I started my undergraduate studies in economics in the late 1970s after starting out as…

The top-end-of-town have captured the growth

This Report – The “Jobless and Wageless” Recovery from the Great Recession of 2007-2009 – published by the Center for Labor Market Studies of Northeastern University (thanks Stephan) should have received headline attention from all the American media outlets instead of the disgusting venting of religious zealotry that goes under the name “debt ceiling debate” which has dominated media space. The Report was published in May 2011 and seeks to examine the way in which the recovering real output in US is being distributed to beneficiaries – workers, firms etc. It shows that the so-called economic recovery in the US has not delivered any tangible benefits to the vast majority of citizens and has rather, concentrated real gains among the top-end-of-town. Given that the recovery has floated on the fiscal stimulus the findings reinforce the biased nature of policy in the US. That indicates poor fiscal design by an incompetent and corrupt government not that fiscal policy is inherently unsuitable for advancing public purpose.

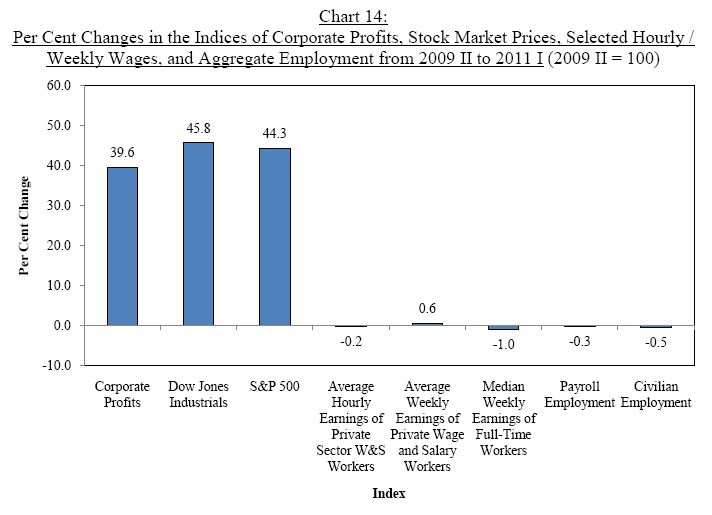

Consider this graph which is taken from Table 14 of the Report mentioned in the introduction. The US Government should resign immediately (including the President and his Administration) for overseeing this failure to advance public purpose.

The graph shows that growth measures for various measures of income and asset values for the period from the June quarter 2009 to the March quarter 2011. It is a stark reminder of what has been going on in the US over the last few decades.

The wage share had already fallen dramatically in the period leading up to the crisis. The fiscal stimulus provided corporate America with a lifeline and a basis on which to continue manipulating the real income produced for their own financial advantage. The big losers have been the workers – both employed and unemployed.

The CLMS Report juxtaposes the fact that despite official modelling (by the National Bureau of Economic Research) indicating that the recession in the US only lasted 18 months, the “massive decline in private sector wage and salary jobs, rapidly rising unemployment and underemployment, and steep increases in the median and mean durations of unemployment” has left an impression on the vast majority workers that the economy is still performing poorly.

Even in March 2011, a national survey showed that “75 per cent of respondents described the nation’s economy as”:

… approximately poor, somewhat poor, or very poor.

Only 9 per cent said it was “very good or somewhat good” (probably all of them working on Wall Street).

These perceptions run contrary to the “official rhetoric” that the economy is on the way to recovery and reflect the outcomes depicted in the graph above.

The facts laid out in the CLMS Report are as follows:

1. “Since the second quarter of 2009, real GPD has increased for seven consecutive quarters. By the fourth quarter of 2010, real GDP had finally surpassed its pre-recession level in the fourth quarter of 2007. Growth unfortunately has slowed considerably in the past quarter, rising at an annualized rate of only 1.8%.”

2. The 4.2% decline in real GDP during the 18 months of the Great Recession was produced by steep declines in national employment and by declining weekly hours of work. Nonfarm payroll employment fell by 7 million or 5% from 2007 IV to 2009 II … Total civilian employment (persons 16+), including the self-employed, fell by just under 6 million or slightly more than 4% over the same time period …”

3. “The steep declines in both payroll employment and aggregate civilian employment during the Great Recession were accompanied by a drop in mean weekly hours of work among private sector wage and salary workers and a very substantial rise in underemployment; i.e., the number of employed persons who worked part-time for economic reasons but desired full-time jobs.”

4. “The highest incidence of these underemployment problems took place among the nation’s younger workers (those under 30 years of age), Hispanics, high school dropouts and high school graduates lacking post secondary degrees, and workers in construction, retail trade, hospitality and accommodation industries, and business services, especially temporary help and labor leasing industries.:

5. “These underemployment problems have held down the median and mean weekly earnings of employed civilians in the U.S. and the growth of real annual wages and salaries.”

6. “The decline in real GDP that would have been expected from a 4 to 5 per cent drop in employment and a 2 per cent drop in average weekly hours of work was cushioned by a rise in labor productivity over the course of the recession.”

So all of those facts are consistent with the way a recession impacts on the labour market and the economy in general.

Recessions impact on a number of economic aggregates in addition to the most visible impact – the rise in unemployment. The great American economist Arthur Okun coined the term The Tip of the Iceberg and I borrowed that for the title of a book I co-authored in 2001. The point is that the costs of recession and the resulting persistent unemployment extend well beyond the loss of jobs. Productivity is lower, participation rates are lower, the quality of work suffers and real wages typically fall.

The facts associated with the current downturn are consistent with this general model.

However, within this context, Okun outlined his upgrading hypothesis (in the 1960s and 1970s) and the related high-pressure economy model, which provided a coherent rationale for Keynesian demand-stimulus policy positions. Two references are Okun, A.M. (1973) ‘Upward Mobility in a High-Pressure Economy’, Brookings Papers on Economic Activity, 1: 207-252 and Okun, A.M. (1983) Economics for Policymaking, Cambridge, MIT Press.

Okun (1983: 171) believed that:

… unemployment was merely the tip of the iceberg that forms in a cold economy. The difference between unemployment rates of 5 percent and 4 percent extends far beyond the creation of jobs for 1 percent of the labor force. The submerged part of the iceberg includes (a) additional jobs for people who do not actively seek work in a slack labor market but nonetheless take jobs when they become available; (b) a longer workweek reflecting less part-time and more overtime employment; and (c) extra productivity – more output per man-hour – from fuller and more efficient use of labor and capital.

The positive side of this thinking is that disadvantaged groups in the economy were considered to achieve upward mobility as a result of higher economic activity. The saying that was attached to this line of reasoning was “all boats (large or small) rise on the high tide”.

Okun’s (1973) results are summarised as follows:

The most cyclically sensitive industries have large employment gaps, and were dominated by prime-age males, offered high-paying jobs, offered other remuneration characteristics (fringes) which encouraged long-term attachments between employers and employees, and displayed above-average output per person hour.

In demographic terms, when the employment gap is closed in aggregate, prime-age males exit low-paying industries and take jobs in other higher paying sectors and their jobs are taken mainly by young people.

In the advantaged industries, adult males gain large numbers of jobs but less than would occur if the demographic composition of industry employment remained unchanged following the gap closure. As a consequence, other demographic groups enter these ‘good’ jobs.

The demographic composition of industry employment is cyclically sensitive. The shift effects are in total estimated (in 1970) to be of the same magnitude as the scale effects (the proportional increases in employment across demographic groups assuming constant shares). This indicates that a large number of labour market changes (the shifts) are generally of the ladder climbing type within demographic groups from low-pay to higher-pay industries.

So prior to the neo-liberal onslaught and during the period that governments were cogniscant of their responsibilities to maintain full employment (and actively used fiscal and monetary policy to attack high unemployment relatively quickly), a recovery reversed the damage caused by the recession. This was in part the basis of my PhD thesis.

The evidence supported the proposition that when the economy is maintained at high levels of employment, workers in low paying sectors (or occupations) also receive income boosts because employers seeking to meet their strong labour demand offer employment and training opportunities to the most disadvantaged in the population. If the economy falters, these groups are the most severely hit in terms of lost income opportunities.

The upgrading thesis also focused on the mapping of different demographic groups into good and bad jobs. The groups who experience the greatest relative employment gains when economic activity is high are those who are stuck in the secondary labour market, typically, teenagers and women.

While these groups were proportionately favoured by the employment growth, the industries with the largest relative employment growth are typically high-wage and high-productivity and employ mostly prime-age males. Expansion is therefore equated with ladder climbing whereby males in low-pay jobs (as a result of downgrading in the recession) climb into better jobs and make space for disadvantaged workers to resume employment in their usual sectors. In addition, favourable share effects in predominantly male industries provide better jobs for teenagers and women.

So there were many benefits from growth which spread out across rising participation, rising wages, rising hours of work, rising employment and falling unemployment.

But the downside is that the iceberg takes a long time to melt if (a) it is large; (b) if the recovery is not robust enough; and (c) if the policy stimulus is poorly designed and targetted. Recovery alone is not sufficient. Real GDP growth has to be consistently strong for some years before the iceberg melts and the upgrading bonuses accrue.

Please read my blog – The aftermath of recessions – for more discussion on this point.

This is exactly the situation that the US finds itself in now. The upgrading benefits that used to accompany growth have been hijacked by the rich and the vast majority of the population have missed out.

This is in fact the topic of a book I am writing at present – based on work I have been accumulating for a decade or so. I first noticed the upgrading effects were weaker after the 1991 recession – which came after about a decade or more of neo-liberal policies in Australia. The reality is that the neo-liberal attack on public purpose has changed the way the distributional system operates – with workers now finding it harder to gain access to real income growth despite contributing more per hour (productivity growth stronger).

The raft of anti-union legislation, deregulation of wages and conditions, etc have combined to shut workers out of the real growth pie.

Further, the capturing of government by the top-end-of-town has clearly meant that the former no longer prioritises employment growth and low unemployment. In my 2008 book with Joan Muysken – Full Employment abandoned – we consider the dynamics of that trend in considerable detail.

Economists have dressed all this up in sophistry – with such outrageous claims as the “natural rate of unemployment” has risen and the mass unemployment is largely voluntary in nature or caused by budget deficits – which has given governments the rationale for abandoning their prior commitments.

Please read my blog – The dreaded NAIRU is still about! – for more discussion on this point.

The upshot is that growth no longer benefits workers as it did in the past.

The CLMS Report found that:

The increases in the nation’s aggregate output during the first seven quarters of recovery from the 2007-2009 recession could have been produced by a combination of forces, including a rise in aggregate employment, increased average weekly hours of work among the employed, and a rise in labor productivity, or real output per hour of work. We have tracked developments in each of these areas over the past seven quarters to identify their contributions to the growth of the nation’s real aggregate output. All of the growth in real GDP since the second quarter of 2009 has been generated by either rising labor productivity or a small increase in mean weekly hours of work.

So some of the key avenues to upgrading have not operated (rising employment and skill mobility, increasing wages, higher participation).

Please read my blog – The origins of the economic crisis – for more discussion on this point.

The CLMS Report concludes that the recovery has been a “jobless recovery” with only modest employment gains occurring in 2010. The way real GDP has risen since the recovery began is largely down to labour productivity growth. The “index of labor productivity (real output per hour of work) in the private nonfarm sector rose … by … just over 5.7%” over the first seven quarters of the recovery and then at a rate of 9 per cent since December 2008.

This raises questions of who capturing the real income growth. We know that a hallmark of the neo-liberal period has been the fall in the wage share in national income in most nations. This has come about because real wages growth has dragged behind productivity growth. The gap between the two represents profits and shows that during the neo-liberal years there was a dramatic redistribution of national income towards capital.

This has been aided and abetted by governments in a number of ways: privatisation; outsourcing; pernicious welfare-to-work and industrial relations legislation; etc to name just a few of the ways.

The problem that arises is if the output per unit of labour input (labour productivity) is rising so strongly yet the capacity to purchase (the real wage) is lagging badly behind – how does economic growth which relies on growth in spending sustain itself? This is especially significant in the context of the increasing fiscal drag coming from the public surpluses or stifled deficits which squeezed purchasing power in the private sector since around 1997.

In the past, the dilemma of capitalism was that the firms had to keep real wages growing in line with productivity to ensure that the consumption goods produced were sold. But in the lead up to the crisis, capital found a new way to accomplish this which allowed them to suppress real wages growth and pocket increasing shares of the national income produced as profits. Along the way, this munificence also manifested as the ridiculous executive pay deals and Wall Street gambling that we read about constantly over the last decade or so and ultimately blew up in our faces.

The trick was found in the rise of “financial engineering” which pushed ever increasing debt onto the household sector. The capitalists found that they could sustain purchasing power and receive a bonus along the way in the form of interest payments. This seemed to be a much better strategy than paying higher real wages.

The household sector, already squeezed for liquidity by the move to build increasing federal surpluses were enticed by the lower interest rates and the vehement marketing strategies of the financial engineers.

The financial planning industry fell prey to the urgency of capital to push as much debt as possible to as many people as possible to ensure the “profit gap” grew and the output was sold. And greed got the better of the industry as they sought to broaden the debt base. Riskier loans were created and eventually the relationship between capacity to pay and the size of the loan was stretched beyond any reasonable limit. This is the origins of the sub-prime crisis.

So the dynamic that got us into the crisis is present again and with fiscal austerity emerging as the key policy direction the welfare of our economies is severely threatened. This is a dramatic failure of government oversight.

The CLMS Report examined who has benefitted from the economic recovery in the US in some detail.

They “tracked changes in the real (inflation adjusted) hourly and weekly earnings of key groups of U.S. workers, in real compensation per hour of work in the business sector, and in corporate profits over the 2009 II to 2011 I time period”. They also tracked “changes in the value of key stock indices, including the Dow-Jones industrial average and the S&P 500.”

The graph I started with provides a summary of their research and is as stark as it is despicable.

They concluded (underline emphasis in original):

Between the second quarter of 2009 and the fourth quarter of 2010, real national income in the U.S. increased by $528 billion. Pre-tax corporate profits by themselves had increased by $464 billion while aggregate real wages and salaries rose by only $7 billion or only .1%. Over this six quarter period, corporate profits captured 88% of the growth in real national income while aggregate wages and salaries accounted for only slightly more than 1% of the growth in real national income. The extraordinarily high share of national income (88%) received by corporate profits was by far the highest in the past five recoveries from national recessions. The closest situation was the recovery during the first six quarters following the end of the 2001 recession in which corporate profits captured 53% of the growth in real national income during the largely jobless recovery during that time period. In the first six quarters of recovery from the 1990-91 recession, corporate profits experienced no growth whatsoever, and they generated on average only 30 per cent of national income growth during the recoveries from the 1981-82 and 1973-75 recessions. Extending this analysis for one more quarter reveals that corporate profits accounted for 92% of the growth in real national income while aggregate wages and salaries declined by $22 billion and contributed nothing to growth.

That is a stunning indictment of the current US Administration. They cannot blame the recalcitrant Republicans because at the critical time they controlled the legislature.

In that sense I agree and disagree with Paul Krugman who in his latest New York Times article (July 29, 2011) – The Centrist Cop-Out – writes:

… for those who insist that the center is always the place to be, I have an important piece of information: We already have a centrist president. Indeed, Bruce Bartlett, who served as a policy analyst in the Reagan administration, argues that Mr. Obama is in practice a moderate conservative.

Mr. Bartlett has a point. The president, as we’ve seen, was willing, even eager, to strike a budget deal that strongly favored conservative priorities. His health reform was very similar to the reform Mitt Romney installed in Massachusetts. Romneycare, in turn, closely followed the outlines of a plan originally proposed by the right-wing Heritage Foundation. And returning tax rates on high-income Americans to their level during the Roaring Nineties is hardly a socialist proposal.

True, Republicans insist that Mr. Obama is a leftist seeking a government takeover of the economy, but they would, wouldn’t they? The facts, should anyone choose to report them, say otherwise.

I disagree that with the assessment that Obama is “centrist” or even “mildy conservative”. His fiscal stimulus has demonstrably favoured the top-end-of-town and he has been willing to sit idly by and allow unemployment and underemployment to fester and wages growth to stall instead of using his position (and initial period of grace courtesy of the polls) to do something about that.

He initially blamed Bush and then started claiming the US had run out of money.

But it is clear by the appointments he made to his Administration and the policies he allowed to be implemented (in the name of fiscal stimulus) that his attention was biased towards preserving the wealth of Wall Street rather than the jobs and homes of the millions of workers who showed faith in him and put him into office.

Subsequently, he has shown the antithesis of leadership by actually conceding ground to the Republicans on the need to cut the deficit. The last thing a responsible leader would be doing in the US situation is advocating and offering deficit reduction.

I agree with Paul Krugman’s assessment that the Republicans are so firmly off the planet that they are actually a danger to their own people.

Friday music segment

Seeing though it is Friday and we have recreation in sight I thought you might like this song from Peter Seeger (1964) written at the time by a very young Tom Paxton. This is a song for all economics students who are forced to use textbooks like Mankiw and the like. The indoctrination level is high the applicability to the real world virtually zero.

You can see other interesting (ideologically-aligned) songs at Political Compass.

Conclusion

I have run out of time and I have a plane to catch.

Saturday Quiz

The Saturday Quiz will be back sometime tomorrow – even harder than last week!

That is enough for today!

To complement your selection, here is a recent great one from Tom Paxton and very funny – I am Changing My Name to Fannie Mae – http://www.youtube.com/watch?v=etUq7IY_7Mc&NR=1&feature=fvwp. Renders the chart less nauseating.

How much of this corporate hold of profits is due to the “balance sheet recession”. If companies are simply selling their excess inventory and holding the money until it (the inventory) is gone., then this blog really helps to cement that theory.

Thoughts?

“The gap between the two represents profits and shows that during the neo-liberal years there was a dramatic redistribution of national income towards capital.”

Actually I just recently read very interesting article from Mat Yglesias who actually pointed that this may not be so: http://thinkprogress.org/yglesias/2011/07/20/274008/what-fills-the-gap-as-wages-fall/

It seems that there is a new different dynamics building up during the last decades which adds more complexity into the question. It seems that it is not only workers vs capitalists now. Now we have a new conflict between one class of “capitalists” (like working people saving in their pension funds) versus new class of people receiving hefty sums as bonuses, options and “other business income”. This is what is most disturbing on our current age – that neoliberals are willing to sacrifice effectivity of free market (via just regulation) in order to sate their hate against government.

Mr. Mitchell,

This is what people here in America have been calling the “Tiffany Recovery”. That is to say, it’s only the rich that seem to be ‘recovering’. I’m sure you’ve heard this too, but I just HAD to say it out loud (so to speak!). You have now just quantitatively proved it. Excellent essay (is it just a blog post? seems like so much more).

I’ve been lurking on your blog for awhile now, and have really love it. Still sinking my teeth into the whole MMT thing….really fills my brain up with amazing ideas. Gotta go read those links you included………

sincerely,

Karl

“It shows that the so-called economic recovery in the US has not delivered any tangible benefits to the vast majority of citizens and has rather, concentrated real gains among the top-end-of-town.”

First, I want to make sure these are correct.

(S-I) of the rich plus (T-G) of the gov’t plus (S-I) of the lower and middle class equals zero(0)

Rearrange with algebra:

(S-I) of the rich equals (G-T) of the gov’t plus (I-S) of the lower and middle class

Rephrase:

savings of the rich equals dissavings of the gov’t plus dissavings of the lower and middle class

Are all three(3) of those correct?

If so, then I believe it is usually/preferred savings of the rich equals dissavings of the gov’t (preferably with debt) plus dissavings of the lower and middle class (preferably with debt).

From:

http://www.cnn.com/2011/OPINION/07/28/balkin.obama.options/index.html

“Sovereign governments such as the United States can print new money. However, there’s a statutory limit to the amount of paper currency that can be in circulation at any one time.”

Is that correct? And if so, what’s the limit?

Great post.

You could almost imagine some Obama talking points.

But that is so 2008.

Also wondering about FedUps point about the limits on printing currency, never heard of it.

Anybody?

But that’s the $Trillion Coin page.

The mal-distribution of wealth is a result of the debt-money system.

The continual flowing from the interest payers to the money-creators.

The ever-increasing cyclical flow of our national wealth to the top receives inadequate attention and small applause for those who lay out the results for all to see.

But, what of its cause?

That is self-evident in the findings of Dr. Bernd Senf:

http://blip.tv/file/4111596

The hundred-year accumulation of compounding-interest in a money system where the interest money is never created, coupled with an economic distribution system that allows the benefits to flow to those CAPABLE OF earning the highest return, results in the accumulation of the wealth of the money-creators, as measured by their monetary assets.

The private, debt-based fractional-reserve banking system must go.

Since money must be created as a national legal construct, that is, colloquially, out of thin air, all of its very real qualities will persist when issued without debt.

The benefit equation from a change to a debt-free money system has been modeled in what Steve Keen described as the most sophisticated systems-dynamic, macro-economic model he has seen.

http://www.monetary.org/yamaguchipaper.pdf

For the Money System Common

Don’t underestimate the impact of outsourced production, they are expenses, not headcount. Increasing productivity often means outsourcing. Components are manufactured outside and brought inside for assembly, with great gains in productivity. Back office work comes in over the internet.

The WaPo just had an article on New Balance running shoes still made in America. The labor graph shows the worker decline in the sector dropping like a stone from the year 2000 and unaffected by the Bush tax cuts. Presume other manufacturing sectors were similar, along with specialty white collar, administrative and back office work.

Coincident is the US Tax Revenue graph that can be found on Wikipedia or obtained from government sites. Tax revenue plunged from 2000 to 2002, paralleling job loss, which dropped from 4 to 6%. It rebounded, probably from the housing bubble and now has resumed it’s decline.

Fed Up & Joe: “Sovereign governments such as the United States can print new money. However, there’s a statutory limit to the amount of paper currency that can be in circulation at any one time.” I think Balkin is just referring to the currency that the US Treasury can directly print, $300 million, I think. No limit on Fed printing Federal Reserve Notes, afaik. Or on “printing reserves” for QE or any other purpose.

Fed Up, if you haven’t seen it, I finally replied to you in an old discussion here .

To FedUp

Got this from John Balkin.

http://www.law.cornell.edu/uscode/31/usc_sec_31_00005115—-000-.html

Says $300 million

But, compared to H6,

http://www.federalreserve.gov/releases/h6/current/

Says there’s $970 Billion outstanding.

For Some Guy, joebhed, and others:

So the $300 million applies just for the U.S. Treasury not the fed (central bank)? Right?

If so, does that mean “coin seigniorage” is not possible?

Plus, thanks for the replies.

joebhed or anyone else, when was that limit passed?

Some Guy, it might be awhile before I respond to the old discussion.

On the issue of limits to borrowing/printing money, it would just help to read this research paper:

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=115128

In the introduction it speaks about prevailing mainstream theories and how these are not rooted in any actual research how the government spends. Then it goes to trough these nuances to build a theory how this all happens. Fast forward to chapter 5 and it answers the question does the government really borrow?