I started my undergraduate studies in economics in the late 1970s after starting out as…

Keynesian and regular economics

Everywhere I look I find examples of politicians and leading lights making macroeconomic statements without understanding macroeconomics. Given that these statements have policy implications that impact on real people making such erroneous statements – no matter how well-intentioned one is – is a dangerous thing that we should avoid. Imagine if I suddenly started to make claims about the strength of bridges such that they would fall down if my advice was taken. There would be a law against that. One notable economist apparently thinks that macroeconomics is not “regular economics” – but rather some far-fetched misplaced set of ideas that would be better forgotten. My view is different. A correctly specified macroeconomics provides a safeguard against falling into logical traps – such as the fallacy of composition. The so-called “regular economics” is a fantasy world where the angels on the pinheads are assumed away into one representative angel who knows all and never makes a mistake (on average). If you want to understand how mass unemployment arises and how it is solved then the mainstream version of “regular economics” will leave you in the dark.

What are some examples?

1. Tax us more, say wealthy Europeans – which reports that several super-rich people in France have signed a letter “begging to make a special contribution to the treasury to help drag France out of the financial crisis”. This follows similar stunts in Germany (the “tax me harder” group) and Italy (the “boss of Ferrari saying that as he was rich, it was only “right” that he stump up more cash”). None of these gestures will solve the problem.

2. Every Day Is a Rainy Day – which provides us with “Eric Cantor’s rule: Money to help those affected by Irene will have to come from somewhere else in the federal budget”. This will worsen the problem.

3. Harvard professor Robert Barro in the Wall Street Journal (August 24, 2011) – Keynesian Economics vs. Regular Economics – claiming that paying an unemployment benefit would cause the unemployed not to work hard enough (overlooking the fact they are not working at all) and also that such a public payment would lead to those that are working to work less – meaning public spending has zero impact. This is lunacy.

First, why won’t the “tax the rich” solve the problem?

The press coverage quoted one rich German who had suggested they increase the marginal tax rate on high income earners (lowered under Gerhard Schröder from 53 per cent to 42 per cent):

I would say to Merkel that the answer to sorting out Germany’s financial problems, our public debt, is not to bring in cuts, which will disproportionately hit poorer people, but to tax the wealthy more … We are always hearing about savings packages, but never tax rises. Yet tax increases are a way out of this mess. That’s where the money is: rich people. Something needs to be done to stop the gap between rich and poor getting even bigger.

I agree that the gap between rich and poor should narrow in all nations although I know there would be a dispute about how that should be achieved (bringing the rich down or the poor up or both) which is tangential to the point I am making here.

Even if the high income earners were sincere (and the evidence in France is that while they are calling for similar things to happen the tax breaks provided under Sarkozy swamp any extra revenue the government would get from higher marginal tax rates) the problem they are referring to is not the problem.

There are two problems in the Eurozone: (a) its basic design by which I mean the absence of a system-wide fiscal authority that can distribute spending to resolve the impact of asymmetric negative demand shocks; and (b) a shortfall of aggregate demand by some billions of Euros.

Problem (b) is shared by other nations that have not surrendered their currency sovereignty in the way the Euro nations have.

Raising more tax revenue does nothing for Problem (b) even if it offsets the spending cuts. If there are no spending cuts and all the fiscal contraction is achieved with tax revenue rises then it will do nothing (assuming the higher taxes were just saving by the rich). If the rich cut their spending then it would worsen the problem although probably not by as much as would occur if the fiscal adjustment was achieved via spending cuts.

Problem (b) requires more spending in total across the Eurozone nations. Considerably more. So raising tax revenue even if it does reduce spending any more than it is now will do nothing to address the problem. It is a vacuous act in that regard.

It might be that higher tax rates for the rich and lower tax rates for the poor and increased public spending aimed at increasing job creation would be a desirable mix. This is the beauty of fiscal policy that is absent in monetary policy.

Fiscal policy can simultaneously alter the level and the composition of aggregate demand by a creative mix of spending and tax policy changes.

So it might be that the rich have too great a command of real resources and policy makers might alter the mix between rich and poor while also bringing currently idle resources into productive use by increasing aggregate demand overall.

But that is not what is on the table in these proposals. They are really about how to distribute the pain of austerity which is a stupid path to be following for any nation with massive unemployment and no demand-pull inflation issues.

Second, why is Eric Cantor such a dill? The soccer player (Cantona) is no implicated!

This Washington Post story (August 30, 2011) – After Irene, FEMA facing a disaster of its own – funding – outlines the problem.

We read:

Now that the big hurricane is behind us – three days for Irene and six years for Katrina – the Federal Emergency Management Agency is running out of money and finds itself operating in a new political and fiscal climate that may be as treacherous as some of the disasters to which it must respond.

In the next few weeks, the agency faces the prospect of trying to mount a disaster response without enough funding because a newly cost-conscious Congress is reluctant to spend money on anything – including disasters – without offsetting it with cuts elsewhere.

FEMA is only running out of “money” because the US Congress is placing artificial restrictions on its capacity to spend. There are clearly idle real resources that can be brought into productive activity in the US at present to assist in the reconstruction.

These resources are at “zero bid” in the private market so carry no “inflation risk” and the government can with a stroke of a pen employ them without putting pressure on the price level.

The Post article quoted Eric Cantor as saying:

Yes, we’re going to find the money … We’re just going to need to make sure that there are savings elsewhere to continue to do so.

I won’t comment on the morality of shoe-horning disaster-relief into the sordid budget debates that are going on in Washington. It is beyond contempt really. I note that while Japan is in the midst of their own “conservative” austerity debates there was no sense that they would use the suffering associated with the tsunami to push for greater cuts.

The day before (August 29, 2011) the Washington Post carried this story – FEMA, to pay for Irene damage, delays funds for rebuilding in tornado-ravaged areas – which detailed where the cuts might be.

Apparently FEMA:

… is temporarily suspending some payments to rebuild roads, schools and other structures destroyed during spring tornadoes in Joplin, Mo., and Southern states and other recent natural disasters to pay for damage caused by Hurricane Irene.

To name a few of the “backlogged” infrastructure projects (from previous weather events etc) that will be suspended due to a “lack of funds”.

But Cantor’s insistence on paying for disasters with funds that would be spent elsewhere demonstrates clearly that he has not made the link between economic activity and spending. It also demonstrates that he hasn’t the remotest idea of what is troubling the American economy.

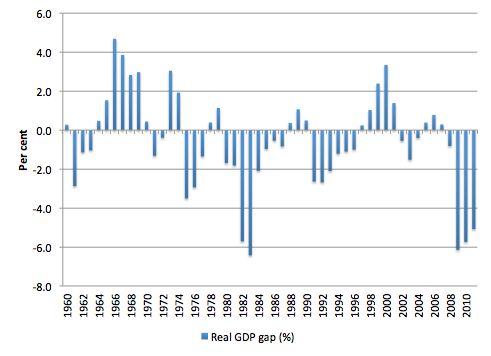

The following graph shows the real GDP gap (% of potential) published by the US Congressional Budget Office.

The 2011 gap is estimated to be around 5.1 per cent down from 5.7 per cent in 2010. In 2010 this amounted to $US884 billion and in 2011 it is estimated to be around $US805 billion.

There are reasons why this is probably a conservative estimate (that is, the gap is likely to be larger than the CBO models estimate). Please read this blog – Structural deficits – the great con job! – for more discussion as to why.

Further, the CBO guess for 2011 is likely to be optimistic given the poor growth performance already observed for the US economy this year. But even taking the official CBO data at face value as it stands – we should reflect on what that figure – $US805 billion means.

It represents the extra aggregate spending that is required to generate enough demand for output such that the productive capacity of the US economy would be operating at potential (that is, full employment in the CBO parlance). As noted, true full employment would probably require significantly more spending that that.

I wonder if Eric Cantor has ever thought about what happens to the dollars he spends (which he received from the government payroll) when he visits a shop. As I have noted in the past – I have never been interrogated by a shop employee as to whether I have a public sector or private sector job before they take my money. I doubt that anyone else has ever been confronted about the validity of their money.

Shops record every dollar they receive in the same way – revenue – income – demand for products which they translate into demand for workers to make, serve and deliver the products.

That massive US output gap (probably closer to 8 or 9 per cent) represents a massive daily income loss for the American people. They will never regain the income that is lost every day. It represents better nutrition, better housing, better education, better cars, better recreational facilities, better of everything that the $US can buy – public or private.

The first thing any government should attend to is the minimisation of these foregone national income opportunities. The only way that they can be minimised is if there is sufficient spending – whether public or private. If the non-government sector is not spending sufficiently to minimise the output gap then there is only one sector left to do the job – the government sector.

This is not rocket science – but it is basic macroeconomics.

To take money from Peter to pay Paul when together they are not earning enough overall is a poor economic policy. Until both Peter and Paul are working fully, there is scope for national income gains in real terms. That quest should dominate the US Congress.

Now the mainstream of my profession will claim that if Peter is “taxed” to pay for Paul then Peter will work less and the chances are that total production will not increase. This can also be represented via interest rate impacts – public deficits allegedly drive up interest rates which force firms to invest less – again the public sector crowds out private spending.

There was an extraordinary Wall Street Journal Op Ed this week (August 24, 2011) by Harvard professor Robert Barro – Keynesian Economics vs. Regular Economics – which calls for evidence that government spending adds anything to aggregate demand.

It followed an equally crazy piece last week which I wrote about in this blog – Why the World hates economics. The ground covered is identical. I guess the WSJ decided that the author of the earlier article wasn’t a big enough hitter and so Barro was wheeled in to add weight to the fray.

What the WSJ should have done was commissioned a reply to the earlier article.

Anyway, Barro, who is the modern inventor of the Ricardian Equivalence concept, is up to his usual tricks. Please read my blog – The impossible equation – for more discussion on this point on how RE has failed dismally both empirically and theoretically.

In his most recent WSJ Op Ed, Barro suggests – by his title – that:

Keynesian economics-the go-to theory for those who like government at the controls of the economy-is in the forefront of the ongoing debate on fiscal-stimulus packages. For example, in true Keynesian spirit, Agriculture Secretary Tom Vilsack said recently that food stamps were an “economic stimulus” and that “every dollar of benefits generates $1.84 in the economy in terms of economic activity.” Many observers may see how this idea-that one can magically get back more than one puts in-conflicts with what I will call “regular economics.” What few know is that there is no meaningful theoretical or empirical support for the Keynesian position.

This is the pot calling the kettle black. The correct statement is that “What few know is that there is no meaningful theoretical or empirical support for the the economics that Robert Barro puts forward” – which is at the heart of mainstream thinking.

The 1 for 1.84 refers to the concept of the expenditure multiplier where a worker earns an extra dollar then spends some of it (save a little) and the extra spending then stimulates further demand and so on. Please read my blog – Spending multipliers – for more discussion on this point.

There is a huge dispute over the size of the multiplier and essentially it evades accurate measurement because of the difficulty encountered when one lacks experimental control.

But the overwhelming evidence suggests that it is above one and that tax effects on labour supply in the aggregate are very low.

But Barro thinks otherwise:

The overall prediction from regular economics is that an expansion of transfers, such as food stamps, decreases employment and, hence, gross domestic product (GDP). In regular economics, the central ideas involve incentives as the drivers of economic activity. Additional transfers to people with earnings below designated levels motivate less work effort by reducing the reward from working. In addition, the financing of a transfer program requires more taxes-today or in the future in the case of deficit financing. These added levies likely further reduce work effort-in this instance by taxpayers expected to finance the transfer-and also lower investment because the return after taxes is diminished.

That is an excellent summary of the mainstream position. It is based on the idea that government increase taxes to pay deficits back. The reality is that governments do not pay deficits back. Deficits are flows which cannot be paid back in any meaningful way.

What could be paid back is the stock manifestation of the deficits under current institutional arrangement – the rise in public debt. But while governments do pay back debt as it matures, they rarely pay back debt in total.

Taxes are not used as a tool to pay back earlier deficits. Government usually rely on economic growth to reduce deficits (via the automatic stabilisers) after a cyclical downturn. They may increase taxes if the economy is overheating – that is, pushing beyond the output gap.

Barro would have a hard time explaining the fact that the US government has run deficits 85 per cent of the years between 1930 and 2011 without engaging in the sort of dynamics that he suggests.

Barro think the multiplier story if valid:

… would be truly miraculous. The recipients of food stamps get, say, $1 billion but they are not the only ones who benefit. Another $1 billion appears that can make the rest of society better off. Unlike the trade-off in regular economics, that extra $1 billion is the ultimate free lunch.

How can it be right? Where was the market failure that allowed the government to improve things just by borrowing money and giving it to people?

I would have thought that the market has failed dramatically in the current episode and in many cyclical episodes in earlier periods. The implicit bias that Barro is expressing here is a denial that cyclical swings in the real economy are examples of market failure.

Consistent with this view is the idea that unemployment is voluntary and an optimising outcome of the an individual preference for more leisure and less work. So rising unemployment in this model is an example of the market working – workers examining the real wage (which signals the price of leisure in these models) and deciding it was better to enjoy a day down the beach. Make that months and months and even years for some down the beach.

And when a major recession comes along Barro and Co explain this by millions of workers making the same calculation together – that leisure is preferred and so they quit. All at the same time.

The problem is that the “facts” do not remotely fit the mainstream story. Quits fall in a downturn as redundancies rise which is exactly the opposite to the dynamics embedded in mainstream theory that says recessions are supply-side events.

Please read my blog – BLF – in denial – for more discussion on this point.

The current crisis demonstrates categorically that the claim that the private self-regulating market will deliver optimal and sustainable outcomes is a myth. There has been massive market failure.

Further, the spending multiplier works because there are idle resources which can be brought into productive use by extra spending. Whether it be private or public spending, firms respond to it by increasing real output if there is spare real productive capacity available.

I have never seen any evidence that shows that other workers quit because there is deficit spending boosting aggregate demand. All the survey evidence seeking information about what drives business and consumer confidence point to the state of spending being a crucial positive force in boosting sentiment.

Barro then asserts that:

Theorizing aside, Keynesian policy conclusions, such as the wisdom of additional stimulus geared to money transfers, should come down to empirical evidence. And there is zero evidence that deficit-financed transfers raise GDP and employment …

If the private sector spending increased by $1 tomorrow, nominal GDP would rise by that amount.

If public spending increased by $1 tomorrow, nominal GDP would rise by that amount.

Otherwise, our whole system of national accounting and measurement would be flawed.

Anyway, I am running out of time today.

Here is some of the evidence that suggests that things were better when governments took responsibility for full employment.

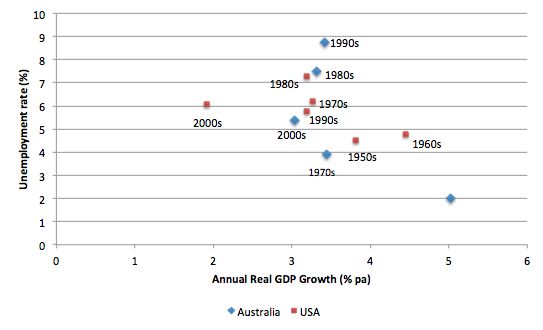

The graph shows the annual real GDP growth (% p.a.) and the unemployment rate (%) for the US (red) and Australia (blue) averaged for the 1950s (US only), 1960s, 1970s, 1980s, 1990s, and from 2000 to now.

The evidence is clear. During the so-called “Keynesian period”, real growth was on average much higher and unemployment rates much lower than in the decades since neo-liberal thinking gained dominance.

I could present broader evidence if I had time (more countries, more measures) but the message would not change. The advanced world performed more strongly in the variables that mattered in the period when there was systematic national government fiscal intervention aimed at maintaining full employment.

Once the “full employability” agenda began (deregulation, privatisation, contracting out, active labour market programs (supply-side), attacks on trade unions, budget austerity, etc) real wages stopped growing in line with productivity, unemployment rose and real GDP growth slowed. Income and wealth inequality also began to increase.

The evidence is unambiguous.

I realise that there is view that the “Keynesian” period was unsustainable and built up inflationary biases that resulted in the next several decades of relatively sluggish growth. I will address that claim in another blog. It also doesn’t stand scrutiny.

Conclusion

The current policy debate is littered with input that is ignorant of even the most basic economics. It is a triumph of ideology over wisdom and the conservative media companies seem hell bent on pushing the misinformation to the detriment of millions.

The Martians must look down on Earth and laugh at how stupid we are allowing total charlatans and ignoramuses to command the main stage.

That is enough for today!

I always enjoyed the wonderful irony of the mainstream argument that paying poor people by increasing benefits makes them work less, but paying rich people more by cutting taxes makes them work more.

I don’t think you need to go any further than that really.

Eric Cantor: U.S. Representative for Virginia’s 7th congressional district.

Eric Cantona: French polymath, and former high-kicking star of Manchester Utd. His foray into economics was contraversial but I don’t think he’s the one you wanted to criticise here.

I must take issue with your reference to ‘Le Roi’ (Eric Cantona) as a dill. I fear that this assumed case of mistaken identity could drive a wedge between Manchester United fans and adherents of MMT.

“It might be that higher tax rates for the rich and lower tax rates for the poor and increased public spending aimed at increasing job creation would be a desirable mix.”

I’m almost certain this would improve the situation. Any policy along these lines would get my vote in a heartbeat.

“Second, why is Eric Cantona such a dill?”

I know he has his quirks, but is this a typo?

“Second, why is Eric Cantona such a dill?”

I don’t think one of my favorite French football stars deserves to be mixed up with a lunatic like Eric Cantor 😉 Cantona certainly wouldn’t be delighted.

“Where was the market failure…?”

Barro shows his ignorance of and/or wilfull blindness to macroeconomics, aggregate demand concepts, the paradox of thrift/over net taxation/underpaid labour…the miracle comes from humdrum utilisation and ‘monetisation’ of unused capital and labour.

Barro says: “Keynesian economics-the go-to theory for those who like government at the controls of the economy…”

That says it all really, doesn’t it? Barro’s entire career has been an ideological mission — not a scientific enterprise. You can see it in the type of work he does. He’s desperate to discredit government and everything he thinks or does reflects this simple ideological bias.

I’ll admit that I’m a fairly ‘big government’ type. By ideology as well as economics. But if I ever caught myself theorising or writing just to make government ‘look good’ that would be it. I’d throw the towel in and just join a political party.

There’s a generation — aging, thank God — of economists in academia and in policy positions that were never open to reason or argument. They read ‘The Road to Serfdom’ when they were young and that was it; every seed of everything they would ever write, think or say was planted at that moment. It’s sad, really.

The title of that article “Keynesian Economics vs. Regular Economics” is hilarious. The clear empirical facts from the historical record are that Keynesian economics WORKED! In any proper nomenclature, Keynesian economics IS regular economics. What is now called “regular economics” (by its own proponents) is not economics at all. It is ideology, snake-oil and balderdash.

Also note that Barro equates Keynesian economics with transfer payments. He doesn’t explicitly say: “Keyensian stimulus is just transfer payments”, but he hints at it.

Of course, the actual stimulus — while wanting — was not, to my knowledge, based on transfers. It was targeted at keeping public sector workers in employment. Barro sets up a strawman, an easy target — transfer payments — and then tears it down. In doing so he gives the illusion that he is in fact tearing down Keynesian economics. It’s a desperate farce really.

But if he’d considered actual Keynesian economics he would have had a harder time with the likes of this:

Barro: “Theorizing aside, Keynesian policy conclusions, such as the wisdom of additional stimulus geared to money transfers, should come down to empirical evidence. And there is zero evidence that deficit-financed transfers raise GDP and employment …”

Note first that he subtly equates ‘Keynesian policy conclusions’ with ‘additional stimulus geared toward money transfers’. Now consider what might have happened to his argument had he included public sector employment — the real ‘Keynesian cure’. Well, he would have had to write: “And there is zero evidence that deficit-financed public sector employment raises GDP and employment…”. Whoops!

Barro is just engaged in misrepresentation here. But you can clearly see what’s going on in his mind. ‘Keynesianism = Welfare State’. That phrase is being played on loop-track in his mind as he writes.

I don’t get this talk about multipliers. Money is free for the govt that is (er, should be) in charge of maintaining full employment. Since the stock of debt can never become a problem, we should print as much as it takes to achieve full employment, the multiplier be whatever it wants to be, even 0.0001.

Worrying about multiplier implicitly assumes money is scrce for the govt that should thus watch its “return on investment”, nonsense.

If at any point in the future the stock of debt proves to big, just tax the money back, what is the problem?

IMHO Barro and the small government crowd don’t want a government so small, society descends into anarchy. They wouldn’t like organized criminal gang warfare we would get in a true Libertarian wonderland….Somalia anyone? They actually want a government right sized to provide for their own personal security and protect the interests of the ruling elites (themselves). The rest of us can go hang as far as they are concerned.

They portray governments as the only entity restricting the liberties of the citizens. How very dare they! They are the ones who perceive themselves as winners in a no holds barred free for all. They hope to impoverish, subjugate and control the bulk of the population. If that is protecting our liberties God help us all.

I wish an elected government to promote an egalitarian, meritocracy with a semblance of equal opportunity at birth. If that means BIG government so be it. We’ve all played monopoly. We know if we join a game with the hotels already on Park Lane and Mayfair we haven’t much of a chance. If we really must have Capitalism, at least find ways to reset the board so we can have a fair crack.

@Phillip Pilkington

I don’t buy the idea that it is a desire for ‘small government’ that drives these disfunctional ideas at all, although I admit they roll it out a lot. I think its pure rhetoric.

You could follow basic Keynsian/MMT principles and still (if you wanted) drown your government in a bathtub; a simple system of unemployment benefits (‘funded’ with deficits, where needed, and using taxation if you were worried about inflation) will do the trick perfectly well, without any need for any government-directed spending or involvement in the economy. It would take one clerk in an office somewhere to go, each month “right : aggregate demand is down a billion, we have a million people on the dole; no worries, set the mail-merge to a thousand dollars and send them all a cheque”.

No, the only rational grounds for wanting to deny the basic principles of macroeconomics is that they want to preserve the privilege of having millions of desperate people begging for jobs, and so need (in democracies) to deny the plain and obvious fact that governments can get rid of it if they want to.

“Small Government” is just a usefull rhetorical device for getting the libertarians and, more imporantly, all the people who feel – often with reason – that governments do nothing but screw them over, to support the program.

@ begruntled

Maybe. But MMT gives a less than desirable view of the capitalist system. It is, in the MMT view, inherently unstable.

Now, take Barro’s ‘New Classical’ view. There you see utopia working itself out automatically through the markets. Now that’s a worldview that someone could shake a stick out.

It’s a moral thing. The ‘New Classicals’ are one step back from the ‘New Keynesians’. The latter have just fallen prey to shabby thinking. The former are the modern equivalent of priests and preachers.

Neil. Great observation. I’m nicking that one just to warn you

Barro is wrong to a point but so is bill Mitchell. The idea that a fall in aggregate demand can simply be substituted by government spending suffers from the same fallacy of composition.

A dollar spent by the government may be the same dollar spent by a citizen, but the government isn’t taking it’s dollar to the same shop that said citizen would have. Whatever structural issue triggered a collapse in aggregate spending isn’t necessarily going to be rectified by spending somewhere else in the economy.

Specifically the government is not buying up houses to prop up the prices and thereby alleviate the need for people to deleverage, spending on bridges and god knows what is at best kicking the can down the road, at worst creating a demand that misallocates resources.

The preference for aggregation validity seems to be underscored by political bias on both sides.

Ron T,

One source of my own confusion about ‘multipliers’ is that MMT veterans, including Bill, use the term to refer to two completely different things. Since they always know, via context, which one they are talking about, they don’t always make the distinction explicit.

The first meaning comes from the (completely erroneous) quantity theory of money, a la Milton Friedman. In this incarnation, the “money multiplier” is the alleged effect of every increase to the economy’s montary base, which increases in the form of bank reserves whenever the government spends money. The money-multiplier is based on the fractional reserve requirement and works like this: the government spends $100 and the fractional reserve requirement is 10%. So the bank with the newly enlarged reserve account keeps $10 to satisfy the requirement and lends out the other $90. The bank where the $90 lands keeps $9 and lends out $81 and so forth until we hit zero. This story concludes that the original $100 results in a many-times-greater increase in the money supply and therefore in the inflationary effect of government spending. But this story is a fairy tale that completely fails to understand real-world bank operations. Banks don’t lend deposits or reserves and their lending is not reserve-constrained in this way.

Bill’s own use of the term ‘multiplier’ (I think he coined it himself) is the very real spending-multiplier. In other words, when the govt spends $100, the *recipient* of the money (not his or her bank) spends all or part of it and, in the latter case, saves the rest. Whatever the money is spent on, the recipient spends it on again, minus the leakages of more saving and also any taxes owed, etc., etc. until it divides to near-zero.

I think one purpose of the discussion today is to distinguish between the two and sort out which is true. When Bill says:

“Barro think the multiplier story i[s] valid”

he is referring to the Q of M “money multiplier”.

When he refers to:

“the concept of the expenditure multiplier”

he is talking about the other one, which he usually just calls the “spending multiplier”

I think the reason for discussing this is to determine how large a combination of spending increases and tax cuts is needed to achieve full employment without overshooting into inflationary territory.

Hope this helps.

Cheers

“I realise that there is view that the “Keynesian” period was unsustainable and built up inflationary biases that resulted in the next several decades of relatively sluggish growth. I will address that claim in another blog. It also doesn’t stand scrutiny.”

I’d be very interested to hear about this. My main worry with full employment spending is that we will run up against oil supply constraints and possibly food constraints (though with food, I think the problem is more in terms of speculation and distribution problems rather than supply) that will lead to high levels of inflation. At the same time, we need to spend more to create an alternative to the oil-based energy economy, which puts us in a bit of a bind.

@ Smith J

Huh?

“A dollar spent by the government may be the same dollar spent by a citizen, but the government isn’t taking it’s dollar to the same shop that said citizen would have.”

Transfer payments — the method of stimulus discussed by Barro and Mitchell — go into citizens hand and are then spent in shops. I think you’ve misunderstood the nature of fiscal stimulus altogether here…

@ Neil.

Your logic is faulty here.

Paying poor people by increasing benefits is paying them for not working.

Cutting taxes for rich people is giving them their money back for (presumably…) work they have performed.

What you could perhaps say is that poor and middle class people should be paid higher wages. Because their productivity has increased enormously in the last decades yet their real wages barely budged.

This would be a line of reasoning that the mainstream would find hard to attack. Why has capitalism failed to provide a reward for its hard and productive workers?

Smith J

“Specifically the government ……. spending on bridges and god knows what is at best kicking the can down the road, at worst creating a demand that misallocates resources. ”

If you do not believe that government spending on specific infrastructure projects encourages growth and jobs, or otherwise misallocates resources, then don’t vote for them – kick them out at the next election. That is the regulating role that democracy plays. This is why I am a big fan of democratic government.

It’s wrong to think that just because government spends money, that automatically it has no positive effect, or is automatically misallocating resources – beyond pure theory, how do you know?

I always smell a rat when neoclassical economists say rising wages are inflationary but will never admit that rising profits are inflationary also. When I buy a product, I have no way of knowing what proportions of its price are wages, other inputs (if any input cost cannot be traced back to wages) or profits. It is clear that if wages/inputs are to go up and profits are to remain the same then the price must go up. It is equally clear that if wages/inputs are constant and profit goes up then the price must increase. If either of these phenomena happen year on year for several years then in the usual course of things (absent certain other preconditions) we have inflation.

In fact, I recall that Adam Smith wrote in The Wealth of Nations that rising profits were more inflationary than rising wages. I don’t fully recall his reasoning for this so please correct me if I am wrong. I think Smith’s reasoning followed the line that wages (and wage inflation) in a finished item were added once at the manufactury. Profit inflation was added several times (thus compounding) as the finished item passed from manufactury to wholesaler to retailer and each level of business added its profit-push inflation. (I am not sure if I have that explanation right. Can anyone correct me on Smith’s reasoning?)

Smith J said: “Whatever structural issue triggered a collapse in aggregate spending isn’t necessarily going to be rectified by spending somewhere else in the economy.”

Would you consider medium of exchange problem(s) to be a structural issue?

Ikonoclast, do you mean profits or profit margin?

I have canvassed the following issue before in another thread of Bill’s blog.

What if an inner capitalist cabal understands Keynes and MMT, understands that MMT in particular is correct and has essentially understood this since 1960 or even earlier? What if it is, and has been, deliberate policy by this cabal to implement monetary policies and run surpluses to impoverish workers by increasing household debt? What if this has been the policy adopted (along with union-busting and privatisation) to reverse worker gains, retrench the welfare state and move back to something resembling indentured labour? Too far fetched? No, I don’t think so.

Objection: “They aren’t that smart.” Well Keynes and the MMT-ers were smart enough to figure out the empirical theory of fiat economics, why would no other intellectual group be smart enough to either figure it out or at least figure out how to appropriate and misuse its insights via a propaganda war and disinformation campaign?

Objection: “They wouldn’t be that Machieavellan.” This objection is just plain naive. Of ocurse they would be that Machieavellan. Do you think that ruling elites who use water-boarding, extraordinary rendition, black prisons, murder, illegal wars, patriot acts and other measures are not going to have a complex set of plans for retrenching the workfare and welfare state and implementing their preferred model, the permanent warfare state?

Objection: “There is no extant evidence of such planning.” Actually there is. The “Omega Project” of the Adam Smith Institute (ASI) was just such a plan.

“The ASI recruited Douglas Mason, another St Andrews alumnus and member of the university’s Conservative Association,[8] who did his most influential work for the Institute. Mason became one of its regular authors,[9] and, in 1982, led the ASI’s Omega Project report, which argued in favour of the compulsory contracting-out of most local services such as refuse collection, the replacement of the welfare state by private insurance, and further privatisation of public sector services and industries, including aspects of the police force.[10][11][12]” – Wikipedia.

At a deeper level than the Omega Project (which openly talked about retrenching the welfare state), it is likely (in my view) that a fuller plan existed to end the Keynesian era, reverse democractic gains in the West and impoverish and re-indenture workers in some fashion. It is clear that the ASI and the Omega Project were and are a “conspiracy in the open” against workers, against democracy and against the public good. To think that there were not more plans and more secret plans behind the Onega Project is again to be naive. As it is, the ASI is now very coy about even about the Omega Project which was semi-public at one time. It is very difficult to find information about it on the web, even on the ASI site.

I am sorry Fed Up, I am not sure. Please give me your definitions of profit and profit margin. My definition of profit (as before tax profit) is Total Business Income minus all Costs of Wages and Other Inputs. I thought it was self-evident that this was profit. By profit margin do you mean a percentage?

If I was imprecise then I mean profit xor profit margin (xor is the boolean “exclusive or” which means either one or the other but not both) whichever suits Smith’s argument properly.

Ikonoclast and quick definition, profit would include Q sold, profit margin would not (markup over cost on each “unit”).

A couple of definitions to clarify my posts above. By “profit” I meant total profits not profit margins.

By “workfare state” I meant a state where the government is the reserve employer who reduces unemployment to the bare minimum (about 2% frictional unemployment) and sets a fair mimimum livable wage by doing so. This wage (singly) would be enough to fully support a family of four with all reasonable costs covered including food, clothes, education, transport, common household amentities plus rent or mortgage payments. I did not mean the debased Nixonian definition of “workfare”.

“I have canvassed the following issue before in another thread of Bill’s blog.”

In substance you’re right, of course. But they just think that this is the right thing to do. They think that this will provide more prosperity. After all, no-one could possibly see themselves as the ‘bad guy’.

Don’t usually quote the J-man, but:

“Father, forgive them; for they do not know what they are doing.”

That their system is currently crumbling is encouraging though. David Cameron is the last of the Thatcherites in Britland. After him nothing they say will make sense. As for the US? Well, I’m not so sure. They’ve all gone a bit la-la over there. But maybe there’s hope.

Jose: re. Tax cuts for the rich, I think Neil might be referring to another prediction of classical economics, which is that as people earn more income, they will desire to spend it on greater quantities of superior goods – of which leisure time is one. So the tax cuts should make them want to work less.

Philip said, “They think that this will provide more prosperity.” I think the operative sentence is “They think that this will provide more prosperity for themselves.” They (the right wing super rich) don’t care about anybody else or anything else. So billions of starving poor and the wrecking of the biosphere don’t count one iota with them. It’s like the old grim humour joke about suffering. “I am totally impervious to suffering. I can inflict it all day.”

@Phillip

“But MMT gives a less than desirable view of the capitalist system. It is, in the MMT view, inherently unstable.”

I can’t agree with this. Quite the opposite; I think MMT demonstrates (as Keynes did) that Capitalism can be quite stable – it just tends to achieve stability at an appallingly innefficient level of unemployment. Further, I think the essential insight of MMT is that this tendency can be quite easily rectified through fiscal policy (I won’t say “transfer payments”, since that implies that government spending is somehow funded by taxation), leaving the actual spending decisions in the hands of the private sector.

Which is not to say I think capitalism is a good idea 🙂 Like Bill – and I suspect yourself – I am privately inclined to think there are much better ways of organising things. But I don’t think that follows from the theory of MMT at all, which is much more a case of saying (to quote from Yes Minister)

“If you must do this damn silly thing, don’t do it in this damn silly way.”

begruntled,

Brilliant quote.

Yes Minister. Over thirty years old and still describing the world accurately.

A central plank of MMT-Chartalism is that deficit spending increases net financial assets and therefore Keynes is wrong.

But in a non-Chartalist view of money, Bond sales are a public liability and therefore deficit spending creates no net new financial assets and Keynes was right.

QE in a non-chartalist view, removes public liabilities.

But in a Chartalist view there are no public liabilities to be removed and Keynes was wrong.

Dear Mr. Mitchell,

Some of those rich Europeans are suggesting a higher -wealth- tax, while this won’t solve the problem (i do understand a bit of MMT by now), don’t you think this is one of the best taxes to raise to decrease the wealth gap and not affect aggregate demand too much?

Thanks yet again for the best blog on the internet!

Sincerely,

HarPe

As a reply to some commentators on this post:

How do we define capitalism? Can there be a mixed economy in a capitalist system, or does it have to be pure? To me, capitalism is a market system with no a state to interfere. A socialist system is a social system with no a market to interfere. That’s how i define them. Can it be capitalism, if capital doesn’t rule entirely, but the people have a vote? All countries today have both a planned and a market economy, so can this be capitalism?

Not that i believe in this capitalism. It’s the most ridiculous idea that if everyone just gets to do exactly what they want without anyone interfering, everything will be fine. Neither do i believe in a wholly planned economy, even if competently managed. Soviet had classes too, though they were defined in personal relations and education and not in assets or wages or capital gains.

@Andrewjudd

“A central plank of MMT-Chartalism is that deficit spending increases net financial assets”

I don’t know about Chartalism, but MMT says nothing of the sort. Quite the opposite, the whole point of MMT is that net financial assets are always zero.

MMTers agree with Keynes that deficit spending increases net *private sector* assets, by increasing *public sector liabilities* by precisely the same amount. They would add that this is true whether or not the deficit is matched by bond issuing.

And they would say that, since debt isn’t any sort of burden to states, and since someone has to be in debt for anyone else to have a financial asset, the government should take on debt to match the private sectors net desire to save.

Begruntled, surely the MMT point is that after the goverment creates its own “debt” by deficit spending, it can annul this debt ie make it dissappear. In fact, depending on the precise financial accounting mechanics it decides to use, it doesn’t even have to create debt, it can just “print” money. In these days “print”money means press a button and credit dollars to a private entity.

I’d never heard the term Fallacy of Composition before I started reading your blog a few days ago. It occurs to me this is one of the major flaws of right libertarianism: its assumption that the rational choices made in individual transactions translate to the aggregate and to national policy. Am I understanding this correctly?

Ben Wolf:

The Fallacy of Composition is the idea that an individual virtue can become a collective vice if everyone does it. The two examples I’ve heard are saving and wage cutting.

When a person saves more, good for them – it’s sound financial planning. But if everyone starts saving more (by spending less), then retail sales drop, stores fire workers or stop buying inventory, and a recession begins.

The other example is companies paying their workers less. They make more profit per widget then – good for the company. But if all companies cut their wages, workers have less money to buy stuff, and the company’s sales drop. A recession occurs.

I’m still having trouble fitting in the ” tax the rich” sentiment if the taxes do not make up any Gov. expenditures.

Don’t get me wrong, I would tax the rich till they wept but that wouldn’t take much would it.

It takes money out of the private sphere but where does it go?

Given it is savings/investment and not actively being spent what good does it do to get it back aside from just not letting the rich have it?

Taxing the rich makes for good policy.

The question that should be asked is how many government officials should one man of means be allowed to purchase? Limiting the money controlled by one person should be put on the same level of importance as limiting the weapons of mass destruction available to one person.

Concentrated wealth puts too many people under the command of one who is not accountable to democratic processes and who may not be displaced when it is demonstrated that he does not merit that kind of command over society.

mickey9fingers

Burning taxes and then spending the same amount of money you just newly printed has no monetary difference at all – it is the same thing as not burning the taxes.

Therefore taxation of 1Billion enables spending of 1Billion for the same monetary impact for either method

Or alternatively of course you can say i can print up 100B in spending if i burn 100B in taxes for the same monetary impact.

The MMT debate seems mainly a debate on how best to either control inflation, or if inflation targeting is a good idea, or if are there better more equitable methods of controlling inflation. The spending versus taxation methodology thing seems a total red herring amounting to nothing at all that just confuses and offers nothing – unless a person does actually believe a government cannot just print up the spending to any amount they desire – constantly emphasising it offers nothing of substance to change our world.

The pot calling the kettle black still acknowledges the kettle is, indeed, black. It just shows the pot’s lack of self-awareness of it sown blackness, as it were. I think a different turn of phrase is in order. May I suggest, “This is a g-d damned lie?” And yes, I realize Professor Mitchell is a better person than that and would never print such a thing. But I’m willing to call a spade a spade, or a dishonest hack a dishonest hack. Harvard Professor indeed.

Isn’t Barro’s problem regarding the spending multiplier the fact that he’s confusing money with economic activity? That seems really poor reasoning on the part of an economist.

Andrewjudd: Burning taxes and then spending the same amount of money you just newly printed has no monetary difference at all – it is the same thing as not burning the taxes.

Spending and taxing is not about monetary differences but about regulating economic activity. Ideally you tax where economic activity is low while monetary surpluses are high (e.g. savings of rich people) and spend where economic activity is high while surpluses are low (e.g. spending of poor people). Additionally you also tax where economic activity is too high relative to economic capacity.

Has Keynes copped a bad rap? Did he recommend spending until the country is bankrupt? Someone stated we can repay the debt by taxing more. If so, why is that not being done? I think that it is an accepted economic principle that “excessive” taxation is a disincentive to earning more income. Likewise, free money is a disincentive to earning any. Government stimulus has a lot in common with dropping money from a helicopter. The thing is, that it must eventually be repaid, and obviously not entirely by the recipients. When we have accumulated deficits around the 100% of GDP level, that is Keynesianism gone mad.

What we have seen thus far is pursuing central bank policies to solve something that they are obviously not solving. They have been complicit in the deficit spending by keeping interest rates down and printing money. The USA is still the world superpower, and that is assisting by virtue of the rates staying so low. The problems are manifest in high unemployment and excessive government debt. The government is spending too much and industry is not active enough in manufacture and services. The consumer is not consuming enough because they cannot afford to. House prices are low because the economy is weak. Obviously the economy has become structurally unbalanced and this has not been solved by massive monetary and fiscal activity. No doubt there are many reasons, some of which I have mentioned, but another is off-shoring. There are many things to be addressed, but the answer to that particular one is fairly obvious.