I started my undergraduate studies in economics in the late 1970s after starting out as…

When an Excel spreadsheet runs wild

US Presidential candidate Ron Paul released his – Plan to Restore America – yesterday, saying that it will deliver a balanced budget within three years – cutting public spending by $1 trillion in year one, slash “regulations” and “reign in the Federal Reserve and get inflation under control”. The 11 -page document has lots of tables and graphs and says that “America is the greatest nation in human history” (plaudits) but if you search for some theoretical framework or some evidential-basis for the numbers presented you will be very disappointed. You will read that Americans have a “respect for individual liberty, free markets, and limited constitutional government” and that returning (public) spending (mostly) to 2006 (nominal) levels is somehow good. Cutting federal employment by 10 per cent is also good. Cutting all regulations is also good. But that is about as far as the textual rendition goes before you hit the tables and graphs. When I read the document I couldn’t help thinking that someone had run wild with an Excel spreadsheet.

The Bloomberg Editorial yesterday (October 19, 2011) – Hidden Utility of Ron Paul’s Balanced-Budget Plan – saw some benefit in Ron Paul’s plan.

They said that “American voters … enthusiastically embrace the need to cut, cut, cut. But they baulk when asked to name specific programs to downsize or lop off” and so Paul’s proposal:

… performed a valuable public service this week when he unveiled a budget plan that shows exactly what balancing the $3.8 trillion budget through spending cuts would look like.

The fact is that the proposal doesn’t show “exactly” anything other than that someone can manage a spreadsheet with some formulas. The Plan to Restore America is devoid of economics which renders it a useless piece of rhetoric – strong on ideology but weak (tragically so) on analytical clout.

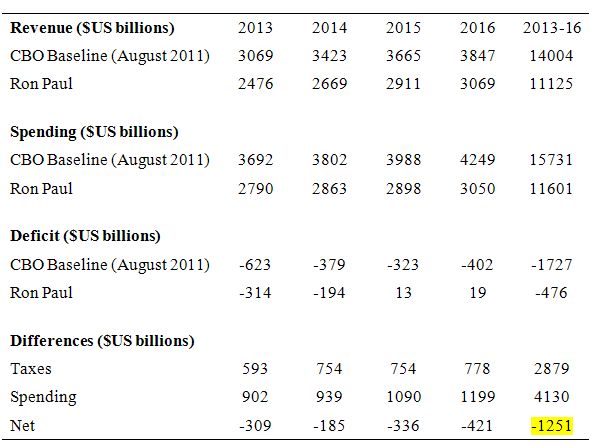

I created the following Table is taken from the data presented in the Plan to Restore America and compares the CBO August 2011 baseline to Ron Paul’s proposal in terms of the differences in the fiscal aggregates. The CBO baseline presents a budget that is inadequate for the current appalling state of the US economy.

In 2011, the CBO estimate the GDP gap will be $US805 billion down from $US884 billion in 2010. I suspect the 2011 estimate will prove to be optimistic given that the economy is slowing somewhat relative to the projections. The GDP gap “equals actual (or projected) GDP minus potential GDP (the quantity of output that corresponds to a high rate of use of labor”. There has been virtually no closure in the massive underutilisation of labour (no matter how one measures the “high rate of labour use”).

So lets just assume the US goes into 2012 with a real GDP gap of $US850 billion which I suspect will turn out to be a reasonable estimate.

What that means is that to push the economy to the production level that the CBO estimates as being “full capacity” there has to be an extra $US850 billion spent in aggregate (about). For reasons I explain in this blog – The dreaded NAIRU is still about! – the CBO estimates of “full capacity” are likely to be biased towards higher unemployment than might actually be the case. So in this discussion, remember I think the problem is likely to be worse than the analysis suggests.

So even their budget baseline (from August 2011) would fall well short of what is needed to fill their own estimate of the spending gap. That should be borne in mind when considering how extreme the rival plan really is.

The CBO estimates the budget deficit (including the cyclical component) will be around $US1,399 billion in 2011. The numbers are clearly estimates but the RAP considers they will be able to achieve a surplus of $US19 billion by 2016 if the spending and tax cuts go as proposed.

The Bloomberg Editorial says that:

In broad terms, Paul … [would be] … slicing $1 trillion from the budget in his first year in office … He would pare back most other programs to 2006 spending levels … would also starve the revenue side of the ledger. Corporations would see tax rates drop to 15 percent from 35 percent. He would extend all the Bush-era tax cuts, abolish taxes on estates and investment income. He wouldn’t end Social Security, but he would let young people opt out of the retirement program. As for that $1 trillion sitting in the overseas bank accounts of U.S. corporations, Paul would allow the money to come home tax-free …

True to his libertarian principles, Paul takes care of that problem by trimming the federal workforce by 10 percent …

And, it goes on.

The Bloomberg Editorial provides some local knowledge to tease out some of the practical implications – for example, “there would be no agency to oversee national parks, federal lands and offshore drilling. Land would have to be auctioned off to the highest bidders, most likely oil-and-gas, coal and timber companies”.

Further, “(e)ach state would have to become the regulator of its financial, manufacturing and health-care industries. A patchwork of rules would result. States might soon engage in a dangerous game of regulatory competition” and some “25 million elderly households … [who] … now depend entirely on Social Security for income … [would be left] … unable to buy food or pay heating bills”.

They also say that “(l)ow-income families would be hit the hardest” by the changes to Medicaid and food stamp programs – effectively culling them of all value.

Even on its own terms (that is, if the spreadsheet doodling was a reasonable representation of what can be achieved) the plan is drastic and likely to be chaotic and damaging to the ordinary citizen. The irony of US politics at present is that the grass roots support for the conservative austerity push is coming from working class Tea Partiers who will be the most damaged by the very policies they in their moments of frenzy seem to be supporting.

But, of-course, the Ron Paul exercise stands in denial of the underlying macroeconomics. It is one thing to make up some numbers and relate them to specific government departments that would have to close to get those numbers etc. But if you do not understand how these aggregates relate over time then the exercise become futile and a gross misrepresentation of what is possible and what is likely.

Some conceptual apparatus

In this blog – What is the balanced-budget multiplier? – I explain the difference between a spending and a tax multiplier and show some simple examples to demonstrate their use.

It is important to understand the difference because the debate about the relative merits of tax cuts and spending increases in stimulating a badly recessed economy like the US comes down to the relative magnitudes of public spending and tax multipliers.

The usual analysis is that government spending multipliers are more expansionary (larger multipliers) than cutting taxes because some of the tax cut is saved while all of the spending is injected into the demand stream. It is a conclusion that is consistent with modern monetary theory (MMT).

Of-course, the neo-liberal bias is towards tax cuts (supported with obvious rhetoric such as “empowering individuals”) rather than government spending (“more socialism”). The conservatives often claim (contrary to all evidence) that tax cuts are more expansionary because the multipliers ignore the so-called disincentive effects that allegedly arise from taxation. The problem is that the empirical attempts to estimate these “disincentive” effects are non-conclusive but the more credible studies do not find large effects at all.

The logic of the spending multiplier is simple (and powerful). Remember the basic macroeconomic rule – aggregate demand drives output with generates incomes (via payments to the productive inputs). This is summarised by the basic rule of Macroeconomics 101 – spending equals income.

What is spent will generate income in that period which is available for use. The uses are further consumption; paying taxes and/or buying imports.

The spending multiplier is defined as the change in real income that results from a dollar change in exogenous aggregate demand sources – which are usually taken to be government spending, private investment and/or exports. This is a simplification but fine for our purposes.

So imagine that the government places an order for $US50 million worth of product X (equipment for public schools or hospital supplies or whatever). The firms producing X will initially react to the order by increasing output (assuming no change in inventories) by that amount of spending which will generate an extra $50 in income as a consequence. So if we assume there is idle capacity and inflation is stable national income increases initially by the full injection of new government spending ($US50 million).

The workers from this firm enjoy higher income (and in disposable terms the difference between the initial spending and their gain is determined by the taxation regime). But disposable income rises in the economy and the workers now have more income to spend. One person’s income is another person’s expenditure and so the more the latter spends the more the former will receive and spend in turn – repeating the process.

Household consumption thus rises in response to the rise in production/income. Households also increase saving as a result of the higher income and imports will also rise. Taxes, saving and imports thus drain some of the initial increase in national income from the expenditure stream. But the initial rise in government spending has induced new consumption spending which then triggers further production increases.

This is where the spending multiplier begins to work. The workers who earned that initial increase in income increase their consumption and the production system responds and income rises and this induces further rises in consumption spending in the next period and firms react with extra output which creates more income and the process continues.

The process continues with each period seeing a smaller and smaller induced spending effect (via consumption) because the leakages (saving, taxation and imports) are draining the spending that gets recycled into increased production.

Eventually the process stops and income reaches its new “equilibrium” level in response to the step-increase of $50 in government spending. At that point the leakages will have risen in total (accumulated over the period of adjustment) to match the initial 50 injection in government spending.

The final change in national income in response to the initial spending stimulus tells you what the magnitude of the spending multiplier value is. Please read my blog – Spending multipliers – for more discussion on this point.

The tax multiplier is the change in income which results from a change in disposable income arising from a tax rate change. Say the tax rate rises at some level of national income. Disposable income will fall and this reduces consumption. The reduction in consumption then multiplies through in the same way as before – firms cut output and income which induces further reductions in consumption etc.

The reason the tax multiplier is likely to be lower is because households do not overall consume every dollar of disposable income. So some of the tax rise is absorbed by lower saving and only the “consumed” proportion of disposable income feeds into the expenditure stream.

The estimation of spending and tax multipliers is one of those vexed areas in economics which illustrate how the discipline departs from the physical sciences. The estimates range widely with the mainstream economists always producing lower estimates than those with a Keynesian bent. The extreme free market economists claim the spending multipliers are well below one and even negative.

But we get some idea of where the central tendency of the distribution of estimates lies.

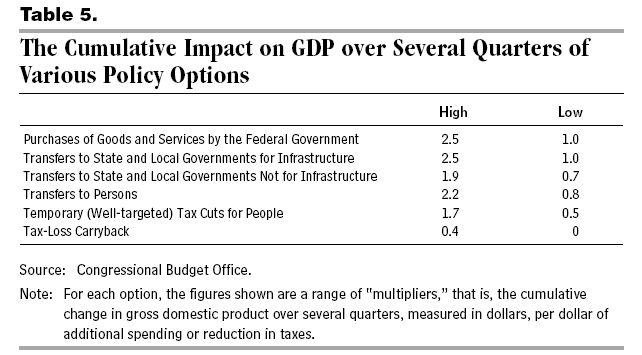

On January 27, 2009, the US Congressional Budget Office produced the following testimony to the Committee on the Budget, U.S. House of Representatives – The State of the Economy and Issues in Developing an Effective Policy Response – and they outlined various multiplier estimates which fall in the “reasonable” range.

Their Table 5 showed “the range of estimated effects on the economy-the multiplier effects-of a one-time increase of a dollar of additional spending or a dollar reduction in taxes. The numbers indicate the cumulative impact over several quarters.

For example, a one-time increase in federal purchases of goods and services of $1.00 in the second quarter of this year would raise GDP after several quarters by $1.00 to $2.50. The effects would not be permanent, however. Over time, they would diminish to zero as resources became more fully employed. In fact, the effects might be mildly negative in the long run because additional national debt would tend to reduce national saving, potential GDP, and the sustainable level of real per capita personal consumption spending.

The following graphic reproduces their Table 5.

How do we interpret these numbers?

The CBO provide an example:

For example, a one-time increase in federal purchases of goods and services of $1.00 in the second quarter of this year would raise GDP after several quarters by $1.00 to $2.50.

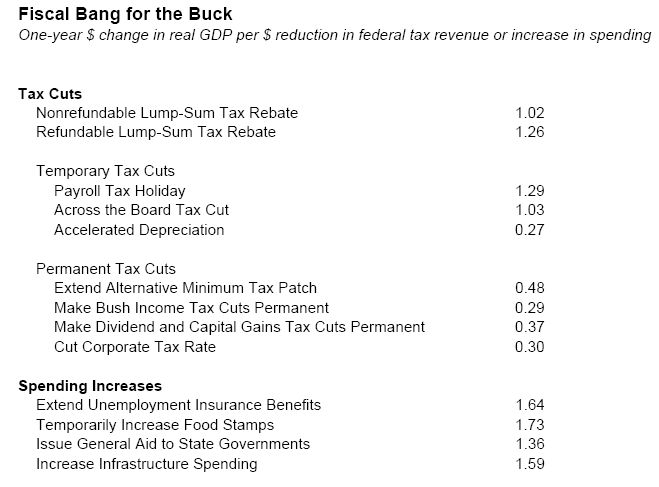

Mark Zandi (from Moody’s Research) presented evidence to the U.S. House Committee on Small Business on July 24, 2008 – A Second Quick Boost From Government Could Spark Recovery – which also considers the likely spending and tax multipliers for the US. I found his testimony eminently reasonable.

The following graphic shows his Table of tax and spending multipliers which are in the “average” range for the broad literature on this topic.

This blog – US fiscal stimulus worked – more evidence – is relevant to this discussion – outlining how multipliers are constructed and the way in which the US fiscal stimulus triggered them for positive outcomes.

What do these multipliers imply?

The point is that the near trillion cut in spending in 2013 would have dramatic impacts on the state of demand (overall spending) in the US. If the US ends 2012 with a spending gap of $US850 billion (approximate) and spending is cut a further trillion with a much smaller tax offset then you can do some sums to work out what might happen to the spending gap.

Even with conservative estimates of the multipliers in the Zandi or CBO tables you can imagine what the impact on the economy would be. You could weave several narratives to understand what might happen of the ground.

I won’t do the sums but multiply a few of the components of Ron Paul’s plan by the relevant multipliers and add them to the GDP gap and then ask yourself what the private sector reaction would be to such an instant “recession”.

The Proposal reads as if Ron Paul thinks the net government outlays do nothing. Even if we agreed that a lot of government spending was not desirable in terms of the way in which the real resources were deployed (so we might say wasteful with better uses indicated) from a macroeconomic perspective the spending still creates income which multiplies throughout the rest of the economy. There is no getting away from that.

What do the 10 per cent of federal employees do each day with the incomes they earn? They go into shops and spend it which creates output and further employment. What does all these other outlays do? They create economic activity (however desirable in substance) throughout the US economy.

The overwhelming evidence is that private spending is subdued because households are in fear of unemployment and business firms already have enough productive capacity to meet the current level of spending and have no incentive to invest in further productive capacity.

Rising unemployment and falling demand (from the near $US1 trillion cuts in 2013) would further undermine private confidence.

The Plan to Restore America considers that the spending cuts will be replaced by the private sector. But that hope is not supported by any credible evidence. The evidence points to the exact opposite conclusion.

It is all very well to preach to the Americans about how great their nation is and to swathe your narrative in terms of patriotism but the market system doesn’t respond to that level or type of discussion. If people are losing their jobs they won’t increase their consumption. Firms will not invest if sales are falling.

And if the private sector further contracts, it is also unlikely that the government’s budget will be able to achieve the sort of outcomes that Ron Paul has in the later columns of his spreadsheet (2014 and on).

Clearly, Ron Paul thinks that by scrapping a swathe of regulations this will create growth.

I recently considered that view this blog – Some further thoughts on the OWS movement. I examined the evidential validity of the claim that growth is being stifled in the US at present by government regulations and intervention. This is the constant Republican (and Ron Paul) narrative and stands in total denial of the lack of spending explanation for the stagnant growth and persistently high unemployment.

The evidence provided by the US Bureau of Labor Statistics – their Extended Mass Layoffs data – overwhelmingly supports the claim that American firms have been sacking workers because there is a shortage of demand (spending). The firms that volunteered “government regulations/intervention” as the reason for laying off their workers constituted a minuscule proportion of the total.

No-one who was familiar with this data would conclude that business regulation is choking the American labour market or was in any way responsible for the substantial drop in labour demand and the rise in unemployment.

The tax debate is similarly compromised. Why would a firm employ more workers if they cannot sell the product even if they can lower the price somewhat if costs fall? I will consider that topic in another blog.

Taking a national income perspective

Further, consider this from a National Accounting perspective. We have rehearsed the sectoral balances many times but they are a very useful framework for considering these sorts of proposal once you add some understanding of the economic factors that drive the strict accounting relations.

The accounting is not an explanation but a summary framework for organising conjectures about the underlying behaviour that drives national income growth.

The sectoral balances are not theory. They have to add up. The theory is in what connects them (national income) and what drives the national income. Further, the theory requires us to understand the feedback between the sectors so summarised.

So a rise in government spending will increase national income which provides the opportunity for private households to increase saving. But it also might stimulate private domestic investment and the impact on the private domestic balance (the difference between private domestic spending and income) then depends on the sensitivities involved.

Further a particular sector may desire a specific outcome (for example, the private domestic sector might desire – once all the decentralised decisions about spending and saving are made to save overall – that is spend less than it earns) but the discretionary actions of the other sectors (government and external in this case) might thwart that desire.

For those new to the blog the framework is briefly outlined as follows.

The relationship between between aggregate spending and income is given by this expression:

(1) Y = C + I + G + (X – M)

where Y is GDP (income), C is consumption spending, I is investment spending, G is government spending, X is exports and M is imports (so X – M = net exports).

So this provides an expression for the sources of national income. Spending equals income – by definition.

Total income is used by households in the following ways:

(2) Y = C + S + T

where S is total saving and T is total taxation (the other variables are as previously defined).

Bringing the sources and uses of national income together we would write:

(3) C + S + T = Y = C + I + G + (X – M)

And noting that C is common to both sides this simplifies to:

(4) S + T = I + G + (X – M)

And if we re-arrange this term to derive the sectoral balances accounting relations for the three aggregate sectors: private domestic; public and external we get:

(S – I) = (G – T) + (X – M)

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)), where net exports represent the net savings of non-residents. Here net exports is equivalent to the current account (and thus includes the net income flows each period).

To put framework into use, we note that Modern Monetary Theory (MMT) teaches us that for any level of aggregate demand and national output there are several incontrovertible facts that arise from the national accounting systems we use.

1. Government deficit (surplus) = Non-Government surplus (deficit) – to the cent.

2. Spending equals income and is the sum of net external spending (exports minus imports), private domestic spending (consumption plus investment) and government spending. A fall in overall spending results in a fall in income (output). A fall in one component of spending can be offset by a rise in another component to maintain existing income levels.

3. The non-government sector is sum of private domestic sector and the external sector.

4. If the external sector is in deficit, then a budget surplus or a balanced budget is always associated with a private domestic sector deficit.

5. If the budget deficit is less than the external deficit then private sector will be in deficit overall.

6. If the budget deficit equals the external deficit then the private domestic sector is in balance overall.

7. If the budget deficit is greater than the external deficit then the private domestic sector is in surplus overall.

8. If the private domestic sector is in surplus overall, it is spending less than its income and thus saving.

9. If the private domestic sector is in deficit overall, it is spending more than its income and building up debt, running down saving, or selling previously accumulated assets.

10. If there is an external deficit, the government and private domestic sectors together cannot reduce their respective debt levels.

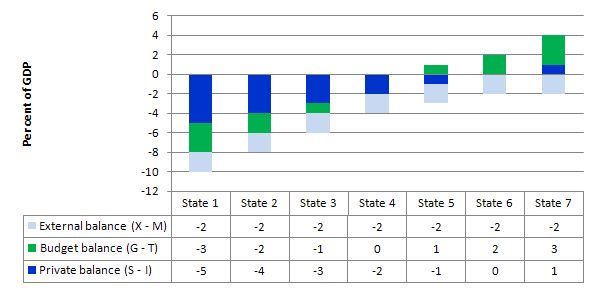

Consider the following graph which provides a range of different national income outcomes. So there have been spending flows between the three sectors which have created a flow of aggregate output and income which then are summarised by these balances. The graph and table summarise the binding relationships between the macroeconomic sectors. A negative (positive) private balance is a deficit (surplus) while a negative (positive) public balance is a surplus (deficit). I have constructed this for a persistent external deficit (negative) of 2 per cent of GDP to provide a control for the different states.

These relationships depicted are not my opinion, subjective interpretation nor my conjecture. They are fixed by the way we define the national accounts and have to be true by definition. While they don’t indicate causality and you have to infer that from specific contextual analysis these relationships always hold for the different circumstances and should be ground into every economists mind who wants to comment or conjecture about macroeconomic matters.

Many of the comments you will read fall foul of these sectoral balances and promote policies and desired outcomes that cannot all be mutually consistent.

So after all the spending flows (and leakages) are exhausted in each period, if there is the coincidence of an external deficit (X – M < 0) and a public surplus (G – T < 0) then the particular national income flows will also force a private deficit (that is, the private domestic sector will be spending more than they earn).

While private spending can persist for a time under these conditions using the net savings of the external sector, the private sector becomes increasingly indebted in the process.

Further, if there is an external deficit then the government sector and the private domestic sector cannot simultaneously be running surpluses (that is, reducing their overall debt levels).

But to really use this framework you need to add theory and trace out how different behaviour will interact to generate national income changes which in turn are accounted for in each period.

Imagine if the private domestic sector desires to save 1 per cent of GDP overall (spend less than they earn) and sets about trying to achieve that goal via all the decentralised spending decisions of households and firms. Also assume for control purpose that the external sector is running a deficit equal to 2 per cent of GDP which is draining local demand relative to national income flows.

What will happen to national income as a result of this behaviour? The answer is it depends on what the government is doing (although it is more complex than that because of the feedback loops between the sectors which I will explain).

Imagine if the structural and cyclical budget outcome (that is, the sum of the discretionary policy choices of government and the impact of the business cycle on its spending and tax aggregates) produced a deficit of 3 per cent of GDP. This is State 7, and all the sectoral choices would have been compatible and national income would be stable and consistent with the desires of the private domestic sector, government and the external sector.

In that situation the desires of the private domestic sector which they would have put into place via their spending decisions would not undermine the growth in national income because the government was prepared to run a deficit consistent with supporting aggregate spending which filled the spending drain (gap) left by the private overall saving and the external sector.

What if the government sector at the time the private domestic sector set about saving overall had embarked on a fiscal austerity program and cut? Then the desires are incompatible at the current level of national income and it is the latter that would adjust via spending changes that would occur.

So as the government starts to cuts its spending while households are trying to cut their consumption spending (say) then aggregate demand will fall and output and national income will fall. The falling income would not only reduce the capacity of the private sector to save but would also push the budget balance towards (or into) deficit via the automatic stabilisers. It would also push the external surplus up as imports fell. Eventually the income adjustments would restore the balances but with a lower GDP overall.

What the sectoral balances might end up like is a matter of how the changing income erodes the capacity of the individual sectors to realise their desires.

This is a highly stylised example and you could tell a myriad of stories that would be different in description but none that could alter the basic point.

If the drain on spending outweighs the injections into the spending stream then GDP falls (or growth is reduced).

From the previous discussion, it is highly likely that the reaction of the private sector to the Plan to Restore America would be to further refrain from consumption and investment as the impacts of the massive net spending cuts started reverberating through the economy.

It is highly unlikely that the US is going to achieve a current account surplus in the period under consideration.

Even the IMF Staff Note to the recent Paris G-20 meeting – The Path From Crisis to Recovery – noted that a major risk for the world economy that requires resolution is the massive outstanding private debt that arose from the housing booms.

The housing markets have a long way to go before they will be stable. The incidence of negative equity is rising in all nations and until the balance sheet implications of that are resolved it is unlikely that private households will start spending with any panache.

The days of credit-binged consumption growth are over (at least for now). Without strong consumption growth, there will be relatively subdued growth (if any) in private capital formation.

The overwhelming message from the IMF (which I agree with) is that the private domestic sectors (in the US and elsewhere) have to reduce their debt levels by increasing their overall saving.

The sectoral balances framework provides some organisation for understanding the implications of those points. If the nation wants to grow (that is, achieve nominal spending growth in line with the real capacity growth plus soaking up idle capacity) and it is unlikely to run external surpluses and the private domestic sector is trying to run down debt levels overall, then the growth process has to be supported with budget deficits.

Budget deficits provide the demand support to allow the other desires/requirements/facts to be realised.

Ron Paul’s plan is in denial of these macroeconomic linkages and will fail before year one is over.

Conclusion

The Bloomberg editorial says that the Plan to Restore America is not a sound approach. They claim their is an “egalitarian way for Americans to share in the burden of achieving fiscal responsibility, but there’s no reason for entire Cabinet departments, the social safety net and the economy to be crushed in the process”.

It is interesting that they hold their “egalitarian” austerity plan out as being reasonable. In fact it also involves drastic and likely to be damaging cuts in net public spending. That they present this as the “reasonable” approach tells you how extreme the public debate in the US about fiscal policy has swung to the conservative (and uninformed) right.

Today I was a speaker at an interesting Euro crisis workshop held by the Monash University EU Centre in Melbourne. I will rationalise my notes etc and maybe write them up next week as a blog.

One of the speakers (from Italy) told the audience that Greece is now running out of medicine in its hospitals because the major suppliers will not supply them for fear that they won’t be paid. That is a stark aspect of the crisis and the leadership failure which I will leave you with today.

That is enough for today!

“The irony of US politics at present is that the grass roots support for the conservative austerity push is coming from working class Tea Partiers who will be the most damaged by the very policies they in their moments of frenzy seem to be supporting.”

It’s not appropriate to call the grassroots Tea Partiers as working class. Look at the sources attached to this section on an article on the Tea Party.

I’m confused by this: “3. The non-government sector is sum of private domestic sector and the external sector.” Shouldn’t “private” be “public” in this equation?

Sadly, Fed bashers (Ron Paul supporters & the Koch Shadow Armey) are in ample supply at various Occupy protests/encampments (at least, per reports I’ve directly received, Wall Street, Boston, Minnesota, & DC) busily trying to co-opt the movement with ghost stories from Jekyll Island, and in at least the case of Boston, have put out public statements indicating support for attacks on the Fed. This is a pretty well-financed effort, and should not be taken lightly by Occupy supporters.

Complexity is a device to avoid being proven wrong, so I like to keep it simple. For instance, my favorite question these days is quite simple: “How does a tax increase or spending decrease reduce unemployment or grow the economy?”

The supercommittee and all those who appointed them or subscribe to their efforts, surely should be able to answer this question. But strangely, though I have posted it on my blog, and written to literally hundreds of old-line economists, columnists and politicians, I’ve not yet received an answer.

Rodger Malcolm (no relation to Bill) Mitchell

“Sadly, Fed bashers (Ron Paul supporters & the Koch Shadow Armey) are in ample supply at various Occupy protests/encampments (at least, per reports I’ve directly received, Wall Street, Boston, Minnesota, & DC) busily trying to co-opt the movement with ghost stories from Jekyll Island, and in at least the case of Boston, have put out public statements indicating support for attacks on the Fed.”

Paul opponents seem constitutionally incapable of drawing distinctions. The Kochs have been dead-set against Ron Paul since the mid-1980s, and have been funding several other candidates. They have not spent one dime on Ron Paul, and they in no way support the abolition of the Fed.

CBO budget produces GDP prediction 18460 19010 19940 21245

compared to

RP GDP prediction 13950 14315 14490 15250, if the ratio of GDP to Government holds at 5 (which it has from 1969 to 2009). This wold be a loss on the order of 5 trillion dollars.

loss 4510 4695 5450 5995

Partha

@Mark: Public Sector = Gov’t; Private sector = Individuals/Households+Businesses

@Mark: Actually, you are right… must’ve been a typo. Probably works best as:

“the government sector = sum of private domestic sector and external sector”

(T – G) = (I – S) + (X – M)