I started my undergraduate studies in economics in the late 1970s after starting out as…

The British government – moving from denial to blame shifting

The British economy is clearly declining and the Government has moved from denying the decline (it initially spent months talking up its claims that austerity would promote growth) to admitting the decline but diverting the blame to others. The others in this case – are the hopeless Europeans who move from one disaster to another. So now the narrative that is emerging in Britain is that its export-led recovery plans are being damaged by the failure of the Europeans to do something about the crisis there. There are two ways of thinking about that. If Europe was such a problem then it has been a problem for nearly 4 years and so it was misguided to deliberately damage domestic growth (via austerity). The other way to look at it is to note that the British economy has resumed growth under the support of the fiscal stimulus (introduced by the previous government) and then started to experience declining growth virtually from the day the current British government announced its scorched earth policy cutbacks. The recent Euro crisis has really nothing to do with that. It is clear that the British government is moving from denial to blame shifting.

The UK Guardian article (November 14, 2011) – Government urged to change course as UK jobs market faces ‘painful contraction’ quotes the conservative MP Mark Hoban (the Financial secretary to the Treasury) who sheets the blame onto Europe on the now obvious decline in economic performance in the UK.

I know the Eurozone is to blame for almost everything, including my plane being late (again) yesterday, but it is far-fetched to blame the bumbling cabal in Brussels and Frankfurt (and Washington – the IMF) for the decline in the British economy that each new data release shows.

Mark Hoban told the Guardian that he “blamed the eurozone crisis for the UK’s economic woes” and was quoted as saying:

The chilling effect of the eurozone casts a long shadow over our economy …

He is the same government minister who has a taste for “silk red cushion covers” on the public tote (Source) despite being a vehement campaigner against “public spending”. He also bought “an £18 bath mat, £18 for a lavatory brush and £240 for eight cushions” using public money (Source) – so he has a keen eye for a bargain.

The quote came after the Chartered Institute of Personnel and Development (CIPD) released their latest – Labour Market Outlook – which paints a very negative view of the British labour market.

The quarterly CIPD Labour Market Outlook “provides a set of forward-looking labour market indicators, highlighting employers’ recruitment, redundancy and pay intentions”. So unlike a lot of data releases it provides some indication of where the economy is going rather than where it has been. Firm expectations drive their output and employment decisions.

In the CIPD Press Release (November 14, 2011) – UK braced for a slow, painful employment contraction while employers hedge their bets says that:

UK employers are scaling back on all employment-related operations … The employment situation will deteriorate further in the fourth quarter of 2011, with the Labour Market Outlook net employment index* having fallen to -3 from -1 in the past three months … Employers also seem to be hedging their bets on all employment-related decisions in response to the current economic uncertainty …he figures point to a slow, painful contraction in the jobs market. Many firms appear to be locked in ‘wait and see’ mode, with some companies scaling back on all employment decisions against a backdrop of increasing uncertainty as a result of the eurozone crisis and wider global economic turmoil. The good news resulting from this lull in business activity is that fewer employers are looking to relocate abroad or make redundancies. The downside is that recruitment intentions are falling, which will make further rises in unemployment therefore seem inevitable given that public sector job losses are outpacing the predictions made by the Office for Budget Responsibility. There is no immediate sign of UK labour market conditions improving in the short or medium term.”

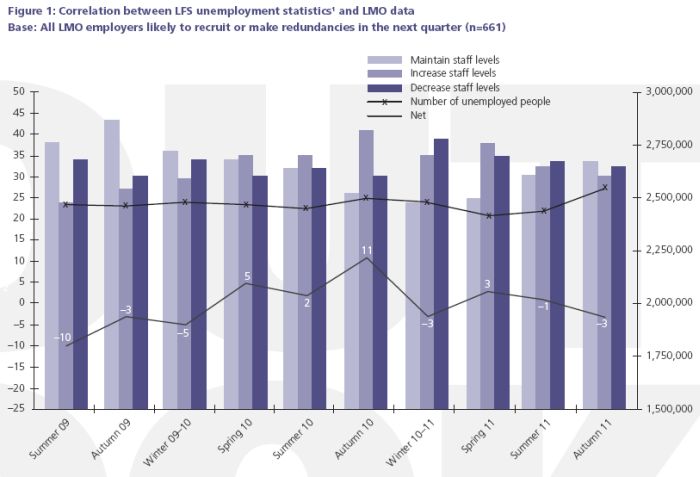

From the Report you read that “Employment prospects are set to weaken further. This quarter’s net employment balance score – which measures the difference between the proportion of employers who expect to increase staff levels and those who expect to decrease staff levels in the fourth quarter of 2011 – has fallen to -3%” and the accompanying Figure 1 shows the recent history of the index. I reproduce that Figure as follows.

The graph combines official unemployment counts from the UK Office of National Statistics (the uppermost black line) with the results of the survey (columns) and the summary “net employment index” (lowermost black line with values disclosed).

There is further analysis of the CIPD Report in this UK Guardian article (November 14, 2011) – UK jobs market faces ‘slow, painful contraction’.

The following graph refutes the British government’s claims that the deterioration coincides with the escalation of the Euro crisis. It shows annual real GDP growth rates from the first quarter 2007 to the most recent June 2011 quarter. Data is available from the UK Office of National Statistics. The shaded area is the period of tenure of the current government.

The British economy plunged deeply into a lengthy recession in 2008 which lasted 6 quarters. The fiscal stimulus finally supported growth which the new government inherited and could have built upon with an appropriate continuation of the fiscal spending support.

Their announced austerity – even though the worst of those cutbacks is coming in the months ahead – caused private confidence to fall almost immediately and you can see the slowing effect in the second quarter after they were elected (December 2010). Since then it has all been downhill.

There are two ways of thinking about this. First, it is clear that the Euro crisis has been an on-going descent as each of the so-called rescue initiatives imposed on the solution by the Euro cabal fail. They fail because the leaders are also in denial – their aim is to hang onto their hegemony and suppress the democratic voice of the citizens of Europe. They think these “solutions” will achieve that but they are also unwilling to take any personal responsibility.

As I noted in yesterday’s blog – The hypocrisy of the Euro cabal is staggering – the Euro bosses are not willing to admit that their ideological presuppositions which drove the flawed design of the monetary union in the first place and have underpinned the false notion that austerity will produce growth are deficient.

They know they have to make public statements which seem to be addressing the problems that the Eurozone faces but cannot solve the problem until they let go of the neo-liberal ideology and start promoting growth through public spending.

But within that context if the Euro situation was so damaging for Britain and its “export-led” growth pretensions why would the British Government introduce a fiscal austerity program? The answer is that they clearly thought the rest of the world would grow and offer them export markets. But with fiscal austerity killing growth everywhere (mostly) it was a fallacy of composition to think that Britain could grow with public spending cuts and a flat private spending outlook.

Please read my blog – Fiscal austerity – the newest fallacy of composition – for more discussion on this point.

So thinking about it that way, it would be clear that the British government is failing.

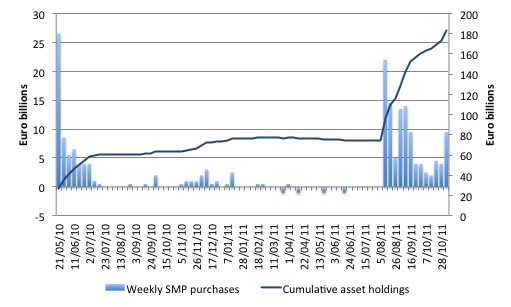

The other way of thinking about it is in terms of logical timing. In this blog – The ECB is a major reason the Euro crisis is deepening – I provided a graph which showed the transactions involved in the ECB’s Securities Market Programme (SMP) which was established on May 14, 2010. This is the program that sees the ECB buying Euro government bonds in the secondary market effectively dealing the private bond markets out of the equation.

The graph (reproduced here) shows the history of the SMP since May 2010 (up to the most weekly statement from ECB – November 4, 2011). The bars shows the weekly purchases (or redemptions) while the blue line shows the cumulative asset holdings associated with the program (now at 183 billion Euros).

It provides some indication of the surges in the Eurozone crisis. Clearly the ECB accelerated purchases at times when the private bond markets were withdrawing from tenders (as evidenced by the widening spreads of member state bonds against the bund).

Real GDP growth in Britain was declining during the “benign” period of the Eurocrisis. It might be argued that that there are long lags and so the earlier Euro gyrations started to impact on Britain’s real GDP growth performance after some period but I don’t think Mark Hoban was arguing along those lines. Even if you make that case, then we are back to the first version of the British government’s failure.

Further, if that was the case, then the British government should be announcing stimulus packages to insulate the economy from the “future” negative impacts of the current Euro decline.

Whichever way you want to think about it – the British government is killing its own economy.

There was also some interesting data released last week (November 9, 2011) by the UK Office of National Statistics. Their – Reasons for leaving last job – 2011 – is derived from the Labour Force Survey and is published annually (this question is included in the survey for the second quarter of each year).

The data provides some further evidence that the neo-liberal version of the labour market is deeply flawed.

The publication “gives information on the reasons why people left their main jobs, focusing on whether the reason they left was voluntary or involuntary. Trends in the rate of people leaving their main job over the past 15 years, either voluntarily or involuntarily, are examined, as are separations broken down by industry, private/public sector, age and gender”.

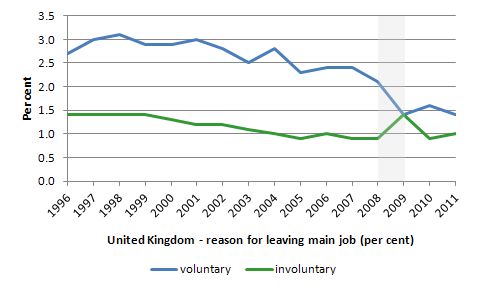

The following graph shows the “Rates of people leaving main job on voluntary or involuntary basis”. The shaded area indicated recession. The ONS say that:

A slowdown in the economy like that experienced in recent years in the UK will impact on the rate of people leaving or changing their job. For example, when job opportunities are limited there are fewer opportunities to move, people are often reluctant to change jobs and some people will become unemployed as businesses shed some of their workforce … Over the fifteen year period between 1996 and 2011, people generally were more likely to leave their job voluntarily than involuntarily. However from the onset of the 2008-09 recession, the percentage of those choosing to leave their job and those being made to leave narrowed

considerably.

The point is obvious. The labour market is more dynamic (from the supply-side) when there is economic growth as workers move between jobs in search of new opportunities and to reflect new skill acquisitions etc. Once a recession hits, this dynamism evaporates and workers bunker down hoping to avoid involuntary unemployment.

This publication provides evidence that should guide lecturers in labour economics about what goes on in labour markets. Unfortunately, students still are exposed to the (neo)-classical labour market as a primary pedagogical vehicle.

The classical framework becomes both the “ideal” that (neo)-classical economics (the mainstream now often referred to as neo-liberals) consider should guide policy and the main teaching model. I know that students find it hard separating the two. The ideal becomes ingrained and is as if the labour market would operate like that if only governments and trade unions stopped interfering with the dynamics of the free market.

It is very insidious. Sure enough they are later told that things might deviate from that but the basic concepts are typically taught within the (neo)-classical framework. There is something in human psychology that finds it difficult to unlearn things.

In Chapters 2 and 7 of my 2008 book with Joan Muysken – Full Employment abandoned – we consider the use of this type of labour market as the primary model upon which the orthodox view of unemployment is based and still pushed down the throats of students today by the mainstream macroeconomics profession in general.

The (neo)-classical model is represented by the following equations and is graphically depicted the graph below:

Labour demand: Ld = f(w) f’ < 0

Labour supply: Ls = f(w) f’ > 0

Equilibrium: Ld = Ls

where w is the real wage which is the ratio of the nominal wage, W and the price level P. The real wage is considered to be determined in the labour market, that is, exclusively by labour demand and labour supply. Keynes showed that this assumption is clearly false.

The labour demand (Ld) function is the derivative of the production function with respect to labour input (the marginal product). The ad hoc imposition of the so-called law of diminishing returns ensures this derivative is positive but declining as employment is increased. Hence, the labour demand function is downward sloping with respect to real wages. This is a short-run relation based on the fixity of other inputs.

In English, this means that as workers are added to some fixed stock of productive capital, they become less and less productive. Firms are supposed to only pay a real wage (that is, some product equivalent) that is equal to what the worker at the margin produces. Thus as productivity falls they are prepared to offer employment at lower and lower real wages.

I recall examples used when I was a student was the “Soft Drink Delivery Truck” where apparently a firm has a truck (capital) and a driver (variable labour). Then they add an off-sider to unload the crates at the delivery point (more labour) and marginal productivity rises. Then they keep adding workers who are hanging off the back of the truck getting in each other’s road (diminishing marginal productivity) and eventually tripping over each other and dropping crates (negative marginal productivity).

And, lo and behold, the Wikipedia entry for Production Theory basics uses that example. The most obvious question was why would a firm do that?

But the point is that the labour demand shape is simply asserted by mainstream economists as a religious belief and has questionable empirical relevance. It also cannot hold at the macroeconomic level. I don’t have time to discuss the complex theory (Cambridge Controversies) that refute most of this theory at the macroeconomic level or the organisational behaviour studies that emphasise teamwork and joint production methods which suggest the theory is not particularly applicable at the microeconomic level.

The labour supply (Ls) function, which is based on the idea that the worker has a choice between work (a bad) and leisure (a good), with work being tolerated to gain income. The relative price mediating this choice is the real wage which measures the price of leisure relative to income. That is an extra hour of leisure “costs” the real wage that the worker could have earned in that hour.

The imposition of the ad hoc assertion that the substitution effect outweighs the income effect means that a rising real wage will elicit increased labour supply and vice-versa. What this means is that the rising cost of leisure is deemed (that is, asserted) to be a more important motivator than the extra income that the worker earns and so they work more as the real wage rises.

The following graph (Figure 2.1 in Full Employment Abandoned) summarises these results. The important Classical result is that the interaction between the labour demand and supply functions determines the real level of the economy at any point in time. Aggregate supply (using the aggregation fudge of the so-called representative firm) is thus a technological mapping from the equilibrium employment determined by the equilibrium relationship into the production function. Say’s Law (in whatever version) is then invoked to assume away any problems in matching aggregate demand with this supply of goods and services.

The equilibrium employment level, E* in the graph, is constructed as being full employment because it suggests that every firm who wants to employ at the equilibrium real wage, w* can find workers who are willing to work and every worker who is willing to work at that real wage can find an employer willing to employ them.

The mainstream economist thus considers the preferences of the workers always have a bearing on the labour market outcome and through price adjustment (real wage flexibility) any changes in supply preferences will – via mediation through the demand side – result in a changing full employment level.

In other words, adoption of the competitive paradigm demands that departures from full employment are ephemeral at best. Any sustained unemployment (say BC in the graph) must be due to a real wage constraint (a real wage, w1, above the marginal productivity at implied equilibrium full employment) which would be competed away more or less immediately.

A fundamental aspect of this labour market conception is that fluctuations in unemployment reflect supply-side changes arising from imperfect information or reflecting changing preferences between leisure and work.

This is the model that forms the basis of the way students are taught about the operations of labour markets. Students are encouraged to consider unemployment as being voluntary or because the real wage is fixed above the “market-clearing” level. Governments might be blamed if they set a minimum wage above this level or trade unions might push wages too high etc.

The implication is that individuals are prevented by misguided governments or trade unions from enjoying employment. But more often the unemployment is considered voluntary and the assertion is that if individuals don’t want to be jobless then they will offer themselves at a lower wage and firms will then employ them (given, by assertion, that the extra workers are less productive).

Holding technology constant (and hence the Ld curve fixed), all changes in employment (and hence unemployment) are driven by labour supply shifts. There have been many articles written by key mainstream economists (such as Milton Friedman) that argue that business cycles are driven by labour supply shifts. The current Republican candidate Herman Cain certainly espoused these ideas recently when he said that the unemployed in the US are to blame for their own state.

The most simple examination of the data (as in the above graph from the UK ONS) suggests this theory fails to apply to the real world. An essential conclusion that you would draw from the supply shift stories is that quits (workers leaving jobs on their own volition) should behave in a countercyclical manner.

All the empirical evidence on quit behaviour from every country runs contrary to that construction. US institutional economist Lester Thurow wrote in his 1983 book – Dangerous Currents:

… why do quits rise in booms and fall in recessions? If recessions are due to informational mistakes, quits should rise in recessions and fall in booms, just the reverse of what happens in the real world.

I also recall reading a lovely account of how the mainstream economists explained the rapid rise in unemployment during the Great Depression (to 30 per cent or more). I cannot remember the reference and it was before the digital era. When I finally quit myself and start sorting all the old papers etc I might find the article where I read it. But the writer said that the mainstream economists wanted us to believe that within the elapse of a year or so, around 30 per cent of the workforce suddenly acquired a new found taste for leisure and decided to quit their work – a sudden outbreak of laziness struck the world during the 1930s!

Conclusion

The decline of the British economy is gathering pace and I expect tomorrow’s labour force data release will show rising unemployment. The CIPD data is a good indicator of what happens in the UK labour market and it is clear that the firms are now reducing their hiring and involuntary job losses are rising.

The British government is to blame for that deterioration. While the Euro shenanigans are not helping any nation the facts are that if exports slow then there is an urgency to replace that spending with domestic growth sources.

With private spending continuing to be subdued in Britain there is only one sector left – the government.

A new form of communication

This photo was published in the Melbourne Age article (November 18, 2011) – Breath of fresh hair as leaders sign green tariff deal

The article explains the picture with a sub-title – “US President Barack Obama mimics Australian Prime Minister Julia Gillard by joking about the need to groom his hair” – after the wind was blowing our leader’s hair a bit. The middle man in the photo is Russian President Dmitry Medvedev.

English

I occasionally get E-mails pointing out errors in syntax, spelling etc. I appreciate the scrutiny and I take the advice into account.

I write the blogs very quickly usually – trying the balance other commitments with my aim to explain things in some detail. I usually try to re-read each post before I hit the publish key but if a taxi is waiting outside or the announcer is saying the gate is closing for a flight I obviously don’t. I try to then go back and correct errors later – but sometimes I don’t.

So I am sorry if I offend the sense of decorum of some people by leaving grammatical and spelling errors.

The other point is that spell checkers in Firefox are US-centric and as we all know Americans cannot spell very well (labor, center, etc)! (joke). So there is always a lot of red underlines in my text which makes it confusing to quickly check what is correct and what is not.

I will strive to improve.

A full day of commitments until late now are ahead …

That is enough for today!

I, at first, wondered too about the ” syntax… etc” errors.

I then realized that the sheer volume of output and the speed at which you must do it explains the issues.

It’s a blog people; and not Bill’s real job. Fill in the blanks and correct the errors yourself.

And thank Bill for the tremendous effort-daily- he spends to try and educate us mis- educated, unwashed, economics students of all ages trying to fill in the blanks and misrepresentations of our own economics educations.

Check the length and depth of these blogs, times 6, against any others.

I couldn’t crank out such volume with so few errors; could you?

I can think of an exquisitely appropriate repository for that 18 English Pounds lavatory brush and it sure isn’t beside Hoban’s toilet.

What I don’t understand is how ‘export led growth’ isn’t a ‘beggar thy neighbour’ policy?

And for the British government to suggest that the welfare of the British people depends upon the continued support of bankrupt countries like Ireland, Spain and Italy. Well…

You can install an Australian English dictionary in the following way, at least in my version of Firefox: Right-click inside the text field with spell checking, go to the sub-menu Languages and select Add Dictionaries. That opens a new tab in which you are shown the dictionaries that are available for download, and the process is self-explanatory from that point on.

Once you have installed a new dictionary, you can use the same right-click menu to switch between dictionaries in case you ever find yourself in the need to use American spelling (joke… more realistically, this is useful when you write in different languages, e.g. I use the functionality to switch between German and English).

The British Government are indeed to blame and they have done a good job of fooling the public into believing austerity is the way forward, so much so that the opposition (Labour) have decided that in order to fall in line with public opinion they too should be looking for a budget surplus in future (just at a slower pace than the Conservatives).

I heard Prime Minister David Cameron on the radio last week lying to the public again; attempting to scare people by saying that if the gov’t do not act on public debt then bond rates will go up and people’s MORTGAGE rates will go up! Needless to say I was fuming to hear him trying to scare the public into thinking that “if the gov’t continues in “debt” then I’m not going to be able to afford my mortgage payments”! It’s really quite shameful.

Krugman never elaborates what he really thinks, but here is Brad Delongs explanation of ‘liquidity trap’: http://delong.typepad.com/sdj/2011/11/the-sorrow-and-pity-of-the-liquidity-trap.html

It is really sad thing to read. How can they be so lost?

@ Bill

Is this the quote you tried to recall from memory?

“Today’s New Classicals must argue that recessions occur when low wages are expected; workers then find leisure less costly in terms of wages foregone and bide their time until remuneration rates improve. But can the Great Depression best be explained as a multi-year withdrawal from labor markets by most Americans because they expected an eventual wage rise? The other explanations that New Classical theory can offer seem no more credible. One is that the utility function of most laborers called for a “… spontaneous out-

burst of demand for leisure…” from 1929-1939. ”

The source is here: http://econpapers.repec.org/article/fipfedcer/y_3a1985_3ai_3aqiv_3ap_3a20-35.htm

Dear Eclair (at 2011/11/17 at 0:38)

Thanks for the research effort.

The section of the quote you provide – “spontaneous out-burst of demand for leisure” is lifted from the original quote I was referring to but in the article you reference there is no attribution to the original.

The original came from an economist of the vintage of Tobin, Brainard or some macroeconomist in that vein.

But you have renewed my curiosity and a renewed search will be mounted.

best wishes

bill