I started my undergraduate studies in economics in the late 1970s after starting out as…

Some further thoughts on the OWS movement

I have been following the Occupy Wall Street developments with interest because ultimately I consider the only reasonable way entrenched elites become unseated is if there is mass action by citizens. I do not think military coups are a very sound way to lay the groundwork for grassroots democracy. I also like the idea of a “leaderless resistance movement with people of many colors, genders and political persuasions” although politics doesn’t take long to creep in and steer movements like these in particular ways. In the last day or so I have become aware that there is some notion among the “occupiers” that the evil they are opposing is fiat currency rather than corporate power particularly that of the financial monoliths. While power does lie in the monetary system the only way of ensuring that this power is democratised is if the currency-issuing entity is freely elected and accountable to us. That is a necessary but not sufficient condition for the advancement of economic development. My input to the OWS movement is by understanding Modern Monetary Theory (MMT) we can appreciate how governments are necessary for the development process and that we have to concentrate on making the fiat currency system work for us and prevent it from being hi-jacked by the so-called 1 per cent.

To kick things off, sometimes, I laugh to avoid crying. Apparently some citizens have decided to cash in on the Occupy Wall Street and they created a WWW site for their so-called “Occupy Party”. The narrative reads as if it is intrinsically related to the OWS movement – 1% versus 99%, “grass roots” etc except the OWS have disowned them.

I checked the Occupy Party’s home page and was besieged with advertisements for “motor cars”; “forex trading” and some book about how to get richer. My conclusion – this party has no class at all.

Here is a snapshot of the front page:

Anyway, in thinking about the OWS action, I went back to development economics today and re-read a fairly old contribution by The Meaning of Development by the late British economist Dudley Seers, who was a trenchant critic of the “neo-classical” approach to development studies which dominated the Post Second World War period. Neo-classical and neo-liberal are interchangeable for our purposes.

I was reminded of this chapter by Seers by a regular reader – who was unable to access it. He now has it.

We often tend to dichotomise the world into advanced and less developing countries (although the new terminology about emerging nations blurs that somewhat). But the advanced world sits smugly while the less developed countries are forced to take their IMF medicine to become like us. Of-course, the IMF medicine doesn’t make them like us but rather further enslaves them.

Please read my blog – Bad luck if you are poor! – for more discussion on this point.

My view is that the current crisis has produced outcomes for the advanced world that are not inconsistent with the problems facing the poorer nations (at least for some demographic cohorts) and the work of Seers (and later Sen) in development economics resonates strongly. This is a theme I am researching and organising my thoughts about for a chapter in a book I am working on.

I also think this resonance helps to explain the motivation for the OWS movement – and could give the movement some sharper focus and disabuse it of damaging ideas with respect to the monetary system.

Seer said that we should be careful not to confuse economic growth (measured by real GDP growth) with development. He says:

The questions to ask about a country’s development are therefore: What has been happening to poverty? What has been happening to unemployment? What has been happening to inequality? If all three of these have become less severe, then beyond doubt this has been a period of development for the country concerned. If one or two of these central problems has been growing worse, especially if all three have, it would be strange to all the result ‘development’, even if per capita income had soared.

He goes on to say that when a nation makes progress on these fundamental issues, educational (literacy etc) and political aims (participation in decision-making, etc) become “increasingly important objectives” and “Later still, freedom from repressive sexual codes, from noise and pollution, become major aims”.

But he emphasises that:

… these would not override the basic economic priorities … A government could hardly claim to be ‘developing’ a country just because its educational system was being expanded or political order was established, or limits set on engine noise, if hunger, unemployment and inequality were significant and growing, or even if they were not diminishing.

He also criticised the “neo-classical” obsession with real GDP growth and preferred to concentrate on what was necessary for development. After discussing the reduction in poverty (and its association with unemployment) he said:

Another basic necessity in the sense of something without which personality cannot develop, is a job. This does not just mean employment. It can include studying, working in a family or keeping house. But to play none of these accepted roles, i.e. to be chronically unemployed, to be chronically dependent on another person’s productive capacity, even for food, is incompatible with self-respect for a non-senile adult, especially somebody who has been spending years at school, perhaps at university, preparing for an economically active life.

It is true, of course, that both poverty and unemployment are associated in various ways with income. But even a fast increase in per capita income is in itself not enough, as the experience of many economies shows, to reduce either poverty or unemployment. In fact, certain processes of growth can easily be accompanied by, an in a sense cause, growing unemployment.

He went on to discuss income distribution and that “equality should … be considered an objective in its own right, the third element in development”.

If you think about what has occurred in the period leading up to the crisis and then since one could construct an argument that the leading economies (bar Japan) have been engaged in a process of “reverse development”. I exclude Japan because they have largely maintained their social safety nets and through their collective approach they have kept unemployment from rising substantially. I am not holding Japan out as some utopia but it clearly manages economic crises better than the West.

In the period leading up to the crisis, the neo-liberal onslaught sought to undermine and reverse many of the gains that were made through a hundred years or more of collective bargaining and Welfare State legislation. In several key ways the conservatives were successful – redistributing national income to profits (away from workers) and providing more “freedom” for financial markets etc.

Capitalism in unable to deliver sustainable prosperity under the conditions that the neo-liberals achieved in the last two decades or so. Greed, dishonesty, corruption etc – giving the financial elites too much power and too much scope to mis-use that power – is not commensurate with “economic development”.

The “reverse development” process was already in train before the crisis. The MMT literature, to which I contributed, was pointing this out in the mid-1990s. It was clear the increased financialisation of the world economy and the reliance on credit-fuelled consumption growth provide an unsustainable growth process. It was just a matter of time before it blew up – despite the denials of the mainstream macroeconomists and central bankers etc.

It did blow up and the “reverse development” process gathered pace. I think it is this process that has generated the OWS movement and its counterparts that are spreading throughout the world. The pre-crisis forebodings led to G20 protests etc but the “reverse development” process wasn’t stark enough for the angst expressed at those protests to really spread and capture the imagination of ordinary people.

The crisis has led to a worsening in all three basic development aims outlined above by Dudley Seers. The US economy is now in a very bad way and the entrenched nature of the malaise is undermining the basic conditions of social life.

First, the income and wealth distributions have increasingly become more unequal over the neo-liberal period but the contrast between rich and poor is now so stark that stability of the social order can no longer be guaranteed. The income distribution in the US now looks like a less developing nation.

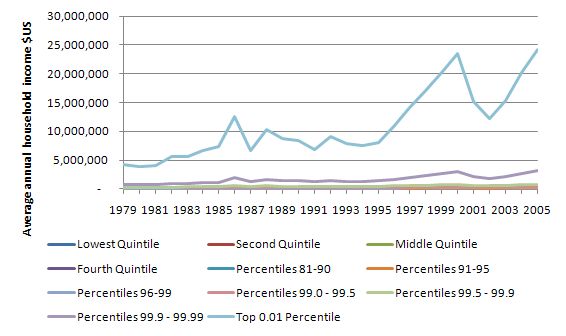

The US Congressional Budget Office provided very interesting data = “Additional Data on Sources of Income and High-Income Households, 1979-2005” which reveals that in 2005, the top 1 per cent of Households on average earned $US24,286,300 (post tax) while the bottom quintile earned $US15,300 on average. The second quintile earned $US33,700, the third $US50,200; the fourth $US 70,300, and even the second last percentile earned on average $US3,191,600.

The following graph shows movement in average household income in the US by distributional cohort (quintiles and percentiles) from 1975 to 2005. There has been virtually no growth in average income for the bottom 60 per cent of the distribution over this period but staggering growth for the top percentile.

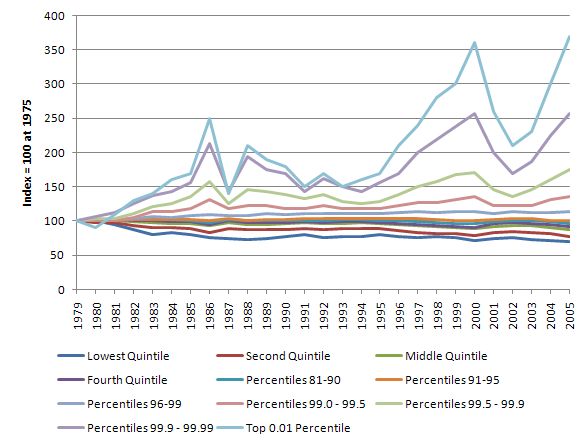

The following graph is taken from the CBO data and shows the post-tax shares in total household income for various cohorts (quintiles and percentiles). I indexed the shares to be 100 at 1975. You can see how the lower quintiles have lost share and the top three cohorts have gained share. These shifts in income distribution have been dramatic and resemble the sort of outcome you would find in a poor nation.

Second, the unemployment rate has now become entrenched at around 9.5 per cent (with minor variations around that) and long-term unemployment has entered the US scene for the first time, previously being a European/Australian phenomenon. Broader indicators of labour underutilisation published by the US Bureau of Labor Statistics suggest that around 18 per cent of available productive workers are idle in one way or another in the US.

The rule of thumb which provides a conservative estimate of the broad labour underutilisation rate is to double the official unemployment rate.

The problem is worse in some of the European nations. Further, the distribution of unemployment is also very unequal. Youth unemployment rates are very high – a wasted generation. Disparities across regional space are also marked.

Third, related to the previous two trends is the growing poverty rates in the advanced world – surely a sign of “reverse development”. What possible case could the advanced world put forward which would suggest that the policy environment that leads to increased poverty rates – long after the so-called “development problem” had been “solved” – was appropriate.

Neo-liberalism stands condemned for this reason alone.

There are other country-specific factors that are driving the OWS movement including the way in which education is funded and the prospects that failing economies (poor job prospects) present our youth (many who are lumbered by enormous debts as neo-liberal governments moved further to a “user pays” higher education system).

These are the issues that the OWS movement is addressing in its own way. Loose perhaps but definitely driven by genuine issues – the disenfranchisement of the majority by an increasingly arrogant and unproductive power elite concentrated in the financial sector, large corporations and the political ranks.

But if we are concerned with economic development (as outlined above) – that is, reducing poverty, reducing unemployment and reducing inequality – then we have to understand that how the monetary system is organised and the conduct of government within it are crucial.

Railing against fiat currency and proposing a return to a Gold Standard, for example, is the anathema of economic development.

Suggesting that private banks be denied the capacity to create credit is similarly misguided.

Some principles that I will expand on in future blogs:

1. Fiat monetary systems are the best way to ensure there is full employment and price stability – and economic development. Convertible currency systems with fixed exchange rates undermine the capacity of governments to pursue public purpose. They bias all adjustment onto external deficit nations which means they become prone to stagnation.

2. Allowing private banks to create credit is not inflationary per se. Banks need to be tightly regulated by government. Banks have to become banks again. Please read the following blogs – Operational design arising from modern monetary theory and Asset bubbles and the conduct of banks for further discussion.

3. Governments are not corrupt by definition and so we have to trust them to issue the currency under monopoly conditions. We then have to create pressure groups to ensure our representatives do not get captured by those who would undermine the economic development process. Governments have to advance public purpose as their primary goal and we have to hold them to account on that.

4. The central bank is really part of government and should be brought within the accountability structures of the elected government. They play an essential role in maintaining financial stability and maintaining the payments system. They should not be allowed to use unemployment as a policy tool to maintain price stability. They would be better placed managing an employment buffer stock system (a Job Guarantee) in that regard. Please read my blog – The consolidated government – treasury and central bank – for more discussion on this point.

5. Flexible exchange rates free government to pursue domestic policy. Severe fluctuations in parities are typically generated by unproductive speculative activity instigated by the investment banks/hedge funds. A truly progressive vision would render all that behaviour illegal. That should be the focus of the OWS movement not the flexibility of exchange rates.

6. We have to have a government sector as the centrepiece of the monetary system whichever way we want to organise the productive economy. The issue is to ensure governments work for us and not the top 1 per cent. Building those accountability structures is what the OWS movement should work towards rather than assuming that we can do away with evil government.

More evidential shortcomings from the neo-liberals

There was a very interesting article in the New York Times (October 4, 2011) – Misrepresentations, Regulations and Jobs

The author Bruce Bartlett has been a free market contributor for many years and has been an advisor to the “Reagan and George H.W. Bush administrations”. It seems in recent years he has realised that “supply side” economics is inappropriate for the age and is now writing very Keynesian pieces.

I find it interesting when people make these paradigm swaps but that sort of analysis is for another blog.

In this article, Bartlett attacks the conservative notion that US unemployment is the result of government regulation. He said:

Republicans have a problem. People are increasingly concerned about unemployment, but Republicans have nothing to offer them. The G.O.P. opposes additional government spending for jobs programs and, in fact, favors big cuts in spending that would be likely to lead to further layoffs at all levels of government.

Republicans favor tax cuts for the wealthy and corporations, but these had no stimulative effect during the George W. Bush administration and there is no reason to believe that more of them will have any today. And the Republicans’ oft-stated concern for the deficit makes tax cuts a hard sell.

These constraints have led Republicans to embrace the idea that government regulation is the principal factor holding back employment. They assert that Barack Obama has unleashed a tidal wave of new regulations, which has created uncertainty among businesses and prevents them from investing and hiring.

So it is more of what I was considering yesterday in the blog – One quarter shorter, three quarters deeper – where all the empirical evidence in Britain is running contrary to the neo-liberal narrative.

Bartlett says that in the US, the Republicans offer “no hard evidence” to support their claim and “it is simply asserted as self-evident and repeated endlessly throughout the conservative echo chamber”.

He cites the House majority leader, Eric Cantor as being particularly transfixed on this idea. On August 29, 2011, Cantor issued this Press Release and backed it up with a media blitz. He said:

We also have a very critical jobs and growth crisis. What we’re looking to do as we return to Washington next week is focus on how we stop the federal government from making it so difficult for small business people to create jobs … Whether you are talking about the National Labor Relations Board which has made decisions that have begun to stop companies from relocating or expanding in states where they choose to create new jobs, or whether it is the EPA which has been on a rampage making it more difficult for small businesses and manufacturers to deal with added costs so they can’t create jobs, this is the point, we want to make it easier for small businesses to grow …

And so it went – railing about the way in which regulation was stifling job creation in the US.

Clearly, he is playing on the fact that Americans are stupid and will accept what is, in fact, a made-up story with no empirical support at all.

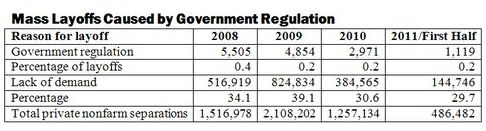

Bartlett produces a Table that is derived from the US Bureau of Labor Statistics site for Extended Mass Layoffs. The relevant table is “Table 2. Reason for layoff: Extended mass layoff events, separations, and initial claimants for unemployment insurance, private nonfarm sector”.

Here is Bartlett’s Table (which is the sum of Layoffs and Separations) as per the BLS definitions. I checked the data and his aggregations are accurate.

Once again the evidence overwhelmingly supports the claim that American firms have been sacking workers because there is a shortage of demand (spending). The firms that volunteered “government regulations/intervention” as the reason for laying off their workers constituted a miniscule proportion of the total.

No-one who was familiar with this data would conclude that business regulation is choking the American labour market or was in any way responsible for the substantial drop in labour demand and the rise in unemployment.

Bartlett also proffers other evidence to support his conclusion that:

In my opinion, regulatory uncertainty is a canard invented by Republicans that allows them to use current economic problems to pursue an agenda supported by the business community year in and year out. In other words, it is a simple case of political opportunism, not a serious effort to deal with high unemployment.

Conclusion

As noted, I will expand on the principles I outlined above in more detail in further blogs. The point is that we will not get very far if the OWS movements and their derivatives get hi-jacked by the sort of Tea Party nonsense that is now crippling the world.

We need governments to be purposeful and to use their currency power to advance the economic development process. There is nothing evil about fiat currency or budget deficits or private banking monetary creation.

The problem comes when the incentive structure of those institutions are perverted by the elites so that the institutions work against public purpose.

Saturday Quiz

The Saturday Quiz will be back sometime tomorrow – even harder than last week!

That is enough for today!

Bill, You say “Suggesting that private banks be denied the capacity to create credit is misguided.” My objection to having private banks create credit (i.e. fractional reserve) is thus.

Private banks can create money or “credit” at essentially no cost (administration costs apart). That probably undercuts the price that genuine savers charge for forgoing consumption so as to enable borrowers to borrow and consume resources.

If an economy is at capacity, the consumption of resources that is occasioned by the above “no cost credit” has to be matched by a REDUCED consumption somewhere else. In practice, government will notice that inflation is rising and will for example raise taxes or cut public spending. Thus a random group of people have to make a sacrifice in order to allow the spending of private banks’ “funny money”.

Alternatively, if the economy is not at capacity, the spending of private bank created money will boost AD. But the increase in AD comes about purely via borrowing. Whence the assumption that 100% of an increase in AD should come that way, rather than partially via increased consumer spending funded by increasing the private sector’s net financial assets (i.e. feeding monetary base into household pockets)?

I suggest that where more AD is needed, it should come from the ultimate source of all demand – the consumer’s spending on private sector stuff and from increased public spending. How much of the resulting increased monetary base private sector entities then want to lend / borrow to / from each other is up to them.

“If you think about what has occurred in the period leading up to the crisis and then since one could construct an argument that the leading economies (bar Japan) have been engaged in a process of “reverse development”. I exclude Japan because they have largely maintained their social safety nets and through their collective approach they have kept unemployment from rising substantially. I am not holding Japan out as some utopia but it clearly manages economic crises better than the West.”

There are plots in “Replotting data from “Total Debt to GDP (%) | Global Finance” at

http://pshakkottai.wordpress.com/2011/10/06/replotting-data-from-total-debt-to-gdp-global-finance/

where Japan (and India, Brazil, Italy) show deficits comparable to private debt (excuding finance industry debt). MMT is supported by this type of plotting data.

Partha

Bill,

“The point is that we will not get very far if the OWS movements and their derivatives get hi-jacked by the sort of Tea Party nonsense that is now crippling the world.”

Agreed, they intuitively know something is wrong, but hit out at the wrong target.

They also fail to appreciate that neither money, nor labour are “limiting resources”.

It looks like the movement has spread to Australia. http://www.greenleft.org.au/node/48979

if anyone knows of any good ows websites i can use to promote the mmt agenda let me know. i am curtently unemployed and have a lot of free time.

Thanks Bill for your passion and light!

Neoliberal supply side strategy worsens growth and employment (see Norbert Reuters: Stagnation as a Trend – Life with Satiated Markets, Stagnating Economies and Reduced Working Hours, 2009

http://portland.indymedia.org/en/2011/09/410738.shtml)

Here’s a comment that I added to http://www.freembtranslations.com on censored economic wisdom. I look forward to your comments.

Without vision, the people perish (Isaiah)! Without vision, arsonists are confused with firefighters and the goat is stylized into a gardener. Perpetual war and short-term constraints are normalized while the future imperatives of sustainability and solidarity fall by the wayside. Unlike the chair, an idea can be shared by a whole people. Access could replace excess; qualitative growth could replace quantitative growth.

Hope like the immigrant is often unwelcome and unsettling. The future should be anticipated and protected in the present, not extrapolated from the present (cf. Jurgen Moltmann, Theology of Hope). The present is more than the present since it contains the promise

Reality is full of paradox and scandal, dialectical and ambivalent, yes and no at once.Goldman-Sachs, the funder of government is also the indicted fraudster. Bank of America turns out Bad for America. General Electric is replaced by General Electric Capital; money washing is more profitable than making refrigerators. General Motors is only a screen for GM capital. Private losses become public losses. The trust crisis means focusing on the twin deficits, the budget and the trade deficits and keeping the Chinese and Japanese in the game. Empire, like Narcissus, fell in love with its own reflection in the pond and drowned (cf. Chalmers Johnson, Nemesis). The American empire could become a republic, learning social ethics from O Canada and the Zapatistas of Chiapas, Mexico

The vision of a world where many worlds fit and everyone has a place is the social vision eclipsed by non-stop consumerism and self-righteousness/self-absorption/narcissism/solipsism/agorophobia (Gracias Marcos and the Zapatistas).

Faith is paradox and scandal, sacrifice and engagement, a leap over seventy-thousand fathoms of water (Soren Kierkegaard). The infinite God who is not necessary but more than necessary (Eberhard Jungel) awaits our return like the Father in the Prodigal Son parable. Imagining the stars arose spontaneously out of dust is as irrational and nihilistic as Rick Perry calling Social Security a monstrous lie and a Ponzi scheme.

Obama is caught in trickle-down private sector euphoria when the private sector is imploding (e.g. private health insurance, oil industry, financial markets).

What a disconnect: politicians and football pushing cars when cities become gridlock!

The horse-sparrow theory – the horse must be fed so the sparrows can live – led to private affluence and public squalor (John Kenneth Galbraith). The financial sector once amassed 15% of the total corporate profits; now they amass 40%. Lobbyists who spend $4 bill a year know how to game the system. Private losses become public losses as long as the government is only an errand boy for Wall Street and the banks. Investment, taxation, trade, labor market and distribution must all be changed in the way of sustainability and respect for nature. The US cannot export Coca-cola, rock-n-roll and financial products forever!

Steady-state economics or zero-growth could replace infinite growth economics. Enough could replace more.; access could replace excess. The future could be full of community centers and free Internet books.

The three crises – mass unemployment, environment destruction and trade imbalance – can only be solved by moving outside the box, moving from quantitative to qualitative growth (cf. Hans Christoph Binswanger, 1983). A job in education costs $40-50K while a job in a chemical dye plant (capital intensive industry) can cost a half a million dollars!

The economy must be embedded in society; society must not be embedded and privatized in the economy (Peter Ulrich, 2011).

Long live alternative economics, reduced working hours, infrastructure investment, redistribution, person-oriented work, labor-intensive investment, mending our own pockets and making speculators into servants!

marc, September 14, 2011

Rob Johnson: Obama’s Plan Helps GOP Agenda

http://therealnews.com/t2/index.php?option=com_content&task=view&id=31&I…

Video: “FDR,” PBS video, 4 hours

http://video.pbs.org/video/1049332797/

Video: “The Corporation,” 3 hours

http://video.google.com/videoplay?docid=4924385683686207744

rodney, there are plenty of wikipedia pages that are in sorry state and could reallybenefit from mmt viewpoints.

For example, in Public-private partnership page it says:

Making a simple comparison, however, between the government’s cost of debt and the private-sector WACC implies that the government can sustainably fund projects at a cost of finance equal to its risk-free borrowing rate. This would be true only if existing borrowing levels were below prudent limits. The constraints on public borrowing suggest, nevertheless, that borrowing levels are not currently too low in most countries. These constraints exist because government borrowing must ultimately be funded by the taxpayer.

Or this: http://en.wikipedia.org/wiki/Internal_debt

You are certainly conversant on much economic data, but you fail to point out what of the chief culprits of the boom/bust Wall Street of the past 35 years: Low, low tax rates on short term cap gains, derivative income, investment real estate, private equity, – much of which is done with very cheap money lent by our major banks.

Occupy Wall Street Tax Manifesto: Tax Speculative Profits at 80%!!

This should be the sole aim of OWS since it is the US short term capital gains, derivative and real estate low tax that are destroying capitalism. Investors, true capitalists, should rally behind these demonstrators and demand that the US tax code makes speculative trading way too expensive to pursue. Put a low tax rates of 28% of 10, 15 year holding periods for long term gains, but for something held under a year, let alone a day tax it at 80%.

Looking at economic stats is great , but also look at the daily volume of the NYSE: nearly 80% is programmed trades!! That’s capitalism? Let’s not kid ourselves. The whole nature of our capital markets has completely changed in the last 25 years. Today: It’s speculation.

The overwhelming abundance of derivatives, hedge funds, private equity is draining real investment resources from the US economy – therefore JOBS. Who do you think the banks are lending to these days? Not small businesses, but the hedge funds, quant traders, etc. And trying to regulate away speculation will never work as long as it is so profitable.

That’s why the central theme for Occupy Wall Street should be “TAX SPECULATIVE PROFITS AT 80%”. Then we will start seeing a change in investment behavior and start redistributing speculative profits into wages!!