I started my undergraduate studies in economics in the late 1970s after starting out as…

An irrational economic absurdity

The title of today’s blog comes from an interesting article I read today in the UK Guardian (February 14, 2011) – The revenge of trickle-down economics – by retired American economist Richard Wolff. It is worth reading. As Wolff noted the persistently high unemployment, loss of income and output and increased poverty in the US and elsewhere is “an irrational economic absurdity”. The problem is simple to solve from an economic perspective. The US government has all the capacity it needs to offer jobs to all those who want them but are unemployed. The wages they paid would flow back into the spending system and stimulate further job creation. Before long, investment would strengthen and firms would be bobbing up from all over to get a share of the action. All it needs is a kick-start and the government is the only sector that can provide it. The alternative is a slow, muddling recovery with millions left behind jobless and penniless in the process. That is no place to be and is just an irrational economic absurdity.

In a pamphlet to support Lloyd George in the 1929 British election, J.M. Keynes wrote:

The Conservative belief that there is some law of nature which prevents men from being employed, that it is ‘rash’ to employ men, and that it is financially ‘sound’ to maintain a tenth of the population in idleness is crazily improbable – the sort of thing which no man could believe who had not had his head fuddled with nonsense for years and years.

I reflect on that quote often because it never ceases to amaze me of the way politicians get away with absurd behaviour and impose policy regimes on their populations that are damaging to many while provide largesse for a few.

Inequality is rising in the advanced world. I did a radio interview the other (ABC) about the recent article in the Economist Magazine (January 20, 2011) – The rich and the rest which claimed that the best way to overcome inequality was still to rely on “trickle down” forces but in the current recession governments might do well to invest in “education, abolishing rules that prevent the able from getting ahead and refocusing government spending on those that need it most”.

I told the ABC (radio) that the trickle down didn’t work and has never worked. I suggested that rising inequality was a fermenting force which when combined with poorly performing economies led to social unrest and possibly outright rebellion (a la Egypt).

Since I started learning economics (in the late 1970s) at a time when there was high unemployment in most advanced economies I was curious as to how the mainstream economics profession continually advocated policies that ignored the reality of mass unemployment – massive income losses borne by society and individuals (and their families) – every day; entrenched inter-generational disadvantage (kids growing up in jobless houses become less likely to have stable work histories); and then a range of other social pathologies – increased crime rates, increased rates of physical and mental illness; increased rates of family breakdown; increased incidence of alcohol and substance abuse.

In some countries unemployment means death through starvation.

I learned at the outset that the claim that the mainstream policy agenda was focused on attaining an optimal allocation of resources was a massive lie no matter how elegant the mathematics that supported the rhetoric appeared. It was obvious from history that whenever governments used their fiscal powers to generate spending (aggregate demand) unemployment fell.

It was also obvious that in the neo-liberal era (from the mid-1970s) governments had resisted using these capacities because the mainstream economists claimed it was better to privatise, deregulate, destroy trade unions, reduce minimum wages, and invoke pernicious welfare-to-work rules to create a new sense of desperation among the unemployed.

Unemployment has never really returned to the lows of the 1960s since that change in the way government policy is designed. The neo-liberals realising that they had a major public relations problem on their hands – persistently high unemployment and rising underemployment courtesy of the demand-starved economies their policies had been inflicted on – started, in earnest, to tell us that the unemployment was not what we thought.

It was clear as I learned more that the mainstream theory was preposterous. The neo-liberals justified the mass unemployment that their policies had created by claiming it was a voluntary phenomena arising out of free and maximising behaviour by the unemployed who were cast as preferring leisure at that point in time to work (and income). In that sense, high unemployment was “full employment” because it was a chosen state.

That allowed the models they used to indoctrinate students with to assume full employment as a starting point. Yes, there were some economists who could see the business cycle. But this was just a transient deviation around the “long-run” trend. There was a sequence of interrelated theories that claimed this was optimal and inevitable and any efforts by government to divert this “natural” tendency would result in inflation.

Accordingly, we were presented with the classical dichotomy or classical neutrality that said that nominal variables in the economy (money stock, prices) were independent of the real variables (employment, production etc) in the long-run. Extreme versions (rational expectations) later denied any relationship between the nominal and the real at any time! So the short-run was the long-run.

So if you wanted to understand the evolution of real output or employment then you needed no knowledge of the monetary system (or money). The rate of inflation was a purely monetary phenomenon and was analysed separately from the state of production.

This allowed the mainstream textbooks to then concentrate on the inflation bogey – it was the problem that had to be solved and that led to the demotion of fiscal policy as an active set of instruments and the promotion of monetary policy as the inflation-first policy weapon of choice. Unemployment has since that time been used as a policy tool (to suppress wage inflation) rather than one of the three policy targets – low unemployment, stable inflation and stable balance of payments.

Which brings me to Egypt.

The giant that sleeps by the Nile – or at least its people have been speaking over the last few weeks and successfully brought down an autocratic government that had imposed a permanent state of emergency on them in order to access certain punitive options including torture.

While the US is extolling the virtues of democracy, I am sure that within the military and security administration they won’t be happy that the government has been toppled given it was one country that allowed illegal rendition without saying a word. When are people going to be put on trial for all those illegal acts?

What happens to the Egypt now the military are in charge will be interesting and I have no insights to offer at all on that topic – just an interested observer like most.

I am not a political scientist nor an expert on the Middle East but I know a lot about the way the labour markets operate in those countries and the sort of outcomes that they deliver.

It is clear that the public revolution in Cairo recently has been both a political and economic event given that the middle and working classes mobilised. While the world news focuses mostly on the political aspects for me the interesting aspects have been related to the economic issues.

But the economic issues have been festering for years. You can read an reasonable account of the economic problems from this article (February 10, 2011) – The Uprising in Egypt: Poverty, Inequality and Unemployment. I don’t endorse everything that is said in that paper but the description of the data is reasonably accurate and saves me the time in repeating it.

Salient facts about the Egyptian economy include:

The population is growing by about 1.8% a year, or nearly 1.5 million, but the population of working age is increasing by about 2.2% a year. This means that hundreds of thousands of young people are entering the labor market every year. As a result, Egypt needs to create a million jobs a year just to prevent unemployment from rising.

Measuring unemployment is no easy task: the official figures define unemployment in ways that keep the number low. In 2005, 34% of those aged 15 to 25 years were unemployed. Among 25 to 30 year-olds, the unemployment rate was 16%. There is no evidence of a fall in these rates since then … There is also mass underemployment: people who work but do not make any significant contribution …

The average Egyptian exists on a very low wage and, as a result, many of those who are gainfully employed nevertheless live in poverty. The large number of low earners and non-earners means that much of Egypt’s national income accrues to the better-off …

In 2010, the inflation rate was 12%, but food prices rose by 20%. As food accounts for 40% of the average Egyptians expenditure, the sensitivity to food price inflation was something that contributed heavily to the unrest in Egypt.

The author says that “(w)hoever succeeds Mubarak will need to improve the economic conditions of ordinary Egyptians or there will be another explosion – and it is likely to happen much more quickly than this one did”.

Which brings me to the US and the latest budget.

Richard Wolff concluded his article The revenge of trickle-down economics with this:

The vast social and personal costs of this irrational economic absurdity – tens of millions unemployed, one third of US productive capacity unutilised (rotting and rusting), and vast quantities of needed output foregone and lost – are ignored lest they raise the uncomfortable question: why do we retain a system as dysfunctional as this?

The answer to his question

His main idea is that the “differences between Democrats and Republicans on the deficit are cosmetic. Both are committed to a broken, corrupt system” and the “hyped choreography of forthcoming battles between Democrats and Republicans is a very secondary sideshow. The battles clothe basic agreement in a disguise of fierce oppositions – perhaps aimed to mollify each party’s none-too-discerning militants”.

Wolff says that:

Both sides agree that government spending will continue to follow the old “trickle down” theory, despite its failure to date. Massive federal outlays on the largest banks, insurance companies and selected other large corporations produced a “recovery” for them, but not in the rates of unemployment, home foreclosures and state and local austerity budgets that keep crippling the US economy. Federal largesse has yet to trickle down, but both parties proceed on the assumption that it eventually will. Neither party tallies the economic and social costs of massive unemployment, home loss and state and local austerity budgets. Neither party offers any alternative to “trickle down”, as if no alternative exists or is worth debating.

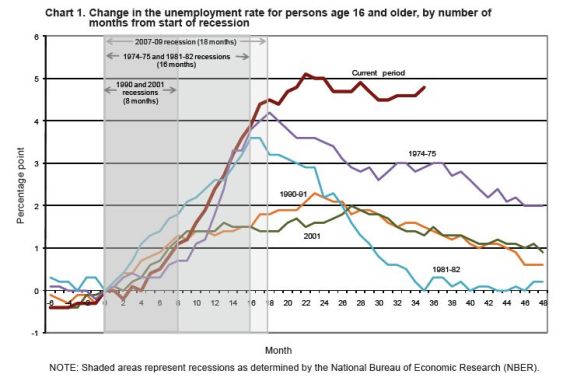

In my recent blog (February 14, 2011) – The third great US “reds under the bed” scare – I provided the following graph which was taken from the December 2010 edition of the Bureau of Labor Statistics Issues in Labor Statistics which focused on “Sizing up the 2007-09 recession: comparing two key labor market indicators with earlier downturns”.

It shows the “Change in the unemployment rate for persons age 16 and older, by number of months from start of recession”. The shaded areas are the NBER recession dating periods. If you need any reminder of the historical significance of the current crisis then this graph should be sufficient. All related aggregates (budget deficits, real GDP losses, public debt movements) will be similarly at historical highs or lows depending on the measure.

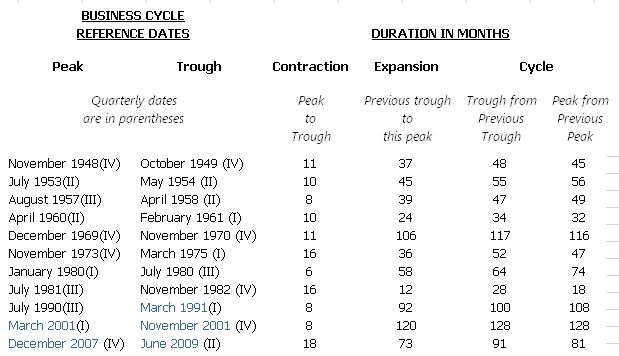

What about the employment analogue of this graph? To complement the above graph, I decided to chart the cumulative employment losses from the peak employment months for the 5 US recessions since 1974 – as a shock weapon! The recessions are typically “dated” using the well-known NBER business cycle dating to determine the peak and the trough of the recessions over the last 60 years. The following table is taken from their output and shows the relevant events since 1948.

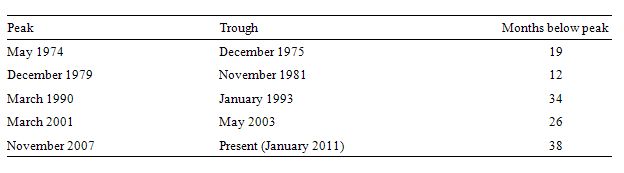

However, the peaks and troughs identified do not necessarily coincide with the peak employment month and certainly do not show the month when the employment level breaks back through the previous peak level (signifying that the economy has regained the overall jobs lost during the recession. The following Table shows the dates that I used to coincide with the peak and the month where the job losses relative to peak become zero again.

Note that in 1974, there was a short recession, a short recovery then a double-dip into a longer recession.

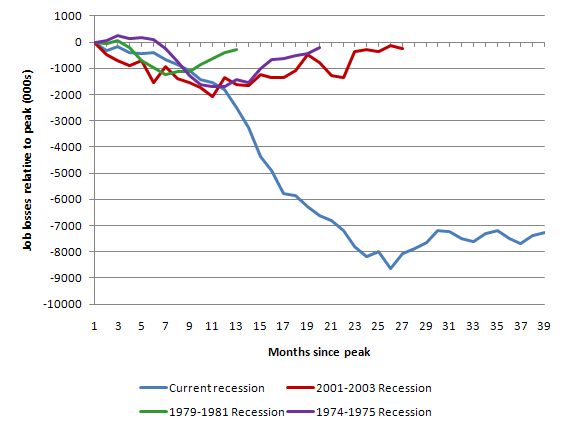

The next graph shows the cumulative employment losses for the 1974, 1981, 1990, 2001 and current recessions. The data is from the US Bureau of Labor Statistics. If that doesn’t give pause for reflection then I am not sure what will.

It was interesting that Wolff listed the alternatives to the way policy is being designed and implemented in the US at present. He points to what he refers to as the alternative to “trickle down” – the “bubble up” theory and notes that during the Great Depression, President Roosevelt finally gave up on the Hooverian austerity and:

Between 1934 and 1940, he created and filled 11m federal jobs with unemployed workers. Their incomes enabled them to maintain mortgage payments and buy goods and services that provided jobs to millions of others and profits to many US businesses. That alternative to trickle-down economics did not suffice to overcome the Great Depression. However, it certainly alleviated more of the economic damage and individual suffering of that breakdown than Bush’s and Obama’s trickle-down economics have achieved in this one.

If you consider that the US economy is still 7 million jobs short of where it was before the crisis but with a larger labour force than then. There are always policy choices and as I noted in yesterday’s blog (February 16, 2011) – Misusing public information – the current policy choices are not necessarily representative of popular opinion in the US.

Wolff notes that “Roosevelt’s bubble-up approach won him the greatest outpouring of electoral support ever achieved by any US president”.

Given the CBS Poll I referred to yesterday why is the US government scared of implementing a Job Guarantee type program and directly targetting wide-scale job creation?

Wolff notes, sensibly, that the public influence dynamics have altered since the 1930s. Trade unions are weak now and there are no broad-based socialist political infrastructure. Further the right-wing are well funded and well organised and can pump out their nonsense nationally 24 hours a day, 7 days a week.

There is a crying need for a well-funded think tank centred around Modern Monetary Theory (MMT) that can devote is attention to influencing the public debate. Our university-based research centres (such as my own – Centre of Full Employment and Equity – are not well-funded and cannot extend far enough. We are continually having to chase research funds which reduces our political capacity.

Eventually, the crisis will abate without significant government intervention albeit the losses by then will be huge. Wolff notes that:

This capitalist crisis is being “resolved” the way they usually are. As unemployment deepens and lasts, wages and benefits decline. As businesses close, the costs of secondhand machines, the rents for office and factory space, the fees of business-serving professionals (accountants, lawyers, etc) drop. Eventually, when those cost declines proceed far enough, capitalists will see enough profit in resuming production to generate a broad and sustainable economic upturn.

In short, just as the crisis was brought on by the profit-seeking investments and speculations of the private sector, so now we wait until the private sector sees a profit in resuming production and thus ending this crisis.

The point is that the crisis could have been ended years ago now by appropriate fiscal action. Not the fiscal intervention that has just propped up the economy – but serious job rich intervention. Iceland, despite the magnitude of its losses in the crisis is doing relatively better than the US in a shorter time because it decided not to bail out its banks.

The US government should announce a further stimulus but this time make it count – it should only create jobs and be 80-90 per cent consumed by the wages bill of those jobs. Then let the workers who are absorbed back into productive employment start spending again. That is the way to resolve this crisis and regain those 7 million odd jobs that are at present lost from production and income generation.

The scale of this problem is so large that if it goes on for too long social instability will spread. I am not saying that the US is facing a Middle Eastern revolt (which now seems to be spreading to Bahrain). But it is also not outside the realm of probability that the unemployment and the poverty that the US government is condoning (by its policy inaction) will cause breakdown in urban stability and increase ethnic rivalry and then spread into total social upheaval.

The US deserves that degree of challenge from its citizens – so badly are they being treated by their government and the right-wing fanatics that have the government in a political vice.

Conclusion

As Wolff noted the situation in the US and elsewhere is “an irrational economic absurdity”. The problem is simple to solve from an economic perspective. The US government has all the capacity it needs to offer jobs to all those who want them but are unemployed. The wages they paid would flow back into the spending system and stimulate further job creation.

Before long, investment would strengthen and firms would be bobbing up from all over to get a share of the action. All it needs is a kick-start and the government is the only sector that can provide it.

The alternative is a slow, muddling recovery with millions left behind jobless and penniless in the process. That is no place to be.

I have run out of my allocated blog time …

So that is enough for today!

There’s a good point in the comments that the ‘trickle down’ effect is more likely to result in the funds being swapped into developing countries’ currencies since that is where the action is and where the profit is.

Nobody is going to invest in new production in the moribund Western/Japanese democracies. There is no profit in it. (Or if there is it is well hidden. I certainly can’t find it).

We need to switch to ‘bubble up’ and we need to do it soon.

Bill;

Regarding “Eventually the crisis will abate…”

This sounds like a description of the cyclical abatement that ends ordinary recessions. But everything you’ve written today, and on many other days, points out how very unordinary and even extraordinary today’s crisis is. I completely agree that it was the principal ignition source of the Egyptian and Middle East revolts, for example. It is a global crisis that can spin out of control in unprecedented and unpredictable ways. And the fact that the authorities don’t understand it and do exactly the wrong things to deal with it lends it even more of this quality.

I don’t think it will abate. I think it will get worse. The dynamics of the financial system aren’t cyclical, for one thing. The Wall Street casino has not been reformed, and it, not the business cycle, has been the recurrent wellspring of the crises of neo-liberalism since the 1970s. All of that hot money is on the hunt for earnings again – all over the world. It is bidding up the BRIC currencies and buying up assets on the cheap. Wall street already owns America. Americans are still so deep in debt we can’t breathe. So Wall Street is coming for everyone else now.

One of two things will happen, according to James Galbraith in “The Predator State”. Either the U.S. will see the rise of a strong reform movement to re-regulate finance, or the U.S. will become so abusive internationally that we provoke an international movement to isolate our economy from the rest of the world. The former project isn’t looking so good these days, though it might still happen. As the Egyptians have just proved, things can change in a hurry. But the latter process seems well underway, and I don’t see it being restrained or moderated from our end. I don’t know exactly what it will look like, but the pushing and shoving over currencies seems to be the stepping off point.

Thanks again for all you do.

I thought of this blog when i read that article also, and the following is another good example which, even if not couched in MMT principlesspecifically, touches on the same ideas as the Wolff article (not to mention the driving force of this blog)….from an employment forum in the Jan/Feb Boston Review: http://www.bostonreview.net/BR36.1/pollin.php

Although I have sympathy for the Egyptian people, I don’t have much hope for their cause. Anyone who reads Chomsky know that the US funnels money to the military leaders in other countries to keep the leaders in line. Unfortunately, the military is now in control in Egypt, and I understand that Mubarak’s replacement is a CIA agent. Where is the hope?

As far as the US, the present President in no FDR. Also, during the time of the great ‘bubble up’ there was a huge crisis brewing in Europe and corporations feared Socialism. No such fear exist today that I know of. There really is no left to speak of since obummer has successfully blocked it. The people may have to wait until this whole house of financial cards falls on itself before MMt is ever accepted.

State of Working America.org have nice interactive flash thing where you can see how the income growth is distributed between Bottom 90% and Top 10% including the share of top 5 and 1 %. There are sliders so you can choose any period between 1917 – 2008.

1917 – 1929 top 10% got it all with top 1% taking about 65-70% while bottom 90% declined. From 1929 to 1970 bottom 90% got 77% and top 10% 23%, top 1% got nothing, but 1929 was a peak level from 1932 it was 73-28% and top 1% roundabout 5%.

1970 – 2008 it was the mirror image of 1917 – 1929, top 10 did take it all while bottom 90 declined, top 1% did take about 60-65%.

1917 – 1929 democracy and labour movments was in its swaddlings, most real political power was in the hands of the elite. 1970 – 2008 political power was on the paper quite different. I assume the trend is in large the same in Europe and the late period similar in OECD. These policies that have shifted wealth from the many to the few have not seldom been administrated by what is labeled social-democrats/labour or liberals as in US. Political parties that claim to work for that common people i.e. bottom 90%. And there is not sign what so ever that the mentioned politixal forces have altered their approach to this state of affairs.

funny, I just stumbled across Wolff today too in http://www.truth-out.org/austerity-comes-america67747, which is out of MMT paradigm (no surprise) but very good in its political analysis and conclusion nonetheless.

I wonder why we all hedge and haw a bit when we talk about an uprising in the US (a la Egypt)? It has happened…In his masterfull three volume classic on FDR, Aurther M Schlesinger describes in one of the chapters various scenes of rioting and unrest across the US in 1932. Although I cannot place my hands on the exact page citation at the moment (like many of you, I suspect, my office is wall-to-wall and floor-to-floor book disorder), I remember clearly reading a fascinating description about how farmers organised against foreclosures… in one of the prairie states, I recall, but cannot name it until I can find the cite. Not only did these farmers organise, according to Schlesinger they also marched on a courthouse, seized and held hostage the judge who was signing the foreclosure papers…threatened to hang him, in fact! My recollection is that order was established in this situation only with the force of arms. So, yes, it can happen…and it has happened. Are we maybe pushing the boundaries again now? An FDR-type was needed then–and today. Too bad the US does not have someone like him at hand.

“It was obvious from history that whenever governments used their fiscal powers to generate spending (aggregate demand) unemployment fell.”

Why use fiscal policy when we have monetary policy? Your argument only makes sense if we assume that monetary policy doesn’t exist, so that aggregate demand falls when government spending falls. This is clearly not the case in reality, though. The central bank can offset any and all demand effects caused by contractionary fiscal policy with a more expansionary monetary policy. Given that we’re close to the zero bound for nominal short term interest rates, that means increasing the monetary base at a faster rate.

It follows from the equation of exchange: M*V = P*Y. In other words, the money supply (however measured) multiplied by its velocity is equal to nominal expenditure (ie. aggregate demand). This is an identity – ie. it’s true by definition. Given that the money supply is the monetary base (B) multiplied by the money multiplier (m), the equation becomes B*m*V = P*Y. B is entirely exogenous and m can only fall as far as 1, so the central bank will be able to offset any negative aggregate demand effects caused by a falling velocity as long as velocity does not fall to zero – ie. as long as people are spending any money at all.

The implication is that cutting government spending will reduce the deficit because there will be no negative effects on aggregate demand and thus no negative effects on growth. All that will change is the distribution of aggregate demand between government and the private sector. In fact, this is likely to have positive effects on the supply side because the private sector is generally more efficient. So why use fiscal policy at all? It has high long run costs and monetary policy does not.

Dear inyourhouse (at 2011/02/17 at 12:11)

I suggest you read some more of my archives. There is no money multiplier.

best wishes

bill

I’ve been looking through some of your older posts, but I don’t really understand them (my fault I expect). I’ll just ask 2 questions relating to an admittedly extreme scenario that I think get to the heart of the issue. Suppose the central bank printed $10 quadrillion tomorrow and then used that to purchase assets. Would aggregate demand increase? If you accept that it would, then surely it follows that fiscal policy is not necessary? If you don’t think it would, then perhaps you could direct me to some posts of yours explaining why it wouldn’t.

inyourhouse:

real assets or financial assets?

“real assets or financial assets?”

Either.

“So why use fiscal policy at all? It has high long run costs and monetary policy does not.”

“Suppose the central bank printed $10 quadrillion tomorrow and then used that to purchase assets. Would aggregate demand increase? If you accept that it would, then surely it follows that fiscal policy is not necessary?”

these two form like voltron into a pretty lazy approach

“these two form like voltron into a pretty lazy approach”

I don’t know what that means.

inyourhouse, I suggest you start with the following of Bill’s posts. They will explain MMT for you thoroughly, but do not expect to understand it all at once. If you are coming at it from a traditional economic perspective, it is counterintuitive and hard to grasp. Once it “clicks”, however, it seems obvious and you will wonder why you never saw things this way before.

Deficit spending 101 – Part 1 https://billmitchell.org/blog/?p=332

Deficit spending 101 – Part 2 https://billmitchell.org/blog/?p=352

Deficit spending 101 – Part 3 https://billmitchell.org/blog/?p=381

Size of deficit 101 https://billmitchell.org/blog/?p=930

Fiscal sustainability 101 – Part 1 https://billmitchell.org/blog/?p=2905

Fiscal sustainability 101 – Part 2 https://billmitchell.org/blog/?p=2916

Fiscal sustainability 101 – Part 3 https://billmitchell.org/blog/?p=2943

Zimbabwe for hyperventilators 101 https://billmitchell.org/blog/?p=3773

Some myths about modern monetary theory and its developers https://billmitchell.org/blog/?p=4157

Modern monetary theory and inflation – Part 1 https://billmitchell.org/blog/?p=10554

Modern monetary theory and inflation – Part 2 https://billmitchell.org/blog/?p=13035

inyourhouse, PS if you want to start with something more basic, try https://billmitchell.org/blog/?p=7864#more-7864.

“Suppose the central bank printed $10 quadrillion tomorrow and then used that to purchase assets.”

at what price? is there a subsidy? isn’t any subsidy a fiscal operation? isn’t central bank an arm of treasury then?

inyourhouse, I think the problem is that the economic stagnation is because there are not customers able to afford the goods and services for sale. If as you suggest “the central bank printed $10 quadrillion tomorrow and then used that to purchase assets” then the people who previously held those assets would be left with cash and the cash would probably get passed around a bit pushing asset prices up a bit more but most of the purchasing power would be conferred to those who already have so much that any extra was irrelevant for anything other than purchasing pre-existing assets. As such the whole procedure would have minimal effect on whether cars got sold or piano lessons were booked etc etc. Possibly some money might trickle down but if money was instead to go directly to those with the greatest propensity to spend it (ie the poorest) then it would immediately boost the economy. Pushing up asset prices also sets the scene for a subsequent crash. Creating sky high equity prices for companies producing a glut of goods that few can afford is asking for trouble.

inyourhous, another problem with trying to stimulate the economy by buying assets as you suggest is that the effects may well entirely spill over into some other country. If country A has no customers able to buy anything or pay back a loan whilst country B has a roaring economy, then the people in country A who sold assets when “the central bank printed $10 quadrillion tomorrow and then used that to purchase assets” are likely to use the cash to invest in country B.