I started my undergraduate studies in economics in the late 1970s after starting out as…

Employers have too much power

I have been travelling the last two days and have disrupted work patterns. But I did manage to read a few things in between other things today which made my hair stand on end and suggest that the austerity debate has moved ground. So desperately lacking is the real evidence which might support the economic claims the conservatives have been using to justify their manic desire to savage public spending when there is 10 per cent unemployment (and worse) – that the deficit terrorists are now appealing to morality – that public deficits and debt are immoral. It makes you wonder why these characters just don’t become stand-up comedians. But given how dangerous they are as a result of their positions in government it is clearly not a laughing matter. I would seek to try these characters for crimes against humanity when it becomes obvious to everyone how wrongful their actions are. It is interesting though – the descent into “moral” arguments means that you can conclude that even the conservatives know that the bevy of economic arguments that they use to justify their damaging policies are nonsense. But there is a new emerging problem. As I write today the entrenched unemployment that the deficit terrorists are now acknowledging they will cause to worsen is giving rise to employers discriminating against the most disadvantaged workers that are seeking work. What this tells us is that the employers have too much power.

I regularly update my transition probability matrices for different countries (sounds like an interesting life doesn’t it!) to work out if it is getting easier for the unemployed to get jobs. For the US you can investigate this issue by examining the Gross labour flows that are available from the US Bureau of Labor Statistics. I last did this in October 2010 in this blog – The plight of the unemployed – under growth and decay.

To fully understand the way gross flows are assembled and the transition probabilities calculated you might like to read these blogs – What can the gross flows tell us? and More calls for job creation – but then. For earlier US analysis see this blog – Jobs are needed in the US but that would require leadership

As a refresher, gross flows analysis allows us to trace flows of workers between different labour market states (employment; unemployment; and non-participation) between months. So we can see the size of the flows in and out of the labour force more easily and into the respective labour force states (employment and unemployment).

The various inflows and outflows between the labour force categories are expressed in terms of numbers of persons. But a useful alternative presentation is to compute transition probabilities, which are the probabilities that transitions (changes of state) occur. For example, what is the probability that a person who is unemployed now will enter employment next period.

So if a transition probability for the shift between employment to unemployment is 0.05, we say that a worker who is currently employed has a 5 per cent chance of becoming unemployed in the next month. If this probability fell to 0.01 then we would say that the labour market is improving (only a 1 per cent chance of making this transition).

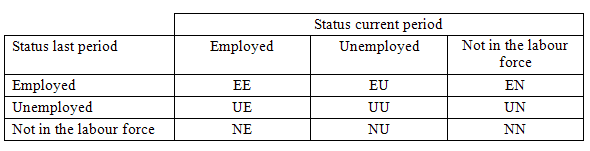

The following table shows the schematic way in which gross flows data is arranged each month – sometimes called a Gross Flows Matrix. For example, the element EE tells you how many people who were in employment in the previous month remain in employment in the current month. Similarly the element EU tells you how many people who were in employment in the previous month are now unemployed in the current month. And so on. This allows you to trace all inflows and outflows from a given state during the month in question.

The transition probabilities are computed by dividing the flow element in the matrix by the initial state. For example, if you want the probability of a worker remaining unemployed between the two months you would divide the flow (U to U) by the initial stock of unemployment. If you wanted to compute the probability that a worker would make the transition from employment to unemployment you would divide the flow (EU) by the initial stock of employment. And so on. So for the 3 Labour Force states we can compute 9 transition probabilities reflecting the inflows and outflows from each of the combinations.

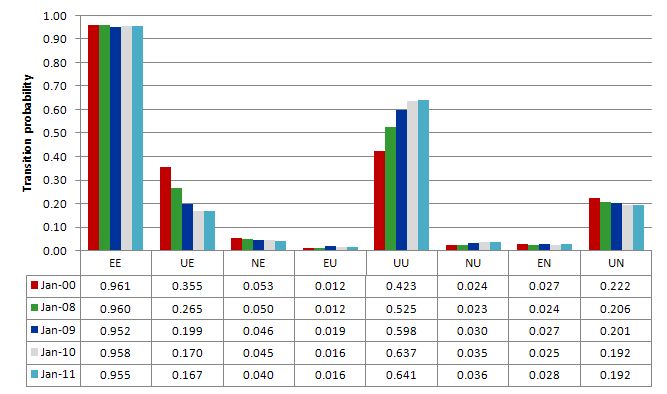

The first graph compares the US transition probabilities as at January 2008, January 2009, January 2010 and January 2011 (see the accompanying Table for values). The data is from the US Bureau of Labor Statistics. I also include the January 2000 observation which is the month when the chances of leaving unemployment for employment (UE) was the highest in this data set (since 1990).

The probability of getting a job if you were unemployed in January 2011 was 16.7 per cent and has hovered around that mark for some months. Twelve months ago it was 17 per cent so the situation has deteriorated over the last year. The chances of remaining unemployed is now rising (64.1 per cent compared to 52.5 per cent in January 2008). An unemployed person is more likely to exit the labour force altogether (19.2 per cent in January 2011) than to enter employment. These transitions (UN) will surely contain a significant hidden unemployment component.

The probability of retaining a job if you have one is virtually unaltered over the period shown although in recent months it has fallen (January 2011 = 95.5 per cent compared to January 2008 = 96 per cent).

Further, new entrants to the labour market face a declining likelihood that they will enter employment (January 2011 = 4 per cent compared to January 2008 = 5 per cent).

Conclusion: It is now harder to transit from unemployment to employment in the US compared to a year ago and much harder than 2 years ago. An unemployed person is much more likely to drop out of the labour force than to enter employment.

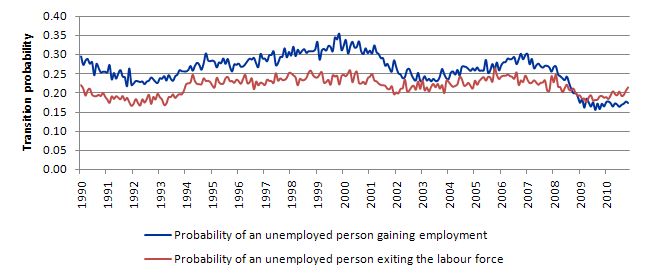

The following graph shows the transition probabilities of an unemployed person gaining employment (blue line) and exiting the labour force (red line) since 1990. You can see that the latter transition overtook the former during the crisis for the first time since the data has been made available.

So life for an unemployed person in the US is not looking up. Then I read this editorial in the New York Times (February 19, 2011) – The Unemployed Need Not Apply – which puts this aggregate data into an even grimmer light.

The editorial says that:

The Federal Reserve is projecting unemployment to continue at or near 9 percent for the rest of the year. That is 13.9 million Americans out of work. Here is more grim news: Barriers to employment for jobless workers may be even higher than previously thought. As the Fed updated its forecast last week, the Equal Employment Opportunity Commission held a forum on discrimination against unemployed job seekers. Members of Congress had urged the commission to explore the issue, after reading press reports of numerous instances in which employers and staffing agencies refused to consider the unemployed for openings.

The message – “the unemployed need not apply” – has at times been explicitly stated in job announcements. In other cases, unemployed job seekers have reported verbal rejections after a recruiter or employer learned they were not currently working.

One of the questions for the E.E.O.C. is whether excluding unemployed applicants is illegal. Jobless workers are not specifically protected by antidiscrimination laws, but various laws outlaw hiring bias on the basis of sex, race, national origin, religion, age and disability. Since African-Americans, older workers – especially older women – and disabled workers have been hit particularly hard in the downturn, discriminating against unemployed people in those groups may violate the law.

In an accompanying – Press Statment – (February 16, 2011) we learn that the Meeting of February 16, 2011 – EEOC to Examine Treatment of Unemployed Job Seekers exposed “the emerging practice of excluding unemployed persons from applicant pools”.

The EEOC has identified employers using “an individual’s current or recent unemployment status as a hiring selection device” which is clearly no surprise. Marx identified a long time ago the role that the reserve army plays in providing the edge to capital in the bargaining process. When the labour market is slack, employers have the sway. They can pick and choose at will and indulge in perverse behaviour including discrimination.

I learned about discrimination early in life – growing up on one of the post war housing commission estates in Melbourne where the adults were typically poor and the baby boomer generation was emerging. Just being poor was enough. I wasn’t black, female, jewish, asian, or disabled. That multiplied the prejudice and clearly I cannot articulate what that feels like. So when I started studying economics and came upon the topic of discrimination I was highly skeptical.

The seminal mainstream work in this field was by University of Chicago economist Gary Becker who’s work has mostly been centred on banal applications of microeconomic behaviour where the paper starts off – we have a problem – government intervention – solution – eliminate the government and free up the market some more. His 1957 book The Economics of Discrimination (which was his PhD thesis) outlined his “tastes and preferences” approach to discrimination where these amorphous “utility-maximizing economic agents” (that is, you and me) calculate “discrimination coefficients” according to our tastes and preferences which allow us to put a monetary value onto our hatred of minorities (although last time I looked males barely outnumbered females!).

Becker claimed that we desire to maximise utility (measured in monetary terms) and we are prepared to forfeit income to indulge our prejudices. The theory then claimed that increased competition was the answer because it made the monetary costs of discriminating against people too high – the competition would soon hire all the good (black) workers and sell into markets where consumers were loathed by the discriminating producers.

Clearly this has been highly contested by those who consider that discrimination is an institutional feature of the social structure rather than being just a manifestation of individual preferences which can be driven out of the market by increased competition.

The problem with the approach is that by engaging in wide-scale deregulation of the labour market, the government would be further shifting power to the bosses (employers). Becker’s model of perfect labour market stylises it as a large number of independent agents coming together with capital and labour for mutual advantage. That is not what capitalism is about though.

Capital stands before many workers – the latter who ultimately have to work to survive and have little real choice in determining who they work for (at the margin). Undermining legislative protections for workers and destroying the trade unions exacerbates that power imbalance.

There is a much better way to reduce discrimination – create full employment.

The EEOC heard evidence during those meetings which showed that while certain racial and ethnic minorities are bearing the burden of the unemployment (20 per cent of African-American workers are unemployed whereas they comprise only 12 per cent of the workforce), the discriminatory practices are likely to frustrate any attempts by government to improve the circumstances of these cohorts.

The EEOC said that:

At a moment when we all should be doing whatever we can to open up job opportunities to the unemployed, it is profoundly disturbing that the trend of deliberately excluding the jobless from work opportunities is on the rise.

Well the solution is simple and doesn’t involve Becker-style deregulation which only hands more power to the employers especially when there is an overall demand constraint (deficiency) preventing the economy from offering enough jobs to satisfy the preferences of the workers for employment.

The solution is for the government itself to undermine the prejudice by ensuring there are enough jobs available. Given that the unemployment is focused among the most disadvantaged workers the most immediate solution that the US government could introduce would be a Job Guarantee.

As I explained in this blog recently – We gonna smash their brains in – a Job Guarantee would ensure that workers could always find jobs at a living minimum wage if they were willing and able to work.

The employers would then have to rethink their hiring behaviour should they wish to expand their output. No longer would they be able to draw from a huge pool of desperate unemployed workers and indulge in vicarious discrimination as they wielded their “market power”.

Instead, bad employers would be sorted out very quickly. That is a much more effective way of dealing with discrimination. Just starve the perverted bosses who wish to indulge.

Having considered all that I wonder why this Wall Street Journal author is earning a wage so low is his contribution to society –

The WSJ column is published under the heading “WSJ Blogs – Deal Journal – An up-to-the-minute take on deals and deal makers” which sounds as if there should be vibrant, cutting edge stuff on offer. Instead you get mindless drivel from a sociopath.

The writer claims that he is “actually hoping for something really bad to happen” in the form of a US government debt default, the Republicans shutting the government down, “Moody’s to downgrade our debt and China and Japan to stop buying Treasurys”, public servants in the US to be unpaid and elderly pensioners “to be handed worthless I.O.U. notes instead of Social Security checks”. He went on to wish that the elderly were deprived of health care. Why?

Apparently:

… then and maybe only then will America wake up and do something about its coming fiscal disaster.

Which fiscal disaster? Well not one that anyone who is actually making deals seems to recognise. This “expert” acknowledges that “The U.S. government bond market, the true and final arbiter of our nation’s fiscal health, is saying something quite different” given yields remain very low and unmoving.

While I don’t accept the statement that the bond markets determine the fiscal health of a nation such as the US – using the logic that this genius would accept – does the evident ease with which the US government issues its debt tell this bone-head something.

Doesn’t two decades of Japan issuing debt with ease (even though their public debt ratio is now 2.5 times or more the disaster level that those other geniuses Reinhardt and Rogoff have been claiming tell this bone-head something.

Apparently, the 2012 US “budget should terrify bond investors. But it didn’t. Treasurys rallied for two days following the release of the budget. They’re rallying again today”.

The author claims that the reason the bond markets are not in open revolt and driving the US government into insolvency is because the market is “just wrong”! Evidently, it is because foreigners are buying about 50 per cent of the debt being issued and the Federal research is buying the rest. The facts of that claim are also disputable but even if it was true what difference would it make to anything? Answer: not a lot.

He claims that the low yields are distorted by the huge Federal Reserve purchases and this is distorting the market. He says:

Remember all those supposedly Triple AAA CDOs and CMOs? Then Bear Stearns, Lehman and everything else, pretty fast. You know the saying, “Everything is okay, until it isn’t.”

The US government is not a private investment bank. Even if the market assessment of the returns on public bonds was wrong it would make no difference to the capacity of the US government to spend. It might have to change a rule or two should the bond markets go into outright revolt and stop buying its debt. While such a result will not happen it wouldn’t matter at all to the capacity of the US government to spend in US dollars.

This character wants a ” big, messy U.S. default to give everybody a different and very necessary frame of mind”. It sounds to me that he is desperate for some evidence to “prove” his theories are consistent with the facts. The problem is that there is no fiscal disaster in the US that doesn’t come in the shape of a bone-headed commentator (like this guy) or a politician who is willing to sacrifice the opportunities of the weak and poor to validate their extremely paranoid and erroneous version of reality.

The only fiscal disaster is that these views are holding political sway and forcing the US government to being implementing an austerity campaign.

It seems that the politicians in the US are heading now threatening to shut down the Government unless the budget cuts are deeper than currently proposed (as if they were not already ridiculously damaging). The US National Public Radio (NPR) carried a story on Saturday (February 19, 2011) – Threat Of Shutdown Looms Large Over Budget Debate and included some quotes from the new speaker of the House the bone-headed John Boehner.

Boehner said:

Our goal is to reduce spending; it is not to shut down the government … Since President Obama has taken office, the federal government has added 200,000 new federal jobs … And if some of those jobs are lost in this, so be it. We’re broke.

Given my earlier discussion of the deterioration in the chances of the unemployed to get work and the discriminatory practices that are compounding that struggle I find this sort of “financial” posturing to be immoral.

The US government cannot go broke! It issues its own currency and can meet all its liabilities in US dollars whenever they arise. To say otherwise is to lie. To then deliberately set out to cause job loss based on that lie is immoral.

The Democrats are not much better. The NPR article reported that they have been playing a spending cutting game where they deliberately targetted government outlays that provide work in Boehner’s home state of Ohio as a sort of juvenile payback.

Politicians are meant to be serving the people. When will the US people follow the lead of those in the Middle East that seem intent on getting rid of governments that have ceased to defend the interests of all? It could not come soon enough in my view.

The conservatives however are casting the austerity campaign as a “moral challenge”. In this article (February 19, 2011) – Ryan says tackling U.S. debt problem is moral challenge.

Ryan is a Republican representative from Wisconsin. He told a conservative gathering that:

We must also recognize that our nation’s debt problem isn’t just a fiscal challenge involving dollars and cents. It’s a moral challenge involving questions of principle and purpose. The size of the budget is a symptom of deeper causes, and it points to different ideas about government … Let’s choose to put proper limits on our government and unleash the initiative and imagination of the world’s most exceptional people …

It is clear that Ryan isn’t among the “world’s most exceptional people”.

The US debt problem is exclusively in the private sector. The relationship to fiscal policy is that expansionary net spending was required when that private debt problem (caused by the sort of policies that the likes of Ryan and Boehner have advocated) exploded and private spending collapsed. Then the only action that saved the US from total economic meltdown was the fiscal intervention. It wasn’t large enough and that is why the unemployment situation is now so bleak.

The US fiscal policy is that the net public spending position is too low.

But you can see the basis of the austerity – it is a religious crusade based on some cock-eyed notion that the size of government is a moral issue. The only moral issue is that the government acts honestly to advance public purpose. Whatever else you might say in the US at present the US government has to be “larger” because it has to expand to generate more jobs for the unemployed. The moral responsibility that governments have is to ensure there are enough jobs and to fill the spending gap when private spending collapses.

If the US private sector was able to spend more and to provide those jobs then government could be smaller in size (as a per cent of total activity). But the issue would be that that smaller size would be consistent with higher employment and lower unemployment. It would not be about “size” per se.

The size of the deficit should never be the object of policy. While fiscal sustainability is being defined by austerity proponents in terms of some arbitrary financial ratios (public debt to GDP etc) the reality is that deficits should be whatever is required to maintain overall spending at the level consistent with full employment. No more, no less. Fiscal sustainability is about fulfilling the government’s responsibility to maintain inclusive society which at the most basic level requires that everyone who wants to work can.

The conservatives have some weird notion that it is per se that matters irrespective of what that scale of activity might mean for the prosperity of nation. They usually lie and claim that cutting back government net spending will be expansionary. It used to be considered non-controversial that government deficits could stimulate production by increasing overall spending when households and firms were reluctant to spend.

In a bizarre reversal of logic, neo-liberals talk about an “expansionary fiscal contraction” – that is by cutting public spending more private spending will occur. This assertion comes with the fancy name of “Ricardian Equivalence” but the idea is simple. Consumers and firms are allegedly so terrified of higher future tax burdens that they increase saving now to ensure they can meet their future tax obligations. So increased government spending is met by reductions in private spending – a stalemate. But they say if governments announce austerity measures, private spending will increase because of the collective relief that future tax obligations will be lower and economic growth will return.

All the evidence shows that firms are currently very pessimistic and will not expand employment and production until they see stronger growth in demand for their products. Consumers are also pessimistic because they worry about losing their jobs. They are also heavily indebted and are trying to save to reduce the risks involved should they become unemployed. By cutting public spending, this pessimism will worsen. The greatest neo-liberal lie is in denial of all the facts relating to human psychology. The early indicators from Britain – poor growth figures and surveys of private firms and consumers pointing to growing pessimism – are already undermining the substance of the Government’s austerity strategy.

The only way economies grow is through producers responding to increased demand for their products. At a time when private demand is subdued, the only way out is for government spending (via deficits) to support the growth process. Austerity will just withdraw the lifeline that has been keeping our economies growing in the last year or so.

So while the conservatives usually lie and claim that austerity is good now it seems some of them are blowing their cover and admitting that if some “jobs are lost in this, so be it”. And then trying to justify this insolence by claiming the higher moral ground.

Sheez!

Conclusion

I think that once the conservatives start appealing to the higher moral ground you can conclude that even they know that the bevy of economic arguments that they use to justify their damaging policies are nonsense.

Where does that leave their mainstream economist lackeys who they wheel out in the media to provide the pointy-head justifications? They were nowhere anyway!

Have to run …

That is enough for today!

I’ve come to the conclusion that the supposed conservative revulsion with the size of the government is based upon a “lion’s share” principle. The lion’s share is of course the dominant male lion’s share, which is the largest simply because he gets to eat first. The rest of the pride gets to eat smaller shares, the carrion feeders less still, and the maggots least of all.

This mirrors quite well the conservative view of government spending. If it is for social purposes, it is bad. The lion doesn’t get to eat first, and he is unhappy with his share. If it is however going first direvtly to major industries (defense, energy, FIRE, etc.), then the lion gets his lion’s share and is happy, while the rest of us get the leavings only after the lion is full, and with the size of our own shares being dependent solely upon how close we dare to come to the lion while he’s eating.

I remember during the Reagan revolution it was always said that tax cuts were good and the benefits would trickle down. It turned out that tax cuts were good for the rich, but tax increases were good for the rest of us since Reagan increased taxes on the masses several times.

So, when I here these servants of the rich say that austerity is good, I wonder who they are good for. Pete Peterson and the Koch brothers are wealthy, big time supporters of all this. So, if these people are pushing the idea that austerity is good it must be serving them is some way. How do these wealthy people plan to gain from austerity? I’m way past any idea that they might be trying to serve humanity.

GLH ~ They are simply worried about the devaluation of their wealth via inflation. They are unconcerned about whether or not that starves the rest of us, because they eat first and are always sated when they leave the table.

If there was guaranteed government employment millions of people currently used to being “bosses” or “managers” would find that their tenure as tin-pot dictators was over. Wal-Mart wouldn’t last a week. This is the SOLE FUNCTION of austerity programs.

Modern economics boils down long winded justifications for forcing the poor to do work demanded by the wealthy at crappy pay, with no job security, social welfare, social stability or labor rights. People who object are given the option of starving in the street or getting tossed into prisons.

Pangolin, apparently in the UK John Lewis Partnership is a good employer to work for. It is a supermarket and department store and is entirely employee owned (since the eccentric private owner donated it to the employees in the 1920s). To my mind, the JG would not lead to such set ups becoming typical. Instead it might lead to supermarkets that had JG staff apart from bosses that were career public sector workers. The outcome might be worse to work for and shop from than Walmart. An asset tax/ citizens dividend set up might mean that supermarkets would only be able to access capital and workers by employing shelf stackers on a partnership basis as in John Lewis. The citizens dividend would mean that workers would not need to work unless they considered what they were doing to be worthwhile. With start up ventures, workers would be able to afford to work for an equity stake rather than needing money for day to day living. That could aid technological innovation.

The basis of the problem, as Marx correctly intuited, is the presumed absolute right to private property along with life and liberty. Jefferson initially penned “the inalienable right to life, liberty and property” in the Declaration before changing “property” to “the pursuit of happiness,” its equivalent in utilitarian terms. Wage labor, of course, is a commodity in this view, and at that time, slavery was legal in the US, and women and children were chattel. “We’ve come a long way, baby,” but not far enough.

Just as there is no invisible hand, there is no absolute right to private property. Both are fictitious ideas used to justify exploitation of workers, the environment, and society as a whole on purely ideological grounds.

Looking for job in US now reminds me of American Idol contest. You land an initial interview every 100 job applications. It is usually a phone interview. If you pass, you go to an actual interview. If you pass that, you are informed that you are among 3 to 6 other happy contestants to appear at final interview.

This is my wife’s first hand experience. Unfortunately during her most recent final interview the employer was kind of disappointed of her inability to land a job and being unemployed for the last two years. A week later she hasn’t heard from them. Guess she won’t be the next American Idol…. again.

Back to the land of auditions. 🙁

P.s. She liked today’s blog a lot.

Here’s a comment I posted somewhere else that I thought some of you (from the US) might enjoy:

Ronald Reagan served as president of the Screen Actors Guild, then he got Alzheimer’s, and was subsequently elected president of the United States on an anti-union platform.

BTW, Ronald Reagan was just chosen America’s best president in a recent Gallup poll. Georege W. Bush beat out Thomas Jefferson. You wonder why America is screwed up?

It seems that in the UK:

http://www.bbc.co.uk/news/business-12521580

This is of course, rubbish, they are not hiring because there is insufficient demand, and they hate the unemployed generally.

I found out from my unemployed friend that the new technique that Job Centres are using to get people off benefits is to make up fake appointments and ‘forget’ to tell the client – then take away their benefit for missing an appointment????

I feel an Eqypt coming on……..

“Looking for job in US now reminds me of American Idol contest. You land an initial interview every 100 job applications. It is usually a phone interview. If you pass, you go to an actual interview. If you pass that, you are informed that you are among 3 to 6 other happy contestants to appear at final interview.”

Yes, finding a job right now is crazy. I’m a University of Chicago MBA (reformed thanks to this web site) with over 20 years of experience. And I have a long history of creating real economic value – business turn-arounds and such. So I was shocked when an interview process drew out over months. I endured several 4-hour sessions solving cases, and then I gave a one hour presentation to the senior management team. That was followed by a one hour session with the company president. End result? No offer, but they enjoyed learning about my perspective on how to improve their business – for free!

I’m going to keep trying.

“There is a much better way to reduce discrimination – create full employment.”

Should productivity gains and other things be used to reduce the number of workers needed and then lower the number of workers available by getting them to retire earlier?

Here’s a comment I posted at Heteconomist.com (Peter Cooper’s excellent MMT-oriented site). I cleaned it up a bit, so I’ll repost it here, since I think it underlies what Bill has consistently been saying:

In economics, there are two types of value, use value and exchange value. In philosophy, there are also two types of value, 1) absolute or intrinsic value, and 2) relative or extrinsic value. The former relates to ends and the latter to means.

On one hand, use and exchange value are extrinsic and relate to means, that is, they are consequential – good for something other than themselves. On the other hand, each person is an end in himself or herself, and persons are never to be considered as means or treated simply as means, because a person has absolute or intrinsic value as an intrinsic good. This is the foundation of liberal democracy as stated in our US foundational documents, which are based on the Enlightenment philosophy that guided the American founding fathers. More generally, it is the basis of human rights, equal justice, and the absence of privilege. It also underlies social solidarity. The imperative here is categorical rather than hypothetical.

The economy is the life-support system for the polity, and the polity is the way that a society cooperates and coordinates for the good (end) of its members (persons). The purpose of a liberal democracy is living the good life in the classical sense, that is, unfolding one’s potential as a human being and as an individual – not just living well. Every human being has an equal right to self-determination and self-expression, bounded only by the same equal rights of others. This is the core of liberalism that underlies social democracy. No one is truly free if anyone is unfree, for if one can be unfree, anyone can be unfree.

In a modern economy, money is a necessary for existence, freedom, and the pursuit of happiness, to which all persons have an inalienable right according to the Declaration. In addition, “we the people” create a social compact through a constitution that acknowledges that one of the chief purposes of government of, for, and by the people is “form a more perfect union, establish justice, insure domestic tranquility, provide for the common defense, promote the general welfare, and secure the blessings of liberty to ourselves and our posterity” (preamble to the US Constitution).

Therefore, the economy as the life-support system for a free people is not an entity independent of people. Rather, it is based on policy determined by the people through their representatives for their mutual benefit under the law of the land. Since it is not possible to exist as a person, let alone to be free or pursue happiness, in a modern monetary economy without sufficient money, there is a responsibility to organize society so that everyone has sufficient money to exercise these inalienable rights of a person. A state that fails to do this is a failed state.

“Efficiency is doing things right, and effectiveness is doing the right thing” (attributed to Peter F. Drucker, citation unavailable). Economists are concerned with efficiency, and policy makers are concerned with effectiveness. The proper course is for policy makers to tell economists that the chief priority is full employment with price stability and let economists figure out how to achieve that. When they come back with a policy that targets inflation using unemployment as a tool, they should be sent back to the drawing boards.

THE problem is income (money), hence employment. ALL attention should be focused on this problem as an ethical matter that supersedes politics and economics. In addition, effectiveness at achieving ends has to take precedence over efficiency with respect to means, although accepting unemployment is accepting economic inefficiency when the huge waste from foregone opportunity and degradation of resources is figured in.

This is the beauty of MMT. It shows how to achieve full employment (everyone willing and able to work has a job offer) along with price stability. This is why, as a philosopher, I am for integrating MMT into society as an ethical issue even more than an economic one.

Unless we get away from thinking chiefly as economists, we are never going to get free from a governing philosophy based on Neoliberalism or Libertarianism, which take (their view of) economics to be the criterion for both ethics and policy. Never let the opponent frame the debate. You are sure to lose. This is about basic morality and values. It should be argued on these grounds.

Tom,

This is a good idea imo. I’ve been observing this for some years now. Many of the people on the other side of this issue are never going to ‘get the math’, so to speak; though many will so it pays to keep making the empirical case for the people who will be able to see it.

But for the others who are for some reason forever blinded to the truth here, which includes the all major policymakers, it makes sense to reframe the issue as a moral one. They cannot win this debate on those grounds either. It may prove to be challenging to get them to engage on that ground though as most people dehumanize the economy (we have to fix “the economy” rather than “we have to ensure all our brothers and sisters have access to a fulfilling means of subsistence”) and separate the economic outcomes from their moral/spiritual beliefs that are supposed to guide them in ALL things.

Sort of like the Godfather movie: “It’s not personal, it’s business” type of thing (then they murder you!) Warped. It IS personal, it always is personal.

I’m with you here, I think “the movement” can easily defend itself on these grounds (and has been, not to take anything away from the MMT thought leaders, they always have the moral high ground imo) . From the Christian perspective, I have much I’ve been able to identify in the ‘The Word’ that is extremely congruent with advocating for the same types of methods and outcomes as MMT seeks. Here in the US, none of the opposition has had the audacity (perhaps YET, give them time they have already redefined the “Red Menace”) to frame austerity/balanced budgets as some sort of Christian values issue, if they ever do I know that can be refuted for sure…. Resp,

FedUp is hoping that productivity gains lead to reduced hours working and an early retirement age.

And in a workers utopia that should be achievable

In Australia in the 1980s many people lived the dream of retiring at age 55 after modestly paid public service careers and settled on the NSW coast.

Thirty years later the dream promoted in the media appears to be continue working part time because those generous superannuation schemes have been replaced by schemes where the individual makes the contributions and all the investment decisions.

Irrational employer prejudices.

In my field of information technology I noticed that blue-eyed programmers were becoming an endangered species on a trip to San Francisco in 1996. Ed Yourdan had written a book The Demise and Fall of the American Programmer in which he postulated that American programmers who entered the field in the 1960s/70s/80s with no formal qualifications were being replaced by Chinese and Russian programmers with strong Maths backgrounds. I thought in 1996 that Silicon Valley was Chinese and that Microsoft in Redmond Washington was Indian. Unfortunately that fashion flowed to Australia and a blue-eyed programmer is a rarity here. The Indians employed to work on the Telstra contracts are no better than the Australian graduates however the software head hunters make greater margins out of imported workers.

“Should productivity gains and other things be used to reduce the number of workers needed and then lower the number of workers available by getting them to retire earlier?”

For my money it should lower the amount of hours that the population is required to work to create the output necessary so that everybody has a minimum standard of living. So I think it would be shared out – since productivity improvements will no doubt increase the minimum standard of living.

There needs to be a separation at some point between ‘income’ and ‘work’. Work should become something you want to do for intellectual fulfillment or because you really, really want a Ferrari (etc, etc). Work that you *need* to do should somehow be proportional to your share of the output needed to maintain the minimum standard of living.

That’s the philosophical starting point. Now how do you get that to a working system?

Neil: Now how do you get that to a working system?

I think it means moving beyond strict market capitalism, in which the market is the arbiter of distribution, therefore, price, therefore, income. The way the options are falsely presented now the choice is between free market capitalism and “socialism.” That is a disingenuous way to frame the debate because not there other options and some have already been suggested. In the 1960’s, Robert Theobald was already exploring the economics of abundance and the guaranteed income, so this hardly a new concept. Milton Friedman was also on board with a negative income tax. Bucky Fuller also pur forward some interesting ideas such as government funding of experimental centers, like Bell Labs, in a variety of field, figuring that it thousands of people were following their noses and had the resources to do so, at least some would come up with innovations that would more than the fund the rest in terms of real output.

It’s basically a matter of formulating and exploring options.

Tom Hickey, I think it is key that socialism tends to mean gov attempting to direct who does what. Redistribution need not involve any of that if gov does not fall into the trap of trying to guide the economy rather than simply enforcing redistribution in a neutral way (such as with a flat asset tax). I think the key concept is that if six billion people are fully able to act on what is the best way to deploy the talents of six billion people, then the economy will fit in with peoples requirements better than if only 10000 people are able to make the decisions.