I started my undergraduate studies in economics in the late 1970s after starting out as…

Beware the wolf in sheep’s clothing

Several readers have written to me asking me to comment on a recent paper that the New York Federal Reserve released as a Staff Report (May 2011) – A Note on Bank Lending in Times of Large Bank Reserves. Apparently, there is an impression that the federal reserve economists might be seeing the light a bit about the banking system and the way economists think about it. The reason that some readers have concluded that is because the substantive conclusion of the paper is that credit expansion is independent of the level of banking reserves held at the central bank. This conclusion is totally consistent with Modern Monetary Theory (MMT) but is at odds with the standard mainstream macroeconomic view (as taught in textbooks) that relies on the money multiplier to draw a (spurious) connection between bank reserves and the money supply. As you will see – my advice is to be very careful when reading such papers – they are not what they seem. The FRNY paper reaches the correct conclusion using erroneous theory which they partition as a special case arising from the extreme circumstances surrounding the crisis. Even in defining their “model” as a special case, they employ flawed logic. It is a case of being beware of the wolf in sheep’s clothing.

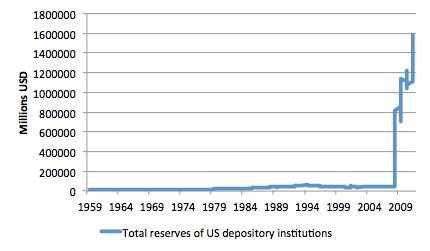

The paper begins by noting that “(t)he amount of reserves held by the U.S. banking system reached $1.5 trillion in April 2011” and if we note the latest (May 2011) data from the US Federal Reserve – Aggregate Reserves of Depository Institutions – the reserves have risen to near $US1.6 trillion as a result of the Fed’s program to purchase ($US600 billion) Treasury securities (which finishes next month).

The following graph shows the evolution of US bank reserves from January 1959 to May 2011 including the extraordinary escalation during the current crisis.

The FRNY authors are clearly challenged by the reserve dynamics revealed in the graph and seek to explain why the “such a large quantity of bank reserves” has not led to “an overly expansive bank lending as the economy recovers”,

From the perspective of Modern Monetary Theory (MMT) such a question is a non-issue. It is as simple as understanding that banks do not lend bank reserves. They are integral to the payments (settlements) system only. Banks are never reserve constrained when it comes to lending and will extend credit to any worthy customer who seeks it.

So the problem that the FRNY paper poses is a non-problem once you fully understand how the monetary system and the banking institutions within it operate.

Please read the following blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – for further discussion.

The reason the FRNY is puzzled by the lack of credit expansion in the face of an unprecedented build-up in bank reserves is because they start from the mainstream textbook approach.

They also note that:

… several economists and financial market participants claim that large levels of bank reserves will lead to overly expansive bank lending … Despite such concerns, little formal analysis has been conducted to show such an effect under the current banking system. It is incumbent on commentators claiming otherwise to specify how large reserves would lead to excessive lending.

Many leading mainstream monetary economists have been issuing warnings since the US Federal Reserve Bank started expanding its balance sheet in this way that there would be a boom in credit and “all that money” would be loaned out and inflation would result.

But the reality has been different. This has been one of the many demonstrations during this crisis of how impoverished mainstream theory is. There completely erroneous predictions cannot be explained by the fact that during the crisis there has been more volatility and uncertainty than usual which has impacted on forecasting accuracy across the board.

Rather, their failure is an intrinsic one – they deploy a totally flawed model which neither saw the crisis coming nor has been able to detail anything credible about how we might attenuate it.

The FRNY paper realises that the mainstream textbook model that underpins most of the public commentary on macroeconomics at present is in trouble and tries to develop what they claim is a new approach to the problem. As you will see there is no saving grace in their approach.

To prepare the readers for what they will eventually deem to be a “special case” of the mainstream model, the authors claim that:

The current banking system in the United States and worldwide no longer resembles the traditional textbook model of fractional reserve banking. Historically, the quantity of reserves supplied by a central bank determines the amount of bank loans. Through the “money multiplier”, banks expand loans to equal the amount of reserves divided by the reserve requirement. However, in many countries, reserve requirements have been reduced either to zero, or to such small levels that they are no longer binding.

Their version of history is seriously deficient. The textbook monetary model has always been an erroneous depiction of the way the system operated.

The money multiplier, which is central to the way the mainstream understand banking, has always been amiss. They think in these terms.

The mainstream theory alleges that the money multiplier m transmits changes in the so-called monetary base (MB) (the sum of bank reserves and currency at issue) into changes in the money supply (M). Students then labour through algebra of varying complexity depending on their level of study to derive the m, which is most simply expressed as the inverse of the required reserve ratio.

So if the central bank told private banks that they had to keep 10 per cent of total deposits as reserves then the required reserve ratio (RRR) would be 0.10 and m would equal 1/0.10 = 10. More complicated formulae are derived when you consider that people also will want to hold some of their deposits as cash. But these complications do not add anything to the story.

The formula for the determination of the money supply is: M = m times MB. So if a $1 is newly deposited in a bank, the money supply will rise (be multiplied) by $10 (if the RRR = 0.10). The way this multiplier is alleged to work is explained as follows (assuming the bank is required to hold 10 per cent of all deposits as reserves):

- A person deposits say $100 in a bank.

- To make money, the bank then loans the remaining $90 to a customer.

- They spend the money and the recipient of the funds deposits it with their bank.

- That bank then lends 0.9 times $90 = $81 (keeping 0.10 in reserve as required).

- And so on until the loans become so small that they dissolve to zero.

The problem is that this is not remotely how the banking system operates.

If it did, you should expect a fairly constant relationship between the monetary base and the measures of the money supply. Indeed, mainstream theory claims that the central bank uses this relationship to control the money supply.

In his Principles of Economics (I have the first edition), Mankiw’s Chapter 27 is about “the monetary system”. In the latest edition it is Chapter 29.

In the section of the Federal Reserve (the US central bank), Mankiw claims it has “two related jobs”. The first is to “regulate the banks and ensure the health of the financial system”. So I suppose on that front he would be calling for the sacking of all the senior Federal Reserve officials given the massive collapse that occurred under their watch.

The second “and more important job”:

… is to control the quantity of money that is made available to the economy, called the money supply. Decisions by policymakers concerning the money supply constitute monetary policy (emphasis in original).

And in case you haven’t guessed he then describes how the central bank goes about fulfilling this most important role. He says that the:

Fed’s primary tool is open-market operations – the purchase and sale of U.S government bonds … If the FOMC decides to increase the money supply, the Fed creates dollars and uses them buy government bonds from the public in the nation’s bond markets. After the purchase, these dollars are in the hands of the public. Thus an open market purchase of bonds by the Fed increases the money supply. Conversely, if the FOMC decides to decrease the money supply, the Fed sells government bonds from its portfolio to the public in the nation’s bond markets. After the sale, the dollars it receives for the bonds are out of the hands of the public. Thus an open market sale of bonds by the Fed decreases the money supply.

The reality is that central banks cannot control the money supply and as we will see bank lending is not constrained by reserves.

Please read my blog – Lending is capital- not reserve-constrained – for more discussion on this point.

The FRNY paper starts their explanation by noting that:

Starting in the late 1980s, the Federal Reserve supplied the quantities of reserves needed to maintain its policy target – the federal funds rate – which is the interest rate at which banks lend reserves to each other in the interbank market. The Fed did not target the amount of reserves, the quantity of deposits or loans on bank’s balance sheets, or broad measures of the money supply.

They are referring to the realisation by Monetarist-obsessed central bankers that their experiment with monetary targetting, which attempted to impose the textbook theory, failed dramatically. Central bankers came under the spell of Milton Friedman and his gang of Monetarist thugs (see Naomi Klein’s 2007 book The Shock Doctrine for an interesting account).

They claimed that the solution to inflation was to control the money supply and so central banks set about imposing targets consistent with their forward estimates of real growth. After several years of monumental failure they gave up but never really admitted that the problem was that Monetarism – of which neo-liberalism is a modern variant – was built on false premises.

Somehow the mainstream economists just blinked and imposed some new “wild” idea on the policy debate (which was inflation targetting).

The whole exercise was a triumph of ideology over reason and understanding.

It wasn’t so much a change in central banking that defines the modern period – the monetary targetting episode could hardly be described as the norm.

So to be clear the mainstream theory of money and monetary policy asserts that the money supply (volume) is determined exogenously by the central bank – independent of the market – by the central bank exploiting the “money multiplier” (based on private portfolio preferences for cash and the reserve ratio of banks) and manipulating its control over base money to control the money supply.

To some extent these ideas were a residual of the commodity money systems where the central bank could clearly control the stock of gold, for example. But in a credit money system, this ability to control the stock of “money” is undermined by the demand for credit.

The theory of endogenous money is central to the horizontal analysis in MMT. When we talk about endogenous money we are referring to the outcomes that are arrived at after market participants respond to their own market prospects and central bank policy settings and make decisions about the liquid assets they will hold (deposits) and new liquid assets they will seek (loans).

The essential idea is that the money supply in an entrepreneurial economy is demand-determined – as the demand for credit expands so does the money supply. As credit is repaid the money supply shrinks. These flows are going on all the time and the stock measure we choose to call the money supply, say M3 is just an arbitrary reflection of the credit circuit.

So the supply of money is determined endogenously by the level of GDP, which means it is a dynamic (rather than a static) concept.

Central banks clearly do not determine the volume of deposits held each day. These arise from decisions by commercial banks to make loans. The central bank can determine the price of “money” by setting the interest rate on bank reserves.

But expanding the monetary base (bank reserves) as I demonstrated in these blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – does not lead to an expansion of credit.

Apart from the Monetarist money targetting fiasco, central bankers understand their inability to control the money supply and instead express their monetary policy aims through the setting of the short-run target interest rate – which in the US is called the federal funds rate.

As I explain in these blogs – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3 – central banks then have to conduct liquidity management operations to ensure its target interest rate is achievable each day.

What are the liquidity management operations of the central bank? A central bank must ensure that all private cheques (that are funded) clear and other interbank transactions occur smoothly as part of its role of maintaining financial stability. But, equally, it must also maintain the bank reserves in aggregate at a level that is consistent with its target policy setting given the relationship between the two.

To understand this better we need to explore the relationship between bank reserves and the monetary policy target. The central bank seeks to keep its short-term interest rate in line with the interbank or market rate. How can the two diverge? Think about the current crisis. The central banks increased bank reserves to keep the system “liquid”. As I explain in this blog – Quantitative Easing 101 – many commentators thought the injection of reserves was about easing credit. But banks don’t lend reserves anyway (except among themselves in the interbank market). More later on that.

But the consequence of increasing bank reserves was to drive the market interest rate below the central bank’s target rate (for example, in the US) which amounts to the central bank losing control of monetary policy.

The reason this happens is that banks with excess reserves will try to lend them out to other banks in the interbank market if there is no return provided by the central bank on those reserves. The competition within the interbank market drives the “market interest rate” down and so a dislocation occurs between the interbank rate and the policy rate.

MMT tells us that contrary to what the mainstream macroeconomics textbooks tell us, budget deficits drive interest rates down.

How? Deficits add reserves to the banking system (after all the transactions are completed and settled) which are in excess of the levels desired by the banks under normal circumstances. The banks dutifully (pursuing profits) try to get rid of these non-earning assets and via interbank market competition drive the market rate down. Remember that the individual banks cannot eliminate as system-wide excess of reserves because all their (horizontal) transactions net to zero.

There are two ways the central bank can impose control over its monetary policy target in the case of excess reserves. First, they can ensure that these excess reserves are drained from the cash system and they can accomplish that by selling government (interest-bearing) bonds to the banks in exchange for the reserves. Second, they can simply offer a competitive return on the excess reserves – which is central to the FRNY paper’s argument which we are coming back to.

I also note that while in theory, deficits drive down interest rates, what happens in reality is a little different. The triumph of ideology again! The conduct of fiscal policy is executed within institutional structures that do not allow these reserve excesses to occur to any degree under normal circumstances.

Governments have voluntarily introduced legislation or regulations that force it to issue debt to match their net spending – in some cases the former has to come before the latter. Under these institutional constraints, it is not accurate to say that budget deficits drive down or put downward pressure on interest rates. If the governments abandoned these gold standard/convertible currency artefacts, which are totally unnecessary in a fiat currency system, then budget deficits would force the central bank to issue debt to maintain a positive interest rate target (that is, to drain the excess reserves).

The point is that operating factors link the level of reserves to the monetary policy setting under certain circumstances. These circumstances require that the return on “excess” reserves held by the banks is below the monetary policy target rate. In addition to setting a lending rate (discount rate), the central bank also sets a support rate which is paid on commercial bank reserves held by the central bank.

Many countries (such as Australia and Canada) maintain a default return on surplus reserve accounts (for example, the Reserve Bank of Australia pays a default return equal to 25 basis points less than the overnight rate on surplus Exchange Settlement accounts). Other countries like the US and Japan have historically offered a zero return on reserves which means persistent excess liquidity would drive the short-term interest rate to zero.

However, at the onset of the current crisis the Emergency Economic Stabilization Act 2008 allowed the US Federal Reserve to offer a return equivalent to the federal funds rate to bank holding excess reserves and it commenced paying interest on October 9. 2008. Under this system, the central bank can always maintain its target rate of interest irrespective of the level of reserves.

The “support” rate (rate paid to banks with excess reserves) effectively becomes the interest-rate floor for the economy. If the short-run or operational target interest rate, which represents the current monetary policy stance, is set by the central bank between the discount and support rate. This effectively creates a corridor or a spread within which the short-term interest rates can fluctuate with liquidity variability. It is this spread that the central bank manages in its daily operations.

As I explain in this blog – Understanding central bank operations – the payment of interest on reserves makes the liquidity management operations of the central bank much easier to manage because there is no longer any correspondence between the volume of excess reserves and the target policy rate.

Having developed the theoretical critique, we can return to the FRNY paper.

First, they claim that the “banking model” they develop is a special case based on the fact that the US Federal Reserve is now paying interest on bank reserves and because minimum reserve requirements are not binding – given the huge volume of reserves that are in the system at present.

We should dismiss the reserve requirements issue first. In this blog – Lending is capital- not reserve-constrained – we learn that reserve requirements place no limit on bank lending – even if they were 100 per cent.

Commercial banks hold reserve accounts at the central bank for the sole purpose of facilitating the payments system (clearing house). Many countries have no reserve requirements other than the accounts must not be in the red on a sustained basis. The US is currently considering eliminating the positive requirements.

Reserve requirements are an artefact of the old gold standard and are irrelevant in the current monetary system. They do not reduce bank risk nor do they comprise a buffer that can be drawn on when there is a run on a bank.

To understand why reserve requirements do no constrain lending you have to understand how a bank operates. Banks seek to attract credit-worthy customers to which they can loan funds to and thereby make profit. What constitutes credit-worthiness varies over the business cycle and so lending standards become more lax at boom times as banks chase market share (this is one of Minsky’s drivers).

These loans are made independent of the banks’ reserve positions. Depending on the way the central bank accounts for commercial bank reserves, the latter will then seek funds to ensure they have the required reserves in the relevant accounting period. They can borrow from each other in the interbank market but if the system overall is short of reserves these horizontal transactions will not add the required reserves.

In these cases, the bank will sell bonds back to the central bank or borrow outright through the device called the “discount window”. There is typically a penalty for using this source of funds. At the individual bank level, certainly the “price of reserves” may play some role in the credit department’s decision to loan funds. But the reserve position per se will not matter. So as long as the margin between the return on the loan and the rate they would have to borrow from the central bank through the discount window is sufficient, the bank will lend.

So the idea that reserve balances are required initially to “finance” bank balance sheet expansion via rising excess reserves is inapplicable. A bank’s ability to expand its balance sheet is not constrained by the quantity of reserves it holds or any fractional reserve requirements. The bank expands its balance sheet by lending. Loans create deposits which are then backed by reserves after the fact. The process of extending loans (credit) which creates new bank liabilities is unrelated to the reserve position of the bank.

The major insight is that any balance sheet expansion which leaves a bank short of the required reserves may affect the return it can expect on the loan as a consequence of the “penalty” rate the central bank might exact through the discount window. But it will never impede the bank’s capacity to effect the loan in the first place.

Reserve requirements when in place are always calculated at some later point in time and are based on total deposits for some prior statement period. Banks then seek to ensure they satisfy whatever reserves are required knowing that they can always borrow them from the central bank if they do not have the necessary cash or are unable to borrow then in the interbank market.

So there is no special case that can be made on the basis of having reserve requirements in place or not. The fact they think that reserve requirements matter in relation to credit expansion shows they are locked into the erroneous orthodox world of money multipliers.

Second, they think that a special case arises when the central bank pays interest on reserves held with them by the banks. As we will see this practice is also irrelevant to considerations of bank lending capacity.

The FRNY authors seek to understand why banks are not lending at present given all the reserves that are in the banking system? They never recognise that banks do not lend reserves. Rather, the implicit assumption in the paper is that the banks deploy these reserves to maximise profits and they have various choices depending on relative returns that are available to them. Their argument is then couched in terms of some weird marginal calculus underpinning what they consider to be bank profitability.

They claim that the banks will not lend unless they can at least earn the “federal funds rate … [which] … “represents a bank´s alternative return on assets and hence is the required marginal return on bank lending”. Accordinly, they say that:

Banks expand their balance sheets so long as the marginal cost of funding is less than the marginal return on bank lending. The federal funds rate sets the level of the required marginal return.

So banks lend when they can detect a profit seeking opportunity. Banks are clearly sensitive to how much the necessary reserves that would accompany the balance sheet expansion will cost them and that will be reflected in the interest rates they lend at. But once that rate is set they will lend as much as is requested by credit-worthy customers.

Continuing to explain their model, the FRNY authors claim that:

Banks lend up to the point where the marginal return on loans equals the return on holding reserves, which is equal to the interest rate on reserves set by the central bank. This provides an indifference result for the quantity of reserves. In particular, while the sizes of banks’ balance sheets expand with increases in reserves, all else equal, the lending decision for a bank is determined by the same marginal return condition as with the former method of monetary policy implementation. A loan is made at the margin if its return exceeds the marginal opportunity cost of reserves, whether that is the federal funds rate as with the prior regime, or the rate of interest on reserves as in the current regime.

You can quickly see the presumptions – all mainstream – all wrong.

At the end of each settlement period (say each day’s end) an individual bank with excess reserves has the following choices: (a) do nothing and accept whatever return the central bank offers – the higher the better; (b) buy government bonds and accept the yield that is attached.

Both choices are free of credit risk as against other assets that the bank might acquire in the course of its business operations. In other words, the existence of a return on excess reserves is not the reason why banks will

Clearly, when the central bank doesn’t offer a return on excess returns this choice becomes more obvious. The choice they do not have is to “lend the reserves out”. To repeat – banks use reserves to facilitate the payments system – any return that they might receive on excess reserves is thus irrelevant to their decision to lend in the credit markets.

The only choice that the payment of interest on excess reserves affects is the portfolio composition that the bank chooses. Banks can always buy government bonds whether there is interest paid on excess reserves or not. So without an interest payment, the banks will prefer government bonds to non-interest bearing reserves. When the central bank pays interest on reserves that choice then becomes dependent on the relative yields involved.

But that has nothing to do with limiting or influencing their capacity to create deposits via loans.

The FRNY paper also conceives of the bank as facing this problem:

1. It accepts deposits and “must choose how many loans to finance … as well as how many reserves … and how many bonds to hold”.

2. “The marginal loan financed by the banking sector has a return exactly equal to the interest rate paid on reserves” which means the “return on the marginal loan” … “and hence the quantity of loans financed” … “is independent of the quantity of reserves”.

Why do they conclude that? Answer: because they think of banks as sitting around waiting for a depositor to turn up with some funds which then go into reserves. The bank then seeks to on-lend those funds and the return on central bank interest on reserves is the difference between lending them out or not. MMT assessment of that proposition: total erroneous.

Banks do not sit around waiting for deposits. They seek credit-worthy customers to lend money to and then have to “fund” that loan book. They do that in a number of ways including offering returns to attract deposits.

The FRNY author’s principle contention that “banking sector’s return on the marginal loan … determines the amount of bank credit” is obvious. Banks will not lend unless the next loan they extend makes a favourable return. But that has nothing to do with any return it gets on reserves.

Why not? Because it doesn’t lend reserves. Loans create deposits and come out of “thin air”. As long as the credit created is profitable then lending will occur. The profitability calculation will be in terms of the “cost” of the funds necessary to ensure the settlement system operates without a particular bank being unable to meet their obligations. At any rate, the banks know that they can always get the necessary reserves from the central bank.

The return on reserves merely affects decisions banks make about holding excess reserves between bonds and cash.

The FRNY paper also considers that banks have to raise deposits prior to lending. Please read my blog – The role of bank deposits in Modern Monetary Theory – to learn why that view is erroneous.

The paper also introduces “frictions” to the model in the form of “positive bank balance-sheet costs” which include the return they have to pay to attract deposits. If these frictions are low and the return on excess reserves exceeds the cost of attracting deposits then lending proceeds as before as long as the return on the marginal loan exceeds the return on reserves. But when these balance sheet costs rise they claim that the presence of excess reserves “crowds out” lending. The conclusion is based on the same flawed logic in the zero friction model and has no application to the real world they seek to explain.

Conclusion

The FRNY authors think that the current situation is special and means that the money multiplier is not binding. These “special” conditions are the excess reserves (which militate against the minimum reserve requirements being operational) and the return the central bank pays on these excess reserves. They think that if these special conditions were absent then the textbook world of the money multiplier and the fractional reserve deposit system would operate again.

The problem is that neither observation makes for a special case which “turns off” the money multiplier. The whole underpinning of their analysis is erroneous.

So for those who thought this was a breakthrough paper – keep a look out for sheep that turn into wolves.

The paper certainly has the correct conclusion – the level of bank reserves do not influence bank lending. But they reach that conclusion using totally incorrect reasoning.

That is enough for today!

Central bankers came under the spell of Milton Friedman and his gang of Monetarist thugs (see Naomi Klein’s 2007 book The Shock Doctrine for an interesting account).

Considering her account of how free market policies were implemented by the military dictatorships in Latin America in the 70s, which were actually a perfect example of corrupt state sponsored capitalism, I wouldn’t recommend reading the book, although there’s a movie based on it available on youtube.

In certain monetary systems banks cannot borrow/refinance/buy reserves from the CB or the interbank market unless they use/own investment grade or higher securities at a discount and this can restrain their capacity to extend credit, especially if the securities they hold are degraded ex post that raises the discount or prohibits their use!

There is a kind of multiplier isn’t there Bill…the bank’s capital, which under Basel rules also doesn’t appear to be much of a restraint ?

Given the make-up of Tier 1 and Tier 2 capital, it seems to me that banks can expand their balance sheets (increase the money supply) pretty much as much as they like, provided, as you say they can find credit-worthy borrowers.

This sentence though “Loans create deposits which are then backed by reserves after the fact.” has always left me with the feeling I was missing something, like there was a 1:1 reserve requirement.

If I’ve now got it right, banks are only seeking deposit funds (and subordinated loans) to maintain their “float”, the reserves they need for the operational needs of their Exchange Settlement Accounts, and nothing else ? If so, is this a judgement call for the commercial banks, at the risk of copping a penalty from the RBA for getting it wrong, or is it a requirement based on the bank’s liabilities ?

Bill- thanks so much for your work. I think that the banking constraints are still a bit unclear. When you throw in the statement here, and in the referenced blog, that “Private banks still need to “fund” their loan book.”, we are thrown for a loop.

Would it be fair to say that banks have to fund their settlement needs- their reserve requirements? They do not have to fund their whole loan book at some instant in time, but only the part of it that is actively being drawn out / settled.

Secondly, it seems important to say what does constrain lending, which is capital requirements. Banks can only lend to some multiple of capital by law, so that is why they continually seek to build capital. They may lend less, as they do now, but they can’t lend more. Is that fair?

Bill, have you seen Ellen Brown’s new article at Truthout? It would be great to have your comments on it. She enjoys a very wide readership.

The article is here:

The Global Debt Crisis: How We Got in It and How to Get Out

http://truthout.org/global-debt-crisis-how-we-got-it-and-how-get-out/1307386310

James McAndrews and Co. seem to be making the same money multiplier mistake again and again. Somehow that will never come out of their system.

On the hand hand, a recent BoE paper seems to have a lot of dope. Haven’t read but looks very nice.

Financial Stability Paper No. 11 – June 2011

Intraday liquidity: risk and regulation

Alan Ball, Edward Denbee, Mark Manning and Anne Wetherilt

http://www.bankofengland.co.uk/publications/fsr/fs_paper11.pdf

Wah! … The Bank of England seems to be making some progress.

Financial Stability Paper No. 10 – April 2011

Growing fragilities? Balance sheets in The Great Moderation

Richard Barwell and Oliver Burrows

http://www.bankofengland.co.uk/publications/fsr/fs_paper10.pdf

… talk of stocks and flows, build balance sheet and transactions flow matrix and even refer to Godley & Lavoie …

Jim, Ellen Brown always strikes me as being a bit erratic in her analysis, though her writing contains plenty of interesting historical stuff.

For example the third paragraph of the article of hers you refer to claims that those who borrow from banks have to pay interest, which can only come from yet more loans from banks. Thus, allegedly, the non-bank sector becomes progressively more and more indebted to banks until “the banks run out of borrowers to support the pyramid” whereupon the system “collapses” and apparently , “we are nearing that point today.”

Seems to me that the flaw in that argument is that bank profits get SPENT (by their shareholders and grossly over-paid senior employees). I.e. flows of money into banks flow out again into the community. Secondly, given that the bank system we currently have has been going on for a century or more, it strikes me as odd that we should be nearing the point of collapse “today”. Why now? Why not twenty or sixty years ago?

Ralph Musgrave “Seems to me that the flaw in that argument is that bank profits get SPENT (by their shareholders and grossly over-paid senior employees). I.e. flows of money into banks flow out again into the community. Secondly, given that the bank system we currently have has been going on for a century or more, it strikes me as odd that we should be nearing the point of collapse “today”. Why now? Why not twenty or sixty years ago?”

The proportion of GDP accounted for by the finance sector has been ratchetting up decade on decade (from 5% in the 1960s to >20% or whatever now). The banks have been bailed out intermittently (savings and loans crisis, 2008 crisis, euro crisis). The bank profits also increasingly get stuffed into asset price inflation rather than “flow out again into the community” in a productive sense.

Stone, Fair point. I.e. the phenomenon you point to in your second paragraph certainly has a demand reducing effect. Though that wasn’t the point Ellen Brown made.

It’s hopeless.

These people will always be building “simple models”, band-aid on band-aid, when what is required is merely a more energetic investigation of real world operations.

Question: I was thinking how to explain that US or Japan will never have trouble selling bonds even if they offer low interest rates. My explanation: the reserves that the banks pay for bonds with can only be used in the interbank system, they cannot be used to purchase stocks and invest in businesses etc, so the return we use to calculate the opportunity cost when buying bonds is the interest-on-reserves, which is zero (say). Therefore, bonds will find buyers even if they offer a much lower rate than returns one can find in the economy. This would answer the question: why do Japanese banks keep buyng Japan’s bonds instead of seeking high returns by investing in China, say?

Is my explanation correct?

I recall an interview with Bernanke a while back (sorry, no link) where he indicated he thought we might go to a zero percent reserve, and that it wouldn’t really change anything except what the banks paid for money. Though true, it struck me as a very odd statement coming from him, because the only way it can be true is if the money multiplier theory is false. Yet in an interview with Obama around the very same time, Obama said the reason he gave the banks money directly rather than via relief to stressed mortgage holders was the money multipliers, and he said it in a manner that CLEARLY indicated he was reciting what he had been told (obviously by his chief advisors, ie, Bernanke) but did not personally know.

This has always bothered me about Bernanke, because more than anyone else advising Obama, Bernanke really seems to know almost everything, and really should be a good advisor. Except that when it comes to actually USING what he knows, he fumbles. All the tools, but without the skill to use them.

Some readers of this blog may find LR Wray’s new series:

Monday, June 6, 2011

Modern Money Theory: A Primer on Macroeconomics for Sovereign Monetary Systems

By L. Randall Wray

to be of interest. As a non-economist, I look forward to that undertaking and suspect that all followers of many MMT blog sites might pick up something of interest over the coming weeks/months:

http://neweconomicperspectives.blogspot.com/2011/06/modern-money-theory-primer-on.html

I’m rather encouraged that this sort of paper is out there at all. It seems to me to be following along in the normal procession of a science explaining a phenomenon: “X doesn’t happen and it’s appearance is an illusion because it contradicts orthodoxy” > “X is a special case and don’t contradict orthodoxy because of these epicycles we’ve added to it” > “X is what’s really happening and is the new orthodoxy.” Perhaps there’s hope for the science of economics yet. After all, ideology can only ignore the pounding it’s taking from reality for so long before it’s completely crippled.

That Obama decided not to directly help borrowers during the credit crisis and instead chose to bail out the banks because he was worried about money multiplier effects is severely depressing to me. It shows that policymakers are more concerned about maintaining the purchasing power of large accounts rather than improving the lifestyles of the majority of citizens. Even if there would have been a multiplier effect in bailing out borrowers rather than lenders, the resulting inflation would have largely included wages, mostly maintaining the purchasing power of wage-earners. Only the big accounts whose income comes from returns on investments would have seen a larger loss of purchasing power, and in my opinion, that would not be a bad thing as it would equalize the vast income and wealth disparities that have developed in the 30 years our government has been fiddling about with monetary policy instead of refining fiscal policy.

We should all just forget about the Obama government. He was brainwashed by Summers, Geithner and Bernanke from day one. There were genuinely progressive economists in his campaign, but they all got herded into commissions and the like. Goolsby – the best of an appallingly bad lot – has now, finally, decamped. It’s over.

This government will now be run as a business school exercise, as the Bush II regime was. No academic cover at all.

If anybody could depict all of the cause and effect sequences Bill has written about in this blog in a flow chart, showing how each variable can interact with and progress to another – I for one would be very very grateful! New pathways in the brain and all of that!

Cheers …

jrbarch

There was a paper along those lines from the australian Reserve bank that was much more explicit, I seem to recall. Anyone got a link?

I need help, please,

bill writes…certainly the price of reserves may play some role in the credit dept.decision to loan funds but the reserve position per se will not matter…

If in some hypothetical situation a banker could anticipate the need to borrow from the CB at day,s end why might this not influence his decision re a particular loan and (with respect), why is it so important to MMT to insist that reserves should not determine lending decisions?

Joe berg,

Businesses in the financial sector typically strive for ~20% margins. 0.5% they need to pay on reserves (1/10 of the loan) will not make them pause.

“If in some hypothetical situation a banker could anticipate the need to borrow from the CB at day,s end why might this not influence his decision re a particular loan”

Firstly the bank only needs reserves to clear its net position. It’s not the amount of reserves the bank has that matters. It’s the price of those reserves.

Unless I’m mistaken it wouldn’t need additional reserves *at all* if it could guarantee that the loan and all the spending on it occurred at the same bank. Which is one of the reasons why banks like to be big and why there are regulations on capital adequacy and reserve requirements. Both of these are an attempt to impose a capital cost on the banks.

Before the thread goes cold, could one of you MMT guns help me and Burk with our simple questions on reserves ?

Dear Burk (at 2011/06/07 at 11:02)

You wrote:

Reserves are only for settlement. There are not minimum reserve requirements in most countries but there is a penalty for having to access reserves from the central bank.

On lending constraints – please read this blog – Lending is capital- not reserve-constrained

Best wishes

bill

Dear John Armour (at 2011/06/07 at 10:59)

You wrote:

Please see my response to Burk.

Reserves are only for settlement.

Ultimately lending is constrained by capital and the willingness of credit-worthy customers to borrow.

best wishes

bill

I agree that the notion that banks need to “fund” their loan book by seeking their own liabilities (deposits) seems odd. The deposits that “fund” the loan are created at the point the loan is made. In that sense, the creation of a loan is self-funding. The “deposits” that the bank seeks are those that are created as a byproduct of cashflows arising from outside the bank, and thus enter the bank’s balance sheet as reserve assets. Deposits have a dual nature on the bank balance sheet, sometimes attached to e.g. a loan asset, sometimes attached to a reserve asset, and it is the nature of the associated asset that is of importance to the bank. I don’t like the terminology of “banks seeking deposits to fund loans” as IMO it perpetuates the myth that banks need deposits in order to lend.

Jim, althought Ellen Brown writes some good stuff, her understanding of monetary mechanics is deficient. It seems that she accepts the nutty debt-virus theory of banking, which has been thoroughly debunkied by those who have an adequate understanding of banking mechanics. Contrary to the claims of debt-virus theorists like Ellen, who think that the interest component of a bank loan requires specific money creation in order to accommodate it, we know that around 98 percent of commercial bank interest income (on average) is spent back into the economy in order to cover the bank’s operating costs (tax, shareholder dividends, interest to depositors, salaries and bonuses to employees, contractors fees, and other overheads). Along with many others, she has fallen into the trap of confusing stocks and flows.

Interesting article, but it seems to be missing an important element. It takes two to tango and it takes two to increase the money supply.

The Fed may be pushing banks to lend more, banks may have the money to lend more, and banks may have the desire to lend more. But what about the fact that nobody wants to borrow?

Borrowing has two time perspectives: borrowing takes place now, but repaying takes pace in the future largely from future earnings. If people are uncertain or pessimistic about the future the interest rate can be near zero and no one will borrow.