I started my undergraduate studies in economics in the late 1970s after starting out as…

Calling Planet Earth – they will print low

More rate rises on the way: economists – where various “leading” bank economists were interviewed about the release of the minutes from the last month’s Monetary Policy Meeting of the Reserve Bank Board and the pending release of today’s wage cost data from the Australian Bureau of Statistics. I heard that we are facing rising wage pressures which would force the RBA to hike interest rates soon and that increased fiscal rectitude was required to ease inflationary pressures. I checked the station to make sure I wasn’t receiving some short-wave radio station from an unknown planet somewhere. As it turned out I disagreed with everything my bank colleagues said which is no surprise. But I decided then to call today’s blog – “They will print low” – which was part a reflection of the opaque jargon these bank economists use to convince themselves that they have something important to say and partly my forecast for today’s wage data. Here are a snippet from last night’s ABC PM segment that I linked to in the introduction:

Journalist: … David de Garis, senior economist with the National Australia Bank. He says it’s wages that are causing the biggest headache for the bank. DAVID DE GARIS: We’ve already seen wages growth pick up to just under 4 per cent over the past year or so and signs are there with the unemployment rate pushing down through 4.9, through 5 and to 4.9 per cent that going forward we expect even more pressure on wages. So that’s pressuring business costs and we’re likely to see some increase in the inflation rate over the next year to 18 months. DAVID TAYLOR: It’s such a big concern that some economists are calling for a change to immigration policy. CommSec economist, Savanth Sebastian. SAVANTH SEBASTIAN: You need to start … increasing the size of the labour force or the workforce and to do that skilled migration in the short term is the key driver on that front. So I think from that perspective you want to see tight fiscal policies so there’s no stimulatory factors to the economy, tight spending from the Government and an improvement in skilled migration. That will help to alleviate some of the pressures on the Reserve Bank. DAVID TAYLOR: In fact figures out tomorrow morning will give analysts a picture of just how much pressure the labour market is putting on inflation. DAVID DE GARIS: But yeah it depends on the flow of data. For instance tomorrow we’ve got the wages numbers for the March quarter as well as consumer sentiment and skilled vacancies data. So there is the potential there to add a little bit more to the picture, particularly the wages numbers which we think will probably print on the high side.So here we have some bank economists – who represent private corporate interests only – presenting themselves as experts on the economy and informing the public (it is a national program) that:

- The government should tighten fiscal policy even further so “there’s no stimulatory factors to the economy”.

- That the labour force is too small despite 12 per cent of it being idle in either unemployment or underemployment and we should bring more people into Australia so they can be unemployed too given that employment growth is not keeping pace with population growth at present.

- That wages are “pressuring business costs” despite today’s figures clearly showing business costs are easing – real wages growing slower than productivity.

- That wage numbers “will probably print on the high side” – when, in fact, they “printed” on the low side and always were going to given that the East coast economy (where most Australians live) is probably close to contracting.

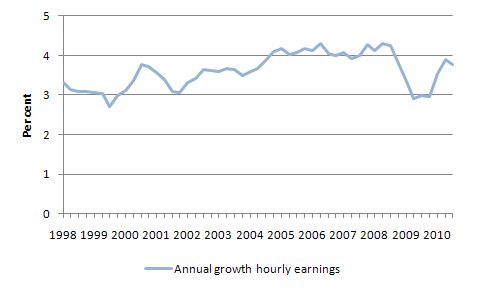

Many commentators focus on this series when making statements about the direction of the labour market. As it stands it doesn’t tell us very much. But today’s data shows that the growth rate was 3.8 per cent and easing.

The ABC News report today – Moderate wages growth reduces rate hike risk – quoted on commentator as saying:

Many commentators focus on this series when making statements about the direction of the labour market. As it stands it doesn’t tell us very much. But today’s data shows that the growth rate was 3.8 per cent and easing.

The ABC News report today – Moderate wages growth reduces rate hike risk – quoted on commentator as saying:

The economic data over the last couple of weeks has indicates that the economic landscape is not as robust as what some commentators may think … The employment data highlighted job losses in the past month, housing prices have recorded the biggest quarterly slide on record, the manufacturing, services and construction sectors continues to suffer and the Aussie dollar is making Australian exports less competitive, while depressing the tourism sector.Exactly. The Sydney Morning Herald carried the headline – Consumers glum as wage growth stalls. They continue to quote one of the worst of the bank commentators who recently had been predicting a wages explosion. Today, she was quoted as saying:

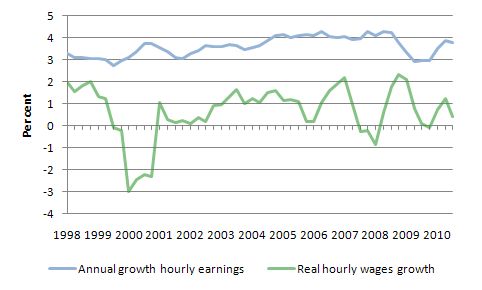

We doubt if the upward trajectory for wages growth has stalled permanently,I doubt that too – growth will be stronger one day when policy makers stop squeezing private spending and private spenders become more confident. But given what is happening in the economy – fiscal retrenchment; households with record levels of debt; high labour underutilisation; housing market contracting; consumer sentiment falling etc – the correct statement might have been – “wages growth is stalling because the economy is slowing”. We need to investigate the matter further to get a better picture of what is happening in the labour market with respect to its distributive role (between labour and capital). So what about real wages? The following graph uses ABS Consumer Price Index data (headline rate) to deflate the hourly rates of pay to allow us to compute real hourly wage growth. That is, the purchasing power equivalent of the nominal wages. I have juxtaposed the real growth series on the previous nominal growth series to let you more easily compare them. The drop in real wages around 2001 was due to the introduction of the Goods and Services Tax (a 10 per cent on most sales) which caused a one-off spike in inflation as the system adjusted. The difference between the two series is the inflation rate. You can see that even when nominal wages growth was above 4 per cent (during our so-called Mining Boom Mark I which came to an end when the GFC hit) real wages growth was fairly modest and went negative just before the crisis due largely to the oil price hikes that preceded the crisis.

When I say real wages growth was fairly modest what benchmark am I making that assessment against? Answer: hourly labour productivity growth.

Real wages growth is measures the growth in what the workers get out of their contribution to production in real terms (the growth in the real goods and services they command as a result of their labour).

Labour productivity growth measures the growth in production per unit of labour. So it is a measure of how the workers per unit contribution is growing per hour (or whatever period you want to measure it over).

In the (non-neo liberal) past, the two growth rates were commensurate. Workers were able to enjoy growing living standards from their labour in proportion to their contribution to production. There was a logic to that. If there was a large negative discrepancy between what the workers received and what they contributed then who would be able to purchase the consumption goods produced?

By ensuring workers real wages kept pace with productivity growth the system reduced the possibility of under-consumption crises – that is, inadequate private consumption spending – which would have created recessions.

The other side of this is that labour productivity growth provides the non-inflationary “room” for real wages growth. Business costs do not rise per unit if real wages growth is “funded” by productivity growth.

Labour productivity (LP) is the units of real GDP per person employed per period:

LP = GDP/L

where LP is labour productivity, GDP is real output and L is employment (labour units). So in English, labour productivity is the real output produced per unit of labour unit added.

The real wage – which is the purchasing power equivalent on the nominal wage that workers get paid each period is a ratio of two variables: (a) the nominal wage (W) and the aggregate price level (P).

The real wage (w) tells us what volume of real goods and services the nominal wage (W) will be able to command and is obviously influenced by the level of W and the price level. For a given W, the lower is P the greater the purchasing power of the nominal wage and so the higher is the real wage (w).

We write the real wage (w) as W/P. So if W = 10 and P = 1, then the real wage (w) = 10 meaning that the current wage will buy 10 units of real output. If P rose to 2 then w = 5, meaning the real wage was now cut by one-half.

But if real wages are growing then the workers have greater purchasing power in real terms and are thus better off. So that is independent of what is happening to productivity.

Nominal GDP ($GDP) can be written as P.GDP, where the P values the real physical output at market prices. The dot just signifies multiplication.

Unit labour costs are measured as the dollars spent on labour input (that is, total labour costs) per unit of real output produced.

Total labour costs are W.L (that is, nominal average wage times the number of workers receiving it). So unit labour costs are written as:

ULC = W.L/GDP

But ULC only tells us part of the story. To get a better impression of what is going on in the economy from a distributional struggle perspective (that is, the battle over real income shares between workers and capital) we need to express ULC in real terms.

We define Real Unit Labour Costs (RULC) which is a measure that Treasuries and central banks use to describe trends in costs within the economy.

RULC = ULC/P

That is, deflated by the price level (P).

We can then see that:

RULC = (W.L/GDP)/P

which (without going into the algebra) is equivalently expressed as:

RULC = W.L/GDP.P

You will also not that RULC is exactly equal to the wage share in national income. So if workers are commanding a greater share of national income, RULC are rising and business profits are being squeezed. Please read my blog – Saturday Quiz – May 15, 2010 – answers and discussion – for more discussion on this point.

Now it becomes obvious that if the nominal wage (W) and the price level (P) are growing at the same pace the real wage is constant. And if the real wage is growing at the same rate as labour productivity, then both terms in the wage share ratio are equal and so the wage share is constant and RULC are constant.

The wage share was constant for a long time during the Post Second World period and this constancy was so marked that Kaldor (the Cambridge economist) termed it one of the great “stylised” facts. So real wages grew in line with productivity growth which was the source of increasing living standards for workers.

The productivity growth provided the “room” in the distribution system for workers to enjoy a greater command over real production and thus higher living standards without threatening inflation.

Since the mid-1980s, the neo-liberal assault on workers’ rights (trade union attacks; deregulation; privatisation; persistently high unemployment) has seen this nexus between real wages and labour productivity growth broken. So while real wages have been stagnant or growing modestly, this growth has been dwarfed by labour productivity growth.

So the wage share has fallen in many nations operating under these conditions. Thus workers could have enjoyed much higher material living standards if they could have claimed more of the productivity growth (and kept the wage share constant). Please read my blog – The origins of the economic crisis – for more discussion on this point.

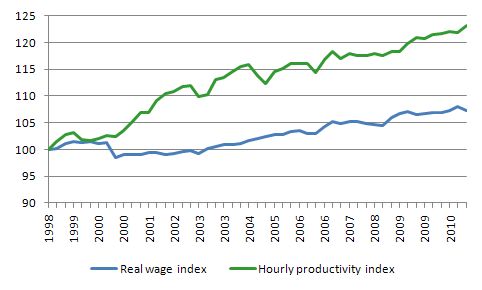

The following graph shows the index numbers for real hourly earnings (as before) and the labour productivity (100 = September 1998). I used the National Accounts measure of GDP per hour worked market sector to align the productivity measure (hourly) with the earnings index. The graph is from the September quarter 1998 to the March quarter 2011.

Now you start getting a better picture of what has been going on. The modest real wages growth over this period (as the neo-liberal deregulation of the labour market and suppression of unions was juxtaposed with entrenched unemployment and rising underemployment) has lagged well behind labour productivity growth. Over this period there has been a systematic redistribution of national income to profits at the expense of workers.

The only way private consumption was able to growth as strongly as it did over this period was because the financial engineers (aided and abetted by lax regulation) convinced households to take on record levels of debt. Further, without this credit binge the economy would have slowed dramatically and the federal government would not have been able to run the surpluses for as long as they did. The Australian economy would have hit the US post Clinton surpluses recession as well.

When I say real wages growth was fairly modest what benchmark am I making that assessment against? Answer: hourly labour productivity growth.

Real wages growth is measures the growth in what the workers get out of their contribution to production in real terms (the growth in the real goods and services they command as a result of their labour).

Labour productivity growth measures the growth in production per unit of labour. So it is a measure of how the workers per unit contribution is growing per hour (or whatever period you want to measure it over).

In the (non-neo liberal) past, the two growth rates were commensurate. Workers were able to enjoy growing living standards from their labour in proportion to their contribution to production. There was a logic to that. If there was a large negative discrepancy between what the workers received and what they contributed then who would be able to purchase the consumption goods produced?

By ensuring workers real wages kept pace with productivity growth the system reduced the possibility of under-consumption crises – that is, inadequate private consumption spending – which would have created recessions.

The other side of this is that labour productivity growth provides the non-inflationary “room” for real wages growth. Business costs do not rise per unit if real wages growth is “funded” by productivity growth.

Labour productivity (LP) is the units of real GDP per person employed per period:

LP = GDP/L

where LP is labour productivity, GDP is real output and L is employment (labour units). So in English, labour productivity is the real output produced per unit of labour unit added.

The real wage – which is the purchasing power equivalent on the nominal wage that workers get paid each period is a ratio of two variables: (a) the nominal wage (W) and the aggregate price level (P).

The real wage (w) tells us what volume of real goods and services the nominal wage (W) will be able to command and is obviously influenced by the level of W and the price level. For a given W, the lower is P the greater the purchasing power of the nominal wage and so the higher is the real wage (w).

We write the real wage (w) as W/P. So if W = 10 and P = 1, then the real wage (w) = 10 meaning that the current wage will buy 10 units of real output. If P rose to 2 then w = 5, meaning the real wage was now cut by one-half.

But if real wages are growing then the workers have greater purchasing power in real terms and are thus better off. So that is independent of what is happening to productivity.

Nominal GDP ($GDP) can be written as P.GDP, where the P values the real physical output at market prices. The dot just signifies multiplication.

Unit labour costs are measured as the dollars spent on labour input (that is, total labour costs) per unit of real output produced.

Total labour costs are W.L (that is, nominal average wage times the number of workers receiving it). So unit labour costs are written as:

ULC = W.L/GDP

But ULC only tells us part of the story. To get a better impression of what is going on in the economy from a distributional struggle perspective (that is, the battle over real income shares between workers and capital) we need to express ULC in real terms.

We define Real Unit Labour Costs (RULC) which is a measure that Treasuries and central banks use to describe trends in costs within the economy.

RULC = ULC/P

That is, deflated by the price level (P).

We can then see that:

RULC = (W.L/GDP)/P

which (without going into the algebra) is equivalently expressed as:

RULC = W.L/GDP.P

You will also not that RULC is exactly equal to the wage share in national income. So if workers are commanding a greater share of national income, RULC are rising and business profits are being squeezed. Please read my blog – Saturday Quiz – May 15, 2010 – answers and discussion – for more discussion on this point.

Now it becomes obvious that if the nominal wage (W) and the price level (P) are growing at the same pace the real wage is constant. And if the real wage is growing at the same rate as labour productivity, then both terms in the wage share ratio are equal and so the wage share is constant and RULC are constant.

The wage share was constant for a long time during the Post Second World period and this constancy was so marked that Kaldor (the Cambridge economist) termed it one of the great “stylised” facts. So real wages grew in line with productivity growth which was the source of increasing living standards for workers.

The productivity growth provided the “room” in the distribution system for workers to enjoy a greater command over real production and thus higher living standards without threatening inflation.

Since the mid-1980s, the neo-liberal assault on workers’ rights (trade union attacks; deregulation; privatisation; persistently high unemployment) has seen this nexus between real wages and labour productivity growth broken. So while real wages have been stagnant or growing modestly, this growth has been dwarfed by labour productivity growth.

So the wage share has fallen in many nations operating under these conditions. Thus workers could have enjoyed much higher material living standards if they could have claimed more of the productivity growth (and kept the wage share constant). Please read my blog – The origins of the economic crisis – for more discussion on this point.

The following graph shows the index numbers for real hourly earnings (as before) and the labour productivity (100 = September 1998). I used the National Accounts measure of GDP per hour worked market sector to align the productivity measure (hourly) with the earnings index. The graph is from the September quarter 1998 to the March quarter 2011.

Now you start getting a better picture of what has been going on. The modest real wages growth over this period (as the neo-liberal deregulation of the labour market and suppression of unions was juxtaposed with entrenched unemployment and rising underemployment) has lagged well behind labour productivity growth. Over this period there has been a systematic redistribution of national income to profits at the expense of workers.

The only way private consumption was able to growth as strongly as it did over this period was because the financial engineers (aided and abetted by lax regulation) convinced households to take on record levels of debt. Further, without this credit binge the economy would have slowed dramatically and the federal government would not have been able to run the surpluses for as long as they did. The Australian economy would have hit the US post Clinton surpluses recession as well.

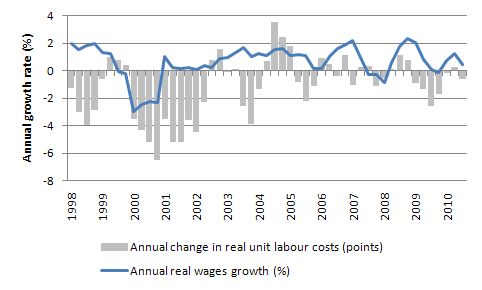

To round off the picture, the following graph shows the annual growth in real hourly earnings (as before) and the RULC (grey bars). The rising gap in the previous graph between real wages growth and labour productivity growth meant that RULC were systematically falling over the period shown. This wasn’t necessarily a smooth process as you can see by the grey bars which show the RULC growth (in annual percentage point terms).

Even during so-called Mining Boom Mark I (just prior to the crisis), the profit share continued to rise and workers were further falling behind.

But if you examine the March 2011 quarter you can see that the labour market is still transferring real income to profits at the workers’ expense because even though real wages grew (by 0.4 per cent over the last year), labour productivity growth was significantly more than that (1 per cent).

To round off the picture, the following graph shows the annual growth in real hourly earnings (as before) and the RULC (grey bars). The rising gap in the previous graph between real wages growth and labour productivity growth meant that RULC were systematically falling over the period shown. This wasn’t necessarily a smooth process as you can see by the grey bars which show the RULC growth (in annual percentage point terms).

Even during so-called Mining Boom Mark I (just prior to the crisis), the profit share continued to rise and workers were further falling behind.

But if you examine the March 2011 quarter you can see that the labour market is still transferring real income to profits at the workers’ expense because even though real wages grew (by 0.4 per cent over the last year), labour productivity growth was significantly more than that (1 per cent).

Conclusion

So while the headlines read that workers enjoyed a 3.8 per cent pay rise over the last year the reality is that in real terms this was a miserly 0.4 per cent and all the while the contribution they were making to production was growing at 1 per cent. The bosses cry in public about rising business costs (and are aided and abetted by these pathetic bank economists) but in private they know exactly what is going on.

That is enough for today!]]>

Conclusion

So while the headlines read that workers enjoyed a 3.8 per cent pay rise over the last year the reality is that in real terms this was a miserly 0.4 per cent and all the while the contribution they were making to production was growing at 1 per cent. The bosses cry in public about rising business costs (and are aided and abetted by these pathetic bank economists) but in private they know exactly what is going on.

That is enough for today!]]>

Yes,I’ve heard these bank (and other institutions) economists on the ABC. They sound like kids fresh out of some university business school. I automatically discount everything they say while having a quiet chuckle.

Tossers are a dime a dozen around the ridges.Has it been ever so?

I had to sign on today. Combined my rent assistance and “Newstart” allowance comes to 20 dollars a fortnight less than my rent. Presumably I should steal food. That’s okay though: I’m delighted to read that we have full employment and are having to import skilled labour. Surely that will mean I need only walk out my front door and trip over a job? And wages are going up all the time! Wonderful news! No idea why everyone I know feels like they are poorer than they were a decade ago.

Frankly, I just don’t fathom the wages explosion meme when the data show the economy beginning to drop away from mid-last year (ie. not ‘recent weeks’). Particularly when the mining sector makes up such a small proportion of the labour market.

In any case, the economists as a group won’t admit a lower path for wages until the RBA do, and we know their track record on inflation over the past year, and growth over the last 6-9mths. Heaven forbid economists get ahead of the game and note (nominal) wages growth are heading to low 3’s at a minimum. It’s what happens when your economy is rooted.

Wow- thanks for the quotes. The class war couldn’t be much clearer, could it?

“After the data, staring at the ridiculous nature of their narratives that had been predicting a housing price bubble, the economists were using words like “soft” and “weak” to describe the housing sector.”

Predicting a bubble?? – we already have a massive one, it’s why the numbers are “soft”. Hardly anyone can afford to buy a house in this country anymore which is why the housing loan numbers are low, that and all the demand that was brought forward by the boost to the FHOG.

As to wage inflation, I’m led to believe the new Liberal govt in NSW is only offering 2.5% for the next few years for all public servants in that state, ie. police, nurses etc, as well a rumored 20% cost savings accross the board for all departments. Now that 20% number may be an ambit claim, but even 5-10% will be very contractionary for the NSW state economy, and will mean many thousands of agency staff will lose their jobs. I work for the state government and know first hand that due to very low recruitment of permanent staff for the last decade of two, some departments employ a lot temporary staff through employment agencies, and because they can be dismissed at a moments notice they will be the first to go in any cutbacks.

These bank economists remind me of the shop owner in the dead parrot sketch…. vooom!! wages will explode if we don’t nail em down with interest rate rises.

Why aren’t the ACTU a wake up to this?