I started my undergraduate studies in economics in the late 1970s after starting out as…

Americans are stupid but they are not alone

I have been travelling the last few days and while sitting at the airport on my way home I have been catching up on all the snippets of text and links I accumulate each day. While the current generations are living through the “digital revolution” we should not forget that 50 odd years ago humans went to the Moon – which at the time was an ingenious demonstration of our capacity for technological marvel. The motives for this feat which were tied up in the Cold War paranoia were clearly suspect but I recall at the time as a young high school student, as all the classrooms were mustered in a TV viewing room to watch the landing, that we are a clever lot. I no longer think that.

Have a look at this graph which is taken from data available at the US Bureau of Labor Statistics and shows the different unemployment duration categories as proportions of total unemployment since 1948. The proportion of those above 27 weeks (which the US terms long-term unemployment) has risen from around 16.5 per cent at the onset of the crisis to 45.1 per cent in April 2011.

It is telling that in most other nations long-term unemployment is categorised as being spells of unemployment above 50 weeks. The lower threshold in the US is a testament that there has never been as large a pool or proportion of long-term unemployed as now. Other nations bowed to political pressure and changed the definition to greater than 50 weeks as a result of having to deal with entrenched long-term unemployment.

The US has never really had a duration problem. Rather it has a turnover problem with lots of short spells of unemployment. Job instability is high in the US but in normal times workers can usually find another job relatively quickly. Those days are now past for the US and it is now having to deal with a European-type problem of entrenched long-term unemployment.

It is dealing with it very badly.

There are two historically aberrant facts around at present in the US (and elsewhere) – very high (absolute) budget deficits and record levels of long-term unemployment.

In that context, ask yourself the following two questions:

1. Has the large budget deficits caused this long-term unemployment?

OR

2. Has the significant rise in unemployment overall (see next graph) and the increased duration caused the large budget deficits?

My answer is obvious. You could never mount a serious case to justify an affirmative answer to the first proposition. The “fiscal contraction expansionists” (aka the RIcardian equivalents) try to argue that line but have never had any empirical support for their propositions. Our laboratories at present – Ireland, Britain etc – are living proof that they lie and their theories are invalid.

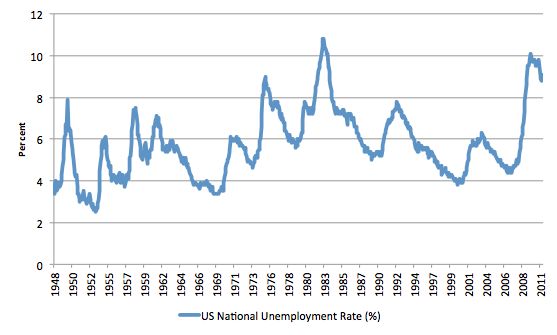

To put that in further perspective – that is, so we don’t just dismiss it as a problem of proportions – the next graph is one that is more familiar to people – the US national unemployment rate from 1948 to April 2011. So the changing duration of unemployment is a significant problem given the scale of the joblessness in the US.

So with unemployment in such a parlous state and more and more Americans entering the status of long-term unemployed it is little wonder that the budget deficit has risen to its current size (and proportion of GDP). The real collapse (the labour market) explains the rise in net public spending – both because the rising unemployment drove the automatic stabilisers (to increase the deficit) and the US government introduced some discretionary stimulus measures.

We can complain loudly about the composition of the fiscal stimulus intervention and the miserable size of it but the fact remains that with the decline in the real economy being so (historically) large, it is no surprise that the budget parameters would reflect that. The budget in this case is like a thermometer.

And I wouldn’t think anyone who was too hot would try to bash the thermometer to get it from recording the temperature.

It also follows that if you adopt a voluntary rule whereby you issue debt into the private debt markets on a $-for-$ matching basis with your deficit then if the latter rises so will the former. There is no surprise in that. There are two solutions to this if it concerns you. First, stop issuing debt – especially as it is not necessary to “fund” a government that issues the currency under exclusive (monopoly) conditions.

Second, if you want to keep issuing debt then you have to deal with the underlying problem – the collapse in the real economy. One gets nowhere by focusing on the reaction and ignoring the cause.

That data tells me that the Americans are collectively stupid. They are stupid for electing a government that doesn’t solve this problem which they could do so overnight – by offering all the unemployed who want to work a public sector job focused on advancing community and environmental sustainability.

Americans are collectively stupid for tolerating politicians from both sides of politics who seek to make this problem worse. I am writing this because I am still reeling from the last latest US payrolls data from the US Bureau of Labor Statistics – which told me that the US economy is now stalling and in danger of slipping back into recession as the US Congress spend hours arguing about matters which relate to the length of an endless piece of string as if they had reached the end already.

The politicians are stupid for arguing about nothing while the country wastes away and the population are stupid for electing the stupid politicians.

The latest BLS employment situation report said:

Nonfarm payroll employment changed little (+54,000) in May and … The number of unemployed persons (13.9 million) and the unemployment rate (9.1 percent) were essentially unchanged in May. The labor force, at 153.7 million, was little changed over the month … The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was essentially unchanged in May at 8.5 million … there were 822,000 discouraged workers in May …

You always have to be careful in analysing monthly labour force data because there are cyclical adjustments going on which sometimes send conflicting signals. For example, sometimes a rising unemployment rate is a sign of a strengthening economy – as the participation response swamps the employment growth. Further, employment growth might be relatively subdued but mask adjustments being made by firms whereby part-time jobs which had been offered as an hours-rationing device as sales flagged are being transformed into full-time jobs – signifying that underemployment (one form of labour wastage) is falling.

But the latest US employment situation report is unambiguous – it is appalling across the board.

There is no employment growth, no drop in unemployment, and no change in the participation rate. That tells me that the economy has stopped growing – the supply-side of the labour market – the labour force is not responding to growth (static participation rate) and the demand-side is weak. Further, involuntary part-time jobs are not being converted into full-time work.

The data also reported that “(o)Over the past 12 months, average hourly earnings increased by 1.8 percent” and with the BLS reporting an inflation rate running at 3.2 per cent in the 12 months to April 2011, we know that the real hourly earnings for US workers have fallen sharply over that period.

So at a time that the economy is cutting the purchasing power of workers (who consume) the politicians are arguing about which party will cut public spending the most.

One piece of data that should send chills down the spines of all those who are toying with curtailing the capacity of the US government to net spend was that:

In May, the number of long-term unemployed (those jobless for 27 weeks and over) increased by 361,000 to 6.2 million; their share of unemployment increased to 45.1 percent.

This number will continue to increase as the unemployed move through the duration categories. With no jobs growth absorbing providing the capacity to absorb the unemployed, the duration of the pool of unemployed rises every day. Talk about trashing the future of your nation! The rise in long-term unemployment will generate costs – individual and society-wide to the American nation – that will reverberate for generations to come – long after some of these bozos in the US Congress are dead and buried.

This special report from the BLS – Long-term unemployment experience of the jobless – though a few years old is insightful as well as distressing. The problem has worsened since that document was written.

Maybe, I thought as I was sitting in the airport lounge today waiting for a flight and sifting through this data, just maybe I am being a little unkind to the American people.

That thought didn’t last for too long.

Then I read the results of the latest US poll conducted by the Washington Post which interrogated the electorate there on matters economic.

The overwhelming result seems to be 48 per cent of the respondents didn’t know what would happen if the US government “DOES NOT raise the federal debt limit”. In terms of the level of concern about this issue 77 per cent of respondents said they very concerned that “(r)aising the debt limit would lead to higher government spending and make the national debt bigger”, 23 per cent said they were not concerned whether the US government defaulted on its outstanding debt liabilities, and 48 per cent said that raising the debt limit was the greater concern than default.

My conclusion – the respondents within those proportions are highly ill-informed and have opinions that are dangerous to the welfare of the American people generally and on an individual level might include themselves.

Then I read in the Sydney Morning Herald article (June 8, 2011) – Republican mainstream toys with US default. The story noted that:

An idea once confined to the fringe of the Republican party is seeping into its mainstream – that a brief US default might be an acceptable price to pay if it forces the White House to deal with runaway spending.

Apparently, an “increasing number of Republicans” think “a period of technical default can be managed without plunging markets into chaos”. A technical default is a default however you want to term it. It demonstrates a massive breach of faith between the government and its citizens (and other asset holders) especially when it is a political act without any grounding in financial imperatives.

One of the most appalling moves in the current madness is that one Republican senator (Pat Toomey) has:

… even introduced legislation directing the US Treasury to prioritise debt service over other payments if the debt limit is not raised.

This is an extraordinary conception. First, if the US government doesn’t meet wages or welfare payments to the unemployed thousands of Americans would be damaged (even if temporarily). Second, the beneficiaries of interest payments on debt are more likely not to belong to a cohort we would classify as disadvantaged. Many top-end-of-town banks and speculators benefit. Third, foreigners would benefit ahead of the US people.

That other dolt – US congressman Paul Ryan said that “holders of US government debt would be willing to miss payments “for a day or two or three or four” if it put the United States in a stronger position to pay them later on, and if investors knew that.”

The sheer idiocy of that conceputalisation is breathtaking. One stupid idea breeds another. The first proposition that investors think there is a danger of an operational (financial) default is ludicrous. The movement in yields tells me that there is a strong demand for US government bonds, “record” deficit notwithstanding.

The bond holders know they are buying a corporate welfare plan offered by stupid governments who could still function just as well if they didn’t issue the debt.

The second proposition – that bond holders who have no fear of a default – would tolerate losing income – is also without foundation. An income loss is a loss.

The bond holders know there is no financial reason for the US government to default. So they also know that the US government will neither be in a stronger nor weaker position “to pay them later on”.

The US government – like any national government that issues its own currency – can never improve its position to repay its liabilities. The concept of strength of capacity is without any application in a fiat-currency system. The issuer of the currency is always able to service their liabilities in that currency.

My ears prick up or my eyes intensify when I hear/read phrases like “runaway spending” as in the statement above by the unnamed Republican politician.

I did some checking using the historical data available from the US Budget Office.

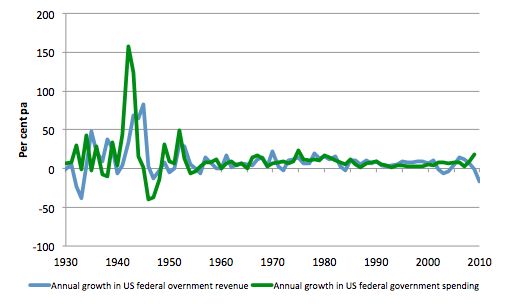

The first graph shows the annual growth in US federal government revenue and receipts since 1930. The current period doesn’t seem exceptional when you see what happened in the 1930s.

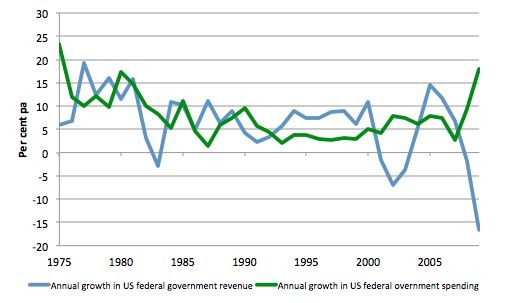

But I thought we might focus on the blue rectangle period to see what went on over that period. There were four recessions of different magnitudes over the period and each time you can see a spike in government spending growth and a drop in revenue growth. That is no surprise.

What stands out in this current crisis is not so much the acceleration in spending growth but the very marked collapse in revenue growth. That tells me that the economy has endured a very serious economic downturn and the spending response has probably not been adequate. I turn that assessment of “probably” into definitely once I marry up that data with the previously discussed labour market data.

There is no evidence of “runaway government spending” in the official data.

With my flight approaching I decided to read just one more thing quickly. I wish I hadn’t have done that.

The mainstream media was once again demonstrating its capacity to act as a mindless mouthpiece – the “journalist as press agent for right wing nonsense” syndrome – for views that have no substance at all. In this case, it was the UK Daily Telegraph which ran a headline (June 6, 2011) – European Central Bank risks being ‘wiped out’ by bail-outs – to which I said to myself – BS.

This journalist had the audacity to give space to this Open Europe report and quotes it as saying that “The ECB is ultimately underwritten by taxpayers which means there is a hidden – and potentially huge – cost of the eurozone crisis to taxpayers buried in the ECB’s books”.

So if it is underwritten then it cannot be wiped out. Of-course, the notion that the ECB is underwritten by anything other than its monopoly fiat capacity to credit any bank account it likes to any sum in euros is not mentioned. That oversight tells me that the journalist is just another mouthpiece for the propaganda merchants. I thought journalists were meant to ask questions and at least seek out balance.

The “balance” presented in the article made me laugh:

Observers in the City said the views were alarmist. One analyst said: “The ECB is backed by all the central banks in Europe, as well as taxpayers.

No, the central banks in Europe derive their powers from the ECB now. It is the ECB that decentralises its currency monopoly to its agents – the National Central Banks (NCBs).

Anyway, against my better judgement, I read the report – A House Built on Sand – from the British-based organisation – Open Europe – which markets itself as “an independent think tank … set up by some of the UK’s leading business people … [it] … believes that the EU must now embrace radical reform based on economic liberalisation, a looser and more flexible structure …”

Which means it is not independent of the free-market ideology at all and is being funded by a business lobby to further their own sectional interests although in advocating austerity I wonder how they can construe that as being in their interests.’

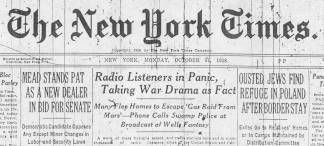

This report has about the same status (but not the class nor wit) of Orson Welles’ 1938 radio broadcast predicting the end of the world. At the time (October 31, 1938) the New York Times carried this headline.

Please read my blog – The US Federal Reserve is on the brink of insolvency (not!) – as background.

The fact is clear. The ECB can never go broke. It can always replenish any losses it makes at any point it wants. The ECB notes that:

Legally, both the ECB and the central banks of the euro area countries have the right to issue euro banknotes. In practice, only the national central banks physically issue and withdraw euro banknotes (as well as coins). The ECB does not have a cash office and is not involved in any cash operations. As for euro coins, the legal issuers are the euro area countries …

The ECB is responsible for overseeing the activities of the national central banks (NCBs) and for initiating further harmonisation of cash services within the euro area, while the NCBs are responsible for the functioning of their national cash-distribution systems. The NCBs put banknotes and coins into circulation via the banking system and, to a lesser extent, via the retail trade. The ECB cannot perform these operations as it does not have its own technical departments (distribution units, banknote processing units, vaults, etc.).

So the operations are at the level of the NCBs but the “ECB has the exclusive right to authorise the issuance of banknotes within the euro area”. This means it can never run out of euros and always approve the electronic entry of any amount of euros into any account (government or private) that it likes.

Some of you might dredge up some voluntary rules that would inhibit the ECB from just crediting an account called capital with as many euros or bonds as it liked. But imagine if the martians were really invading (as the Orson Welles broadcast implied) – or to be more specific – imagine if the Chinese decided to launch a ground invasion on America (to get back their bond investment when the stupid Congress defaults).

How long would voluntary rules last if the US government wanted to defend its borders? Not long. All rules are political constructs. The same goes for the ECB.

There was a public outcry after the Orson Welles broadcast and the network (CBS) was censured and censored.

It would be far more appropriate to censure and censor this current lot of alarmists.

When it comes to thinking about a national governments fiscal capacities think about this.

The global financial crisis has wiped off billions of dollars in nominal value from the asset holdings that people might have had (or whatever currency the assets were denominated in). There have been many personal stories about the fraught future awaiting pensioners who had been persuaded to reverse-mortgage their already owned homes in search of greater bounty via various speculative ventures.

Even those who didn’t explicitly speculate lost significant amounts of their superannuation (deferred-pension) balances.

Others lost fortunes of varying amounts as their house values collapsed. Millions became unemployed and lost their livelihoods and have been plunged into poverty.

Millions more have died from starvation because they lost the capacity to purchase food.

What could a national government which issues its own currency do about that?

The day before the crisis unfolded – (day being a conceptual period) – the same people were planning their retirements, renovating their homes, enjoying the leisure that they had after work and the flexibility that their incomes brought. The developing world was reducing death rates by starvation (albeit slowly).

There were not enough jobs then but millions more workers were earning incomes than is the case now.

Quite apart from whether they should have done anything – which is a different debate – the US government could have replenished all superannuation accounts to their previous value, provided jobs for all workers who became unemployed, compensated all firms for lost profits, ensured the value of housing remained at is pre-crisis levels etc. On purely financial grounds there would be no problem in the US government crediting relevant accounts to make that happen.

Would this have been inflationary? Why would it have been given that all the government would be doing is maintaining aggregate demand and wealth stocks at their previous level and protecting private citizens from major debt default.

The same thing goes for the ECB, which in the Eurozone system really has the status of a combined central bank/fiscal authority without the political mandate from the people for either role. But it could ensure no member state government becomes insolvent and it could provide the euros at any time to ensure people had a viable job offer.

The crisis is a voluntary human folly imposed on the majority by the elites.

I am not suggesting the government should fully insure the private sector from poor decision making. Certainly mal-investments occur and need to be expunged. But while the “market” is seeing to that process, the national government has to ensure that the victims of this process are not damaged. They can always ensure that.

As an aside, the question of private wealth funding summits and research etc has come to a head in the last week with the US-based Roosevelt Institute – which claims to be “carrying forward the legacy and values” of the Roosevelts (FDR and wife) – accepted $US200,000 from the Peter G. Peterson Foundation to prepare a document as part of the 2011 Fiscal Summit organisation by Peterson. The Roosevelt paper claimed their was a fiscal problem in the US that needed net spending cuts.

Yves Smith wrote an exposition of this “progressive” sell-out – Bribes Work: How Peterson, the Enemy of Social Security, Bought the Roosevelt Name.

Yves Smith wrote:

And so it is that the arch-enemy of Social Security, Pete Peterson, rented out the good name of Franklin Delano Roosevelt, the reputation of the Center for American Progress, and EPI. All three groups submitted budget proposals to close the deficit and had their teams share the stage with Republican con artist du jour Paul Ryan. The goal of Peterson’s conference was to legitimize the fiscal crisis narrative, and to make sure that “all sides” were represented.

The New Deal 2.0 lot at Roosevelt responded to the accusations soon after – Speaking Truth to Power. Their “defense” was pathetic. They accepted the money, got some students to workshop a paper about deficit reduction, and claimed it was in the cause of advancing liberal views. They cannot get beyond the fact that the PGP compromised them by giving them cash to write material supportive of his deficit terrorism. The matter has since moved to other blogs and sites as so-called progressives (including the EPI) try to defend the indefensible – progressives taking money from Peterson.

The problem I also have is that several MMT writers remain associated with the New Deal 2.0 initiative and I think that association compromises their message. My views have been expressed privately as well.

Conclusion

Time to fly back home.

I repeat – Americans are stupid but they are not alone.

Tomorrow the Australian Labour Force data comes out and I guess I will have my head buried in that.

That is enough for today!

“the beneficiaries of interest payments on debt are more likely not to belong to a cohort we would classify as disadvantaged”

See the interesting table of wealth distribution in a recent Paul Krugman blog: http://krugman.blogs.nytimes.com/2011/06/07/who-are-the-rentiers/

Financial Securities: 60.6% (Top 1% of distribution); 37.9% (Next 9%); 1.5% (Bottom 90%).

So unless financial securities are comprised overwhelmingly private bonds, then the domestic beneficiaries of government interest payment are indeed, as you might expect, the rich.

On the Roosevelt Institute question, the Peterson tactic of paying an institution nominally of a different political view to push your point of view clearly has a double benefit. Not only does it enhance the point of view being pushed, while lowering the reputation of the rival institution, but when all this comes into the open, it creates divisions among the all-too-easily divided ‘progressive’ side. It seems to me that the best possible outcome from here is that the MMTers stay with the Roosevelt Institute, which returns the money to Peterson.

Bill, on a similar but tangential topic, I noticed in today’s RBA chart pack that except for the GDP spurt in 07 or 08 from the Aust. stimulus package that Australian GDP has been trending downwards since at least 1995 and the chart only started at 1993.

Re Bill’s point that deficits can be funded by new money instead of debt, Keynes and Milton Friedman made this point, as did a German economist, Claude Hillinger, plus Warren Mosler. I’ve put the sources below.

As to what the logic is in funding via debt rather than new money, I am baffled. Under the former, the government / central bank machine pays (interest) to borrow something it can produce itself at no cost. That strikes me as pointless. But perhaps I’ve missed something.

A possible “pro debt” argument is that debt finance keeps politicians hands off the dollar bill printing press. But the problem with that argument is that politicians can still print debt and there’s not much difference between printing money and printing debt.

1. Milton Friedman (p.250), http://nb.vse.cz/~BARTONP/mae911/friedman.pdf

2. Keynes (2nd half of 5th para), http://www.scribd.com/doc/33886843/Keynes-NYT-Dec-31-1933

3. Claude Hillinger (p.3, para starting “An aspect of…”) http://www.economics-ejournal.org/economics/journalarticles/2010-23

4. Warren Mosler (2nd last para). http://www.huffingtonpost.com/warren-mosler/proposals-for-the-banking_b_432105.html

Funding a deficit through debt rather than 100% new money creation requires less monetary expansion. Whether this is a good thing or not depends on macroeconomic circumstances.

Americans are stupid in this context mainly for believing the US govt could become the next Greece and face a funding crisis that shuts off our ability to spend, drives us hat in hand to the imf for a bailout with forced austerity measures, with the only alternative to print money and instantly hyper inflate ourselves into Zimbabwe, and all that nonsense.

Otherwise, unless some new line of nonsense emerged, the US would likely take some of the pro employment options you suggest. We did do a somewhat large deficit increasing ‘stimulus package’ but that was all we dared ‘risk’ due to our misguided worries over finances.

There is no ‘answer’ to the financial question short of understanding MMT and the understanding that there is no problem

On public knowledge of deficits, defaults and their importance, I can’t put my hand on my heart and say Aussie would answer any differently….

On Republicans and default, this demonstration of a willing malfeasance and malevolence against their own people is breathtaking. They are simply going more Austrian by the day, and the fact that a guy like Ron Paul gets airtime on these issues illustrates the point and is deeply concerning.

At least the Depression had a few years of 12% average annualised growth before stupidity won the day again……

Dan, Thanks for your response, but I’m still in the dark. Under what “circumstances” would debt be better than new money?

I am not suggesting the government should fully insure the private sector from poor decision making. Certainly mal-investments occur and need to be expunged. But while the “market” is seeing to that process, the national government has to ensure that the victims of this process are not damaged. They can always ensure that.

How could mal-investments be expunged if the government sustains nominal aggregate demand? It’s not possible, loss of income is the signal needed to detect mal-investment and take action. Sustaining nominal aggregate demand will keep those mal-investments alive for too long, and then you get Japan for the past two decades.

Maybe I dramatize, but it seems to me that neoliberalism will bring down the western civilization.

MamMoTH

Loss of income for whom? Commercial property investors have not been hit anywhere near as hard as households have in this crisis. The signal should be declining asset values which should hit equity, not trickle down theories of income loss signals.

I believe our good Senator Toomey has been given the green light by his patrons to assert this political default. When we see all of the deliberate distortions that have been enginered during the last 2 years, we can be confident that the bond holders who “matter” are fully on board with this strategy, even if it means a temporary loss of interest income. But after all, each of us needs to sacrifice in our own unique way.

pebird, what prevented commercial property investors from taking bigger losses?

MamMoTh, You make the same mistake that Austrians make. They think that years of austerity is needed to get rid of malinvestments. The reality is that in the average sized economy hundreds of businesses go bust every day, and hundreds of new ones start up every day – regardless of whether the economy is booming or in recession. A business which is going downhill will last slightly longer in a boom than in a recession: that’s the only difference.

Ralph, I think that is one of the few things the Austrians have it right. Businesses go bust every day, and new ones pop up. However a depression caused by widespread mal-investment in one sector that is a huge part of the economy (real estate, the financial sector) is different because too many businesses go bust at the same time. So my question is, if the government sustains aggregate demand, what will signal where mal-investment is to get rid of it?

“Re Bill’s point that deficits can be funded by new money instead of debt, Keynes and Milton Friedman made this point, as did a German economist, Claude Hillinger, plus Warren Mosler.”

There’s no economic difference between issuing money and issuing (short term) debt. Money has the cosmetic advantage of not increasing the national debt, but the cosmetic disadvantage of increasing the monetary base (often claimed to cause inflation).

So my question is, if the government sustains aggregate demand, what will signal where mal-investment is to get rid of it?

Sub-aggregate distribution?

“So my question is, if the government sustains aggregate demand, what will signal where mal-investment is to get rid of it?’

Well, you allow the failed businesses and companies to really fail (no bail outs) and at the same time time you maintain aggregate demand by, say, sending every taxpayer a rebate of $ 5,000 or $10,000 or whatever is needed to keep the economy running.

Plus you hold the shareholders and executives accountable. Shareholders are wiped out and executives pay with their own assets. Social security will then take care of their basic needs for survival.

And don’t tell me this is impossible. In Brazil, for instance, there are dozens of executives of failed businesses living at the expense of families and friends. Their bank accounts were blocked and their private assets sold by the courts in order to make them pay for their incompetence.

This is what capitalism should be about. You fail, you pay.

But of course the US hasn’t been a capitalist society for a long time.

“So my question is, if the government sustains aggregate demand, what will signal where mal-investment is to get rid of it?”

New competitors with good investment taking market share from the living dead.

What you need to do is open up a space where investors can get in. That is the problem at the moment. The mal-invested supply is inefficient and it remains propped up with low interest rates and bailouts. However the overall demand has dropped down towards it. You end up with a zombie situation. There is no gap there for fresh investment.

Whereas if you’d looked after demand, then the demand would have remained constant as supply fell (due to inefficiency and a small amount of failure). That creates the space for new investment to come in and finish off the inefficient.

So businesses still fail, but due to inefficiency, mal-investment and lack of demand in their niche, not a general overall lack of demand.

There are two ways to get that investment gap. You let demand fall and supply/prices fall further, or you prop up demand and allow supply/prices to fall less far. Both situations continue until you get you an appropriate amount of excess of demand over supply. Investment then should respond to the demand by trying to fill the hole.

MamMoTh, You’ve entered a hornet’s nest! My answer to your last comment is thus. Why is there a need to identify the businesses which will survive given healthy aggregate demand, but which will fail given a fall in demand in say 2011? Some of the latter businesses will get their act together and will survive a recession in ten years time. So why let a recession happen now and destroy them now? In contrast, some businesses will go from bad to worse and fail regardless of whether we have a strong recovery or double dip. Let them go bust: that’s the free market doing its work. I.e. if government maintains demand, mal-investments which in future years will get significantly more “mal” will eventually go bust. Problem solved, and there is no need for a recession to help solve that problem.

As to your question “what will signal where mal-investment is”, the answer is (in the case of competently run businesses) the profit and loss account. That is the business owner will see what is happening and close the business down in an orderly fashion. As to incompetent owners, they suddenly find they’ve run out of cash and loan facilities. (Except, of course, in the case of HBOS, RBS and others with good political connections, ho, ho.)

MamMoTh: “So my question is, if the government sustains aggregate demand, what will signal where mal-investment is to get rid of it?”

The trade off is liquidation of malinvestment, risking a depression and massive unemployment to purge it, or suffer some malinvestment for awhile but save employment in the present and let the normal course of events under capitalism resolve inefficient allocation of capital (“Trust the process”). MMT chooses the latter. It is much less costly in quantity and quality.

hi bill

what do you think about this study on EU debt?

http://www.eudebtwriteoff.com/

Dear Professor I have a slightly off topic question. The unemployment graph titled US National Unemployment Rate seems to follow a pattern of reduced employment during U.S. foreign troop deployments into conflict zones. It seems that spending American resources on troop deployment is so economically disruptive, if the goal is to reach 100 employment, that even though you are eliminating a potential labor force expansion by deploying otherwise employable young people, unemployment continues to rise. While 1983 appears to present a increase of unemployment that differs from my hypothesis I would like to point out that while Reagan liked proxy fighters and limited engagement instead of the shock and awe of the bushes, his administration oversaw the largest increase of resource dedication toward the security sector since WW2. So I ask does military and security sector spending have a negative or a positive effect on the American economy, specifically how does it effect American employment?

Ralph Musgrave said: “As to what the logic is in funding via debt rather than new money, I am baffled.”

I’m going to rephrase that. As to what the logic is in funding via debt rather than new medium of exchange with no bond attached, I am baffled.

I believe the assumption is that real aggregate demand is unlimited or that real aggregate supply can never reach real aggregate demand so that real GDP grows by the amount real aggregate supply grows.

With that assumption, you now spoil the rich and businesses with real “earnings” growth from productivity growth and other things so they want to borrow to expand. Next, make sure the workers get negative real earnings growth and trick them into borrowing to make up the difference. Now real aggregate supply expands as fast as possible and workers’ retirement date moves back (they retire later in life, if at all) so that you won’t run out of workers in the future.

As long as more and more debt does NOT produce wage inflation and/or price inflation, there won’t be any problems (in their mind anyway).

That means poor economic assumptions and/or just trying to come up with excuses to spoil the rich, the bankers, and the economists.

MamMoTh, do you actually mean a mal-investment in time because of debt?

If more medium of exchange is created with no bond attached (present spending in the present) instead of with a bond attached (debt/loan, future demand brought to the present) IN THE PAST, would that “mal-investment” have occurred?

pebird, commercial property investors have been hit harder than households, it is just that you don’t hear about it.

“Dan, Thanks for your response, but I’m still in the dark. Under what “circumstances” would debt be better than new money?”

Ralph, I think the circumstances would be those in which we were closer to full capacity and full employment. In such circumstances, chasing goods with newly-created money might be inflationary, since the economy cannot easily respond to the additional dollar demand with additional output, and so the added dollars would just bid up prices. In such circumstances, if important additional government spending is seen as desirable – to help invest in additional capacity, for example, in the form of infrastructure creation – wouldn’t it be better to attract existing monetary resources away from ongoing private sector purchases, in exchange for promises of future interest payments, rather than produce new monetary resources? The money creation is postponed to the maturity of the bonds, and that might be in the interest of price stability.

Dan, I don’t think your argument holds. Going back to the start of the argument, Bill’s original point was that a deficit can be funded by new money. I.e. he is ASSUMING a deficit or “stimulus” is needed. In that scenario, new money beats borrowing in my view.

In contrast, if an economy is at capacity, then obviously new money is ruled out else inflation ensues, but stimulus from a “borrow and spend” policy is also ruled out.

As regards the hypothetical scenario you propose just above, i.e. where an economy is NEAR capacity, obviously any money printing has to be done with care, but so too does any stimulus from “borrow and spend”.

As regards government funding infrastructure projects (at full employment), as you say, private sector demand has to be curtailed to leave room for extra public sector demand. But this is a totally different scenario: not one that is central to the argument here. In this “infrastructure” scenario, there is a choice between two ways of curtailing private sector demand: increased tax or borrowing. New money doesn’t come into it.

Incidentally, where a government wants to fund $X of public spending by borrowing, it stikes me the amount of borrowing will need to be much more than $X to get the requisite demand reducing effect. I suspect governments have not cottoned onto this point.

Ralph,

Your argument is correct, however it is the assumptions that matter. ‘Full employment’ cannot be full in an economy that is so productive that it can produce everything everybody demands before it exhausts the labour supply. The equilibrium will always fall short of full production in that case – the Paradox of Productivity.

You need an external surplus or an unfunded government deficit to fill the demand shortfall just so you can get the last bit of supply produced.

So at least part of what you describe as ‘structural’ is in fact part of the automatic stabilisers – unless the economy is considered unproductive.

MamMoTh wrote

“Sustaining nominal aggregate demand will keep those mal-investments alive for too long, and then you get Japan for the past two decades.”

And what, pray, is wrong with living in Japan, compared to the rest of the West ? Health care? GINI? Life expectancy? Social stability? What have the Japanese suffered exactly these “past two decades”?

MamMoTh and nealb:

Take a look at this Harvard Business Law Review article:

“www.hblr.org/2011/02/understanding-the-commercial-real-estate-debt-crisis”

Some of the highlights:

“Over 50% of outstanding commercial real estate debt is held by banks, which reported that as of September 30, 2010, only 4.41% of such mortgages were more than 90 days delinquent.”

“Most commercial real estate is owned in a single-asset limited liability company or limited partnership, which serves to segregate exposure to contract and tort liability.”

“This ownership structure is significant in the debt context because most permanent commercial real estate loans are non-recourse or limited-recourse to the parent company or individuals behind the single-asset entity.”

We are witnessing a brilliant strategy executed by the Republicans. There isn’t really a debt crisis, so they are going to manufacture one by voluntarily defaulting on the US debt. That will ‘prove’ their point that our debt is unsustainable so they can proceed with dismantling our meager social safety net.

Vassilis, my remark about Japan has nothing to do with what their current standard of living is compared to that of the rest of the West, but about how it would compare with itself had Japan not stagnated for the past 20 years.

Right on Bill! I am with you on the issues you raise here, including how some economists hide their incorrect views behind the NEW DEAL2.0 and some other institutes you do not mention confusing issues!

There is no functional difference between “borrowing” and “printing money”. Government deficits are 100% new money to the economy, period. I know there is lot of confusion out there among mainstream economists, that’s why no-one should listen to them.

Here is a study about those issues:

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=115128

For those that do not know, there is a possibility for NCBs to issue reserves directly and not only currency via the Emergency Liquidity Assistance (ELA) already used by the bank of Ireland (70+ billion euros) which in the case of Greece according to my calculations can be over 120 billion euros! It needs post approval by the ECB board and can be refused with 2/3 majority (but who will refuse after it is done fearing the damage to the euro!) So the NCB can act as a cetral bank in a emergency circumsatnces ant thse can be defined by the NCB!!!

I some enlightening comments about Greece in the comments of this blog. About the off market credit default swaps that Greece bought to conceal its debt : would anyone have an opinion regarding the sale of the counterparty exposure to NBG a few years after the contract was initiated?

https://billmitchell.org/blog/?p=14739&cpage=1#comment-17838