Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – April 2, 2011 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

Eurozone nations can only alter their international competitiveness by reducing domestic wages and prices because they no longer have a floating currency.

The answer is False.

The temptation is to accept the rhetoric after understanding the constraints that the EMU places on member countries and conclude that the only way that competitiveness can be restored is to cut wages and prices. That is what the dominant theme emerging from the public debate is telling us.

However, deflating an economy under these circumstance is only part of the story and does not guarantee that a nations competitiveness will be increased.

We have to differentiate several concepts: (a) the nominal exchange rate; (b) domestic price levels; (c) unit labour costs; and (d) the real or effective exchange rate.

It is the last of these concepts that determines the “competitiveness” of a nation. This Bank of Japan explanation of the real effective exchange rate is informative. Their English-language services are becoming better by the year.

Nominal exchange rate (e)

The nominal exchange rate (e) is the number of units of one currency that can be purchased with one unit of another currency. There are two ways in which we can quote a bi-lateral exchange rate. Consider the relationship between the $A and the $US.

- The amount of Australian currency that is necessary to purchase one unit of the US currency ($US1) can be expressed. In this case, the $US is the (one unit) reference currency and the other currency is expressed in terms of how much of it is required to buy one unit of the reference currency. So $A1.60 = $US1 means that it takes $1.60 Australian to buy one $US.

- Alternatively, e can be defined as the amount of US dollars that one unit of Australian currency will buy ($A1). In this case, the $A is the reference currency. So, in the example above, this is written as $US0.625= $A1. Thus if it takes $1.60 Australian to buy one $US, then 62.5 cents US buys one $A. (i) is just the inverse of (ii), and vice-versa.

So to understand exchange rate quotations you must know which is the reference currency. In the remaining I use the first convention so e is the amount of $A which is required to buy one unit of the foreign currency.

International competitiveness

Are Australian goods and services becoming more or less competitive with respect to goods and services produced overseas? To answer the question we need to know about:

- movements in the exchange rate, ee; and

- relative inflation rates (domestic and foreign).

Clearly within the EMU, the nominal exchange rate is fixed between nations so the changes in competitiveness all come down to the second source and here foreign means other nations within the EMU as well as nations beyond the EMU.

There are also non-price dimensions to competitiveness, including quality and reliability of supply, which are assumed to be constant.

We can define the ratio of domestic prices (P) to the rest of the world (Pw) as Pw/P.

For a nation running a flexible exchange rate, and domestic prices of goods, say in the USA and Australia remaining unchanged, a depreciation in Australia’s exchange means that our goods have become relatively cheaper than US goods. So our imports should fall and exports rise. An exchange rate appreciation has the opposite effect.

But this option is not available to an EMU nation so the only way goods in say Greece can become cheaper relative to goods in say, Germany is for the relative price ratio (Pw/P) to change:

- If Pw is rising faster than P, then Greek goods are becoming relatively cheaper within the EMU; and

- If Pw is rising slower than P, then Greek goods are becoming relatively more expensive within the EMU.

The inverse of the relative price ratio, namely (P/Pw) measures the ratio of export prices to import prices and is known as the terms of trade.

The real exchange rate

Movements in the nominal exchange rate and the relative price level (Pw/P) need to be combined to tell us about movements in relative competitiveness. The real exchange rate captures the overall impact of these variables and is used to measure our competitiveness in international trade.

The real exchange rate (R) is defined as:

R = (e.Pw/P)

where P is the domestic price level specified in $A, and Pw is the foreign price level specified in foreign currency units, say $US.

The real exchange rate is the ratio of prices of goods abroad measured in $A (ePw) to the $A prices of goods at home (P). So the real exchange rate, R adjusts the nominal exchange rate, e for the relative price levels.

For example, assume P = $A10 and Pw = $US8, and e = 1.60. In this case R = (8×1.6)/10 = 1.28. The $US8 translates into $A12.80 and the US produced goods are more expensive than those in Australia by a ratio of 1.28, ie 28%.

A rise in the real exchange rate can occur if:

- the nominal e depreciates; and/or

- Pw rises more than P, other things equal.

A rise in the real exchange rate should increase our exports and reduce our imports.

A fall in the real exchange rate can occur if:

- the nominal e appreciates; and/or

- Pw rises less than P, other things equal.

A fall in the real exchange rate should reduce our exports and increase our imports.

In the case of the EMU nation we have to consider what factors will drive Pw/P up and increase the competitive of a particular nation.

If prices are set on unit labour costs, then the way to decrease the price level relative to the rest of the world is to reduce unit labour costs faster than everywhere else.

Unit labour costs are defined as cost per unit of output and are thus ratios of wage (and other costs) to output. If labour costs are dominant (we can ignore other costs for the moment) so total labour costs are the wage rate times total employment = w.L. Real output is Y.

So unit labour costs (ULC) = w.L/Y.

L/Y is the inverse of labour productivity(LP) so ULCs can be expressed as the w/(Y/L) = w/LP.

So if the rate of growth in wages is faster than labour productivity growth then ULCs rise and vice-versa. So one way of cutting ULCs is to cut wage levels which is what the austerity programs in the EMU nations (Ireland, Greece, Portugal etc) are attempting to do.

But LP is not constant. If morale falls, sabotage rises, absenteeism rises and overall investment falls in reaction to the extended period of recession and wage cuts then productivity is likely to fall as well. Thus there is no guarantee that ULCs will fall by any significant amount.

Question 2:

Modern Monetary Theory (MMT) refutes the claim that government spending can crowd out private spending.

The answer is False.

The normal presentation of the crowding out hypothesis which is a central plank in the mainstream economics attack on government fiscal intervention is more accurately called “financial crowding out”.

At the heart of this conception is the theory of loanable funds, which is a aggregate construction of the way financial markets are meant to work in mainstream macroeconomic thinking. The original conception was designed to explain how aggregate demand could never fall short of aggregate supply because interest rate adjustments would always bring investment and saving into equality.

In Mankiw, which is representative, we are taken back in time, to the theories that were prevalent before being destroyed by the intellectual advances provided in Keynes’ General Theory. Mankiw assumes that it is reasonable to represent the financial system as the “market for loanable funds” where “all savers go to this market to deposit their savings, and all borrowers go to this market to get their loans. In this market, there is one interest rate, which is both the return to saving and the cost of borrowing.”

This is back in the pre-Keynesian world of the loanable funds doctrine (first developed by Wicksell).

This doctrine was a central part of the so-called classical model where perfectly flexible prices delivered self-adjusting, market-clearing aggregate markets at all times. If consumption fell, then saving would rise and this would not lead to an oversupply of goods because investment (capital goods production) would rise in proportion with saving. So while the composition of output might change (workers would be shifted between the consumption goods sector to the capital goods sector), a full employment equilibrium was always maintained as long as price flexibility was not impeded. The interest rate became the vehicle to mediate saving and investment to ensure that there was never any gluts.

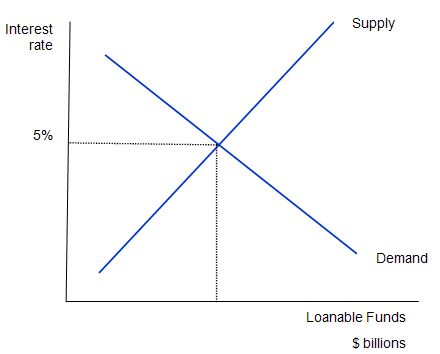

The following diagram shows the market for loanable funds. The current real interest rate that balances supply (saving) and demand (investment) is 5 per cent (the equilibrium rate). The supply of funds comes from those people who have some extra income they want to save and lend out. The demand for funds comes from households and firms who wish to borrow to invest (houses, factories, equipment etc). The interest rate is the price of the loan and the return on savings and thus the supply and demand curves (lines) take the shape they do.

Note that the entire analysis is in real terms with the real interest rate equal to the nominal rate minus the inflation rate. This is because inflation “erodes the value of money” which has different consequences for savers and investors.

Mankiw claims that this “market works much like other markets in the economy” and thus argues that (p. 551):

The adjustment of the interest rate to the equilibrium occurs for the usual reasons. If the interest rate were lower than the equilibrium level, the quantity of loanable funds supplied would be less than the quantity of loanable funds demanded. The resulting shortage … would encourage lenders to raise the interest rate they charge.

The converse then follows if the interest rate is above the equilibrium.

Mankiw also says that the “supply of loanable funds comes from national saving including both private saving and public saving.” Think about that for a moment. Clearly private saving is stockpiled in financial assets somewhere in the system – maybe it remains in bank deposits maybe not. But it can be drawn down at some future point for consumption purposes.

Mankiw thinks that budget surpluses are akin to this. They are not even remotely like private saving. They actually destroy liquidity in the non-government sector (by destroying net financial assets held by that sector). They squeeze the capacity of the non-government sector to spend and save. If there are no other behavioural changes in the economy to accompany the pursuit of budget surpluses, then as we will explain soon, income adjustments (as aggregate demand falls) wipe out non-government saving.

So this conception of a loanable funds market bears no relation to “any other market in the economy” despite the myths that Mankiw uses to brainwash the students who use the book and sit in the lectures.

Also reflect on the way the banking system operates – read Money multiplier and other myths if you are unsure. The idea that banks sit there waiting for savers and then once they have their savings as deposits they then lend to investors is not even remotely like the way the banking system works.

This framework is then used to analyse fiscal policy impacts and the alleged negative consquences of budget deficits – the so-called financial crowding out – is derived.

Mankiw says:

One of the most pressing policy issues … has been the government budget deficit … In recent years, the U.S. federal government has run large budget deficits, resulting in a rapidly growing government debt. As a result, much public debate has centred on the effect of these deficits both on the allocation of the economy’s scarce resources and on long-term economic growth.

So what would happen if there is a budget deficit. Mankiw asks: “which curve shifts when the budget deficit rises?”

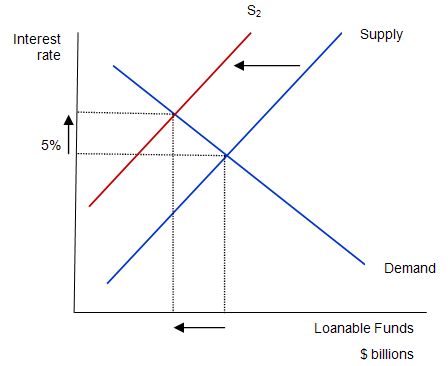

Consider the next diagram, which is used to answer this question. The mainstream paradigm argue that the supply curve shifts to S2. Why does that happen? The twisted logic is as follows: national saving is the source of loanable funds and is composed (allegedly) of the sum of private and public saving. A rising budget deficit reduces public saving and available national saving. The budget deficit doesn’t influence the demand for funds (allegedly) so that line remains unchanged.

The claimed impacts are: (a) “A budget deficit decreases the supply of loanable funds”; (b) “… which raises the interest rate”; (c) “… and reduces the equilibrium quantity of loanable funds”.

Mankiw says that:

The fall in investment because of the government borrowing is called crowding out …That is, when the government borrows to finance its budget deficit, it crowds out private borrowers who are trying to finance investment. Thus, the most basic lesson about budget deficits … When the government reduces national saving by running a budget deficit, the interest rate rises, and investment falls. Because investment is important for long-run economic growth, government budget deficits reduce the economy’s growth rate.

The analysis relies on layers of myths which have permeated the public space to become almost “self-evident truths”. Sometimes, this makes is hard to know where to start in debunking it. Obviously, national governments are not revenue-constrained so their borrowing is for other reasons – we have discussed this at length. This trilogy of blogs will help you understand this if you are new to my blog – Deficit spending 101 – Part 1 | Deficit spending 101 – Part 2 | Deficit spending 101 – Part 3.

But governments do borrow – for stupid ideological reasons and to facilitate central bank operations – so doesn’t this increase the claim on saving and reduce the “loanable funds” available for investors? Does the competition for saving push up the interest rates?

The answer to both questions is no! Modern Monetary Theory (MMT) does not claim that central bank interest rate hikes are not possible. There is also the possibility that rising interest rates reduce aggregate demand via the balance between expectations of future returns on investments and the cost of implementing the projects being changed by the rising interest rates.

MMT proposes that the demand impact of interest rate rises are unclear and may not even be negative depending on rather complex distributional factors. Remember that rising interest rates represent both a cost and a benefit depending on which side of the equation you are on. Interest rate changes also influence aggregate demand – if at all – in an indirect fashion whereas government spending injects spending immediately into the economy.

But having said that, the Classical claims about crowding out are not based on these mechanisms. In fact, they assume that savings are finite and the government spending is financially constrained which means it has to seek “funding” in order to progress their fiscal plans. The result competition for the “finite” saving pool drives interest rates up and damages private spending. This is what is taught under the heading “financial crowding out”.

A related theory which is taught under the banner of IS-LM theory (in macroeconomic textbooks) assumes that the central bank can exogenously set the money supply. Then the rising income from the deficit spending pushes up money demand and this squeezes interest rates up to clear the money market. This is the Bastard Keynesian approach to financial crowding out.

Neither theory is remotely correct and is not related to the fact that central banks push up interest rates up because they believe they should be fighting inflation and interest rate rises stifle aggregate demand.

However, other forms of crowding out are possible. In particular, MMT recognises the need to avoid or manage real crowding out which arises from there being insufficient real resources being available to satisfy all the nominal demands for such resources at any point in time.

In these situation, the competing demands will drive inflation pressures and ultimately demand contraction is required to resolve the conflict and to bring the nominal demand growth into line with the growth in real output capacity.

Further, while there is mounting hysteria about the problems the changing demographics will introduce to government budgets all the arguments presented are based upon spurious financial reasoning – that the government will not be able to afford to fund health programs (for example) and that taxes will have to rise to punitive levels to make provision possible but in doing so growth will be damaged.

However, MMT dismisses these “financial” arguments and instead emphasises the possibility of real problems – a lack of productivity growth; a lack of goods and services; environment impingements; etc.

Then the argument can be seen quite differently. The responses the mainstream are proposing (and introducing in some nations) which emphasise budget surpluses (as demonstrations of fiscal discipline) are shown by MMT to actually undermine the real capacity of the economy to address the actual future issues surrounding rising dependency ratios. So by cutting funding to education now or leaving people unemployed or underemployed now, governments reduce the future income generating potential and the likely provision of required goods and services in the future.

The idea of real crowding out also invokes and emphasis on political issues. If there is full capacity utilisation and the government wants to increase its share of full employment output then it has to crowd the private sector out in real terms to accomplish that. It can achieve this aim via tax policy (as an example). But ultimately this trade-off would be a political choice – rather than financial.

Question 3:

In general, the OECD and IMF estimates of the impact of the automatic stabilisers are biased downwards.

The answer is True.

This question is about decomposing the impacts of the automatic stabilisers from those attributable to the underlying fiscal stance. Both the revenue and spending side of the budget are adjusted.

The budget balance is the difference between total revenue and total outlays. So if total revenue is greater than outlays, the budget is in surplus and vice versa. It is a simple matter of accounting with no theory involved. However, the budget balance is used by all and sundry to indicate the fiscal stance of the government.

So if the budget is in surplus we conclude that the fiscal impact of government is contractionary (withdrawing net spending) and if the budget is in deficit we say the fiscal impact expansionary (adding net spending).

However, the complication is that we cannot then conclude that changes in the fiscal impact reflect discretionary policy changes. The reason for this uncertainty is that there are automatic stabilisers operating. To see this, the most simple model of the budget balance we might think of can be written as:

Budget Balance = Revenue – Spending.

Budget Balance = (Tax Revenue + Other Revenue) – (Welfare Payments + Other Spending)

We know that Tax Revenue and Welfare Payments move inversely with respect to each other, with the latter rising when GDP growth falls and the former rises with GDP growth. These components of the Budget Balance are the so-called automatic stabilisers

In other words, without any discretionary policy changes, the Budget Balance will vary over the course of the business cycle. When the economy is weak – tax revenue falls and welfare payments rise and so the Budget Balance moves towards deficit (or an increasing deficit). When the economy is stronger – tax revenue rises and welfare payments fall and the Budget Balance becomes increasingly positive. Automatic stabilisers attenuate the amplitude in the business cycle by expanding the budget in a recession and contracting it in a boom.

So just because the budget goes into deficit doesn’t allow us to conclude that the Government has suddenly become of an expansionary mind. In other words, the presence of automatic stabilisers make it hard to discern whether the fiscal policy stance (chosen by the government) is contractionary or expansionary at any particular point in time.

To overcome this uncertainty, economists devised what used to be called the Full Employment or High Employment Budget. In more recent times, this concept is now called the Structural Balance. The change in nomenclature is very telling because it occurred over the period that neo-liberal governments began to abandon their commitments to maintaining full employment and instead decided to use unemployment as a policy tool to discipline inflation. I will come back to this later.

The Full Employment Budget Balance was a hypothetical construct of the budget balance that would be realised if the economy was operating at potential or full employment. In other words, calibrating the budget position (and the underlying budget parameters) against some fixed point (full capacity) eliminated the cyclical component – the swings in activity around full employment.

So a full employment budget would be balanced if total outlays and total revenue were equal when the economy was operating at total capacity. If the budget was in surplus at full capacity, then we would conclude that the discretionary structure of the budget was contractionary and vice versa if the budget was in deficit at full capacity.

The calculation of the structural deficit spawned a bit of an industry in the past with lots of complex issues relating to adjustments for inflation, terms of trade effects, changes in interest rates and more.

Much of the debate centred on how to compute the unobserved full employment point in the economy. There were a plethora of methods used in the period of true full employment in the 1960s. All of them had issues but like all empirical work – it was a dirty science – relying on assumptions and simplifications. But that is the nature of the applied economist’s life.

Things changed in the 1970s and beyond. At the time that governments abandoned their commitment to full employment (as unemployment rise), the concept of the Non-Accelerating Inflation Rate of Unemployment (the NAIRU) entered the debate – see my blog – The dreaded NAIRU is still about!.

The NAIRU became a central plank in the front-line attack on the use of discretionary fiscal policy by governments. It was argued, erroneously, that full employment did not mean the state where there were enough jobs to satisfy the preferences of the available workforce. Instead full employment occurred when the unemployment rate was at the level where inflation was stable.

NAIRU theorists then invented a number of spurious reasons (all empirically unsound) to justify steadily ratcheting the estimate of this (unobservable) inflation-stable unemployment rate upwards. So in the late 1980s, economists were claiming it was around 8 per cent. Now they claim it is around 5 per cent. The NAIRU has been severely discredited as an operational concept but it still exerts a very powerful influence on the policy debate.

Further, governments became captive to the idea that if they tried to get the unemployment rate below the NAIRU using expansionary policy then they would just cause inflation. I won’t go into all the errors that occurred in this reasoning.

Now I mentioned the NAIRU because it has been widely used to define full capacity utilisation. The IMF and OECD use various versions of the NAIRU to estimate potential output. If the economy is running an unemployment equal to the estimated NAIRU then it is concluded that the economy is at full capacity. Of-course, proponents of this method keep changing their estimates of the NAIRU which were in turn are accompanied by huge standard errors. These error bands in the estimates mean their calculated NAIRUs might vary between 3 and 13 per cent in some studies which made the concept useless for policy purposes.

But they still persist in using it because it carries the ideological weight – the neo-liberal attack on government intervention.

So they changed the name from Full Employment Budget Balance to Structural Balance to avoid the connotations of the past that full capacity arose when there were enough jobs for all those who wanted to work at the current wage levels. Now you will only read about structural balances.

And to make matters worse, they now estimate the structural balance by basing it on the NAIRU or some derivation of it – which is, in turn, estimated using very spurious models. This allows them to compute the tax and spending that would occur at this so-called full employment point. But it severely underestimates the tax revenue and overestimates the spending and thus concludes the structural balance is more in deficit (less in surplus) than it actually is.

They thus systematically understate the degree of discretionary contraction coming from fiscal policy.

Accordingly, the underestimate the impact of the automatic stabilisers.

The following blogs may be of further interest to you:

- The dreaded NAIRU is still about!

- Structural deficits – the great con job!

- Structural deficits and automatic stabilisers

- Another economics department to close

Question 4:

If there is an external deficit, efforts by the private domestic sector to increase its overall saving as a percentage of GDP, will ensure the government budget is in deficit, irrespective of what the government desires.

The answer is True.

This question requires an understanding of the sectoral balances that can be derived from the National Accounts. But it also requires some understanding of the behavioural relationships within and between these sectors which generate the outcomes that are captured in the National Accounts and summarised by the sectoral balances.

Refreshing the balances (again) – we know that from an accounting sense, if the external sector overall is in deficit, then it is impossible for both the private domestic sector and government sector to run surpluses. One of those two has to also be in deficit to satisfy the accounting rules.

The important point is to understand what behaviour and economic adjustments drive these outcomes.

So here is the accounting (again). The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

Equating these two perspectives we get:

C + S + T = GDP = C + I + G + (X – M)

So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

A simplification is to add (I – S) + (X – M) and call it the non-government sector. Then you get the basic result that the government balance equals exactly $-for-$ (absolutely or as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances).

This is also a basic rule derived from the national accounts and has to apply at all times.

So what economic behaviour might lead to the outcome specified in the question?

If the nation is running an external deficit it means that the contribution to aggregate demand from the external sector is negative – that is net drain of spending – dragging output down.

Assume, now that the private domestic sector (households and firms) seeks to increase its saving ratio (as a percentage of GDP). Consistent with this aspiration, households may cut back on consumption spending and save more out of disposable income. The immediate impact is that aggregate demand will fall and inventories will start to increase beyond the desired level of the firms.

The firms will soon react to the increased inventory holding costs and will start to cut back production. How quickly this happens depends on a number of factors including the pace and magnitude of the initial demand contraction. But if the households persist in trying to save more and consumption continues to lag, then soon enough the economy starts to contract – output, employment and income all fall.

The initial contraction in consumption multiplies through the expenditure system as workers who are laid off also lose income and their spending declines. This leads to further contractions.

The declining income leads to a number of consequences. Net exports improve as imports fall (less income) but the question clearly assumes that the external sector remains in deficit. Total saving actually starts to decline as income falls as does induced consumption.

So the initial discretionary decline in consumption is supplemented by the induced consumption falls driven by the multiplier process.

The decline in income then stifles firms’ investment plans – they become pessimistic of the chances of realising the output derived from augmented capacity and so aggregate demand plunges further. Both these effects push the private domestic balance further towards and eventually into surplus

With the economy in decline, tax revenue falls and welfare payments rise which push the public budget balance towards and eventually into deficit via the automatic stabilisers.

If the private sector persists in trying to increase its saving ratio then the contracting income will clearly push the budget into deficit.

So we would have an external deficit, a private domestic surplus and a budget deficit.

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

Question 5: Premium Question

When a government runs a continuous budget deficit public spending builds up over time and eventually exposes the economy to inflation risk.

The answer is False.

This question tests whether you understand that budget deficits are just the outcome of two flows which have a finite lifespan. Flows typically feed into stocks (increase or decrease them) and in the case of deficits, under current institutional arrangements, they increase public debt holdings.

So the expenditure impacts of deficit exhaust each period and underpin production and income generation and saving. Aggregate saving is also a flow but can add to stocks of financial assets when stored.

Under current institutional arrangements (where governments unnecessarily issue debt to match its net spending $-for-$) the deficits will also lead to a rise in the stock of public debt outstanding. But of-course, the increase in debt is not a consequence of any “financing” imperative for the government because a sovereign government is never revenue constrained being the monopoly issuer of the currency.

The point is that there is no inflation risk per se with continuous budget deficits. The only time inflation becomes a risk from the demand side if nominal spending outstrips the capacity of the real economy to expand output.

A continuously increasing budget deficit might create those conditions, but a correctly calibrated continuous budget deficit will not because it will be just filling the non-government spending gap.

The following blogs may be of further interest to you:

404 on http://www.boj.or.jp/en/type/exp/stat/exrate.htm

Did you mean:

http://www.boj.or.jp/en/statistics/outline/exp/exrate.htm/ ??

Note from bottom of 404 page:

The Bank made a comprehensive renewal of its web site on January 31, 2011. Please note that URLs for all of the site’s pages, with the exception of the top page, accordingly have been changed.

I got 4 out of 5 this week – missed on Question One.

“Mankiw thinks that budget surpluses are akin to this.”

An interesting question is if mainstream thinking on this and other issues comes from the belief that money is a “thing”, “the most liquid of commodities”. Having been originated before and independently of States, in times immemorial one does not know of. Which, like gold, exists in a finite supply or quantity. In this view, States are users of money as any other people.

If that is the case, as I think it is, then one may recognize that mainstream thinking has logical internal consistency. The State cannot be the creator of money and if the issuer of the currency (a convenient representation of money) it should be strongly constrained. I believe that even mainstream economists understand that it is not possible to transfer instantly and physically gold from New York to Beijing at the touch of a key. And displacing physically gold from country to country is a foolish way of clearing current accounts. Given these and other inconveniences of the concept of money as a commodity, they probably concede that fiat currencies are a necessary evil, which should be adequately controlled by limiting as much as possible the control and use that States can exercise on them. In particular, State debt means that the State has taken a “thing” from someone.

I believe that in adopting this concept of money, mainstream economists are simply aligning with the majority of the population. This concept is a “mattress in the road to prosperity”.

Money can only be a thing in an inferior, low human grade, manifestation. In its superior, high human grade, manifestation, money is a relation. And a relation of trust among humans as it stands out. The designation “fiat money” does not full justice to this and even concedes to the “money as a commodity” concept, as commodities can be made. In its Latin root, “fiat” means “that it be made”. Fiat money would be more precisely designated as “trust money”.

In fact, trust cannot be made. Trust is a relation among people. It does not come into being as a *thing*, but as a psychological *behavior* expressing cooperation among people and the development of conditions for cooperation. An evidence to this comes from the observation that commodity monies – as cigarettes in a prison – develop in situations where trust and cooperation among people are pathologically impaired.

The “money as a commodity” concept inherently expresses a judgment of distrust in the functioning of society as a whole. The logic of trust money is that a local or component value (good or service) is exchanged against widespread or systemic value (money). At the contrary, the logic of commodity money is that a local or component value (good or service) is exchanged against a local or component value (money). Therefore it should not come to us as a surprise that an economic theory construed on the “money as a commodity” concept is blocking humankind from going into the next step of prosperity.

How is this relevant to MMT ideas dissemination? At the roots of mainstream economics and MMT lie two irreducible concepts of money. I would say that the probability that people recognize the truth of MMT is proportional to their acceptance of the money as a relation concept.

Re #4:

I usually think this with the private sector balance expressed as (S – I), so a positive is net saving. But: If there’s an external deficit (say, -5%) but the private sector balance (S – I) is an even larger negative (say, -10%), then the (G – T ) term has to be negative as well (-5% here) — a budget surplus like the USA in 1999, say. If the private sector then increases its desire to net save, so that (S – I) falls to a smaller negative (e.g., – 9%), the budget surplus has to fall, but it’s still possible that it’s a surplus (G – T) = -4%.

I read this as saying that the government balance will move *towards deficit*, but I don’t see that it guarantees that the government balance must be *in deficit*.

Why is my “FALSE” answer incorrect?

As usual I disagree with some of Bill’s answers. This time it’s those of 2 and 4. I also disagree with his solution to question 1, though not his conclusion.

Question 1:

The question does not ask whether such efforts are guaranteed to work. There are two real reasons why it’s false – firstly, the question only asks about alteration – it doesn’t specify improvement! So Eurozone nations can (negatively) alter their international competitiveness by increasing domestic wages and prices.

The second reason is that international competitiveness depends on more than price, and Germany seems to have done rather well competing on quality.

Question 2:

I accept that other forms of crowding out are possible, but in these other forms it the spending itself is not crowded out but instead causes the crowding out.

Question 4:

If the question had specified successful efforts by the private domestic sector then I’d agree. But it did not.

PG “At the roots of mainstream economics and MMT lie two irreducible concepts of money. I would say that the probability that people recognize the truth of MMT is proportional to their acceptance of the money as a relation concept.”-

I agree. To me it is also important to ensure that the financial system is as simple as it can possibly be made. As money is a relation, it is vital that that relation has a grounding in mutal comprehension and trust. I feel that unnecessary complexity has built up in the system so as to create exploitable information disadvantages.

I agree with Aidan on Q4. Given that careful reading of Prof. Mitchell’s questions is a requirement for successful quiz taking, I too interpreted that “efforts” to mean a possibility, not a given. Unless you assume that the private sector can always reduce consumption to increase savings, I would have worded the question somewhat differently.

It has just been a long time between 5 of 5s.

I agree with b2r on Q4.

stone said: “To me it is also important to ensure that the financial system is as simple as it can possibly be made.”

Try an all currency (no debt) financial system.

b2r

(G-T) = (S-I) + (M-X)

If (M-X) is positive

and (S-I) is positive i.e. more saving

the (G-T) will be positive i.e. there has to be a budget deficit

@Andy:

You are correct that a trade deficit combined with a private sector surplus will require a budget deficit — that’s the USA today, among other nations. But that’s not the case I proposed. I envisioned a trade deficit combined with an even larger private sector deficit — negative (S – I), as at the end of the Clinton era, when a government budget surplus was the flip side of the strong rise in private sector indebtedness. I certainly agree with the general MMT view that such a budget surplus was doomed to be a brief interlude, since it implies an ultimately unsustainable shrinkage in private sector net financial wealth. But it happened, at least for a while.

My objection to Bill’s answer to #4 then pictured a move by the private sector towards (relatively greater) net saving; the arithmetic then requires that the budget surplus will have to shrink, but it doesn’t imply that there must be an immediate reversion to a budget deficit. I would bet that one could find in the actual numbers for the sectoral balances, somewhere around 2000 to 2001, precisely the case I pictured — a lower budget surplus, but (before the recession came on fully and Bush policies kicked in) not yet a budget deficit. Maybe Bill would regard this as a quibble — once the shift towards net saving begins, it’s likely to create the sort of self-sustaining decline in spending that Bill’s answer describes. And I do note now that Bill says the shift to greater net saving will “push the public budget balance towards and eventually into deficit via the automatic stabilisers.” But “eventually” isn’t the same as immediately, and since the statement in the question says “…ensure that the government budget is in deficit,” I think one has to judge that to be false. It is not necessarily true that the budget “is in deficit” immediately, and getting there “eventually” isn’t quite the same thing.

b2r

This is an accounting identity describing any one period. By definition, in that period, unless the external sector moves into surplus the result of net savings in the private sector will produce the budget deficit outcome.

Looking again at the wording of the question, I am 100% sure Bill was not musing about future periods when he used the word \’enusre\’. He was using it in relation to the current period.

In any case it seems you\’ve got the general idea. Now move on to the the other operational realities of the monetary system. Central banking and bank reserves, what drives lending etc. Much more fun.

@Andy

I’m fine with your last sentence — accounting is a precondition, but not a substitute, for a good analysis, and analysis is more fun as well as more important.

But, one more (last) try, after which I won’t belabor the point further: I guess I didn’t read Bill’s answer closely enough. About the consequences of an increase in private net saving, he writes:

“Both these effects push the private domestic balance further towards and eventually into surplus

With the economy in decline, tax revenue falls and welfare payments rise which push the public budget balance towards and eventually into deficit via the automatic stabilisers.”

I have no problem with these statements for the case Bill has in mind. But, read carefully, he doesn’t seem to be considering the case I had in mind. If the private sector is pushed “eventually into surplus,” then it apparently wasn’t *in surplus to start with*. The process he describes, employing two uses of the word “eventually,” is entirely plausible. But it’s irrelevant to the case I was posing, which is both theoretically possible and factually relevant, for anyone who remembers (sadly) the nonsense spouted by many about the Clinton era, when the government budget was *already in surplus* before any change in private net saving occurred.

You say “I am 100% sure Bill was not musing about future periods …. He was using it in relation to the current period.”

If so, then his conclusion is clearly not a general one. Write the sectoral balance identity as

(S – I) = (G – T) + NX

Assume initial conditions such that (as % of GDP) the terms have values implying an initial budget surplus:

-10 = -5 + (-5)

Now, assume as in question #4 that we have “efforts by the private domestic sector to increase its overall saving as a percentage of GDP” such that the (S – I) term becomes less negative in the current period. I argue that the following is an entirely possible current period accounting outcome:

-9 = -4 + (-5)

So it is NOT the case that “the government budget is in deficit, irrespective of what the government desires” in the *current period* (no matter what scenario then “eventually” unfolds).

Q.E.D

(I’m not saying this is a general case either, nor that Bill’s story of contractionary impact is wrong – it isn’t. But the statement as written has exceptions and thus can’t be “true.”)

b2r:

I don’t think you are comparing like with like.

You seem to be trying to bring together actual changes in any one period with their accumualted ‘totals’

Using your formula

(S-I) = (G-T) + NX

The changes are:

-1 = -1 + 0

(S-I) is not increased savings. Its increased debt matched by a budget surplus

You did have me scurrying though

Sorry. Still scurrying

+1 = +1 + 0

Increased savings is matched by budget deficit

Not so. Increased private saving is matched by a reduction in the budget surplus. But the surplus is still there (though smaller) in the current period, as is required to allow the still negative flow of private net saving.

Dear b2r and Andy

Both of you are correct. The wording of Question 4 in last week’s quiz left open an ambiguity where the private sector could be in a large deficit and start to save thus reducing their deficit but the budget position could still be in surplus (for a time).

From an educational perspective it was a poorly worded question. Sorry! One word like “overall” would have been a better addition.

But at least the discussion has been educational.

best wishes

bill