I started my undergraduate studies in economics in the late 1970s after starting out as…

We need to read Karl Marx

I know it is fashionable these days, particularly on the left to claim that class is dead – that its not about class any more – that left-right is dead – etc. But there was an interesting Bloomberg article (August 29, 2011) – Give Karl Marx a Chance to Save the World Economy – by one George Magnus, who is listed as a senior economic adviser at UBS Investment Bank. Confused? Why would a banker invoke the thoughts of the long-dead and usually vilified (by bankers) philosopher? For me it is always a normal part of thinking to go back to Marx because his dissection of capitalism – the sources of profits and the importance of seeing beyond the superficial exchange relations and thus understanding class relations embedded in production – has not, in my view, been bettered. And now a banker is suggesting that need to read Karl Marx.

Even so-called progressives these days, think it is fashionable to claim that class is dead – that its not about class any more – that left-right is obsolete – etc.

I recall a US PBR Interview earlier this year with the Democrat-leaning founder of the Huffington Post said, in response to a question about political perceptions of the now AOL-owned site, that:

… I’m tired of hearing myself say — it’s time for all of us in journalism to move beyond left and right. Truly, it is an obsolete way of looking at the problems America is facing.

I guess it would be if you had made millions on the back of free labour. But that is a typical position these days. The conservatives, of-course would always argue that because they seek to obfuscate the workings of the class hierarchy.

They have a vested interest in developing the “free market” myth where we are all, essentially, free traders and own-producers at heart who agree (aided by market forces) to specialise into labour suppliers or capital providers. The myth continues that we are all free traders – everything is voluntary and all exchanges are mediated by market prices which deliver equalised use values to each exchanger to be enjoyed upon completion of the same.

I clearly do not hold that view – that left- and right-wing is an obsolete dichotomy. While I think the dichotomy can be enriched by adding another axis to form a quadrant (for example, Politicial Compass), the left-right axis still has relevance.

The free market – everything can be understood at the exchange level – view falls in a hole when we focus on the labour market. After all, workers do not sell labour – they rather sell labour power (the capacity to work). That immediately invokes a managerial imperative. Why? Answer: because the use-value of the labour power is enjoyed (extracted) within the actual exchange (that is, while the workers are still at work). The use-value – the source of profit – is uncertain and a control function is indicated.

Bosses have to control the realisation of that use value as production in an environment where the majority of workers would rather not be there. That is a very different dynamic environment to one where we go into a shop and buy a trinket to be enjoyed later.

Essentially left and right, for me, is about class dynamics and I am using class in the Marxian sense here. I know there are complex layers over the basic capital-worker distinction and certainly these layers are exploited by the power elites to obscure them further (for example, gender, sexuality, race etc) but when push-comes-to-shove the struggle over the distribution of income arising from production is still highly significant.

We cannot really understand the crisis unless we understand the underlying class dynamics. Sure enough I usually say that the crisis is the result of poor government policy and a failure to employ the fiscal tools at the disposal of governments in an appropriate way. But the question that follows is WHY?

Why are our governments coming under pressure to tighten fiscal policy when it is clear that more spending is desperately required and it doesn’t look like it will come from the non-government sector?

Getting real – how is it that the political debate is being swamped by those who want large spending cuts at a time when unemployment and underemployment in the largest economy is moving close to 20 per cent?

How is it that we ignore the fact that every day, millions of workers are slowly or less slowly exhausting all the wealth that they had built up over their working lives just to live a basic life because their incomes have dried up through lack of work?

How is it that people who say that unemployment benefits should be cut now when for millions they are the only lifeline can even be taken seriously?

How is it that when the major investment banks of Wall Street (and elsewhere in other nations) – who had acted with as much regard for the law and civil society as the bootleggers and dope dealers of the prohibition period – looked like going broke as their bets exploded in their faces – could the government, within hours, announce massive bailouts – yet something as basic as creating public jobs at a minimum wage is deemed unaffordable?

How is it that thousands of criminals are still turning up for work each day in the financial sector and extracting massive bonuses for performing totally unproductive work when thousands of poor (black) individuals are being imprisoned every day for minor crimes against property and usually against their own kind?

Anyway, what has Marx got to do with all of this?

George Magnus says that:

Policy makers struggling to understand the barrage of financial panics, protests and other ills afflicting the world would do well to study the works of a long-dead economist: Karl Marx. The sooner they recognize we’re facing a once-in-a-lifetime crisis of capitalism, the better equipped they will be to manage a way out of it.

This is being said by an advisor to an investment bank and is being published by Bloomberg.

The basis of Magnus’ call for us all to read Marx lies in his view that, while the “wily philosopher’s analysis of capitalism had a lot of flaws … today’s global economy bears some uncanny resemblances to the conditions he foresaw”.

I have been involved in my share of arcane debates about what Marx said and whether we can reinterpret his predictions (falling rate of profit etc) to make them square with the facts. Whatever utility we might get from those rather in-crowd debates, the bottom line is that the basic insights of Marx are still of relevance.

And in noting that we should start with reinstating attention to class.

George Magnus says:

Consider, for example, Marx’s prediction of how the inherent conflict between capital and labor would manifest itself. As he wrote in “Das Kapital,” companies’ pursuit of profits and productivity would naturally lead them to need fewer and fewer workers, creating an “industrial reserve army” of the poor and unemployed: “Accumulation of wealth at one pole is, therefore, at the same time accumulation of misery.”

George Magnus then relates that insight to the current situation in the US “particularly” where “U.S. Companies’ efforts to cut costs and avoid hiring have boosted U.S. corporate profits as a share of total economic output to the highest level in more than six decades, while the unemployment rate stands at 9.1 percent and real wages are stagnant”.

I have written before about who has benefitted from the nascent growth in the US since the crisis began. Please read this blog – The top-end-of-town have captured the growth – which categorically shows that the employed workers have not enjoyed real wages growth while profits have soared and the growing ranks of the unemployed and underemployed have not enjoyed anything.

The neo-liberal period – crisis included – has been an attack on the conditions of workers and the suppression of the lower ends of the income distribution. In this blog – The origins of the economic crisis – I outline how deregulation has dramatically altered the distribution of national income over the last 30 years in the advanced nations with governments being the facilitators.

George Magnus says that in addition to rising profits and entrenched unemployment:

U.S. income inequality, meanwhile, is by some measures close to its highest level since the 1920s. Before 2008, the income disparity was obscured by factors such as easy credit, which allowed poor households to enjoy a more affluent lifestyle. Now the problem is coming home to roost.

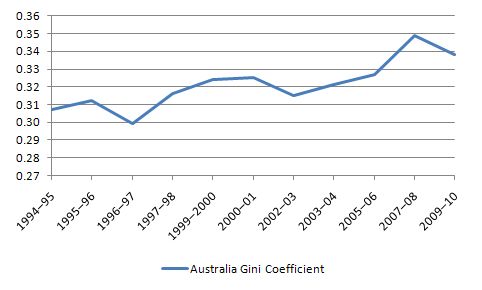

Interestingly, the Australian Bureau of Statistics released the latest data today for Household Income and Income Distribution, Australia, 2009-10 which allows us to see the impact of the crisis (partly) on income inequality.

This graph plots the Gini Coefficient (which the ABS say is “a single statistic that lies between 0 and 1 and is a summary indicator of the degree of inequality, with values closer to 0 representing a lesser degree of inequality, and values closer to 1 representing greater inequality”) for Australia from 1994-95 to 2009-10.

To put it in perspective, the values for the US and the UK would be “off the top” of the graph. But the so-called “egalitarian” land of Australia (a myth that is embedded into us as school children) is becoming more like the US every year. There was some respite during the crisis but the trend is clear.

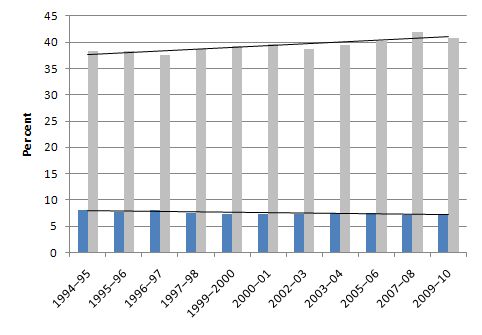

The ABS show that the bottom quintile (20 per cent) of the income distribution receive 7.1 per cent of total income, the next quintile (20-39 per cent) receive 12 per cent; the next quintile (40-59 per cent) receive 16.9 per cent, the fourth quintile (60-79 per cent) receive 23.3 per cent; and the top quintile receive 40.8 per cent of total income.

The ABS also show that the wealth distribution:

… is much more unequal than for income … 20% of households with the lowest net worth accounted for only 1% of total household net worth, with an average net worth of $31,829 per household … The wealthiest 20% of households in Australia account for 62% of total household net worth, with an average net worth of $2.2 million per household.

The US income and wealth distributions are more skewed than this.

The next graph shows the shares in total household income of the bottom (blue columns) and top (grey columns) quintiles of the income distribution. The black lines depict the linear regression trend of each of the series and the direction is obvious.

This data is consistent with the dramatic shifts in factor shares in national income. The data above is focused on the household unit. Factor shares is based on “class” in that it considers wage and profit income. The two distributional perspectives are tied together and offer different views of the same underlying trends (with some complexities).

One of the characteristic features of the last thirty or so years has been the dramatic rise in the profit share (and the commensurate fall in the wage share).

The assault on regulation and the attack on workers’ rights brought about a growing gap between labor productivity and real wage growth. The result has been a dramatic redistribution of national income toward capital in most countries. For example, in the G7 countries between 1982 and 2005 there was a 6 percent drop in the share of national income paid as wages (as opposed to interest or dividends). This was a global trend.

In the past, real wages grew in line with productivity, ensuring that firms could realize their expected profits via sales. With real wages lagging well behind productivity growth, a new way had to be found to keep workers consuming. The trick was found in the rise of “financial engineering,” which pushed ever increasing debt onto the household sector.

Capitalists found that they could sustain sales and receive an additional bonus in the form of interest payments-while also suppressing real wage growth.

Households, enticed by lower interest rates and the relentless marketing strategies of the financial sector, embarked on a credit binge.

The increasing share of real output (income) pocketed by capital became the gambling chips for a rapidly expanding and deregulated financial sector.

Governments claimed this would create wealth for all. And for a while, nominal wealth did grow-though its distribution did not become fairer. However, greed got the better of the bankers, as they pushed increasingly riskier debt onto people who were clearly susceptible to default. This was the origin of the subprime housing crisis of 2007-08.

This is what George Magnus is referring to when he talks about how “easy credit, which allowed poor households to enjoy a more affluent lifestyle” obscured the underlying inequality dynamics.

George Magnus further invokes Marx when he talks about the “Over-Production Paradox”:

Marx also pointed out the paradox of over-production and under-consumption: The more people are relegated to poverty, the less they will be able to consume all the goods and services companies produce. When one company cuts costs to boost earnings, it’s smart, but when they all do, they undermine the income formation and effective demand on which they rely for revenues and profits.

This problem, too, is evident in today’s developed world. We have a substantial capacity to produce, but in the middle- and lower-income cohorts, we find widespread financial insecurity and low consumption rates. The result is visible in the U.S., where new housing construction and automobile sales remain about 75% and 30% below their 2006 peaks, respectively.

As Marx put it in Kapital: “The ultimate reason for all real crises always remains the poverty and restricted consumption of the masses.”

This has been a topic that I have spent a lot of time thinking and writing about. We cover it in our 2008 book – Full Employment abandoned.

Keynes used the inability of the Neoclassical economists to explain the reality of the 1930s to introduce the concept of involuntary unemployment. Understanding the meaning of involuntary unemployment requires a prior understanding of how the concept of effective demand was introduced into the analysis. The aim was to negate the Classical view that the real outcomes of the economy were determined by the full employment equilibrium achieved in the labour market. In other words, aggregate demand – or more correctly – effective demand matters.

Post Keynesians typically begin with Keynes’ General Theory (1936) in explicating the principle of effective demand. However, the essential elements underpinning the critique of Say and the modern understanding of involuntary unemployment in a monetary capitalist economy can be found in Marx, particularly in Theories of Surplus Value (1863).

Particularly in Chapter 17 there are various discussions about the Classical (Ricardian) denial of the possibility of generalised overproduction and how that erroneous view is based on the idea that products exchange against products. This is at the heart of Classical neutrality which ultimately is the modern version of the claim that fiscal and monetary policy cannot favourably alter real conditions in the economy.

In Theories of Surplus Value Vol 2, Chapter 17 (para 705) we read:

The conception (which really belongs to [James] Mill), adopted by Ricardo from the tedious Say (and to which we shall return when we discuss that miserable individual), that overproduction is not possible or at least that no general glut of the market is possible, is based on the proposition that products are exchanged against products, or as Mill put it, on the “metaphysical equilibrium of sellers and buyers”, and this led to [the conclusion] that demand is determined only by production, or also that demand and supply are identical. The same proposition exists also in the form, which Ricardo liked particularly, that any amount of capital can be employed productively in any country.

Marx really laid into Say. This paragraph also highlights why the use of “barter economy” examples is deeply flawed. A monetary economy has dynamics that are not captured in a barter world where products exchange against products directly.

If we mapped the current conservative (neo-liberal) position (and most of mainstream economics) back into the classical propositions that Marx was attacking we would find the correspondence to be close to 100 per cent in terms of concepts and implications.

They were wrong then and by logical extension they are wrong now.

The existence of a circuit breaker in the form of idle money stocks (recognising that money is more than a means of exchange but also an independent form of commodity) led Marx to conclude that there was the possibility of stagnation (defined as a conflict between purchase and sale) – (see Theories of Surplus Value Vol 2, Chapter 17, paras 710-711).

Interestingly, in TSV (Vol II, Ch XVII, para 712) Marx also anticipated the modern distinction between nominal and effective demand which lies in the understanding of the real contribution of Keynes. Marx noted that in denying the possibility of a general glut, Ricardo appeals to unlimited needs of consumers for commodities and any particular saturation would be quickly overcome by increased demands for other commodities.

He then (TSV, Vol II, Ch XVII, para 712) rhetorically asked for an explanation of the connection between ‘over-production’ and ‘absolute needs’ and indicated that capitalist production and quotes Ricardo’s denial of the “possibility of a general glut in the market”:

Too much of a particular commodity may he produced, of which there may he such a glut in the market, as not to repay the capital expended on it; but this cannot be the case with respect to all commodities; the demand for corn is limited by the mouths which are to eat it, for shoes and coats by the persons who are to wear them; but though a community, or a part of a community, may have as much corn, and as many hats and shoes, as it is able or may wish to consume, the same cannot be said of every commodity produced by nature or by art. Some would consume more wine, if they had the ability to procure it. Others having enough of wine, would wish to increase the quantity or improve the quality of their furniture. Others might wish to ornament their grounds, or to enlarge their houses. The wish to do all or some of these is implanted in every man’s breast; nothing is required but the means, and nothing can afford the means, but an increase of production …

Marx retorted:

Could there be a more childish argument? It runs like this: more of a particular commodity may be produced than can be consumed of it; but this cannot apply to all commodities at the same time. Because the needs, which the commodities satisfy, have no limits and all these needs are not satisfied at the same time. On the contrary. The fulfilment of one need makes another, so to speak, latent. Thus nothing is required, but the means to satisfy these wants, and these means can only be provided through an increase in production. Hence no general overproduction is possible.

What is the purpose of all this? In periods of over-production, a large part of the nation (especially the working class) is less well provided than ever with corn, shoes etc., not to speak of wine and furniture. If over-production could only occur when all the members of a nation had satisfied even their most urgent needs, there could never, in the history of bourgeois society up to now, have been a state of general over-production or even of partial over-production. When, for instance, the market is glutted by shoes or calicoes or wines or colonial products, does this perhaps mean that four-sixths of the nation have more than satisfied their needs in shoes, calicoes etc.? What after all has over-production to do with absolute needs? It is only concerned with demand that is backed by ability to pay. It is not a question of absolute over-production-over-production as such in relation to the absolute need or the desire to possess commodities. In this sense there is neither partial nor general over-production; and the one is not opposed to the other.

Note the reference to the capitalist market being “only concerned with demand that is backed by ability to pay. It is not a question of absolute over-production – over-production as such in relation to the absolute need or the desire to possess commodities.”

I urge you to read the whole section in Theories of Surplus Value because its wisdom lies at the heart of the modern problem of high unemployment and stagnant growth. Keynes didn’t offer much more than you can find in this work by Marx.

George Magnus says that the message of Marx in the current crisis is that:

… policy makers have to place jobs at the top of the economic agenda, and consider other unorthodox measures. The crisis isn’t temporary, and it certainly won’t be cured by the ideological passion for government austerity.

He lists “five major planks” for revival:

1. “we have to sustain aggregate demand and income growth” and governments “must make employment creation the litmus test of policy”.

2. “lighten the household debt burden”. He thinks governments should assist low income households to “restructure mortgage debt, or swap some debt forgiveness for future payments to lenders out of any home price appreciation”. In this 2009 blog – When a country is wrecked by neo-liberalism – I outlined a desirable policy initiative to help home-owners who were facing eviction from their homes because they could no longer service their debts. It is similar to that being advocated now by George Magnus.

3. help banks “to get new credit flowing to small companies, especially” by relaxing capital adequacy rules and direct public “spending on or indirect financing of national investment or infrastructure programs”. The exact nature of the intervention is disputable but the intent is not. The solution must see aggregate demand being stimulated and with flat non-government spending, the responsibility for pushing the spending out lies with the government.

4. “to ease the sovereign debt burden in the euro zone, European creditors have to extend the lower interest rates and longer payment terms recently proposed for Greece”. While this would provide temporary relief it doesn’t get to the heart of the matter which is the flawed (and dysfunctional) design of the overall monetary system. Such “relief” would not solve the inherent problem.

5. “to build defenses against the risk of falling into deflation and stagnation, central banks should look beyond bond- buying programs, and instead target a growth rate of nominal economic output”. I do not support the central bank being a major player in counter-stabilisation policy. I will write about this in more detail another time.

Conclusion

I found it interesting that a person who advises the financial markets would suggest that Karl Marx retained relevance. It is clear that capitalism has reached a crisis point after 3 decades of deregulation, privatisation, welfare cuts etc were argued would optimise its performance. It was clear that all this neo-liberal legislation did was to push more power to capital, redistribute real income away from the workers, and reduce the political capacity of governments to use fiscal policy and regulation to mediate the class struggle and sustain full employment.

Capital has never like full employment. Marx knew that. The last thirty years or so has seen the gains made by workers and their unions over a century of struggle eroded away by the relentless attack on their rights and conditions.

The class struggle is alive and dominant this crisis.

I should add that today in the Murdoch Press in Australia there are articles starting to appear which blame the unions for the crisis and claim that the Australian government’s decision to retract some of the worst industrial relations laws that the previous conservative government had enacted which gave massive power to the employers has also caused our economy to slow down. Stay tuned for more of these sort of “class based” attacks.

That is enough for today!

(Re) Tweeted to Joey Barton and Stephen Fry, so that’s possibly 3.5 M people who might learn something vital! 😉

To back what Bill writes, I want to take up the theme of what it feels like, as an individual thinking citizen, to live in our current society, a society where neoliberal economics and the needs of the wealthy elite rule everything. I am recently retired but I retain plenty of memories, thoughts and feelings about work. What I say here is equally true of how I feel now and how I felt in the last fifteen years of my working life.

I feel disaffected, alienated and powerless. I feel that my citizenship and general membership of this society is functionally useless and pointless. I feel that the whole direction of my society is meaningless and indeed worse than meaningless. It is destructive of environmental and individual human worth. I have no influence over the direction of my society just as I had no influence over the direction of my workplace when I worked. Our whole society and system seems to have a “logic” (or rather an illogic) and momentum of its own which individual citizens have no influence over. I mean individual citizens other than those belonging to the small, wealthy and powerful vested interest class.

At work (Federal Public Service), I watched as managerialism took over and managed us around in circles for fifteen years. I complained at times and pointed out the illogic and pointless circuitous nature of the progressive reorganisations. I pointed out how we had no organisational memory and kept cycling through failed management theories and initiatives from past years, often in cycles as short as three years. Any sugestion that I was an atypical malcontented type does not hold water. The best educated, best adjusted personalities and most enlightened thinkers amongst my peers and line managers were in most part as marginalised as I was. Those in charge at management level were generally less well educated in any formal sense, clearly had less capability in written language skills, report writing skills, mathematical skills and conceptual, logical and analytical skills. In addition, their organisational and people management skills were usually mediocre to poor.

The one characteristic that these organisationally successful people had was some level of “political” skill. This skill seemed to consist mainly of the ability to always support and be obedient to the “party line”; the party line in this case being the political and managerial ideology of the day and the particular (usually inane) initiatives being pushed at any particular time. It never seemed to matter to these people that a current round of re-organisation initiatives was diametrically opposed to those implemented only a few years ago. If this was pointed out, reactions varied from slightly discomfited to angry and overbearing. Excuses were produced that the situation was different now (though it was not logically explained how the situation was different) or more blatantly it was said that it had to be done and that workers at my level could not question it.

The key component of this condition, which seems general in our society now, is that corporate conformist power structures triumph over logic and equity. (Not only were the tenets of logic offended by many of the initiatives, the tenets of social equity for both workers and citizens were also offended on any reasonable judgement.) What has happened to our society that parochial ignorance and narrow sectional self-interest (witness the Murray-Darling fiasco) triumph over rational, scientific and logical policy that is also the best policy for social equity and sustainability? What has happened to our society that neoliberal economic prescriptions, corporate managerialist conformism and adherence to continually failing policies (failing on any objective measure) triumph over rational, scientific,logical and humane policy?

What is the source of this power based apparently on ignorance, conformism and amnesia about the lessons of the past which allows it to so triumph? There is a deep malaise in our society and system, which manifests itself in the stubborn survival of failed “solutions”, stubborn adherence to failed and inhumane policy (ten years and counting in the Iraq and Afghanistan to achieve nothing but the mass slaughter and impoverishment of mainly innocents and non-combatants) and stubborn refusal to address or even admit real problems like climate change and resource depletion.

And this brings me full circle. I feel alienated, disaffected and powerless. This has all been going on for far too long. Do we have to have a catastrophic crisis before anything changes (and even then not necessarily for the better)? Apparently so.

Hi Ikonoclast,

For me, I am not here to fulfill ‘society’ or try and find my fulfillment in society. I am a human being – that means I have a heart that needs to be fulfilled. And a mind that needs to be clear. I came into this world alone, and having enjoyed the company of many wonderful people, none can leave with me.

There are 6.9B people on the planet, and billions and billions more have come and gone, will come and go – mostly without a trace after a few generations. It is never about the society; it is always about you! Only you can fulfill yourself and only you will know when you are full! Wisdom says, enjoy each day! If you can leave behind a little memento like the MMT guys are working on – good for you and them …. but as they say, even good works can bind if you’re not free!

You and I are both aging; if I stand on a beach to watch the sunrise and look West I will feel some warmth on my back and see the play of light as the shadows draw away – if I turn around I will appreciate the source of Life (however I understand it and feel it and appreciate it). The rest is a story. Dance on their heads!!

Well, at least I’m old enough to say stuff like this and hopefully get away with it!!

Cheers ….

jrbarch.

Another key difference between at trinket you buy and labor is that the trinket can demand its price and doesn’t care of you walk away. A worker doesn’t have that power and faces starvation or some other form of deprivation if they refuse a wage that’s at least enough to feed them. It’s sad that you can see acknowledgement of this, not only from more liberal economists, but also from conservative luminaries such as Friedman and Hayek, yet the smug superiority that Objectivism offers seems to have drowned out any acknowledgement of that, fact, even from those that otherwise claim to not subscribe to it.

Educated people all over the world are opening their ears to new, better ways of thinking about the economy. The time is ripe for the revolution — at least in the sphere of economic theory. And Bill Mitchell and his readers are among the agents of this revolution — proletarian economic theorists!

Just so there’s no mistaking that this “just happened” to be written by someone from UBS, note the nice glossy 13-page UBS publication (16 August 2011) by the same author, “The Convulsions of Political Economy“, which leads off with this quote from Marx:

I’ve been waiting for an appropriate blog to ask some questions I’ve had for a while. Given the increasing (and overwhelming) share of income that is flowing to people who are more likely to save it than spend it, doesn’t this make deficit spending correspondingly less effective both for stimulating the economy and for creating new jobs? Similarly, doesn’t the acceleration of productivity investment that many companies have been making during the recession allow them to absorb more of any increase in aggregate demand that results from deficit spending without the need to create as many new jobs? Is there any metric that measures the changing effectiveness (in terms of producing new jobs) of various sorts of deficit spending given these changing factors? These considerations keep driving me back to government as employer of last resort as perhaps the only plausible solution to our economic problems and I’m very afraid that this is politically unlikely.

“There are 6.9B people on the planet, and billions and billions more have come and gone, will come and go – mostly without a trace after a few generations. It is never about the society; it is always about you! Only you can fulfill yourself and only you will know when you are full! Wisdom says, enjoy each day!”

No, it’s not just about me. I do not live in a vacuum. My life revolves around my family, my community, and my colleagues. We are social creatures, and I, for one, cannot sleep when so many suffer and live in misery.

@Ikonoklast;

Regarding: “Do we have to have a catastrophic crisis before anything changes (and even then not necessarily for the better)? Apparently so.”

In a sense, I think this is always true. Karl Marx certainly did, and that was what his generation thought all revolutions were – spontaneous popular revolts against unbearable conditions. I agree with good old Karl that the capitalist system’s inherent susceptibility to various kinds of crisis and slump is what moves it, almost tectonically, toward some economic form that must ultimately transcend it. But we’re light-years away from that. The most any of us alive today can hope for is that we might restrict the tendency of modern-day financial capitalism to destroy the resource base of our worldwide industrial civilization, and thus condemn future generations to lives far more uncomfortable than ours.

When I can’t think of anything else in the world that makes me want to defy the odds you so eloquently invoke – I think of that.

Cheers

YES!!! Disagree or agree with Marx is one issue but to deny that he was possible one of the greatest minds of the 19th, 20th, and possibly the entire modern era is without a doubt.

It is amazing to see a banker call for Marx. wow.

Marx understands modern society more thoroughly then well modern society itself! He’s a must read for any honest intellectual.

“… I’m tired of hearing myself say – it’s time for all of us in journalism to move beyond left and right. Truly, it is an obsolete way of looking at the problems America is facing.”

Here is a real world observation.

Almost all of the “left” and “right” in power are rich.

Once again:

savings of the rich = dissavings of the gov’t (preferably with debt) plus dissavings of the lower and middle class (preferably with debt)

IMO, it should be savings of the rich plus savings of the lower and middle class = the balanced budgets of the various levels of gov’t plus the dissavings of the currency printing entity with currency and no bond/loan/IOU attached.

One of many very cogent statements of crisis from TSV:

“Therefore:

1. The general possibility of crisis is given in the process of metamorphosis of capital itself, and in two ways: in so far as money functions as means of circulation, [the possibility of crisis lies in] the separation of purchase and sale; and in so far as money functions as means of payment, it has two different aspects, it acts as measure of value and as realisation of value. These two aspects [may] become separated. If in the interval between them the value has changed, if the commodity at the moment of its sale is not worth what it was worth at the moment when money was acting as a measure of value and therefore as a measure of the reciprocal obligations, then the obligation cannot be met from the proceeds of the sale of the commodity, and therefore the whole series of transactions which retrogressively depend on this one transaction, cannot be settled.”

I make a few comments on Marx below. Obviously, I wrote my comment in the thread above to give a subjective account of the feelings of alienation of a government worker (myself) under late stage capitalism (and managerialism, which I think is an efflorescence of late stage capitalism). JRBach replied with some ontological philosophising which was not entirely beside the point. Yes, in some senses we are only isolated and transient beings and a philosophical attitude must be adopted to deal with that. Yet, in other very real senses we are social beings and feeling beings (while we last) and it is a shame for human lives, health, sensibility and potential to be treated as they are under late stage capitalism. I understand that conditions were far worse in earlier epochs and still are in third world countries. That does not excuse the damage to human sensibility and potential through alienation in advanced capitalist countries.

Marx and Engels theorised at a time when most physical labour was heavy and often dangerous, whether or not tied to feeding or operating crude early industrial machinery. Most mental labour consisted of tedious clerical copying, tallying and calculating in unhealthy and cramped conditions. Blake’s “dark satanic mills”, Engels’ “Conditions of the Working Class in England” and Dickensian counting houses all come to mind. Under these conditions, concern for workers and agitation for improvements had a strong humanitarian aspect as well as the decided revolutionary aspect feared by rulers and capitalists.

Marx himself was presciently aware of the further development potential of automation (under capitalism) and its effect on the content and meaning of labour as “toil and trouble”. This becomes evident in a passage from Grundrisse (Grundrisse der Kritik der Politischen Ökonomie – Outlines of the Critique of Political Economy). Here, Marx just misses a final step which was to comprehend the real significance of energy of immediate non-biological origin, as a factor in production (as exergy or energy available for useful work).

“As large-scale industry advances, the creation of real wealth depends less on labour time and the quantity of labour expended than on the power of the instrumentalities (Agenten) set in motion during the labour time. These instrumentalities, and their powerful effectiveness, are in no proportion to the immediate labour time which their production requires; their effectiveness rather depends on the attained level of science and technological progress; in other words, on the application of this science to production.”

What Marx identifies as the cause of the instrumentalities’ (automated machinery) effectiveness, namely science and technology omits at least one key aspect of that science and technology. This is its capacity for unleashing large extra quantities of energy for useful work. Marx continues a little further on;

“The theft of another man’s labour time, on which the social wealth still rests today, then appears as a miserable basis compared with the new basis which large-scale industry has created.”

Once energy harnessing is recognised as a key feature, we then perceive that theft of labour is replaced by theft from nature in late stage capitalism. We deplete vast unrenewable stores of energy and spread entropy (waste and despoliation) everywhere.

Marx’s line of thought clearly and consciously posited the looming obsolescence of his own version of the labour theory of value as it is bound to a certain phase of early industrial capitalist development. The vision of land (or nature) as the source of wealth was in the fore-ground in all stages of historical development up to and including the 18th Century Europe of the Physiocrats apart from the Mercantilist’s dead-end theory. This truth does not cease to exist or lose its essential content in 19th C Europe during and after the Industrial Revolution. It simply becomes background as the dramatic spectacle of human labour robbed by capital is fore-grounded by the conditions in this historical stage of industrial capitalism. Then, as a new historical age is reached (the age of automation and heavy industrialization) the labour theory of value, as a central and useful tool of political economy and even metrics, recedes into the background under the power of the instrumentalities (Agenten) which word we would now translate as automated machinery or machine-agents.

Human labour is relegated to the background by the productive power of machine-agent automation in late stage, heavy industrial, capitalist production. The driving physical forces of this late stage capitalism are the enormous amounts of energy derived mainly from the earth’s non-renewable stock of fossil fuels. The driving agent-forces take on a more and more inhuman aspect as the automaton-agent elements of our systems seem to coalesce into a super automaton-agent or over-system which we can’t stop and which seems to operate us as much as we operate it. Just as the conflict of 19th C capitalism centred on the co-option of human labour and the antagonisms of labour and capital, which were then quasi-resolved by the power of the instrumentalities in the 20th C, the conflict of 21st C capitalism centres on the co-option of non-renewable energy and nature in general and the consequent antagonism of nature and capital. As we approach the limits to growth, late stage capitalism threatens to destroy the biosphere and the biosphere threatens to destroy capitalism.

Conclusion

Biophysical Economics provides the new techniques and tools for resolving the current antagonism of nature and capital. The engine of capitalism must be moderated and tamed if it is not to destroy or badly degrade that part of nature which we depend on, namely the biosphere. It is clear from the historical survey and current trends that the source of wealth is nature (the environment). The agent of wealth is man. The mediating system is the dissipative system known as the economy. While capital and the coalesced automaton-agent are allowed to continue in the irrational and dangerous autopilot mode preferred by corporate capital, broad democratic demand for action on climate change and resource depletion remains ignored and even suppressed.

The autopilot analogy is appropriate. Autopilots have parameters and goals programmed in and this is the state of the economy under corporate capital. If the autopilot through some mistaken assumption, and consequent mistakes in the calculating and programming in of parameters and goals, is flying the whole shebang into a previously uncharted but now detected mountain and if the manuals and methods of the pilots (corporate capitalists) stubbornly and blindly deny the existence of the mountain and preclude reprogramming of the autopilot, then we have a critical problem. Hopefully, progress in Biophysical Economics will enable more people to see the problem and increase the demand for change.

i have only one additional remark: Marx doesn’t speak about WHAT we are producing, while nowadays the majority of the stuff is produced to sell and make profit. The dogma of profit means: selling more, so ‘good’s are produced to become waste as quick as possible: http://www.storyofstuff.com

So it’s not only who is in charge but also what we do.

Nice series of video lectures by David Harvey on reading Capital, Volume I …. I think he has Vol II in the works as well:

http://davidharvey.org

Short of comment except to say thanks for the perspective.

Am awaiting comment on Obama’s appointment of Professor Krueger.

Is it going to be “off with their heads” for the cabal of Geitner, Sumner, et al?

Previously major shifts in societal norms have only come as a result of Revolution and or Major Wars both of which at least in the Western World are highly unlikely. A major reset in economics of this magnitude will create a whole new set of winners and losers and as Turkeys do not vote for X mas as they say hell will freeze over first before the current set of power brokers will embark on any sort of transition where they stand to lose their status or power.

I’m afarid my freinds it is down to the people like you and I, we have to educate our families and our freinds, have discussions with our work colleagues and our neighbours, seek out the Connectors, the Mavens and the Salesman among us and in the words of Malcolm Gladwell create the Tipping Point that finally expose the Thousand lies and reveals the Single Truth!

“Capital has never like full employment. Marx knew that.”

Amen.

However, capital is destined to cannibalise itself.

The endogenous growth in in credit money in US, UK Aust etc, has simultaneously increased private reserves (deposits). We now have a situation where there is too much capital (deposits) relative to economic output. The scale of capital dwarfs opportunity to such an extent return on capital has to fall (see Japan), and the share of output shifting back to labour is inevitable.

Nothing highlights this better than the absurdity of the Australian superannuation system. With a balance now of $1.3T, investors seeking a 10% return equates to $130bn PER ANNUM. So Australian GDP has to grow by 10% per annum to meet these return expectations. It simply simply will not happen.

Now the debate is to increase superannuation contributions (private sector borrowing from itself) so that the superannuation industry is forecast to increase to $5T by 2020. How can you generate a return on $5T in an economy running at $2T?

Capital will compete away the returns. It can be the only outcome. The consequence is a greater share of output will fall back to the workers.

Capitalism have killed itself.

It seems like people here are arguing we need less and less freedom and more and more government controls. Yet such societies have been shown to be devoid of spirit and progress with ever greater alienation of the individual for the collective good. What any of this has to do with MMT I have no idea.

The simplistic equation or hypothesis that “less government control equals more (individual) freedom” is false when posited in and for a democratic society. We can easily come up with other equations or hypotheses in this situation. Let us restate the implied hypothesis and then state other more plausible hypotheses in the deomcratic context.

A. Less government control equals more (individual) freedom.

B. Alternative hypotheses;

1. Less government control means more inequality.

2. Less government control means greater political and economic instability.

3. Less government control taken to extremes equals anarchy.

4. Less democratic government control means a less democratic society overall.

People who want to heavily emphasise individual libertarian freedoms against overall democratic control and decision making are advocating inequality, exploitation, oligarchic oppression, instability, anarchy and the effective end of democracy.

Some complicating contemporary factors that neither Marx not Keynes could have foreseen:

Rick Bookstaber, Workers of the world, good night!

Tom Hickey, Economics and Energy (see the links)

Wikipedia, Economics of Global Warming

Ikonoclast your alienation would probably be better dealt with by psychological rather than economic means.

If you believe inequality is some sort of cause to your problems rather than a straw man argument I would like to see you back it up with facts not hypothesis that does not match real world history.

Stability is an illusion in a chaotic universe. Neither absence nor presence of government will change that.

Again what any of this politics has to do with MMT escapes me.

Capitalism is certainly imperfect, at best MMT might shed some light on how to improve it.

This has everything to do with MMT.

When thinking about a society, we can catogorise people by sex, age, location.

In an MMT world, I think about people either sitting on the deposit side of a bank balance sheet (owner of capital), or on the asset side (borrower).

I think the reason Australia today is in relatively good shape is income is well distributed (much better than the US anyway). if you take this to the extreme (perfectly distributed wealth) private debt levels can be significantly higher compared to an economy with large income disparities. This is because interest paid is received by the same person.

In a world of MMT, fair distribution of wealth actually maintains capitalism and minimises the need for government macro policies which MMT advocates especially during balance sheet recessions. The US is an excellent example where wealth disparity creates a real need for an MMT type of response.

When you come up with a means to distribute wealth that is fair and takes into consideration the differences in people’s location, ability, needs, ambitions and opportunities let us know, until then arguing for this or that distribution is arbitrary subjectivity that has no basis in objective reality.

Material inequality is a nothing more than a convenient scapegoat because the universe refuses to fit to your desired simplification. You will make same complaint until we replace everyone with your clone, because every bit of difference between people amplifies material inequality. Stability is an illusion of your arbitrary simplification, or more precisely your refusal to deal with complexity and difference.

So I have to ask … I know people in my personal life that make their living doing some niche work …. self employed, thoroughly libertarian in philosophical outlook. Usually one man show …. life coaches … or … self help gurus publishing and selling their own ebooks …. or marketing some specialized service to cooperate execs. No employees or maybe one or two. So not really doing much exploitation of workers.

They seem to do quite well.

Where would such folk fit in a Marxian schema …. Petty Bourgeois? Or do they not fit at all?

They are usually all puffed up about their own ability to succeed and the wonders of capitalism …. everybody can be like them (according to them). What should I say to them?

Ken

*** “What’s dumb is to oversee an economy that has lost that many millions of jobs … to downgrade the credit of this country … to put fiscal policies in place that were a disaster back in the ’30s and try them again in 2000s,” Perry said.***

That was US president candidate Rick Perry today. For anyone who doesn’t already know he is a right-wing, Tea Party, slash government spending kind of a guy.

If only he knew how right his words were … just not in the way he believes!

Struck me as so ironic that I just had to share …

Ken

Ken, you said, “They are usually all puffed up about their own ability to succeed and the wonders of capitalism,” which made me laugh (because I agree). I am particularly amused by the ones who call themselves “self-made businessmen” while they get fat on the excessively generous government contracts flowing from a privatisation program which has amounted to legalised public theft. That scenario was what the Howard Govt and its supporters/beneficiaries specialised in for over a decade. Things aren’t much better now as Labor has sold out to the mining corporates and betrayed the workers.

Value, Price, and Profit.

Far easier to read than Capital and gets the basic Marxian message across.

Smith J:

Do you realize how important government is to capitalism? Probably 90% of the state’s function is the protection of private property. Do you think capitalism could survive in a world where you could just take what you want, or do whatever you feel like? How long could a corporation last in a world where the price of a good is a brick through the shop window?

“Stability is an illusion in a chaotic universe. Neither absence nor presence of government will change that”

Maybe if you only look at the universe on a subatomic level. Me, I’m human, so politics will have an effect on me. Are you really saying that Somalia and Sweden are equally stable because of “chaos theory something something”?

Neither state nor market will provide more than the illusion of stability. You seem to be chasing utopia on the back of the material inequality bogeyman and so far nobody has anything to argue beyond religious belief in a system nobody is willing to define, other than by personal disenchantment with the present and that old chestnut, material inequality. If only everyone owned the same car and same sized house all our problems would end!

MMT is not a political system, it is just a set of observations on fiat money. How one goes from these to state good, wealth evil is not just stretching credibility but ignoring history.

Interestingly I’ve noticed the fallacy of composition seems to be rather pervasive, countercyclical aggregate demand spending also seems to suffers from myopia of the fallacy of composition, maybe this particular shortcoming comes from political bias…

Bottom line – capitalism can not survive with extreme differences in wealth.

Again railing against the reality that freedom is inequality of outcome. No wonder alienation and depression are driving forces here, your stuck in cactch22 and can’t see why.

“Again railing against the reality that freedom is inequality of outcome”

I’d say we’re railing against the exterminationism that implies.

I guess that’s where we differ I choose to be optimistic

George Magnus on Marx again, this time in a letter to the Financial Times (31 August 2011): Capitalism is having a very Marxist crisis

Note to Ikonoclast: Nice take-down of the “less government = more freedom” meme.

I’m not optimistic but I am adaptable.

Smith J: “Material inequality is a nothing more than a convenient scapegoat because the universe refuses to fit to your desired simplification.”

So Smith seems to act on faith that inequality is fair because the rich have earned it. How? By their hard work of shuttering US factories to participate in labor arbitrage? By financialization of the economy that has brought the entire world to its knees?

I have no problem with people who create real wealth becoming wealthy. but that bunch at Goldman Sachs? Please!

Inequality is neither fair nor unfair. It is simply the mathematical outcome of aggregate choices faced with small differences. Conflating material inequality with bad policy/actions is as pointless as claiming that good actions/policy will lead to some subjectively preferential distribution of wealth.

If you have any evidence you can force an arbitrary distribution of wealth without total loss of freedom then by all means share it.

While the question of “fairness” isn’t something that can be discussed “scientifically”, the question if MMT is “neutral” on the question of equality vs. inequality can, IMO, be anwered objectively (without any “moral” claims). At least, I gave the question a try – please read:

“Is MMT neutral concerning income equality / inequality?”

http://habit.ch/forum/viewtopic.php?f=5&t=175

Comments would be most welcome…

Well, the truth is that extreme inequality never works. All societies that come perpetuate in a extreme inequality tend to collapse one an or an other.

It’s not a matter of coercion or freedom, taxes are coercion, property is coercitive, almost all human interactions are based one way or an other in some sort of coercion as much as on freedom. But it’s all about perceived social structure and cohesion.

So we can argue all we want, but unless you perpetuate inequality through force, in a democratic regime it won’t work, people will eventually revolve. And even in an authoritarian regime is an unsustainable position in the long run.

It’s not a matter of tastes or opinions, it’s a matter of facts and what works or doesn’t.

Dear Dismayed Aug31 1:10

I agree we do not live in a vacuum, that family and community are important – that we all need to sleep soundly and there is absolutely no human reason why people should suffer and live in abject misery (other than greed but that is not ‘reason’)!

Still, your existence is about You. It wasn’t given to anybody else. And fulfillment is not dependent on anything outside of your own consciousness, is the insight I was stating!

Just trying to take the edge off the aging process and exit the excuses!!

Cheers,

jrbarch

I’m not saying capitalism or extreme wealth distribution is fair or unfair. And I agree with Smith when he/She says “It is simply the mathematical outcome of aggregate choices faced with small differences”.

I’m just saying capitalism can not survive with extreme differences in wealth.

If someone can prove otherwise, I am all ears (eyes).

Karl Marx argued that revolution was impossible in a society that lived on the family farm. He believed that urbanization and industrialization were both requirements for a Communist revolution. In the 1920s, half of all Americans lived on a farm. Family farms that remained free of debt, enjoyed full-employment during the 1930s. Those that used debt to expand, were destroyed.

The Federal Reserve Bank is a Marxist and Fascist institution. It creates the debt necessary to enslave a Republic, and the politics that are required to increase our indebtedness. Whether this country spends money on social programs (Socialism), or military expansion (Fascism), we end up borrowing money from the Federal Reserve. As an added bonus, the privately owned corporation also charges us interest to use its Federal Reserve Notes as our currency!

prof premraj pushpakaran writes — 2018 marks the 200th birth year of Karl Heinrich Marx!!!