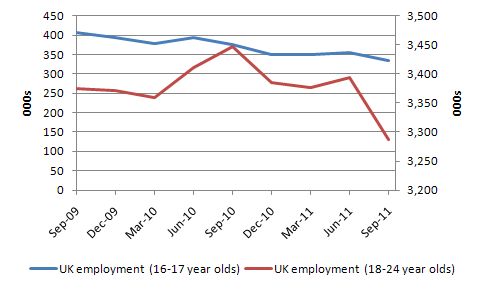

The following graph shows the evolution of seasonally adjusted youth unemployment in Britain since September quarter 2009 splitting the data into 16-17 year olds (blue line, left-axis) and 18-24 year olds (red line, right-axis).

The official data shows that 16-17 year-olds have lost 60 thousand jobs (net) since June 2010 while 18-24 year-olds have fared even worse losing 124 thousand (net) jobs.

Unemployment has risen by 22 thousand for 16-17 year-olds and 70 thousand for 18-24 year olds. The reason that unemployment hasn’t risen as much as employment has dropped in net terms is because there has also been a substantial fall in labour force participation for both cohorts. That is, hidden unemployment has risen sharply as well.

Larry Elliot’s UK Guardian article (November 16, 2011) – Coalition sheds crocodile tears over young jobless – has the file-name (see link) “youth-unemployment-caused-by-coalition-policies” which is different from the title of the article.

But the intent is clear:

Youth unemployment has risen above 1 million, but the eurozone crisis and slow global growth aren’t to blame – the coalition is … (total) Unemployment rose at its fastest rate on the internationally agreed measure for almost 17 years, employment fell even more precipitously and – surprise, surprise – the number of young people out of work rose through the politically sensitive 1 million level.

Once again the government is blaming the Eurocrisis. Please read my recent blog – The British government – moving from denial to blame shifting – for more discussion on this point.

I promise not to keep writing blogs with the theme – British government blames the Eurozone crisis – as more bad news in Britain appears. It will get very repetitive and boring. The economic data will continue to deteriorate in Britain and the Government there will continue to sheet the blame home to anyone but themselves.

The evidence, however, is too stark. The Government is squarely culpable here – a deliberate strategy to undermine the welfare of its own citizens and deny its youth the chance at acquiring life-long experience and skills.

The research evidence tells us that if youth are denied an effective transition from school to work and languish in unemployment or hidden unemployment then their adult prospects are significantly impaired. The disadvantage that entrenched youth unemployment causes spans the generations.

Larry Elliot also rejects the “Eurozone is to blame” ruse:

… the explanation provided by the coalition is bogus. Unemployment is what is known as a lagging indicator of economic performance; it takes time for a slowdown in activity to feed through into the jobless figures.

Europe’s crisis only really moved into its new, dangerous phase in late July and August, and would not have had any impact on the employment data, which covers the period from July to September …

… the evidence is that the labour market has been steadily weakening throughout 2011, with a marked deterioration over the past three or four months.

It is obvious that the British “government inherited an economy in which unemployment was coming down. It is now going up. The government inherited an economy where schemes to help young people into work were nibbling away at youth joblessness. It scrapped schemes such as the Future Jobs Fund to save money:.

If you go back to last year when the new British government was outlining its plans it claimed that cuts in public spending would be more than offset by private spending growth and exports growth.

The Chancellor appealed to a bastardised version of the mainstream economics notion of Ricardian Equivalence which claims that private spending falls when there are budget deficits because people start to save in anticipation of the alleged higher tax rates. Once the government announces its intention to cut the deficit these private spenders resume spending.

The labour market version is that the jobs lost in the public sector are “far outweighed by the opportunities that would be created by a liberated and thriving private sector” (as Larry Elliot characterises the Chancellor’s position).

This is the same lie that accompanied the privatisation push – that there would just be a transfer of jobs from the public to the private sector. The empirical evidence clearly shows that privatisation resulted in less private jobs being created relative to public jobs lost.

Larry Elliot reports that:

Wednesday’s figures give the lie to the chancellor’s breezy optimism: 111,000 jobs were shed by the public sector in the three months to June, while 41,000 were created in the private sector. And this, note, was the three months to June. It was only subsequently that the big deterioration in the labour market took place.

So I don’t think it is a very hard case to argue that the British government is deliberately undermining the welfare of its citizens in pursuit of its holy grail – a budget surplus.

Which brings me to the second point – quite apart from what we might think about this appalling labour market data – will they succeed in their fiscal ambitions?

The answer is: probably not. The automatic stabilisers will seek revenge for the unemployed.

Here is what any sensible analyst would say about the state of the British economy at the time the new Government took office.

1. It was starting to grow after a very drawn-out and deep recession.

2. The private sector was over-indebted and had adopted a very cautious spending approach while it sorted out the balance sheet risks that were manifest as a result of the credit binge leading up to the crisis.

3. The fiscal stimulus provided by the Labour government, albeit insufficient, had provided spending support to facilitate the private deleveraging process and foster economic growth.

4. Employment was rising and unemployment was falling.

5. Patience was needed as in all “balance sheet recessions” because the process of restructuring private balance sheets to reduce the exposure of over-indebtedness takes a long time (decade or so) and the economy was in need of substantial fiscal support over this adjustment phase.

6. The British government – sovereign in its own currency – was able to provide whatever level of fiscal support that was necessary to drive growth and a renewed private saving effort. There was no “sovereign debt” crisis in Britain and – how could there be – it issues its own currency.

Then a new government is elected and announces a harsh austerity program on the false supposition that there is a sovereign debt crisis.

What would any sensible analyst then predict? Well go back to my blogs of the period (me being sensible 🙂 that is).

1. Growth would stall and then fall.

2. The cuts in public spending would further undermine the already fragile state of private spending.

3. Export growth would not save the day because the tomfoolery of public austerity was almost universal – given the dominance of neo-liberalism around the advanced world.

4. Employment would falter then drop and unemployment would rise.

5. Less advantaged workers in the labour market (for example, the youth with less experience) would endure the labour market deterioration disproportionately.

6. Tax revenue would fall and the deficit would probably rise as a result of the automatic stabilisers working.

It is clear that predictions 1-5 are proving to be very accurate. What about Prediction 6?

Each quarter, the British Treasury publish their – Forecasts for the UK economy: a comparison of independent forecasts – the latest being November 2011 (just out). They make depressing reading.

The forecasts are pointing to a very bad 2012 for Britain in terms of falling real output growth and rising unemployment.

The British Office for Budget Responsibility predicted that the Government would borrow £122 billion in 2011-12 whereas the independent forecasters are predicting this amount will be somewhat higher – meaning a higher deficit despite the substantial spending cuts and tax rises that will impact over the entire financial year.

The divergence between the official forecasts provided at the time of the Budget by OBR and the more recent “market-conditioned” forecasts by the independent panel widens in 2012-13, suggesting, again, a higher deficit.

This UK Guardian article (November 16, 2011) – Osborne to miss deficit target as UK economy stalls and unemployment rises – suggests that it will be fairly accurate too.

The article reports that:

George Osborne is braced to admit this month that the scale of Britain’s economic slowdown, demonstrated yesterday by youth unemployment spiralling to more than 1 million, means he will be unable to meet his main deficit reduction target before the next election.

It is now expected that the Office for Budget Responsibility (OBR) will declare … on 29 November that the downturn’s impact is more permanent than thought and the government may not be able to meet its commitment to eliminate the structural deficit – the part of the deficit unaffected by growth – by 2014-15, as he predicted in the June 2010 budget.

The expected delay is symptomatic of the damage on the public finances being wrought by lower-than-expected growth and deepening unemployment.

Which was totally predictable.

All the deniers are getting onto the bandwagon.

The most recent (November 15, 2011) – Bank of England Inflation Report to the Chancellor admits that:

The prospects for the UK economy have worsened. Global demand slowed … Household and business confidence fell, both at home and abroad. These factors, along with the fiscal consolidation and squeeze on households’ real incomes, are likely to weigh heavily on UK growth in the near term.

This translated into a downgrading in the Bank’s forecast for real GDP growth by “around 1 percentage point since July”. Bank Governor said in his Introductory Statements to the report that real GDP growth in the UK would be:

… broadly flat until around the middle of next year. We continue to face a difficult economic environment.

The Guardian reported that the “deputy prime minister, Nick Clegg, has pointed out that youth unemployment has been rising since the middle of the last decade, suggesting a deeper structural labour market problem and not just a decline in demand”.

Be prepared for more of that nonsense. Every time there is an entrenched recession that the government mishandles and unemployment rises and gets stuck, you hear the claim that it is structural not cyclical.

The easiest answer to that is this: Announce that the government will provide a public sector job at a decent minimum wage to anyone who wants one and then see how many of the unemployment turn up to the depot to start work.

If few turn up – then the “unemployment” is not due to a lack of jobs.

My prediction, millions will turn up in Britain tomorrow if the Government announced the scheme today.

Conclusion

On January 24, 2011 I wrote this blog – Ricardians in UK have a wonderful Xmas and on March 30, 2011, as more evidence emerged I wrote this blog – How are the laboratory rats going?.

I noted that this is an extraordinary period of economic history – given that there is so much data and information now freely available and easily accessed from almost anywhere (for most citizens in advanced nations).

It is also a period where the big ideas of economics are being put to test in the real-life laboratories around the world.

While I don’t want to “enjoy” the personal hardships that are growing by the day in our so-called “rich” nations, as an academic researcher the data is very useful to confront the orthodoxy with.

The upshot is that the evidence is firmly rejecting the principle notions that drive neo-liberal thinking in economics. The mainstream failed to see the crisis coming and now they are once again calling the policy shots they are making it worse.

In between, we had a short period of fiscal stimulus – which clearly worked to generate a growth impulse.

At some point, policy makers will escape the neo-liberal straitjacket and reflect on what has happened during this era. It will be when they reject the neo-liberal religion and start doing what they should be doing – advancing the welfare of their citizens. We are witnessing a number of failed states now in the advanced world.

Historical note

Yesterday, my flight was delayed for a while due to a military operation at the airport connected with the visit of the US President to Australia.

Today he is speaking to our Parliament:

Note the sub-heading from the news feed. Remember when George W. Bush described Australia as a regional sheriff for the US. It seems we still want to continue to play the role of the lackey and allow America to have an increased military presence in Australia.

Note:

I am taking a few days off up the coast from later this afternoon to hang out on the beach and surf a bit. I do not know in advance whether there will be Internet connectivity where we are going – Blueys Beach.

Should there be no connectivity there will be no blog tomorrow nor will I be able to moderate comments. My “vacation” ends on Sunday and I will be able to deal with things Internet again then for sure.

Here is a photo of Blueys in tranquil mode:

Here is a link to when it works.

Either way, is fine!

There will be a Saturday Quiz on Saturday (duh!) with Answers and Discussion on Sunday as usual.

Bon vacances!

That is enough for today!

Stephanie Flanders:

“Mervyn King had two big messages in his latest press conference today, one for people here in the UK and one for the eurozone.

The message for the UK audience was “be patient”: the outlook seems bleak, but rest assured, the government and the Bank have done more or less everything they can do to get the country back on track. It’s just going to take longer than we thought – maybe a lot longer, depending on what happens across the Channel.”

And when asked for explanation for this economic malice their answer is simply ‘uncertainty’. That is no explanation, but excuse. They have no aswer. I hope people would start to wake up and see that these so called ‘economic experts’ have no clothes.

There is nothing uncertain in declining spending and contracting economy.

Billy, the UK government does indeed have a job strategy. They are paying a number of large corporations and charities a fee to take the unemployed on workfare programmes: work for 30 hours a week and recieve £1.87 an hour (the same as current unemployment benefit that is so low there it is impossible to pay for any winter heating at all, and paid by the UK government. refuse to do it and all benefits are immediately stopped). At least one huge supermarket chain has allegedly responded by gleefully sacking huge numbers of their full-time minimum wage staff to make room for the free labour courtesy of the UK government. Workfare recipients are easily identifiable in the stores. They are the ones trying out their new skills of putting beans on shelves or mopping floors in their own clothes since the workfare recipients do not receive company outfits to work in. This is the future of our graduates and school leavers, though those from more affluent backgrounds may be lucky enough to work for free at a friend\’s company or think-tank as an unpaid intern and therefore not entitled to the state unemployment benefit and so no prized training in tin-stacking will be provided to them.

The Guardian published an article about it recently

Bill, that cretin Grayling was waxing enthusiastic in front of a number of jobless young the other evening, claiming how effective the apprenticeship scheme was. Well, a recent report shows that it isn’t. http://www.ippr.org/images/media/files/publication/2011/11/apprenticeships_Nov2011_8028.pdf. Some businessmen are even claiming, unusual for them, that a permanent underclass may be emerging amid this wreckage. http://www.guardian.co.uk/education/2011/nov/17/permanent-underclass-emerging-businesses-warn. And @Ellie is right. Some employers are scamming the scheme.

I showed a friend of mine Inside Job the other night, which clearly depicts the massive frauds involved in the financial crisis, and it so depressed him that he couldn’t watch it all the way to the end. After we turned the DVD off, he asked where the revolution was? He isn’t convinced about the potential effectiveness of the Occupy movement.

Looking at the ‘total wanting work’ (Unemployed plus ‘inactive wants a job’) the rise has been 50,000 since June 2010.

Having said that there has been a big increase in ‘inactive doesn’t want a job’ under the retirement age – 213,000

And that seems to be mostly explained by an increase in students and early retirement, plus people moving off the ‘inactive wants a job’ queue and either giving up or becoming properly unemployed.

I wonder how much of the economic activity is being funded by generous baby boomer pension pots?

The government is thinking about the uprating of benefits, pensions etc. They have already downgraded this by moving from RPI to CPI. With a 5.2% uprating figure that should be implemented next April, there are already voices saying this isn’t ‘fair’ on those in work who are receiving no increase or worse, cuts, in their pay. Watch the autumn statement due soon. The Government clearly wants to reduce this uprating figure. Thus they are nibbling away at the automatic stabilisers. It might seem small, but it will reduce the overall demand in the economy. I also expect the autumn statement to slice away other parts of government expenditure, increasing the downward spiral. Our economic situation will continue to decline for a while yet. I had hoped the LibDems would break from the Conservatives, but that doesn’t seem likely at the moment, so our next chance to express a view at the ballot box won’t be for a while yet.

Nice beach Bill. Have a good break.

@Richard1

I don’t think it is going to decline for a while yet. It is going to plummet like a stone, once the poor are cleared out of London, the unemployed are tossed out into the streets as the housing benefit cuts kick in. To many in the UK are still convinced the unemployed are unemployed because they are lazy, we have BBC Newsnight questioing the graduates who studied the ‘wrong degrees’, the seemingly abandonment of those with terminal illness by the welfare state that is coming down the pipeline via the welfare reform bill, the loss (I’m led to believe of even grants to the poor to allow them to bury their dead)…… it’s all so depressing. And many of those in work are refusing to spend any more than the minimum fearing their turn on the dole.

The social contract is being shredded and when the population realises this, well. I’m scared, I’m literally scared to think past the next 24 hours and have been for months now, like so many others.

“well. I’m scared, I’m literally scared to think past the next 24 hours and have been for months now, like so many others.”

Yep, and when you’re scared you don’t spend.

If you fear for your job you won’t spend and you certainly won’t borrow.

If you fear for you retirement then you will save and not spend.

If you fear for your children’s future you will save and not spend.

If you fear for your health you will save and not spend.

This is why we introduced a decent retirement pension at a know age, public health care and good public education.

Because only people comfortable and secure in their life will open their wallets and thus provide a market for current production.

Apprenticeship in Canada is for skilled trades only, can last up to 5 years, and includes testing and certification. It is a serious investment made by the employer and the employee. What is going on the UK is a joke, and should not be call ‘apprenticeship’.

I’m afraid that I am cynical enough to believe that this is a deliberate wrecking of the UK economy. The scorched earth policies will not affect the super-rich and the transnational corporations who will have their wealth safely locked away in tax havens. This shrinking of the welfare state will create rich pickings for the largely US private health companies, and will drastically affect worker’s rights to their employer’s advantage. I have certainly heard that so doing will allow the UK to be competitive with China and India, but in any event the financial elite are not attached to a particular country. George Osborne’s economic policies are those of the plutonomy… the imperative is to maintain and increase the wealth of the 1%. The rest of us are irrelevant to the global economy, and so irrelevant. Unfortunately, the populations of the UK and the EU have been ‘groomed’ for 32y by misinformation, secrecy and hidden agendas. Many people trust no politicians and switch off the news because they don’t believe any of it.

In the meantime, the urgency of climate change and peak oil flow are totally ignored by politicians and the media. It is a very frightening prospect.

The world has just ‘welcomed’ its 7 billionth person. An increasing number and variety of jobs are done better, more efficiently and cheaper by machines than by people. Technology and industrialisation is increasing in the most populous countries. If this confluence continue to rise, unemployment is also bound to rise, substantially. Thoughts, Malthus?

Like Syzygy, I suspect there is a blatant ideological component, for several reasons. Firstly because this pattern follows the same pattern used by the Conservative Party when they came to office the last time. Secondly the deliberate ‘down playing’ of evidence: Having had policies largely (although not always perhaps) based on evidence it is a very unwelcome development that there is no room for rational debate. Thirdly because of the selective nature of policies to ‘encourage growth’ – I say selective because they closely track the lobbying of a number of relatively small interest groups rather than responding to more wide-spread concerns in society. Fourthly, because at a time when the government should be concentrating on its economic programme such huge efforts seem to be expended on attacks on equalities.

All this makes me pretty convinced that the reasoning for cuts and changes to employment law in particular is spurious (or at least partly so) and that there is a deep seated (although seldom artculated) programme of social re-engineering to strengthen the power and wealth of a particular minority at the expense of others. I am not naive enough to suggest for one moment that this pressure wasn’t pre-existing underway by the previous administation, but I am concerned about the accelerated pace of this and the real-world impacts to those in society given that we maybe heading into a particularly severe recession. I am also concerned that we are heading for a ‘shattered society’ where we maybe returning to class-warfare.

How does a system that must grow, but cannot do so any longer, behave? It cannabilises itself. Technocratic techniques of exploitation progress from the periphery inward, until there is no ‘other’ left to consume and exploit.

Noone should be surprised that a system that relies on exploitation of labour and the environment for it’s much touted ‘success’ should ultimately begin to devour those who have been passive beneficiaries of the system. The middle classes have silently supported the status quo for decades, (with some notable exceptions), standing by while structural adjustment programs were forced on the poor of developing countries, and are now becoming the targets of those same policies. “First they came for the socialists…”

This crisis was decades in the making, the product of a system that, unless changed radically, will destroy the very habitability of this planet. We need more than reform, we need a revolution.