I started my undergraduate studies in economics in the late 1970s after starting out as…

Its grim on both sides of the Atlantic

I have been sick today which is rare and have had trouble remaining vertical for very long. So the blog is a little shorter than usual. Just as well the subject matter might have disrupted my recovery. I note the UK economy is being deliberately sabotaged by its elected representatives which seems to conjure up a very weird construction of what we elect governments for. And in that context, the deficit terrorists are ramping up their calls for major fiscal retrenchment in the US. I thought Americans could read English – maybe they missed the British Office of National Statistics National Accounts release – it is pretty obvious – real GDP growth now negative again courtesy of a negative contribution from government in the December quarter. And the terrorists seem to want the same for the US. Its grim on both sides of the Atlantic.

UK National Accounts – fourth quarter 2010

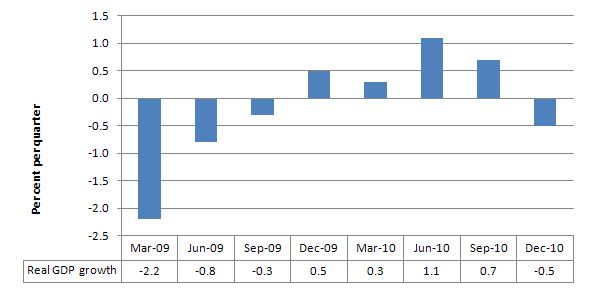

The UK Office of National Statistics released the December quarter National Accounts yesterday and it was no surprise that they revealed the British economy is once again contracting – real GDP declined by 0.5 per cent.

The following graph shows you the quarterly real GDP growth since the first quarter 2009 and you can see that the growth gains the British economy was making driven by the fiscal stimulus have been dissipating as the government chokes the economy with its austerity drive. Further, the impact of the recent (January) VAT rises of 2.5 per cent are yet to be felt. Stay tuned for an ugly March quarter result.

Why? The newly elected British government has abandoned any semblance of responsible economic management and is not only pushing up pressure on prices via VAT increases (which by the way will only be once off increases not inflation) but has also decided it is better for unemployment to be rising and people losing incomes than it is to maintain the fiscal stimulus which kick-started growth in 2009 and early 2010.

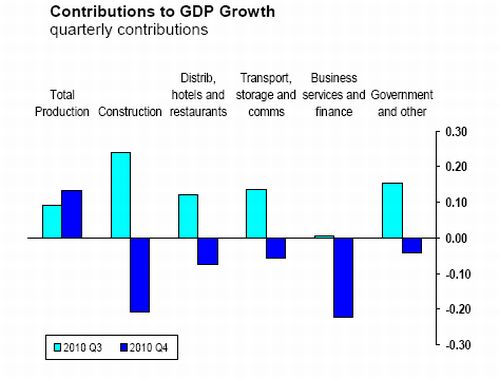

The following Graph shows the various components that contributed to the final contraction. Not the contraction of government in line with most of the other components. So government was running pro-cyclical policy.

The ONS claim that the construction and services sector was impacted by the bad December weather which is no doubt true. They said:

The disruption caused by the bad weather in December is likely to have contributed to most of the 0.5 per cent decline, that is, if there had been no disruption, GDP would be showing a flattish picture rather than declining by 0.5 per cent.

This result comes after four quarters of growth (albeit slowing in September). Even if the ONS’s assessment of the weather impact is accurate (that is, real GDP growth was zero in the December quarter) it still means that the economy is trending down and hovering on recession again.

The progressive side of politics should be running TV advertisements every night exposing who is winning out of this scandalous policy stance. But then the most progressive (so-called) of the main parties is actually in bed with the Tories so what hope is there. It will be a long Winter in the old land.

And can’t they read in the US

In the same week as it was clear that the British National Accounts data was going to be bad two US-based articles appeared in the Financial Times which were advocating that the US follow it British forebears down the austerity road.

I guess you have to see these articles in the context of the recent ABC Network interview that Ron Paul gave where he indicated he wanted to cut the US federal budget by $US500 billion (lots) and declared that the:

US government must admit bankruptcy and stop cheating people with devalued money …

It is funny because his public utterances about the US government’s disregard for the unemployed while they bailout banks and capitalists are sound. But he hasn’t a clue about the role that the government deficit is playing to keep the US economy afloat. I would like a journalist to ask him to outline where he thinks the aggregate demand is coming from if the government cuts there budget by his desired quantum.

And of-course, the US government can never be declared bankrupt and anyone who supports politicians who propose that myth is lacking an adequate education – probably because there hasn’t been enough public spending on government schools.

So if you consider the first FT article by Robert Rubin (January 24, 2011) – America must cut its deficit but not in haste – in that context and then it almost appears reasonable.

I last gave much attention to Rubin in this blog – Being shamed and disgraced is not enough – where I provided some discussion of his role in the financial crisis. I noted that in January 2009, Rubin, the former US Treasury Secretary, was named by Marketwatch as one of the “10 most unethical people in business”.

Rubin later became Chairman of Citigroup after his political career ended. He left just before its near collapse amidst criticism of his performance. In 2001, he used a mate in the US Treasury Department to try to put pressure on the bond-rating agencies to avoid downgrading Enron’ debt which was a debtor of Citigroup.

In the FT article, Rubin notes that the US is facing three big fiscal challenges. First, its slow recovery is locking in “stubbornly high” unemployment. I agree – that is the primary problem and the primary fiscal challenge.

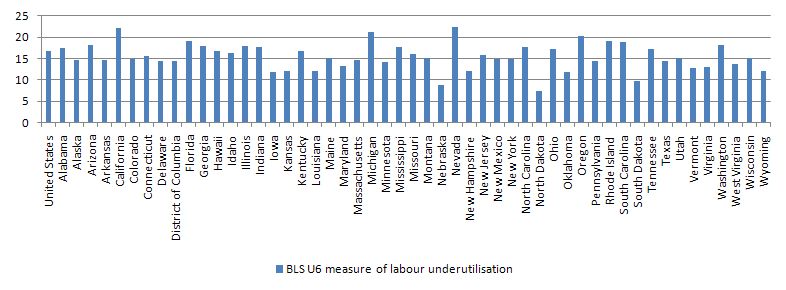

The following graph shows the scale of the problem – it is the US Bureau of Labor Statistics – “Alternative measures of labor underutilization by state, fourth quarter of 2009 through third quarter of 2010 averages (percent)” – here I graph the U6 measure.

Scan your eyes over the states and note that some have more than 1/5 of their available workforces idle at present.

Overnight, the latest US BLS Regional and State Employment and Unemployment news release came out and said:

In December 20 states had over-the-month unemployment rate increases, 15 states and the District of Columbia had decreases, and 15 states had no change. Nonfarm payroll employment decreased in 35 states and the district and increased in 15 states

If I was the US government I would see this situation as being dire an in need of immediate attention. In that context, the US government should respond to that challenge by increasing the stimulus and aiming it squarely at job creation.

Rubin identifies that the US government is also facing “serious shortfalls in public investment in education, infrastructure, research and much else critically threaten longer-term competitiveness, growth, job creation and the imperative of improved income distribution”. I agree without reservation.

There is massive excess capacity among productive resources in the US which could be brought to bear in resolving these serious shortfalls. How? Increase the fiscal stimulus and start educating Americans about the effectiveness of public infrastructure and more a equal income distribution.

But Rubin has other ideas – his second (non) challenge:

Second, our structural fiscal trajectory is unsustainable with multiple, serious risks (while at the same time, our large cyclical deficits are exacerbating debt levels and interest costs).

First, the large cyclical deficits are adding to public debt levels and interest costs. So what? The link between the deficits and the debt is a purely voluntary one that the US government could change at any time. I recommend they do that because the benefits of the public debt issuance (guaranteed annuities) favour the rich more than the poor.

But distributional matters aside, using descriptors like “exacerbating” means that debt and interest payments are bad. They are not bad. They are unnecessary but in terms of the beneficiaries (those who buy the debt) they are all good. After all, the purchasers of the bonds make informed and free choices to buy the paper and then enjoy the income flows that pertain to them.

In a world where we extol the virtues of private wealth and increasing private incomes – I find it odd that we sequester public sources of the same as being bad and all other manifestations of private wealth and income as being good.

But those quibbles aside – which really just tell you that Rubin is an neo-liberal ideologue – I want answers to the following questions:

1. What exactly is an unsustainable structural fiscal trajectory?

2. What are the “multiple, serious risks”?

The best Rubin offers is that a “serious fiscal programme with two critical components. A strong initial phase of deficit reduction should be enacted now to take effect in two or three years, to reduce deficits to the level where the debt-to-gross domestic product ratio begins to decline”.

The deficits and debt ratio will fall as soon as the US economy starts growing robustly enough. There is just enough fiscal stimulus in the US system at present to keep some growth going

It is easy to throw these terms around to scare the bjesus out of the public but to actually spell out in coherent terms what the problem is with continuous deficits which support strong economic and employment growth and allow the private domestic sector to save overall so households and firms can better risk-manage the fluctuations in markets is more difficult.

Rubin fails to specify what the problem actually will be. The only thing he offers is a rehearsal of the standard neo-liberal line that:

Recovery will not be sustained and strong until measures for a sound fiscal regime are enacted, because of the adverse effects on business confidence and the market risks of our current fiscal trajectory.

Where is the evidence for that? Is there a shortage of buyers for US Treasury bond issues? Last time I looked the bond tenders were always more than “times covered” – meaning they never have a problem selling the debt.

Are yields rising which might indicate that bond buyers are getting a bit worried? Answer: definitely not.

By the way, rising public debt yields can also (and usually do) indicate that the private sector is becoming more confident and diversifying their portfolios into riskier investments and so the demand for risk-free government debt falls (which means price falls and yields rise). The lesson is that you always have to be very careful making any conclusions about the direction of bond yields. Context is everything!

Anyway, where is the evidence that business confidence is low because of the deficits? Are GM investors unhappy that the government bailed out their company and provided it with the scope to restore some health?

Where are the market risks coming from as a result of the deficits?

In other words, this is just throwaway scare lines that have no substance.

Didn’t Rubin read my blog the other day – Ricardians in UK have a wonderful Xmas where I document evidence that the private sector in the UK are refusing to spend because they are scared of the government cutbacks and rax rises and the increased probability of becoming unemployed.

Rubin did become a little more specific later in the article:

The risks of our fiscal position are serious and multiple. And while these risks become more severe over time as our debt position worsens, all of these either have begun to materialise or could do so in the near term, so we should act now. To be specific about the risks, deficits could crowd out private investment, which could choke off a private investment recovery. Moreover, the capacity for public investment is already diminishing, and could be exacerbated by growing entitlement costs and mounting interest payments.

So crowding out and running out of money. That is it in a nutshell.

To be succinct (I am sick today!):

1. Crowding out is an invention of mainstream macroeconomics textbooks. In terms of their monetary effects on bank reserves – budget deficits put downward pressure on interest rates. Unless you subscribe to the extreme end of mainstream economics which espouses concepts such as 100 per cent crowding out via financial markets and/or Ricardian equivalence consumption effects, you will conclude that rising net public spending as percentage of GDP will add to aggregate demand and as long as the economy can produce more real goods and services in response, this increase in public demand will be met with increased public access to real goods and services.

The normal presentation of the crowding out hypothesis which is a central plank in the mainstream economics attack on government fiscal intervention is more accurately called “financial crowding out”. At the heart of this conception is the theory of loanable funds, which is a aggregate construction of the way financial markets are meant to work in mainstream macroeconomic thinking. The original conception was designed to explain how aggregate demand could never fall short of aggregate supply because interest rate adjustments would always bring investment and saving into equality.

At the heart of this erroneous hypothesis is a flawed viewed of financial markets. The so-called loanable funds market is constructed by the mainstream economists as serving to mediate saving and investment via interest rate variations.

This is pre-Keynesian thinking and was a central part of the so-called classical model where perfectly flexible prices delivered self-adjusting, market-clearing aggregate markets at all times. If consumption fell, then saving would rise and this would not lead to an oversupply of goods because investment (capital goods production) would rise in proportion with saving. So while the composition of output might change (workers would be shifted between the consumption goods sector to the capital goods sector), a full employment equilibrium was always maintained as long as price flexibility was not impeded. The interest rate became the vehicle to mediate saving and investment to ensure that there was never any gluts.

So saving (supply of funds) is conceived of as a positive function of the real interest rate because rising rates increase the opportunity cost of current consumption and thus encourage saving. Investment (demand for funds) declines with the interest rate because the costs of funds to invest in (houses, factories, equipment etc) rises.

Changes in the interest rate thus create continuous equilibrium such that aggregate demand always equals aggregate supply and the composition of final demand (between consumption and investment) changes as interest rates adjust.

According to this theory, if there is a rising budget deficit then there is increased demand is placed on the scarce savings (via the alleged need to borrow by the government) and this pushes interest rates to “clear” the loanable funds market. This chokes off investment spending.

So allegedly, when the government borrows to “finance” its budget deficit, it crowds out private borrowers who are trying to finance investment. The mainstream economists conceive of this as the government reducing national saving (by running a budget deficit) and pushing up interest rates which damage private investment.

The analysis relies on layers of myths which have permeated the public space to become almost self-evident truths. This trilogy of blogs will help you understand this if you are new to my blog – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3.

The basic flaws in the mainstream story are that governments just borrow back the net financial assets that they create when they spend. Its a wash! It is true that the private sector might wish to spread these financial assets across different portfolios. But then the implication is that the private spending component of total demand will rise and there will be a reduced need for net public spending.

Further, they assume that savings are finite and the government spending is financially constrained which means it has to seek “funding” in order to progress their fiscal plans. But government spending by stimulating income also stimulates saving.

In this context, private agents can always access credit from banks if they have adequate credentials (creditworthiness). There is no finite pool of funds available for investment and as private spending expands it brings forth its own saving via income growth.

The following blog – When a huge pack of lies is barely enough – provides more discussion of these ideas.

2. The US government cannot run out of money. The growing entitlement costs and mounting interest payments can always be accomodated in a financial sense. Whether you want the aged to have nice health care or pensions is a purely political and social question. It has nothing to do with the government’s capacity to deliver such care – unless you want to argue that the US is going to run out of real resources so will have to cut back eating (which wouldn’t do the majority of the population that much harm anyway) to allow for health care – or some other trade-off.

I don’t see that as being a possibility just yet and is not the basis of the neo-liberal attack on public provision anyway.

For a more coherent conceptualisation of what fiscal sustainability means please read this suite of blogs – Fiscal sustainability 101 – Part 1 – Fiscal sustainability 101 – Part 2 – Fiscal sustainability 101 – Part 3.

But Rubin’s article – crazy as it is – was just dilution personified when compared to the other FT article I read this week (January 23, 2010) – Indebted America risks an age of austerity – by Roger Altman and Richard Haass, both former US bureaucrats.

They claim that unless the US government makes severe cuts to the budget to fix its “deteriorating and unsustainable fiscal condition” the “global financial markets” will do it for them and then it will get ugly.

They claim that the US cannot “indefinitely run up debt at the current, astronomical rate”. When was the last time the US had unemployment statistics across its regional space as depicted in the graph above? When the US government addresses that problem and gets people back into work again the budget deficit will start to contract.

I also love the descriptor – “astronomical”. The growth in public debt in the US at present is in fact rather orderly. But the point is that the private sector overall cannot indefinitely run up debt but the US government clearly can. Should it though? That is the nub. They can but they shouldn’t.

But in saying that I recommend they abandon their stupid voluntary rule that says they have to match their deficits $-for-$ with debt issuance. That is a gold standard hangover and that convertible currency system ended in 1971 – yes – 40 years ago. For a nation that prides itself of innovation and being dynamic a 40-year lag in finding out that the monetary system has changed is very un-dynamic.

And if they did that then the concerns of the authors that the global financial markets will force “ugly budget changes: larger than necessary, indiscriminate and imposed virtually overnight” are totally unfounded. But even if the US government persists with their arcane debt issuance they still are in control.

What if the financial markets rebel? The Federal Reserve buys the debt! There is never a need for the US government to make ugly budget changes against their will. They are in charge after all.

Please read my blog – Who is in charge? – for more discussion on this point.

The authors invoke the usual scaremongering – “No one can predict when markets might move on America, but it is a question of when, not if”. When have the market ever “moved” on the US government in the past and forced ugly budget changes agains their will? Answer: Never.

So the debate has to be about “if” rather than just asserting that. History tells us that there will not be this sort of problem.

The authors say that if when the markets do move:

The result would be an age of American austerity. No category of federal spending, from defence to Medicare, would be spared. Taxes on most or all individuals and businesses would rise. Economic growth would slow. The consequences for America’s international role, and for world stability, would be profoundly negative.

America is already in an age of austerity. Economic growth is already slow. The reason is that the US government has been listening to opinions like this and not using its fiscal capacity to tackle the lack of aggregate demand that is preventing employment growth from picking up and eating into the huge pools of idle labour.

The way I look at it, the situation in many US regions is dire now. Following the advice of these characters will surely worsen that situation.

The rest of the article is a reiteration of nonsensical IMF debt extrapolations and a comparison with Italy and Greece. No mention of Japan. Apparently the US will reach Italy and Greece “within nine years”. This is obvious nonsense unless the US government surrenders its currency sovereignty and joins the Eurozone.

Any commentator who conflates the EMU with a sovereign monetary system is telling you that he/she doesn’t have a clue about the way monetary systems work.

How can you honour a man who ran 10 surpluses in 11 years and set us up for the crisis

It is Australia Day today (aka invasion day if you are indigenous or sympathetic to their troubles). The federal government hands out awards on this day as a symbol of national unity and recognition.

I would have given our top civic honours to each on of the unemployed who the government forces to live in demeaning circumstances as the buffer against inflation and as a vehicle to discipline the wage demands of the workers to ensure that real GDP is distributed to profits so that the top-end-of-town are happy and keep contributing to the coffers of the main political parties.

But I am obviously out of touch. The Labor government chose instead to award our top civic honour to the past conservative Treasurer who oversaw record levels of household debt, rising inequality, and failed after 11 years in office to achieve full employment. He was surplus obsessed and starved our nation of the first-class public infrastructure (telecommunications, education, hospitals, roads, ports, railways, water management systems, etc) that we clearly require to be a sophisticated (rich) nation.

He also oversaw a massive redistribution of national income to profits. Yet the Labor government (so-called party of the workers) decides to give him the top medal.

I liked the ABC News report – Costello heads Australia Day honour roll where Costello was reported as being humble and saying:

I’ve tried to make our country a better place and make a contribution to it … I went into public life to try to make a difference and I devoted 20 years of full-time effort to do that. I hope I did make a difference.

Fine. Humility is good. Leave it to others to determine the contribution you made and whether it made a difference or not.

Then in the next sentence, just in case someone (like me) took him to task for his appalling record of economic management, Costello provided this:

To have a measure of recognition of that humbles me, but I feel enormously grateful that that contribution has made Australia a better place.

How dare the Labor government honour this man!

Conclusion

I have been sick today and so didn’t type much. More tomorrow – on the World Economic Forum – if I can bring myself to read the report.

That is enough for today!

get well soon, bill. thanks for the write-up, nice breath of reality after the us state-of-the-union and shyster rebuttal

A couple of lines from Obamas State of the Union speech:

“We are poised for progress. Two years after the worst recession most of us have ever known, the stock market has come roaring back. Corporate profits are up. The economy is growing again.

…

We will put more Americans to work repairing crumbling roads and bridges. We will make sure this is fully paid for, attract private investment

…

Within the next five years, we will make it possible for business to deploy the next generation of high-speed wireless coverage to 98% of all Americans.

…

All these investments – in innovation, education, and infrastructure – will make America a better place to do business and create jobs.

…

we set a goal of doubling our exports by 2014

…

But now that the worst of the recession is over, we have to confront the fact that our government spends more than it takes in. That is not sustainable. Every day, families sacrifice to live within their means. They deserve a government that does the same.

So tonight, I am proposing that starting this year, we freeze annual domestic spending for the next five years. This would reduce the deficit by more than $400 billion over the next decade, and will bring discretionary spending to the lowest share of our economy since Dwight Eisenhower was president.

This freeze will require painful cuts

…

Now, most of the cuts and savings I’ve proposed only address annual domestic spending, which represents a little more than 12% of our budget. To make further progress, we have to stop pretending that cutting this kind of spending alone will be enough. It won’t .

The bipartisan Fiscal Commission I created last year made this crystal clear. I don’t agree with all their proposals, but they made important progress. And their conclusion is that the only way to tackle our deficit is to cut excessive spending wherever we find it

…

This means further reducing health care costs, including programs like Medicare and Medicaid, which are the single biggest contributor to our long-term deficit. … including one that Republicans suggested last year: medical malpractice reform to rein in frivolous lawsuits.

…

To put us on solid ground, we should also find a bipartisan solution to strengthen Social Security for future generations.

…

If we make the hard choices now to rein in our deficits, we can make the investments we need to win the future.

…

A 21st century government that’s open and competent. A government that lives within its means.”

So there going to be fantastic investments in innovation, education, and infrastructure but first they have to “make the hard choices” then they shall venture into the promised land of investments in innovation, education, and infrastructure. How many unemployed will there be how much have the deficit increased after the “hard choices” have been made and the promised land of abundant investment will materialize out of thin air.

Peter Costello,aka Mr Smirk,he of the Bonus Babies.That a Labor government would honor this jerk is indicative of where we are at politically. Why don’t we just have a government of national unity composed of Labor,Liberals,Nationals and Greens.They are all in bed together anyway.

No hope for Australia without some serious civil strife.How do you motivate sheep?

I think you forgot to mention on the other side of the Tasman aswell!

Quotes from John Keys speech today (and remember, he was Merill Lynches global head of foreign exchange for a while, as well as serving on the foreign exchange committee of the NY Fed Reserve. He should know better):

“The Government’s books had been left in a mess, with Treasury projecting no end to budget deficits and government debt spiralling out of control. Even so, when we tally up everything the Government is spending this year, we still need to borrow $300 million a week on average to pay the bills. Now, as the economy recovers, borrowing $300 million a week is unaffordable and is holding the economy back.

Rising government debt adds to New Zealand’s total indebtedness to the rest of the world. Through decades of under-saving, over-spending and over-borrowing, the public and private sectors have together built up a net foreign debt equivalent to 85 per cent of GDP. To put it in context, the only other developed countries with a foreign debt the size of ours are Greece, Portugal, Spain and Ireland.

When we are borrowing $300 million a week, have an overvalued exchange rate, and face the prospect of a credit rating downgrade, the Government believes it should be spending less and therefore borrowing less. I have therefore challenged my Ministers to balance the books more quickly. The only way to spend more money is to borrow it or to raise taxes. Borrowing more would lift our debt to dangerous levels… That is why the Government is going to reduce growth in its spending, get back to surplus faster than previously indicated”

Last but not least,

“And of-course, the US government can never be declared bankrupt and anyone who supports politicians who propose that myth is lacking an adequate education – probably because there hasn’t been enough public spending on government schools.” Lol, thats a good one, thanks!

Couple questions as I try to wrap my mind around MMT.

Here in America, everyone thinks we are “funded” by China. As if they are a loan shark and might decide to cut us off or make us pay 100% interest on money we owe them.

Obviously this is about the debt issuance Bill mentioned in this article.

Couple questions.

1. What percentage of our “national debt” is debt issuance?

2. Bill says “What if the financial markets rebel? The Federal Reserve buys the debt!” How exactly would that work? I just don’t understand the mechanics of how that would work?

Thanks,

Adam

One can wonder how interested China would have been to pile up large chunks of US dollars, US trade deficit, if there haven’t been US public debt to store it in. It’s probably a prerequisite for US to be able to consume things assembled I China to a barging price.

Obama keep up the usual stuff about “globalization”, it’s an external threat and menace (besides terrorism) that is hunting USA and its citizens, sort of the cause have nothing to do with the domestic politics it’s those evil Chinese’s and foreigners. But if the people are willing to make sacrifices and hard choices, i.e. slashing Medicare, Medicaid and Social Security those evil foreigners could be fended off and maybe beaten.

I found a book the other day in our free local book exchange entitled, “Beyond Our Means: How America’s Long Years of Debt, Deficits and Reckless Borrowing Now Threaten to Overwhelm Us.” It’s by Alfred L. Malabre, Jr., who it says is the Wall Street Journal Economics Editor. Certainly an impressive post, granted no doubt after many years of astute reporting on all issues economic.

Needless to say, I eagerly snatched up the offering, wondering what so accomplished a person might have to say. A few sentences from the book’s Introduction capture its tone: “For a very long time, we’ve been living beyond our means-for so long, in fact, that now, sadly, it’s beyond our means to put things right, at least in an orderly, reasonably painless manner. … No amount of governmental, or for that matter private, maneuvering will avert a very nasty time ahead.” Mr. Malabre, it seems, is here more dismal about our economic prospects than most, claiming not that we are approaching a point of no return, but rather that we have unknowingly already gone over the cliff.

The book is ©1987. Apparently, it is a really high cliff, because we have not yet hit the bottom.

________

(1) Debt, The Grim Reaper, NY Times book review of Beyond Our Means, April 12, 1987

http://query.nytimes.com/gst/fullpage.html?res=940DE3DB1E3EF931A25757C0A961948260

(2) Alfred Malabre Jr., brief bio. Malabre’s career with the Wall Street Journal spanned from 1058 to 1994, when he retired. Now 79, he lives quite comfortably in a lovely community at the scenic far end of Long Island. There is obviously good money to be made writing such nonsense.

http://www.newsbios.com/newslum/malabre.htm

bill,

today i was speaking with a friend and tried to explain to him the basic mechanics of MMT using a verbal version of your “business card economy”.

i was pleasantly surprised when right after i said “conversely, if the govt runs a surplus then the private sector would have to run a deficit by drawing down their savings”, my friend followed up with

“so if we draw down our savings and try to maintain/better our standard of living because we think that the govt running surpluses are a good thing, we would actually have to go borrow from the banks?”

“yes”

“how daft is that for govt policy?”

“quite so actually”

“no wonder we’re all in debt!”

“there’s other reasons for that, like a lousy banking system, excessive focus on consumption and growth… and of course, good old greed, govt surpluses are just one of them”

“i see… so you mean to say that govts can run deficits forever and that’s actually a good thing for me?”

“i’m not sure, but i think you’re half right”

“huh?”

“i mean, if the govt just spends like an idiot on useless stuff, eventually inflation will begin to kick in and they will have to raise taxes to curb inflation, which basically means trying to shrink the money supply”

“i see… how do you define useless?”

“my opinion is ‘on things that produce no future benefit’… things like military spending, which is basically destructive… though i won’t deny that the technology stemming from it can be passed on for other uses”

“so you can’t really define useless?”

“i guess its subjective, that’s why”

we stopped awhile to sip our coffee. a momentary silence passed by. then my friend asked,

“so you’re supportive of bailing out the banks?”

“no man, just the ones to stem the panic first. i don’t approve of govt spending to save idiots.”

“that’s good to know.”

“let’s continue this next week, i’m hungry.”

Adam–

For a detailed discussion of china, see: http://mpettis.com/2010/02/what-the-pboc-cannot-do-with-its-reserves/

Basically China won’t stop buying US debt because they need to to maintain the yuan peg. The can’t stop without lowering their trade to the US, and that will kill Chinese growth. And if they did, it wouldn’t matter because the USG does not need to issue debt (to borrow money, there are good reasons to do so, but those are monetary operations).

MMT is tough to get into, but its worth it. I found thinking about the following questions useful:

-what would happen if the US government stopped issuing debt?

-what would happen if the USG stopped running deficits?

Also, this introduction by Cullen Roche is helpful and (with all due respect to Bill) a simpler introduction: http://pragcap.com/resources/understanding-modern-monetary-system

Enjoy.

Daniel

Bill,

if inflation is not a problem as you believe

how do you explain the price of gold going higher in the last years?

After watching the SOTU spectacle yesterday I can only agree: Its really grim on the other side of the Atlantic. First the Obama State of the Union Address. Like a parrot he’s saying the same things again. We will double our exports! But this time really. We will educate all employment problems away. You know my dear citizens right now you are too dumb for a decent job. The rest of the speech: bla bla bla.

And then comes Paul Ryan with even more silly bla bla bla. Drivels about imminent US bankruptcy? I mean if this is the oft-proclaimed brainiac of the GOP there is really urgent need for some basic education improvements. Last but not least the highlight of yesterday: Michelle Bachmann. Her speech was obviously written by the chief editor of The Onion.

What exactly is wrong with the people in Minnesota? Why do they elect someone to public office who instead of organizing some tea party event is only 100% qualified to organize Tupperware parties at home. But I’ve a remedy at hand. Before running for public office US citizens must pass a basic intelligence test. This would save normal citizens a lot of time in the future by not having to listen to complete idiots.

Stephan,

Bachmann is HIGHLY educated in many ways, as is Ryan, Obama, etc..

Link_http://en.wikipedia.org/wiki/Michele_Bachmann

B.A., J.D., L.L.M.

Martin–

Why do you think the price of gold is the sole measure of inflation? And why do you prefer that measure over others?

And more to the point, why do you think Gold is not in a speculative rise? We have seen severe price increases in commodities before, and those were not “inflation” (see: Oil in 2008)?

Personally, I think panic/mania and the availability of Gold ETFs are a big part of the story.

Daniel

@Matt

Michelle Bachmann is highly educated? You are joking? Evolution is a theory which is simply wrong because not proven? Who are these many Nobel price winners who believe in Intelligent Design like Michelle Bachmann? In regard to your “B.A., J.D., L.L.M.”. I don’t give a damn about this pseudo credentials. I’ve a book in my shelf from two US PhDs “Galileo Was Wrong” who claim the sun revolves around earth. Here some Amazon review from another “scholar”:

In one thing I agree with Mister Michael Jones: “Now that the Enlightenment is over” everything is possible. Even a Michelle Bachmann in the US Congress. Good luck on that experiment!

Dear Bill,

Feel better!

isn’t gold probably the most useless indicator of price appreciations, increasing demand? what’s it used for, really, besides hoarding?

Sorry to hear you’re under the weather, Bill.

In regards to your comments about Ron Paul, during your recovery you might enjoy reading: ‘The Truth About the Tea Party – Matt Taibbi takes down the far-right monster and the corporate insiders who created it’ at: http://www.rollingstone.com/politics/news/matt-taibbi-on-the-tea-party-20100928.

Matt Taibbi calls Ron Paul a ‘principled crank’. Ron Paul certainly is an odd character who aggressively excoriates the ‘American empire’ (his term!) in his book and continually questions US military spending. He also favours the gold standard and a zero deficit… His son Rand, recently elected US senator for Kentucky, is also against the US occupation of Iraq (see the ‘National Defense’ clip on his 2010 election campaign website) and questioned its presence in Afghanistan immediately after he was elected in November. He also wants to cut federal spending by $500 billion in 1 year!

Never, NEVER, trust a book that has the author’s academic credentials on the dust jacket.

Matt: “Bachmann is HIGHLY educated in many ways, as is Ryan, Obama, etc..

Link_http://en.wikipedia.org/wiki/Michele_Bachmann

B.A., J.D., L.L.M.”

One of the principal problems with US governance is that the people who enter government are generally trained in law rather than science, engineering, economics, finance, business management, and other problem-solving areas. With all due respect to lawyers, they are great at making the worse case sound better, but they are lousy problem-solvers. 🙂

Stephan,

I was just trying to say that she was well educated, I generally have much respect for education, but yes, that doesnt make her correct in her conclusions on fiscal policy and potential outcomes, she is WAY off here imo. Her bio makes it sound like she was a tax attorney for some time, apparently for the US IRS: ” Wiki: According to Bachmann, she represented the Internal Revenue Service “in hundreds of cases”[10] (both civil and criminal) prosecuting people who underpaid or failed to pay their taxes.” How about that! A dreaded “tax collector”!

Her Wiki also indicates that her family has helped raise many foster children, I think this is admirable. Also it looks like she has been a Christian political activist, I’m not sure that can be easily accomplished without compromising what I consider to be important tenets of the faith. It looks to me that she has had a lot of conflicts between her political career (tax collector/prosecutor?) and her faith. I witnessed this with Treasury Secretary Paulson too (he made some revealing statements in his autobiography), there seems to be a pattern of inner conflict with these people, that then results in unjust outcomes.

Myself being a Christian too, the ‘Functional Finance’ of Abba Lerner (‘Educated one of God the Father’) has a very strong resonance with me, I see MUCH Biblical congruity in FF, Bachmann has probably never even heard of it. Resp,

Education isn’t necessary synonymous that a person is “educated”, knowledgeable and sane. As it use to be idiots was overall pretty harmless but now with the late century’s education frenzy they are “educated” and can be highly dangerous and lethal. Any uncritical belief in authority is dangerous, be it science or a “facade” of credentials

“There are some ideas so stupid that only an intellectual would believe them.”

George Orwell

During the Vietnam War a poll showed, the more education the higher trust that the authorities like politicians and generals where telling the truth.

The neo-liberal revolution have built on the notion, it’s not politics its science. It’s hard to debate when the opponent smash with this is what science and research says, are you in the position to call this in question. The same method was used by soviet propaganda when they were at its heights, pumping out “scientific” proof the commie systems superiority. It’s a clever method, it’s quite a task to debunk what claims to be scientific findings and when it’s done its usually too late to have a public impact. As the old Arab proverb say, a good lie can walk from Baghdad to Constantinople while the truth try to find the sandals.

“The dogs may bark but the caravan moves on.”

“This is the kind of obviousness that a child can see-though the child may, later in life, become browbeaten into believing that the obvious problems are “non-problems”, to be argued into nonexistence by careful reasoning and clever choices of definition.”

— Roger Penrose

“… so obvious that it takes really impressive discipline to miss it …”

— Noam Chomsky

studentee: “isn’t gold probably the most useless indicator of price appreciations, increasing demand? what’s it used for, really, besides hoarding?”

Lots of reasons that demand for gold has increased and the price has run up. Gold is traditionally a safe haven in turbulent times. Those who saw the crisis developing moved into gold when a global depression seemed to be a distinct possibility. That, I think, was the beginning of this cycle of increasing demand. Inception of gold ETF’s also increased demand. Some see gold as a hedge against inflation, but historically it hasn’t been so good in this regard. Some central banks have also been buying gold. Finally, in a speculative environment price momentum becomes a driver.

Another factor is increased prosperity in emerging nations. Asians traditionally love gold. As Chinese and Indian become more prosperous, they buy more gold. India is traditionally the world’s biggest market for gold.