The other day I was asked whether I was happy that the US President was…

The OECD should close and its staff redeployed into productive activities

The now totally discredited OECD has started a special section of their WWW site which they call – Restoring public finances. Many person-hours of labour have gone into its construction and the documents and “analysis” (so-called) that you can access there. They even have an article from ECB boss Jean-Claude Trichet which would be laughable if it wasn’t so damaging (given his influence). The OECD is another of those organisations (such as the IMF) that promoted policy agendas (deregulation etc) which not only entrenched persistently high unemployment during the growth year but also set in place the conditions that ultimately led to the crisis. But like a drunk who sneaks a drink then denies it, the OECD seems incapable of introspection and acknowledging that it is part of the problem not the solution. Its policy agenda caused the crisis. Now it is lecturing the world in aggressive tones about how its policy agenda (unchanged) should be ramped up even more vigorously. My view is that OECD should just close its doors and its staff should be redeployed into productive activities.

I loved the heading on this OECD page on its Restoring public finances pages – OECD Factblog – which had an article entitled Defying fiscal deficits.

The article was full of misnomers such as:

1. “Government budgets are under pressure as the recession and economic crisis continue to take a toll”

2. “The crisis has pushed public deficits and debt to unsustainable levels for many countries”.

Apparently that is the assessment of “OECD experts” which note that “weak economic activity causes tax revenues to dwindle, forcing crisis-embattled governments to borrow in a cautious market to pay for services and welfare, and in some cases, still limping banking sectors”.

We could have a Modern Monetary Theory (MMT) quiz to separate the facts from the fiction here. I remind people that this is a major international institution and not some well-funded personal toy – like the Peter G. Peterson Foundation Foundation or the Cato Institute – which we expect to pump out lies according to the misguided and devious agendas of their masters.

The OECD began life as as the Organisation for European Economic Co-operation (OEEC), which administered the Marshall Plan funds aimed at the reconstruction of Europe after World War II. In 1961, this organisation became the OECD. It was a solid Keynesian-based organisation that well understood the role that activist fiscal policy played in promoting stable growth and full employment.

Just like the IMF has been taken over by neo-liberals (PhDs trained at right-wing US academic factories) so has been the fate of the OECD. It is now one of the foremost institutions promoting mis-perceptions and lies about the way the monetary system functions and the operational realities that governments can exploit (via fiscal policy) should they have the will.

The OECD Jobs Study agenda has been the principle policy framework since the early 1990s and has promoted privatisation, deregulation and massive welfare changes all aimed at weakening trade unions and making the most disadvantaged workers more desperate.

Their endorsement of inflation-first macroeconomic policies where monetary policy plays the prominent role and uses unemployment to discipline the inflation generating process and fiscal policy is largely contractionary has left a legacy of persistently weak growth, entrenched high unemployment and rising underemployment.

Last week I wrote a blog – The IMF – incompetent, biased and culpable – which reported on the “independent” evaluation of the IMF and demonstrated how badly it had performed leading up to the crisis. The IMF helped cause the crisis we are enduring at present.

The same could be said of the OECD. It only started to acknowledge that its policies were failing and based on wrong modelling in 2006 – but by then things had gone too far.

Over the last 20 years or so, many academic studies sought to establish the empirical veracity of the orthodox view that unemployment rose when real wages and workplace protections increased. This has been a particularly European and English obsession. There has been a bevy of research material coming out of the OECD itself, the European Central Bank and various national agencies, in addition to academic studies. The

overwhelming conclusion to be drawn from this literature is that there is no conclusion. These various econometric studies, which have constructed their analyses in ways that are most favourable to finding the null that the orthodox line of reasoning is valid, provide no consensus view as Baker et al (2004) show convincingly.

In the last 10 years, partly in response to the reality that active labour market policies have not solved unemployment and have instead created problems of poverty and urban inequality, some notable shifts in perspectives are evident among those who had wholly supported (and motivated) the orthodox approach which was exemplified in the 1994 OECD Jobs Study.

In the face of the mounting criticism and empirical argument, the OECD began to back away from its hard-line Jobs Study position. In the 2004 Employment Outlook, OECD (2004: 81, 165) admitted that “the evidence of the role played by employment protection legislation on aggregate employment and unemployment remains mixed” and that the evidence supporting their Jobs Study view that high real wages cause unemployment “is somewhat fragile.”

Then in 2006, the OECD Employment Outlook entitled Boosting Jobs and Incomes, which claimed to be a comprehensive econometric analysis of employment outcomes across 20 OECD countries between 1983 and 2003 went further. The study sample for the econometric modelling included those who adopted the Jobs Study as a policy template and those who resisted labour market deregulation. The Report revealed a significant shift in the OECD position. OECD (2006) found that:

- There is no significant correlation between unemployment and employment protection legislation;

- The level of the minimum wage has no significant direct impact on unemployment; and

- Highly centralised wage bargaining significantly reduces unemployment.

These conclusions from the OECD in 2006 confounds those who have relied on its previous work including the Jobs Study, to push through harsh labour market reforms; retrenched welfare entitlements; and attacks on the trade unions. It makes a mockery of the arguments that minimum wage increases and comprehensive employment protection will undermine the employment prospects of the least skilled workers.

OECD (2006) found that unfair dismissal laws and related employment protection do not impact on the level of unemployment but merely redistribute it towards the most disadvantaged – including the youth who have not yet developed skills and have little work experience.

But this point is obvious. In my own work (references are available on request) I have consistently pointed this point out. In a job-rationed economy, supply-side characteristics will always serve to only shuffle the queue. But you cannot say that the unfair dismissal laws and related employment protection have caused the unemployment! The problem is that there have not been enough jobs overall.

Anyway, back to the opening set of propositions (misnomers).

Government budgets do not come under “pressure” which implies that a rising deficit is bad (rising and then too much pressure) and surpluses are good. This sort of conception is deeply flawed. Budget balances are just ex post measures of private spending (and saving) decisions and government discretionary spending and taxation choices.

Once the latter (government discretionary spending and taxation choices) then the budget outcome is entirely driven by private choice. The private sector can always have a lower deficit by spending more overall.

A budget outcome cannot be understood in isolation from what else is going on in the economy – that is, the contribution of the external sector and private domestic sector.

A rising budget deficit will only be problematic if the economy is already at full employment and governments try to push nominal spending growth ahead of the growth in productive capacity. But then an expansion of private sector spending under similar circumstances will be just as problematic.

In general, focusing on the budget deficit as if it is a legitimate policy target is misguided in the extreme.

Then we read that the OECD experts think the “crisis has pushed public deficits and debt to unsustainable levels for many countries”. Which countries? Sovereign or the non-sovereign countries of the EMU (including those who peg against the Euro and/or issue public debt in foreign currencies)?

The article in question compares Ireland, with Germany with Canada, with the UK and more. It is simply not possible to compare a nation that is non-sovereign and operates with what is effectively a “foreign currency” (for example, Ireland) with the UK or the US, both of which are fully sovereign in their own currency. Attempting such comparisons, demonstrates either the height of ignorance or total dishonesty or both.

The Eurozone runs an entirely different monetary system to that managed by, say, the US government. The choices and constraints that each monetary system offers the respective governments are very different. In the case of the Eurozone nation, the government is financially constrained and is at the behest of the financial markets. It doesn’t set its own monetary policy, cannot adjust via exchange rate depreciation (or appreciation) and doesn’t issue its own currency.

In the case of a fully sovereign nation, such as the US or UK, the government is never revenue constrained because it is the monopoly issuer of the currency. It sets its own interest rate regime, can enjoy exchange rate flexibility (which allows it to focus macroeconomic policy on domestic targets) and any constraints it places on its budgetary process or targets it creates for budget outcomes are entirely voluntary.

At any point, the government of such a nation could exploit the full operational reality of the fiat monetary system it manages and tell financial markets to take “a long walk off a short pier”. Japan has been successfully doing this for years.

So there is no legitimate comparison between these monetary systems.

Then you have to ask what does unsustainable mean? You can mount an argument that unsustainable is when the government can no longer spend. For an EMU nation that point might come when funding sources including the tax base are exhausted. For a nation such as the US or the UK that point can never come.

I qualify the last statement by noting that the US government (as an example) can buy whatever is available for sale in US dollars. So there are real resource constraints on the spending of a sovereign government but that is not what the deficit terrorists ever think about. They are obsessed with financial ratios and never relate these to the real economy.

So I like to remind people of the blanket truth – a sovereign government can always afford to buy all unemployed labour (that has zero bid in the private labour market) and can always put such labour to productive use. The concept of fiscal sustainability has no application until the government has at least bought all such labour.

Please read my suite – Fiscal sustainability 101 – Part 1 – Fiscal sustainability 101 – Part 2 – Fiscal sustainability 101 – Part 3 – for further discussion.

Then we read that the “OECD experts” had noted that:

… weak economic activity causes tax revenues to dwindle, forcing crisis-embattled governments to borrow in a cautious market to pay for services and welfare, and in some cases, still limping banking sectors.

The first point about weak economic activity causing lower tax revenues and increased spending (via welfare payments) is fine. It just relates to the automatic stabilisers that are built into budgets and ensure that the budget outcome is determined by the private sector ultimately.

Why we have to include terminology like “crisis-embattled governments” in a description of the operation of the automatic stabilisers is beyond me. It is just an emotional ploy to lead the reader into thinking that the rising budget deficits are the problem.

Egypt has had a crisis-embattled government. The US government is not embattled. It might be incompetent and misguided but the embattled are the unemployed and the homeless and those for who the crisis has further eroded their circumstances.

Then you read further lies – that these “crisis-embattled governments” have been forced “to borrow in a cautious market”. Which governments have been forced to borrow and which markets have been cautious. I would measure caution by bond tender take-up and with the exception of the EMU, there has been no problems over the last several years. The bond yield movements (remaining low) tell you the story.

Japan has been issuing very low yielding debt for years through thick and thin and has the highest public debt ratio around. Are their funding sources “cautious”. How would you measure that other than via yields and the “times covered” type statistics (this refers to how many times the bond tender target is subscribed). Yields remain low and there is no shortage of buyers of public debt (EMU excepted).

So that OECD statement is a lie – a blatant attempt to colour the argument.

Moreover, most governments are not forced to borrow from the markets. They choose to do so because they are caught up in the neo-liberal mythology that such practices will discipline there capacity to spend. There is truth in the argument. By whipping up a frenzy about the public debt ratios, the right-wing can impugn governments at will.

But what most people do not understand is that a government could just abandon these arcane institutional arrangements – which see them matching their net spending $-for-$ by borrowing from the private bond markets – any time they liked. They are a hangover from the gold standard, fixed exchange rate days which collapsed in 1971 because that type of monetary system was unworkable.

The neo-liberals promote the myth and pressure governments to maintain these institutions (and even further restrict themselves) because they suit their own agenda which is to get a larger share of real income for corporations and less for the workers.

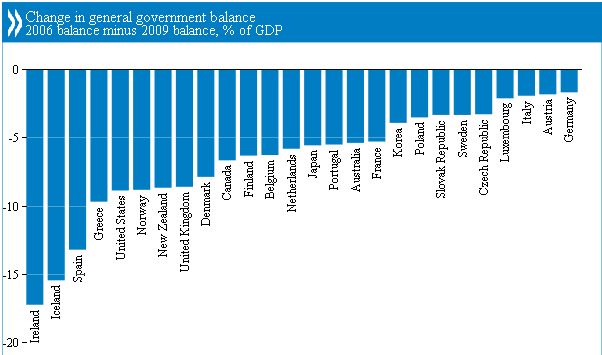

The OECD article then provided this graph which shows the change in the budget outcome from 2006-2009. The supporting text is intended to ensure our level of concern is high and is in descending order from left to right:

They claimed that nations faced “tough budget decisions” meaning cuts. The agenda that is then foreshadowed is more of the same – “the quality of reforms will be crucial for rebuilding confidence, stability and a stronger, cleaner, fairer world”.

I can only say that the OECD has nothing to offer in designing reforms that satisfy these goals. They are another organisation that has outlived its useful life and is now just part of the problem.

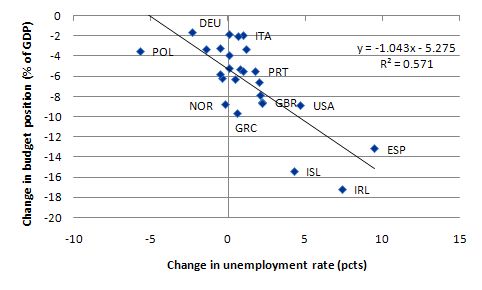

I prefer this version of the above graph using the same OECD data augmented by the Main Economic Indicators series on harmonised unemployment rates. It shows the unemployment rate change from 2006-2009 and the change in the budget outcome over the same period (as in the previous graph).

This graph puts the matter into better perspective. Budget deficits have risen because economic activity collapsed as a result of a sharp fall in private demand. Preceding this collapse was a major failure of the financial system which arose as a direct result of the deregulation agenda promoted by organisations such as the OECD.

The fall in private demand and the failure by governments to expand the discretionary components of their deficits large enough has led to substantial rises in unemployment in many countries. The results are obvious. The only policy concern is the unemployment. The budget outcome is irrelevant.

Then we (briefly) come to the OECD’s presentation – The Fiscal Imperative – apparently written by Jean-Claude Trichet the boss of the European Central Bank.

Tichet says:

Governments and central banks managed to avoid a global economic catastrophe, but the crisis has left a legacy of nearly bankrupt governments. A quick return to solvency is required.

Once again here are the “dinner party” questions you have to ask when a right-wing lunatic like Trichet is spouting forth as if they know something. Although I would caution against staging or attending dinner parties with such guests on the list.

Which governments are “nearly bankrupt”?

What does “nearly bankrupt” mean as opposed to insolvency?

When does a government become insolvent?

The fact is that a sovereign government has no solvency risk ever – that is, if it issues its own currency and only issues liabilities in that currency. It is impossible for such a government to become bankrupt (that is, default on its nominal liabilities) on financial grounds. It might default for political reasons but instances where that happens are extremely rare (and explainable – such as Japan defaulting on debts owed to enemies during WW2).

The US government will never default on its nominal liabilities issued in US dollars. Nor will the Australian government, the governments of Britain, Japan, Canada, etc etc.

Only EMU nations (and other nations that voluntarily surrender their currency sovereignty) have solvency risk. So Trichet’s lecture is applicable, perhaps, to only a small number of governments.

Trichet mimics the neo-liberal language:

1. “The biggest of these challenges comes from a deterioration in public finances of unprecedented scale and geographical reach”.

2. The automatic stabilisers have placed “significant pressure on government budgets”.

3. “There is little doubt that all countries among the advanced economies are now in urgent need of implementing a credible medium-term fiscal consolidation strategy”.

None of these statements make any sense at all when applied to sovereign governments as explained above.

The biggest challenge facing governments is clearly that of unemployment – getting people back to work. Governments that fail that challenge will be toppled – one by one. The urgent need is not to cut deficits but to create jobs. You cannot create jobs by cutting deficits when private spending remains weak. To say otherwise is to lie.

Trichet then claimed that:

Sustainable economic growth depends on sustainable public finances … Unexpected and unavoidable events, such as the natural disasters that struck several countries in 2010, may require emergency government support. We can only face these if we have spare capacity in our public finances.

These ppropositions are total nonsense.

First, sustainable economic growth requires a steady growth in aggregate demand consistent with the growth rate of productive capacity. There is no credible study that shows that running budget surpluses is good for growth.

Budget positions have to support aggregate demand when necessary. That support is definitely required when you have persistently high unemployment rates.

Second, there is no such thing as a “budget buffer” to ward of evil when it strikes. The government’s budget choices are not limited or enhanced by its previous budget choices (other than in political terms – that is, it is sometimes hard to cut a program). There is no such thing as “spare capacity in our public finances”.

The US government could expand its deficit tomorrow (probably by 5 per cent of GDP) without a problem. That would probably be sufficient to provide enough jobs to soak up the unemployed. The point is that it makes no difference to a government’s capacity to run a deficit this year whether that government ran a surplus or deficit last year. To say otherwise is a total lie.

Trichet says that:

Fiscal buffers are essential when our economies are in a typical business cycle. They are even more necessary when our economies are coping with exceptional circumstances.

This statement is totally false. There is no such thing as a sovereign government “saving” in its own currency. It makes no sense for a government that is never revenue constrained because it is the monopoly issuer of the currency to “save”. The act of saving is to forgo present consumption to enhance future consumption. A government is never constrained financially so can exploit desired spending choices whenever.

Trichet then claims that past history is irrelevant for assessing the impacts of fiscal consolidation. He says:

Those who argue against a determined move toward fiscal consolidation are, in my view, underestimating that under extraordinary economic circumstances, established empirical relationships may no longer function in the same way as before. Today we are navigating in largely uncharted territory. Fiscal imbalances imply that it is no longer possible to trust the basic models that economists use to measure the impact of stimulus spending-or deficits for that matter-on economic growth. In these conditions, other factors, much more difficult to measure, come into play. I believe that, in the vast majority of OECD countries, orderly and resolute medium-term fiscal consolidation will boost confidence among households, enterprises, investors and savers.

The well-known and thoroughly discredited Ricardian defense!

Ireland tried this in 2009 – things have got worse.

The UK is in the process of trying it – things are getting worse.

The whole concept is bereft. Please read my blog – Ricardians in UK have a wonderful Xmas – for more discussion on this point.

And finally, Trichet cannot help but claim the Euro experiment has been a wonderful success despite most nations facing insolvency risk and the system being bailed out by the ECB (acting beyond its original conception). He said:

The remarkable track record of price stability over the last 12 years and the solid anchoring of inflation expectations are key elements for confidence in the euro area and in Europe.

You have to laugh then cry. The Eurozone has failed. It failed to meet the demands placed on it by the first major negative demand shock that arrived. Nations are close to bankruptcy. Unemployment has sky-rocketed in many countries. Standards of living have plunged.

That is nothing I would call remarkable.

Ingenious job creation scheme

As an aside, I note that the Republicans in America are still debating where the US president was born. In the News Limited article Republicans refuse to accept Barack Obama was born in US we read that despite birth certificates, a birth notice in a Honolulu newspaper at the time, there is still a majority (51 per cent) of Republicans who will vote in the upcoming primaries who think he was born elsewhere and is therefore not qualified to do the job.

My recommendation – hand over all their jobs to the unemployed so they can spend more time researching the issue and uncovering damaging evidence that the US President is not qualified to be so. Then when they have found this evidence he can be sacked. In the meantime those who actually want to use their time productively (the unemployed) will get a chance. Good idea, no?

Conclusion

Once you have purged yourself from reading the OECD nonsense (dangerous though it is) I recommend you read this excellent article – Deficit hysteria grips Washington.

I met the author at the Washington Teach-In last April and he is one of the few financial market commentators who understands how the monetary system operates and what is a problem and what is not!

There is hope!

That is enough for today!

Don’t read the comments on the MarketWatch article though. The depth of ignorance shown in there may lead you to conclude that the Labour market should be treated like the market for cattle and the excess turned into meat pies. 🙂

A comment on the OECD chart “Chang in general government balance” 2006 minus 2009

The Swedish number is probably the one part of the 3 tier system that consist of “the state”, “commune” and “pension trust funds”. Its an interconnected system where “the state” act as a hub. Normally when IMF, WB, EU; oECD make their assessments of the public finances and the state of the economy they don’t separate this but asses the consolidated government sector and maybe mention the state in an subordinate clause. Probably to accommodate the local economists, the affair of the part that is called “the state” did come to prominence in the late 70s when the right wing neoliberal assault started, the idea was to scare people with the state deficit and ignore the affairs of the consolidated government.

The number for the consolidated in last year’s budget proposal was:

2005 _ 2

2006 _ 2,4

2007 _ 3,8

2008 _ 2,5

2009 _ -0,8

(these might have been revised since then, the 2009 deficit has been revised to less dieficit a few points, don’t remember how much)

The mean yearly unemployment during the same period according to Eurostat:

2005 _ 7,6

2006 _ 7

2007 _ 6,1

2008 _ 6,2

2009 _ 8,3

“The idea that austerity measures could trigger stagnation is incorrect,”

Jean-Claude “Pangloss” Trichet

First of all I’d like to thank you for your blogs that I found in general always educative and entertaining, especially for someone studying at one of the “right-wing US academic factories” (even I don’t think that they are that bad). But I have to point out, as an european, that you seem to misunderstand the goal of the ECB. The monetary union has always been thought, by its creators, as a catalyst for political union.

Yes, it is in the short-term a stupid system but sadly enough only a crisis can make further integration acceptable. Then again it can be said that “in the long-run…” but if war has now become unthinkable in Europe we should never forget that it is because of the EU and a stop in the process of integration could be fatal to the EU. So dismiss the EMU as a stupidity is not false but a little unfair.

Finally the ECB is far from being as independent as it claims, as you said it has already bailed some european countries. A point that could be made is that little countries, like Ireland and Portugal, have few influence and could be considered as not sovereign. But it would be a tremendous surprise for me to see France or Germany being attacked by financial markets and the ECB doing nothing about it. These countries are for me as sovereign as the UK or the US, they just like to pretend they are not but then again so is the UK right now. The EMU just need, like the US and the UK, to acknowledge the consequences of a fiat currency…

Hi lads,

I asked a few questions on another post yesterday and am very grateful for the responses. I’ve just been reading some of the entries and am really learning from this site, thanks Bill. Keep it up.

Now to aid the learning process, a couple of Q’s for you guys. From this blog I got the term, “Deficit Terrorists”. I like it. Well, one of the most famous commentators on the Irish Economy has recommended slashing 23Bn Euros from government spending http://trueeconomics.blogspot.com/2010/05/economics-30052010-gargantuan-task.html He’s a famous Neo-liberal but generally leads the agenda setting in the media here. Can those of you more knowledgable than I confirm that this guy is a charlatan or should I cut him some slack??

Also, Bill you mention that Ireland is not a sovereign due to our use of Euro. What could we do to abandon the euro and return to our own currency?? As in what levels of taxation would be required and how would one go about this etc??

Thanks to anyone willing or able to help.

Kaiser

Kaiser:

Abandoning the Euro and regaining your old Irish Pound is probably the first priority. Internally that would be easy; just offer to swap one Euro for one Irish Pound and declare all taxes be paid in Pounds. No need to raise taxes; lower them if anything on the lower income brackets.

The problem is that any external debts will still be denominated in Euros. If you continue to honor these debts (racked up by neo-liberals clueless about the economy) then your country will continue to struggle for years until that debt is repaid. The answer is partial default.

Perhaps declare you will now only pay that debt back in Irish Pounds; or maybe freeze interest payments and declare you will pay it back eventually – still better than never. Or just flat out default.

Chances are the consequences will be that the Irish Pound will plummet in value. Suddenly your export sector looks fantastic! The worst problem will then be imports, especially oil. The trick then will be to very quickly make sure everyone is employed (massive deficit spending via national job guarantee) and that your domestic economy gets back into shape. It will be rough, with fuel shortages and so forth, but if you don’t blink, eventually the speculative attacks on your currency will subside and you will have a decent exchange rate again. At that point you can honor old debts in Euros (being that most of your exports will be to Euro countries) or just good old Irish Pounds, and then everyone will trust you again.

I really don’t know much about your economy, sorry. But that’s one reasonable scenario and probably applies to all Euro countries.

Ireland (like Spain) is a joke. It is a classic case of what happens when a country, constitutional monarchy or Republic, becomes dominated by corrupt, drunk politicans’, as opposed to a direct democracy or a nationwide referendum. Ah, if only all countries has a President Ólafur Ragnar Grímsson – who may yet AGAIN veto the next piece of legislation in relation to the IceDebt program. Let’s hope he does.

http://www.icenews.is/index.php/2011/01/17/president-of-iceland-gordon-brown-should-apologise/

http://www.icenews.is/index.php/2011/02/17/iceland-president-to-invite-anti-icesave-campaigners-home/

It seems the President of Iceland understands how a fiat currency system can enrich one’s citizens:

“…Additionally, the interview also discusses Iceland’s negotiations with the European Union. Grimsson said the main reason why Iceland applied for EU membership was due to the fact that after the collapse of its banking system, it seemed impossible in the long run for the country to keep its own currency.

However, Grimsson continued, “We’ve seen euro-zone countries moving from one crisis to another. That has changed the picture.” He said it must be possible for Iceland to join the European Union without adopting the euro, and referred to Poland and Denmark as examples”.

Read more: http://www.icenews.is/index.php/2011/01/17/president-of-iceland-gordon-brown-should-apologise/#ixzz1EHNMAjaN

I find the argument of apparently endless wars in Europe rescued by EMU incredible. It is on par with deficit terrorists. Often one gets wars when the structure of social fabric reaches its breakable limits. It certainly reminds me of what I see outside of my window. And I am amazed that people suffering the most from the system defend it the most.

Disclosure: yes, I live in eurozone though in one of “better” countries.

“if war has now become unthinkable in Europe we should never forget that it is because of the EU”

Is it really EU that have created peace in western Europe? Or is it that it’s not really possible to wage war between industrial nations as in Europe, the price is too high and there is no chance to gain anything. The wars in Europe have always to gain something economically. Or is it that with America as the winner of WWII and the new global hegemonic power the former European colonial global powers was stripped of its colonies and global dominance and subordinated as wassails to America, or maybe the cold war and a nuclear umbrella over Europe could chill of any one from start a war that would lead too eternal destruction.

I believe neither EU nor the euro have very much to do with it. But I’m getting more and more afraid that we might see a balkanization of EU if this mad economic policy perpetuated by Heinrich Brüning loony’s like Trichet, Osborne and the rest of the eurocrats are continued. Just listen to them, we are dealing with seriously dangerous lethal psychopaths.

“in the short-term a stupid system but sadly enough only a crisis can make further integration acceptable”

Sort of imposing grand scale creative destruction on the innocent Europeans to force them into the European utopian super state? Gimme A Break

“A point that could be made is that little countries, like Ireland and Portugal, have few influence and could be considered as not sovereign. But it would be a tremendous surprise for me to see France or Germany being attacked by financial markets and the ECB doing nothing about it.”

So Ireland, Portugal and everybody in Europe got to be under the yoke of ECB as an instrument of Germany and France so they don’t start another war at each other.

Those currency snakes did break, the ERM imploded, all Europe have done in its vain attempt to lock the currencies have failed. Maybe it’s this ideas that are wrong not the poor Europeans or the market. The ERM (Eternal Recession Mechanism) did break when Bundesbank start to get inflations hallucinations about the German reunion and raised interest rates.

War has many forms, you don’t need to kill someone to annoy him, and if you think that nuclear power can stop countries that fought WWI (the stupidest war ever) to go at each other you are very optimistic. Finally the wars were never about the colonies…

Anyway the only thing I wanted to say is that the EMU is not necessarily a bad thing, the ECB doesn’t want to bailed Ireland so what ? The UK could have bailed itself but preferred stupid measures of austerity. If the ECB was in favor of MMT would you say that the EMU is a broken system ?

“If the ECB was in favor of MMT would you say that the EMU is a broken system ?”

Yes, I would still say It’s a failed system simply because there is not one nation. It is not acceptable by Estonians to pay pensions to Irish and the pensions in Ireland are higher than labor wages in Estonia yet this kind of solidarity is necessary in monetary union. It doesn’t matter if those payments are direct payments or ECB financing Ireland’s debt. It is not acceptable by member states right now.

If they would have understood MMT than they would have never created EMU. It requires a central government with fiscal power, federalism really and that is not happening in Europe. If there is no federalism the system will fail and the sooner the better to end this agony.

All these countries borrowing in foreign currency is not going to create peace. It is going to create tensions because defaults will happen. There is not going to be any tensions if Galway is living off of Dublin somehow and It can last forever but there is going to be tensions if Dublin is living off of Tallinn, It cannot go on forever, at least that’s the mindset. We are not United States, we are not Australia. Federalism is not going to happen for at least next 20 years in Europe and I doubt if ever.